IKF Finance Limited, a fast-growing NBFC focused on rural and semi-urban India, recently witnessed a major equity transaction involving private equity major Creador (via Rajadhiraja Ltd.). This is not a routine share transfer—it signals a strategic ownership reset at a time when IKF’s balance sheet and profitability are scaling rapidly.

The Big News: Equity Issuance & Ownership Change

Nov 2025

IKF Finance amended its Articles of Association (AOA) following a large block transaction that brought in a new institutional shareholder.

Transaction Snapshot

Pricing & Share Data

-

Shares outstanding (July 2025): 9,38,59,991

-

Transaction CMP: ~₹455 per share

-

Pricing: Premium to recent unlisted market quotes

Strategic Implications

-

Creador enters as a significant minority shareholder

-

Signals strong institutional confidence

-

Enables shareholder agreement and governance restructuring

Why this matters:

Creador typically backs scalable, profitable financial services companies entering their next growth phase. Entry of a PE fund combined with exit of early investors often precedes IPO readiness or accelerated balance-sheet expansion.

Company Snapshot: Who is IKF Finance?

-

Incorporated: 1991 (33+ years old)

-

Headquarters: Vijayawada, Andhra Pradesh

-

Business Model: Secured, asset-backed lending

-

Core Focus: Rural and semi-urban India

-

Borrower Base: Self-employed individuals, transport operators, MSMEs

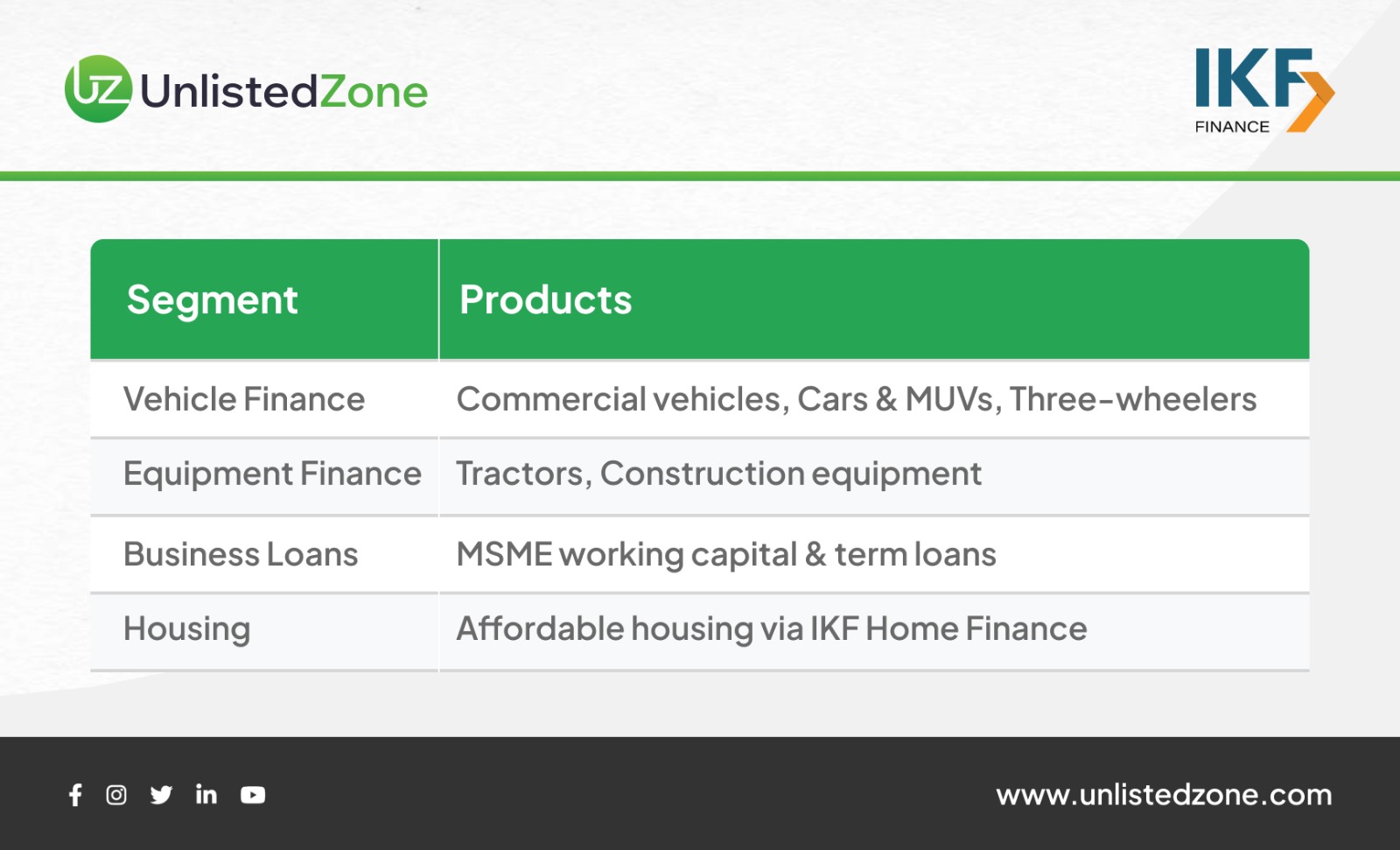

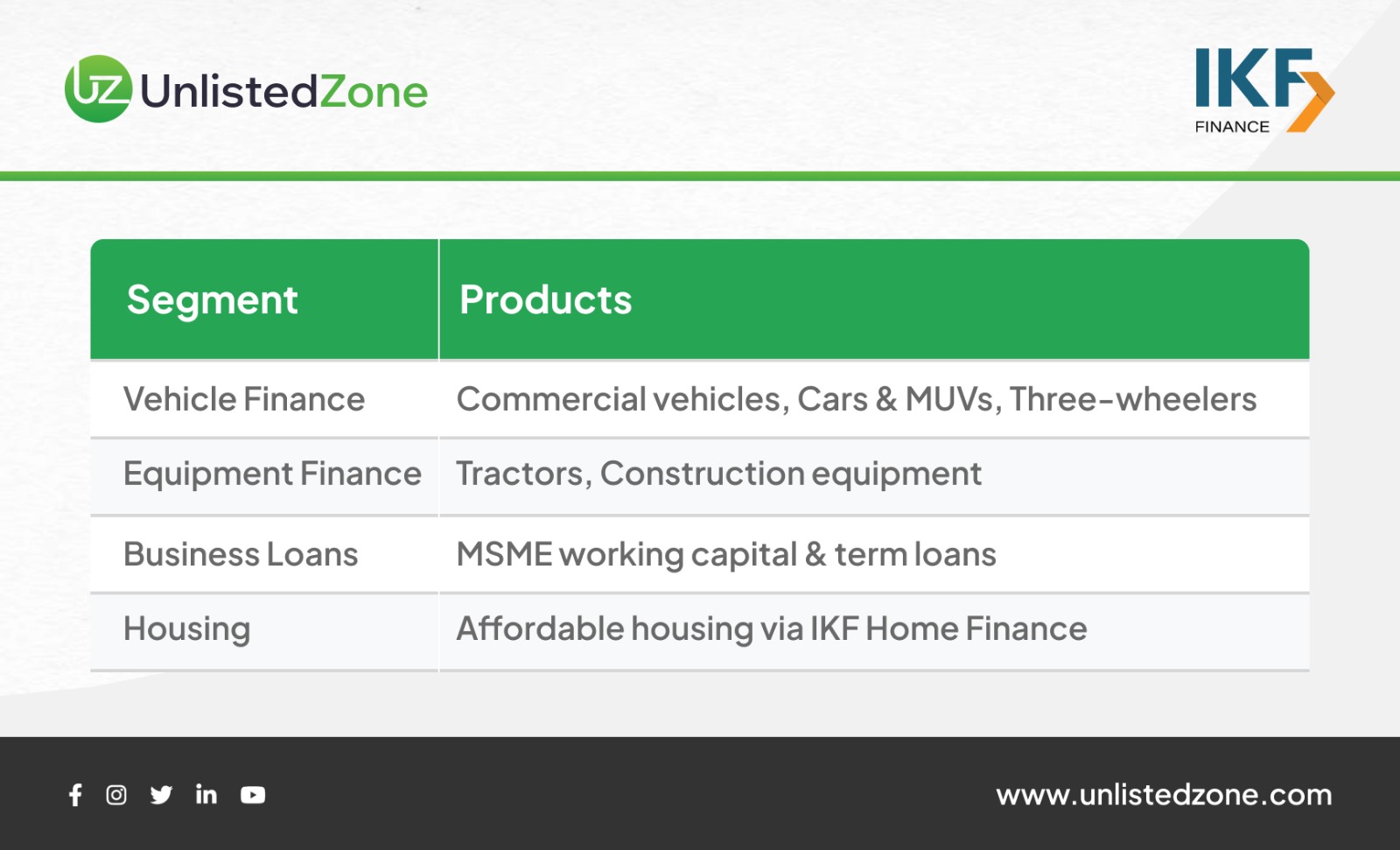

Loan Products

Financial Growth: Rapid and Profitable

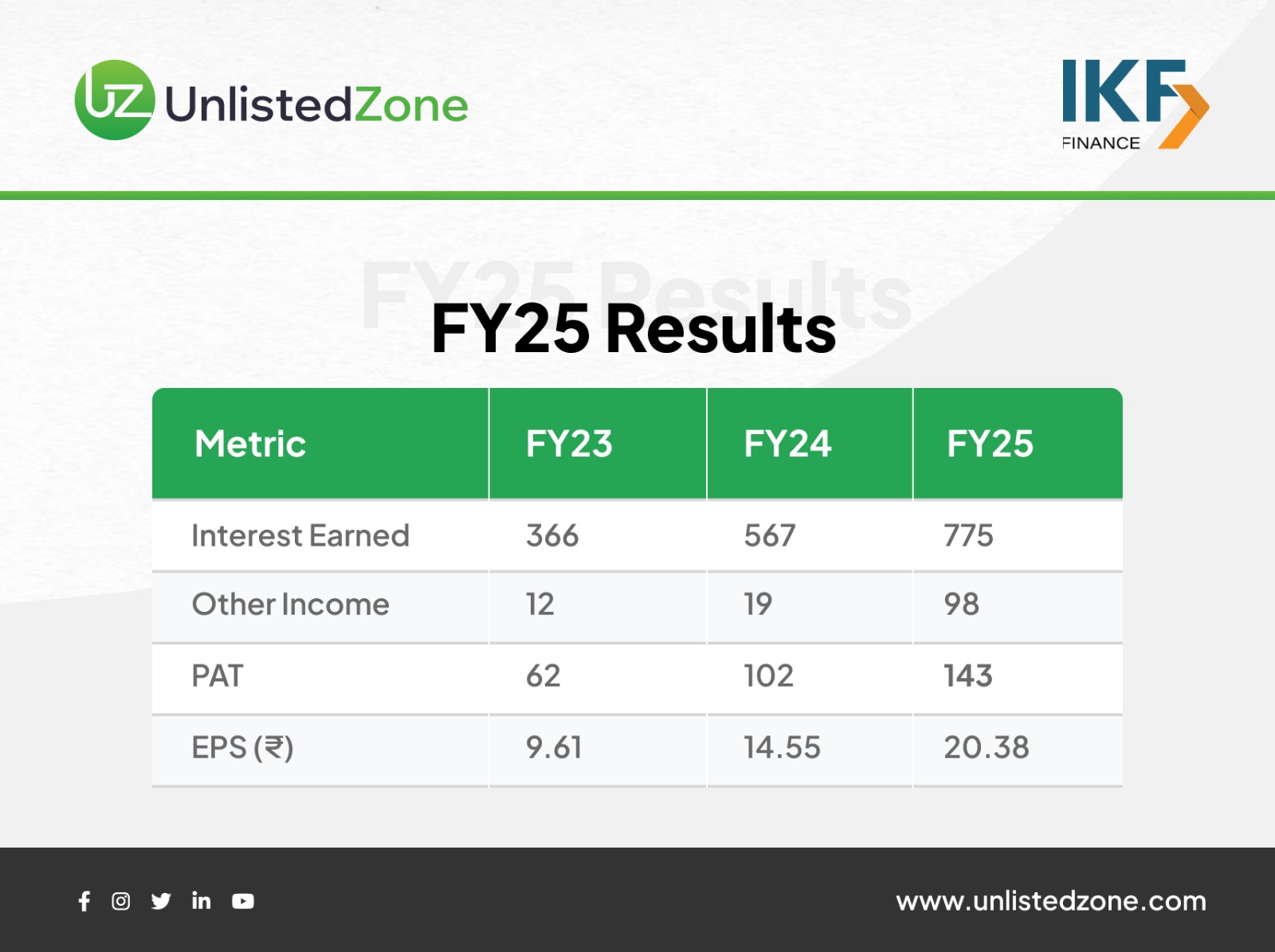

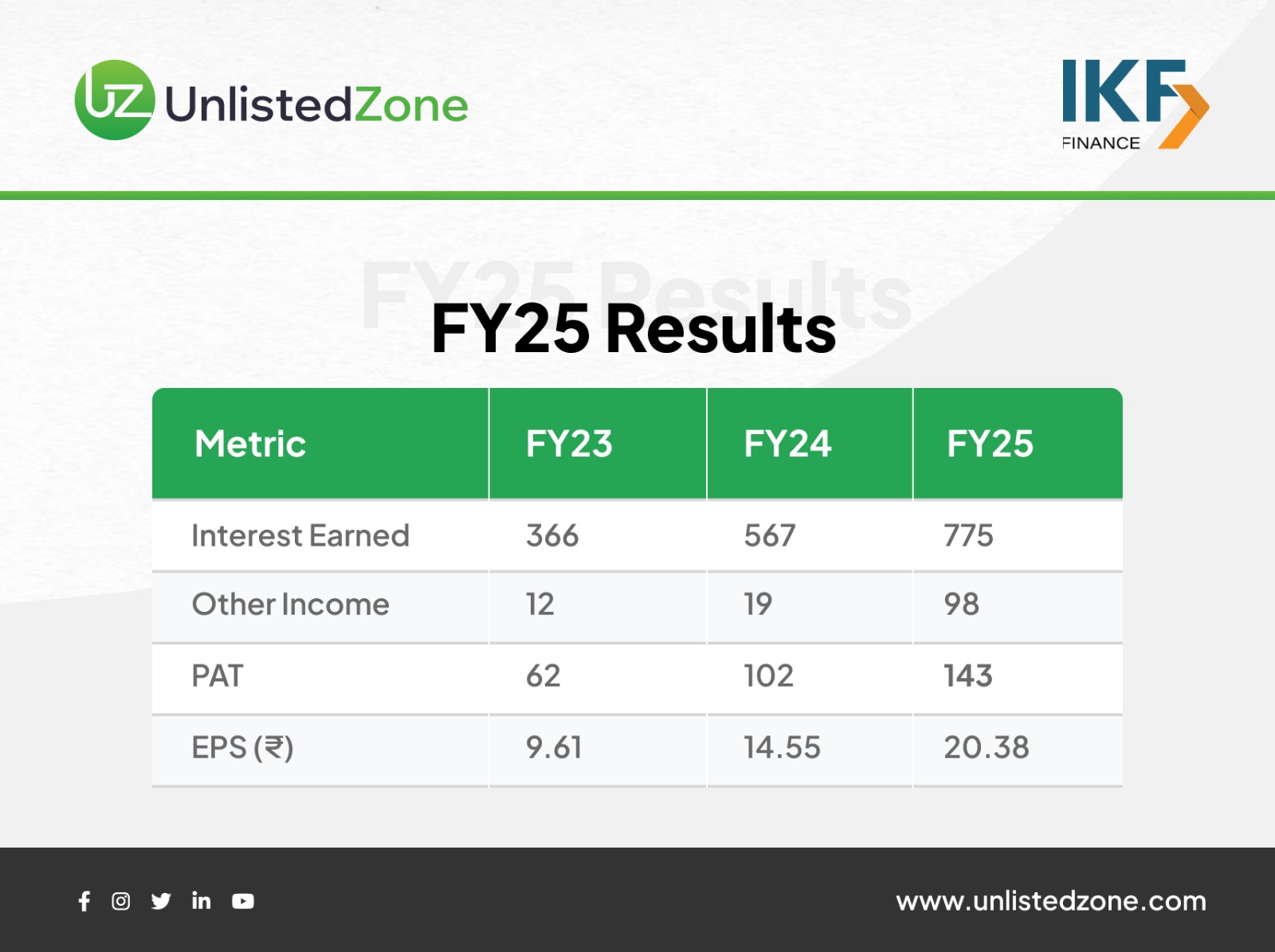

Profit & Loss Snapshot (₹ Cr)

Highlights:

