Who Is Maxvalue Credit and Investments?

Maxvalue Credit and Investments Limited is a non-banking financial company (NBFC) focused on retail and small-ticket lending, primarily across southern India.

The company offers a diversified loan portfolio that includes:

-

Auto Loans

-

Gold Loans

-

Trader & MSME Loans

-

Microfinance Loans

Alongside lending, Maxvalue also provides investment products to its investors in the form of fully secured Non-Convertible Redeemable Debentures (NCDs) and Subordinated Debt, strictly in line with regulations prescribed by the Reserve Bank of India (RBI) and the Companies Act, 2013.

In simple terms, Maxvalue borrows money at regulated costs, lends it across secured and semi-secured products, and earns the spread—while maintaining capital buffers well above regulatory thresholds.

Safe on Capital, Soft on Profits — What’s Really Going On?

At first glance, this NBFC looks safe. Capital adequacy is strong, branches are spread across four southern states, and gold loans now dominate the portfolio. But dig deeper into the numbers, and a more nuanced story emerges—one of shrinking income, stressed asset quality in key segments, and profitability under pressure.

Income Is Falling—and Fast

Total income declined sharply:

-

FY23: ₹136.7 crore

-

FY25: ₹104.7 crore

That’s a ~23% drop in just two years.

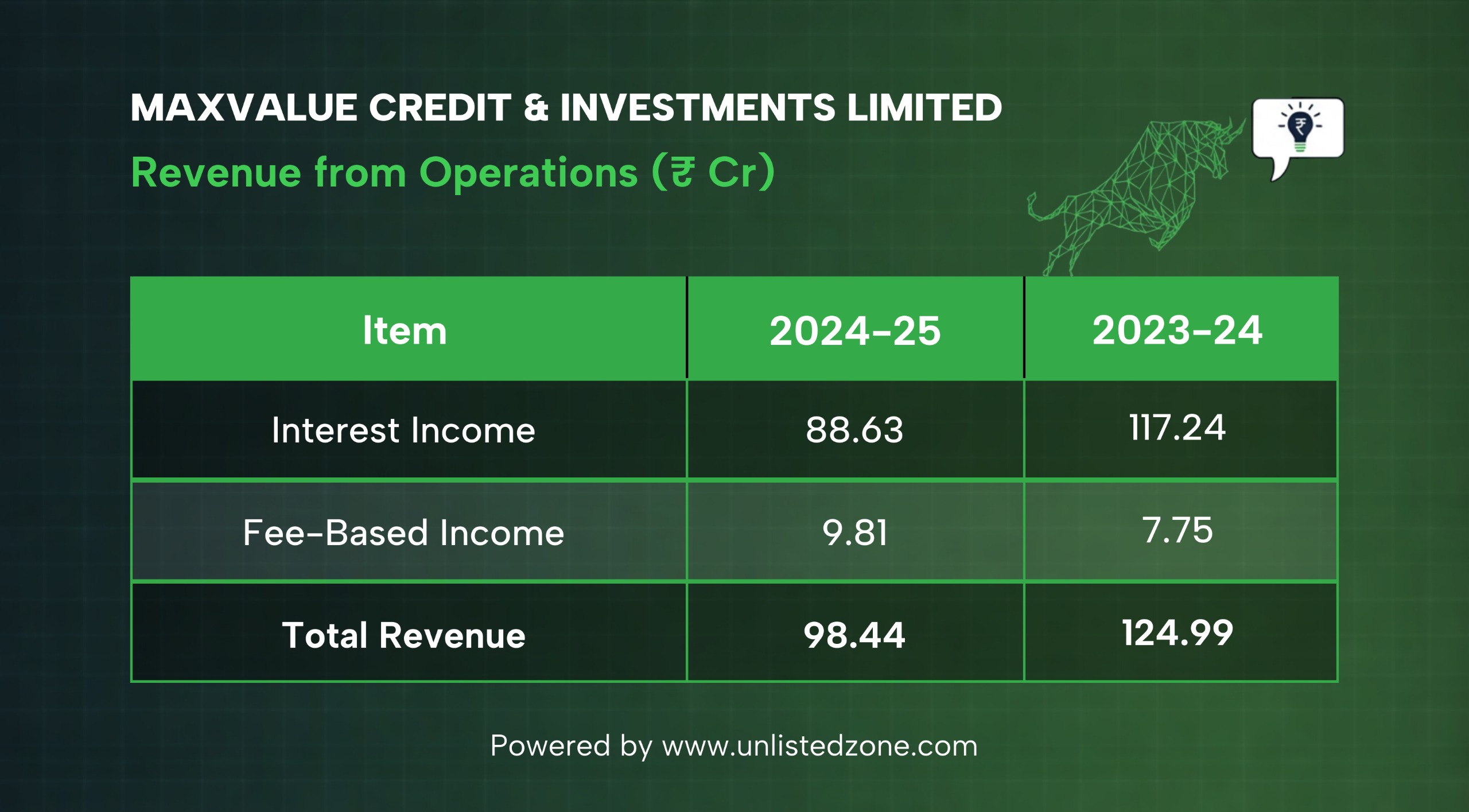

The core reason? Interest income, which fell from ₹117.2 crore to ₹88.6 crore. While fee-based income did grow (₹7.8 crore → ₹9.8 crore), it wasn’t enough to offset the fall in lending income.

Translation: The lending book is either shrinking, yielding less, or both.

Revenue from Operations (₹ Cr)

