Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

In the rapidly evolving defense technology landscape, RRP S4E Innovation Pvt. Ltd. has emerged as a specialized force in electro-optic systems, serving the Indian Army and other strategic clients. The company’s expertise spans repair, maintenance, and upgradation of precision optical devices, complemented by pioneering innovation in nano spectrometry, vacuum systems, and elemental analysis. Positioned among the top three electro-optics firms in India, it differentiates itself through technological excellence and cost leadership—offering products nearly 30% more affordable than competitors.

Manufacturing Capacity: 25,000 units per month with a diverse product line including reflex sights, telescopic sights, thermal imaging systems, AI-based fencing, radiation detectors, and drones.

Diversification: Expanded into drone camera production for remote operations and environmental technologies like air purifying devices to fight urban pollution.

Global Reach: Secured international orders from the UK, USA, and other regions through strategic partnerships.

Leadership: Founded by Padma Shri awardee Rajendra Chodankar (2021–22), emphasizing client-centric and innovation-driven growth.

Financial Growth: Strong order book exceeding ₹100 crore and preparing for a major IPO, reflecting solid investor confidence and ambitious expansion plans.

1. Reflex Sights – Designed for rapid target acquisition using illuminated reticles, enabling shooters to aim with both eyes open while maintaining high situational awareness.

2. Telescopic Sights – Precision optical devices offering long-range accuracy, widely used in military, hunting, and sports applications, featuring adjustable crosshairs for windage and elevation.

3. Thermal Sights – Infrared-based imaging systems that detect heat signatures, ensuring clear visuals even in total darkness, fog, or smoke—ideal for tactical and surveillance use.

4. II Tube-Based Sights (Image Intensification) – Night vision devices that amplify ambient light for enhanced clarity in low-light environments, vital for military and search operations.

5. Long Range Cameras – High-resolution imaging systems capable of capturing visuals across several kilometers, integrating optical zoom and thermal sensors for surveillance, border security, and reconnaissance.

RRP S4E Innovation Ltd. stands as a symbol of India’s growing self-reliance in defense technology, blending indigenous innovation with global standards to empower both national security and industrial advancement.