-

Interest income more than doubled in two years

-

PAT grew at a strong CAGR

-

EPS increased over 2x between FY23–FY25

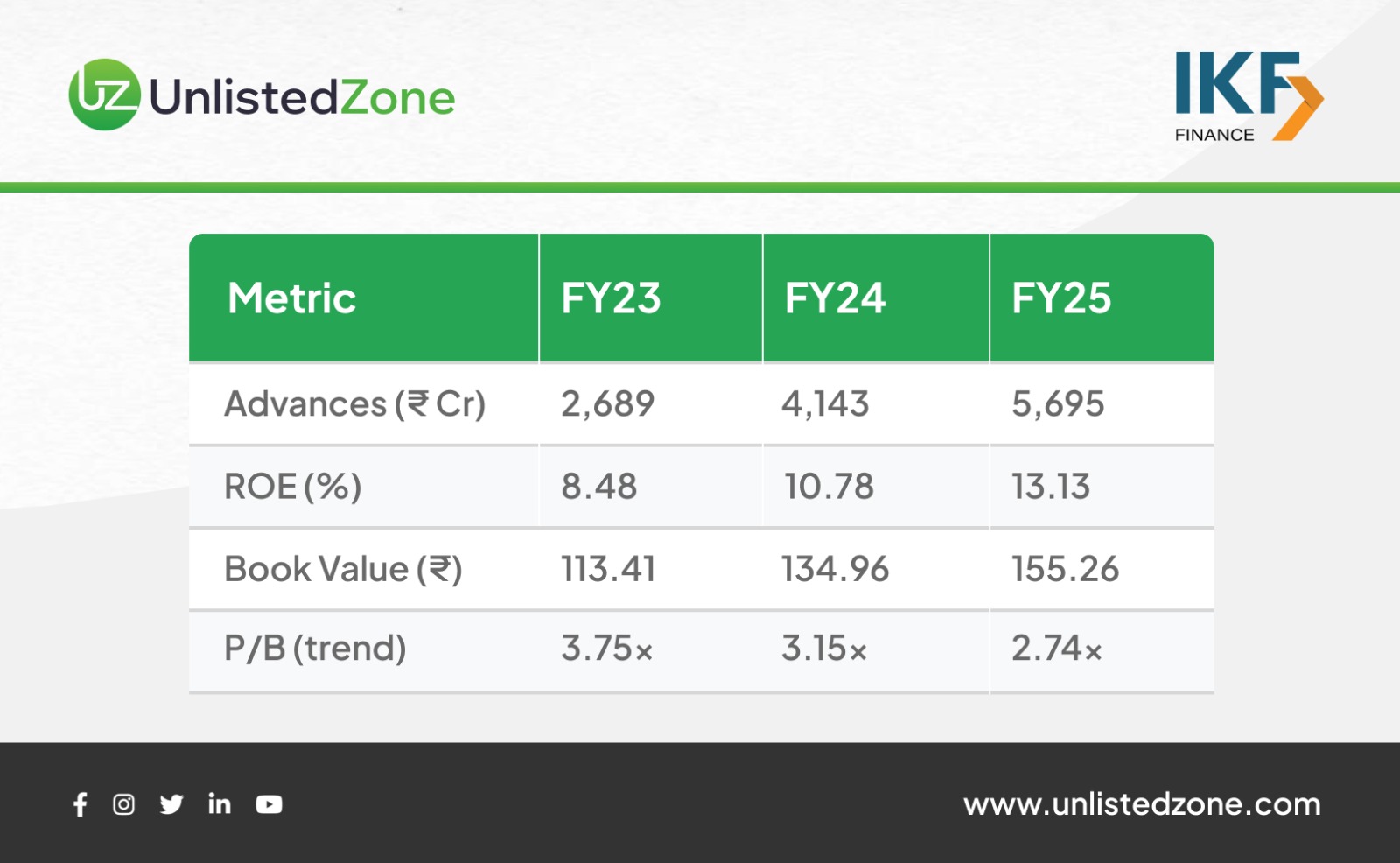

