Can MSEI Finally Restart Trading?

For long-term investors in Metropolitan Stock Exchange of India Limited (MSEI), one question has remained unanswered for years: “When will the exchange actually revive?” On 8 January 202...

Introduction

Bharat Hotels Limited (BHL), a prominent player in the Indian hospitality sector, has recently released its annual financial report for the fiscal year 2022-23. The report reveals a compelling narrative of remarkable financial recovery and growth, following a challenging period due to the COVID-19 pandemic. In this blog, we will dissect the key highlights from the annual report and what they signify for investors evaluating BHL's prospects.

Financial Performance Highlights A Surge in Revenue

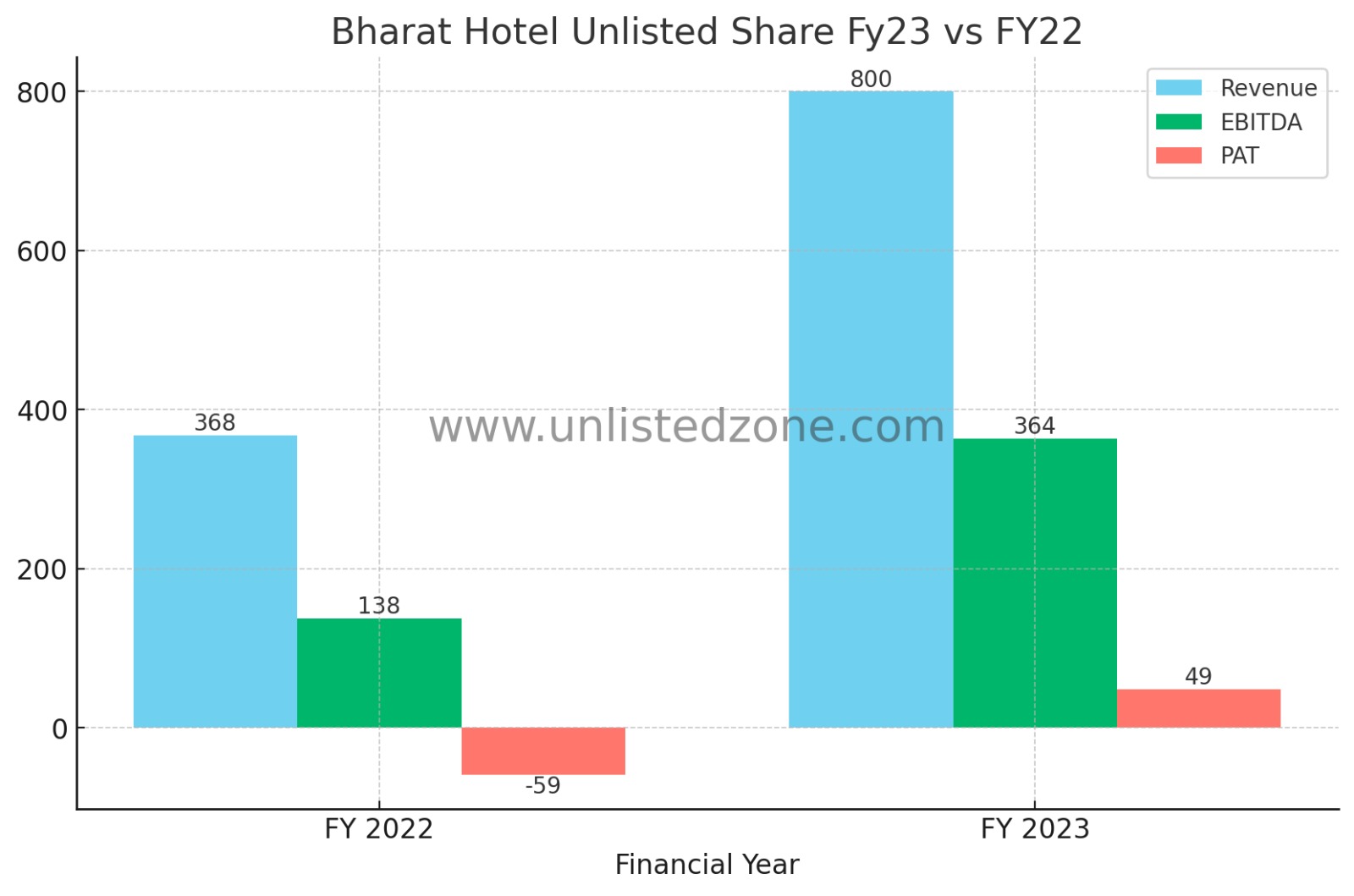

The first thing that stands out from the report is the phenomenal revenue growth. BHL recorded a 117% increase in its revenue from operations, climbing to Rs. 800 crore in FY 2022-23 from Rs. 369 crore in FY 2021-22. This surge can be attributed to the successful vaccination drive, reopening of international borders, and the overall economic growth in the country.

A Closer Look at Expenses and Profits

While total expenses also increased by 88% to Rs. 444 crore, the rise is considerably less than the revenue growth, indicating improved operational efficiency. More impressively, BHL's EBITDA soared by 162% to Rs. 364 crore, showcasing an enhanced ability to generate income from its operations. Profit Before Tax (PBT) and Net Profit also displayed significant improvements. PBT registered a 230% increase, reaching Rs. 134 crore, turning around from a loss of Rs. (103) crore in the previous fiscal. Net Profit rose to Rs. 50 crore, marking a 129% increase and recovering from a loss of Rs. (59) crore in FY 2021-22.

Cash Flow Insights

Strong cash flow management is crucial for any business, and BHL appears to have excelled in this area. The company generated robust net cash from operating activities, reaching Rs. 317 crore, an increase from Rs. 136 crore in the previous year. BHL also showed positive trends in cash flow from investing activities and improved cash flow from financial activities.

Strategic Financial Moves

During FY 2022-23, BHL issued 1,10,000 Non-Convertible Debentures to repay existing debt. This move not only helped the company clear its loans but also signaled strong financial management to potential investors.

The Bigger Picture

Founded in 1981 by Lalit Suri, BHL has been a leader in the Indian hospitality industry. Its portfolio includes premium properties such as The Lalit New Delhi, The Lalit Mumbai, and The Lalit Jaipur. The financials for FY 2022-23 indicate that the company has not only weathered the storm of the COVID-19 pandemic but is also well-positioned for future growth.

Conclusion

Bharat Hotels Limited's financial performance for FY 2022-23 reveals a success story of resilience and strategic financial management. The company has managed to turn the tide with impressive revenue growth, profitability, and cash flow management. For those looking to invest in the hospitality sector, BHL's recent financial performance offers compelling evidence of a company on the rise, making it a candidate worthy of consideration.

https://unlistedzone.com/shares/bharat-hotels-limited-share-price-buy-sell-unlisted-shares-of-bharat-hotels/