The National Commodity & Derivatives Exchange (NCDEX) — once the face of India’s agri-commodity trading revolution — just released its H1 FY26 results.

And the story is one of contrasts: revenues are flat, losses persist, but the company is armed with deep pockets and big ambitions.

1.The Numbers: A Business That’s Spending More Than It Earns

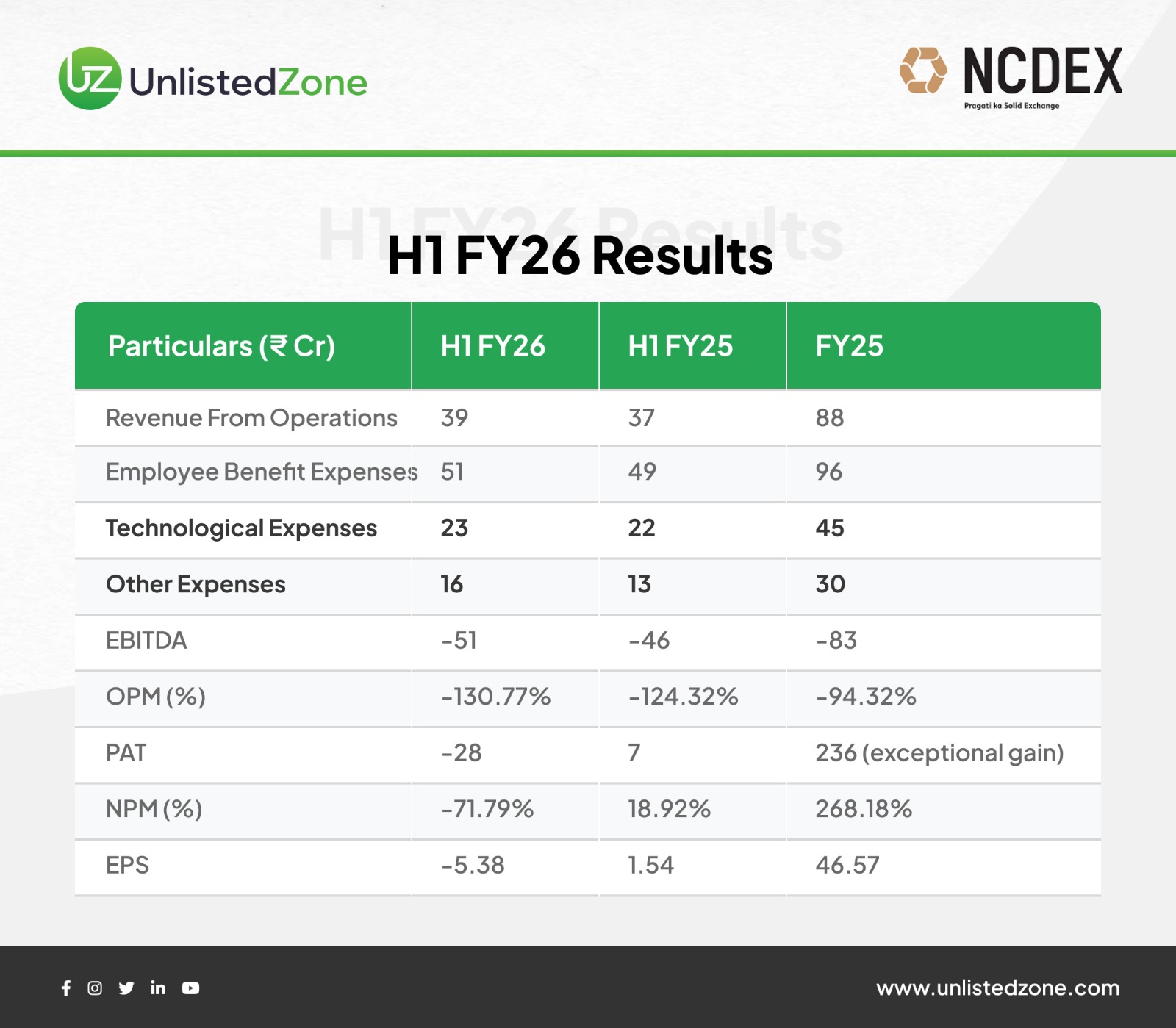

In the first half of FY26, NCDEX reported ₹39 crore in revenue, nearly flat compared to ₹37 crore in the same period last year.

But here’s the catch — costs continue to climb.

That takes total operating expenses to ₹90 crore, about 2.3× its revenue.

The result? An EBITDA loss of ₹51 crore and an operating margin of –130.77%.

