Utkarsh Small Finance Bank has come up with its annual report 2021 and same is available with UnlistedZone. Let us see how it has performed in the last one year.

About Utkarsh Small Finance Bank

Utkarsh Small Finance Bank has commenced Banking operations on Jan 23, 2017 and has since spread its footprint consistently to include a customer base that covers the unserved and underserved segment across various States and UTs of India. The Bank re- envisioned its Vision, Mission and Value Statements during FY 2020-21 to signify its ability to offer excellence in banking services across social strata.

Utkarsh Small Finance Bank mainly provides loans under various categories such as;

a. Micro-Finance Individual and Group.

b. Retail loan - Personal, Business, Commercial Vehicles etc.

c. Wholesale banking Loan

d. Housing Loans

In the pandemic, the micro-finance loan book was most affected.

P.S- In the unlisted market, the shares of Utkarsh Microfinance are available which is a holding company of Utkarsh Small Finance Bank. As per information available in the market, before the IPO the shareholders of Utkarsh Microfinance will get shares of Utkarsh Small Finance bank in the proportion as per calculated valuation.

Highlights of FY20-21

a) Launched digital on-boarding of accounts.

b) Launched non-fund based facility and working capital loans.

c) Utkarsh Small Finance Bank has filed its Draft Red Herring Prospectus (DRHP).

d) They have tied up with Mastercard for International Debit Card offering.

e) BT-KPMG – Best Small Finance Bank in 2021- SFB category.

f) Team Marksmen and Media partner CNBCTV18 have recognised Utkarsh Small Finance Bank as one of the Most Trusted Brands of India FY 2020-21 •

g) Utkarsh Small Finance Bank was awarded State Level Outstanding Performance Award by NABARD Year – 2020 for Joint Liability Group under Small Finance Category by NABARD.

Utkarsh Small Finance Bank Presence

We have a presence in 16 states, 2 Union Territories, 188 districts and having 558 branches.

Financial Highlights of FY20-21

a) Utkarsh Small Finance Bank has clocked revenue of 1,725 Crore in FY 2020-21, compared to 1,406 Crore in FY 2019-20, clocking a year-on-year growth of 22.68%. The growth is mainly attributed to increase of gross loan portfolio and increase in deposits.

b) The operating profit of the Bank stood at 438 Crore in FY 2020-21 compared to 350 Crore in FY 2019-20, clocking a year-on year growth of 25.13%.

c) Utkarsh Small Finance bank in order to counter the impact of Pandemic has made provisions of 286 Crore in FY 2020-21 compared to 100 Crore in FY 2019-20, registering a year-on-year increase of 187.25%. (

This is the main problem which is happening with Small Finance banks).

d) Due to higher provisions, PAT stood at 111 Crore in FY 2020-21 compared to 186.74 Crore in FY 2019-20.

e) The Return on Assets (RoA) stood at 1.04% and Return on Net Worth (RoNW) at 9.99% for the year ended March 31, 2021.

