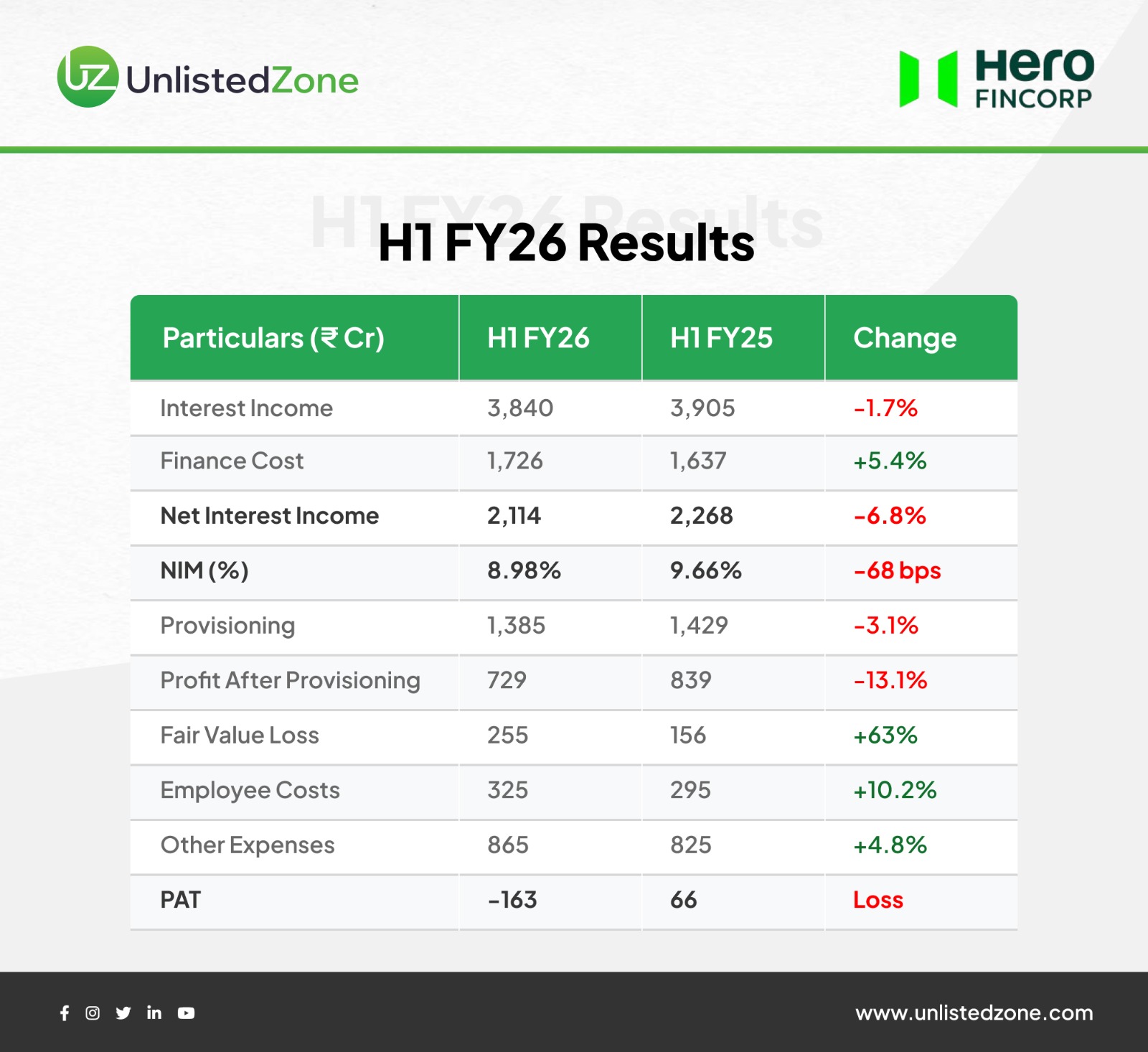

Hero FinCorp has announced its H1 FY26 results, showing significant challenges. The company reported a loss of ₹163 crore compared to a profit of ₹66 crore in H1 FY25.

