India’s IPO market isn’t reopening because sentiment improved. It’s reopening because profits returned.

Two very different companies — ESDS Software Solutions and OYO (via parent Prism) — just crossed critical IPO checkpoints:

Different sectors. Different histories. One common thread: both are approaching the market with profitability, not promises.

Let’s break down why this matters — UnlistedZone style.

A) ESDS Software Solutions: SEBI’s Nod to a Profitable Indian Cloud Challenger

ESDS Software Solutions has done something rare in India’s cloud infrastructure space — built profitable scale with proprietary technology.

SEBI’s clearance for its IPO, along with a size increase from ₹600 Cr to ₹720 Cr, signals strong visibility on both demand and execution.

IPO snapshot

Companies don’t upsize IPOs post-SEBI review unless institutional appetite and earnings confidence are high. This is expansion capital, not balance-sheet repair.

Who is ESDS?

Founded in 2005 and headquartered in Nashik, ESDS is a cloud computing and data centre services company operating across 19 countries.

Its clients span BFSI, healthcare, government, manufacturing, and e-commerce — sectors where uptime and compliance matter more than raw scale.

Founder Piyush Somani positioned ESDS as a homegrown alternative to AWS, Azure, Google Cloud, Sify, and Netmagic — but with a sharply defined niche.

The moat: eNlight Cloud

ESDS’s core differentiator is eNlight Cloud — India’s first patented cloud platform, with patents granted in the US and UK.

What makes it different:

-

Real-time auto-scaling of CPU and RAM

-

Zero downtime during scaling

-

Converts customer CAPEX into OPEX

For regulated industries like banks and hospitals, this isn’t a feature — it’s a requirement.

