What are Pre-IPO Shares?

Pre-IPO shares are shares that are not yet publicly traded. Unlisted stocks are sometimes known as private equity. Pre-IPO investments are those that can be made before a business goes public. In the past decade, the market for Pre-IPO shares has gained a great deal of popularity, and good returns are the primary reason for this trend. When the company becomes public, investors anticipate larger profits on these reduced shares. However, it is a dangerous investment because you do not know the company's financials or the market's reaction to them. The success of a Pre-IPO investment is dependent on three factors: the company's current stage, its management team, and market sentiment.

How to Invest in Pre-IPO Shares?

a) From our Website

There are many platforms for an investor to invest in Pre-IPO shares nowadays. With us, there are three ways to invest in Pre-IPO shares.

1. Visit our website at UnlistedZone.

2. Click on the Unlisted Shares List

3. A list of unlisted shares will appear with a searchable button. Now click on the search button and type in the name of the company you are interested in.

4. Scroll down and click on the green button to buy the shares of the specific company.

5. A form will pop up. Fill it out and submit it. Our team will reach out to you soon to close the deal.

b) From our CRM Portal

You can also invest in Pre-IPO shares through our CRM Portal. Follow the steps given

1. Visit our website. UnlistedZone.

2. Go to the footer section and click on UnlistedZone Client Portal.

3. Login if you are registered already, or you can create a new account to log in.

4. After successful login, complete your KYC by uploading your CMR copy and Pan card. You can now invest in Pre-IPO shares available on the platform.

5. Click on Shares

6. You can invest in Pre-IPO shares here by searching from the search bar. You can also see the historical performance of the share from the graph.

c) From our App

You can invest in Pre-IPO shares through our app as well. Follow the steps given to invest in Pre-IPO shares-

1. Install our app, UnlistedZone from the Google Play Store.

2. Register yourself and then log in.

3. Click on 'More' and upload your CMR copy.

4. Click on "Check Prices' and search for the specific company you are interested in. From here you can invest in Pre-IPO shares.

5. Click on the "Buy" option.

6. A form will be displayed. Fill in the form asking about the basic details and click on "Place Order." The team at UnlistedZone will contact you and close the deal.

What are the top 5 Pre-IPO shares in India?

There are many stocks in the Pre-IPO shares category that have given extraordinary results. Investing in Pre-IPO shares is risky, but if you do invest with proper research, then you can make good money in these shares. We have listed the 5 best Pre-IPO shares, which have a monopoly, duopoly, or are among the market leaders in the industry, and it is likely that they will provide higher returns. These companies have a higher potential to grow exponentially in the future. In addition to that, Pre-IPO shares are generally available at a cheaper price than IPOs because their current market cap is much smaller. These companies are-

1. National Stock Exchange (NSE) - NSE stands for “National Stock Exchange." It was incorporated as a stock exchange in 1993. The NSE is the leading stock exchange in India which offers the most advanced and modern technology, which enables shorter settlement cycles and book entry settlement. Using an electronic trading system, the NSE provides a transparent securities market. The NSE is the most preferred stock exchange in India. For more detail, please click here

2. Studds Accessories Limited - Incorporated in 1983, Studds Accessories Limited is the world’s largest helmet manufacturer. The company provides safety to two-wheeler riders. With 2000 employees, the company has a presence in 59+ countries. In India, the company now has a 25% market share, followed by Vega and Steelbird. The company also acquired SMK Europe in 2019, a company known for producing protective and technologically advanced products. For more details, please click here

3. Pharmeasy- Pharmaeasy is India’s largest online pharmacy, which delivers medicine to your doorstep, along with diagnostic test services and doctor-on-call services. It connects patients to its nearby pharmaceutical shop. The company has partnered with licensed pharmacies to evaluate the prescriptions and drugs. The major sources of revenue for the company come from featuring ads on the homepage or search for results, fees from the sale of drugs, and income from diagnostic tests. For more details, please click here

4. Elofic- Incorporated in 1951, Elofic is a product-based R & D driven company. Faridabad-based, Elofic is the largest manufacturer of automotive filters, lubes, and automotive coolants in India. The company is a dominant leader in the industry. It is the largest filter exporter in the country. Almost 30% of the total revenue of the company comes from the export of automotive filters. For more details, please click here

5. Orbis Financial Corporation Limited- Orbis Financial Corporation Limited is an established financial services company committed towards investors' services in inter-related verticals, namely custody and fund accounting services, equity and commodity derivatives clearing registrar, and transfer and transfer agency and trustee services. For more details, please click here

All of the companies mentioned above have strong financials and a grip on the market. Some of these stocks are undervalued, the companies have very little debt, and high cash reserves, and have grown at a decent CAGR in the last 5 years. They have a market share that is far greater than their competitors. These companies have significant upside potential with room for growth.

