About the Company

Capgemini Technology Services India Limited (formerly known as IGATE Global Solutions) is the Indian subsidiary of Capgemini SE, France, a global leader in consulting, technology, and digital transformation.

-

Brief History & Overview:

Capgemini entered India through acquisitions (Kanbay, IGATE) and gradually became one of the largest offshore delivery hubs for the group. It operates across application development, consulting, digital transformation, AI, and cloud solutions.

-

Business Model:

The company works primarily as the offshore IT & consulting arm of its parent. Services include IT services, application outsourcing, consulting, and BPO. India acts as the execution backbone, while revenues are largely generated from global clients.

-

Industry Positioning:

Within India’s IT services landscape, Capgemini stands alongside Infosys, Wipro, TCS, Cognizant, Accenture as a strong global IT vendor with significant market presence.

Key Highlights of the Year of Capgemini Technology Unlisted Shares

-

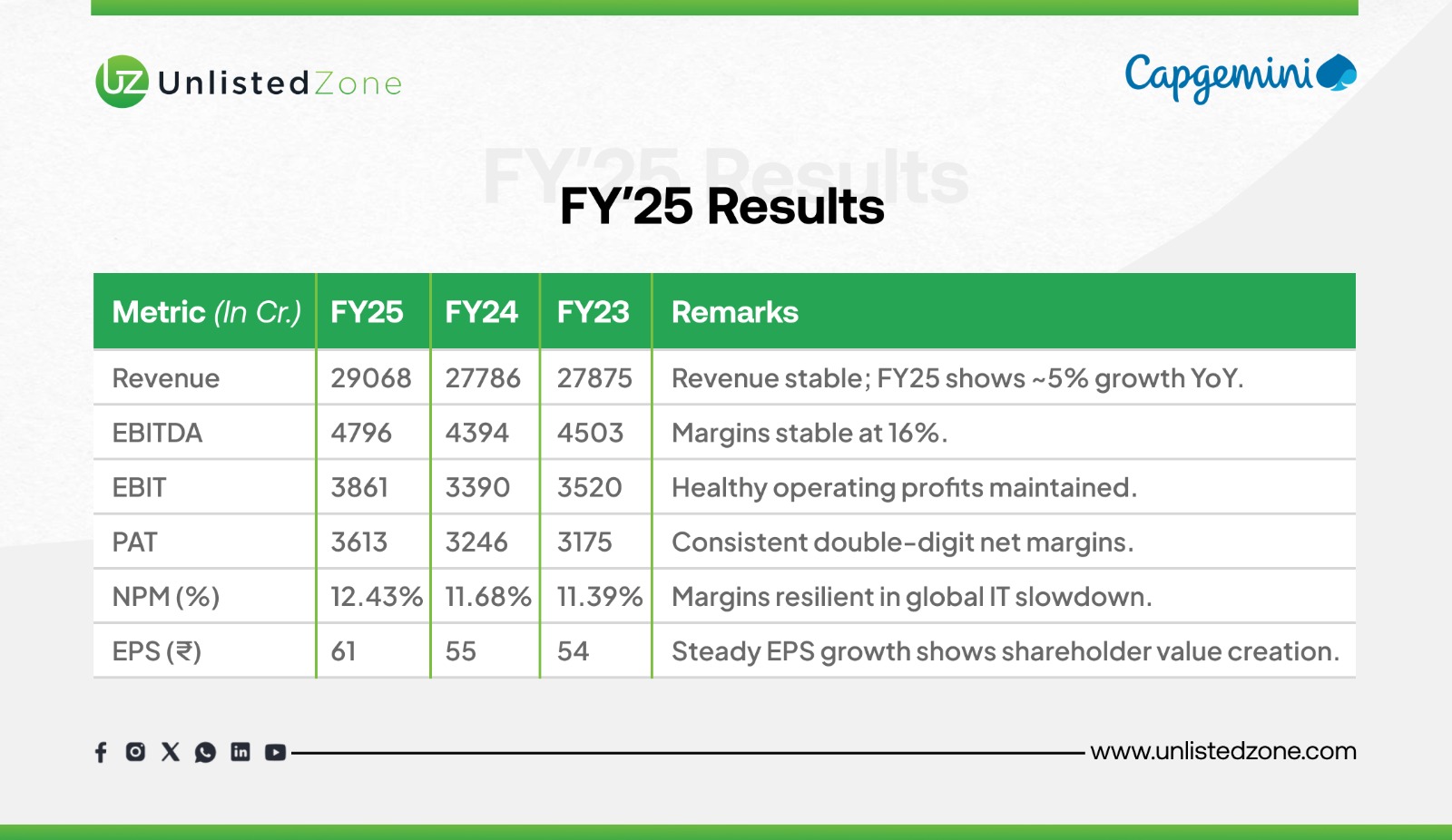

Revenue crossed ₹29,000 Cr in FY25 with consistent profitability.

-

Maintained double-digit margins (EBITDA ~16%, PAT ~12%) despite industry headwinds.

-

Dividend payout in FY25 led to higher financing outflows.

-

Strengthened digital capabilities with investments in AI, Cloud, and Cybersecurity centers.