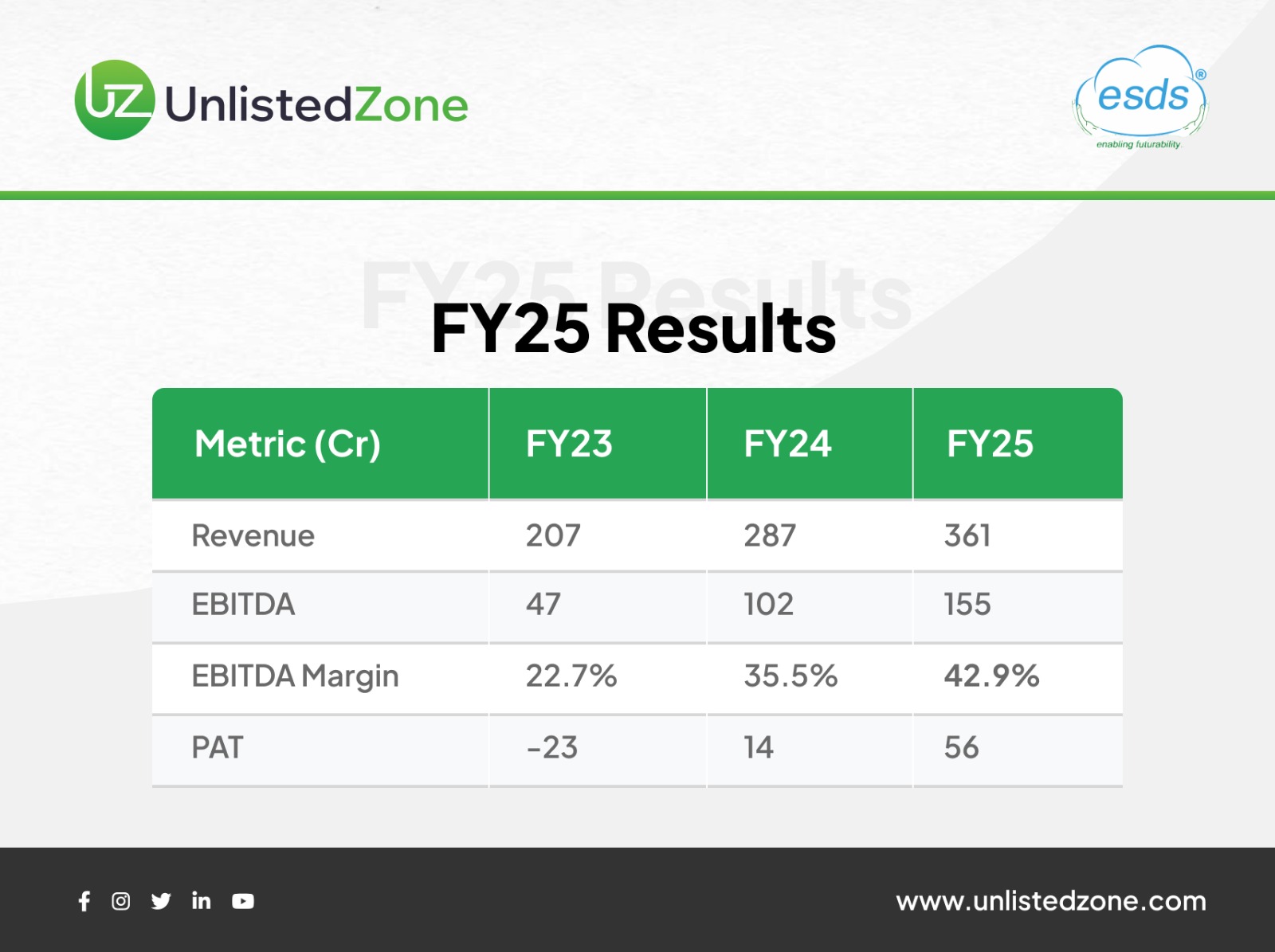

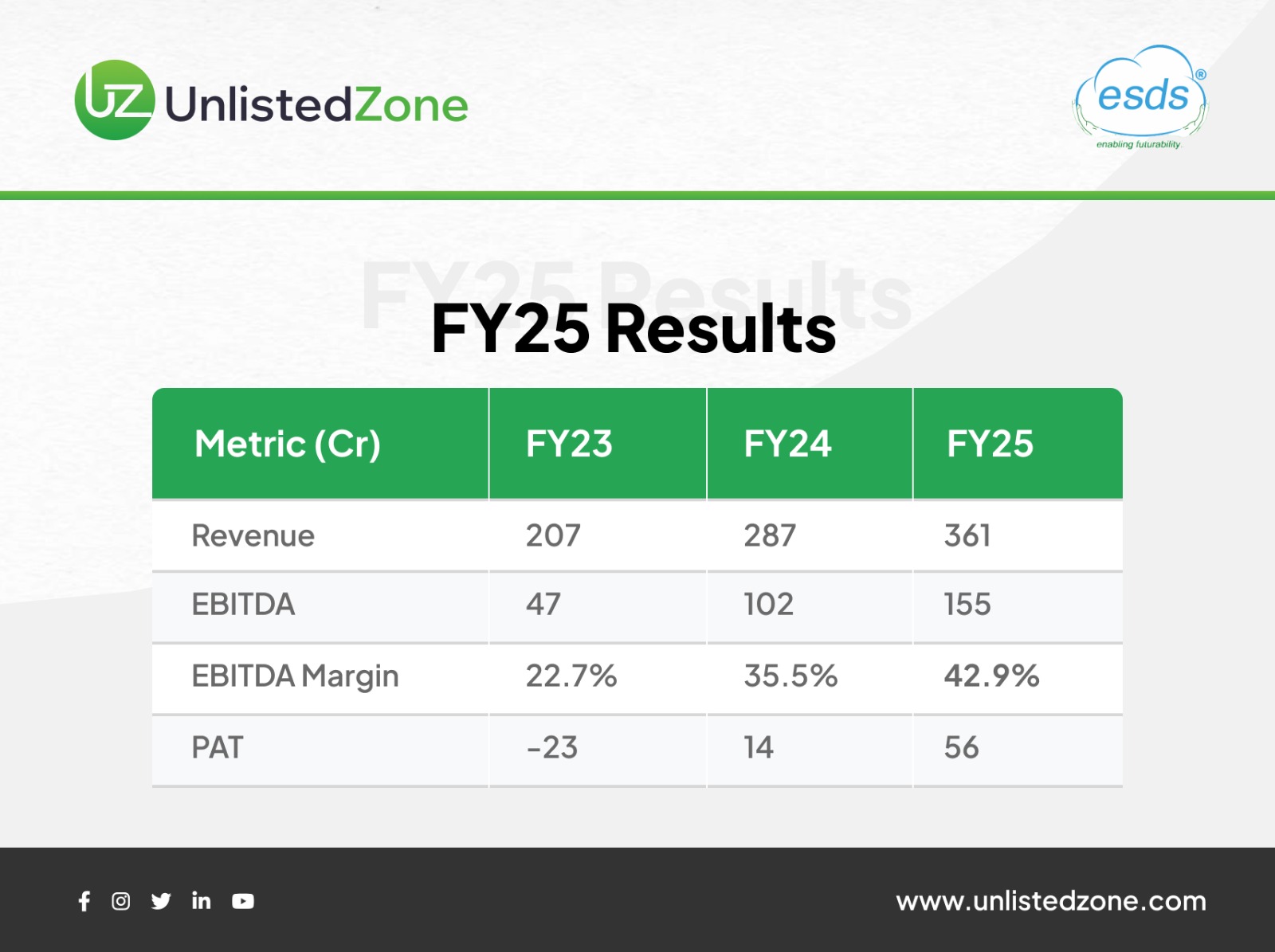

ESDS Financials: Operating Leverage in Action

What stands out:

-

Revenue CAGR with margin expansion

-

EBITDA margins nearing 43% — rare for infra-led tech

-

Clear shift from losses to sustained profitability

The global pivot investors are watching

ESDS’s valuation story changed materially in FY25.