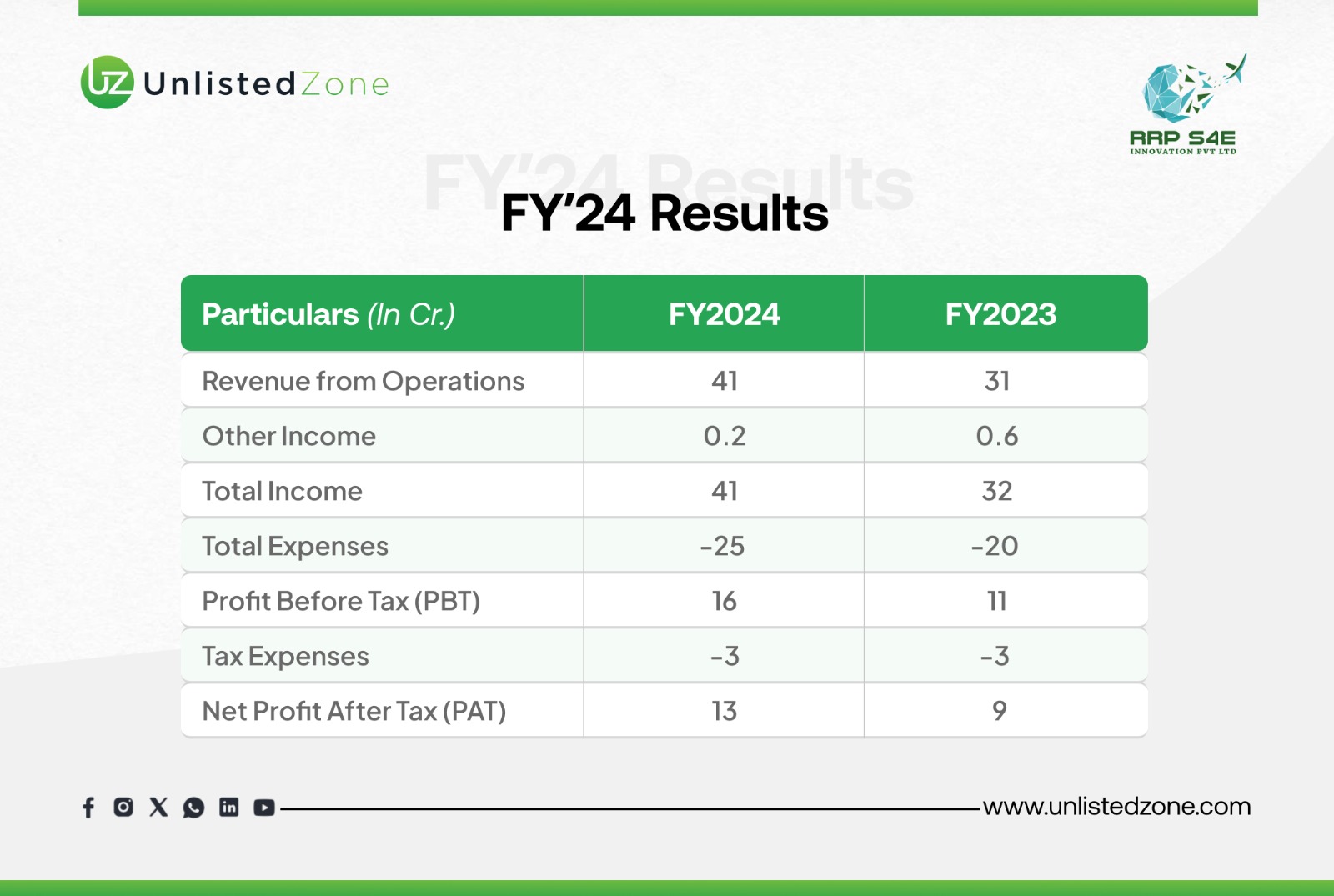

RRP S4E Innovation delivered a stellar financial performance in FY24, marked by significant growth in revenue and profitability.

Analysis:

The company achieved, rising from ₹31 crore in FY23 to ₹41 crore in FY24. Despite higher operating expenses, profit before tax surged 43%, while net profit jumped over 50%, underscoring strong operational efficiency and scalability.

Strong 32% growth in Revenue : Revenue from Operations increased significantly from ₹31 Cr in FY23 to ₹41 Cr in FY24.

Higher Profitability: Profit Before Tax (PBT) saw robust growth OF 43%, rising from ₹11 Cr to ₹16 Cr.

Improved Bottom Line: Net Profit After Tax (PAT) also grew healthily from ₹9 Cr to ₹13 Cr.

Controlled Expenses: While Total Expenses increased from ₹20 Cr to ₹25 Cr, this was in line with the higher scale of operations, as profits grew at a faster rate.

Interpretation:

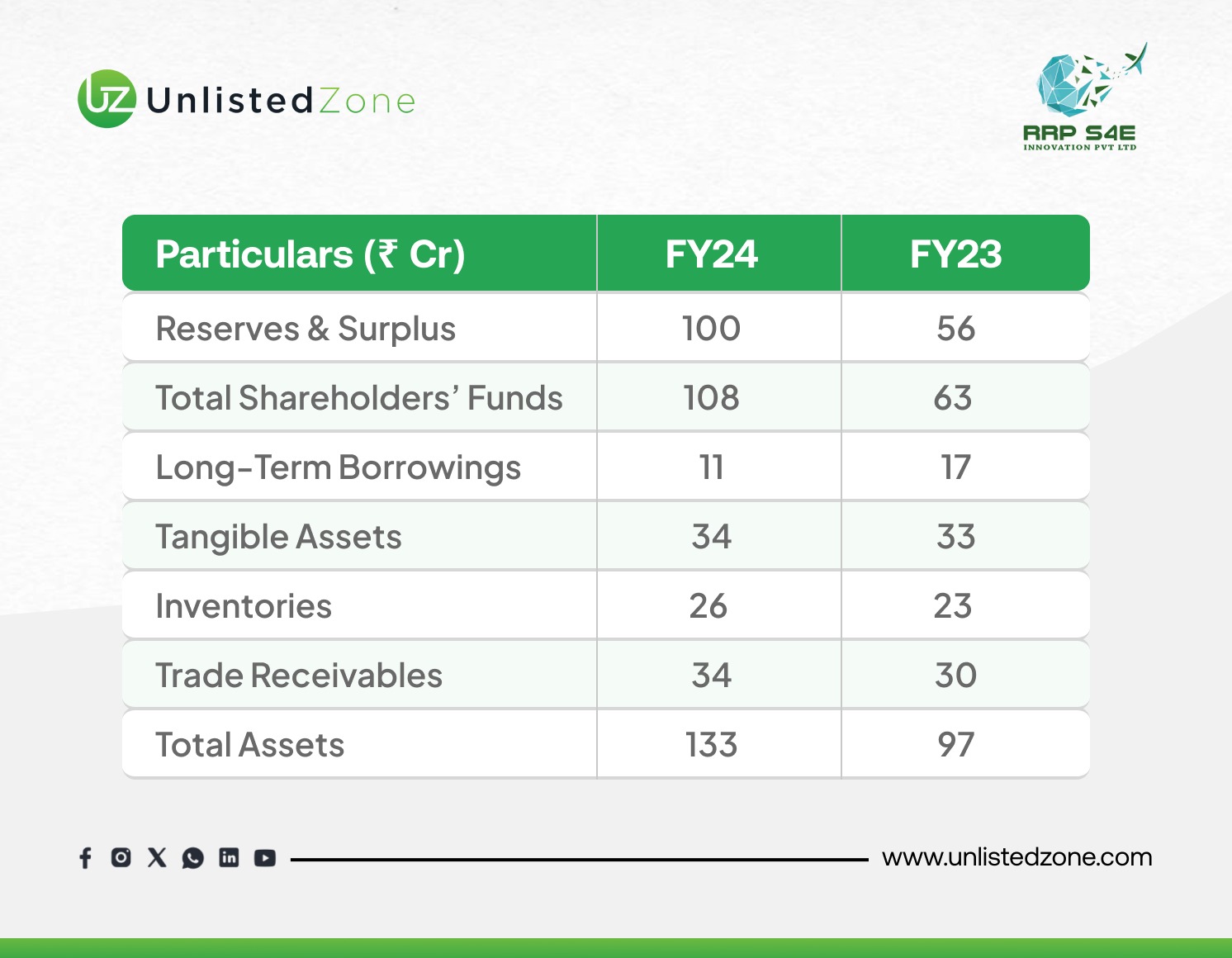

Strengthened Equity: Reserves & Surplus grew substantially from ₹56 Cr to ₹100 Cr, boosting Total Shareholders’ Funds from ₹63 Cr to ₹108 Cr.

Reduced Debt: Long-Term Borrowings decreased from ₹17 Cr to ₹11 Cr, indicating improved financial leverage and lower interest obligations.

Asset Growth: Total Assets expanded significantly from ₹97 Cr to ₹133 Cr, reflecting company growth and investment.

Key Asset Increases:

Tangible Assets increased slightly (₹33 Cr to ₹34 Cr), showing stable capital investment.

Inventories rose (₹23 Cr to ₹26 Cr), likely to support higher sales.

Trade Receivables The company’s trade receivables stand at ₹34 crore against revenue of ₹41 crore, which is significantly high. This indicates that a large portion of the sales remains uncollected, leading to stretched working capital and putting pressure on cash flows from operations.