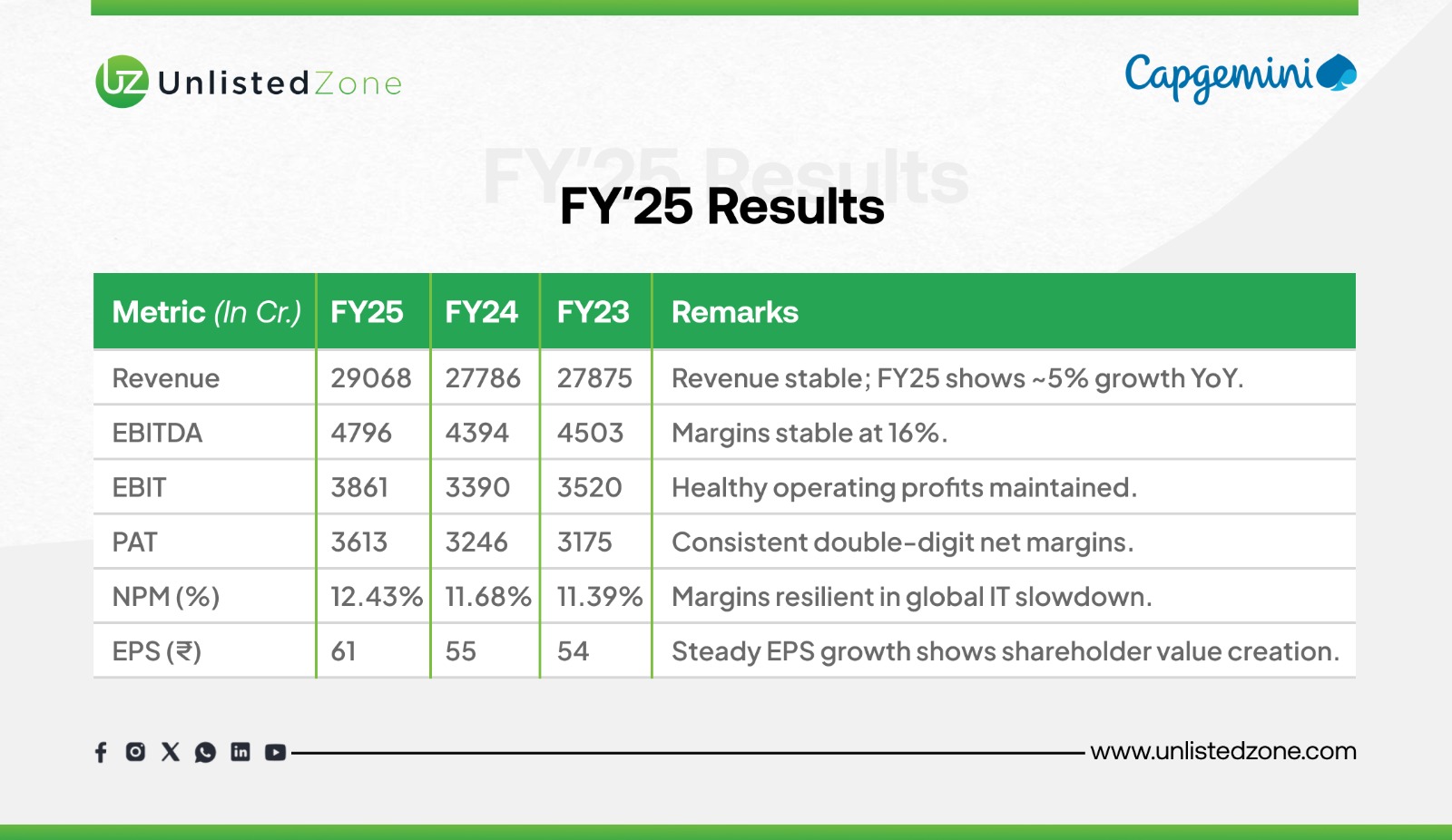

Financial Performance (₹ in Cr.) of Capgemini Technology Unlisted Shares

Insight: Profitability is consistent, aided by strong cost management and efficient offshore delivery.