This followed a ₹38.6 Cr investment in its overseas subsidiary (ESDS Cloud FZ LLC), reducing India-only risk and improving global scalability optics.

B) OYO: Shareholders Signal the IPO Engine Is Back On

While ESDS represents a first-time listing, OYO’s IPO comeback is about credibility regained.

Prism, OYO’s parent, has secured shareholder approval to raise ₹6,650 Cr via IPO, along with a 1:19 bonus issue — a classic pre-listing capital structure clean-up.

This approval allows Prism to move ahead with regulatory filings and timeline finalisation.

In short: the IPO machinery is officially warming up again.

Has OYO fixed its business?

For years, OYO’s public market ambitions were derailed by losses and volatility.

FY25 changed that.

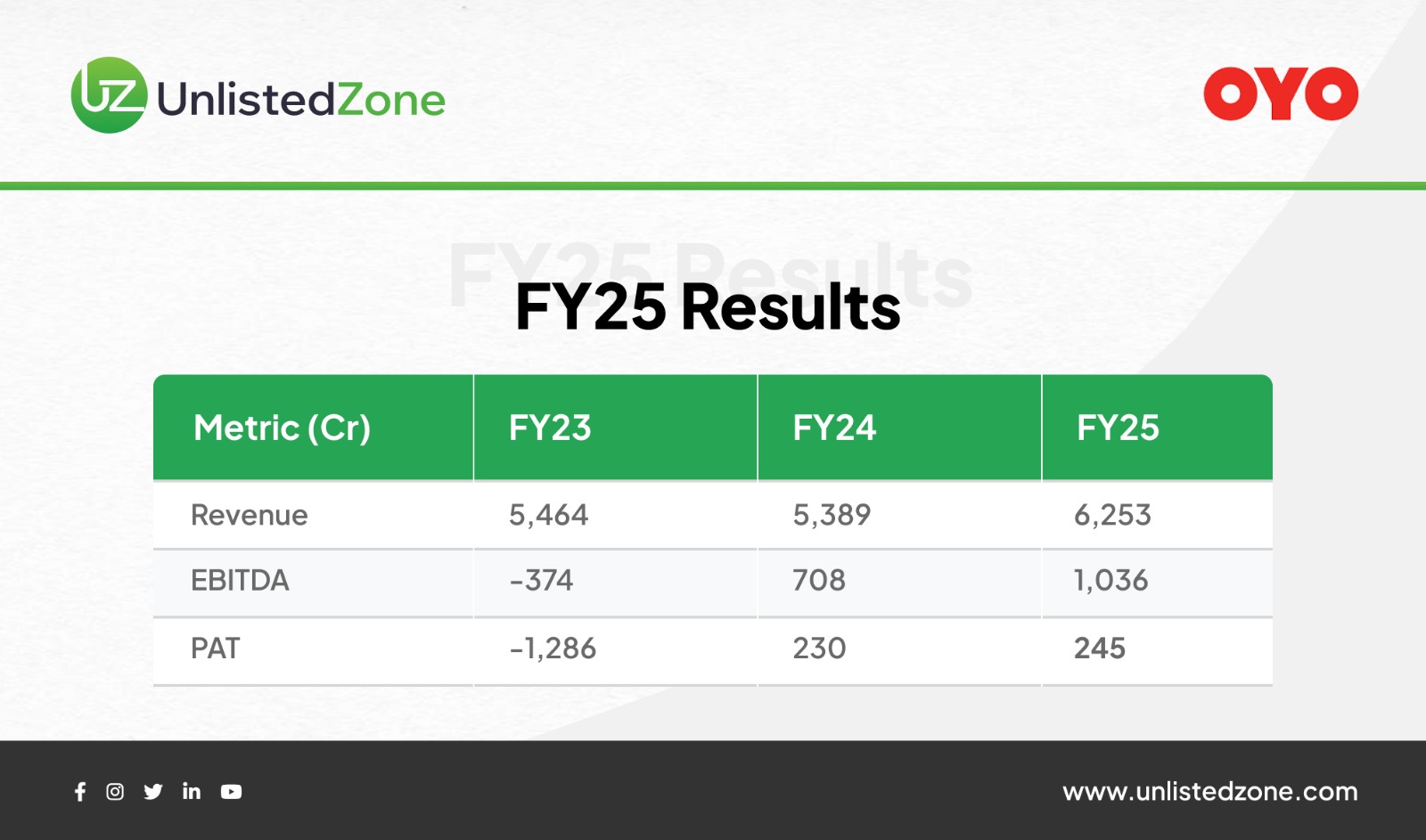

