Introduction of Studds

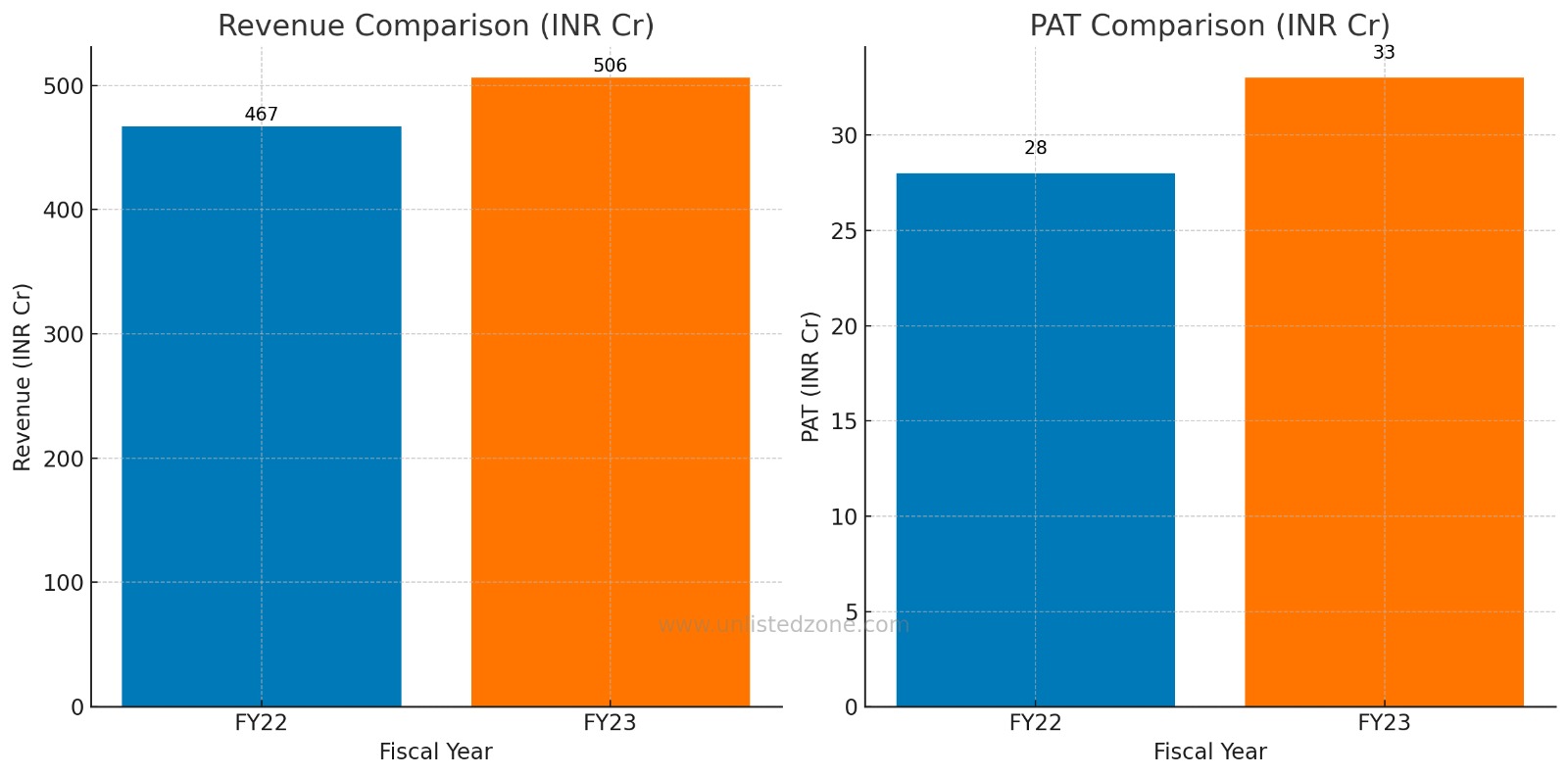

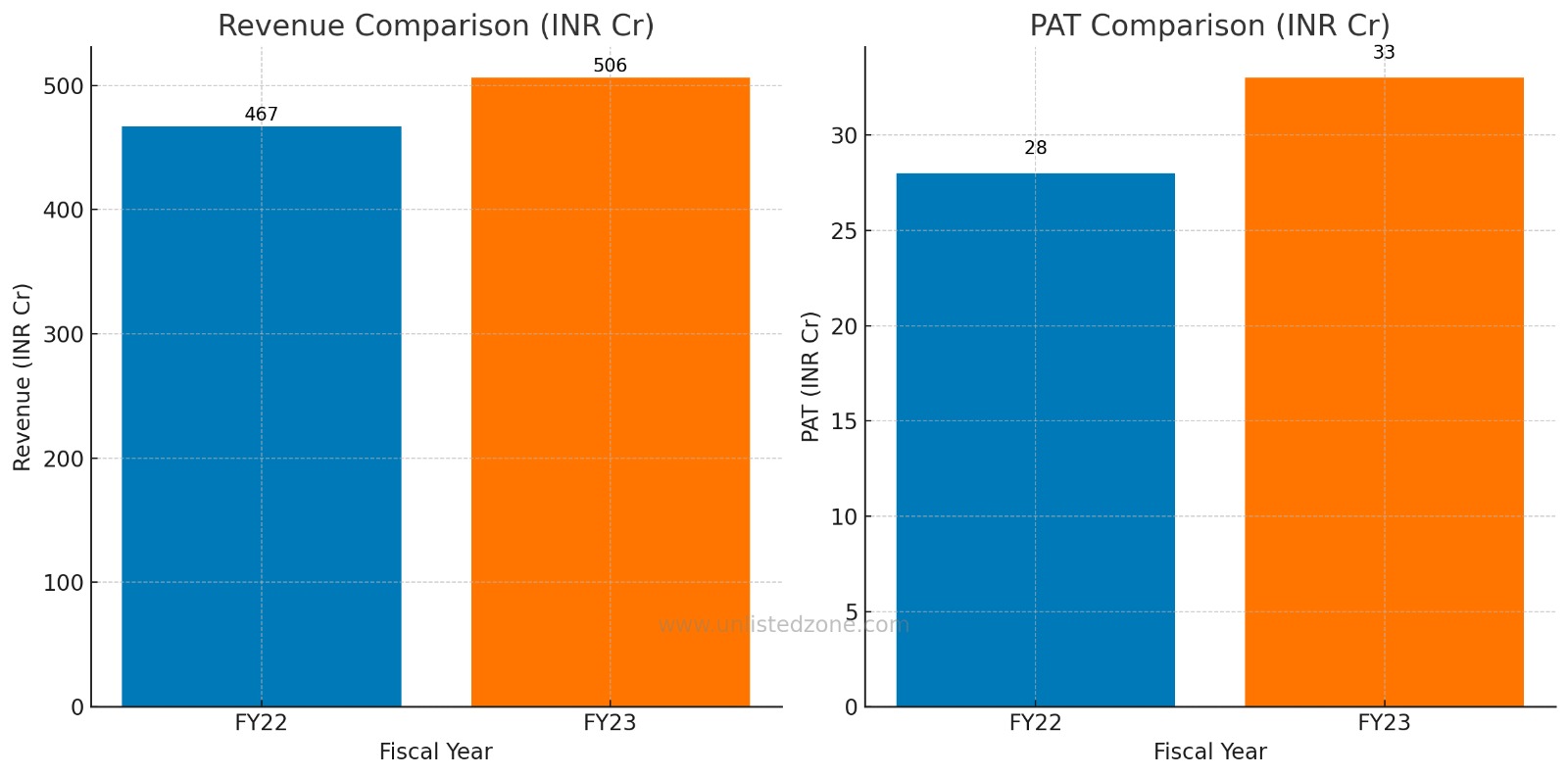

Studds, a prominent player in the helmet manufacturing industry, has shown a rather modest 7% growth in total revenue for the fiscal year 2022-23, increasing from approximately INR 467 Cr last year to INR 500 Cr this year. This blog aims to delve deeper into the company's financials, market position, and potential growth drivers to evaluate its investment viability in the unlisted share market.