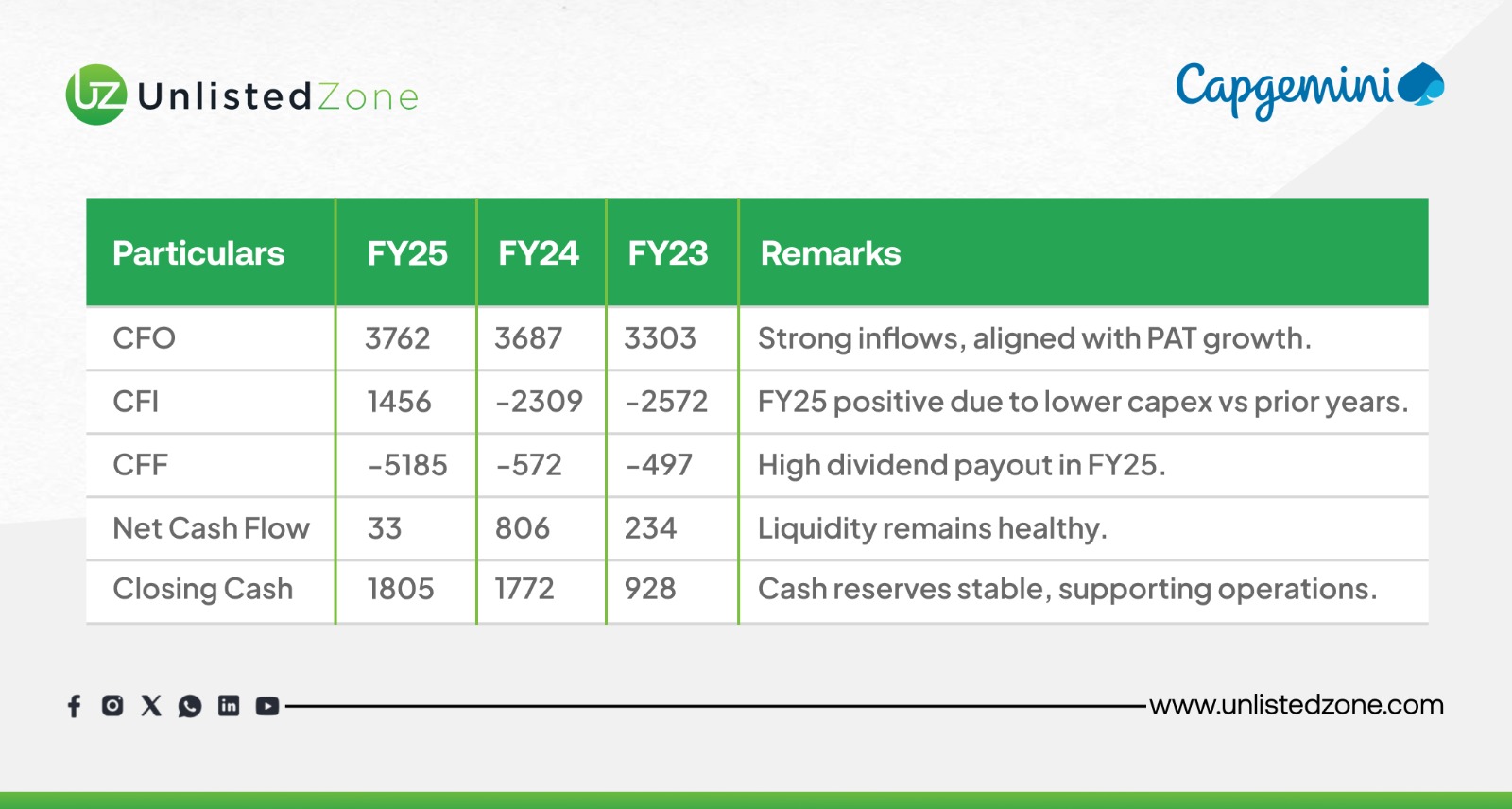

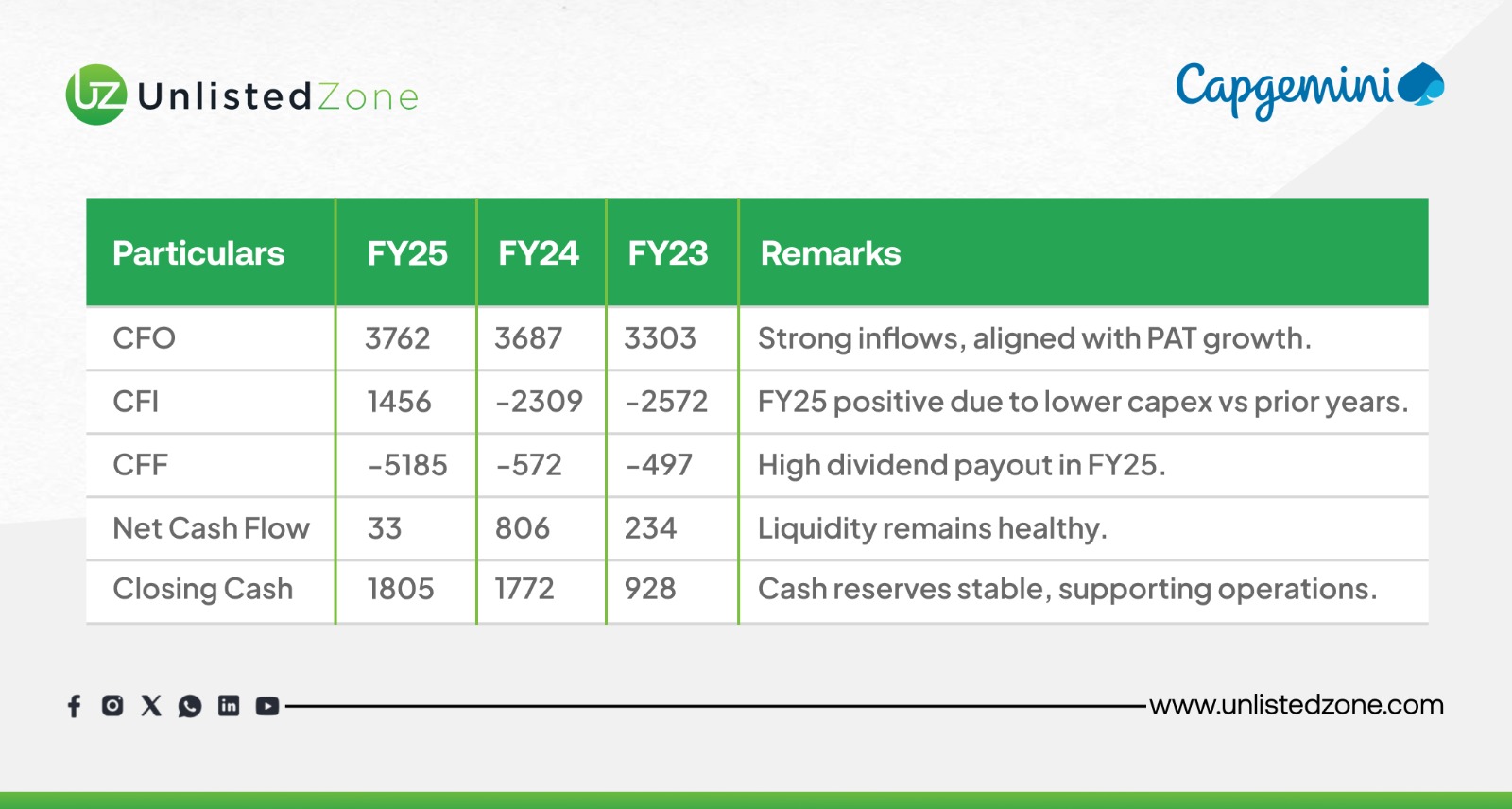

Cash Flow Statement (₹ in Cr.) of Capgemini Technology Unlisted Shares

Insight: Company continues to be a strong free cash flow generator.