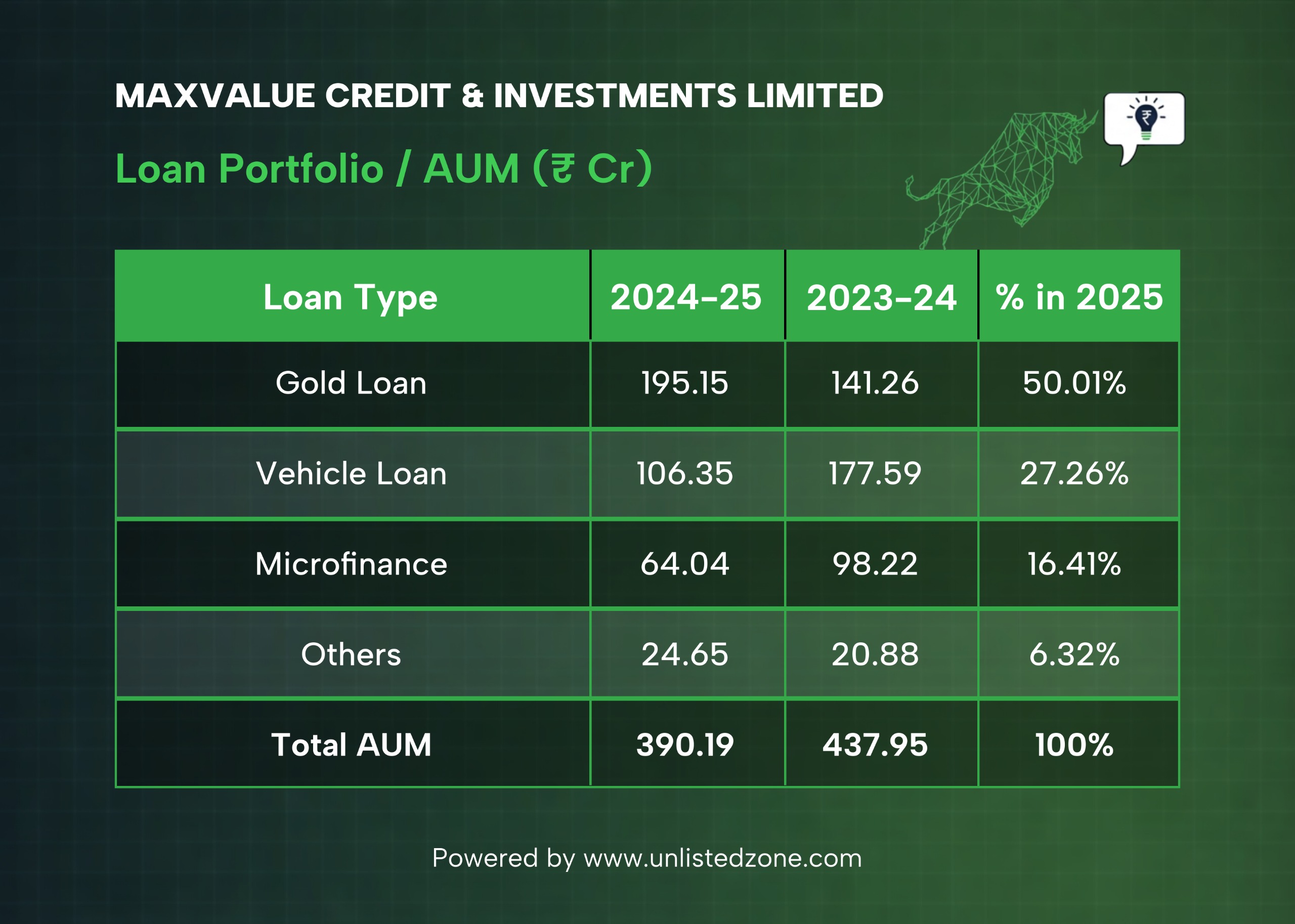

