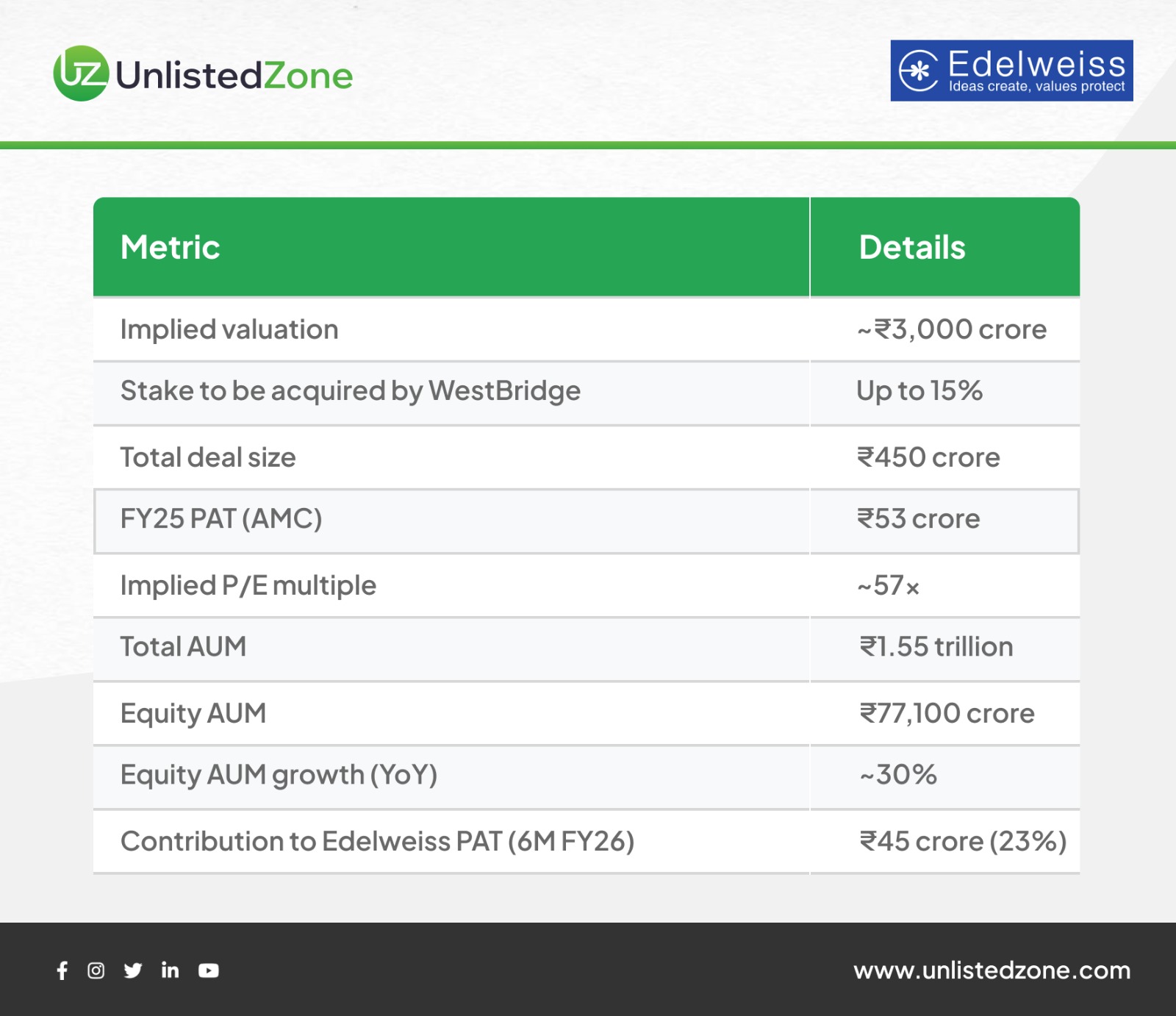

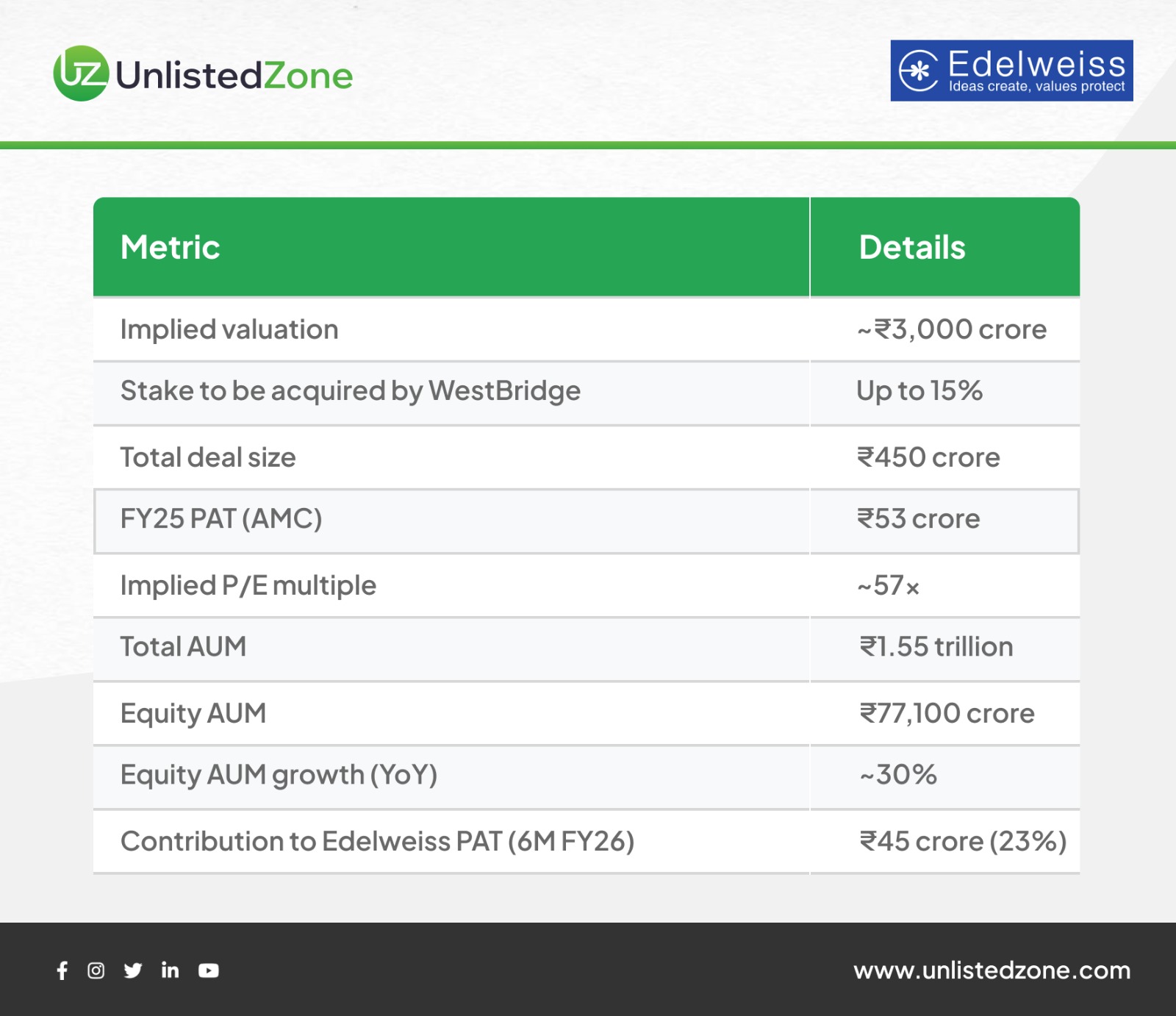

Edelweiss Financial Services has sold 10% of Edelweiss Asset Management (AMC) to WestBridge Capital, as part of a larger transaction that values the AMC at ~₹3,000 crore. WestBridge will eventually acquire up to 15% for ₹450 crore, with the remaining stake to be transferred by March 2026.