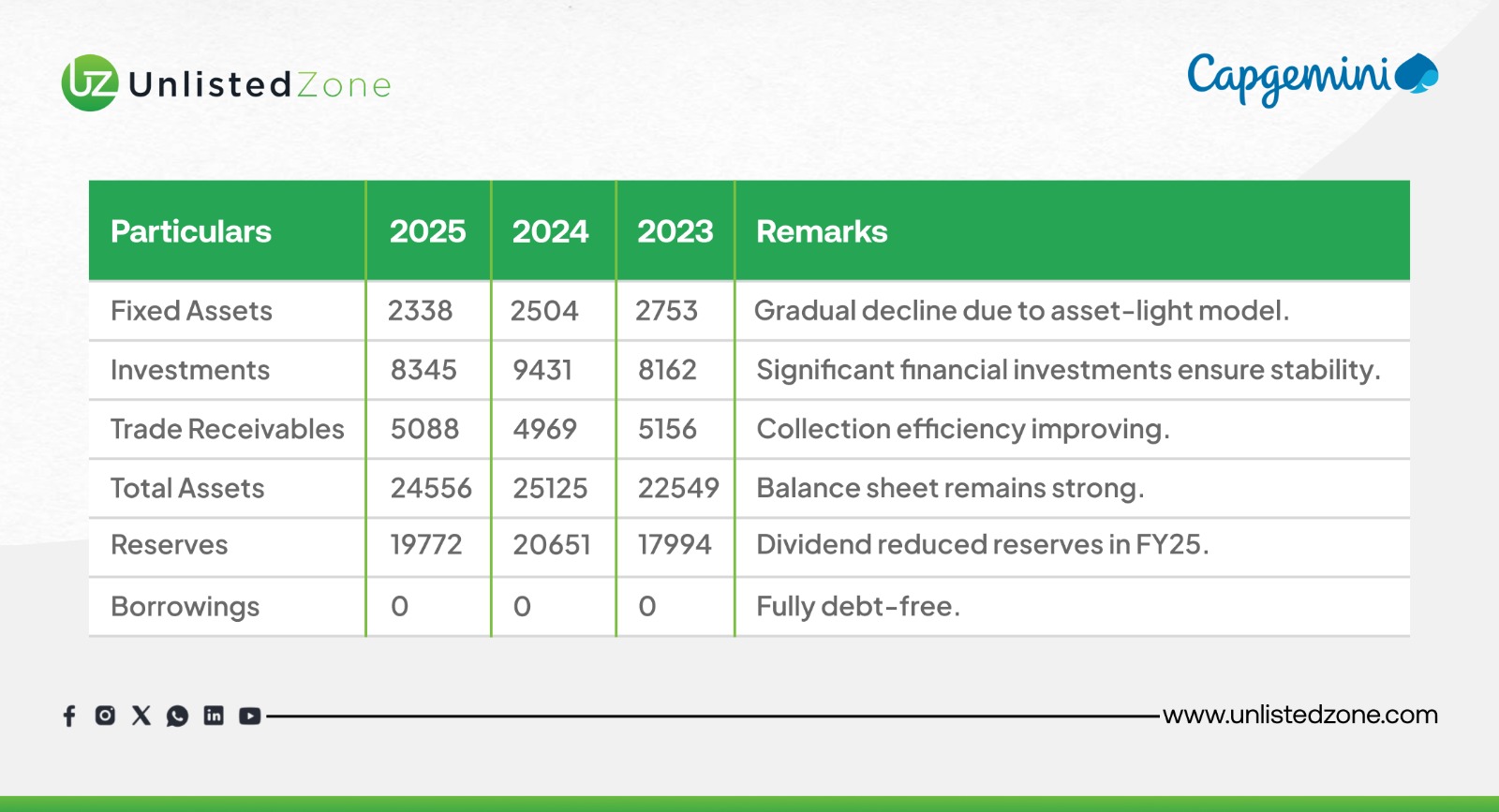

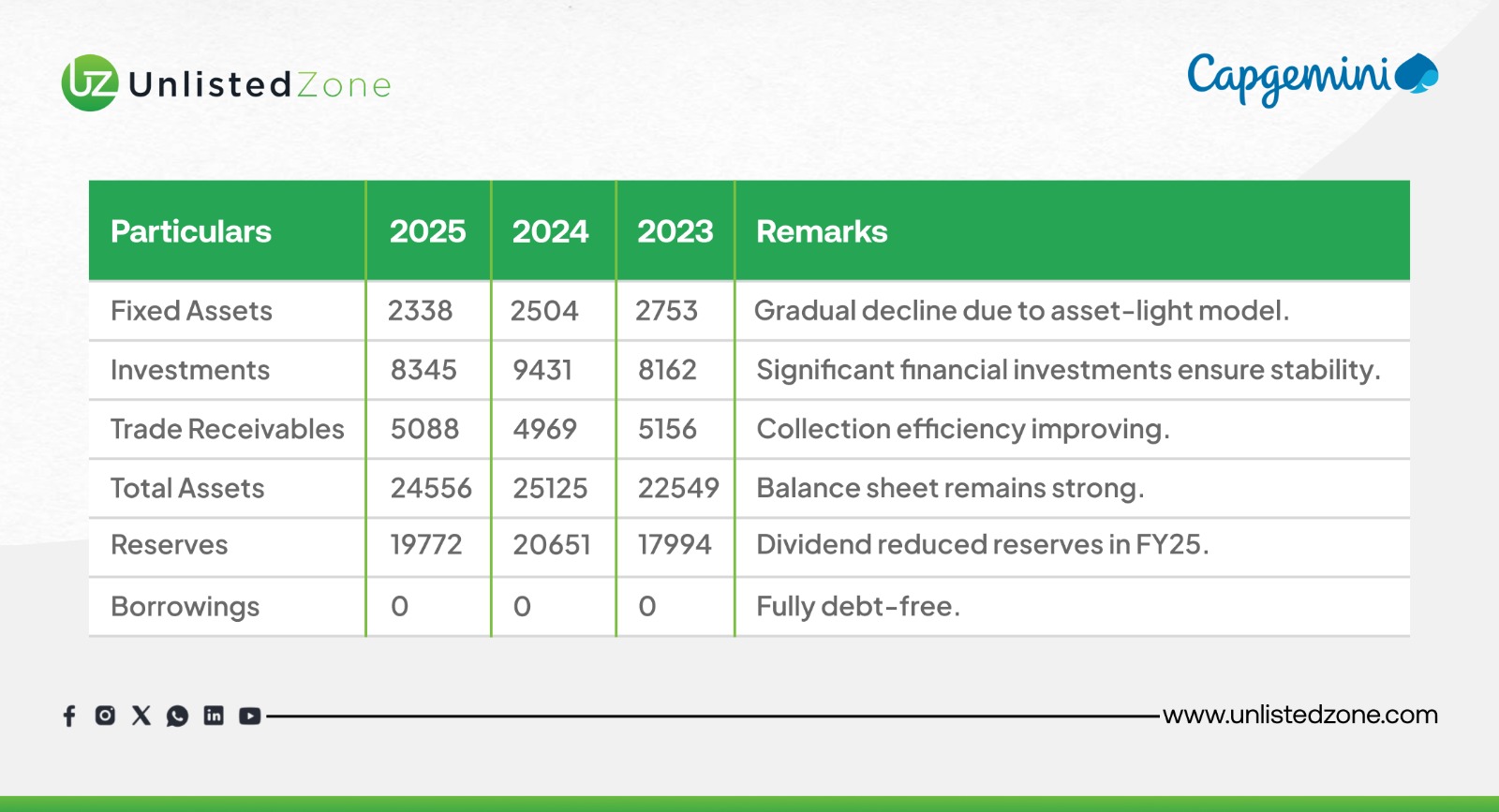

Balance Sheet Strength (₹ in Cr.) of Capgemini Technology Unlisted Shares

Insight: Debt-free operations with strong reserves highlight balance sheet strength.