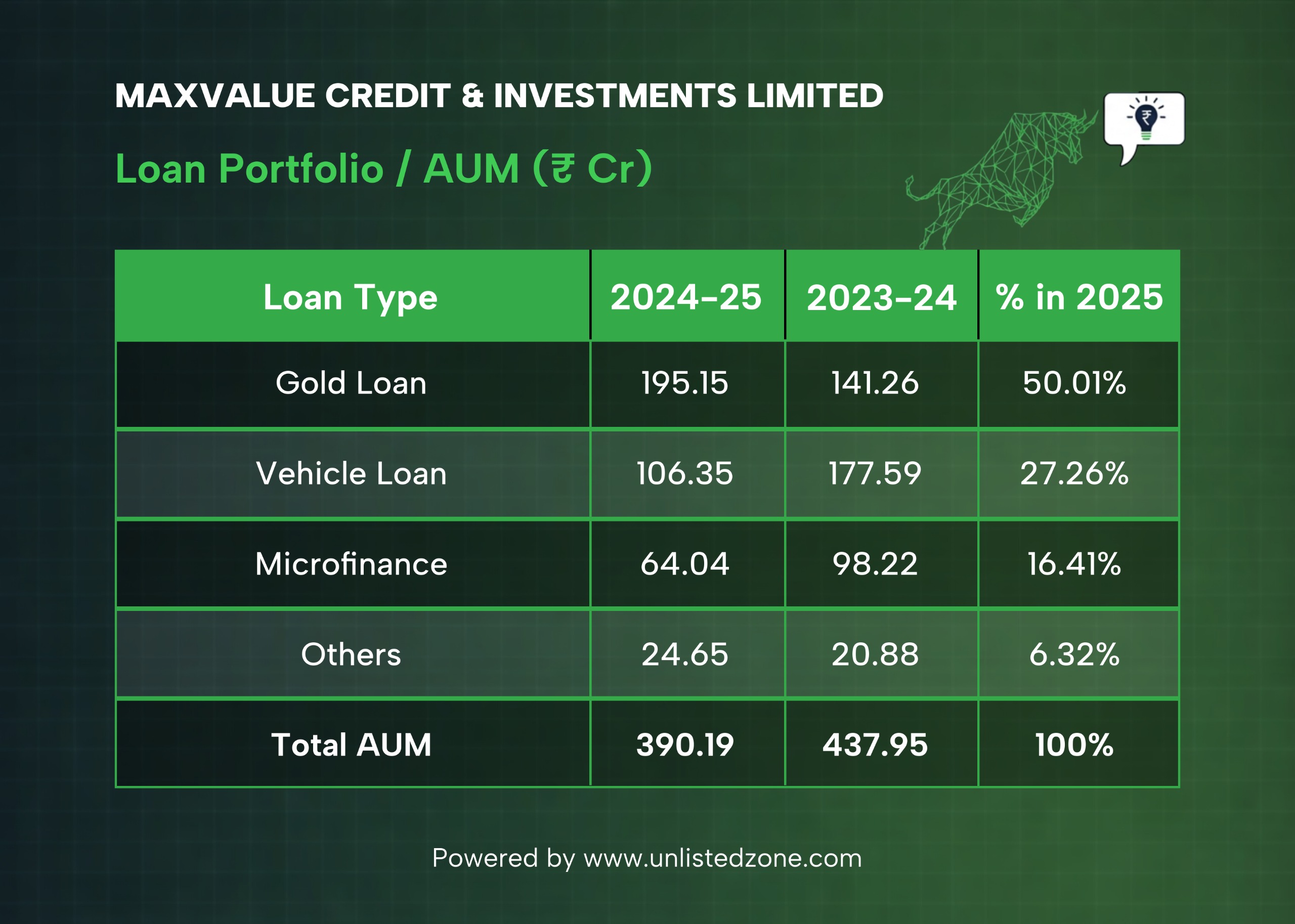

Loan Portfolio / AUM (₹ Cr)

