Brief About Shriram Life Insurance

Shriram Group entered the insurance business to serve people in bottom of the pyramid and provide better value and wider range of services to its customers. Sanlam, a leading financial services group and one of the largest insurers in South Africa has partnered Shriram Group in both its Life and NonLife Insurance ventures. The effective leveraging of the network and brand equity of Shriram Group and strategic guidance by Sanlam Group have facilitated a steady growth of the insurance companies.

Business Performance of Shriram Life Insurance in FY2021

(i) The domestic life insurance industry registered 7% growth for new business premium in financial year

2020-21, largely driven by growth in Individual & Group Single premium policy. While private insurers saw their growth at 16 %, Life Insurance Corporation of India (LIC) registered growth at 3 % in last financial year.

(ii) Shriram Life Insurance's Individual New Business saw a growth of around 15% as compared to 14% growth for private industry and 10% growth for LIC.

(iii) In FY21, the total premium income of the company was Rs. 2019 Crores as compared to Rs. 1729 Crores in the previous year.

(iv) Shriram Life Insurance has the Solvency Ratio of 190%, against the requirement of 150%.

(v) This year Shriram Life Insurance has declared a dividend of Rs.1.67 per share.

(vi) As on 31.03.2021, Shriram Life Insurance has a branch network of 455, and has active advisor force and POSPs of 3784 and 90 respectively.

