Company Overview

Studds Accessories Limited, founded in 1972, started its journey by manufacturing helmets in a small garage. Over the decades, it has grown into the world’s largest two-wheeler helmet manufacturer, producing more than 7.5 million helmets and motorcycle luggage annually as of FY 2025.

The company holds the unique distinction of being the only Indian helmet manufacturer with a European Safety Agency-certified lab, underscoring its commitment to global safety standards.

A) Operations & Market Reach

-

Headquarters: Faridabad, India

-

Manufacturing Facilities: 4 state-of-the-art plants

-

Product Portfolio: 50+ products across 4 key verticals:

-

Helmets

-

Motorcycle Accessories

-

Face Shields & Masks

-

Bicycle Helmets

-

Domestic Market Share: 27.4% in India

-

Global Footprint: Exports to 70+ countries worldwide

With a legacy of over 52 years in safety gear manufacturing, Studds benefits from a robust dealer network and advanced R&D capabilities.

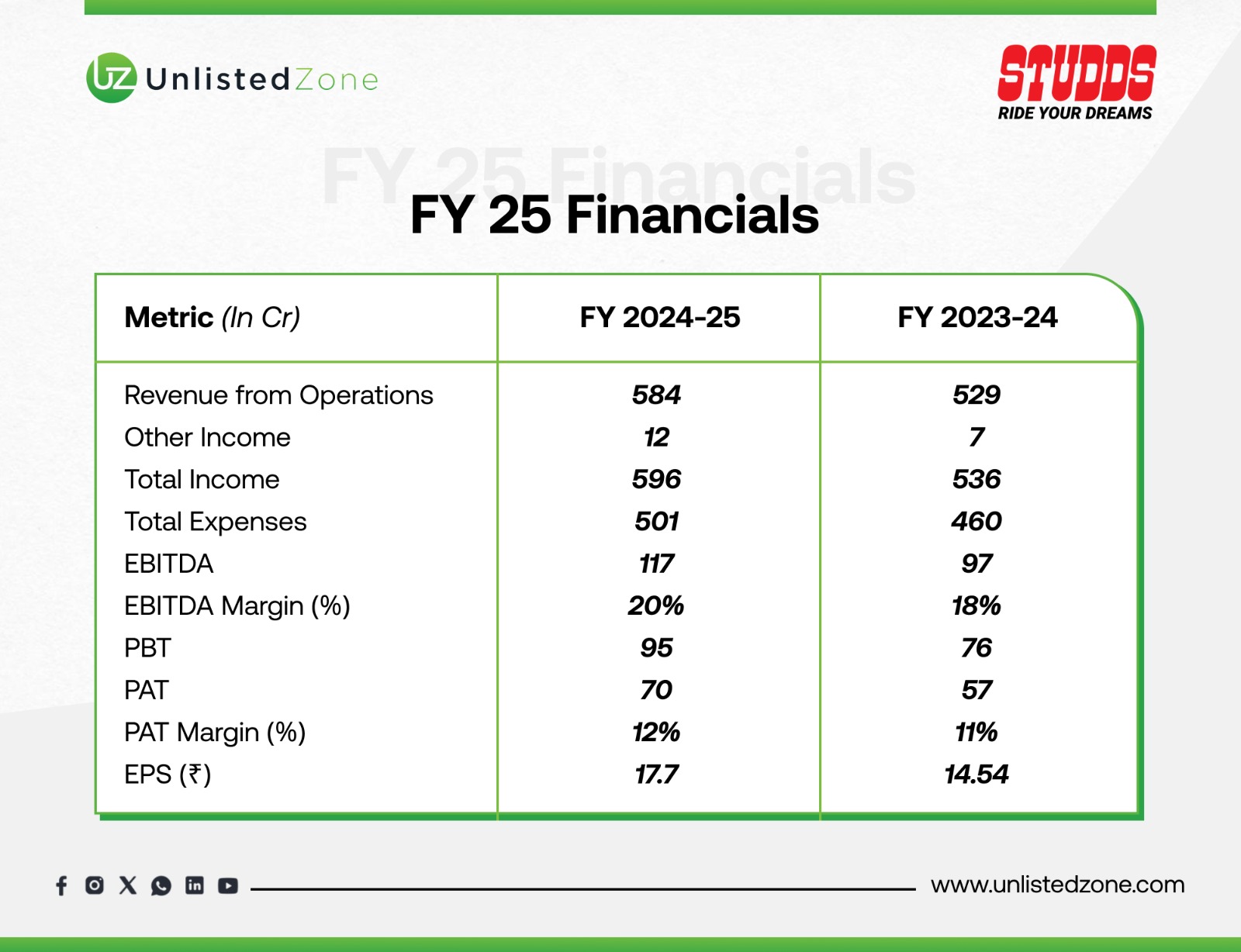

B) Financial Performance (₹ in Crores)

📈 Studds reported a 10% increase in revenue and a 23% rise in net profit (PAT) in FY25 compared to FY24. This growth reflects not only strong demand for helmets and accessories but also better cost management, which led to margin expansion (EBITDA margin improved from 18% to 20%). EPS also rose to ₹17.7 from ₹14.54, showing stronger value creation for shareholders.

