A) About the Company Veeda Lifesciences Unlisted Shares

History & Overview:

Veeda Clinical Research Limited was Incorporated on April 23, 2004, and headquartered in Ahmedabad, Gujarat, Veeda Clinical Research Limited transitioned into a public limited company in June 2021. In FY 2024–25, it underwent a strategic rebranding to Veeda Lifesciences, signaling a shift from being a generics-focused CRO to an innovation-driven global drug development partner.

Business Model & Segments

The company operates as a single segment CRO, with integrated services spanning:

-

Clinical Trials – Phase I to Phase IV studies.

-

Healthy Volunteer Studies (BA/BE) - Specializing in bioavailability (BA) and bioequivalence (BE) studies.

-

Biopharma Services – biologics, large molecules, and bioanalytical services.

-

Subsidiaries:

The company operates as a single, unified segment, with the Chief Operating Decision Maker (CODM) reviewing performance holistically.

Industry Positioning:

-

Among India’s largest independent full-service CROs.

-

Operational footprint: 532 beds across 4 Ahmedabad facilities, 1 in Mehsana, 2 pre-clinical sites in Bangalore.

-

Global client base in 27 countries, including Dr. Reddy’s, Mankind, Granules, and international pharma like Upsher-Smith (USA).

-

Well-positioned in the global CRO market, which is benefiting from rising R&D outsourcing and demand for complex clinical trials.

B) Key Highlights of FY 2024-25 of Veeda Lifesciences Unlisted Shares

-

Rebranding & Strategic Shift:

-

Transition from Veeda Clinical Research Limited → Veeda Lifesciences.

-

Reflects move towards being a global integrated partner using AI, technology, and real-world data.

-

Acquisition of Health Data Specialists (Heads):

-

Established footprint in 25 locations across EU, North America, Asia-Pacific.

-

Major driver of 57% revenue growth in FY25.

-

Significantly boosted oncology and late-phase trial capabilities.

-

Infrastructure Investments:

-

Digital Transformation:

-

Regulatory Success:

C) Financial Performance of Veeda Lifesciences Unlisted Shares

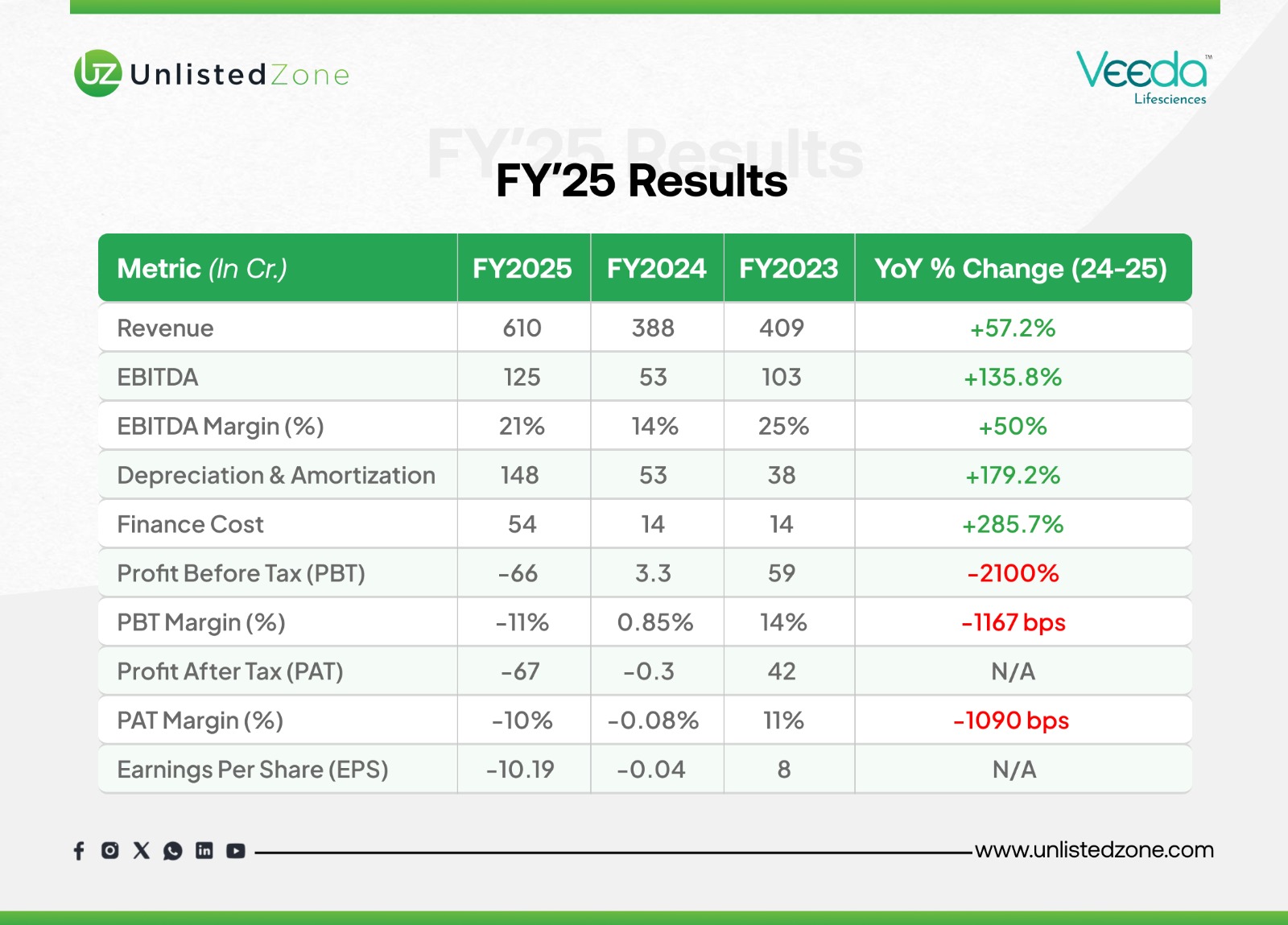

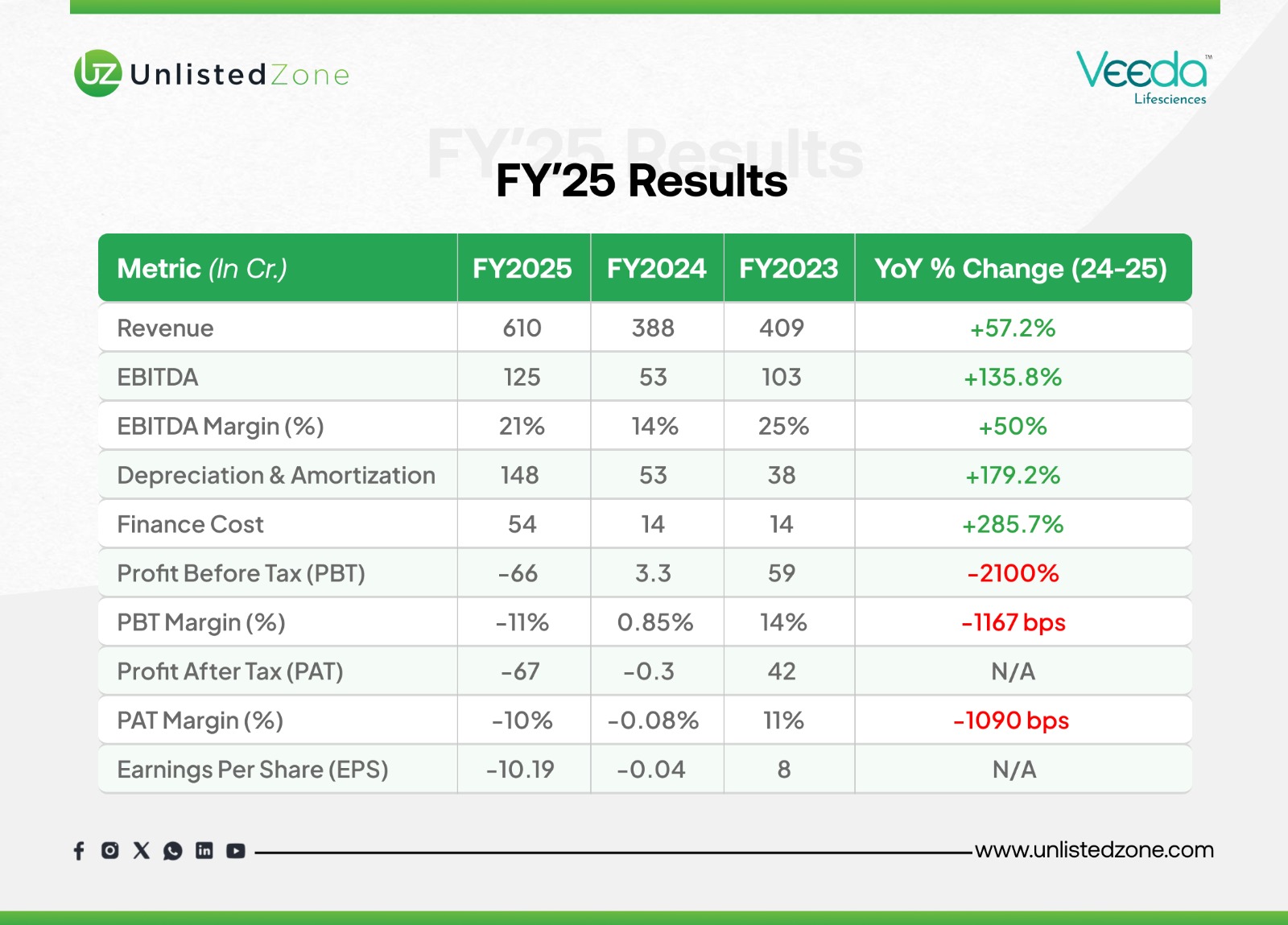

P&L (₹ Cr) of Veeda Lifesciences Unlisted Shares

-

Revenue: 57% YoY growth, primarily fueled by the acquisition of Heads. This reversed a previous dip and indicates strong top-line expansion..

-

EBITDA: 136% increase Operational performance improved significantly, showing the initial benefits of scale.

-

EBITDA Margin: 20.5% vs. 13.7% vs. 25.2% → improved but below FY23 highs.

-

PAT: ₹-67Cr vs. ₹-0.3 Cr vs. ₹42Cr → turned negative due to higher D&A (₹148 Cr) and finance costs (₹54 Cr).

-

EPS: ₹-10.19 vs. ₹-0.04 vs. ₹8 → heavy dilution impact.

👉 Analysis: Strong topline growth and operational leverage, but bottom line weakened due to post-acquisition costs, higher debt servicing, and depreciation.

Balance Sheet (₹ Cr) of Veeda Lifesciences Unlisted Shares

-

Total Assets: ₹1,863 Cr vs. ₹2,040 Cr (FY24) → down 8.7%.

-

Fixed Assets: ₹582 Cr vs. ₹190 Cr → +206% (capex + acquisition impact).

-

Borrowings: ₹406 Cr vs. ₹260 Cr → +56% , indicating debt was used to finance the acquisition and expansion.

-

Share Capital: ₹13.1 Cr vs. ₹13.6 Cr

-

Reserves: ₹849 Cr vs. ₹1,047 Cr → fell due to losses, directly impacted by the net loss of -67 Cr in FY25, which eroded retained earnings.

👉 Analysis: Expanded asset base with stronger capital structure, but reserves erosion from losses. Debt remains moderate with Debt/Equity at 0.06.

