Overview

Kanara Consumer Products Limited (formerly known as Kurlon Limited) is conducting an ExtraOrdinary General Meeting on January 20, 2026, to approve a merger of its two wholly-owned subsidiaries into the parent company.

Why the Merger is Happening

Strategic Rationale

1. Post-Kurlon Brand Sale Repositioning

After selling the iconic ‘KURLON’ brand, Kanara Consumer Products has been actively looking to venture into new business activities. The merger of its two subsidiaries is part of this strategic expansion and growth plan.

2. Operational Efficiency & Cost Reduction

-

Economies of scale through consolidated operations

-

Reduction in overheads – elimination of duplicate administrative, managerial, and corporate structures

-

Streamlined financial reporting and centralized management

-

Optimal resource utilization across the combined entity

3. Financial Synergies

-

Leveraging the strong cash flow of the parent company to fund the growth of subsidiaries whose cash cycles are less stable

-

Better access to capital markets through a stronger combined balance sheet

-

Simplified investment management

4. Risk Diversification

By consolidating businesses in different sectors (natural extracts and consultancy/investments), the company aims to create stable revenue streams and reduce business risk.

The Subsidiaries Being Merged

1. Manipal Natural Private Limited (Transferor Company 1)

Business: Manufacture and export of herbal and ayurvedic products

-

Natural herbal extracts

-

Ayurvedic products for beauty, body care, and medicinal use

-

Cultivation of medicinal plants

-

R&D of herbal and nutraceutical products

2. Kanara Consulting and Service Management Private Limited (Transferor Company 2)

Business: Consulting and investment services

-

Administration and management consultancy

-

Marketing and organizational advisory

-

Investment company dealing in shares, debentures, and securities

Merger Structure

-

Type: Merger by absorption under Section 233 of the Companies Act, 2013

-

Appointed Date: April 1, 2025

-

Share Exchange Ratio: None (no new shares issued as both are 100% subsidiaries)

-

Treatment: All shares of subsidiaries held by the parent will be cancelled and extinguished

-

Dissolution: Both subsidiaries will be dissolved without winding up

Financial Position (As of March 31, 2025)

Kanara Consumer Products Limited (Parent Company)

Key Observations:

-

Strong cash position with assets of ₹1,378+ crores

-

Highly profitable with ₹86.5 crores net profit

-

Primary income from investments/other income rather than operations

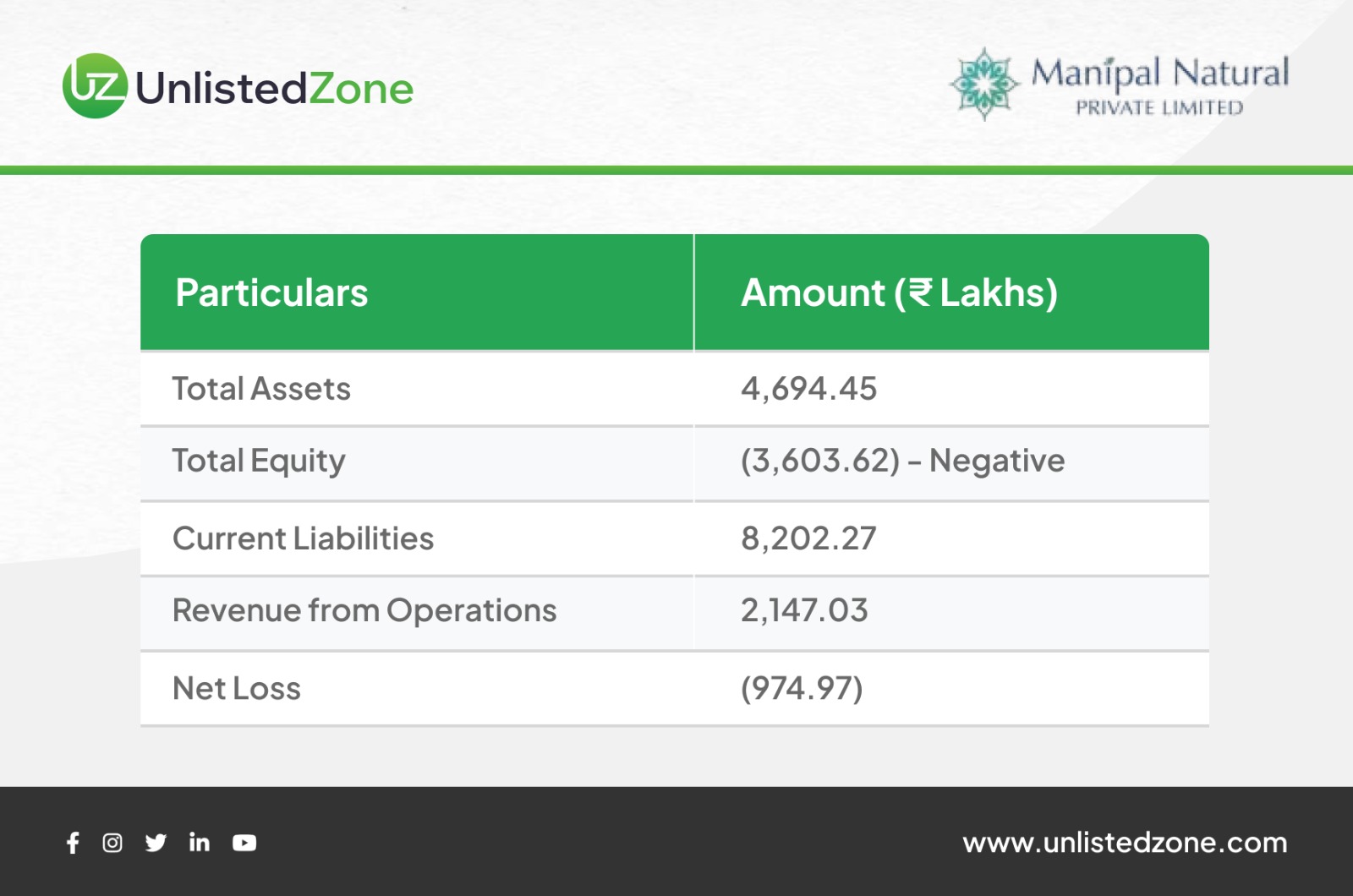

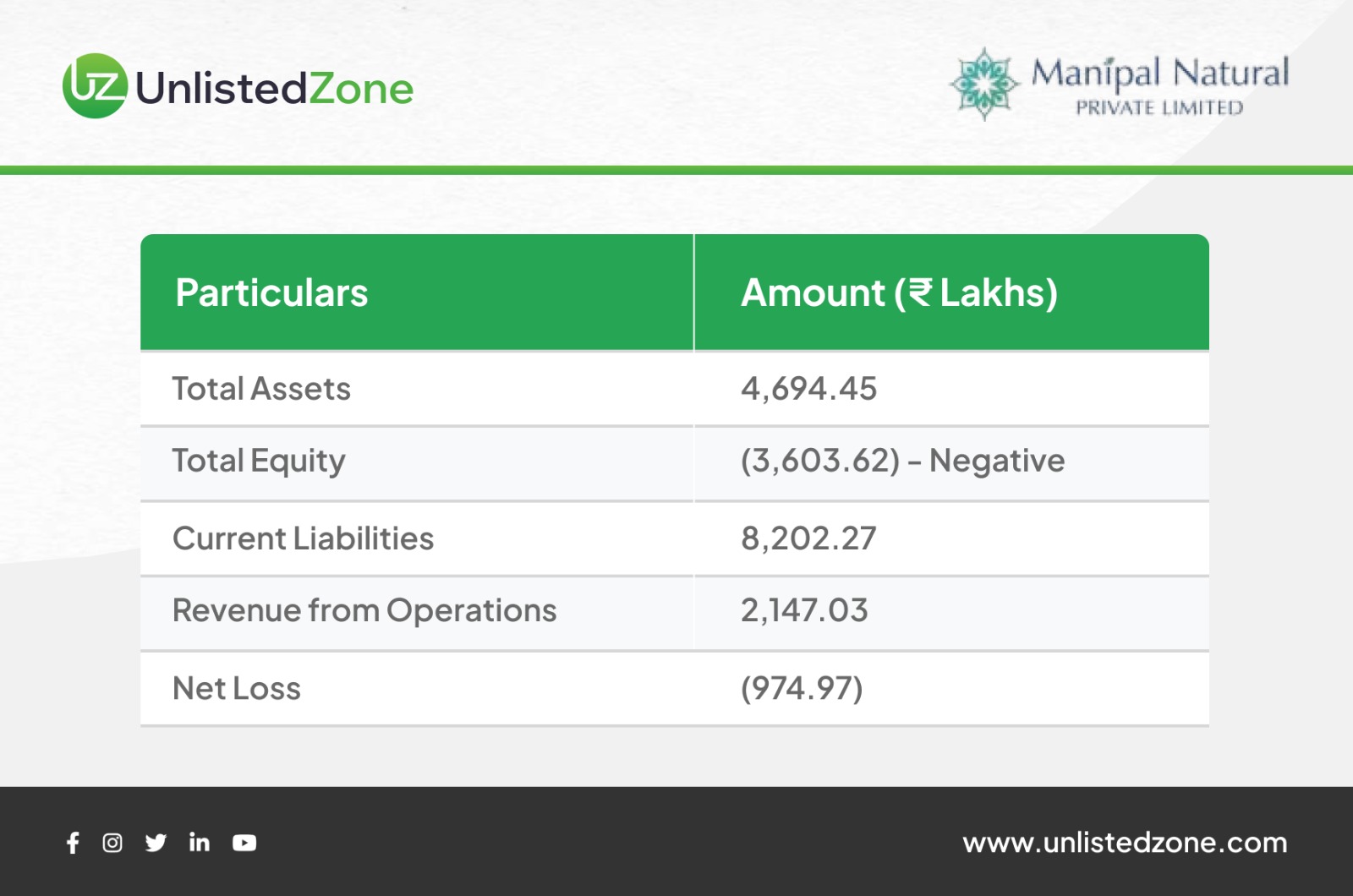

Manipal Natural Private Limited (Subsidiary 1)

Financials (₹ Lakhs):

Kanara Consulting and Service Management Pvt Ltd (Subsidiary 2)

Status: Loss-making with negative equity due to accumulated losses

Financials (₹ Lakhs):