The real question: Is this valuation justified given Edelweiss AMC’s AUM and profitability?

What exactly happened?

-

Date of transfer: 17 December

-

Stake sold: 10% (additional 5% to follow)

-

Buyers: WestBridge affiliates — Setu AIF Trust, Konark Trust, MMPL Trust

-

Regulatory approvals:

-

CCI: 21 October

-

SEBI: 12 November

-

Investor exit window: Closed on 2 December

This was a fully regulator-approved transaction with no structural surprises.

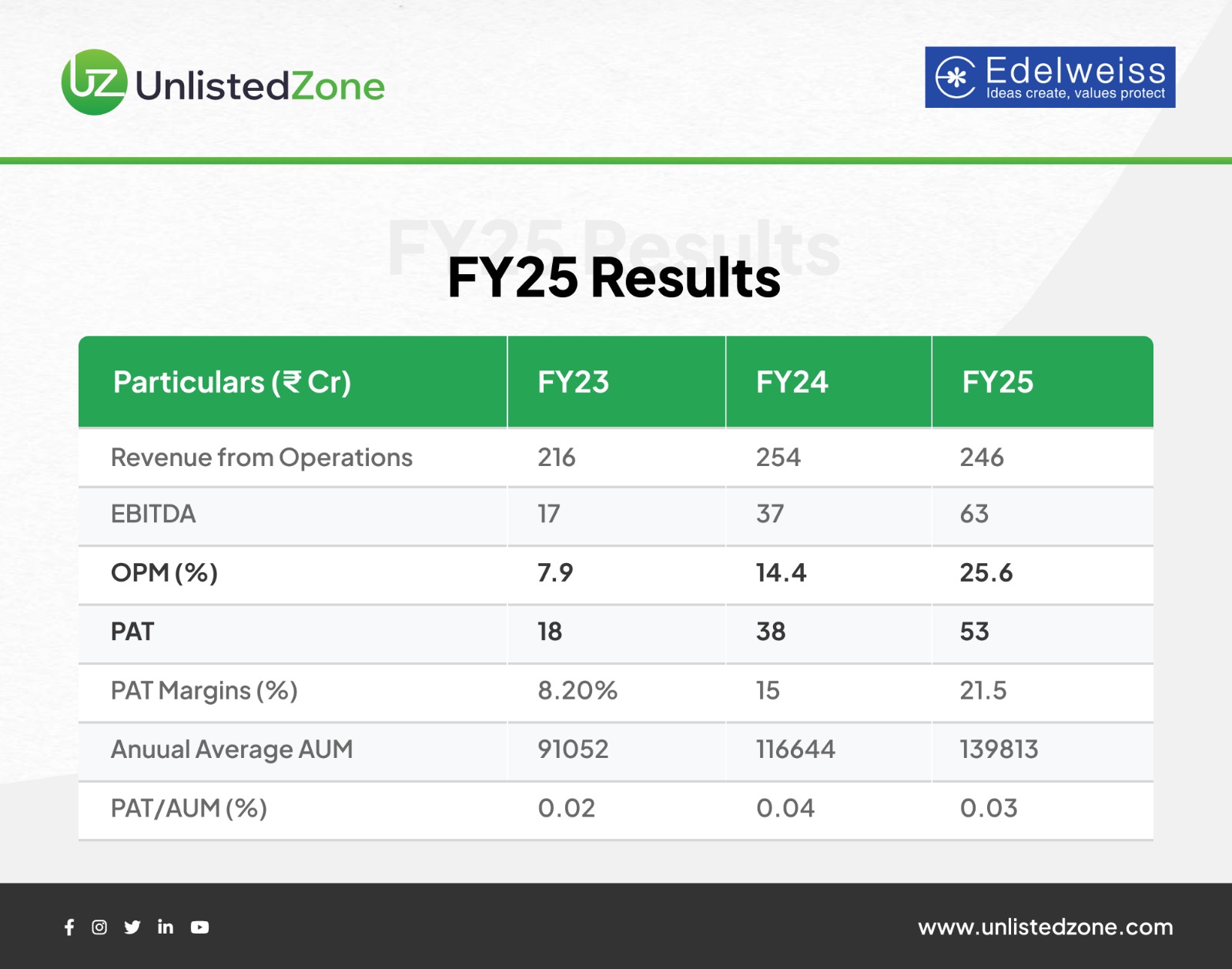

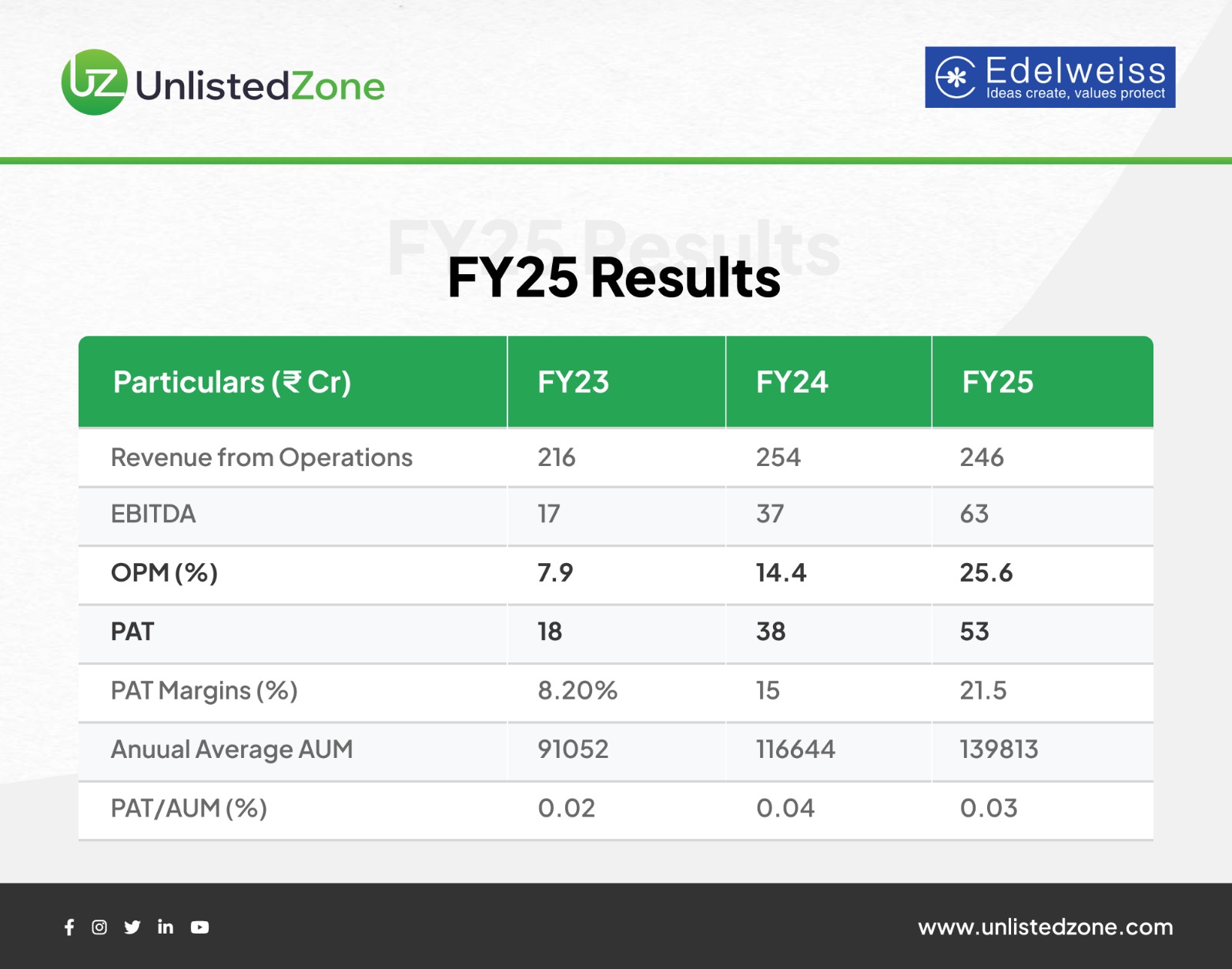

Financials Performance in Crores

Key numbers at a glance

Why WestBridge is interested

WestBridge manages $7+ billion in AUM globally and typically invests in:

-

Scaled financial platforms

-

Predictable cash-generating businesses

-

Long-term structural growth stories

Edelweiss AMC fits this profile well:

-

Profitable asset management platform

-

Strong equity AUM growth

-

Diversified products (Mutual Funds, AIFs, PMS)

-

Operating leverage beginning to reflect in profits

In simple terms, WestBridge is backing India’s rising equity participation trend.