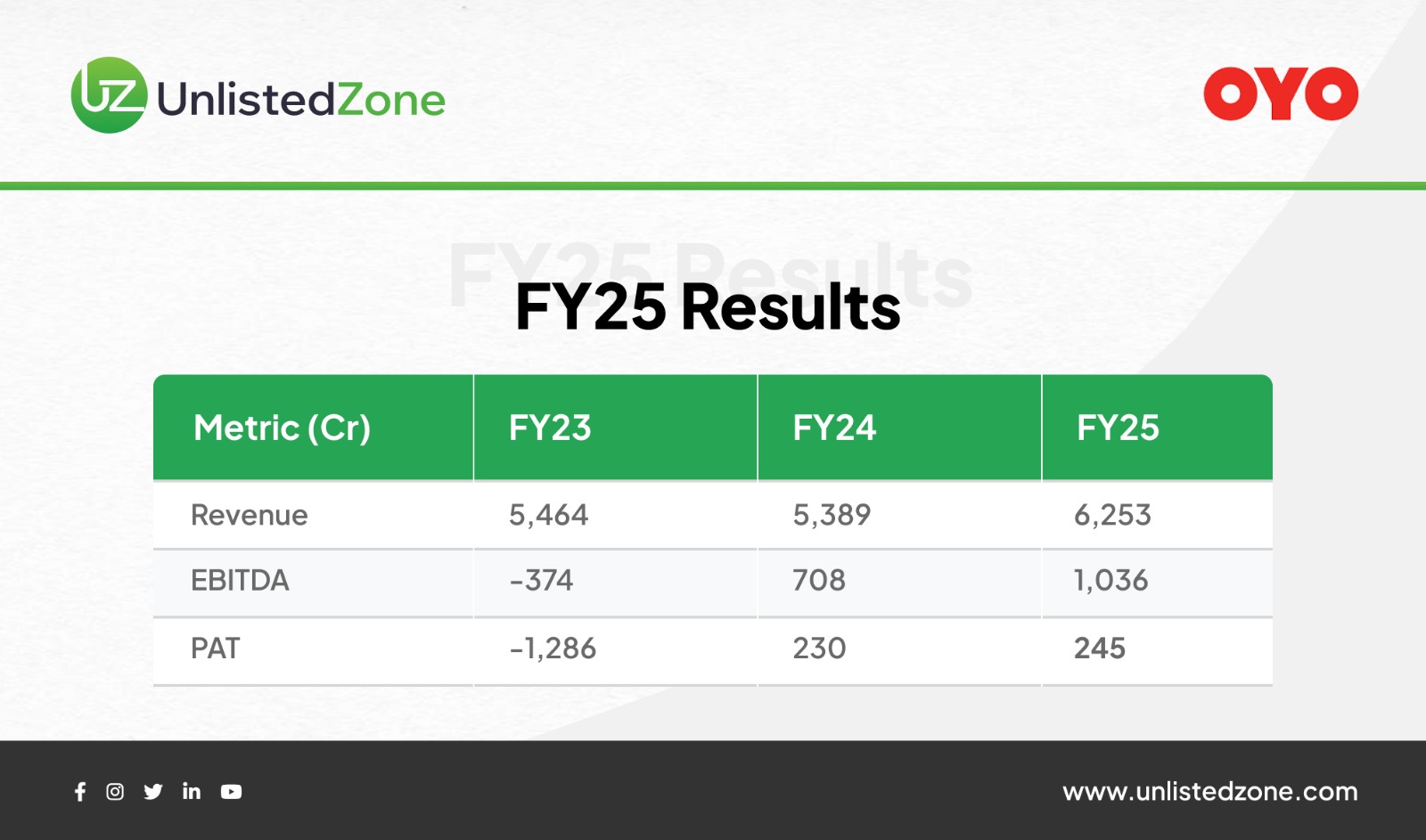

OYO Financials (₹ Cr)

What this tells us:

This isn’t cosmetic profitability. It’s structural.

Why profitability changes everything

Public markets no longer reward growth without discipline.

Today’s IPO filters are simple:

-

Predictable cash flows

-

Scalable unit economics

-

Capital efficiency

Both ESDS and OYO now tick these boxes — albeit in very different ways.

The UnlistedZone Take

This isn’t an IPO revival driven by easy liquidity.

It’s a quality reset.

-

ESDS is entering markets with patented tech, expanding margins, and global optionality.

-

OYO is returning with profits, scale, and a repaired balance sheet.

Different journeys. Same signal.

India’s next IPO wave belongs to companies that already make money — and want capital to scale it further.