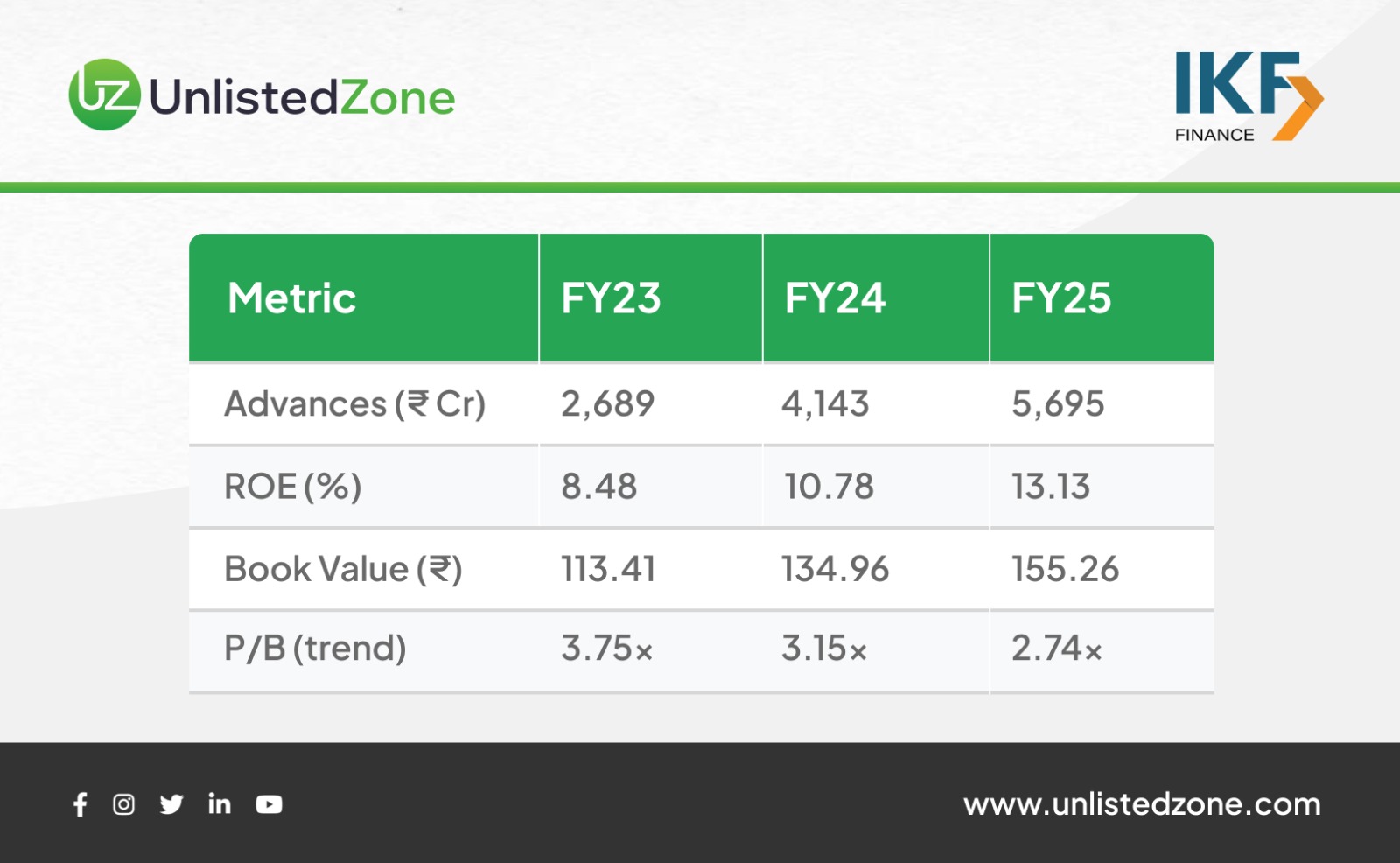

Balance Sheet Expansion: Growth with Control

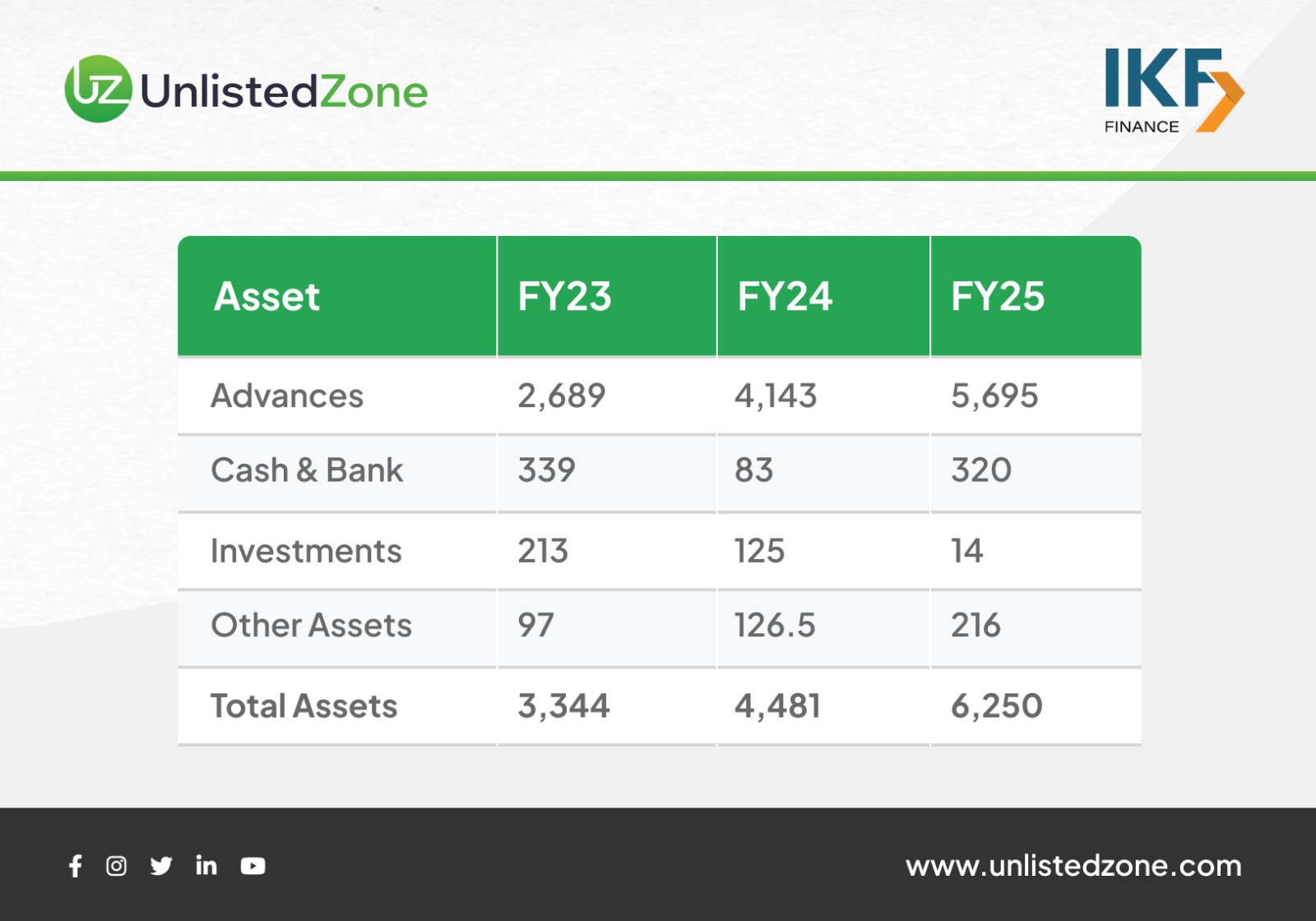

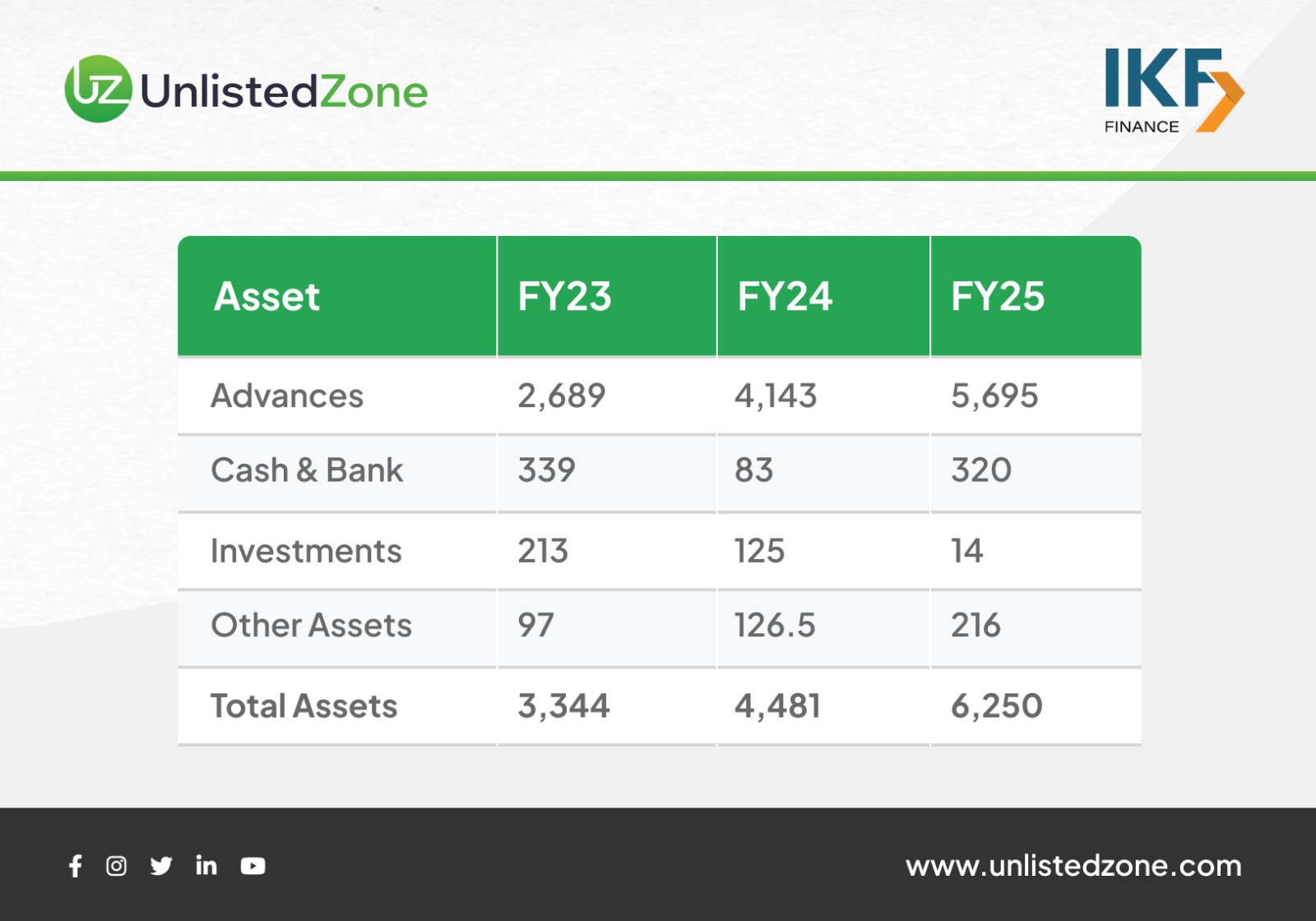

Assets (₹ Cr)

