Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

In what could be one of India’s biggest market events of the decade, SEBI chairman Tuhin Kanta Pandey has finally confirmed that the National Stock Exchange (NSE) is set to receive its long-pending No-Objection Certificate (NOC) for its IPO by the end of this month.

If this happens, it will unblock an IPO that has been stuck for almost 10 years, making it one of the most delayed public listings in Indian corporate history.

NSE first filed its DRHP in December 2016. But what followed was a long list of compliance hurdles and regulatory scrutiny.

Co-location controversy and allegations of preferential access to algorithmic traders

Governance lapses flagged by SEBI

TAP (Trading Access Point) architecture and network concerns

Multiple unsuccessful NOC attempts in 2019, 2020, and August 2024

NSE has since settled several major disputes, including a ₹643 crore penalty for the co-location and connectivity issues.

SEBI chief Pandey stated in Chennai:

“We will give the NOC to NSE by this month end. Listing and other procedures regarding the IPO will be taken care of by them.”

This indicates regulatory closure and shifts the responsibility to NSE to resume listing procedures.

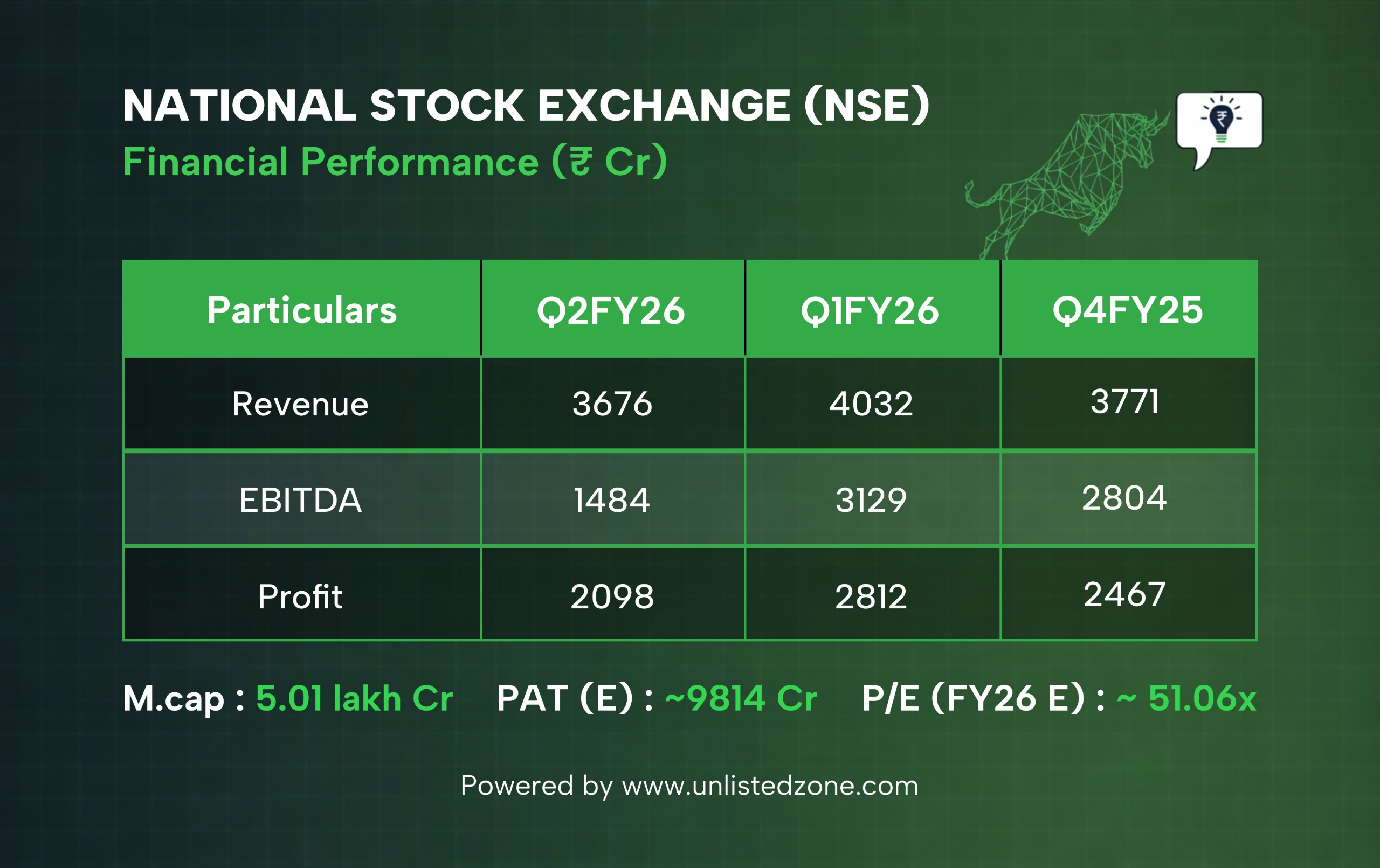

Market Cap: ₹5.01 lakh crore

Estimated FY26 PAT: ~₹9814 crore

P/E multiple (FY26E): ~51x

SEBI clarified that it does not decide valuations. Its focus is only on ensuring robust disclosures. New advertisement norms now clearly label whether an IPO is SME or mainboard.

Nearly 100,000 videos removed for illegal stock tips

AI tool Sudarshan deployed to scan influencer content

Stricter norms for misleading financial promotions

SEBI’s high-level committee is still evaluating conflict of interest rules for officials. More discussions are ongoing regarding public disclosures and governance frameworks.

Opportunity to invest in India’s largest exchange

Exposure to a monopoly-like business model

Strong profitability and high entry barriers

Increased transparency

Stronger governance frameworks

Potential to attract global institutional investors

After nearly a decade of delays, NSE’s IPO may finally be set in motion. With regulatory clearance likely this month and strong financials supporting the narrative, 2026 could witness one of the most significant listings in Indian market history.