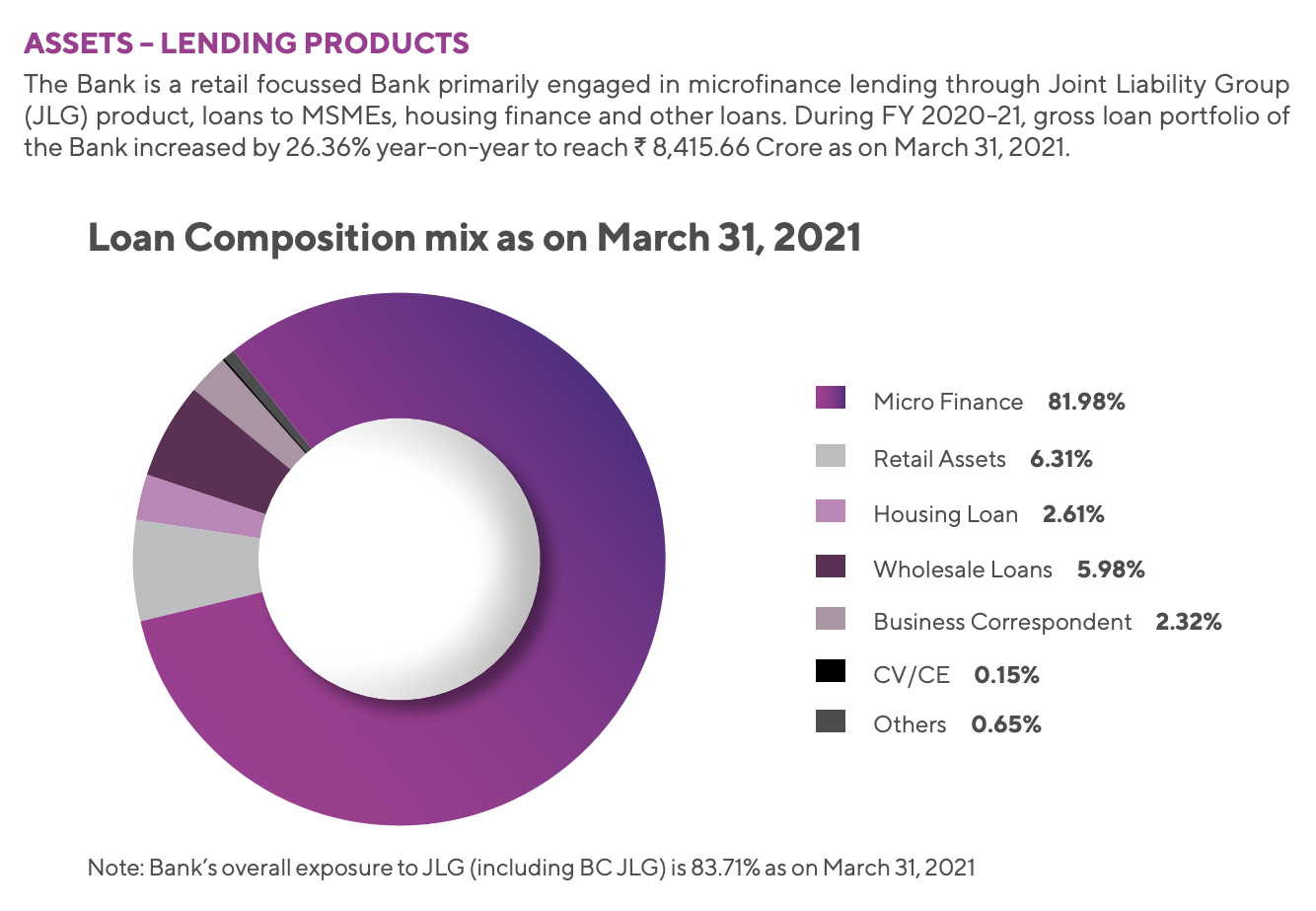

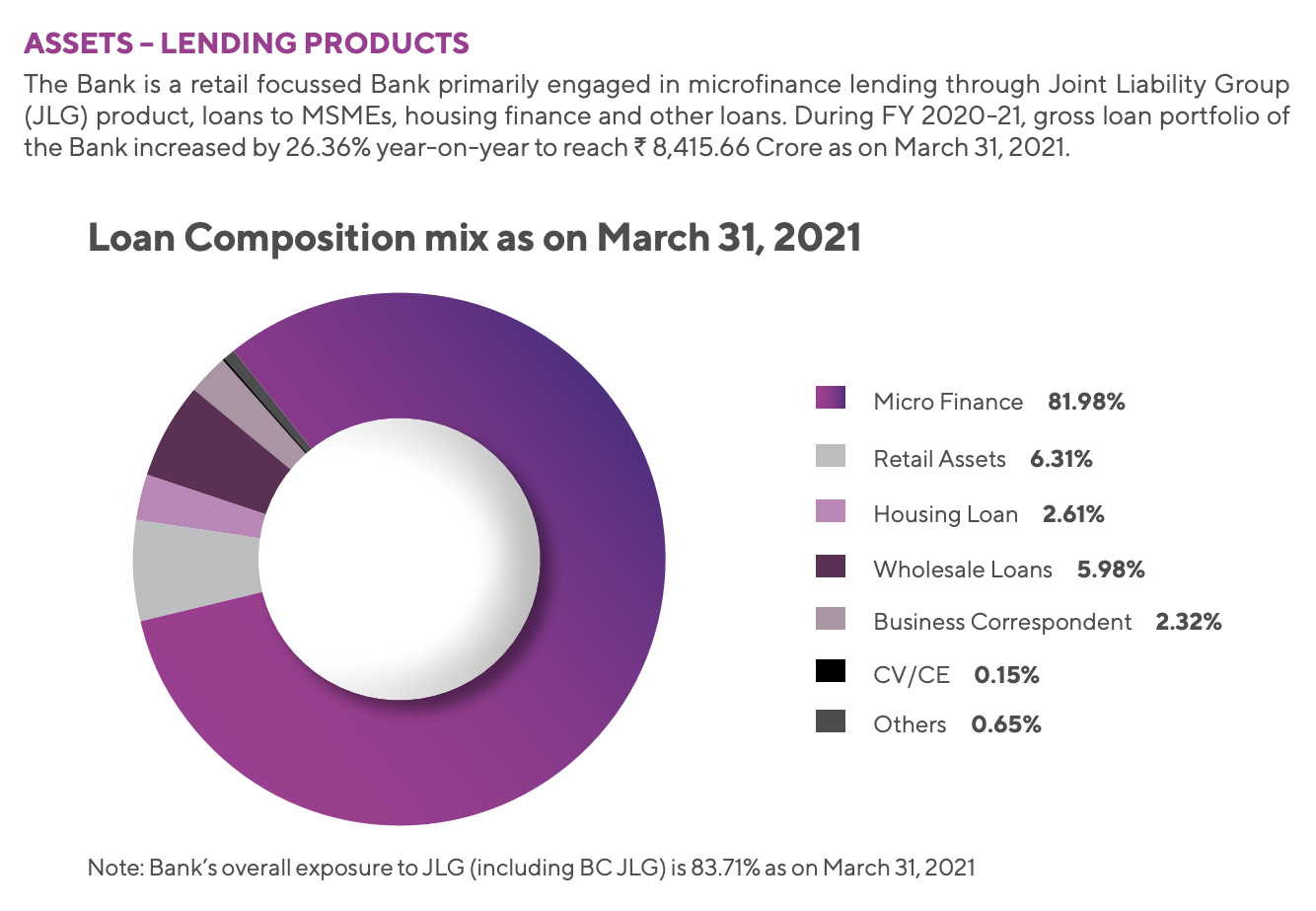

f) The Loan Book during this period was at

8,416 Crore across various business units namely Micro-banking, Wholesale Banking, Retail Assets (MSME and personal Loans), Housing Loans, Business Correspondents, Commercial Equipment and Construction Vehicles and others. The Micro-finance portfolio contributed to around 82% while other businesses contributed around 18% towards the Loan Book.

g) During FY 2020-21, the Bank successfully opened 16 new micro banking branches. Bank’s micro-finance loan portfolio has grown by 17.82% during FY 2020-21 to reach 6,899 Crore as on March 31, 2021.

Micro-finance Loan is the Core business- Most affected by Covid-19

a) Utkarsh Small Finance being an NBFC-MFI, micro-finance remains a focused business segment for the Bank.

b) Micro-finance lending comprised 81.98% of the gross loan portfolio of the Bank as on March 31, 2021. Under micro-finance lending, the Bank focuses on financial inclusion of the underprivileged and economically weaker sections of the society, who get very limited or no access to financial services. The Bank provides JLG loans, individual loans, swacchata loan and two-wheeler loans under micro Loan Composition mix as on March 31, 2021

c) Bihar and Uttar Pradesh has been core geography for the Bank’s micro-finance portfolio. Micro-finance loans continues to be substantially diversified with an average ticket size of 27K (based on outstanding loan portfolio), with tenors ranging between 12 to 24 months.

d) As on March 31, 2021, the Bank had more than 25 lakh active loan accounts under micro-finance lending spread across 141 districts and 11 states, serving through 420 micro banking outlets.

NPA Situation of Utkarsh Small Finance Bank

NPA Situation of Utkarsh Small Finance Bank

a) As on 31.03.2021, the GNPA stands at 315 Crores and Net NPA stand at 108 Crores.

b) As on 31.03.2020, the GNPA was at 44 Crores and Net NPA was at 11 Crores.

So, massive jump has seen in the NPA levels due to Covid-19. And, due to high provisioning of NPA, the PAT has suffered for the bank.

Valuation and Expected price band of Utkarsh Small Finance Bank

Book Value as on 31.03.2021 = 16

