Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

A) About NSE

The National Stock Exchange (NSE) plays a pivotal role in the Indian financial landscape, serving as a cornerstone for investors and businesses alike. Understanding its financial performance and other significant factors affecting the business over time provides valuable insights into the broader economic trends and market sentiment.

B) FY23 vs FY24 NSE Financial Performance

In fiscal year 2023, NSE reported a revenue of ₹12,650 Cr, which saw a robust increase to ₹14,793 Cr in fiscal year 2024, reflecting a significant year-on-year growth of approximately 16.95%. Similarly, the Profit After Tax (PAT) showed a positive trend, rising from ₹7,501 Cr in FY23 to ₹8,406 Cr in FY24, marking a notable year-on-year growth of around 12.02%.

Consolidated total expenses reached ₹5,350 crore, increasing significantly due to factors like SEBI-mandated contributions to the Core SGF and rising regulatory fees. Standalone expenses showed a similar trend, reaching ₹6,139 crore, reflecting business growth and regulatory compliance.

Consolidated earnings per share (EPS) came in at ₹167.79, while the standalone EPS was ₹129.15.

Let's explore how NSE performed in FY23 compared to FY24, highlighting significant developments and trends that shaped its performance during these periods.

P & L Statement (Figures in Cr)

|

Parameters |

FY23 |

FY24 |

|

Revenue |

12650 |

14793 |

|

Cost of Consumed Material |

0 |

0 |

|

Gross Margins |

100 |

100 |

|

Change in Inventory |

0 |

0 |

|

Employees Benefits Expenses |

366 |

460 |

|

Other Expenses |

1859 |

2709 |

|

EBITDA |

9631 |

11611 |

|

OPM |

81.23 |

78.56 |

|

Other Income |

794 |

13 |

|

Finance Cost |

0 |

0 |

|

D & A |

384 |

439 |

|

EBIT |

9247 |

11172 |

|

EBIT Margins |

77.99 |

75.59 |

|

PBT |

10041 |

11184 |

|

PBT Margins |

84.69 |

75.67 |

|

Tax |

2540 |

2778 |

|

PAT |

7501 |

8406 |

|

NPM |

63.37 |

56.87 |

|

EPS |

151.54 |

169.82 |

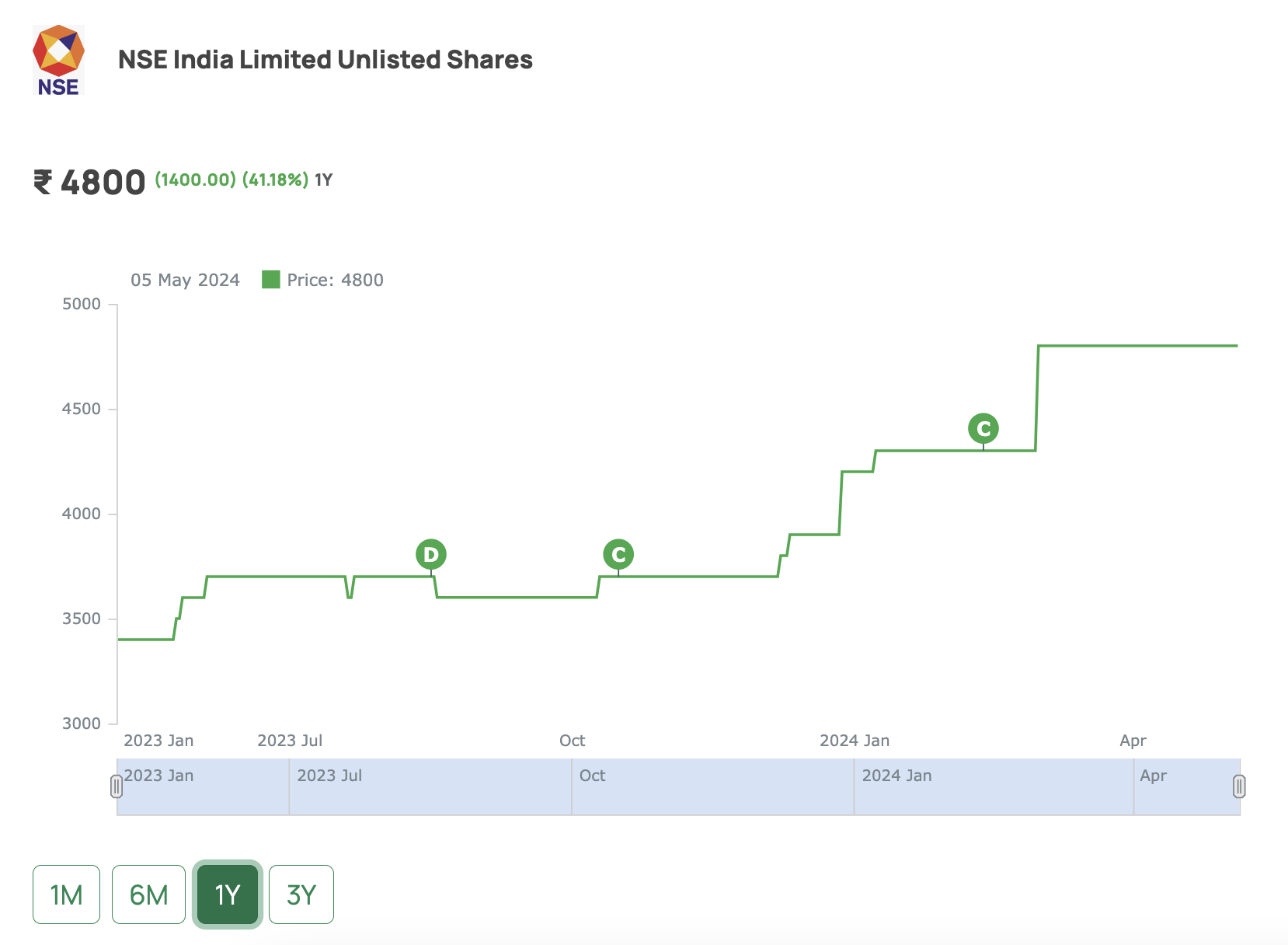

C) NSE Price movement in the last one year

The NSE unlisted share price experienced a notable upward trajectory over the past year. In May 2023, it stood at INR 3600 per share, witnessing a subsequent increase to INR 4200 by January 2024. As of May 2024, the share price has further appreciated to approximately INR 4800 per share, indicating a commendable overall increase of approximately 33.33% from May 2023 to May 2024.