Insight: Debt-free operations with strong reserves highlight balance sheet strength.

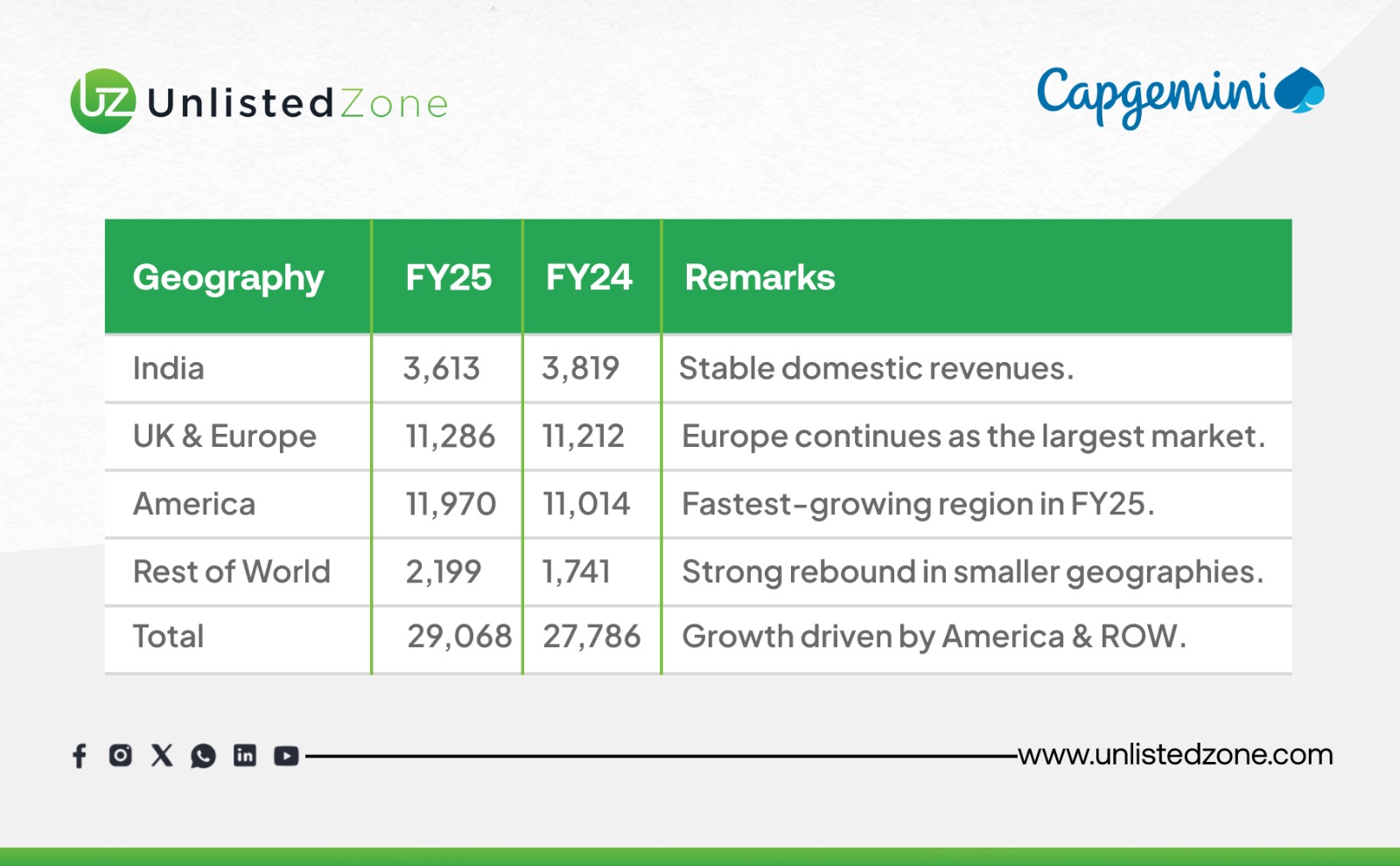

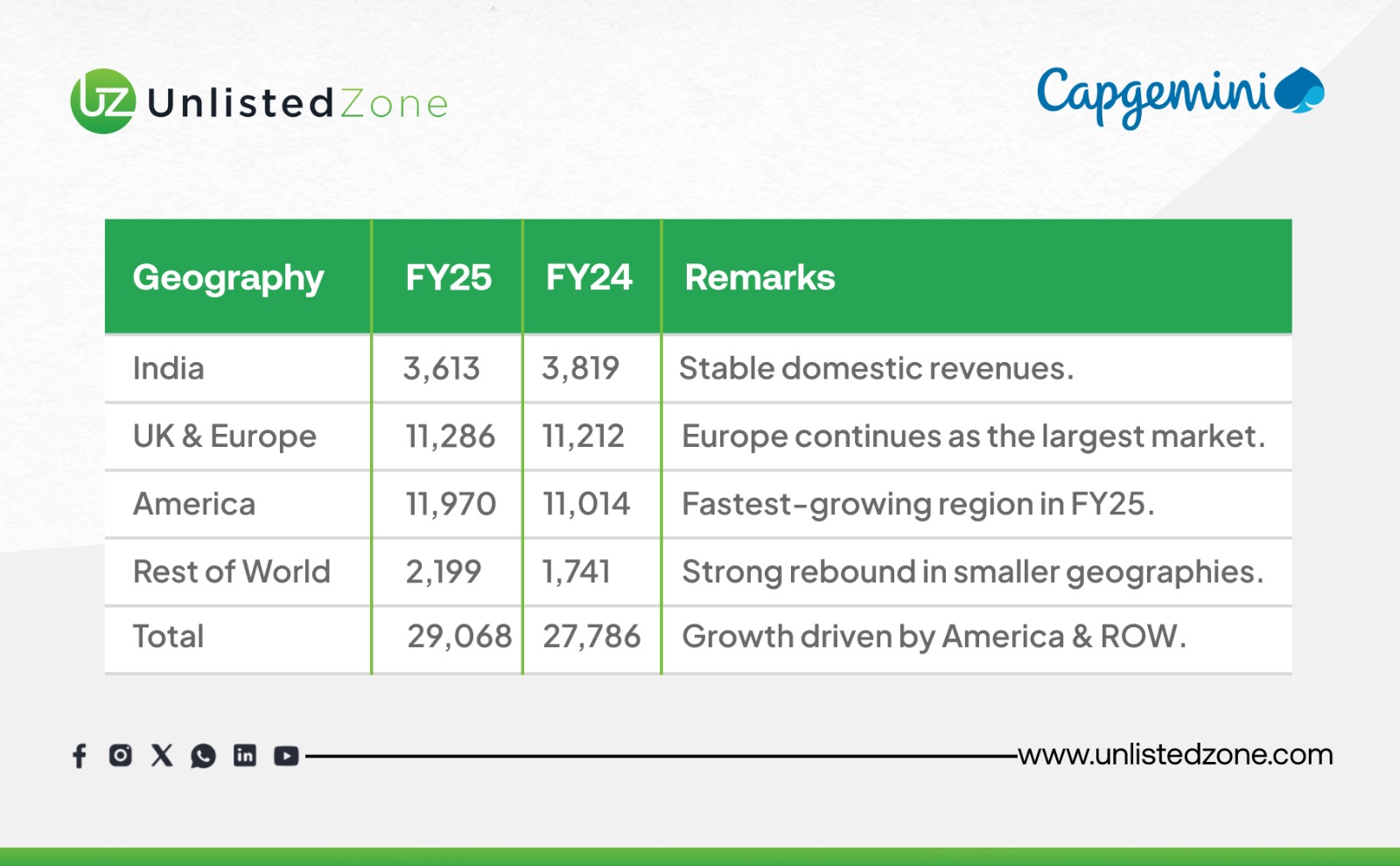

Segment / Geography-Wise Analysis of Capgemini Technology Unlisted Shares

Insight: Over 80% revenues come from Europe & America, highlighting global dependence.

Management Discussion & Analysis (MD&A) on Capgemini Technology Unlisted Shares

-

Outlook: Global clients are focusing on cost optimization + digital transformation, supporting offshore demand.

-

Risks: Currency volatility, US/Europe slowdown, rising attrition in IT sector.

-

Strategy: Investment in AI, cloud computing, and cybersecurity to capture next-gen IT spending.