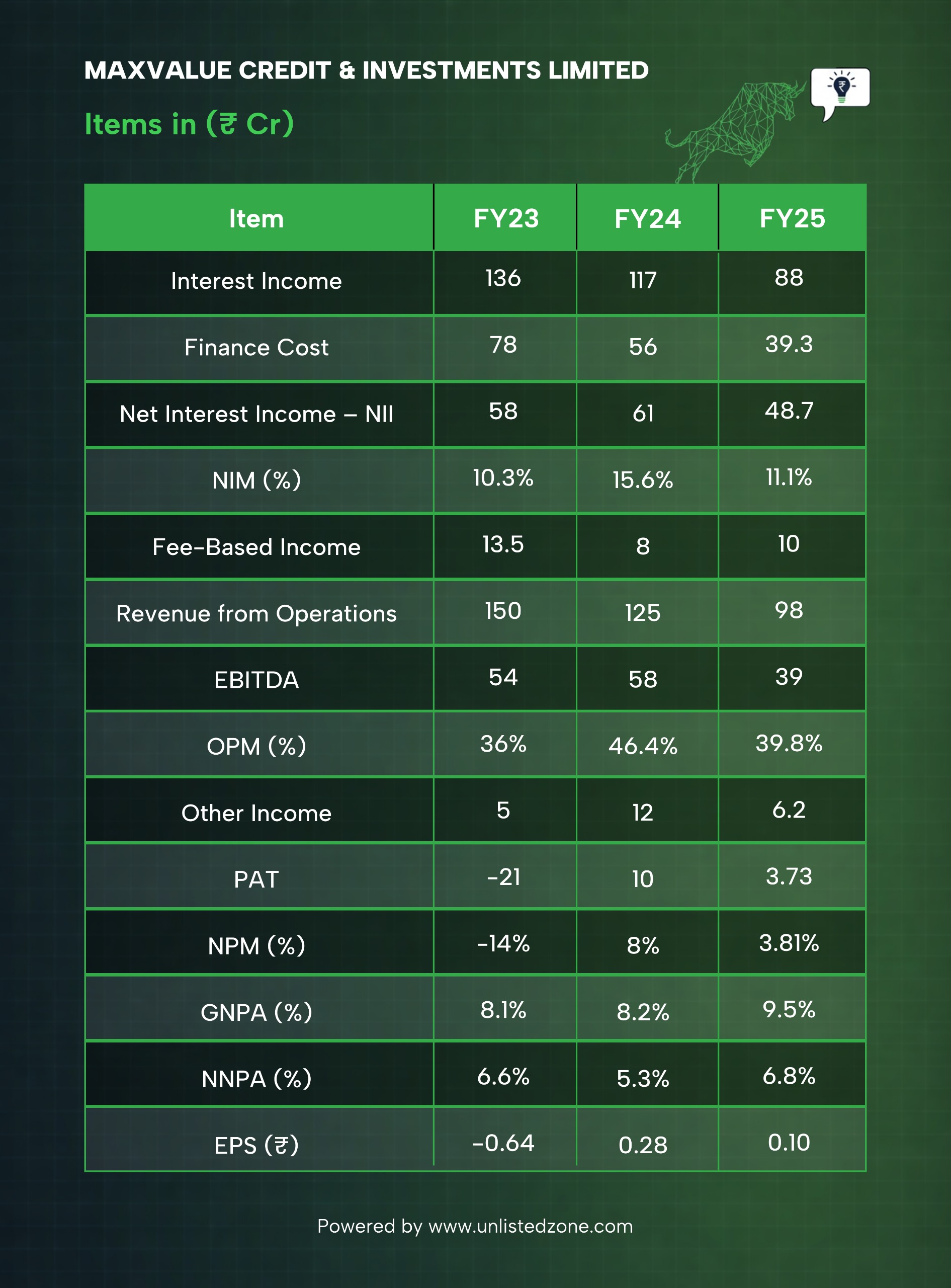

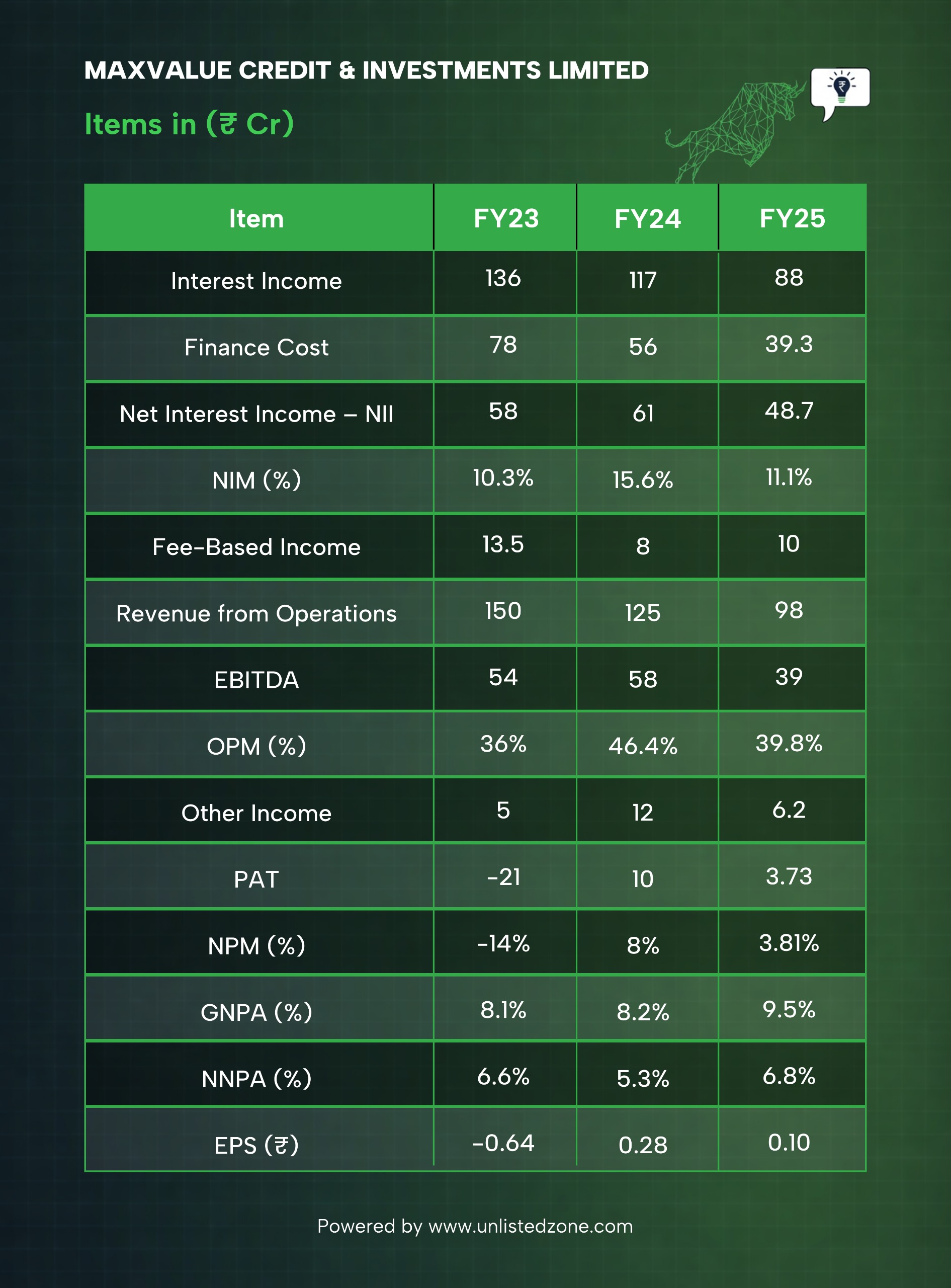

Profitability & Margin Snapshot (FY23–FY25)

What this reveals:

-

NII peaked in FY24 but slipped in FY25 as loan growth slowed.

-

NIM expansion in FY24 was driven by lower funding costs; FY25 shows margin compression despite cheaper borrowings.

-

Operating margins remain healthy, but they cannot fully offset falling revenues.

-

Asset quality deterioration in FY25 (GNPA & NNPA) directly explains the sharp drop in PAT.

Profits: From Recovery to Regression

After years of losses, the company finally turned profitable in FY24 with a PAT of ₹10 crore. But the relief was short-lived.

-

FY24 PAT: ₹10.4 crore

-

FY25 PAT: ₹3.7 crore

Margins compressed sharply:

So while the company stayed in the black, profitability weakened significantly.

