For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years:

“When will the exchange actually revive?”

On 8 January 2026, MSEI released a circular that attempts to answer this question—not with promises, but with market structure.

It’s called the Liquidity Enhancement Scheme (LES).

Let’s break down why this circular matters, what has changed on the ground, and whether this can genuinely restart the exchange or is just another experiment.

A) First, the Core Problem MSEI Has Always Faced

Exchanges don’t fail because they lack listings.

They fail because nobody trades.

MSEI’s biggest challenges have been:

-

Thin or non-existent order books

-

Wide bid–ask spreads

-

No certainty of entry or exit

-

Low confidence among retail and institutional investors

This created a vicious cycle:

-

Investors avoided the exchange due to low liquidity

-

Low liquidity kept volumes depressed

-

Depressed volumes discouraged brokers and market makers

LES is designed to break this cycle from the liquidity side, not from marketing or branding.

B) What Exactly Is the Liquidity Enhancement Scheme?

In simple terms, MSEI is saying:

“We will pay professional market makers to continuously provide buy and sell quotes, so that investors always see liquidity on the screen.”

This is not new globally.

It is how serious exchanges operate.

But for MSEI, this is the first large-scale, incentive-driven attempt to institutionalise liquidity.

C) The Most Important Shift: Mandatory Two-Way Markets

Under LES:

-

Designated Market Makers must provide both buy and sell quotes

-

Quotes must be present for 85–90% of market hours

-

Single-side quotes don’t count

Why this matters:

-

Investors are no longer stuck holding shares without exit

-

Prices don’t jump irrationally due to one-sided orders

-

Trading becomes predictable rather than speculative

Liquidity is no longer optional—it’s an obligation.

D) Depth Matters More Than Just Quotes

MSEI hasn’t stopped at “best bid–best ask”.