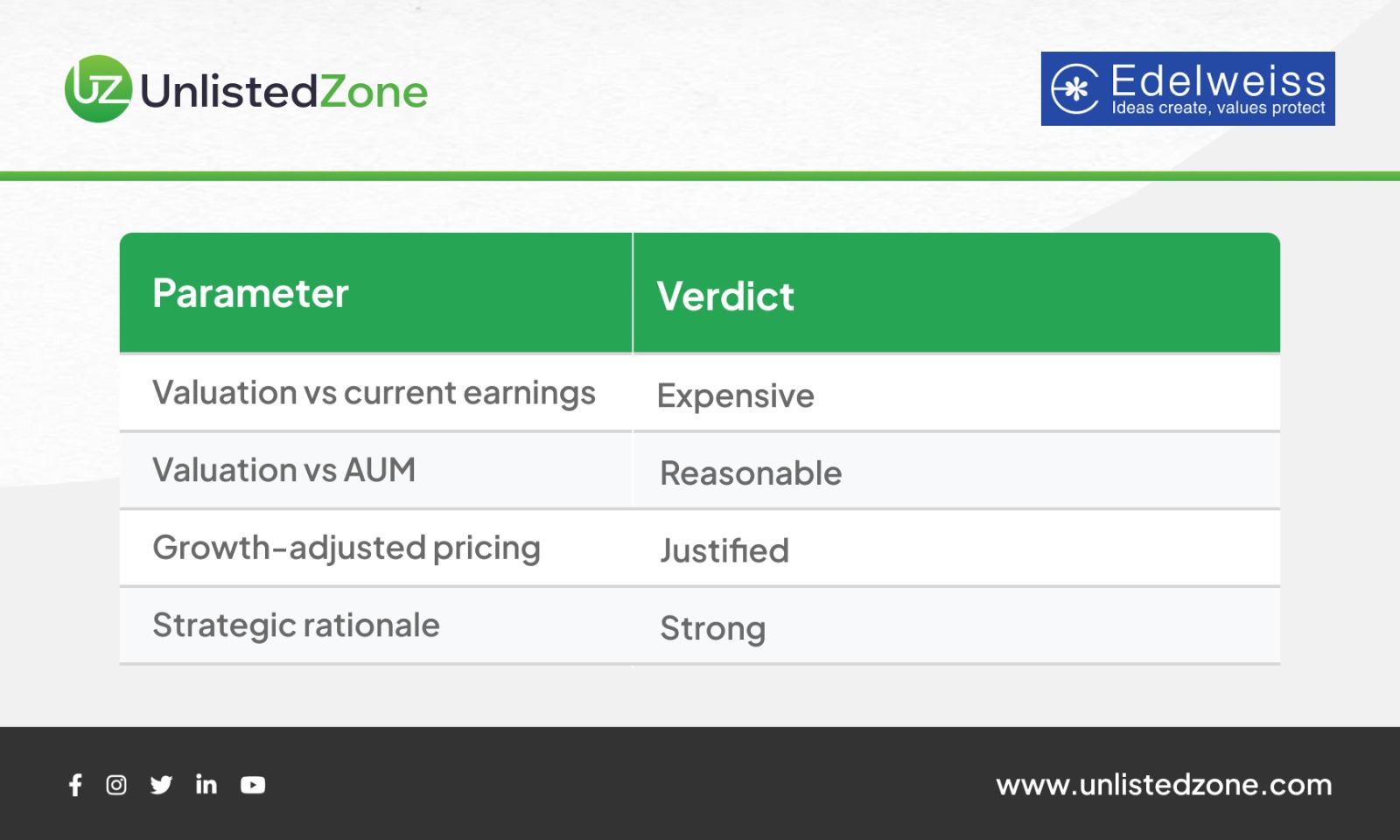

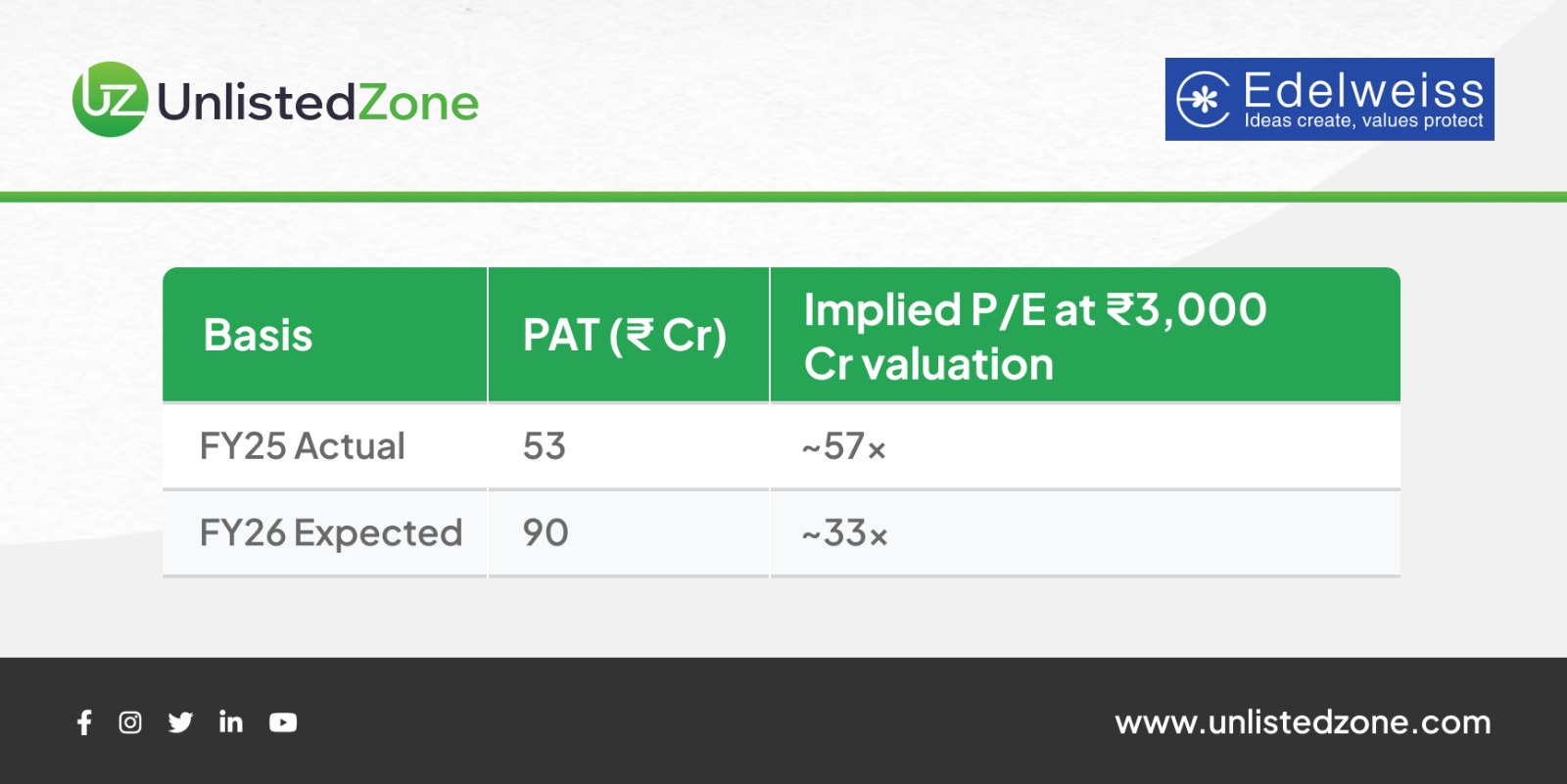

The valuation debate: Is 57x P/E too expensive?

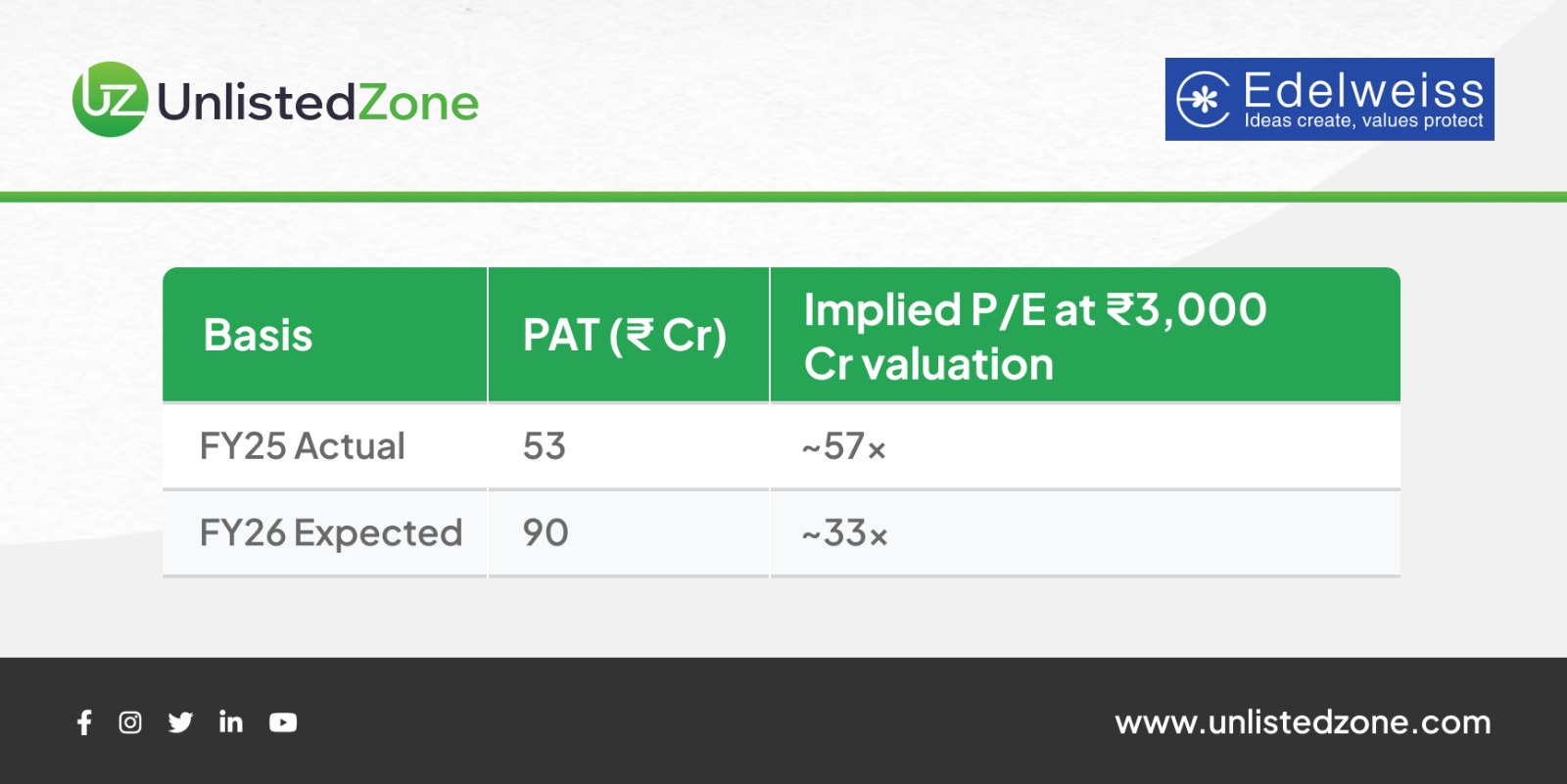

Re-rating the deal with FY26E PAT of ₹90 crore

The initial narrative around the deal focused on a ~57x P/E, derived from FY25 PAT of ₹53 crore. However, management guidance and operating leverage point to a FY26E PAT of ~₹90 crore, which meaningfully changes the valuation picture.

At ~33x FY26E earnings, Edelweiss AMC no longer looks expensive. Instead, it starts to look undervalued relative to listed peers, especially given its growth trajectory.