And that impressive ₹236 crore profit in FY25? That wasn’t operational strength — it came from a one-time exceptional gain.

Without it, NCDEX has been loss-making for multiple years.

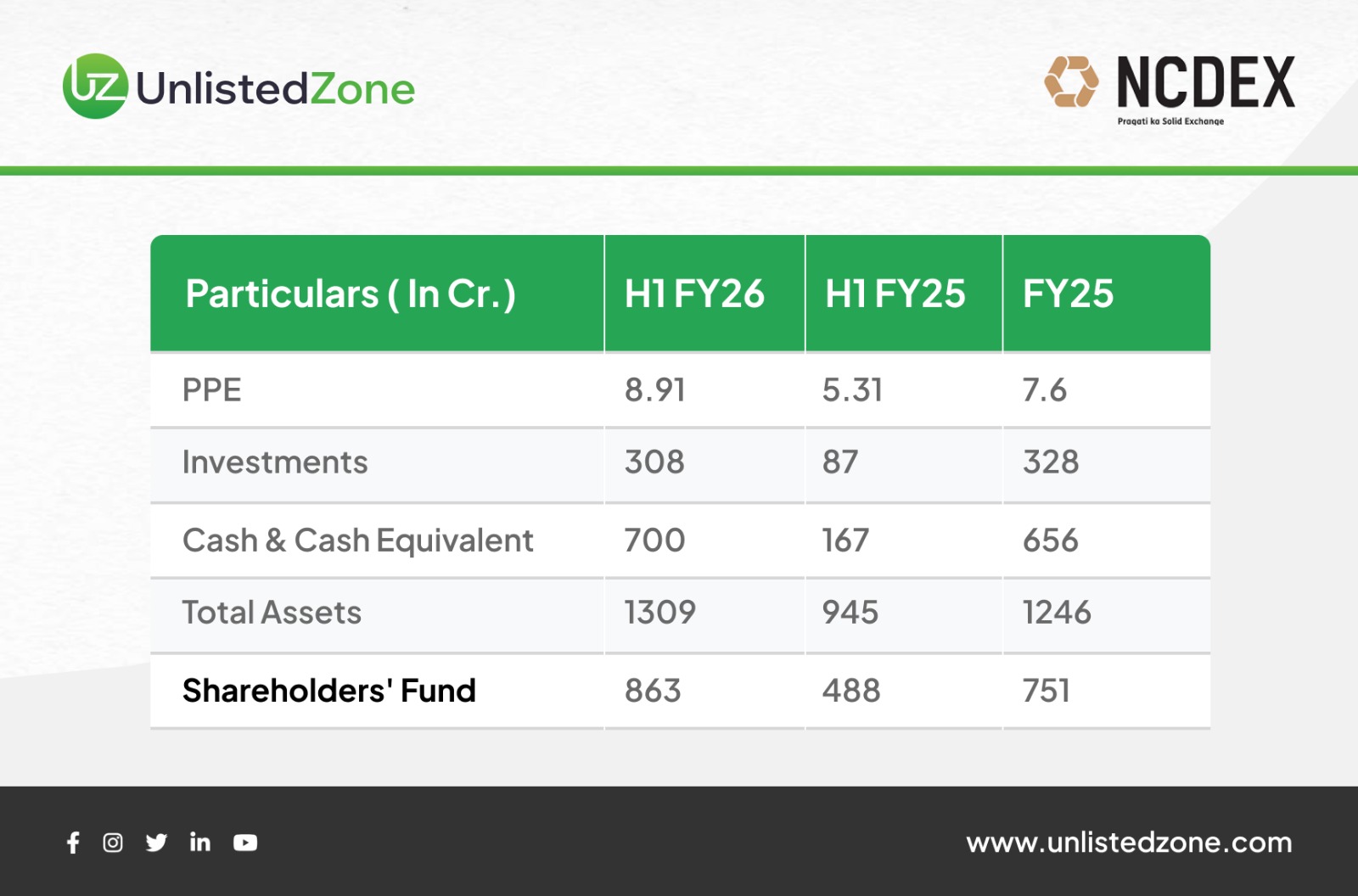

2. Financial Fortitude: Cash Is King

