Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

The name RRP Defense Ltd. has suddenly started appearing across exchange filings and investor discussions.

But behind the new identity lies an older listed company — Euro Asia Exports Ltd. — that was acquired and renamed before beginning its current wave of transactions.

Let’s look carefully at how this restructuring unfolded, what’s actually happening inside RRP Defense, and what the numbers say.

Originally, Euro Asia Exports Ltd. was a small, listed trading company.

In 2024, a group led by the RRP Group (Rajendra Chodankar and associates) acquired management control of Euro Asia Exports.

After the takeover, the company:

Changed its name to RRP Defense Ltd.,

Altered its business objects to focus on defence manufacturing and technology, and

Began the process of merging other RRP group entities into the listed vehicle.

In short, this isn’t a newly listed defence manufacturer — it’s an existing listed shell being used as a holding platform to bring in private group businesses.

On 7th November 2025, RRP Defense’s Board approved the acquisition of 100% equity in RRP Drones Innovation Pvt. Ltd., a recently formed drone company based in Navi Mumbai.

The deal was structured as a share swap, not cash:

1.27 crore new shares of RRP Defense will be issued at ₹178 per share,

In exchange for all 2.83 lakh shares of RRP Drones.

Total consideration: ₹226.88 crore.

After the allotment, RRP Drones will become a wholly owned subsidiary of the listed entity.

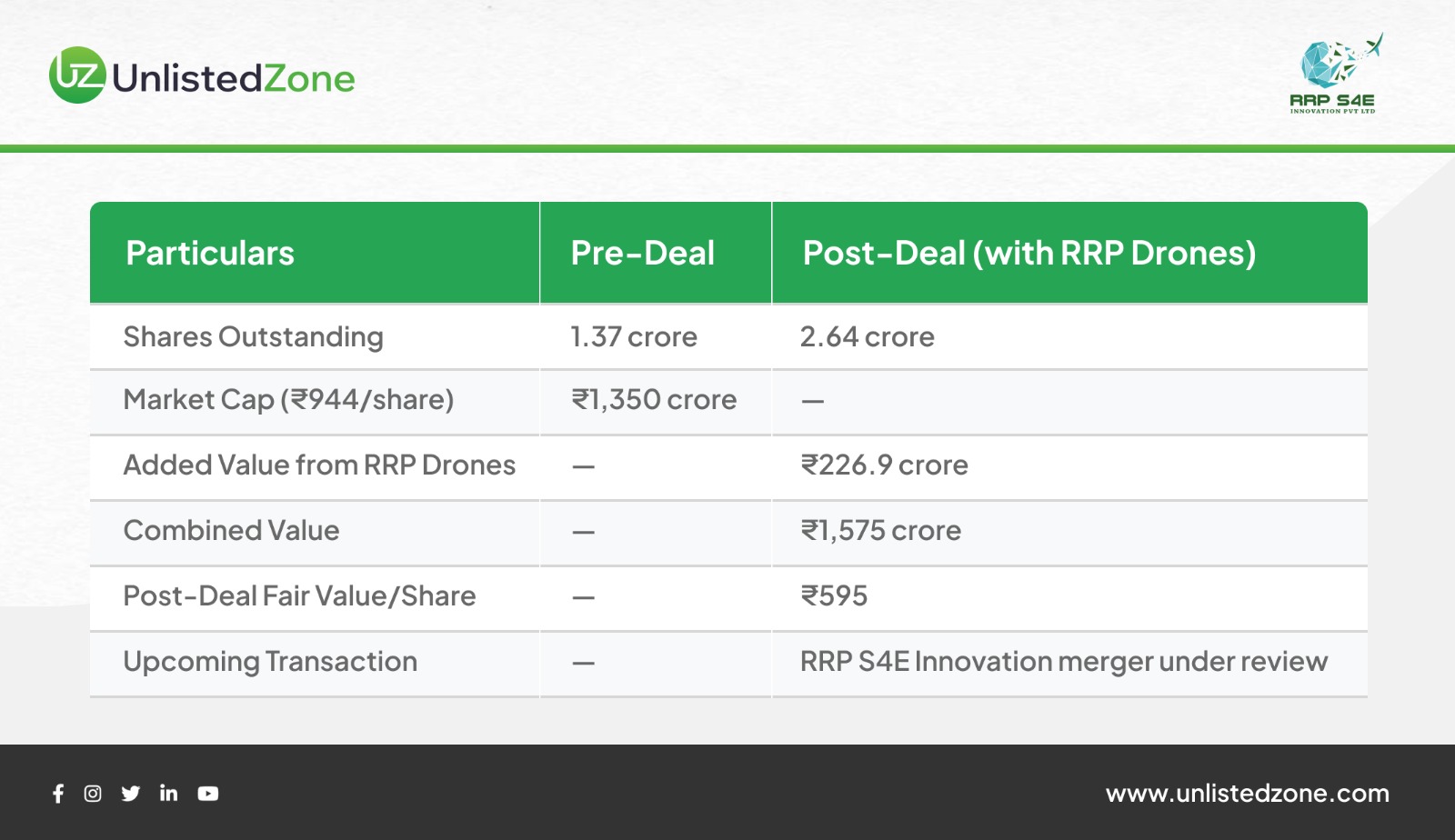

Before the acquisition, RRP Defense had:

1.37 crore shares outstanding,

Share price around ₹944,

Market capitalization of approximately ₹1,350 crore.

After issuing 1.27 crore new shares for the swap, the total share count will rise to 2.64 crore shares.

If we simply add the ₹226.9 crore value of RRP Drones to the existing ₹1,350 crore market cap, the combined implied valuation becomes about ₹1,575 crore.

That gives a post-deal fair value per share of:

₹1,575 crore÷2.64 crore shares=₹595 per share (approx.)

So, even though the current trading price of RRP Defense is ₹944, its fair post-acquisition value works out closer to ₹595 per share.

This implies that the market is already pricing in future growth assumptions — possibly from upcoming mergers or new defence projects — rather than present fundamentals.

Alongside this acquisition, the Board also discussed merging another group company, RRP S4E Innovation Ltd., into RRP Defense.

A three-member committee has been formed to study the merger structure, valuation, and fairness report.

If approved, the merged company would consolidate:

RRP Drones Innovation Pvt. Ltd. – Drone manufacturing and training

RRP S4E Innovation Ltd. – Electronics and embedded systems

RRP Defense Ltd. (formerly Euro Asia Exports) – The listed parent

However, no merger ratio or valuation report for S4E has yet been released.

RRP Defense’s recent activity is part of a reverse acquisition and consolidation strategy — where an existing listed company is used as a vehicle to bring multiple private entities under one public umbrella.

Such structures are not uncommon, but they often raise questions about:

The operational scale of the incoming businesses,

The justification of valuations, and

The actual revenue base of the merged entity.

Until the company discloses audited consolidated financials for FY26 post-merger, it will remain difficult to assess whether the current ₹1,350 crore market cap (or the post-deal ₹595/share fair value) reflects business reality or market speculation.

To summarize:

RRP Defense Ltd. was formerly Euro Asia Exports Ltd., a listed company acquired by the RRP Group.

The new promoters are now consolidating their private ventures — RRP Drones and RRP S4E — into this listed entity.

On paper, the combined value after the drone acquisition stands near ₹1,575 crore, implying a fair per-share value of ₹595.

While the structure may look ambitious, investors should watch for financial disclosure, audit transparency, and operational data from these newly merged businesses before assuming this valuation is justified.

At the moment, the story is more about restructuring than revenue.