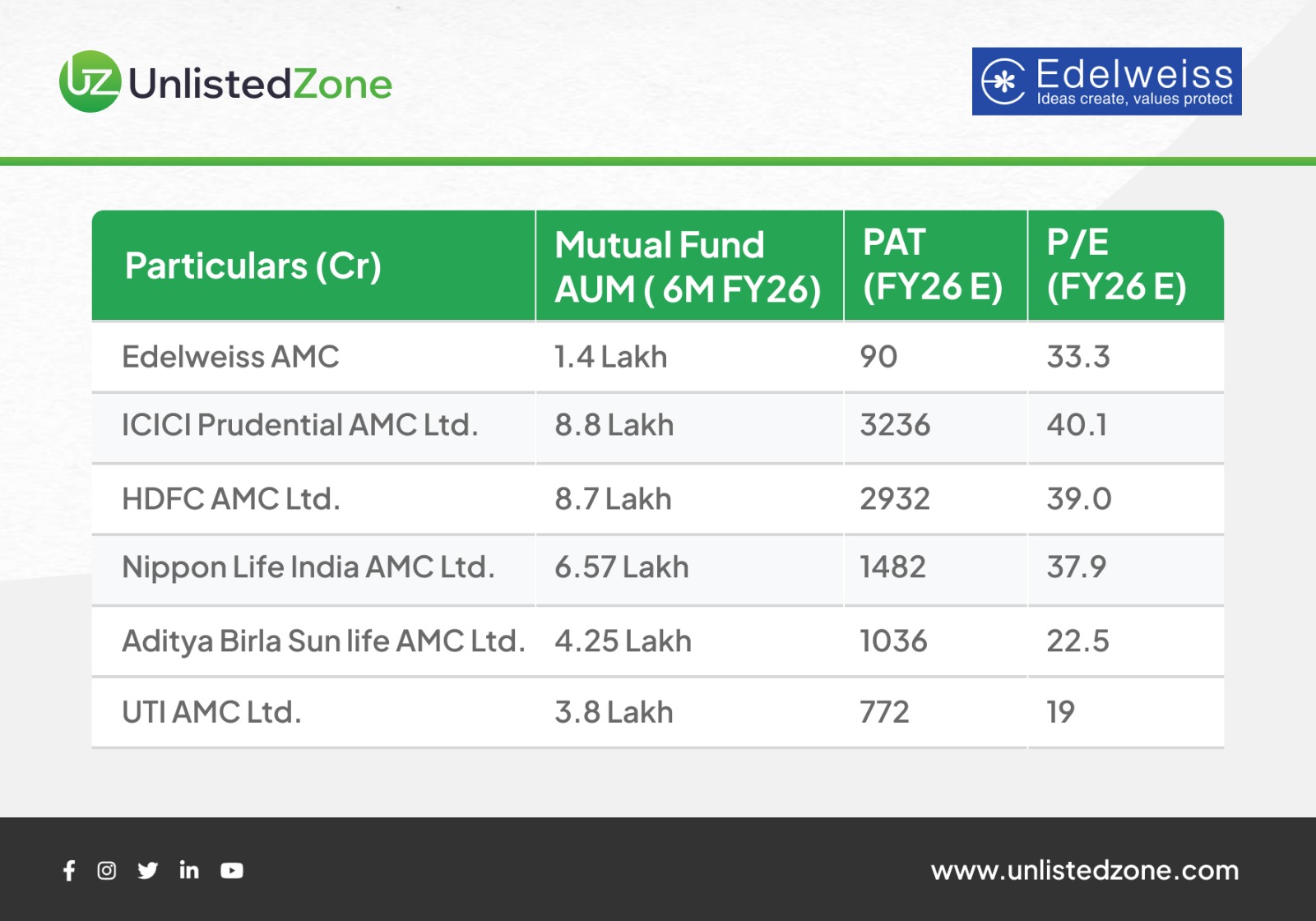

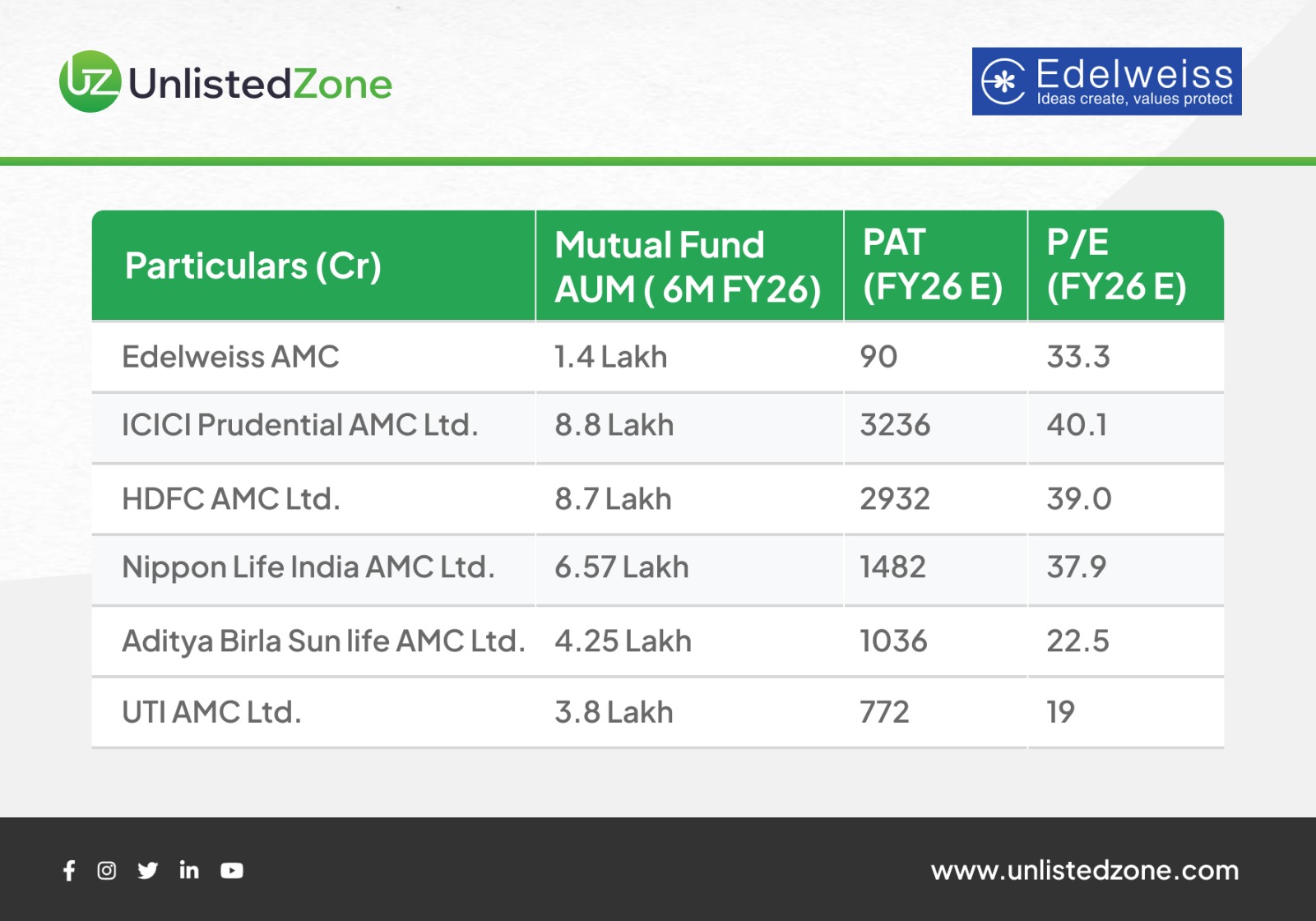

Industry comparison: How Edelweiss stacks up against listed AMCs

A forward-looking comparison puts the valuation into sharper context.