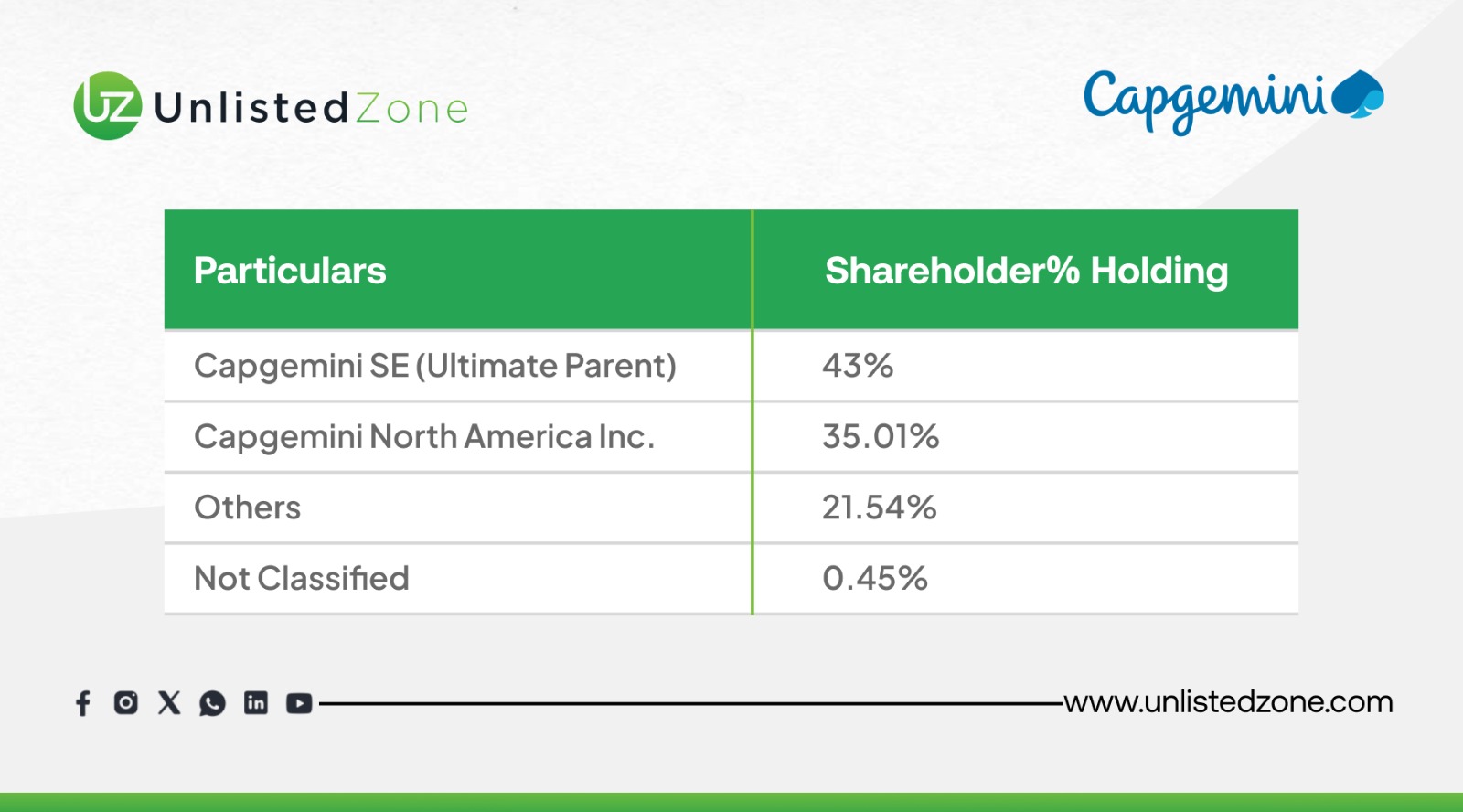

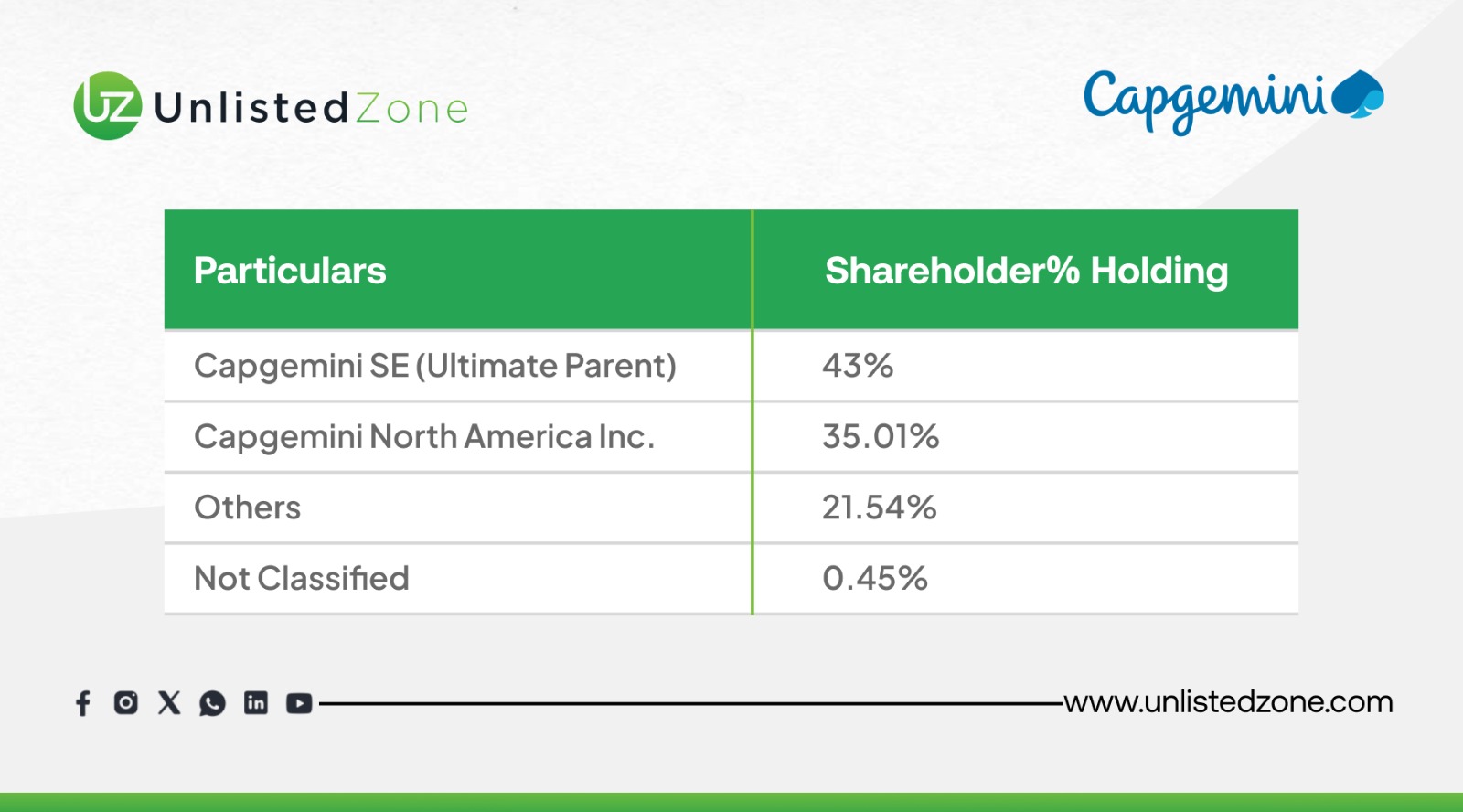

Shareholding Pattern (FY25) of Capgemini Technology Unlisted Shares

Insight: Strong promoter backing ensures stability and alignment with global strategy.