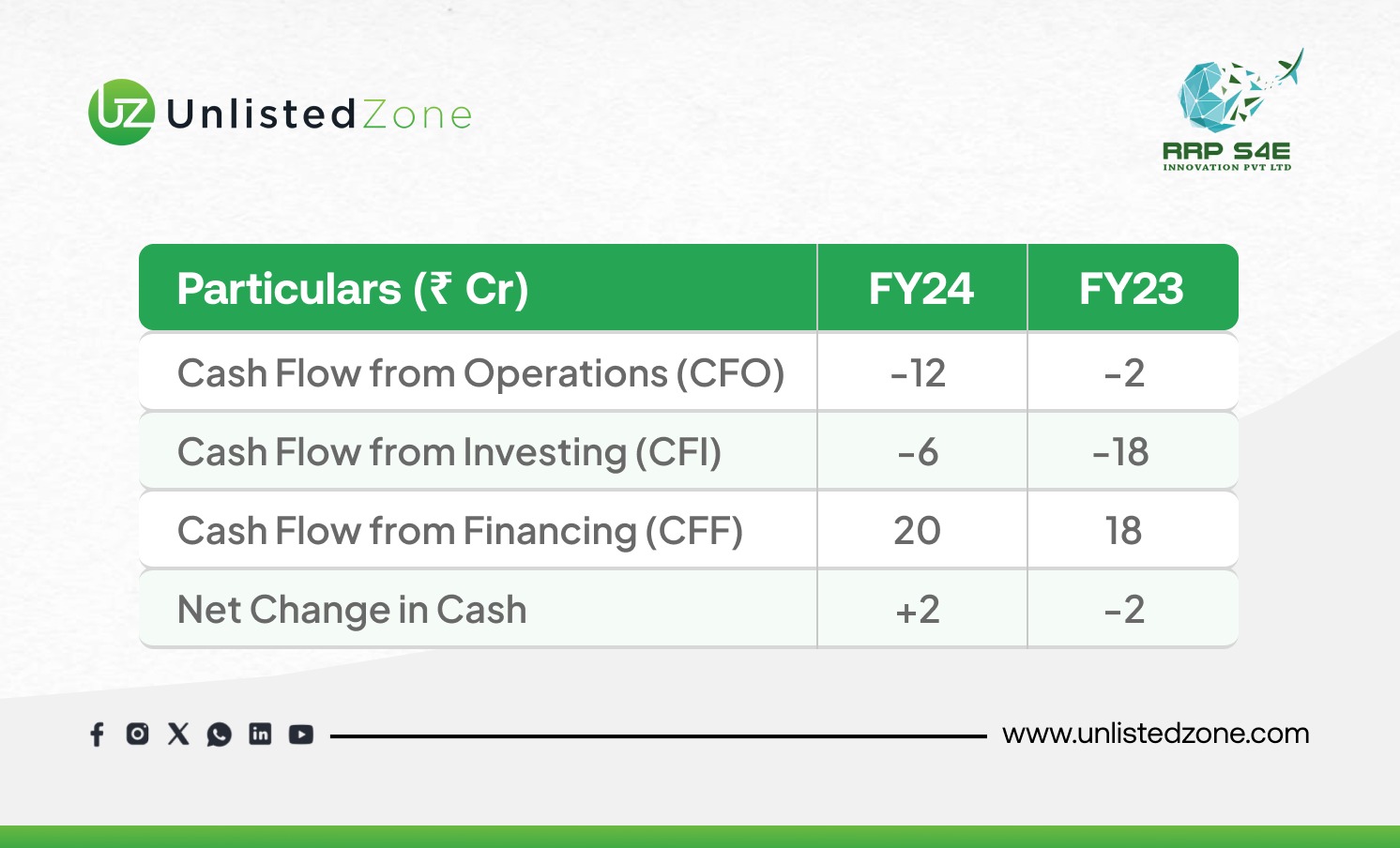

Analysis:

Negative Operating Cash Flow: Cash Flow from Operations (CFO) was negative and worsened from -₹2 Cr in FY23 to -₹12 Cr in FY24, indicating core business activities consumed more cash than they generated.

Investment Continues: Cash Flow from Investing (CFI) was negative in both years (-₹18 Cr in FY23 and -₹6 Cr in FY24), showing ongoing investment in assets, though at a lower rate in FY24.

Financing as Key Source: Cash Flow from Financing (CFF) was strongly positive (₹18 Cr in FY23 and ₹20 Cr in FY24), meaning the company relied on external funding (like loans or equity) to fund its operations and investments.

Marginal Cash Increase: Despite operational cash burn, the strong financing inflow led to a net increase in cash of ₹2 Cr in FY24, a reversal from the net decrease of ₹2 Cr in FY23.