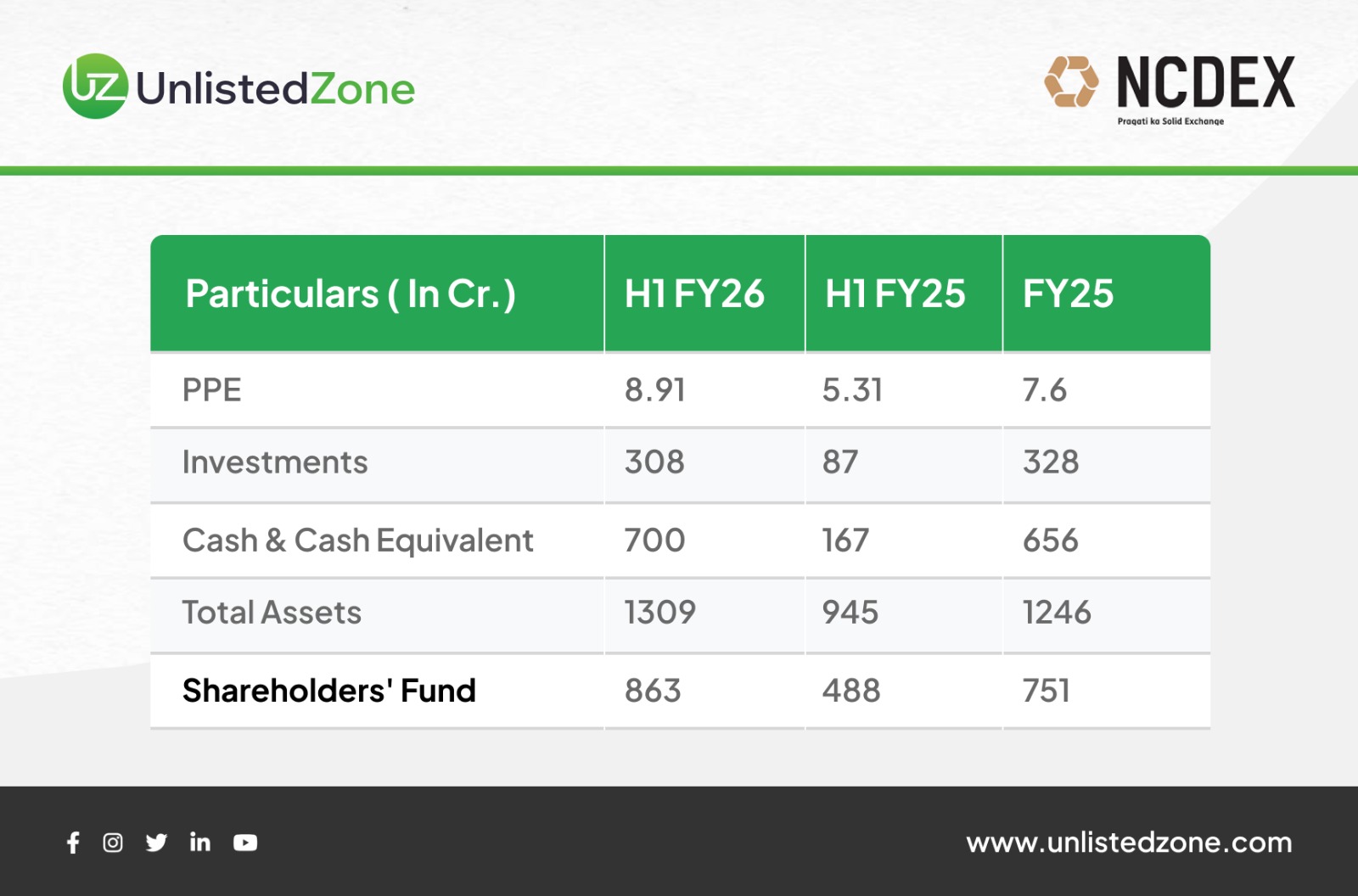

Despite these losses, NCDEX remains financially rock-solid.

It’s sitting on ₹700 crore in cash and another ₹308 crore in investments, taking its total assets to ₹1,309 crore.

Shareholders’ equity has climbed to ₹863 crore, showing no immediate financial stress.

