If you looked at Ambadi Investments Limited’s financials for the first time, you’d probably do a double take.

Net profit margins above 300%.

Profits that are several times higher than revenue.

At first glance, it looks absurd.

But once you understand what kind of company Ambadi really is, the numbers start making perfect sense.

Let’s break it down — UnlistedZone style.

First, what does Ambadi Investments actually do?

Ambadi Investments Limited (AIL) is not a regular operating company.

It is:

-

A Core Investment Company (CIC)

-

Classified as an NBFC – Middle Layer by RBI

-

A holding company for the Murugappa Group

In simple terms:

Ambadi doesn’t exist to sell products aggressively. It exists to hold, manage and grow investments in Murugappa Group companies.

And that single fact explains almost everything you see in its financials.

The Murugappa connection (this matters)

Ambadi is part of the 124-year-old Murugappa Group, one of India’s most respected business houses.

The group:

-

Generates total group revenue of INR 778 Billion (77,881 Cr) which includes multiple businesses in Agriculture, Engineering, And Financial Services.

-

Has 9 listed companies including CG Power, Tube Investments, Coromandel International and Cholamandalam

-

Employs 83,500+ people

Ambadi sits quietly at the top, holding long-term stakes in these businesses.

Why Ambadi’s P&L looks strange

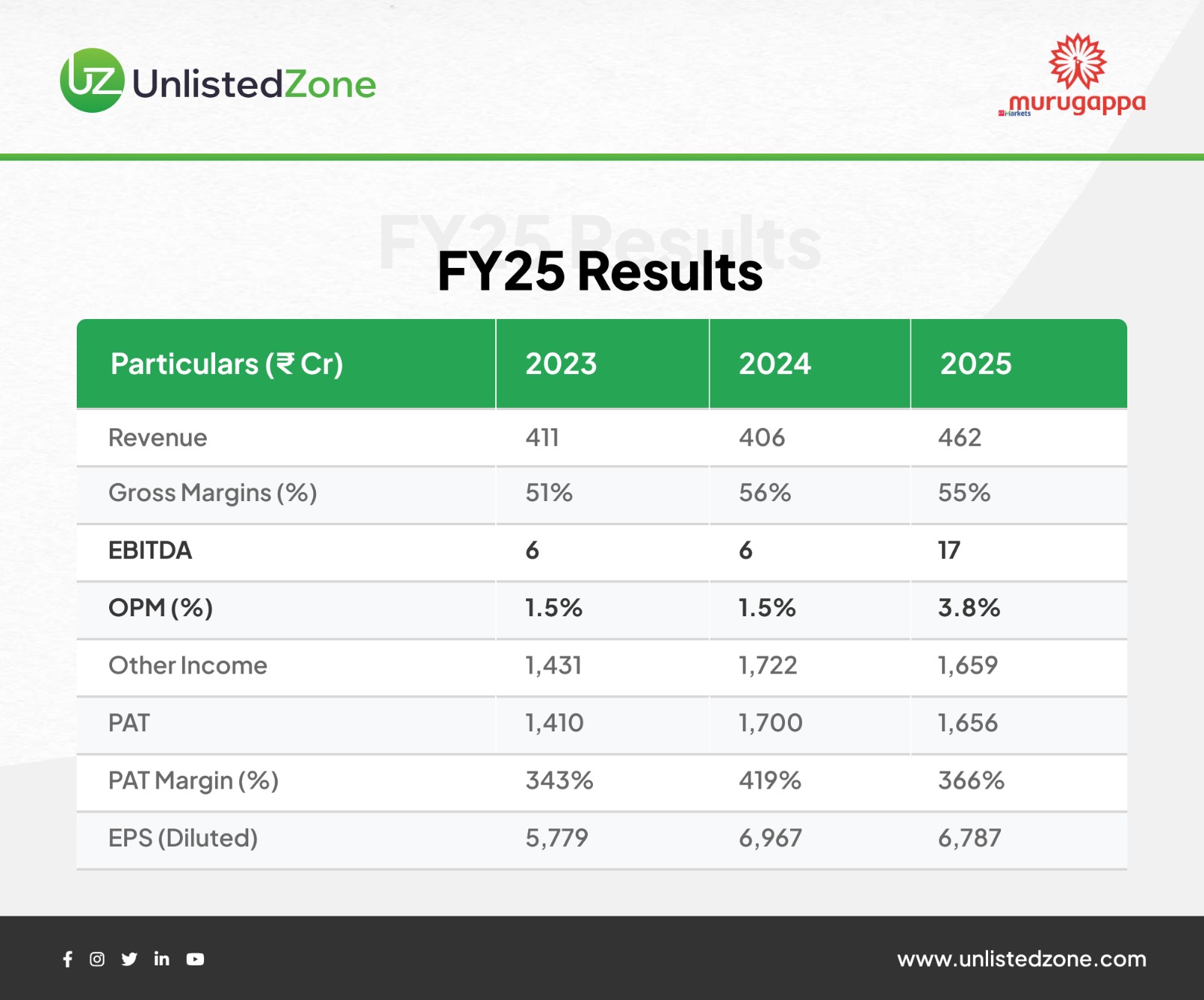

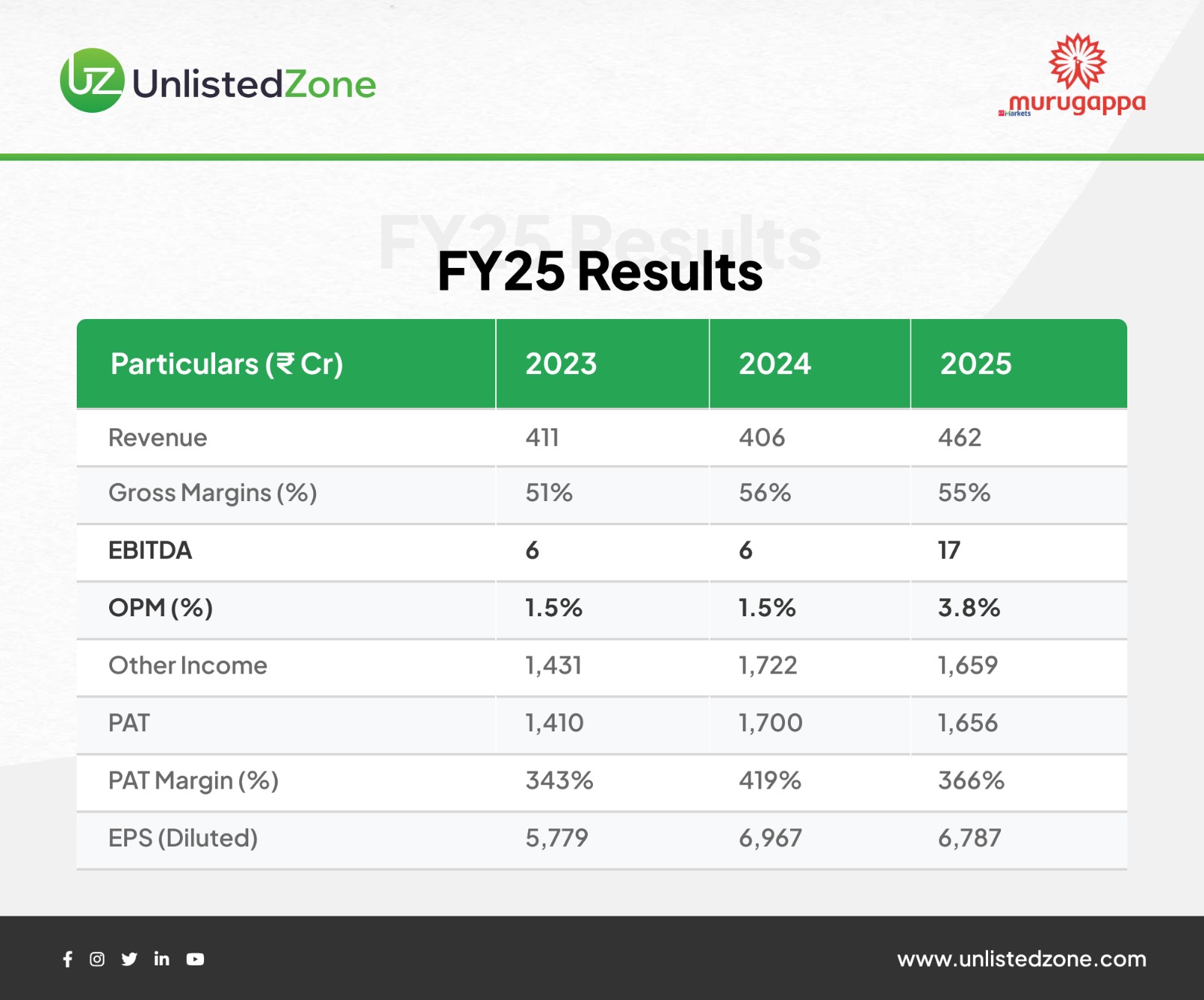

Let’s start with the headline numbers.

Revenue vs Profit (FY25)

That’s a net profit margin of 366%.

Impossible for a normal company.

Completely normal for an investment holding company.

Why?

Because Ambadi’s real engine isn’t sales. It’s investment income.