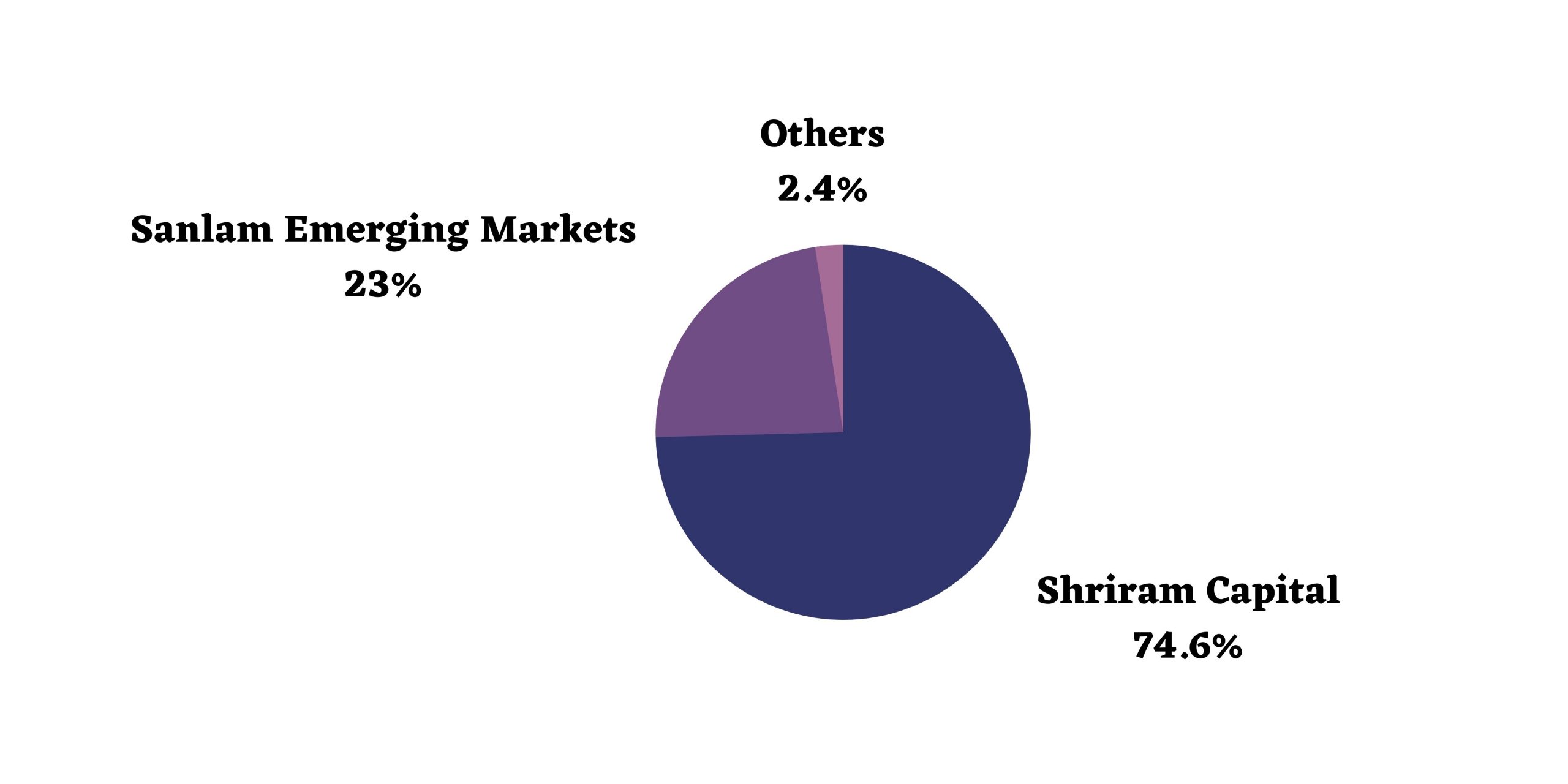

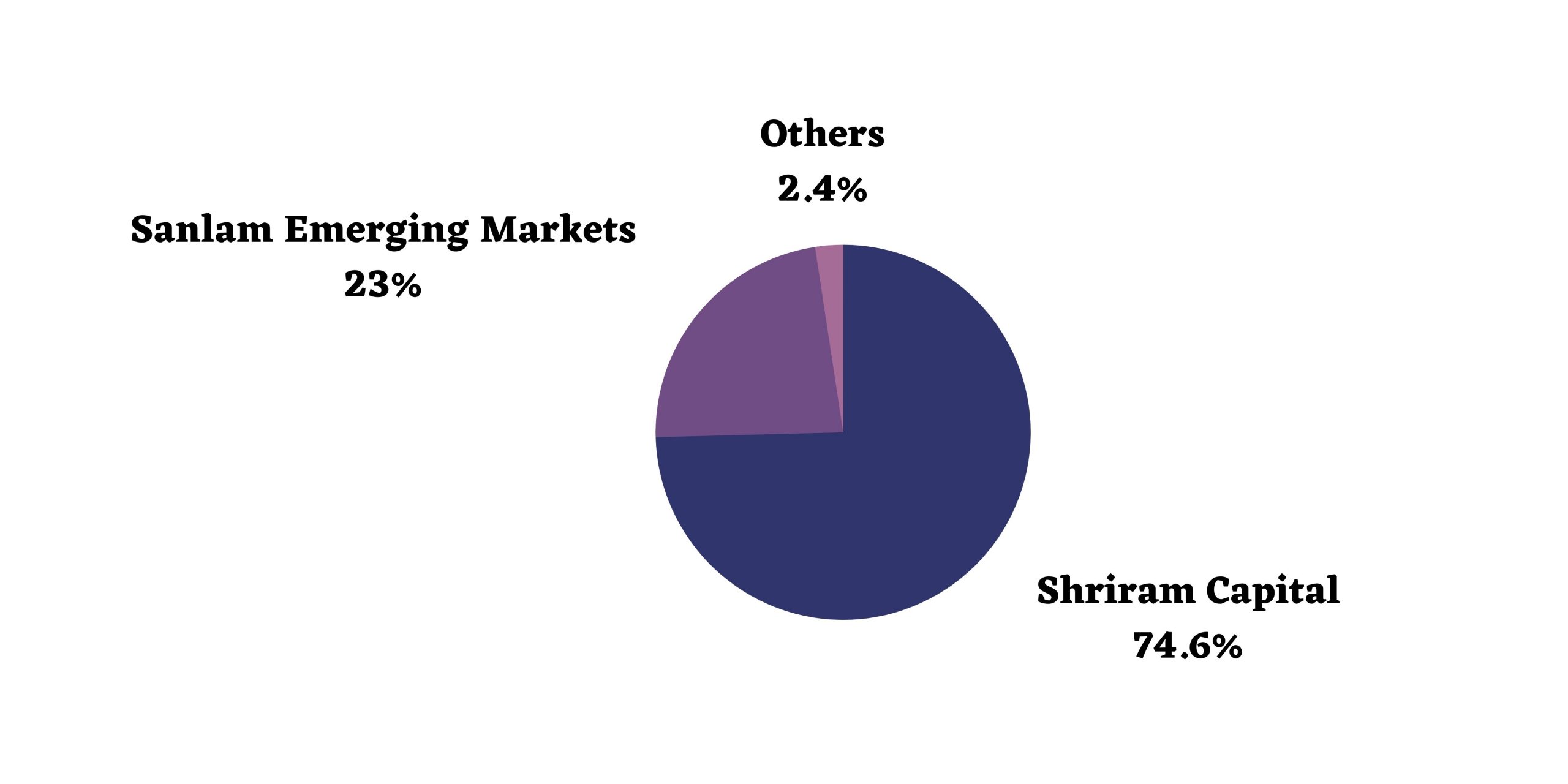

Shareholding Pattern as on 31.03.2021

Increase in Share Capital in FY2021

Increase in Share Capital in FY2021

The share capital has increased by 6,61,748 no. of equity shares. These are ESOPs issued by company at ~24 per share.

Share Capital as on 31.03.2021 = 17.63897 Crores.

Financial Performance in FY2021

(i) Premium income has increased from 1723 Crores to 2013 Crores in FY21. Jump of 17%.

(ii) Other Income has increased from 322 Crores to 520 Crores in FY21.

(iii) Commission expense has increased 112 Crores to 122 Crores in FY21.

(iv) PAT of 106 Crores in FY21 which was just 35 Crores in FY20.

Valuation of Shriram Life Insurance

In unlisted market, it is trading at Rs. 325 per share.

Mcap = 5729 Crores.

GWP = 2013 Crores

Peer Comparison

| Company |

GWP |

Mcap |

Mcap/GWP |

| HDFC Life |

38,583 |

1,38,688 |

3.59 |

| SBI Life |

45,000 |

1,00,705 |

2.24 |

| Shriram Life |

2000 |

5720 |

2.86 |

The valuation of Shriram Life looks stretched.

Increase in Share Capital in FY2021

The share capital has increased by 6,61,748 no. of equity shares. These are ESOPs issued by company at ~24 per share.