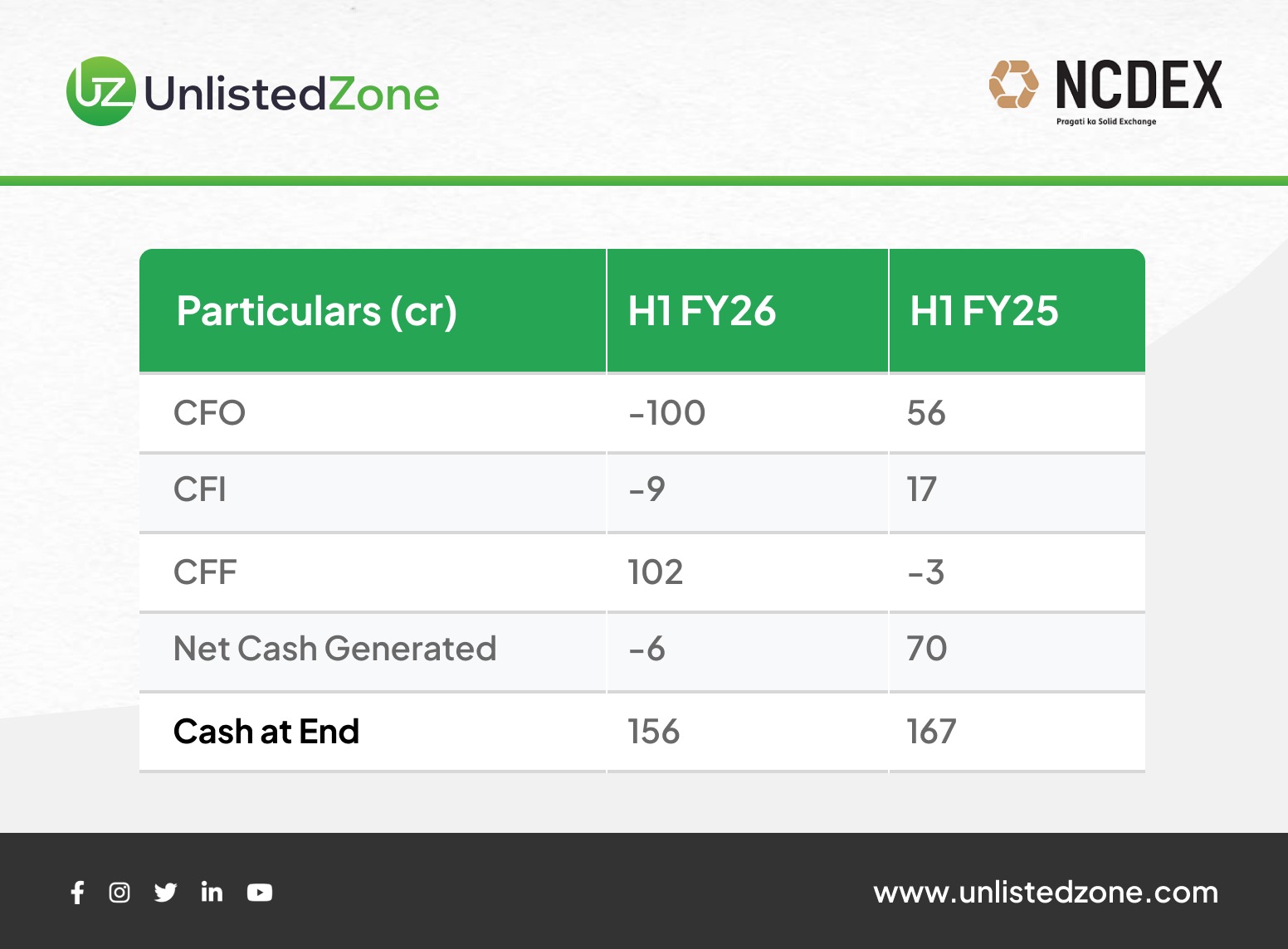

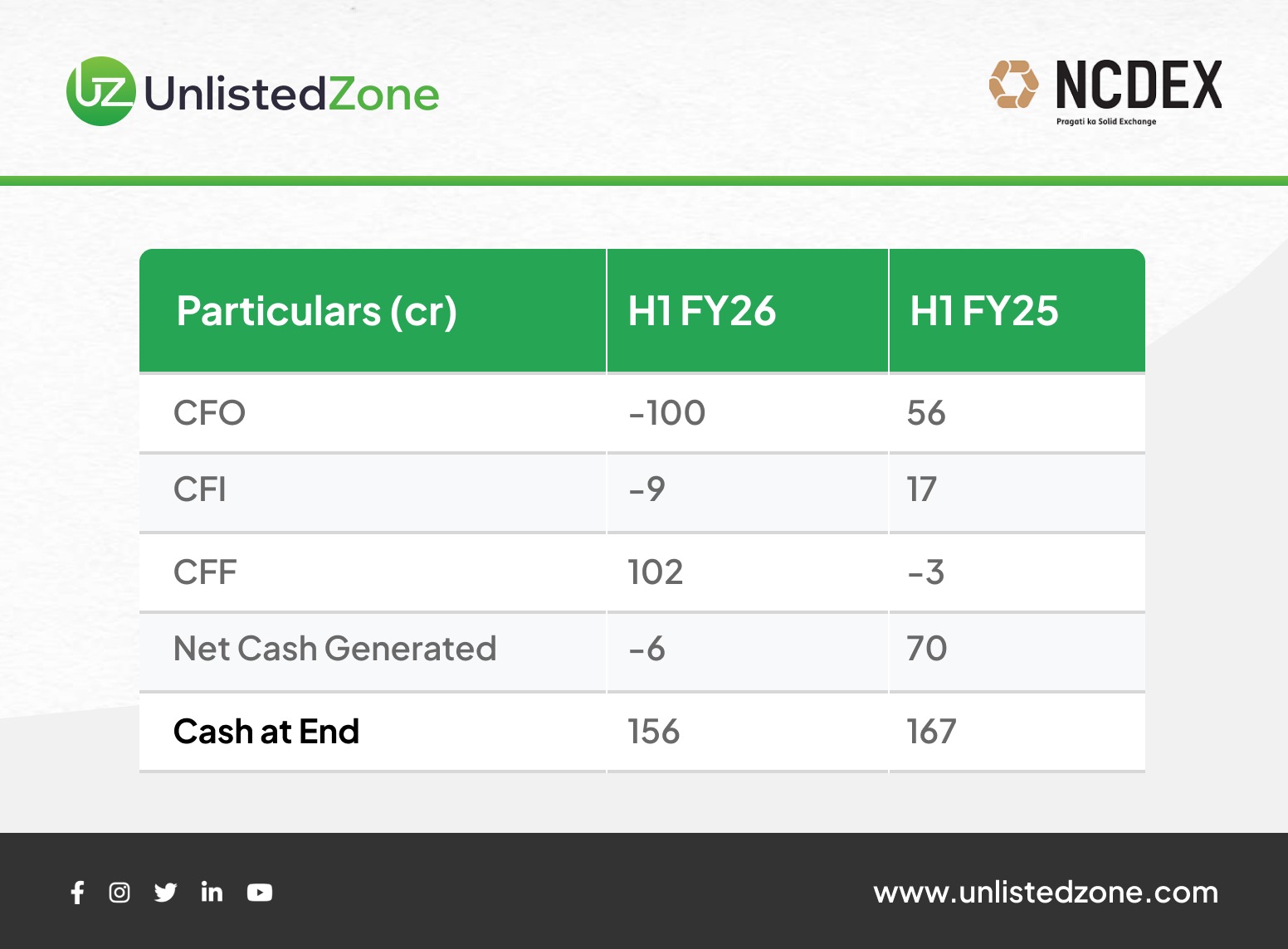

But the problem is on the operations side — cash flow from operations turned negative (–₹100 crore) in H1 FY26, signalling that the company is using its reserves to sustain itself.

In short: it’s cash-rich, but the business isn’t self-funding yet.

3. The Big Pivot: From Commodities to Capital Markets

Now comes the strategic twist.

Recently, NCDEX raised ₹770 crore from a clutch of investors — and it’s not just about plugging losses.

The exchange is gearing up for a massive pivot into the equity and mutual-fund distribution space, an area currently dominated by BSE StAR MF and NSE NMF.

That could explain the spike in employee and tech expenses — NCDEX is building the digital and regulatory backbone needed to enter new markets.

It’s also seeking regulatory approval to launch equity trading, marking its transformation from a niche agri-exchange into a multi-asset market platform.

4. Beyond Borders: The Sri Lanka Expansion

But NCDEX’s ambitions don’t stop at India’s borders.

According to reports, it’s now eyeing a 20% stake in Sri Lanka’s first commodity exchange, bringing its exchange-building expertise to the island nation.

For NCDEX, which faces stiff competition and flat trading volumes in India, this is both diversification and soft-power play — an attempt to become a regional exchange brand rather than just a domestic player.

5. The Big Picture

At this point, NCDEX looks like a company in transition:

-

Financially healthy with ₹700 crore in reserves.

-

Operationally weak with continued losses.

-

Strategically ambitious, expanding into equities, mutual funds, and overseas markets.

If its diversification bet pays off, NCDEX could reinvent itself as India’s next multi-asset fintech exchange — bridging commodities, equities, and digital funds.

But if execution falters, the heavy spending could turn into another cash-burn cycle.

UnlistedZone Take

-

The ₹770 crore fundraise signals that NCDEX is betting big on reinvention.

-

Rising tech and employee costs aren’t inefficiency — they’re early-stage investment in its new business model.

-

The Sri Lanka move hints at a global vision beyond agri-commodities.

-

But without a clear turnaround in core trading volumes, profits will remain elusive.

In short — NCDEX today is not just surviving; it’s rebuilding its identity.

Whether it becomes the next-gen exchange powerhouse or just a well-funded experiment will depend on how fast this transformation takes off.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.