A) The Key Financial Metrics

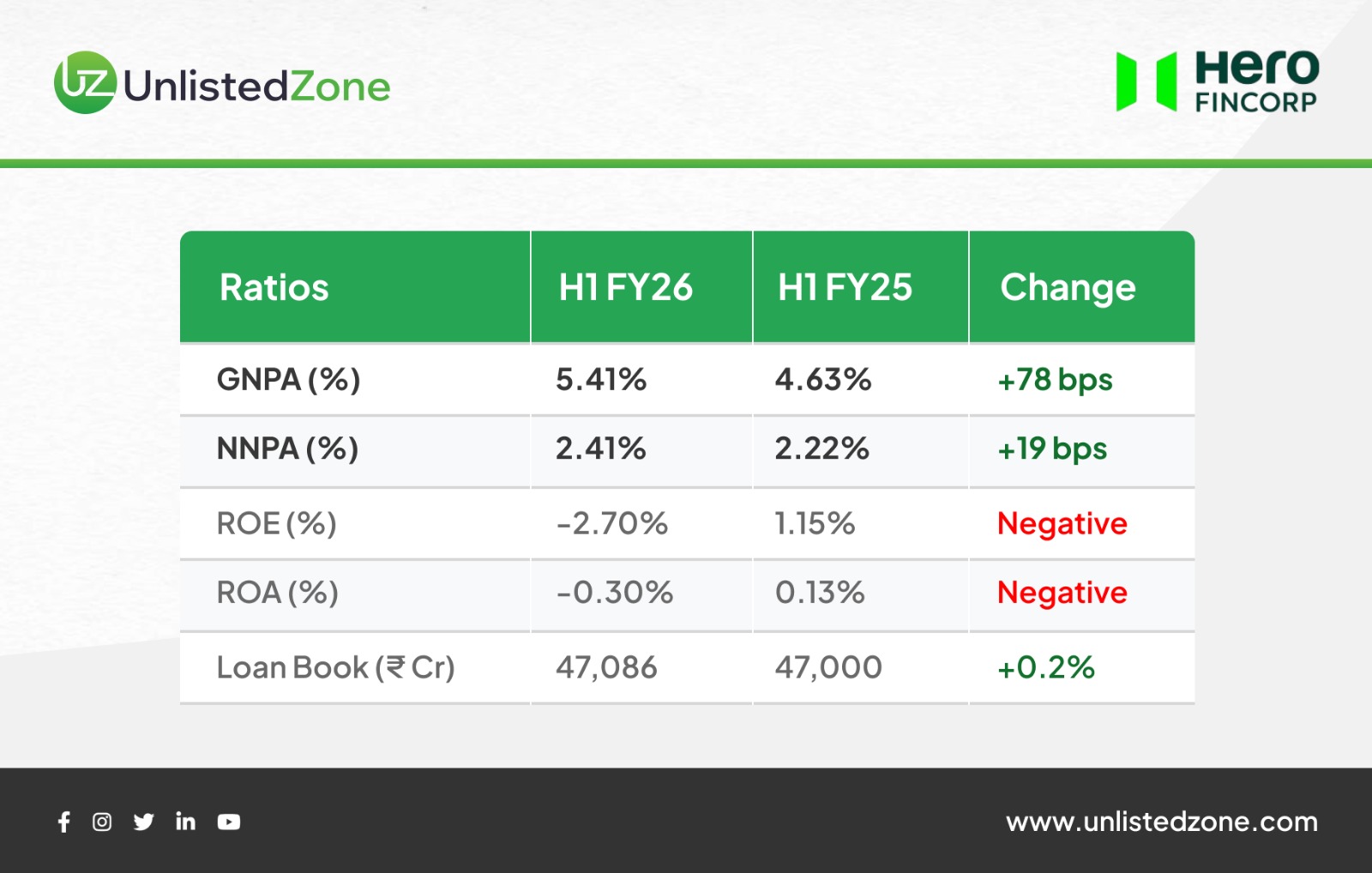

B) Asset Quality Metrics

C) What's Driving the Loss?