What are the risks associated with Pre-IPO shares?

Pre-IPO shares are associated with a significant risk of fraud and cons. Some individuals may sell fraudulent shares to early investors who are unaware of their deception. In contrast to the public market, the unlisted market lacks any regulatory framework. The unlisted market relies only on the element of trust. The other risk is that investors may lose money if the company does not get listed on the stock exchange, or if it is unsuccessful in getting listed on the stock exchange. If the company does not go public for some reason, liquidity is also a key risk associated with Pre-IPO shares. In addition, a delayed IPO of the firm may decrease its value, resulting in a decline in the share price of the company, which may ultimately result in investor losses. One of the most prevalent dangers is that the company may not be able to raise sufficient capital for their business and may be forced to close before going public.

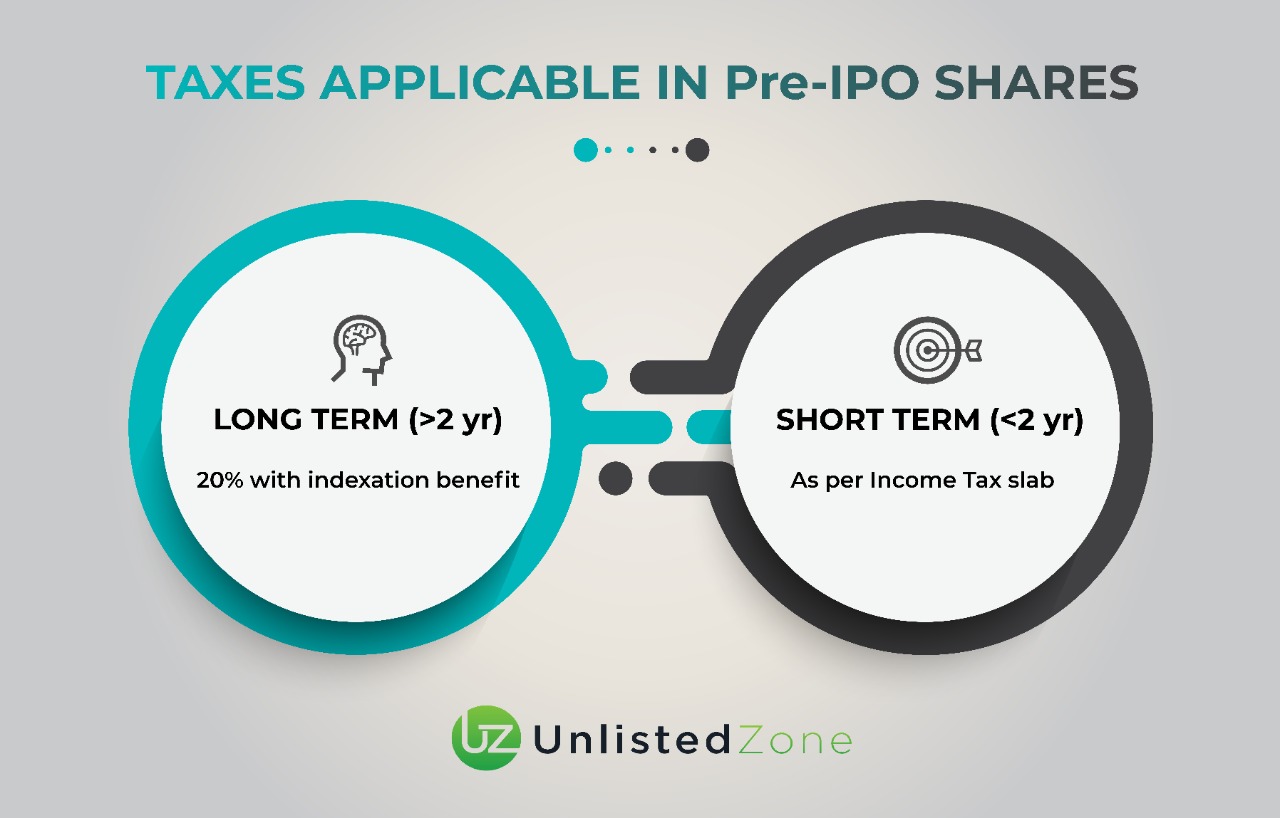

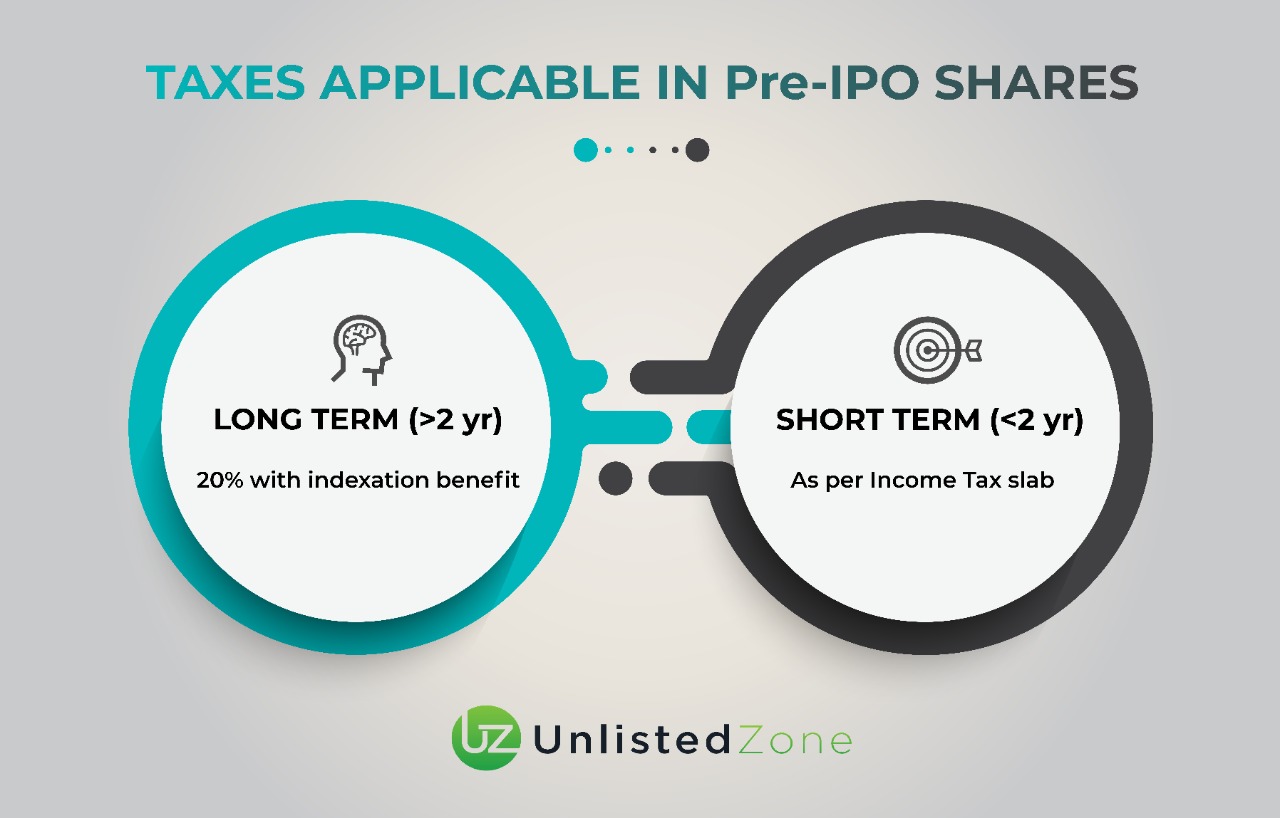

What are the taxes on Pre-IPO shares?

Pre-IPO shares are subject to tax at the time of transfer.

Long Term Capital Gain (LTCG) and Short Term Gain (STCG) are applicable on the Pre-IPO shares. If you sell Pre-IPO shares after 2 years of buying, LTCG is applicable at the rate of 20% tax with indexation benefit. If you sell Pre-IPO shares before 2 years of buying them, short term capital gain is charged as per the normal tax slab for investors. Before investing in any pre-IPO shares, it is always a good idea to do your own research on the company and its management team.

This way, you will know everything about the company, its business model, scope of scalability and future, history, what they're working on, their competition, and anything else that might be relevant to your investment decision.