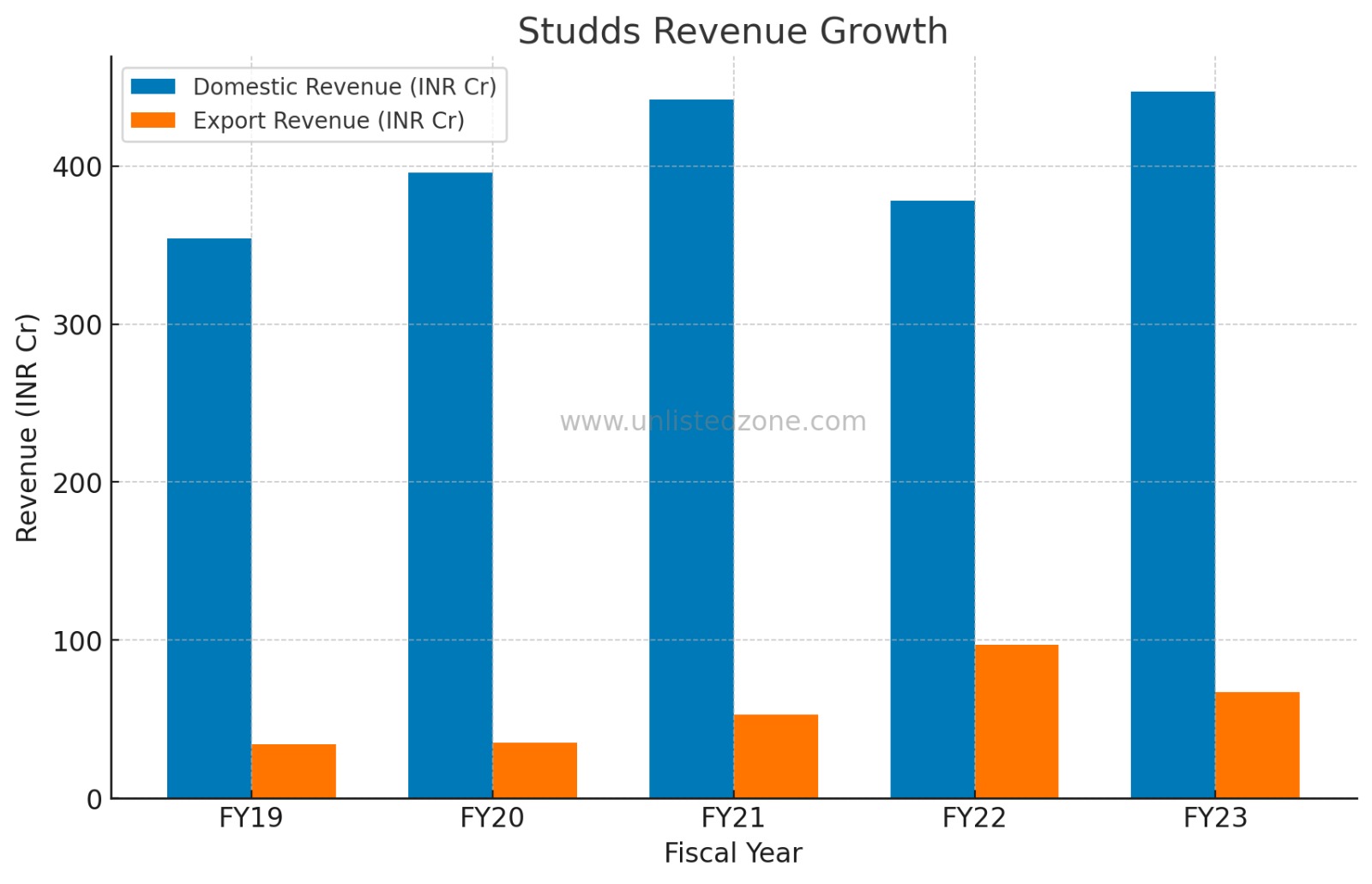

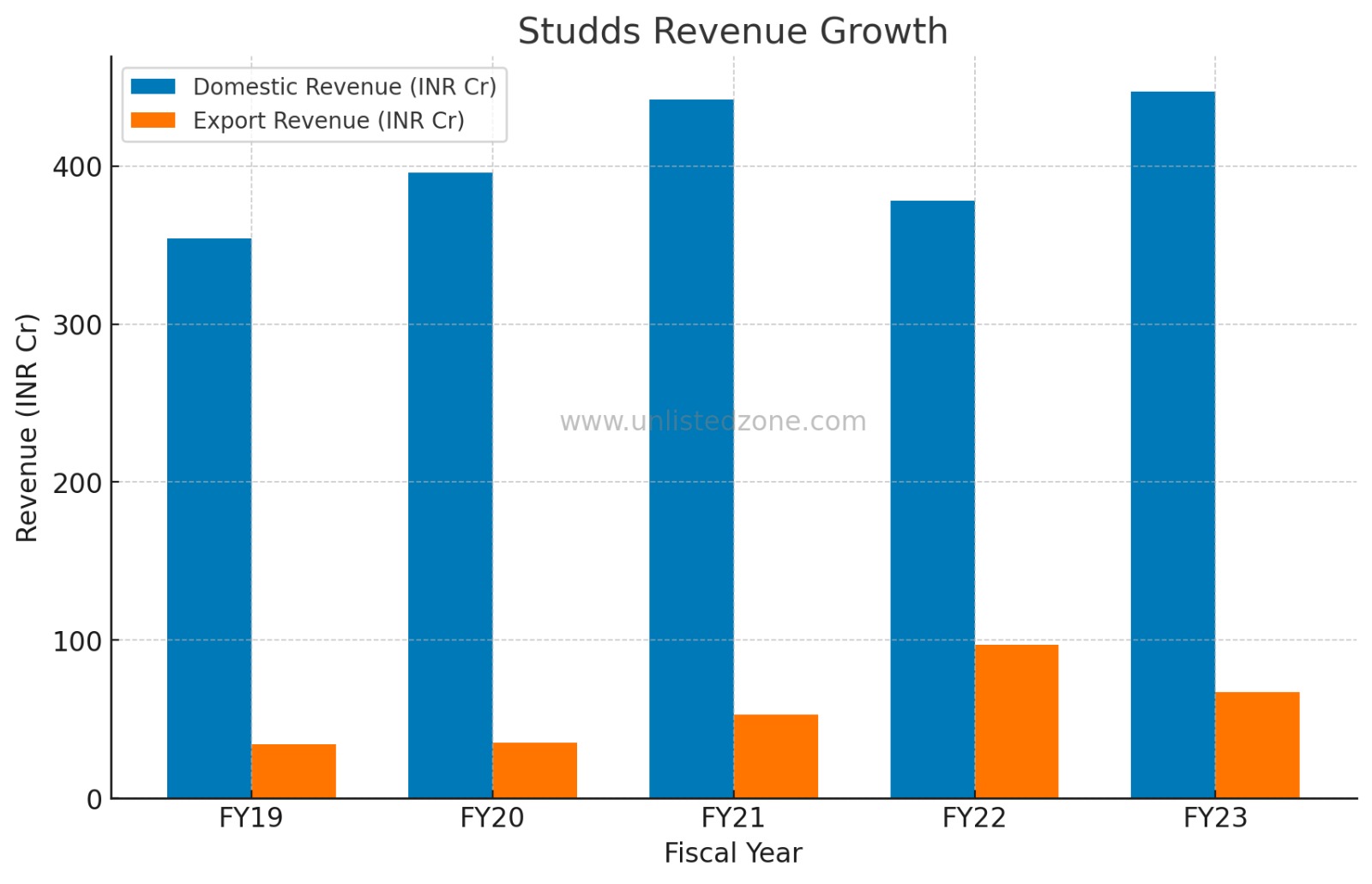

Revenue Growth: A Closer Look

Domestic Market

Studds has been experiencing growth in the domestic Indian market. The company's domestic sales grew from INR 378 Cr in FY22 to INR 447 Cr in FY23, marking an 18% growth. However, when compared to the FY21 figure of INR 442 Cr, the growth appears to be negligible.

Export Market

The export market has been a challenge for Studds, showing a decline from INR 97 Cr in FY22 to INR 67 Cr in FY23, a de-growth of 30%. This is a concern, as 20% of the company's business comes from exports. In coming years, the Exports gaining prominence with the

Make in India initiative.

The government’s Make in India initiative has given a boost to the manufacturing of helmets in the country. As a result, Indian-made helmets are becoming popular in other countries as well. The export market for helmets is expected to grow in the coming years due to rising demand and the government’s support for domestic manufacturing. This has created new opportunities for manufacturers to expand their customer base.