If we see the current P/B of Ujjivan Small Finance which is also doing major loans in micro-finance, it is available at 1.1x. However, the G.NPA levels of Ujjivan Small Finance as on 31.03.2021 stands at 7% which is way above Utkarsh Small Finance which is having 3% G.NPA.

So, if we give the P/B of 2x to Utkarsh Small Finance Bank, then Expected Price band of Utkarsh Small Finance Bank would be 32-35 per share.

Valuation = ~2700-2800 Crores.

NPA Situation of Utkarsh Small Finance Bank

a) As on 31.03.2021, the GNPA stands at 315 Crores and Net NPA stand at 108 Crores.

b) As on 31.03.2020, the GNPA was at 44 Crores and Net NPA was at 11 Crores.

So, massive jump has seen in the NPA levels due to Covid-19. And, due to high provisioning of NPA, the PAT has suffered for the bank.

Valuation and Expected price band of Utkarsh Small Finance Bank

Book Value as on 31.03.2021 = 16

If we see the current P/B of Ujjivan Small Finance which is also doing major loans in micro-finance, it is available at 1.1x. However, the G.NPA levels of Ujjivan Small Finance as on 31.03.2021 stands at 7% which is way above Utkarsh Small Finance which is having 3% G.NPA.

So, if we give the P/B of 2x to Utkarsh Small Finance Bank, then Expected Price band of Utkarsh Small Finance Bank would be 32-35 per share.

Valuation = ~2700-2800 Crores.

NPA Situation of Utkarsh Small Finance Bank

a) As on 31.03.2021, the GNPA stands at 315 Crores and Net NPA stand at 108 Crores.

b) As on 31.03.2020, the GNPA was at 44 Crores and Net NPA was at 11 Crores.

So, massive jump has seen in the NPA levels due to Covid-19. And, due to high provisioning of NPA, the PAT has suffered for the bank.

Valuation and Expected price band of Utkarsh Small Finance Bank

Book Value as on 31.03.2021 = 16

If we see the current P/B of Ujjivan Small Finance which is also doing major loans in micro-finance, it is available at 1.1x. However, the G.NPA levels of Ujjivan Small Finance as on 31.03.2021 stands at 7% which is way above Utkarsh Small Finance which is having 3% G.NPA.

So, if we give the P/B of 2x to Utkarsh Small Finance Bank, then Expected Price band of Utkarsh Small Finance Bank would be 32-35 per share.

Valuation = ~2700-2800 Crores.