Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

Berar Finance Limited is a Non-Banking Financial Company (NBFC) categorized under the Middle Layer as per RBI’s Scale-Based Regulation. Its core business revolves around asset financing, with a primary focus on two-wheeler loans. The company’s target market lies in the semi-urban and rural areas of Central & Western India. Berar Finance began its journey as a personal loan provider in Maharashtra and has since evolved into a deposit-taking NBFC.

Disbursement Growth: Disbursements increased by 22.67% in FY 2024-25.

Customer Base: Serves a growing base of approximately 2.94 lakh (294,000) customers.

Branch Network (as of March 31, 2025):

Total Branches: 134 branches + 1 Head Office.

State-wise Distribution: Maharashtra (41), Madhya Pradesh (24), Chhattisgarh (24), Telangana (17), Gujarat (8), Karnataka (7), Odisha (13).

Recent Expansion (Post-March 31, 2025): Opened 27 new branches, taking the total count to 162 branches. Expansion focused on Andhra Pradesh (9), Odisha (8), Jharkhand (3), Chhattisgarh (3), Gujarat (2), Maharashtra (1), Telangana (1).

Products: Two-wheeler loans (mainstay), Vehicle refinance, Used car loans, Personal loans, MSME loans, LAP

Customer Base: 2.55+ lakh customers

Branches: 115+ (expanding to 162 in 2025)

Geography: Central & Western India, rural/semi-urban focus

Milestones:

Shifted from franchise → direct branch model

Raised equity from institutional investors

FY24 disbursements: ₹957 Cr

AUM (2025): ₹1,383 Cr

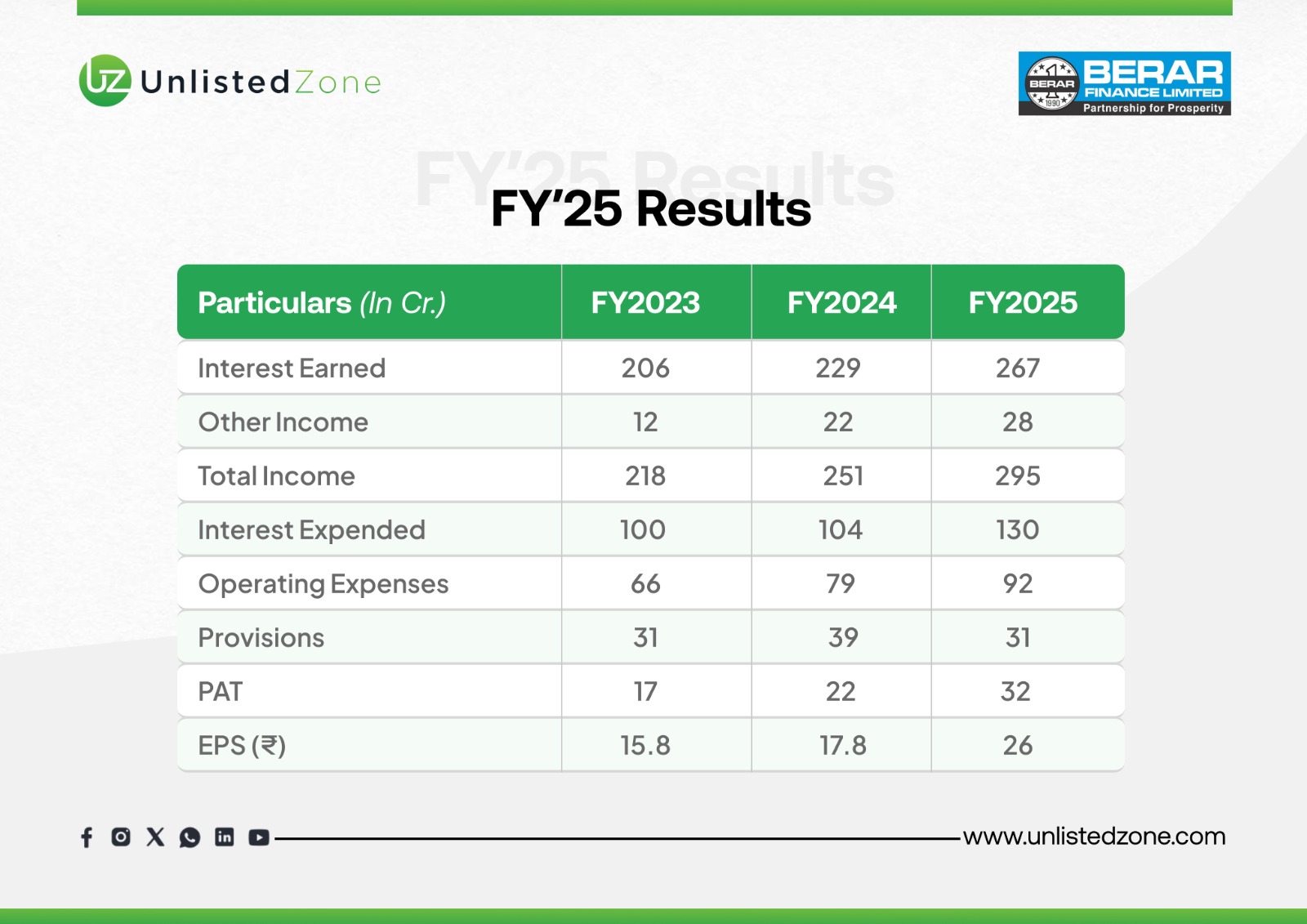

B) Financial Performance Analysis (2022–2025)

Key Profitability Insights:

PAT Margin improved from 8.2% (2023) to 11.9% (2025)

Interest Spread consistently 40–42%

Cost-to-Income ratio improved from 33.5% → 31.2%

Product-Wise Revenue Contribution:

Two-wheeler loans dominate the portfolio.

Secured MSME loans and LAP showing growth.

Geographic Performance:

Strong presence in Maharashtra, MP, Chhattisgarh, Telangana, Gujarat, Karnataka, and Odisha.

Recent expansion into Andhra Pradesh and Jharkhand.