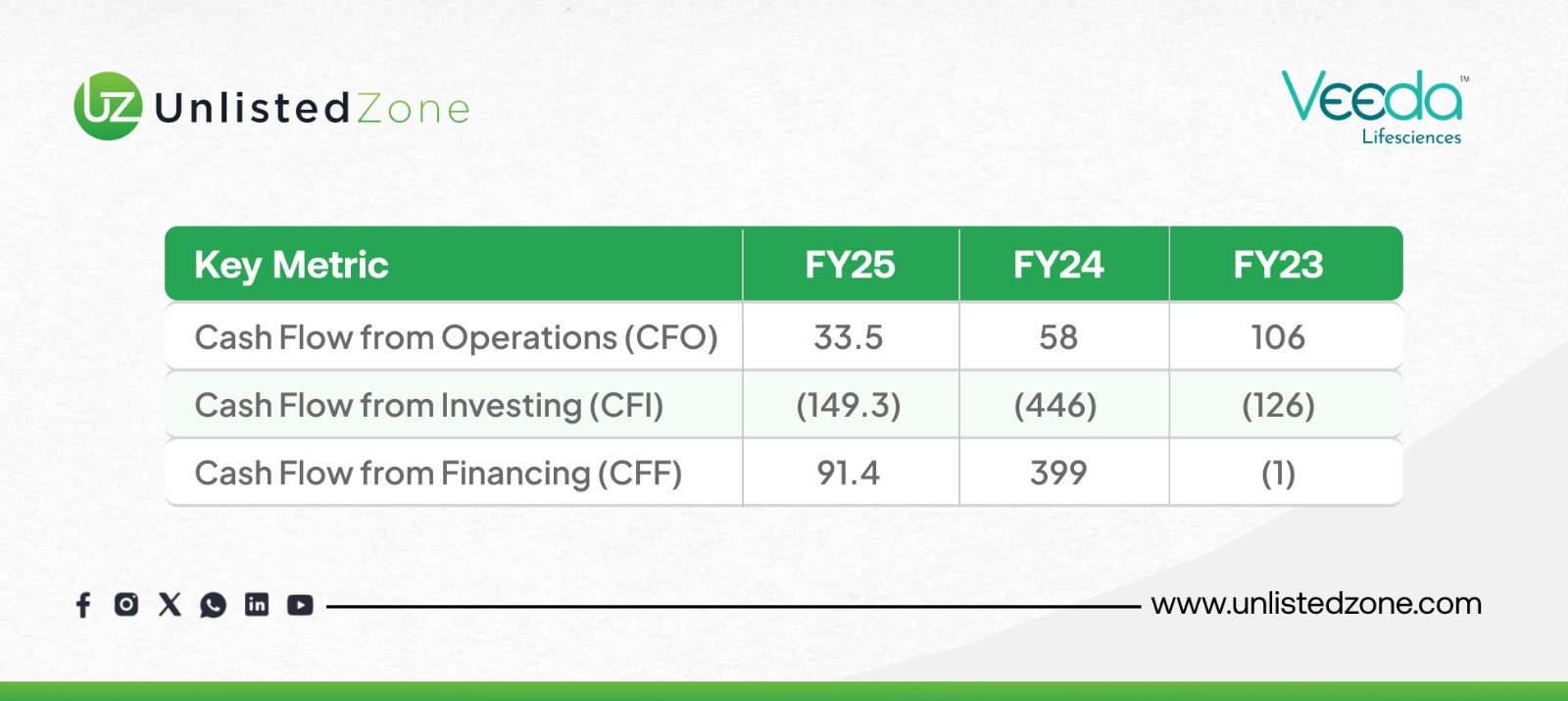

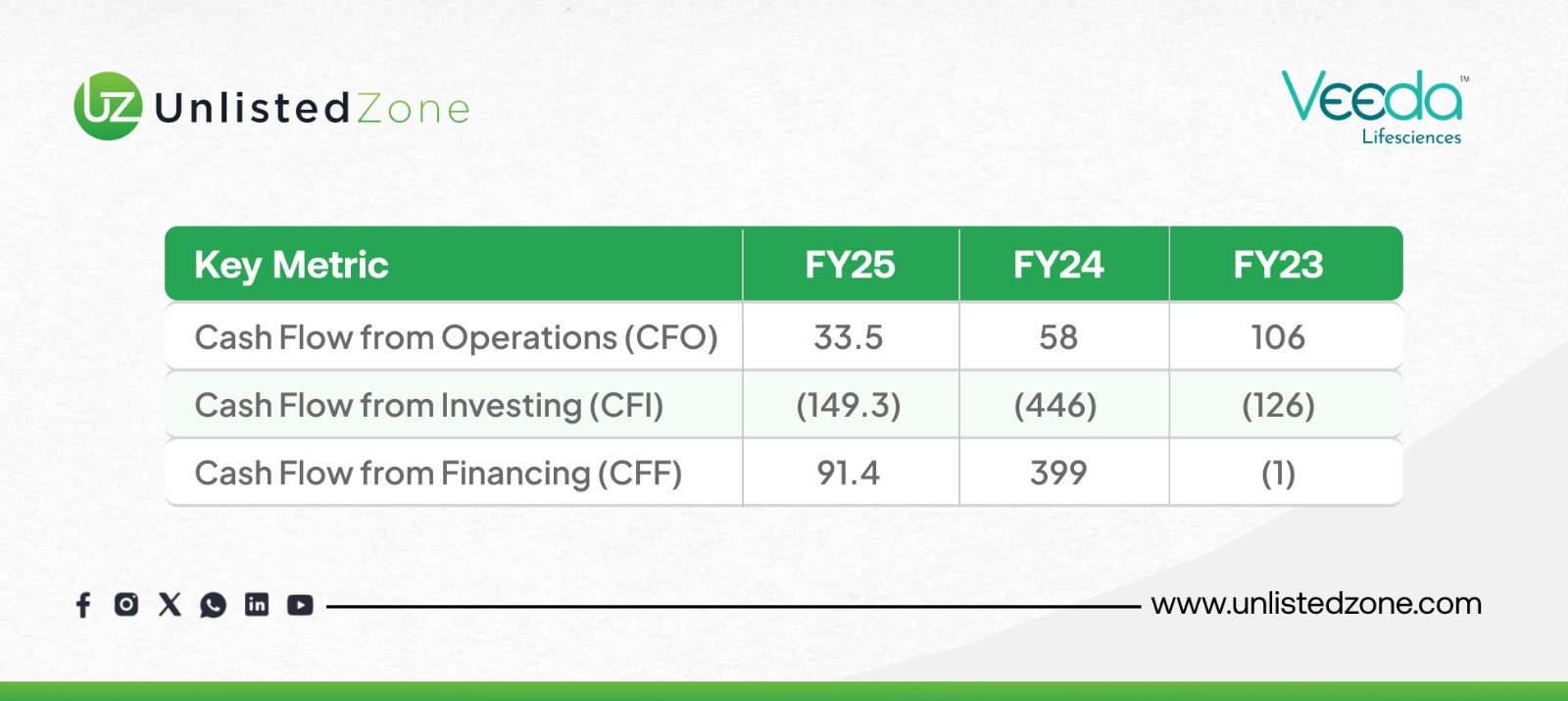

Cash Flow (₹ Cr) of Veeda Lifesciences Unlisted Shares

-

CFO: ₹33.5 Cr vs. ₹58 Cr vs. ₹106 Cr → still positive despite PAT loss, which is a healthy sign.

-

CFI: ₹-149.3 Cr vs. ₹-446 Cr vs. ₹-126 Cr → high investments in FY25.

-

CFF: ₹91.4 Cr vs. ₹399 Cr vs. ₹-1 Cr → equity infusion and borrowings funded growth.

-

Net Cash: -₹24.4 Cr vs. ₹11 Cr vs. ₹-21 Cr → slight cash burn due to expansion.

👉 Analysis: Core ops remain cash-positive. Heavy capex/acquisition spend absorbed via financing inflows.

D) Segment / Geography Analysis of Veeda clinical (Standalone) of Veeda Lifesciences Unlisted Shares

Revenue by Geography FY25 Vs FY24 (₹ Cr):

-

India: ₹96 Cr (FY25) vs. ₹101 Cr (FY24) → slight decline.

-

US: ₹36 Cr vs. ₹35Cr → marginal growth.

-

Greece: ₹32 Cr vs. ₹47 Cr→ sharp decline.

-

Ireland: ₹4 Cr vs. Nil → new addition.

-

Others: ₹94 Cr vs. ₹92 Cr → stable.

-

Total Revenue: ₹262 Cr vs. ₹275 Cr → down ~5%.

👉 Observation: Global expansion balanced out India/Greece declines. Stronger diversification post-Heads acquisition.

E) Ratio Analysis FY25 vs FY24 of Veeda Lifesciences Unlisted Shares

-

Current Ratio: 1.06 (FY25) vs. 1.08 (FY24) → liquidity dipped -1.8 % but remains healthy.

-

Debt/Equity: 0.47 vs. 0.24 → decreased slightly , due to debt raised and reserves cut out .

-

ROE: -7.7% vs. -0.02% → negative due to losses.

-

Net Profit Margin: -10.98% vs. -0.08% → -99% change a heavy bottom-line drag.

-

Trade Receivable Turnover: 4.43 vs. 4.10 → improved collection efficiency by 8%.

F) Shareholding Pattern of Veeda Lifesciences Unlisted Shares

-

Basil Private Ltd: 33.83%

-

Bondway Investment Inc.: 19.20%

-

Others (public & institutions): 46.97%