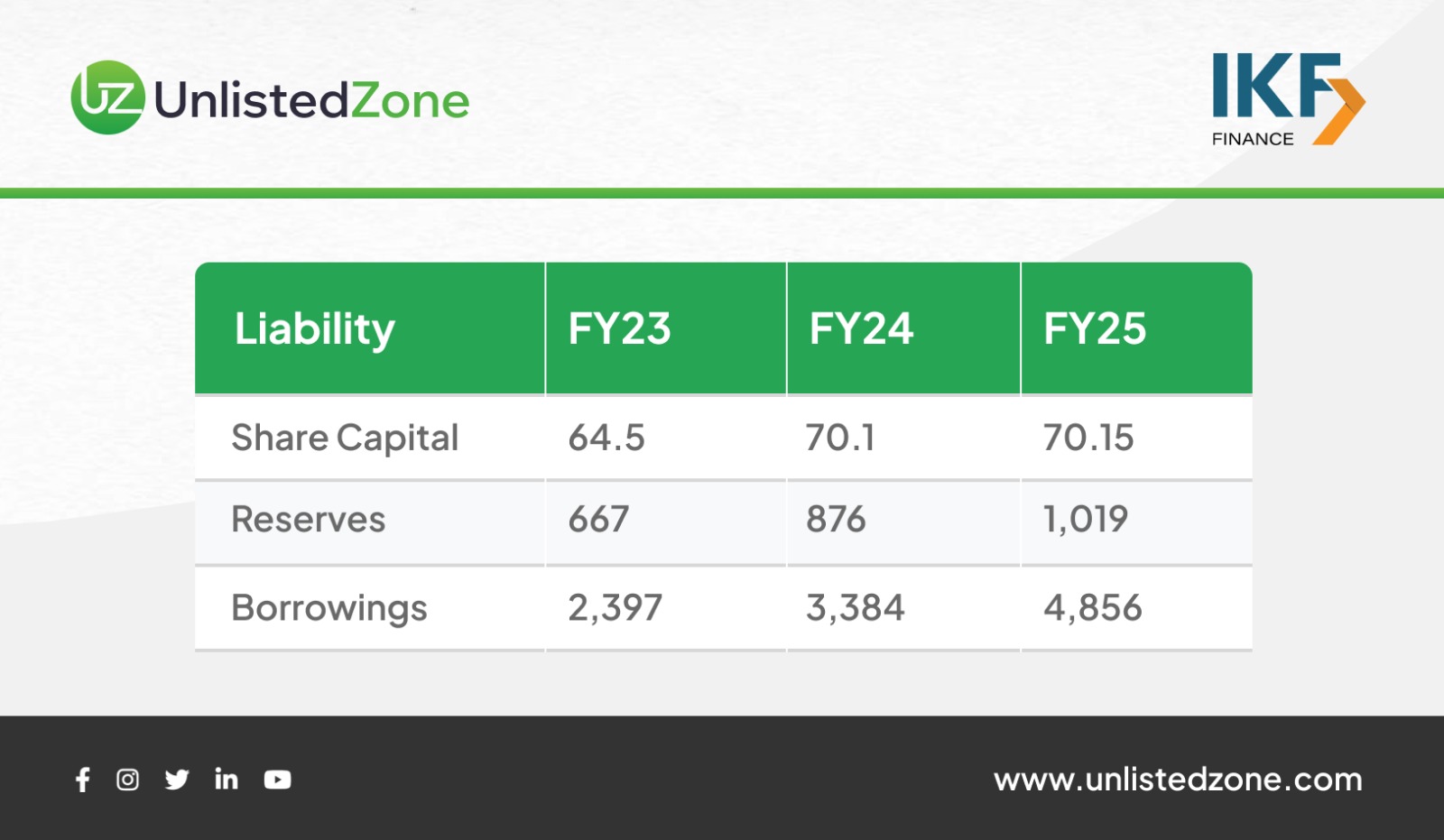

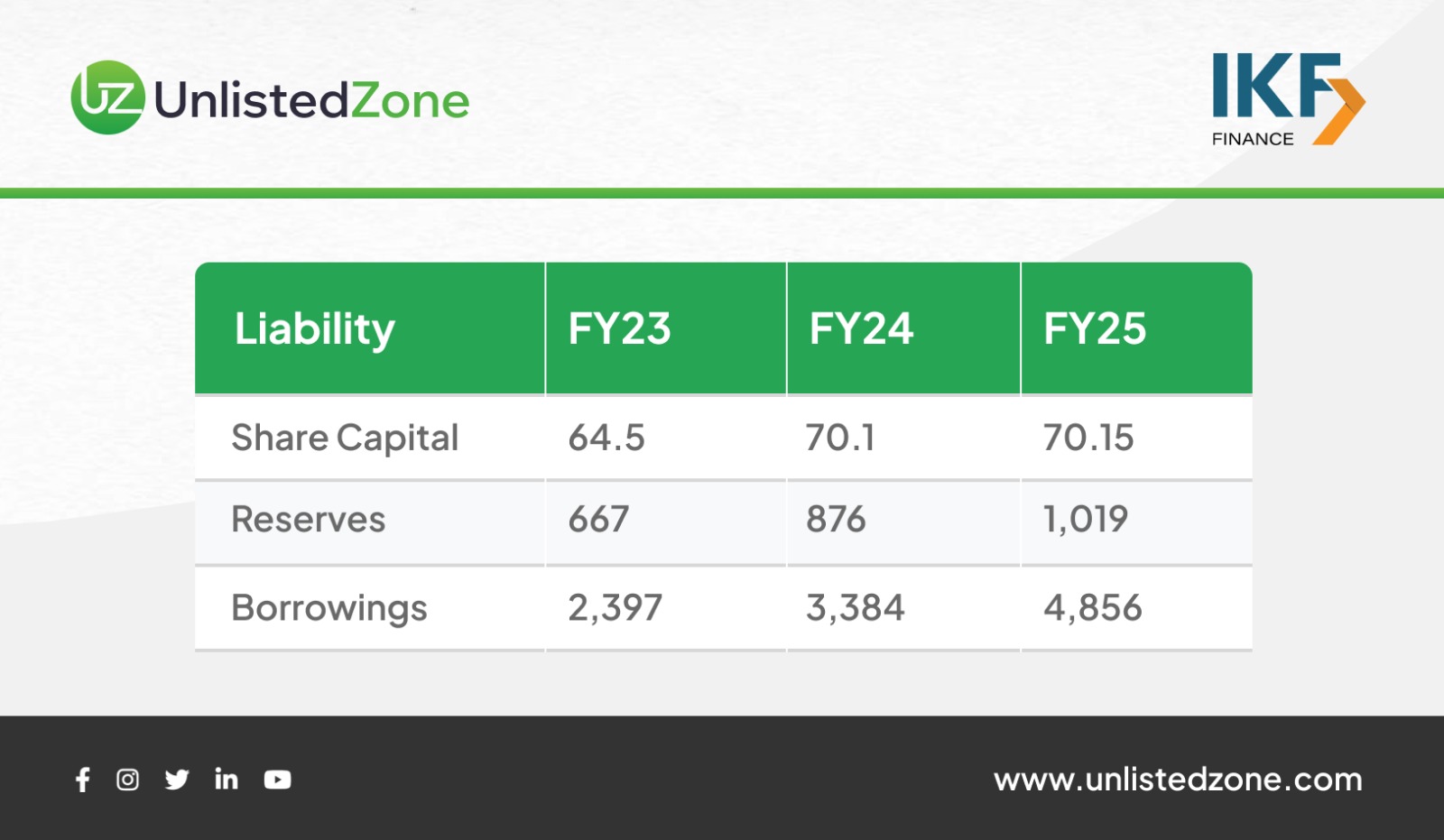

Liabilities (₹ Cr)

Key Observations:

-

Advances grew 2.1x in two years

-

ROE improved from 8.48% to 13.13%

-

Capital base strengthened alongside asset growth

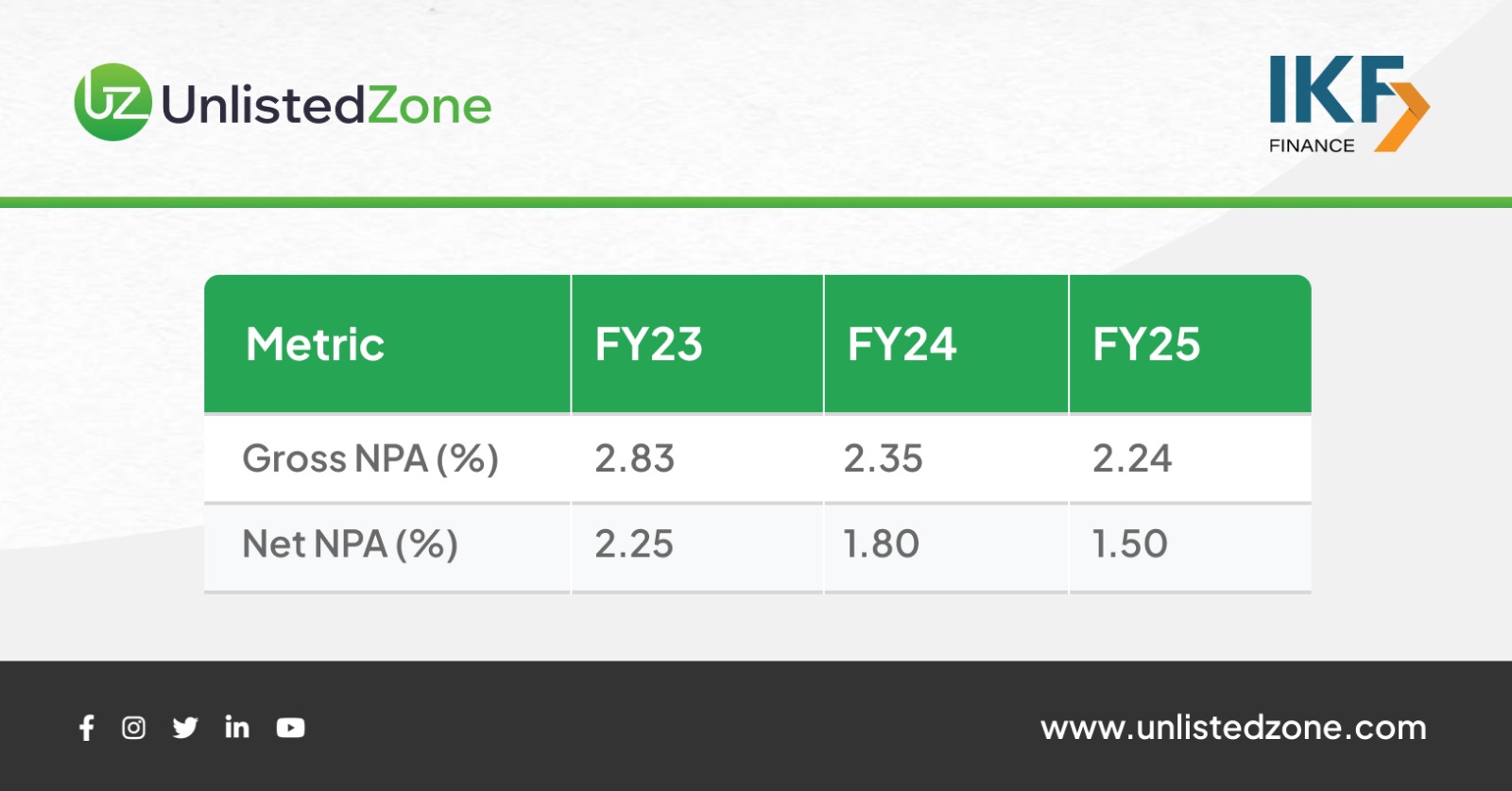

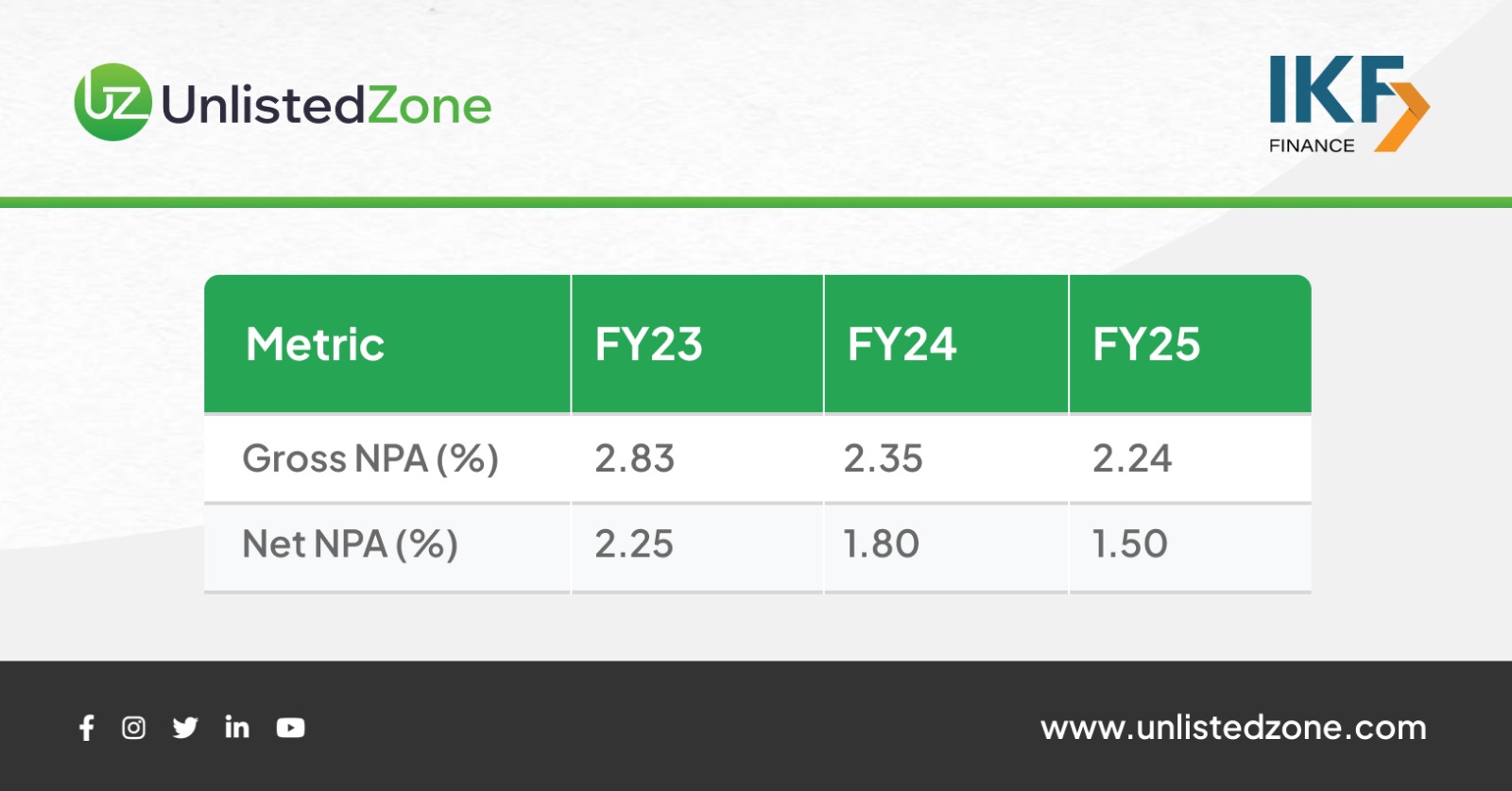

Asset Quality: Improving Despite Scale

For a rural-focused NBFC, sub-2.5% GNPA reflects disciplined underwriting and strong collection efficiency.