CAR (2025): 24.95% (vs RBI requirement: 15%) ✅

LCR (2025): 104.5% (requirement: 100%) ✅

Debt/Equity (2025): 3.1x ⚠️

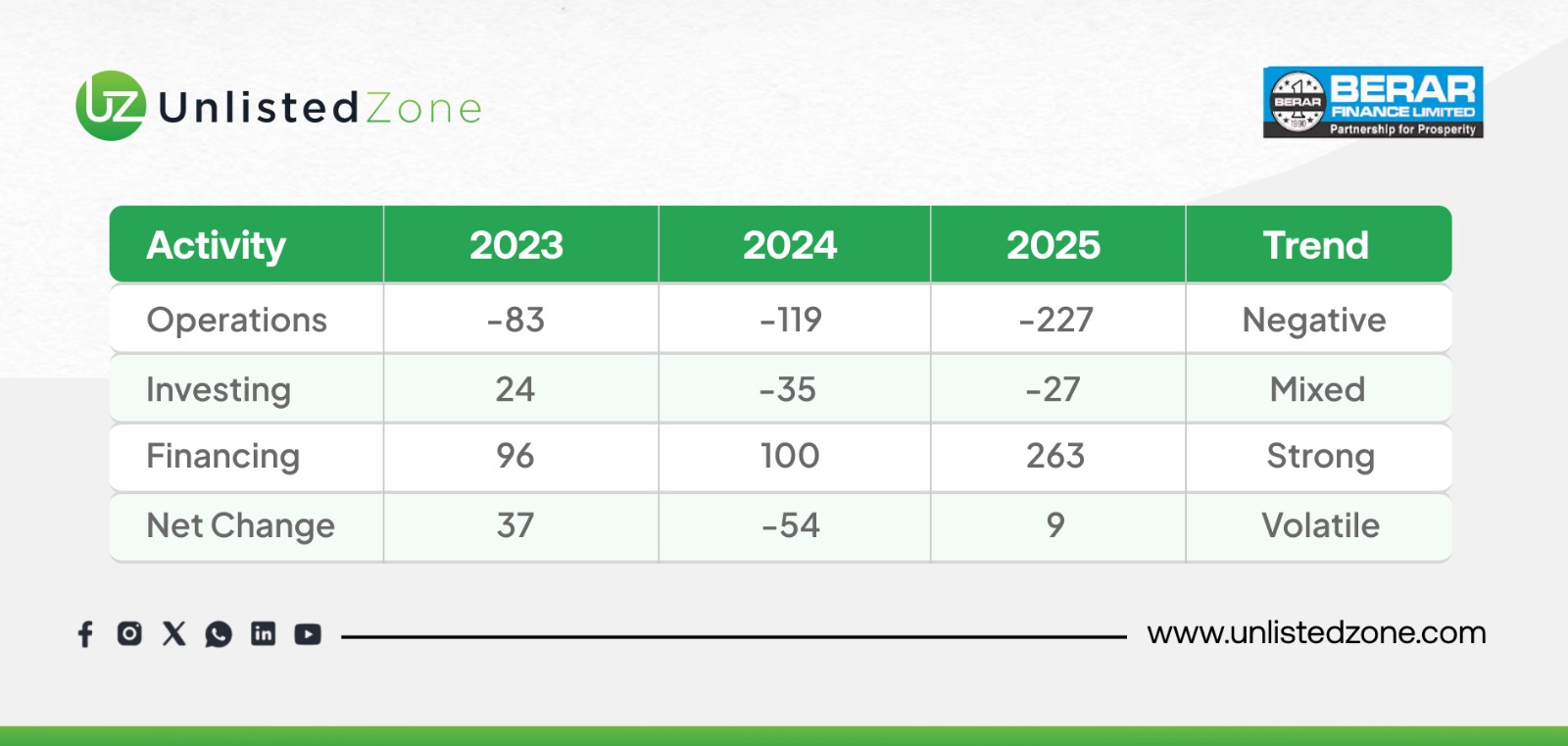

Observation: Persistent negative operating cash flow → reflects high working capital needs due to aggressive advances growth.