Insight:

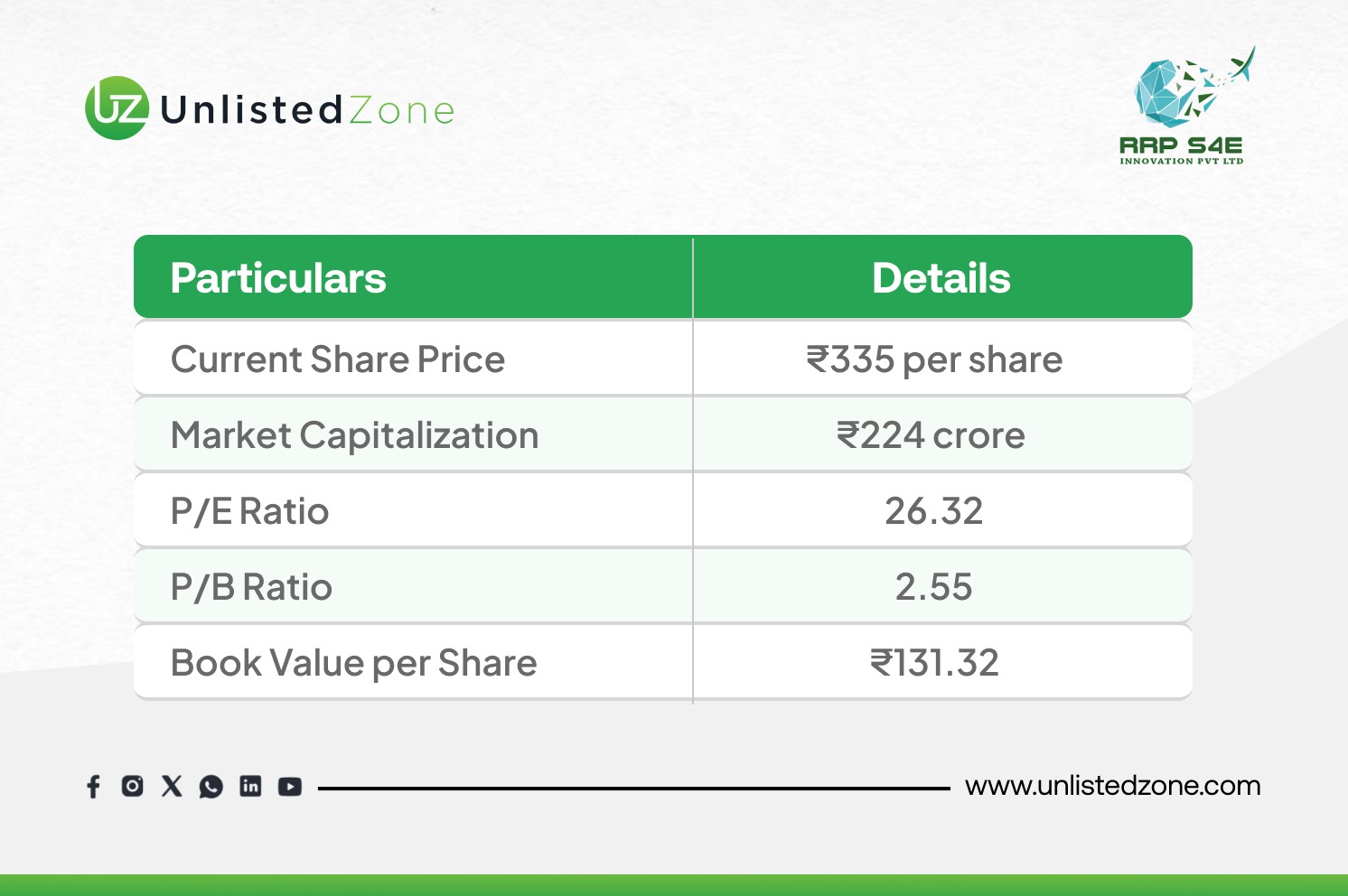

At a P/E ratio of 26.3 and P/B ratio of 2.55, RRP S4E Innovation’s valuation reflects strong investor confidence and sustained market optimism, supported by consistent profitability and strategic growth prospects ahead of its IPO.

RRP S4E Innovation Ltd. stands at the intersection of technology, defense, and innovation, driving India’s self-reliance in electro-optic and surveillance systems. With a visionary founder, diversified product line, growing international footprint, and consistent financial strength, the company is poised to emerge as a key force in India’s defense-tech ecosystem.

As it prepares to go public, RRP S4E represents a blend of innovation, credibility, and national purpose—a true embodiment of “Make in India” excellence.

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.