What stands out:

-

Edelweiss AMC trades at the moderate forward P/E of 33x among major peers

-

Larger AMCs enjoy scale stability, yet command 20–40x forward earnings

-

Edelweiss, despite smaller AUM, is growing faster in equity assets, justifying convergence in multiples over time

This comparison strongly suggests that WestBridge entered at a conservative forward multiple.

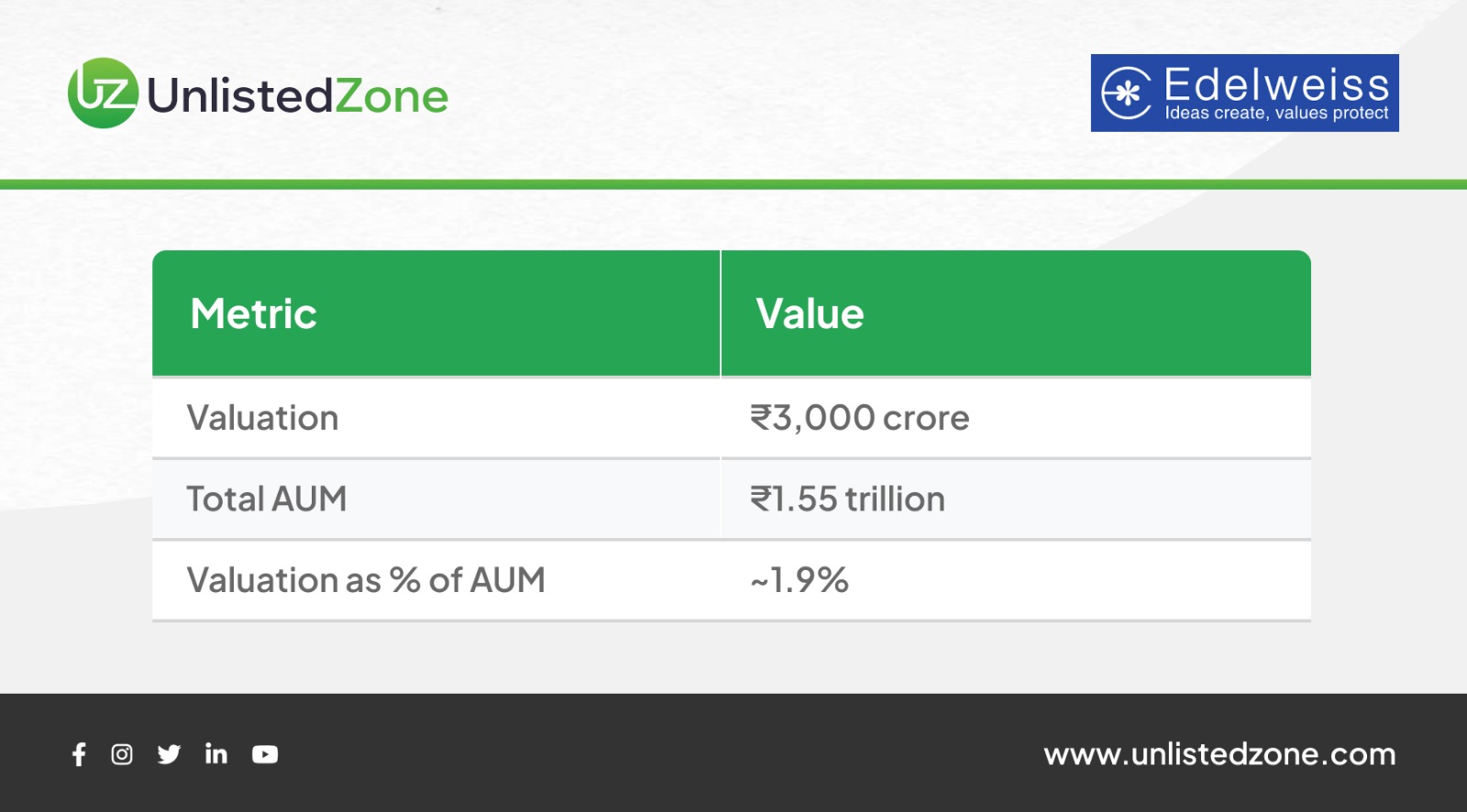

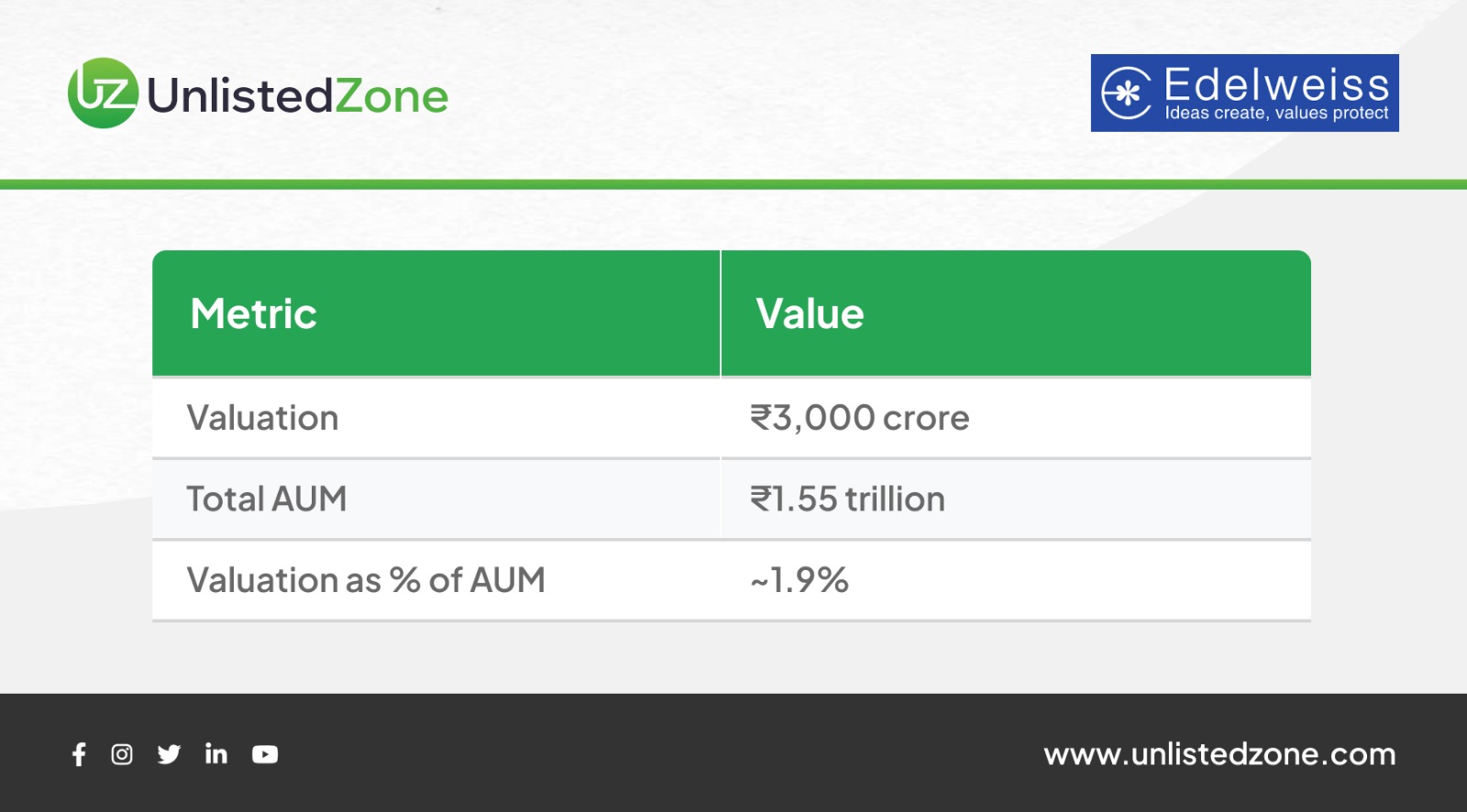

AUM-based sanity check (the more relevant lens)

AMCs are often valued as a percentage of Assets Under Management, not just earnings.

Is the ₹3,000 crore valuation justified?

Looking at the deal through multiple lenses, the answer increasingly tilts towards yes.

1. Forward earnings justify the price

At a valuation of ₹3,000 crore and FY26E PAT of ₹90 crore, Edelweiss AMC is valued at ~33x forward earnings. This is:

In effect, WestBridge is paying less for future profits than what the market assigns to mature AMCs today.

2. AUM-based valuation is within comfort zone

Within the industry's standard valuation range of 5-15% of AUM, Edelweiss AMC sits at ~1.9%, compared to HDFC AMC's ~8% valuation on its ₹12 lakh crore AUM with a Market Capitalization of More than 1 lakh Crore.

Given Edelweiss AMC increasing equity mix and improving margins, a move towards the upper end of this band over time is plausible.

3. Scale-up optionality is not fully priced in

Despite strong growth, Edelweiss AMC operates at a much smaller scale than peers. As AUM scales up:

The current valuation does not fully price in this operating leverage.

4. Downside protection for the buyer

Even if growth moderates, the entry multiple of ~33x FY26E relative to peers trading at 20–40x. This asymmetry—limited downside, meaningful upside—makes the valuation attractive for a long-term investor.