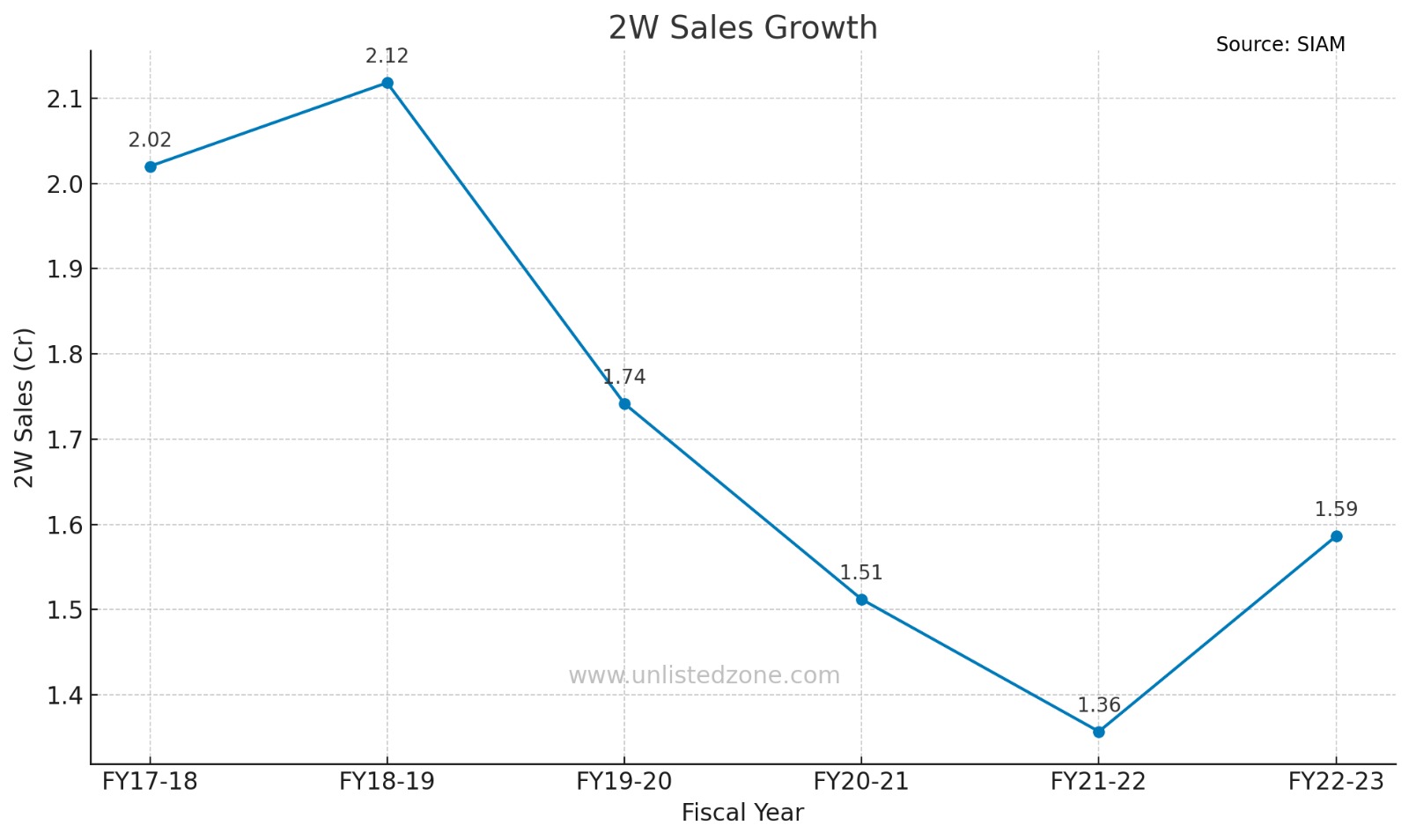

Factors Impacting Growth

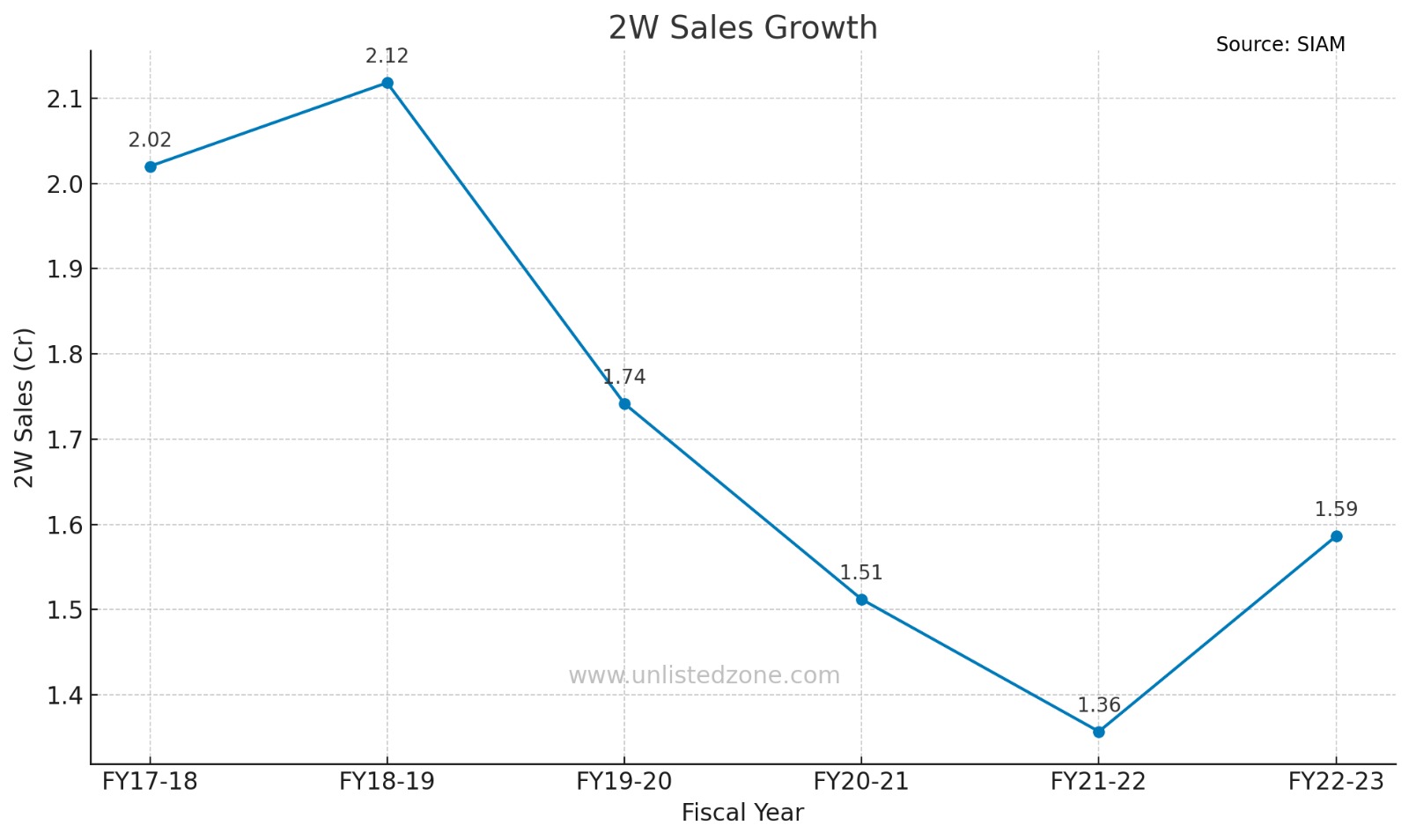

The Two-Wheeler Industry

The two-wheeler industry has been experiencing a consistent decline since its peak in 2019. According to data from SIAM, two-wheeler sales have been following a downward trend from 1.7 Cr in 2019 to 1.25 Cr in 2023. This directly impacts the demand for helmets and, consequently, Studds' growth.

Emergence of Electric Vehicles

The electric vehicle market in India is showing signs of growth, with around 7 lakh EVs sold last year. Although this figure is still small, the growth in EV sales can potentially fuel the helmet market in the future.

Financial Health of the Company

Studds has maintained a robust balance sheet with an Interest Coverage Ratio above 1.31x and a Debt-to-Equity Ratio below 0.5. The company has generated a total cash flow from operations of INR 112 Cr in the last three years. The working capital cycle is well-managed, and most of the capital expenditures in the past three years have been covered by cash flows from operations. The finance cost for FY23 was only INR 3 Cr, indicating a strong financial standing.

a) Revenue increased from INR 467 Cr in FY22 to INR 506 Cr in FY23.

b) PAT saw a jump, from INR 28 Cr in FY22 to INR 33 Cr in FY23.

Valuation Insights

At present, Studds' unlisted shares are available at INR 900, with a market capitalization of INR 1800 Cr. With a PAT of INR 33 Cr for this fiscal year, the P/E ratio stands at 54x, which appears to be on the higher side. The growth trajectory for the next 2-3 years would need to be analyzed for a more accurate valuation.

Conclusion

While Studds has shown moderate growth and maintains a strong financial position, challenges in the export market and the broader two-wheeler industry could pose hurdles to its future growth. Further information from the management regarding their future growth plans will be critical in deciding the investment worthiness of Studds in the unlisted share market. Investors and advisory firms must exercise due diligence and await further information before making investment decisions.

https://unlistedzone.com/shares/studds-accessories-limited-share-price-buy-sell-preipo-unlisted-shares-of-studds-accessories-limited/