1. The Revenue-Cost Squeeze:

- Net Interest Income dropped 6.8% (₹154 crore decline)

- Finance costs increased 5.4% (₹89 crore increase)

- NIM compressed by 68 basis points from 9.66% to 8.98%

- Getting squeezed from both sides - earning less while paying more

2. Rising Bad Loans:

- GNPA crossed the 5% mark, reaching 5.41%

- This is a 78 basis points jump in just six months

- Indicates stress in the loan portfolio, particularly from unsecured lending

3. Fair Value Losses:

- ₹255 crore loss on fair value adjustments vs ₹156 crore last year

- This ₹99 crore additional hit contributed significantly to the final loss

4. Operating Expense Growth:

- Employee costs up 10% to ₹325 crore

- Other expenses rose 5% to ₹865 crore

- Opex growing while revenues are declining

5. Flat Growth:

- Loan book grew just 0.2% to ₹47,086 crore

- Virtually stagnant compared to last year

D) The Strategic Pivot

Hero FinCorp has made a strategic decision to halt unsecured lending due to rising NPAs. According to recent industry reports, the company is now focusing on:

- Two-wheeler financing (leveraging Hero MotoCorp ecosystem)

- Loans against property (secured lending)

- Secured MSME loans

Management has indicated a target of 14% disbursement growth through these secured products in FY26. However, this transition will take time to show results.