Source: www.unlistedzone.com

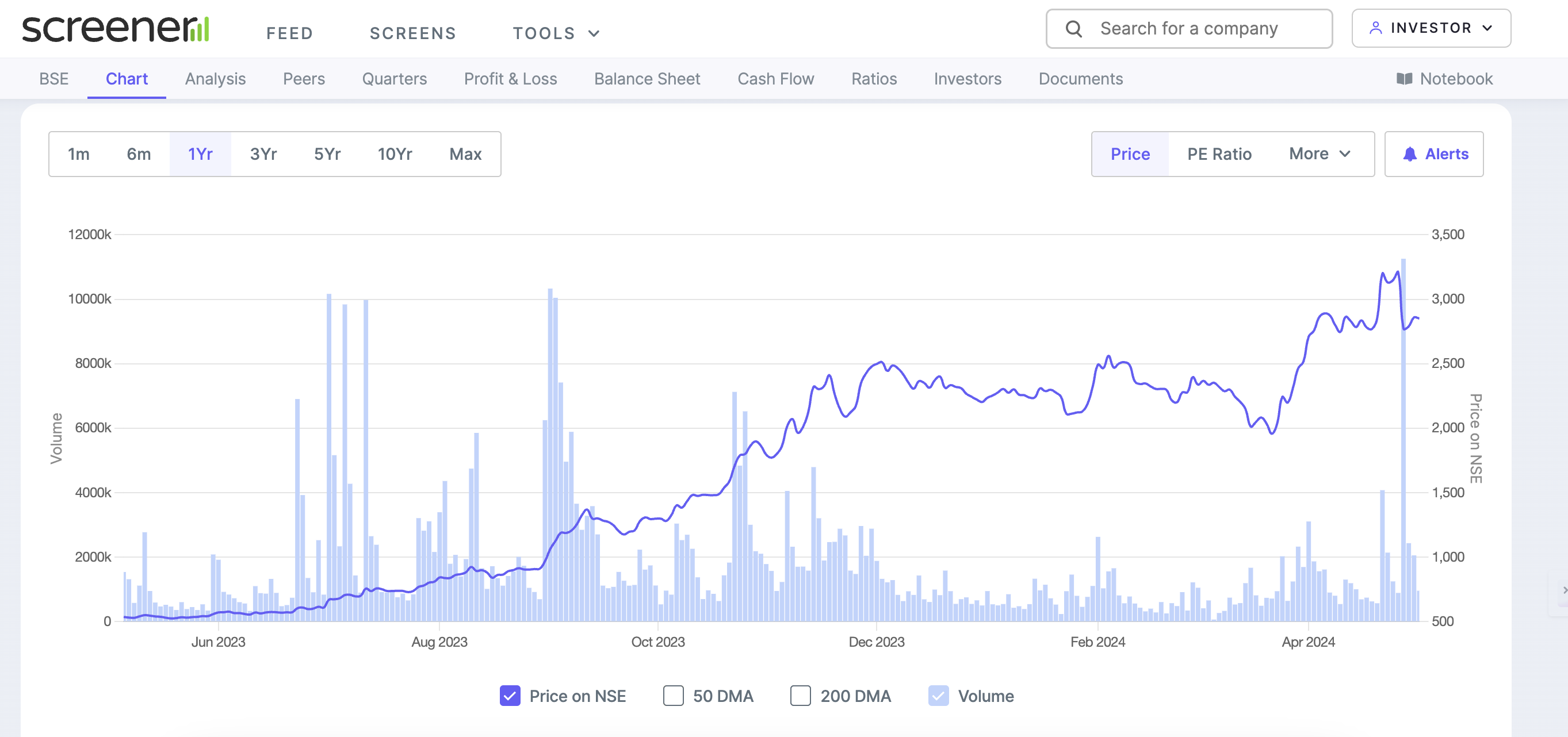

D) Returns given by BSE vs NSE

The NSE and BSE, both prominent stock exchanges in India, have witnessed notable fluctuations in their unlisted share prices over the past year. The NSE share price experienced a commendable increase from INR 3600 in May 2023 to INR 4800 in May 2024, marking a percentage increase of 33.33%. In contrast, the BSE share price soared from INR 540 in May 2023 to INR 2845 in May 2024, reflecting a substantial percentage increase of 426.85%. This indicates that the BSE share price has significantly outperformed the NSE share price during this period, showcasing a remarkable growth trajectory for investors.

E) BSE Share Price 1 Year Return

The surge in BSE share price is fueled by robust options revenue growth and the introduction of the Futures and Options (FnO) business, which significantly boosts income. Positive market sentiment is driven by optimistic revenue and profit growth outlooks. Despite high initial clearing costs, scalability is expected to gradually reduce expenses. As BSE expands operations and trading volumes increase, economies of scale are anticipated to enhance margins.

F) BSE vs NSE Valuation

The valuation disparity between the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) highlights their contrasting market standings and operational landscapes. With a valuation of INR 185,000 crore, the NSE boasts a substantially higher market worth compared to the BSE, valued at INR 38,592 crore. However, NSE is available at P/E of just 28x as compared to BSE at 94x.