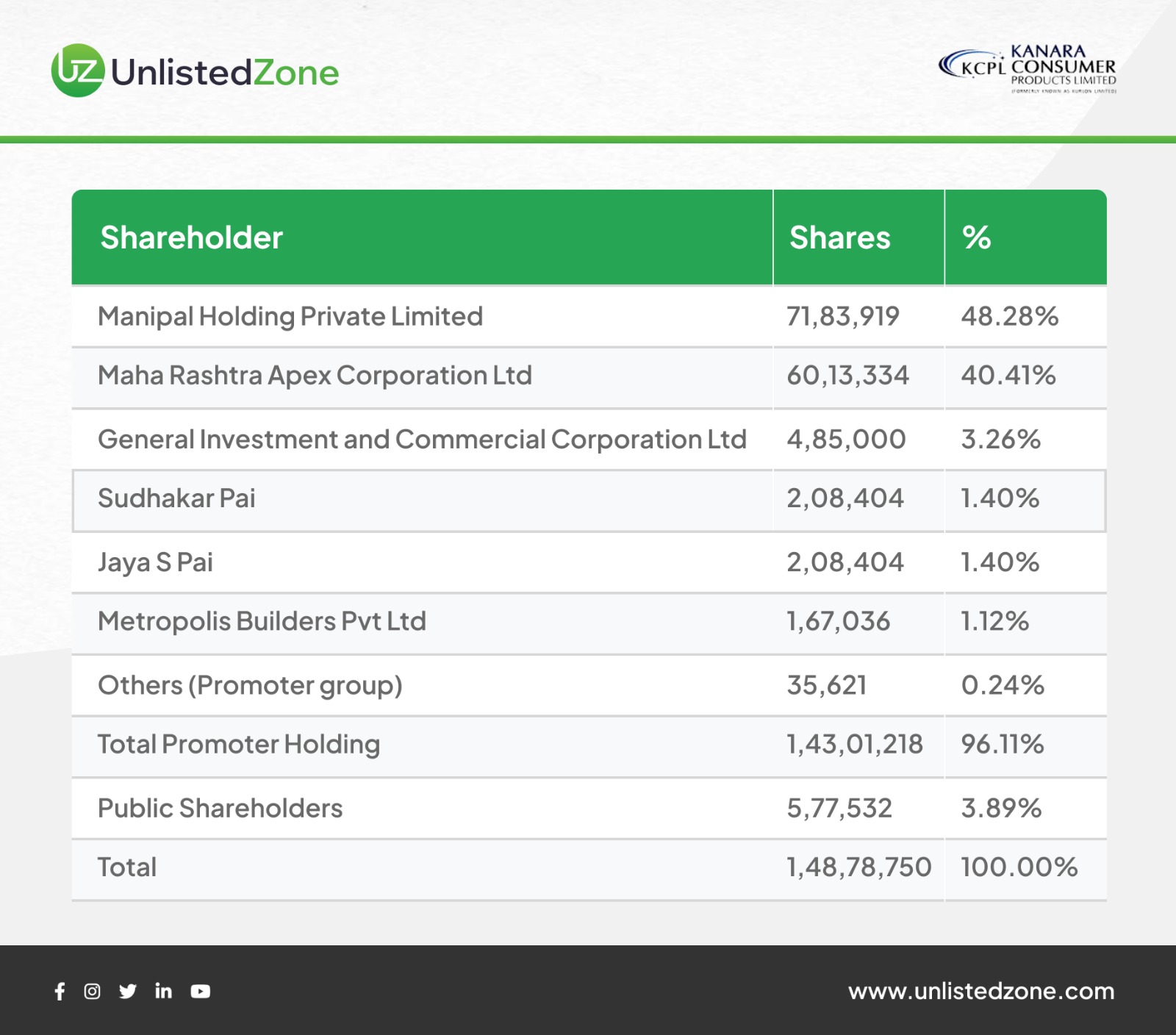

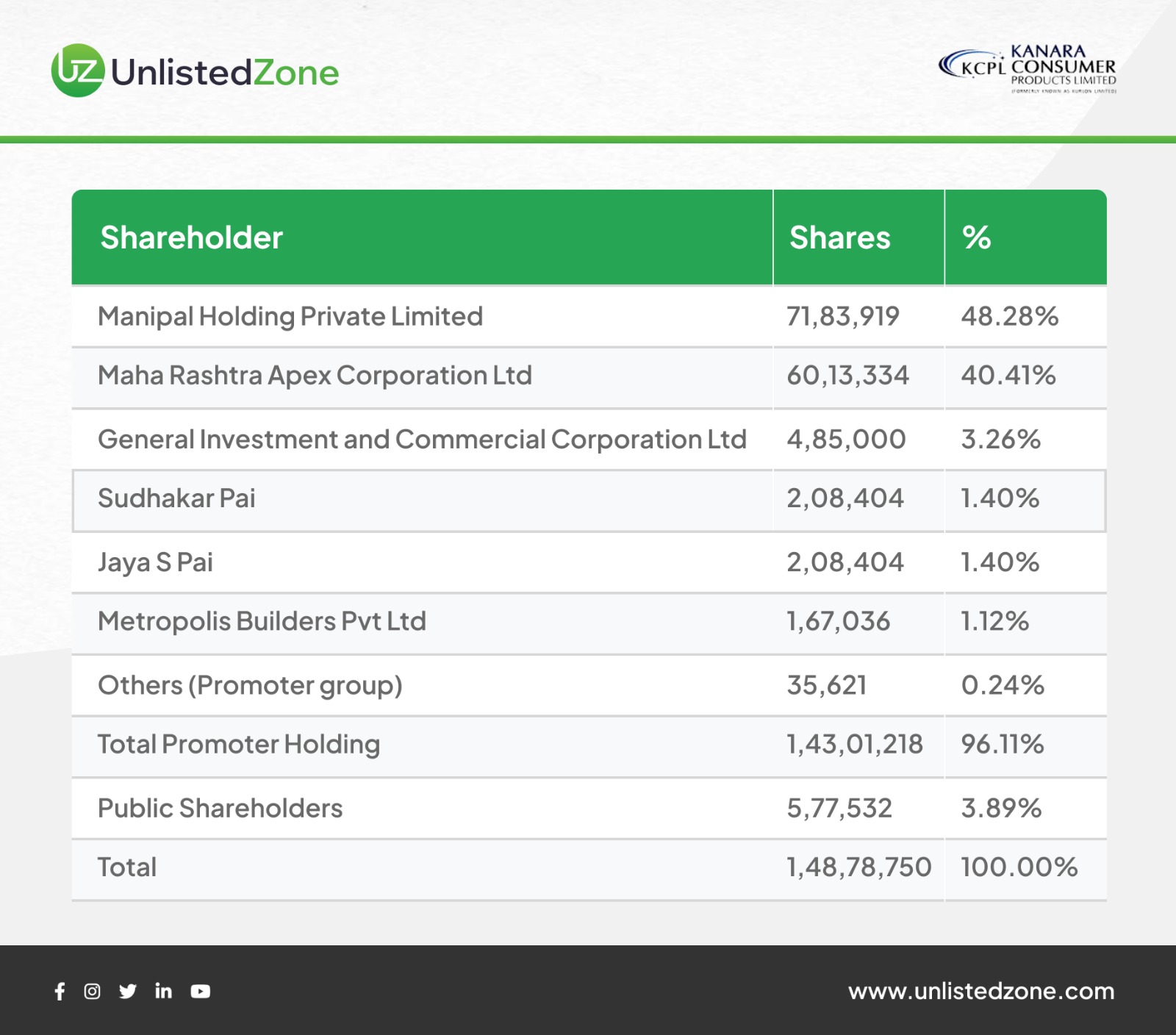

Shareholding Pattern

Promoter Holdings (96.11% – Promoters & Interested Entities)

Ownership Structure: The company is heavily promoter-controlled with the Manipal Group entities holding the dominant stake.

Business Operations

Current Business Profile

Kanara Consumer Products Limited:

-

Real Estate: Developers, builders, and managers of immovable properties (lands, buildings, hotels, cold stores)

-

Consumer Goods (Expansion): Manufacturing and trading in nutrition foods, nutraceutical foods, health foods, beverages, and packaged foods

-

Investment: Holding shares and securities in other companies

-

Post-Merger Services: Software development, advertising, and technical consultancy

Combined Business Post-Merger

-

Herbal and ayurvedic product manufacturing

-

Real estate development and management

-

Consumer goods and nutraceutical foods

-

Business consulting and management services

-

Investment management

Capital Structure Changes

Authorized Share Capital Increase

-

Current: ₹35,00,00,000 (3.5 crores)

-

Post-Merger: ₹40,10,00,000 (4.01 crores)

-

Increase: ₹5,10,00,000

This increase accommodates the consolidation of business operations.

Expected Impact

Short-Term Effects

-

Temporary reduction in financial ratios (Net Profit Margin, ROE, EPS, Debt-Equity Ratio) due to absorption of loss-making subsidiaries

-

Integration costs and operational adjustments

Long-Term Benefits

-

Business diversification across multiple sectors

-

Operational efficiency through consolidated management

-

Cost savings from elimination of duplicate structures

-

Enhanced growth potential leveraging the parent’s strong financial position

-

Better market positioning for new business ventures post-Kurlon brand sale

Conclusion

The merger is a strategic restructuring move by Kanara Consumer Products to consolidate its operations after the sale of the Kurlon brand. While the subsidiaries are currently loss-making with negative equity, the parent company’s strong financial position (₹86.5 crores profit, ₹1,378 crores assets) can absorb these entities and leverage their operational capabilities for future growth in herbal products and consulting services. The merger eliminates corporate redundancies and positions the company for diversified business expansion beyond its traditional mattress business.