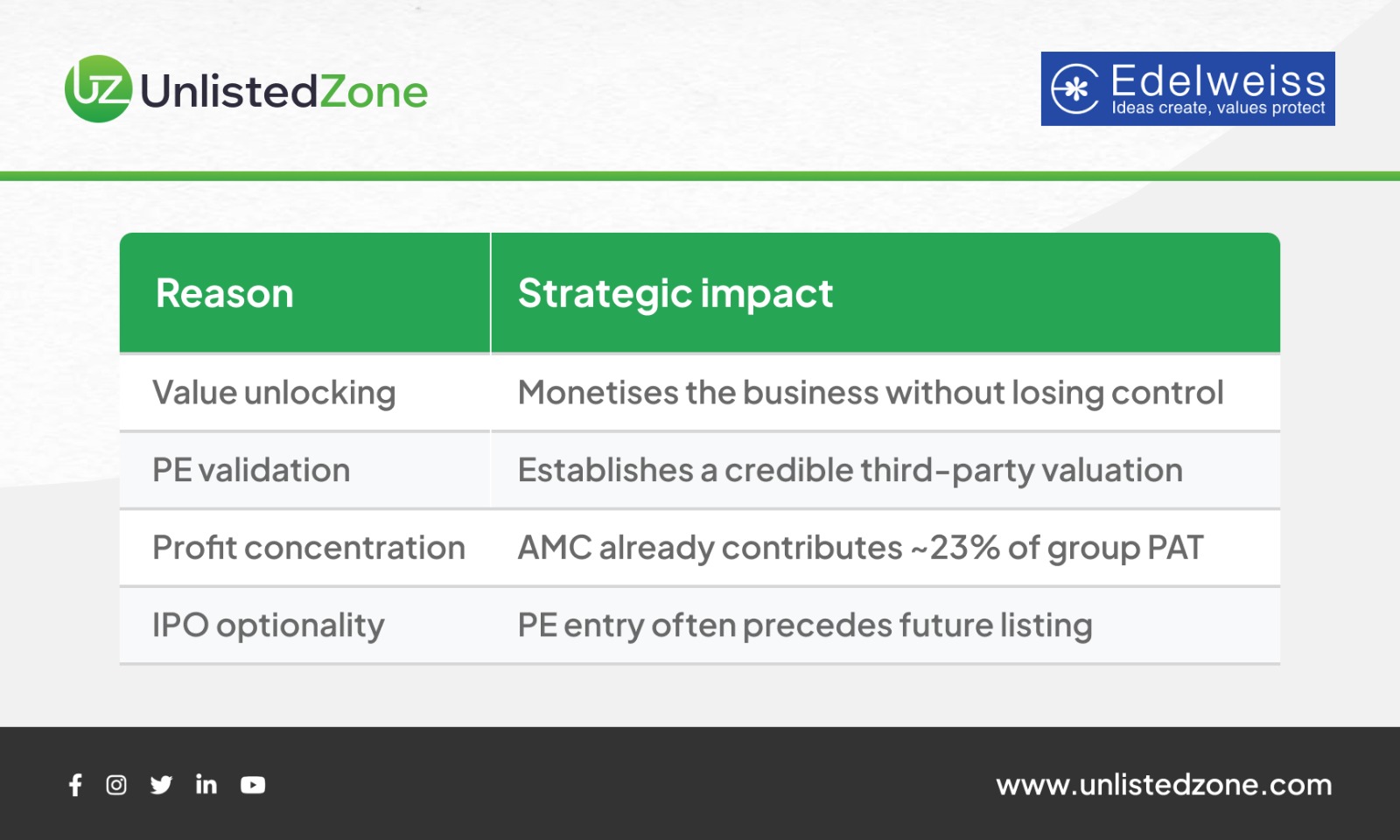

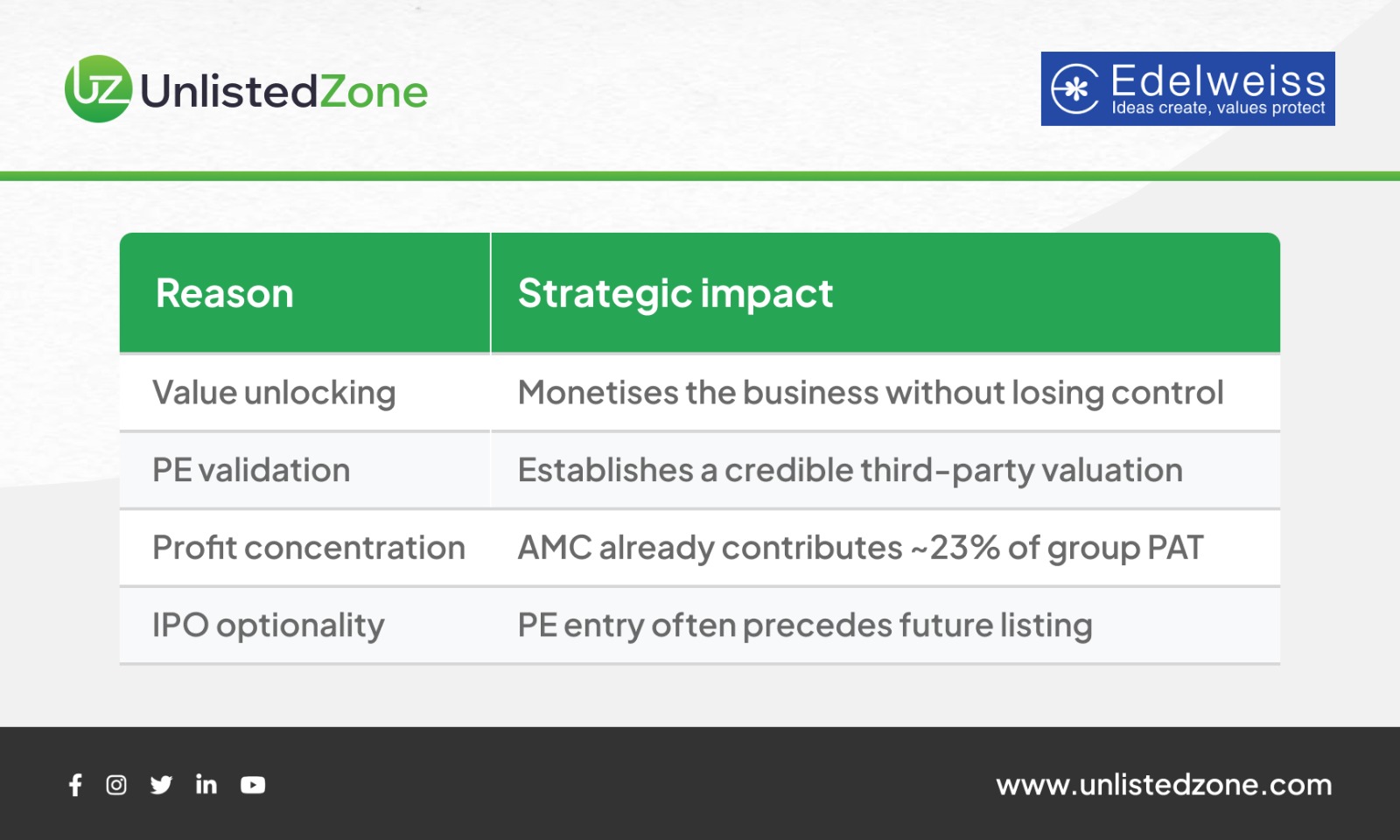

Why Edelweiss chose to sell now

This deal is not a full exit—it is strategic monetisation.

Edelweiss is effectively reducing risk while retaining upside.

Why WestBridge is comfortable paying up

WestBridge is not buying current earnings—it is buying:

-

Sustained equity AUM growth

-

Margin expansion as scale improves

-