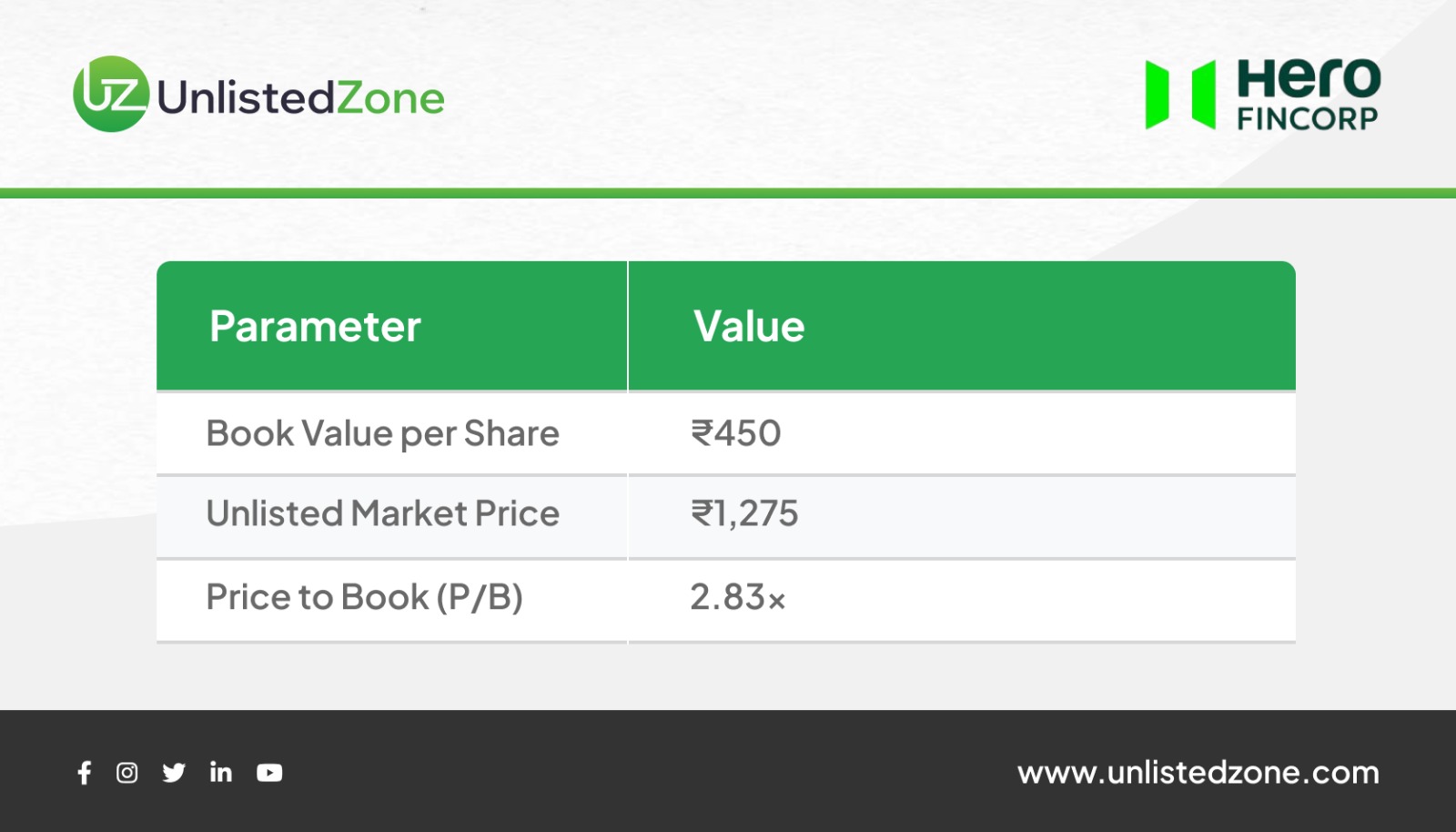

E) Valuation Snapshot of Hero-Fin Corp Unlisted Share

F) Understanding the Challenges

Hero FinCorp is facing multiple headwinds:

1. Revenue Pressure:

- Interest income declining as lending activity slows

- Net Interest Income down 6.8%

- Margins compressed by 68 basis points

2. Cost Inflation:

- Borrowing costs rising by 5.4%

- Operating expenses growing double-digit

3. Asset Quality Stress:

- NPAs rising faster than expected

- GNPA now above the 5% threshold

4. Growth Constraints:

- Conscious slowdown in disbursements

- Exit from unsecured lending

- New secured products taking time to scale

G) The Positive Factors

Despite the challenges, some supporting elements remain:

1. Strong Parentage: Hero MotoCorp association provides brand credibility

2. Strategic Correction: Exit from unsecured lending is a prudent long-term decision

3. Healthy NIM: Despite compression, NIM of ~9% is still reasonable for NBFC sector

4. Established Network: Wide distribution presence across India

5. Credit Ratings: Maintains AA+ ratings from CRISIL, ICRA, and CARE

6. Proactive Management: Taking corrective actions to address issues

H) What to Monitor in Coming Quarters

For those tracking Hero FinCorp unlisted shares, key indicators to watch:

1. Asset Quality: Will GNPA stabilize or continue rising?

2. Profitability: When will the company return to positive PAT?

3. Margin Trend: Can NIM stabilize around 9% or will it compress further?

4. Secured Portfolio: How quickly can new products scale up?

5. Cost Control: Will operating expenses be managed better?

6. Funding Costs: Can borrowing costs be brought down?

I) The Road Ahead

Hero FinCorp is in a transition phase, recalibrating from higher-risk unsecured lending to lower-risk secured lending. This strategic shift makes sense for long-term sustainability, but the short-term impact is visible in H1 FY26 results:

- Lower revenues

- Flat growth

- Profitability challenges

- Asset quality stress from legacy portfolio

The next 2-3 quarters will be critical to see whether:

- NPA situation stabilizes

- Secured lending gains traction

- Company returns to profitability

- Business model transition succeeds

J) Context for Unlisted Share Holders

For those holding or tracking Hero FinCorp unlisted shares, these results show the company is going through a challenging period. The H1 FY26 performance reflects:

- Legacy issues from past unsecured lending

- Transition costs of business model pivot

- Broader NBFC sector headwinds

- Regulatory tightening on unsecured loans

The Hero brand and institutional backing provide a foundation, but near-term financial performance will likely remain under pressure until the recalibration is complete.

The Bottom Line: Revenue declining, costs rising, margins compressing, NPAs increasing, and profitability turned negative - a challenging phase for Hero FinCorp.

For the latest updates on Hero FinCorp financial results and unlisted share information, stay connected with UnlistedZone.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own due diligence and consult financial advisors before making any decisions. Unlisted shares carry significant risks including liquidity constraints.