Even if you give 40x multiple to NSE Unlisted Share, the fair value would be around = 169*40 = INR 6700 per share.

The NSE's implementation of cutting-edge technologies and innovative products, such as options trading and electronic trading platforms, further solidifies its market leadership. In contrast, while the BSE retains historical significance and remains a crucial trading platform, its valuation reflects relatively modest trading volumes and market share. Despite the valuation contrast, both exchanges play pivotal roles in India's financial ecosystem, catering to the varied needs of investors and businesses across the nation.

G) Bonus and Dividend Announcement by NSE Unlisted Share

The National Stock Exchange (NSE) has unveiled a generous package for its shareholders, including a notable bonus share issuance at a ratio of 4:1 and a substantial dividend of 90 per share. This move reflects NSE's commitment to enhancing shareholder value and confidence in its future growth trajectory. By offering bonus shares and a significant dividend payout, NSE demonstrates its strong financial performance and commitment to delivering attractive returns to investors.

After Bonus adjustment the Price will come around INR 1000.

H) How to Buy NSE Unlisted Shares?

One can buy NSE unlisted shares using the UnlistedZone platform. UnlistedZone provides a seamless avenue for purchasing NSE unlisted shares. With the UnlistedZone app and website, acquiring these shares is convenient and straightforward. If you have any uncertainties or queries along the way, don't hesitate to reach out to us via email at sales@unlistedzone.com.