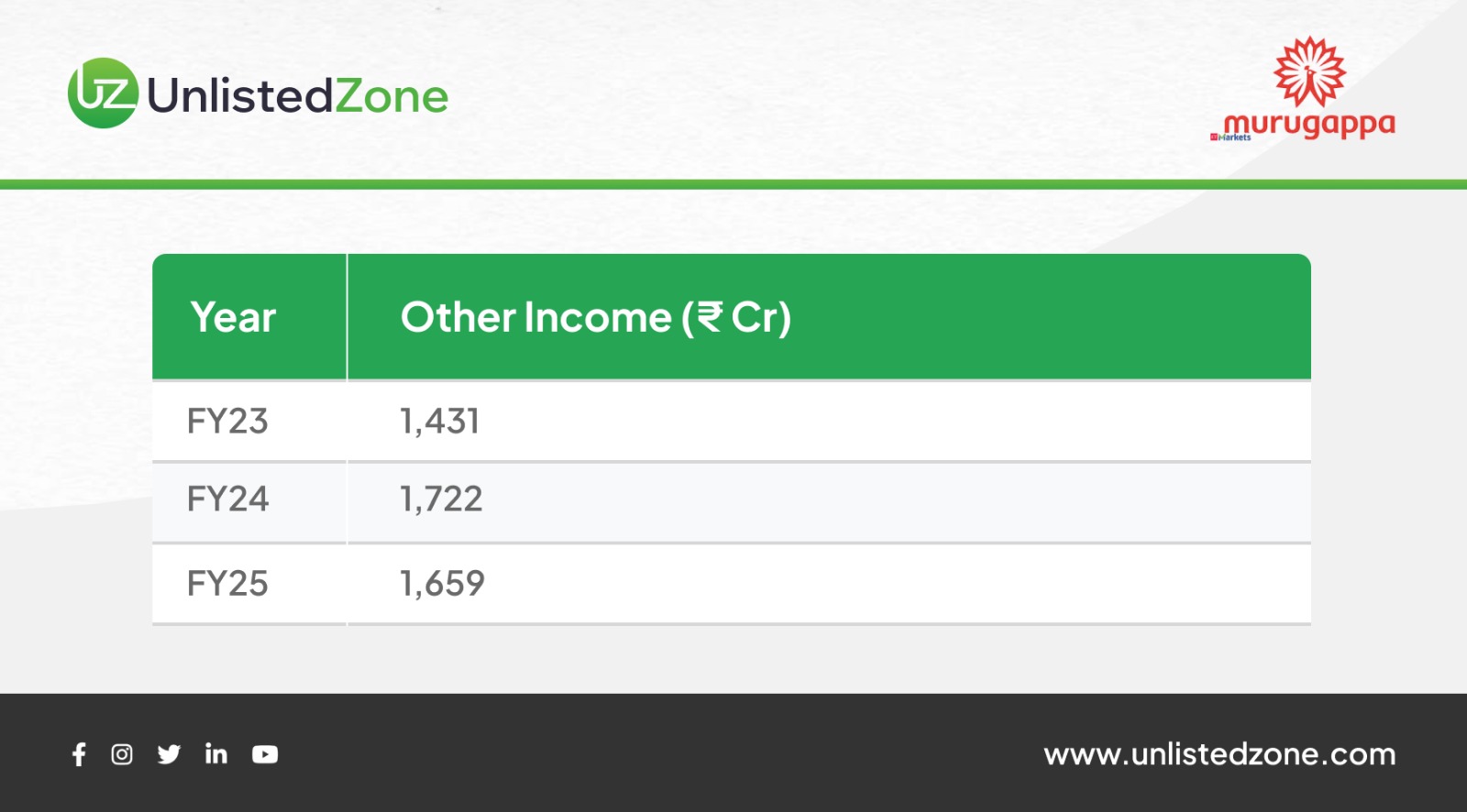

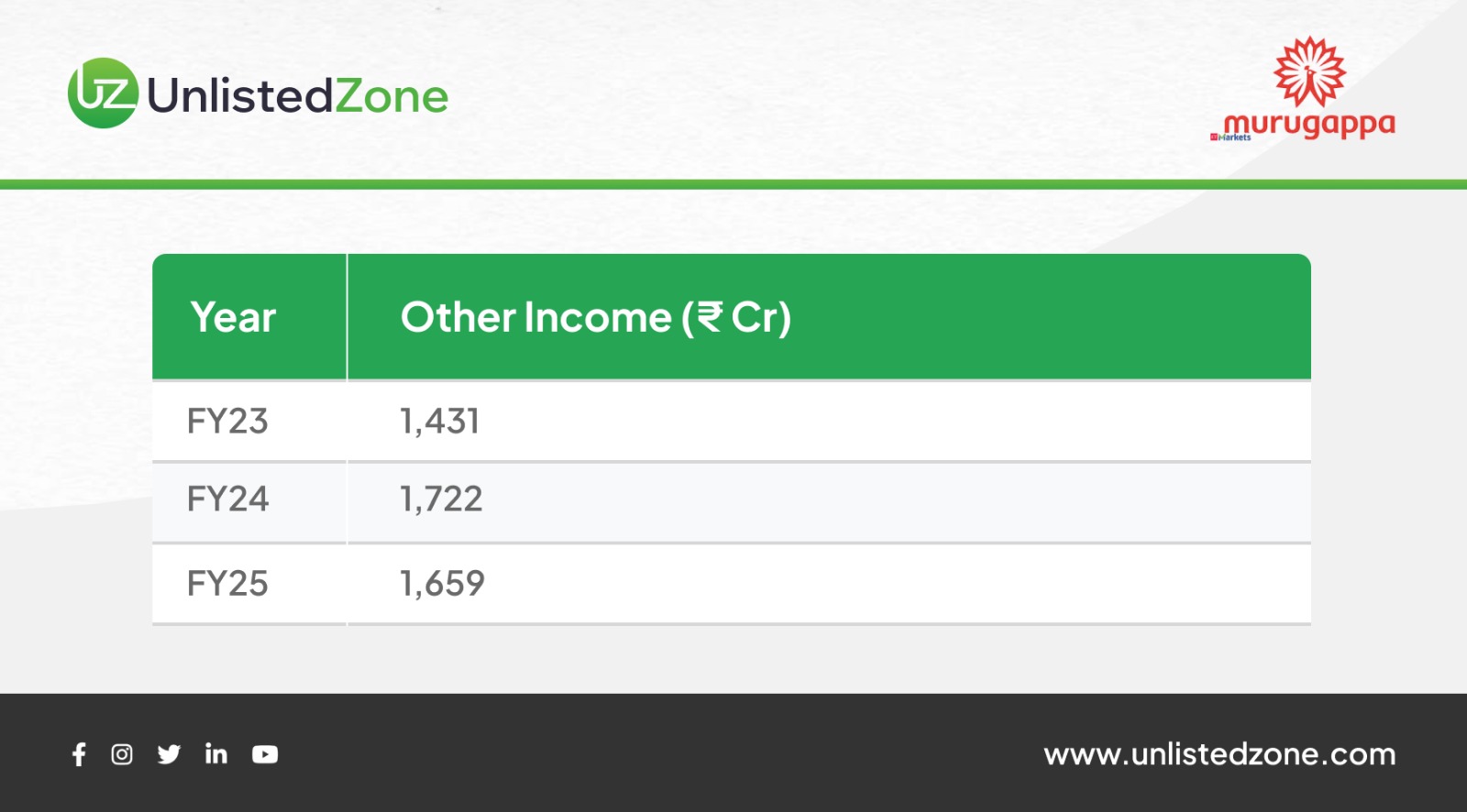

The real cash machine: “Other Income”

Look at this line carefully:

This single line item is 3–4x larger than operating revenue.

And it includes:

So profits don’t depend on selling tea or pepper — they depend on how well Ambadi’s ₹12,000+ crore investment book performs.

Then why does Ambadi even have “operations”?

Good question.

Ambadi still reports:

-

Sale of tea, pepper and other products

-

Services revenue

-

Eco-operations, timber, scrap, export benefits

In FY25:

But here’s the catch:

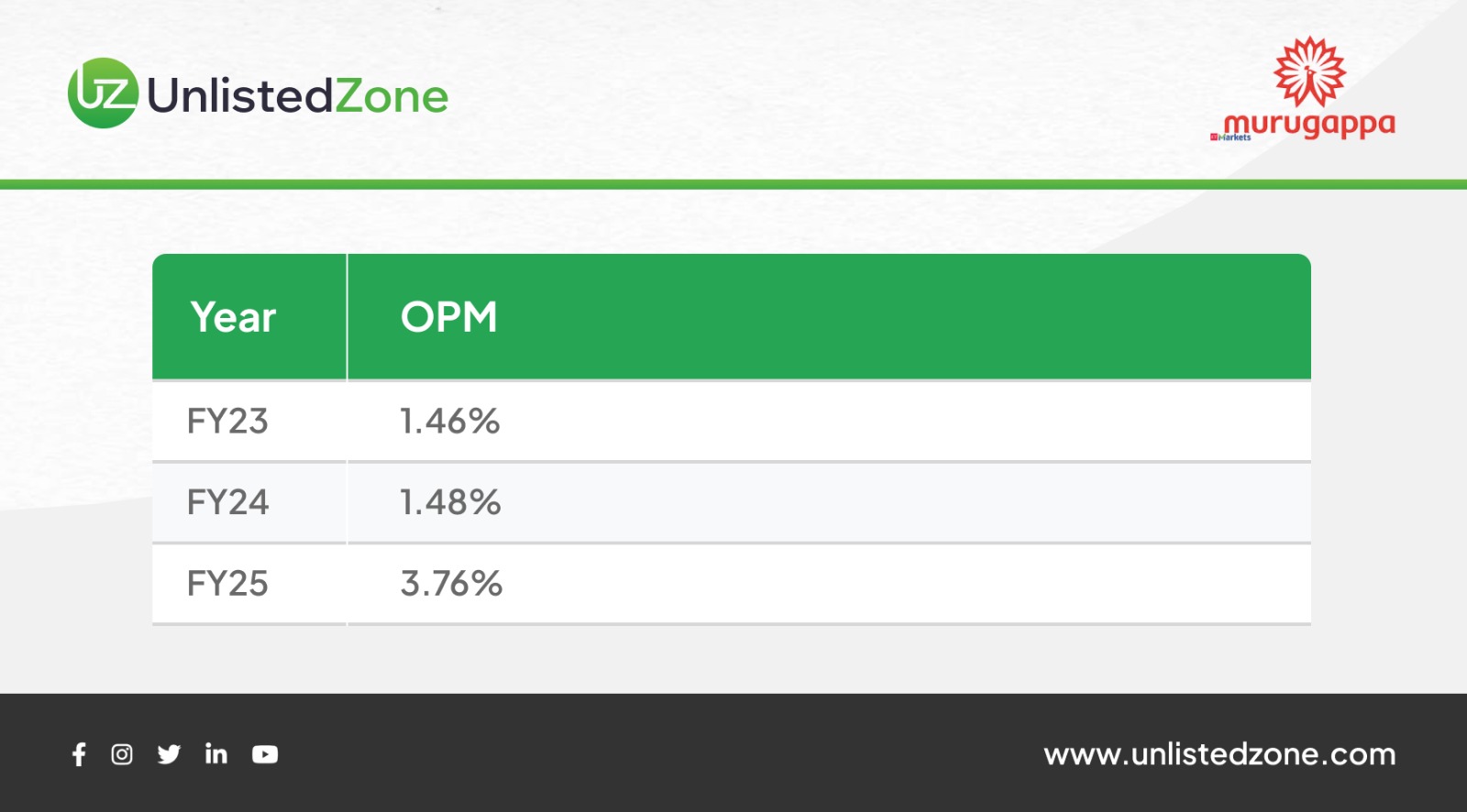

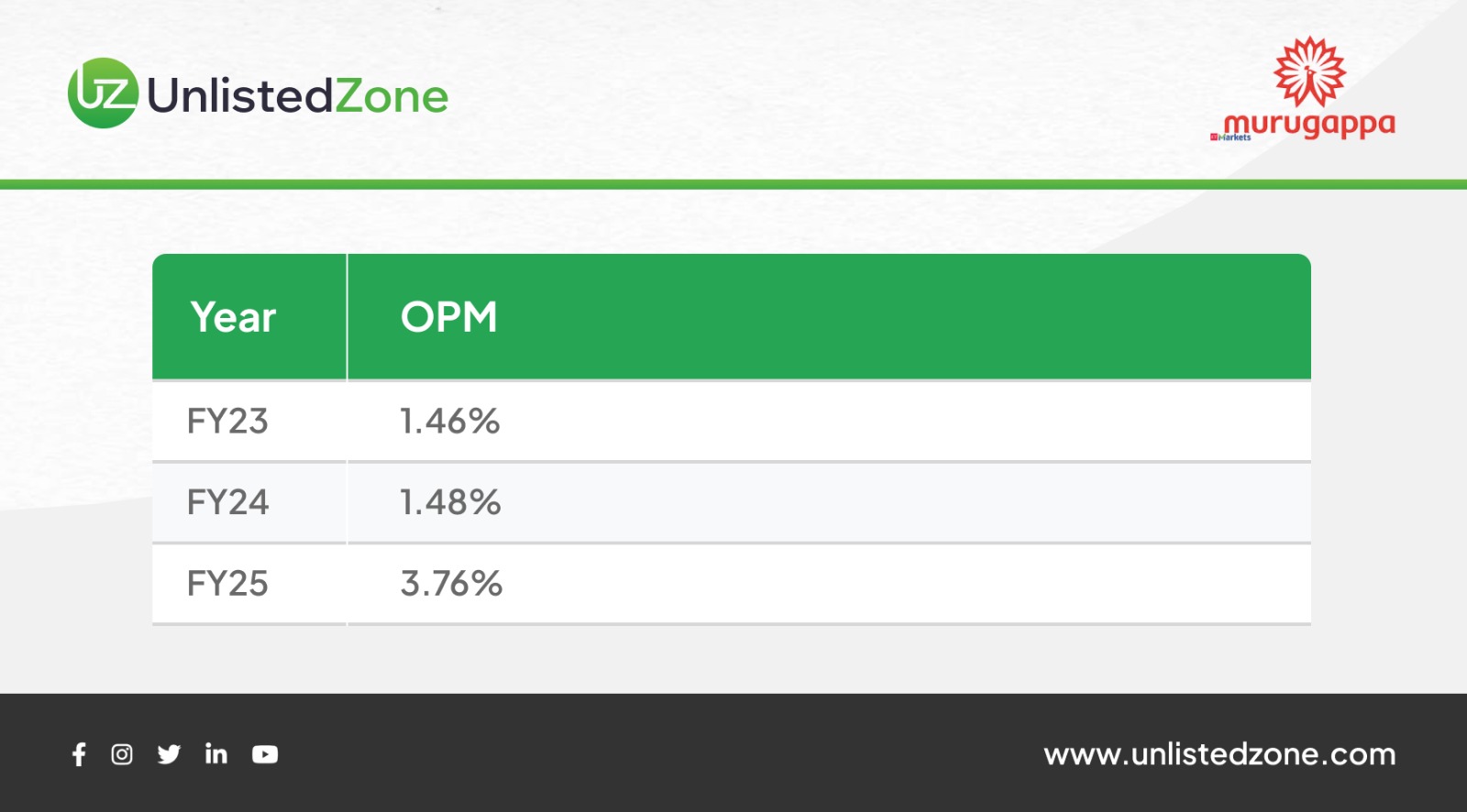

Operating margins tell the truth

This is not a business trying to maximize operating profits. It’s a company whose real value sits on the balance sheet, not the shop floor.

Cost structure: tightly controlled

Despite massive revenue numbers:

-

Employee costs stay around ₹130 crore

-

Other expenses rise moderately

-

Finance costs are negligible (~₹2–3 crore)

Why?

-

Almost no debt

-

No aggressive expansion

-

No heavy capex

This is classic holding-company behavior.