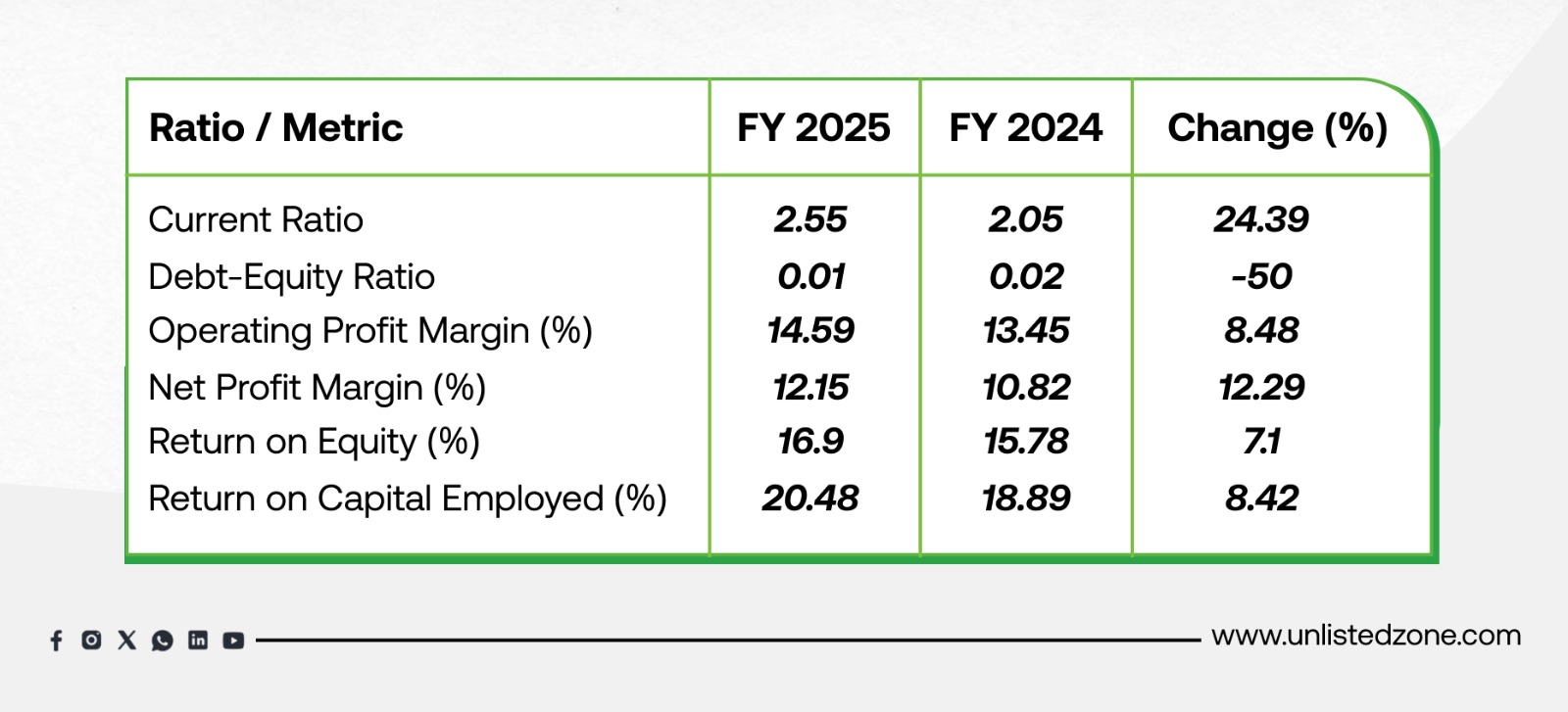

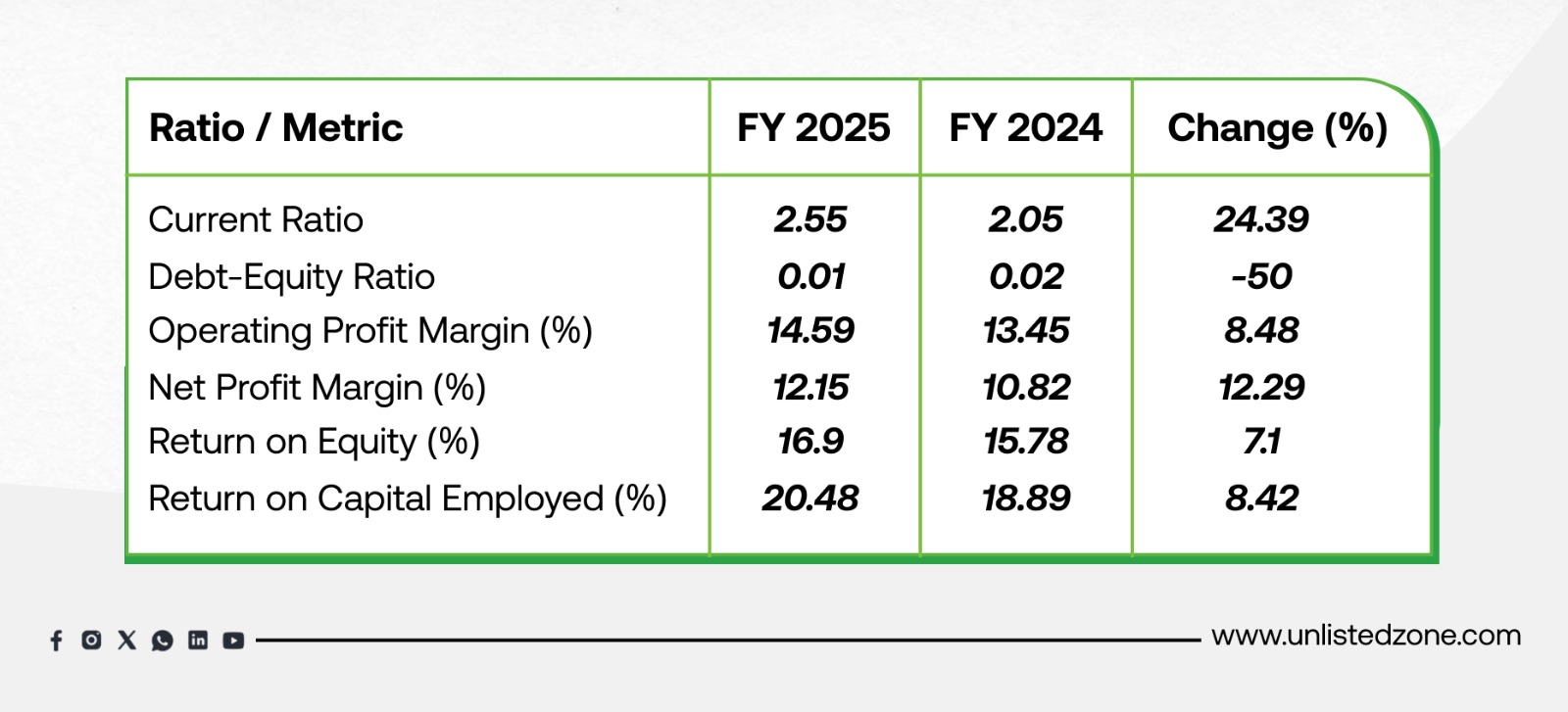

C) Ratio Analysis

The ratios indicate healthy liquidity (Current Ratio 