Future earnings compounding

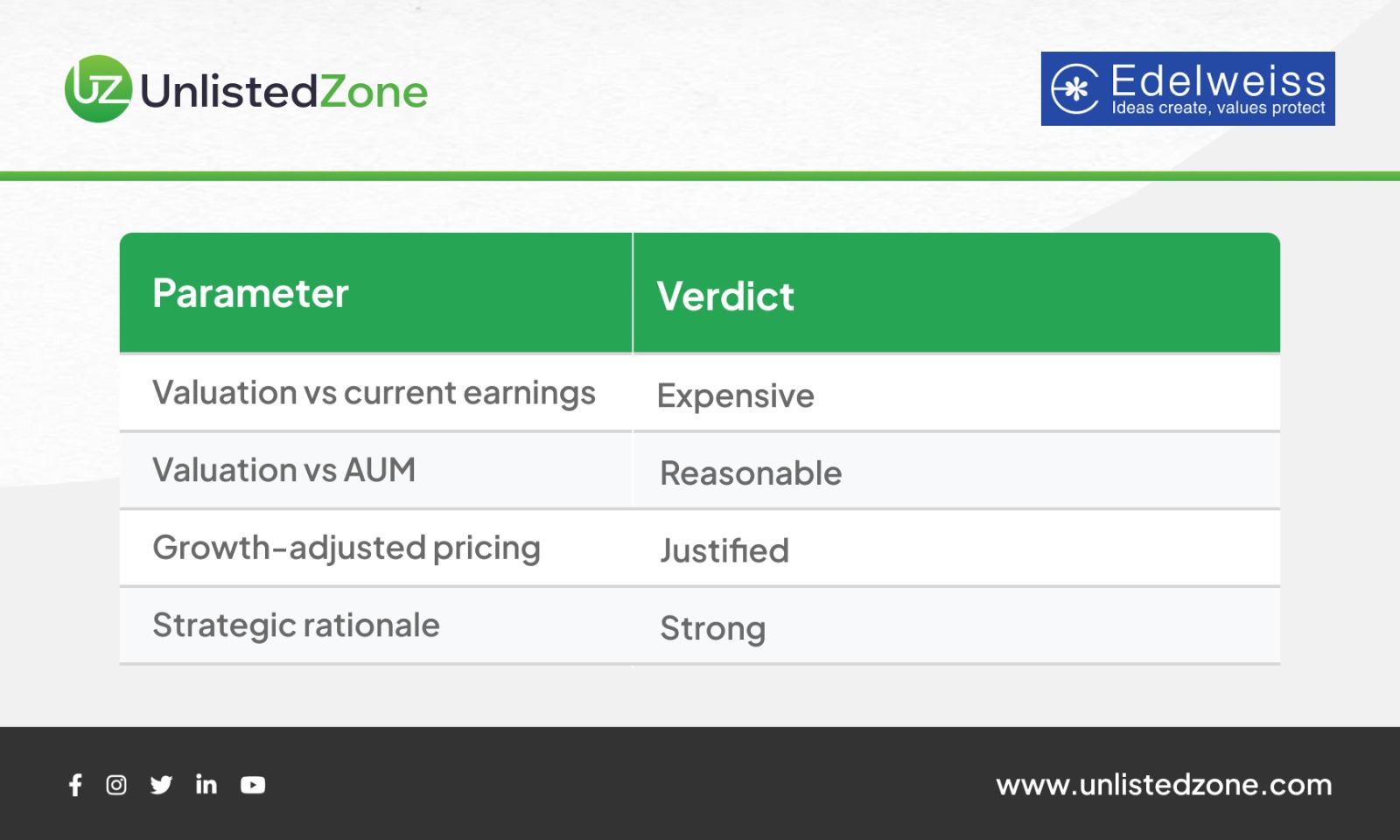

Final verdict: Reasonable or not?

Bottom line

This is not a bargain deal. It is a growth-priced, conviction-led transaction.

Edelweiss monetised its AMC at the right time.

WestBridge is betting that India’s asset management growth runway is far from over.

In asset management, AUM growth—not current profits—ultimately decides who’s right.