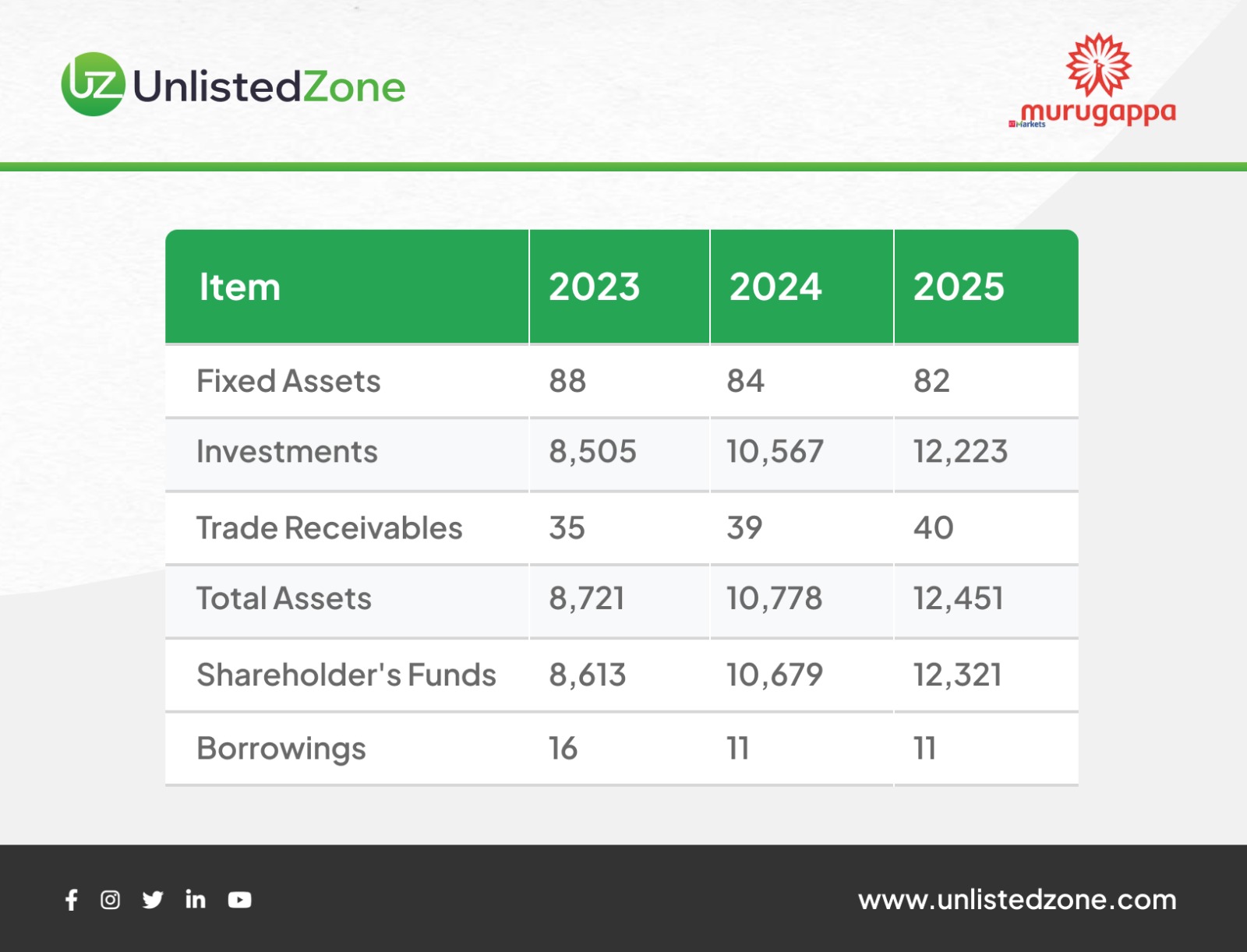

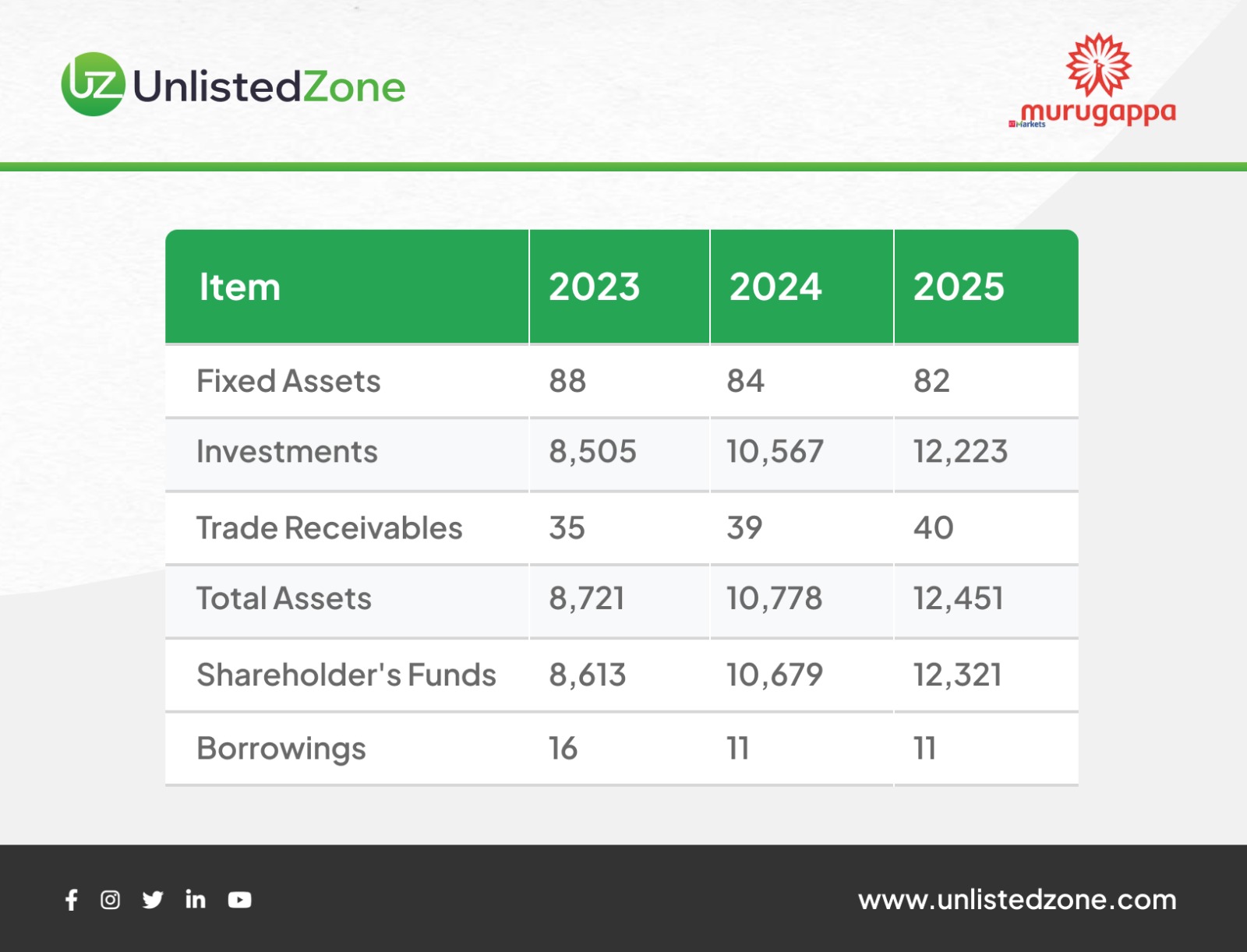

Balance sheet: Where the real story is

If you want to understand Ambadi, ignore the P&L for a moment and look here.