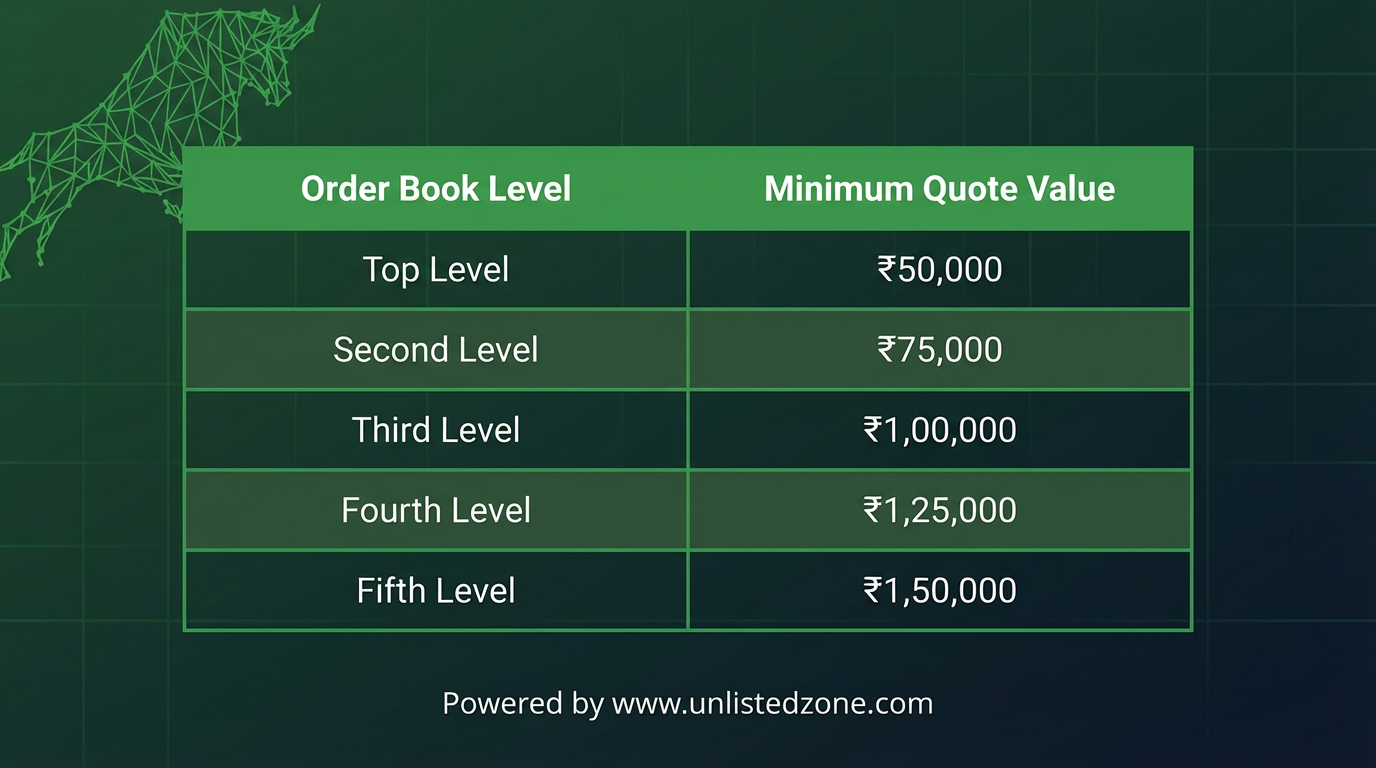

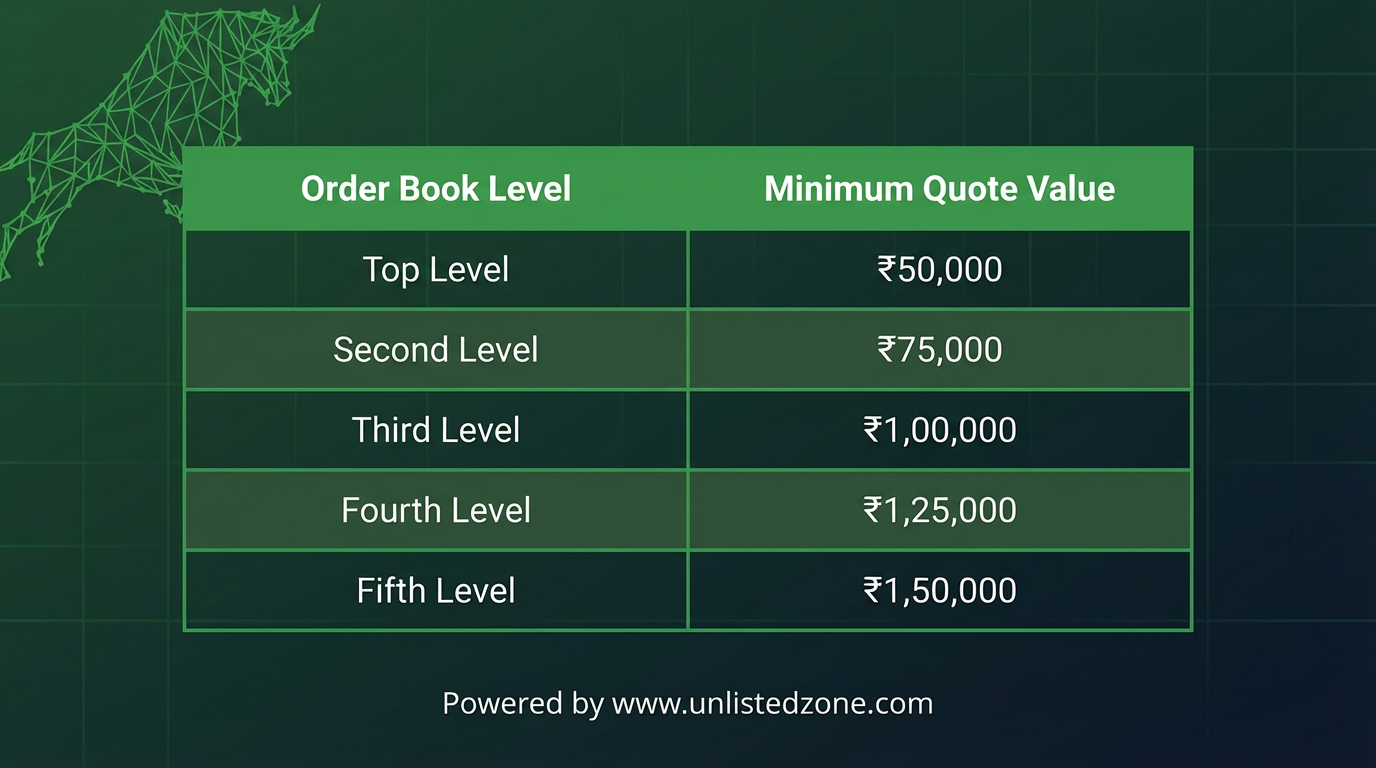

Market makers must quote across five levels of the order book, with increasing value commitments:

This is crucial because:

-

It creates real depth, not cosmetic liquidity

-

Large orders don’t distort prices

-

Volatility reduces naturally

This is how exchanges protect investors during sudden buying or selling pressure.

E) Tight Bid–Ask Spreads = Lower Hidden Costs

LES also caps the maximum bid–ask spread:

Why this matters:

Liquidity isn’t just about volume—it’s about fair pricing.

F) The Incentive That Changes Everything

Here’s the headline number:

₹40 lacs per month per market maker

That’s not symbolic. That’s serious capital.

Plus:

This does two things:

-

Makes market making economically viable

-

Attracts serious, tech-driven trading members—not casual participants

Liquidity costs money. MSEI has finally acknowledged that.

G) Why the Stock List Is Strategically Important

The scheme covers 130 high-quality, widely followed stocks, including:

-

Large banks and financials

-

PSU majors

-

IT, FMCG, metals, auto

-

New-age names like Swiggy, Meesho, Lenskart

This matters because:

-

Liquidity must start with familiar names

-

Investors compare prices with NSE/BSE instantly

-

If prices converge, confidence follows

Once trust is rebuilt in liquid names, activity can expand organically.

H) What This Means for Investors in MSEI

For MSEI shareholders, this circular is important for one reason:

It signals structural intent, not cosmetic intent.

Instead of:

-

Press releases

-

Rebranding

-

One-off announcements

MSEI is investing in:

-

Market depth

-

Execution certainty

-

Price discovery

These are the foundations of a functioning exchange.

I) But Will This Alone Restart the Exchange?

Short answer: Not immediately—but it’s a necessary first step.

LES can:

But for a full revival, MSEI will still need:

-

Sustained participation beyond incentives

-

Regulatory support continuity

-

Broker ecosystem expansion

-

Product innovation over time

Liquidity can be bought initially.

Trust has to be earned gradually.

J) The Big Takeaway for Long-Term Investors

This scheme does not guarantee success.

But it does confirm something important:

MSEI is no longer ignoring its core weakness.

For investors who have stayed invested hoping for a restart, LES is the strongest operational signal so far that the exchange wants to compete on market quality—not narratives.

The real test will be:

If that happens, this circular may be remembered as the point where MSEI stopped talking about revival—and started engineering it.