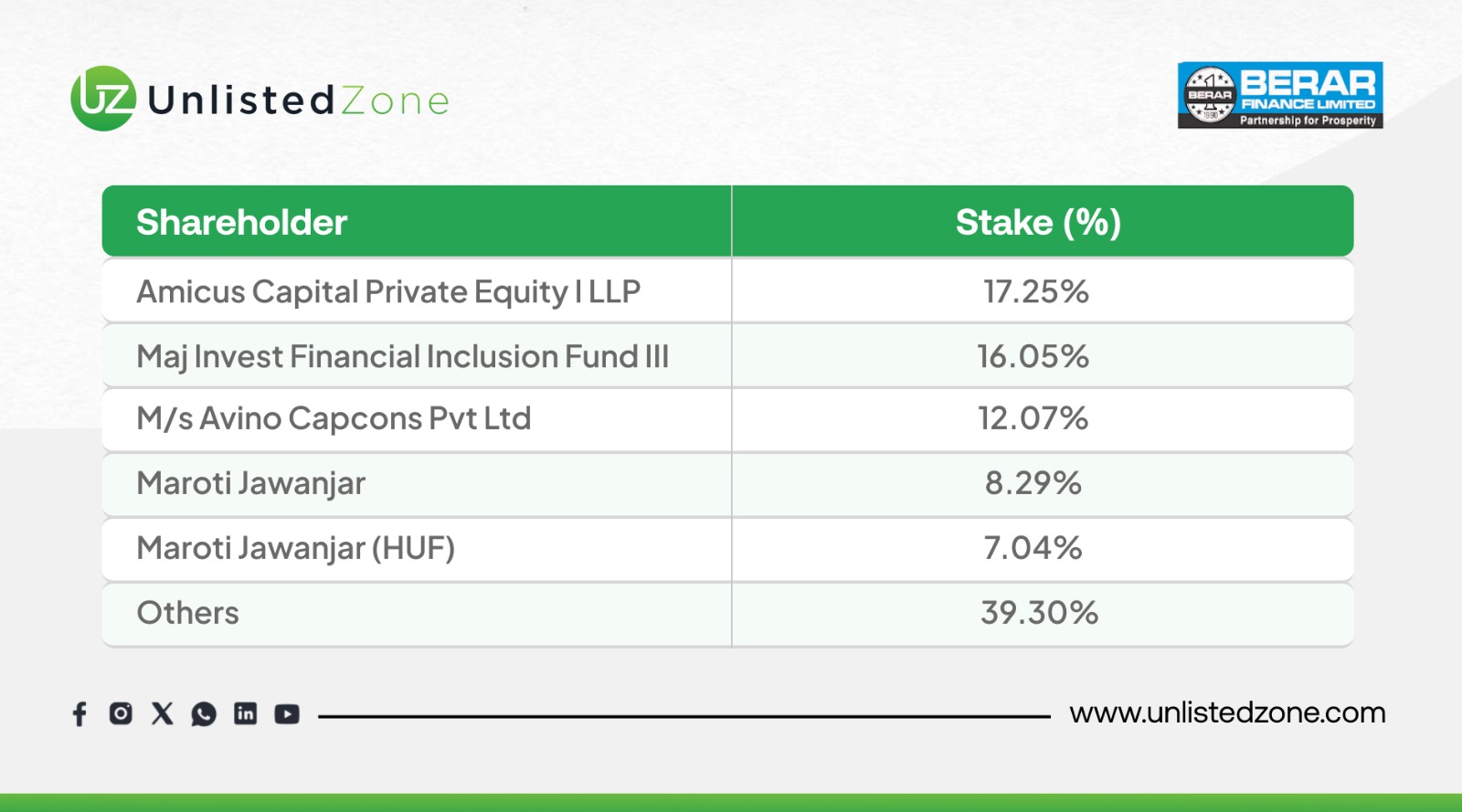

👉 Institutional Holding: 45.37% → Strong investor confidence

Market Cap: ₹278 Cr

Price per Share: ₹225

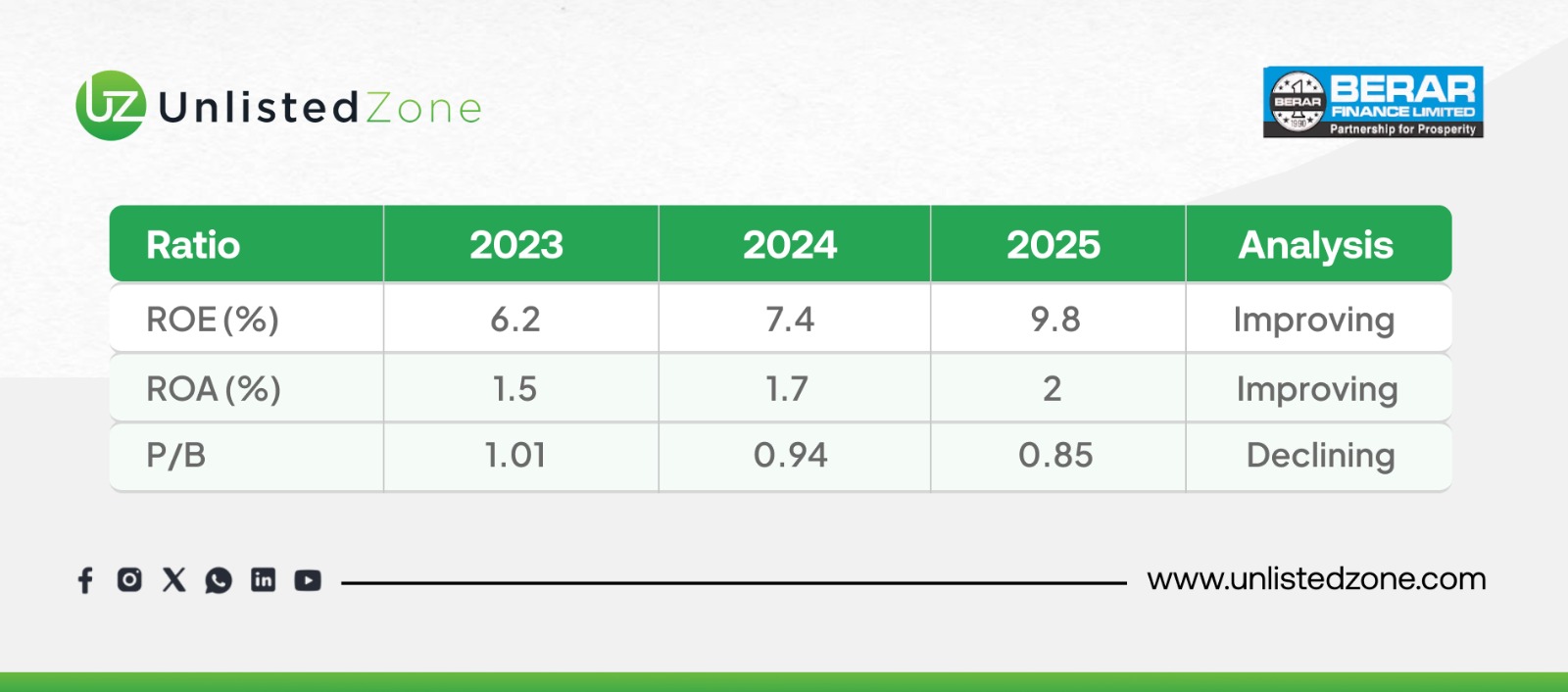

P/E Ratio: 8.67 (sector avg: 15–20x)

P/B Ratio: 0.82 (<1 → undervalued)

Book Value per Share: ₹273.43

Debt/Equity: 3.1x

Market Outlook:

Management is optimistic about rural credit demand, supported by improving rural sentiment, easing inflation, and government focus on financial inclusion.

Risks & Challenges:

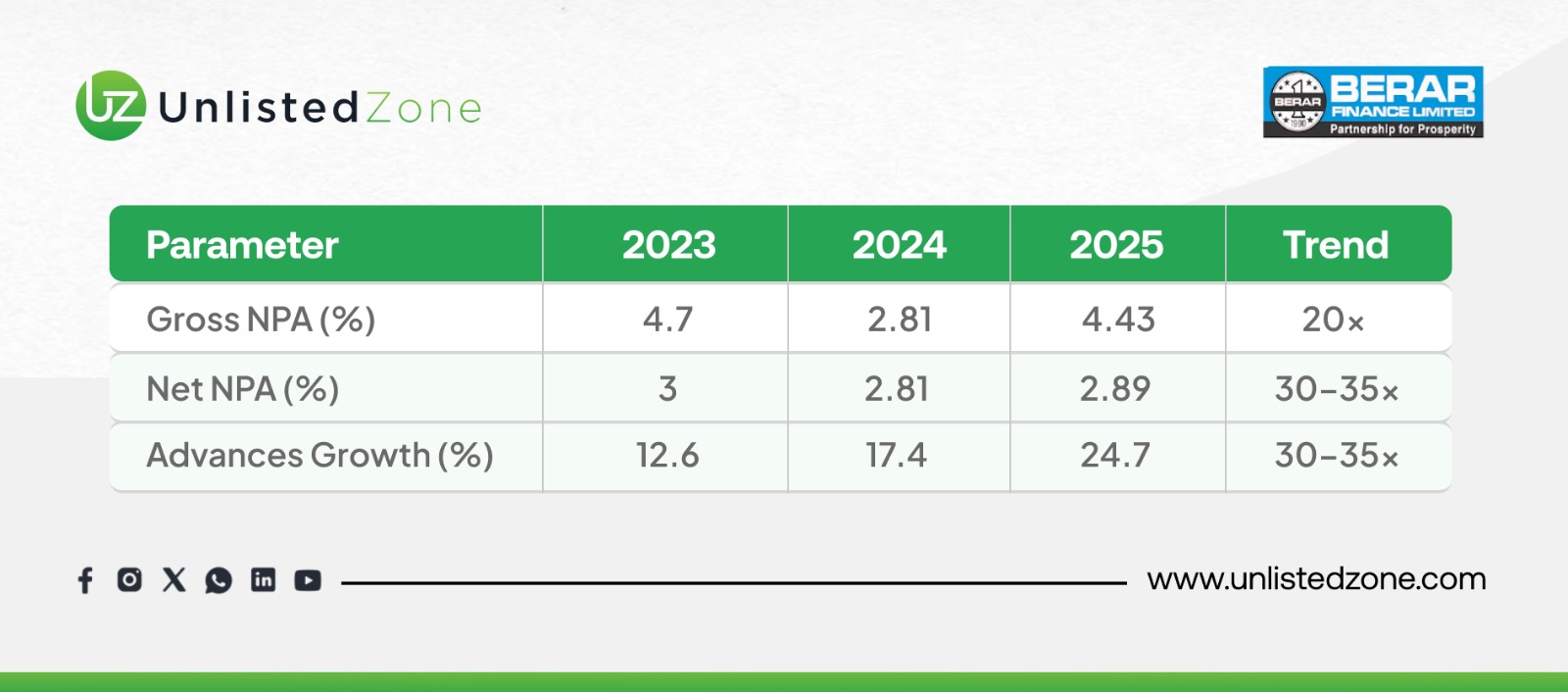

Asset quality volatility (GNPA: 4.43% in FY2025).

Rising borrowing costs.

Dependence on economic cycles affecting rural income.

Strategic Roadmap:

Continue branch expansion in untapped regions.

Enhance digital capabilities for better customer acquisition and service.

Diversify product mix to reduce reliance on two-wheeler loans.

✅ Strengths

Strong CAR (24.95%) & liquidity

Rural/semi-urban stronghold

Diversified loan book

Institutional investor backing

⚠️ Concerns

Volatile GNPA (2.8–4.7%)

Negative operating cash flows

High leverage (3.1x D/E)

Heavy reliance on two-wheeler financing

🚀 Opportunities

Rural credit under-penetrated

Strong vehicle financing demand

Geographic expansion & digital lending

Positive Indicators:

Advances growth accelerating (+24.7% in 2025)

ROE improving to 9.8%

Meets all RBI regulatory requirements

Strategic Focus Areas:

Branch expansion (162 by 2025)

Product diversification

Asset quality stabilization

Digital adoption & cost optimization

Bull Case:

Low P/E (8.7) vs sector (15–20x)

P/B < 1 (undervalued)

Strong AUM growth trajectory

Rural-focused growth aligned with govt policies

Bear Case:

Asset quality volatility

Negative cash flows

High leverage

Rising competition in vehicle financing

Berar Finance is showing strong growth fundamentals with accelerating loan book, improving ROE, and a clear rural-focused strategy. However, asset quality volatility and negative operating cash flows remain red flags.

Valuation looks attractive (P/E 8.7, P/B 0.82) and institutional backing provides comfort. If asset quality stabilizes, stock re-rating potential is high.

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.