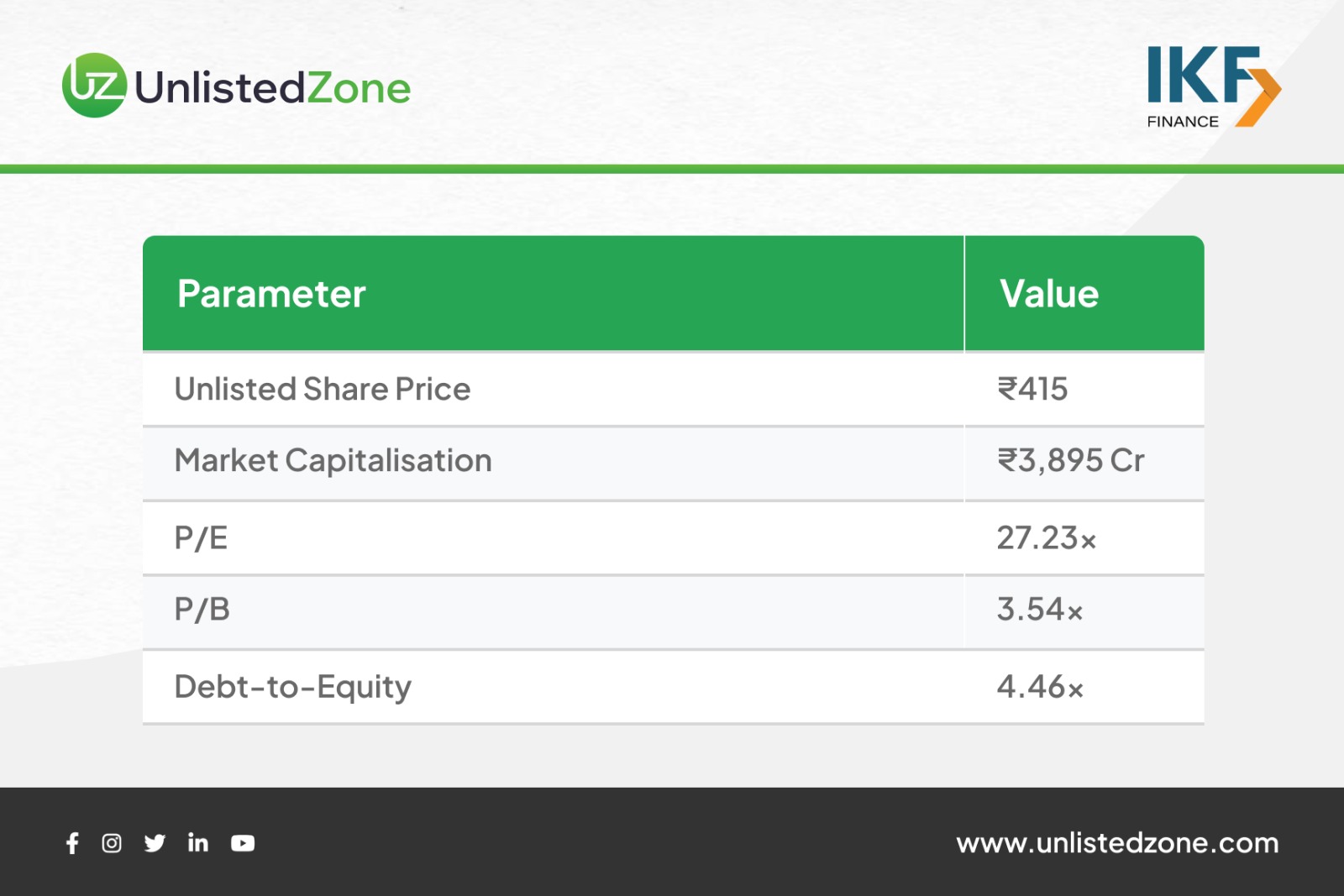

Efficiency & Valuation Metrics

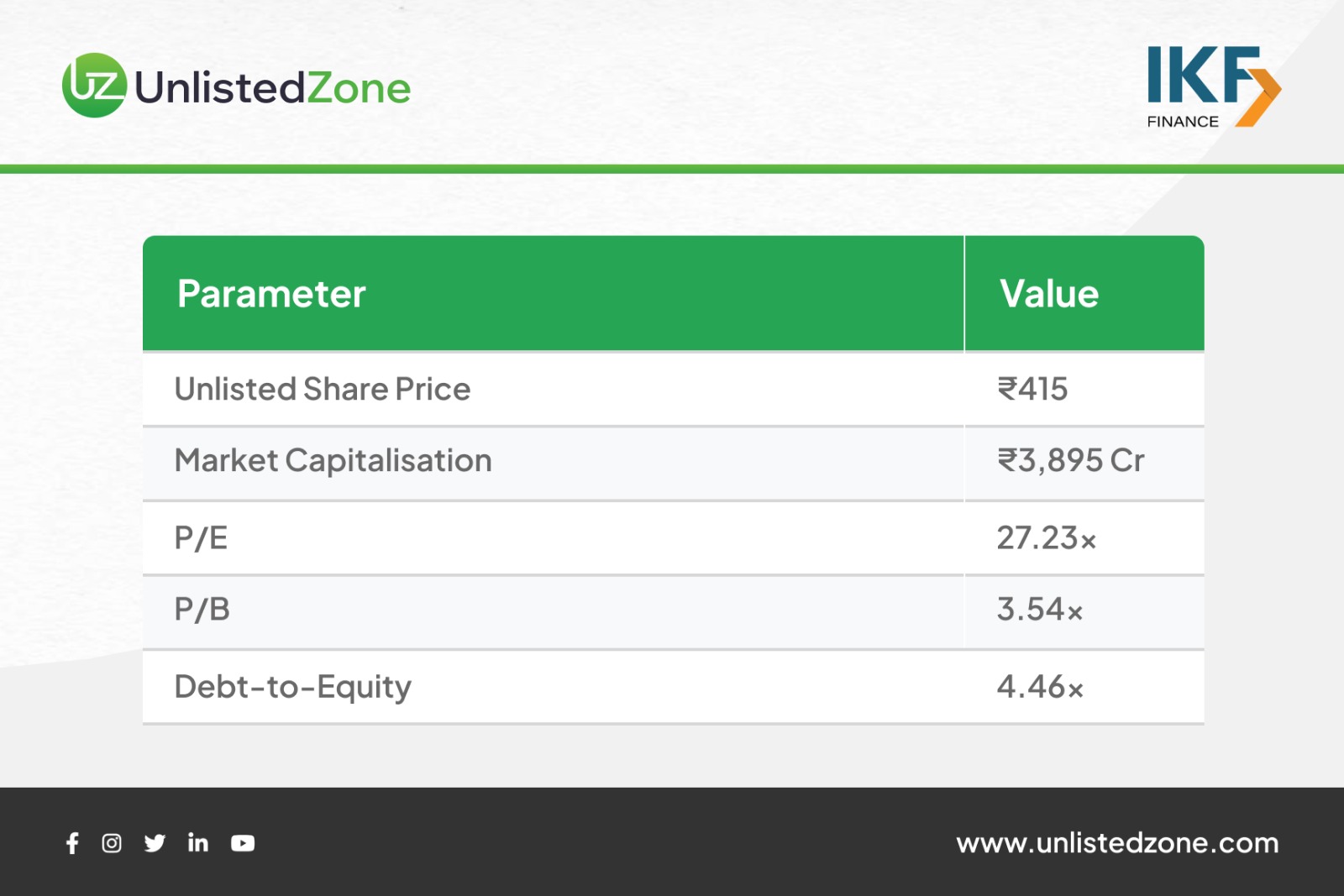

Unlisted Market Snapshot

The UnlistedZone Take

-

Creador’s entry validates IKF Finance’s business model and growth trajectory

-

Financials show a rare mix of high growth with improving asset quality

-

AOA amendments and capital restructuring hint at IPO preparation or accelerated expansion

-

Valuations are rich for an NBFC, but justified if 20%+ growth sustains

Bottom Line:

IKF Finance is transitioning from a regional lender to an institutional-grade NBFC. The recent equity issuance is the clearest signal yet that the company is preparing for its next big leap.