Share Capital as on 31.03.2021 = 17.63897 Crores.

Financial Performance in FY2021

(i) Premium income has increased from 1723 Crores to 2013 Crores in FY21. Jump of 17%.

(ii) Other Income has increased from 322 Crores to 520 Crores in FY21.

(iii) Commission expense has increased 112 Crores to 122 Crores in FY21.

(iv) PAT of 106 Crores in FY21 which was just 35 Crores in FY20.

Valuation of Shriram Life Insurance

In unlisted market, it is trading at Rs. 325 per share.

Mcap = 5729 Crores.

GWP = 2013 Crores

Peer Comparison

Increase in Share Capital in FY2021

The share capital has increased by 6,61,748 no. of equity shares. These are ESOPs issued by company at ~24 per share.

Share Capital as on 31.03.2021 = 17.63897 Crores.

Financial Performance in FY2021

(i) Premium income has increased from 1723 Crores to 2013 Crores in FY21. Jump of 17%.

(ii) Other Income has increased from 322 Crores to 520 Crores in FY21.

(iii) Commission expense has increased 112 Crores to 122 Crores in FY21.

(iv) PAT of 106 Crores in FY21 which was just 35 Crores in FY20.

Valuation of Shriram Life Insurance

In unlisted market, it is trading at Rs. 325 per share.

Mcap = 5729 Crores.

GWP = 2013 Crores

Peer Comparison