Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

India wants to become a serious player in high-value aerostructures — the stuff that goes into aircraft wings, UAV frames, satellite components, and next‑gen defence platforms. Singularity AMC has now invested $11.14 million (nearly ₹100 crore) into Lohia Aerospace Systems, signalling strong private‑capital confidence in India’s aerospace manufacturing capability.

Lohia Aerospace manufactures advanced composite materials, high‑precision aerostructures, and systems for aircraft, UAVs, defence platforms, satellites, and mobility applications. They supply directly to global OEMs.

Their portfolio includes:

Aircraft composite parts

UAV and drone airframes

Passenger‑to‑Freighter conversion components

Business jet structural components

Space and communication composite structures

Automotive and mobility composites

India’s aerospace and defence market is valued at $27.4 billion and is expected to reach $54.4 billion by 2033 at a 7% CAGR. Demand for composite materials is accelerating globally as platforms shift from metal to lightweight, high‑strength composites.

Lohia Aerospace has vertically integrated operations, deep engineering capability, advanced manufacturing systems, and a strong export track record. With a training and R&D ecosystem spanning India and Israel, the company possesses scalable talent and process strength.

Anurag Lohia (MD) sees the investment as a milestone that accelerates global expansion, strengthens product offerings, and aligns with the Aatmanirbhar Bharat mission. Singularity AMC’s leadership highlights Lohia’s precision manufacturing and strong quality focus as key reasons for backing the company.

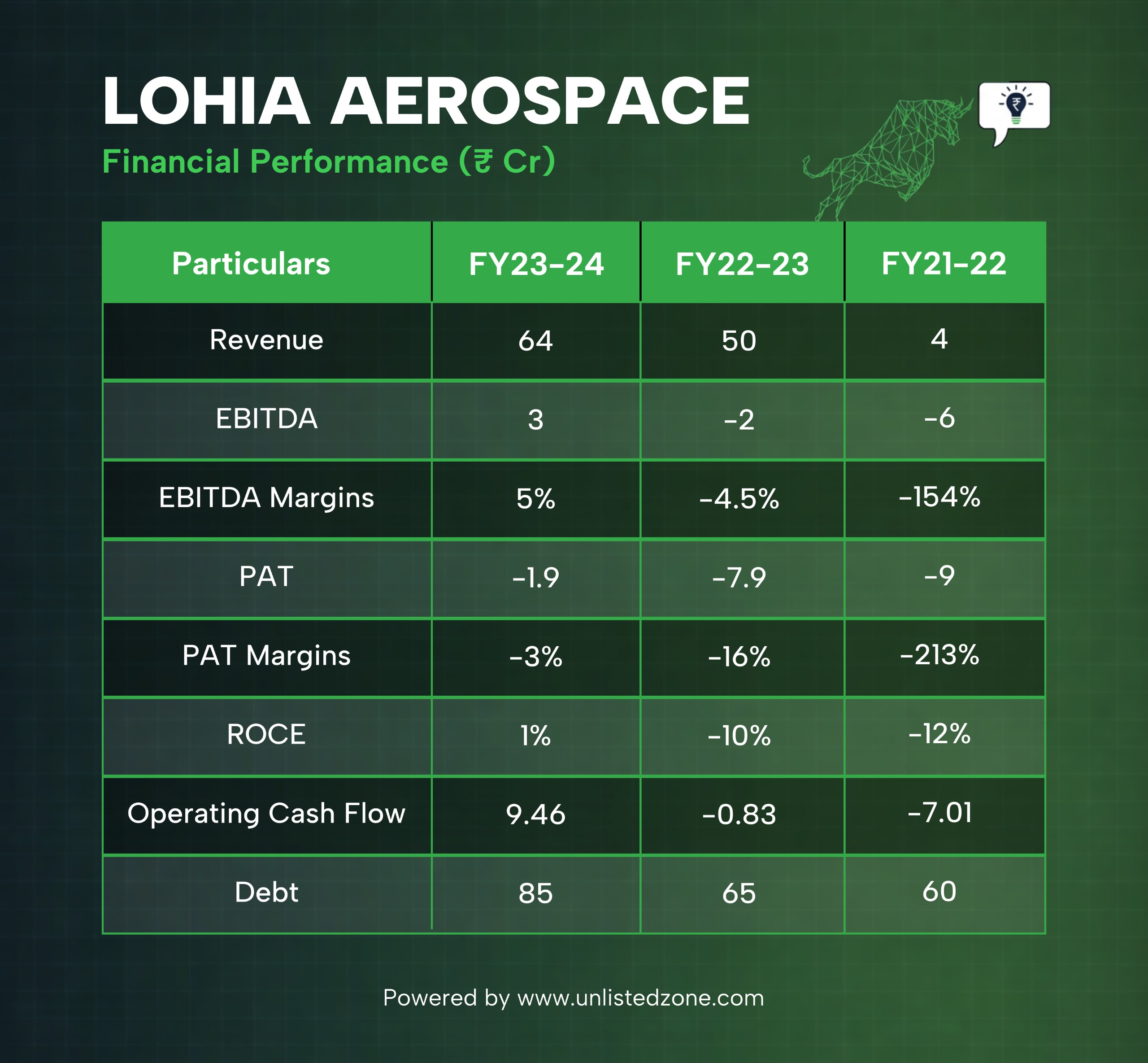

Lohia Aerospace has grown rapidly:

Revenue rose from ₹4 crore in FY22 to ₹64 crore in FY24.