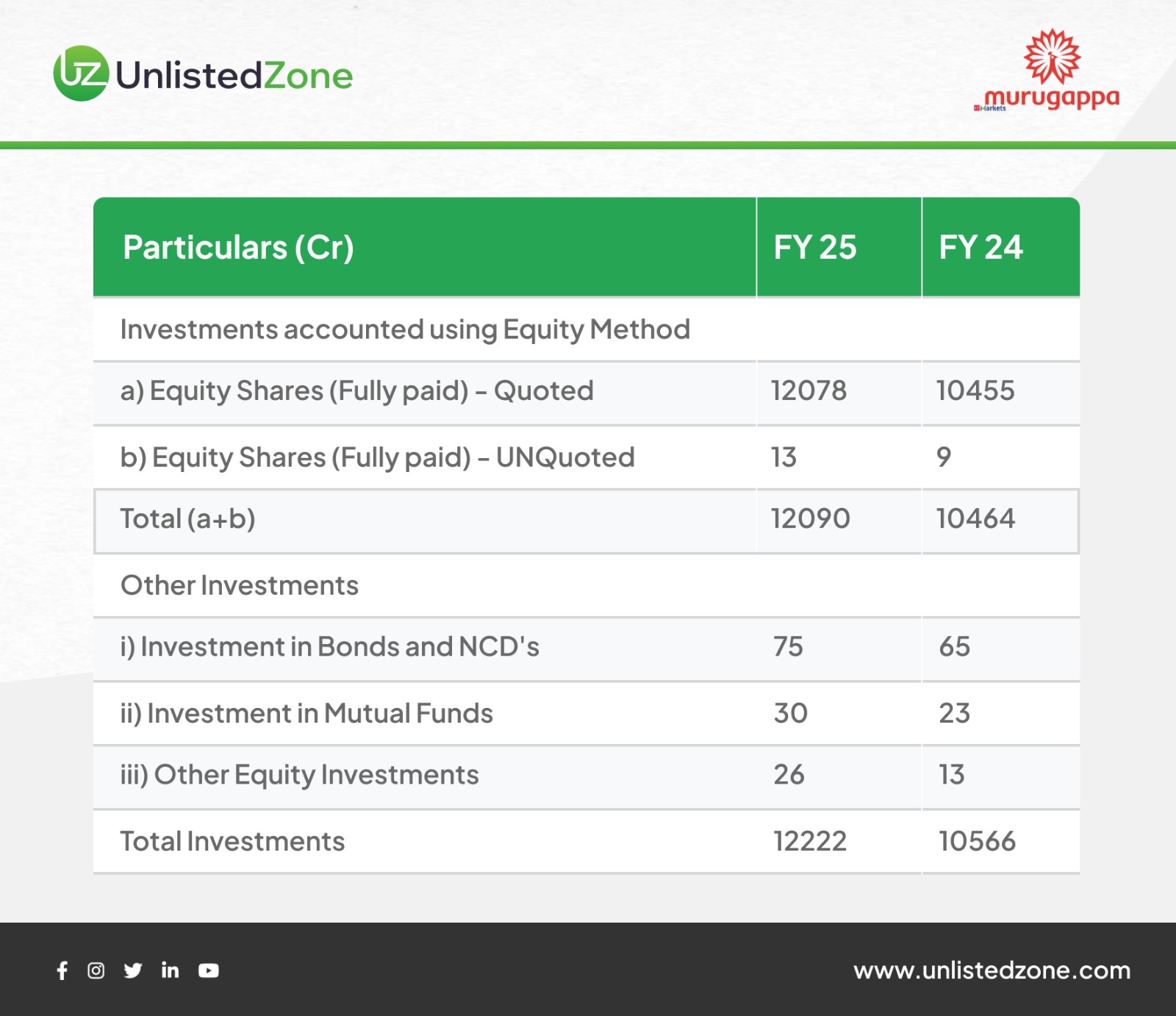

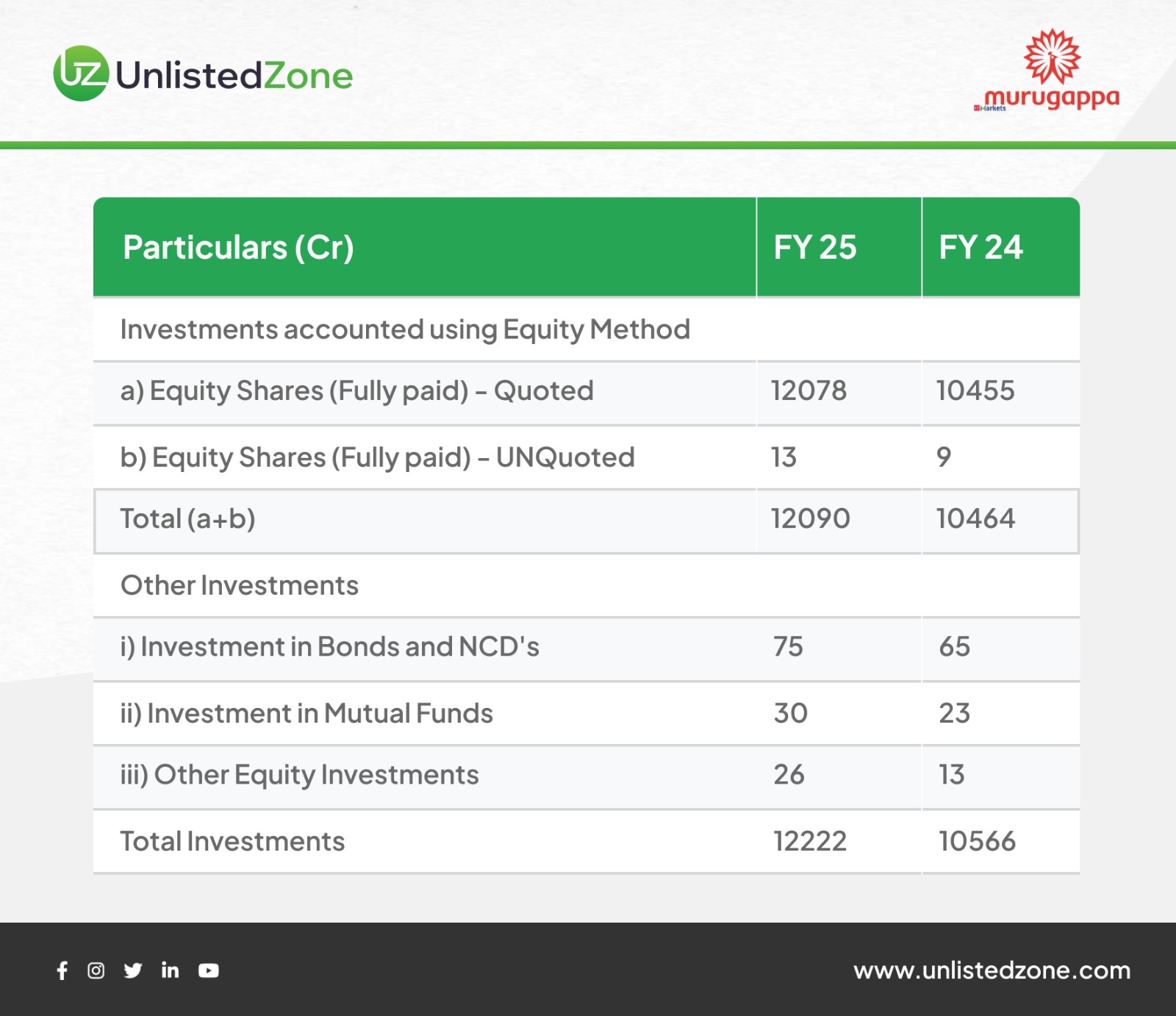

Investments

-

98% of total investments are in Associate Companies.

-

Top 4 Associates:

-

Cholamandalam Financial Holdings (37% of Assets, 49% of P&L)

-

E.I.D.-Parry India (24% of Assets, 20% of P&L)

-

Tube Investments of India (15% of Assets, 14% of P&L)

-

Carborundum Universal (8% of Assets, 5% of P&L)

-

Together, these four make up 84% of total assets and 88% of total profit.

-

Ambadi is a strategic holding company, not a diversified fund.

That’s a ₹3,700 crore increase in just two years.

This is Ambadi’s core asset.

Capital structure

Translation:

Almost the entire company is funded by retained earnings, not debt.

This makes Ambadi extremely resilient.

Why EPS looks absurdly high

EPS in FY25: ₹6,786 per share.

This happens because:

EPS here is not meant to be compared with manufacturing or consumer companies.

It reflects ownership of a massive investment portfolio, not operational efficiency.

So how should investors actually view Ambadi?

Think of Ambadi as:

-

A gateway to the Murugappa Group’s value

-

A long-term capital allocator, not an operating business

-

A company where NAV and investment performance matter more than revenue growth

The bottom line

Ambadi Investments is not designed to impress with flashy operating margins.

It exists to:

Once you view it through that lens, the 300% profit margins stop looking crazy — and start looking intentional.

Sometimes, the most powerful companies don’t shout through revenue.

They whisper through balance sheets.