G) Valuation Insights (Unlisted Market) of Veeda Lifesciences Unlisted Shares

H) Management Discussion & Analysis (MD&A) on Veeda Lifesciences Unlisted Shares

Opportunities:

-

Oncology, rare diseases, cell & gene therapy offer high-margin growth.

-

AI-driven trial management will cut costs & time.

-

Expanding global reach ensures diversified revenue base.

Risks:

-

Integration risk of Veeda, Heads & Bioneeds.

-

Margin pressure from high fixed costs.

-

Competition with large multinational CROs.

Strategic Roadmap:

-

Invest in AI, analytics, decentralized trials.

-

Focus on end-to-end client partnerships.

-

Strengthen presence in high-growth geographies & therapeutic areas.

I) Future Outlook (FY 2025-26) of Veeda Lifesciences Unlisted Shares

-

Growth to be led by oncology, rare diseases, and biotherapeutics.

-

Expect margin recovery as integration costs normalize.

-

Plans to deepen strategic global partnerships with pharma companies.

-

Will leverage AI, digital platforms & real-world data to enhance efficiency.

J) UnlistedZone View on Veeda Lifesciences Unlisted Shares

Veeda Lifesciences is in the middle of a transformational growth cycle. FY25 was an investment-heavy year, showing robust revenue growth but subdued profitability. With a low debt-to-equity ratio, strong liquidity, and a growing global presence, it is structurally well-placed for long-term growth.

Investment Thesis:

-

Attractive for HNIs/long-term investors seeking exposure to India’s global CRO play.

-

Short-term valuations appear stretched given losses, but medium-to-long-term value creation potential remains high.

Risks:

-

Execution & integration challenges.

-

Profitability turnaround remains critical.

-

Global competition could limit pricing power.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.