EBITDA turned positive at ₹3 crore in FY24.

Cash flows improved significantly.

PAT remains negative due to expansion and debt servicing.

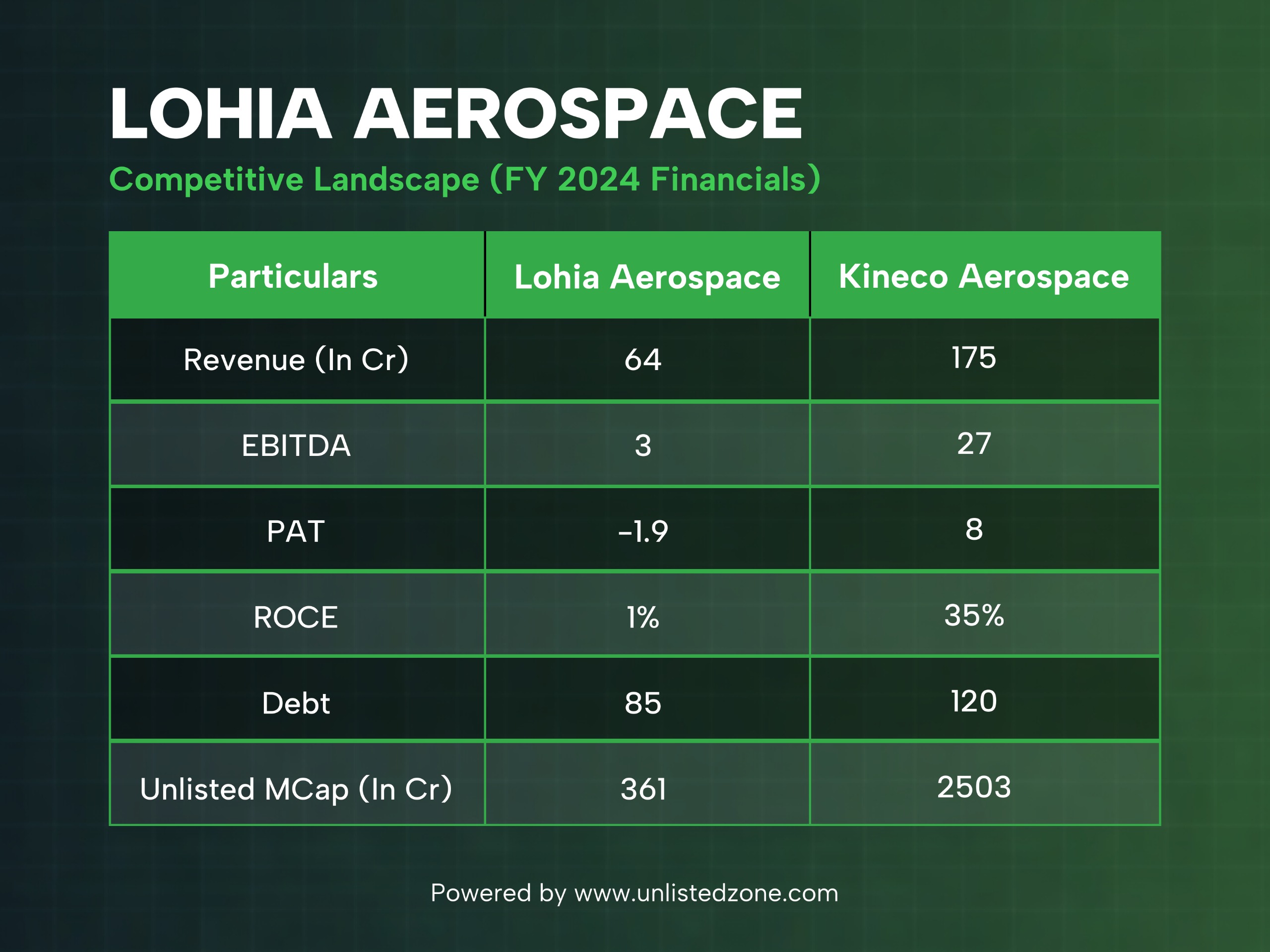

Against peers like Kineco Aerospace (₹175 crore revenue, ₹27 crore EBITDA), Lohia is smaller but scaling quickly with stronger export alignment.

As of March 2024, Lohia Aerospace had 2.50 crore shares outstanding.

In November 2025, the company issued an additional 45.77 lakh shares. This issuance comprised two components:

32.9 lakh shares were issued as part of a debt-to-equity conversion, with shares being transferred to promoters.

12.8 lakh shares were issued through a rights offering.

Consequently, the total number of outstanding shares increased to 2.957 crore.

The last round valued the company at ₹122 per share, implying a pre‑money valuation of roughly ₹361 crore.

Investors are effectively valuing the company at over 6x FY24 revenue, indicating confidence in long‑term export‑driven scaling rather than current profits.

Singularity AMC has invested approximately ₹100 crore in Lohia Aerospace, though the specific valuation and issue price of the transaction remain undisclosed.

India is pushing to become a global hub for aerospace composites.

Private capital is entering the sector aggressively.

Lohia Aerospace is emerging as a credible international supplier with deep technical competency.

The investment positions Lohia as a key player in India’s aerospace manufacturing landscape, ready to ride the next decade of defence and aviation growth.