Cost Control Helped—But Not Enough

There is one positive: operating discipline.

Between FY22 and FY25:

-

Employee expenses fell from ₹36 crore to ₹33 crore

-

Other expenses nearly halved from ₹58 crore to ₹26 crore

-

Finance costs dropped sharply from ₹96 crore to ₹39 crore

Despite this, profits still fell—highlighting that revenue pressure, not costs, is the real issue.

Loan Book: Safer Mix, Smaller Size

Total AUM shrank:

-

FY24: ₹438 crore

-

FY25: ₹390 crore

But the composition improved:

The strategy is clear: shift toward secured, lower-risk lending—even if it means slower growth.

The Real Red Flag: Asset Quality

Gross NPAs stand at ₹37.1 crore, or 9.5% of whole loan book—high for comfort.

The stress is concentrated:

Gold loans, however, remain extremely stable.

The legacy vehicle and microfinance book is hurting returns and absorbing provisions.

Physical Footprint

The company operates 139 branches, largely concentrated in:

-

Kerala (78)

-

Karnataka (50)

Plus:

-

8 microfinance hubs

-

7 auto loan hubs

This southern focus aligns well with gold-loan-led lending.

The UnlistedZone Take

This is a classic case of stability over speed.

The NBFC is deliberately shrinking risky portfolios, cutting costs, and leaning into gold loans. That makes the balance sheet safer—but also caps growth and profitability in the near term.

If asset quality in vehicle and microfinance loans improves, earnings could stabilise. If not, expect profits to remain muted despite strong capital buffers.

Safe? Yes.

High-growth? Not yet.