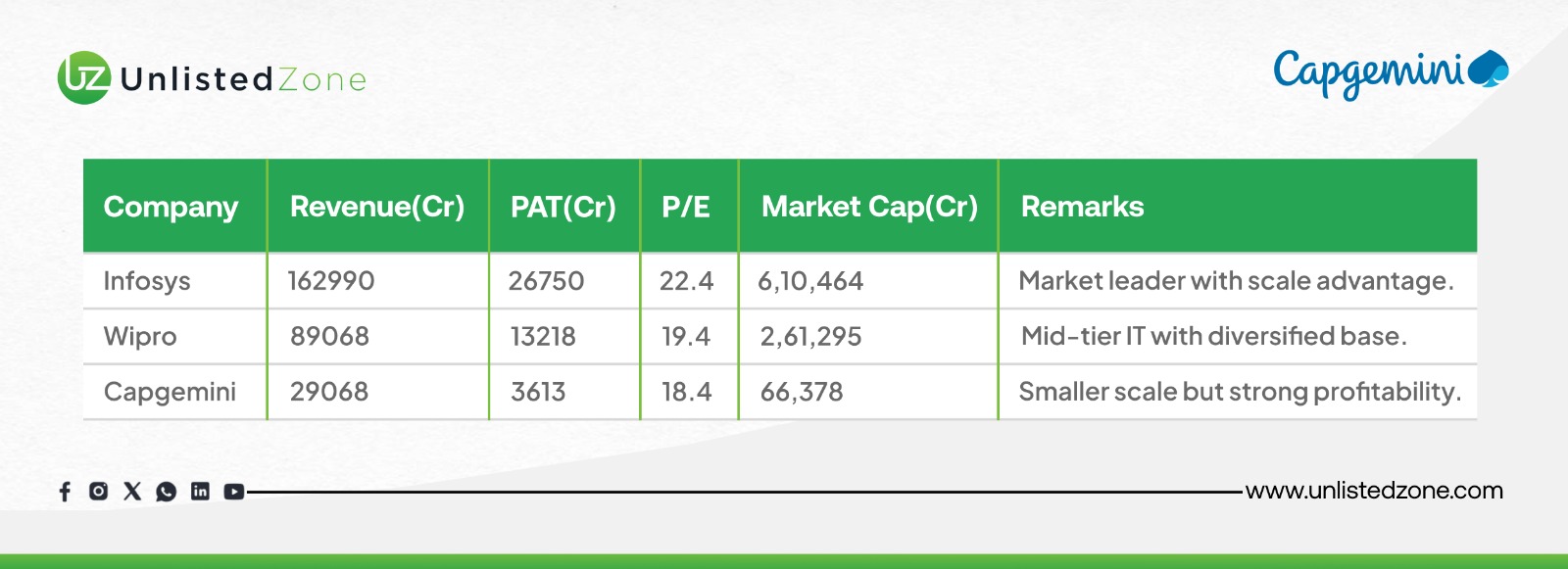

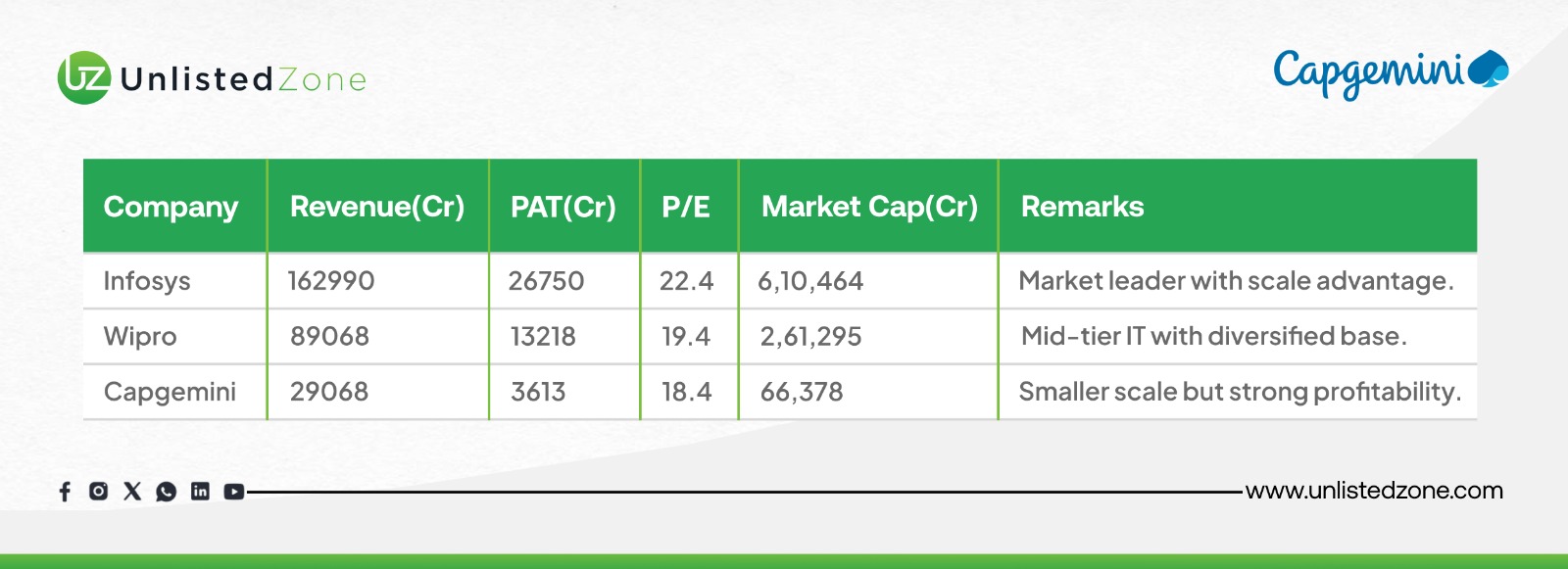

Peer Comparison (FY25) of Capgemini Technology Unlisted Shares

Insight: Though smaller in size, Capgemini trades at attractive valuations with comparable margins.

Valuation Insights of Capgemini Technology Unlisted Shares

-

Market Cap (Unlisted): ~₹66,378 Cr

-

P/E Ratio: 17.96

-

P/B Ratio: 3.27

-

ROE: 18.22%

-

Debt to Equity: 0

-

Book Value per Share: ₹3,363

Insight: Attractive valuations with strong ROE and zero debt make Capgemini a stable unlisted investment.

Future Outlook of Capgemini Technology Unlisted Shares

-

Growth Opportunities: Rising global demand for AI, cloud, and digital consulting.

-

Management Guidance: Focus on cost optimization + new digital capabilities.

-

Industry Tailwinds: Global digital transformation spending remains strong.

-

Headwinds: Macroeconomic slowdown in US/Europe and pricing pressure.

UnlistedZone View

Capgemini Technology Services India Ltd. is a debt-free, cash-generating IT services giant backed by strong promoter ownership. With steady margins, healthy ROE, and attractive valuations, it is well-suited for HNIs and long-term investors seeking stable returns in the Indian unlisted IT space.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.

Insight: Debt-free operations with strong reserves highlight balance sheet strength.

Insight: Debt-free operations with strong reserves highlight balance sheet strength.