2.55), negligible debt (D/E 0.01), and steady improvement in margins. Both ROE and ROCE strengthened, reflecting higher profitability and efficient capital usage. These trends highlight Studds’ strong financial resilience and ability to sustain growth with minimal leverage.

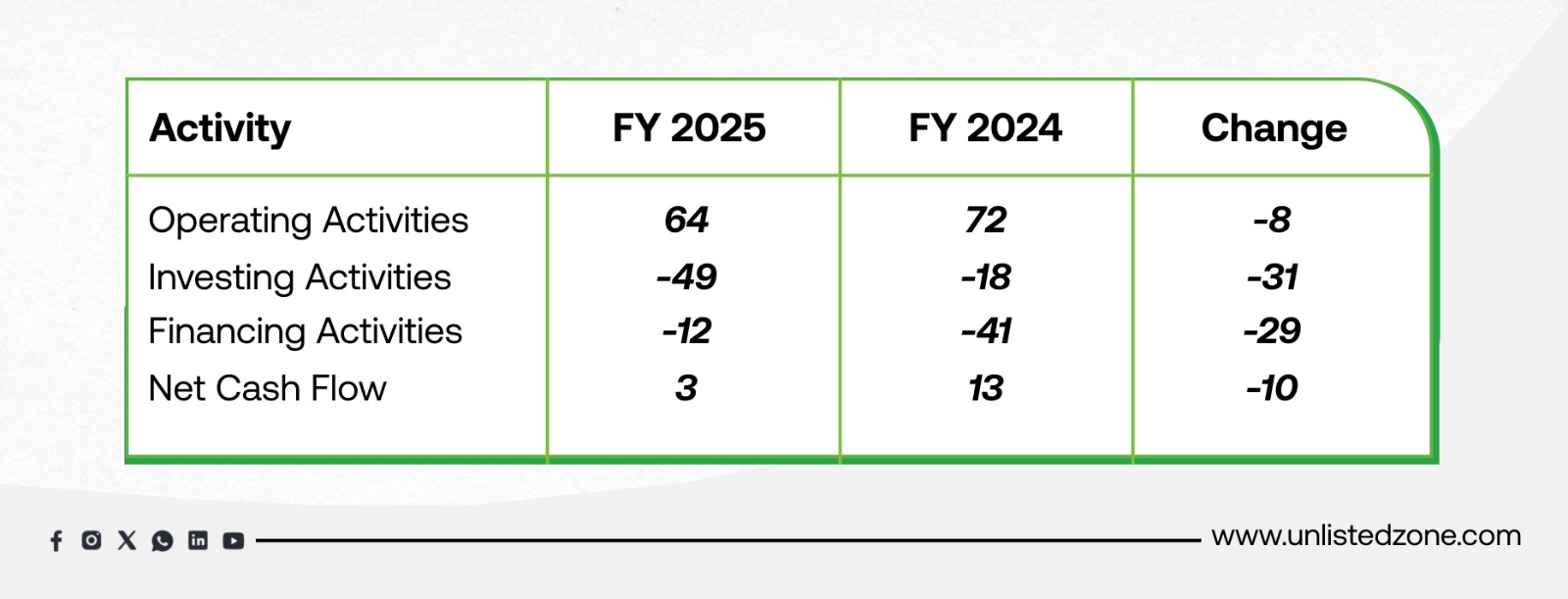

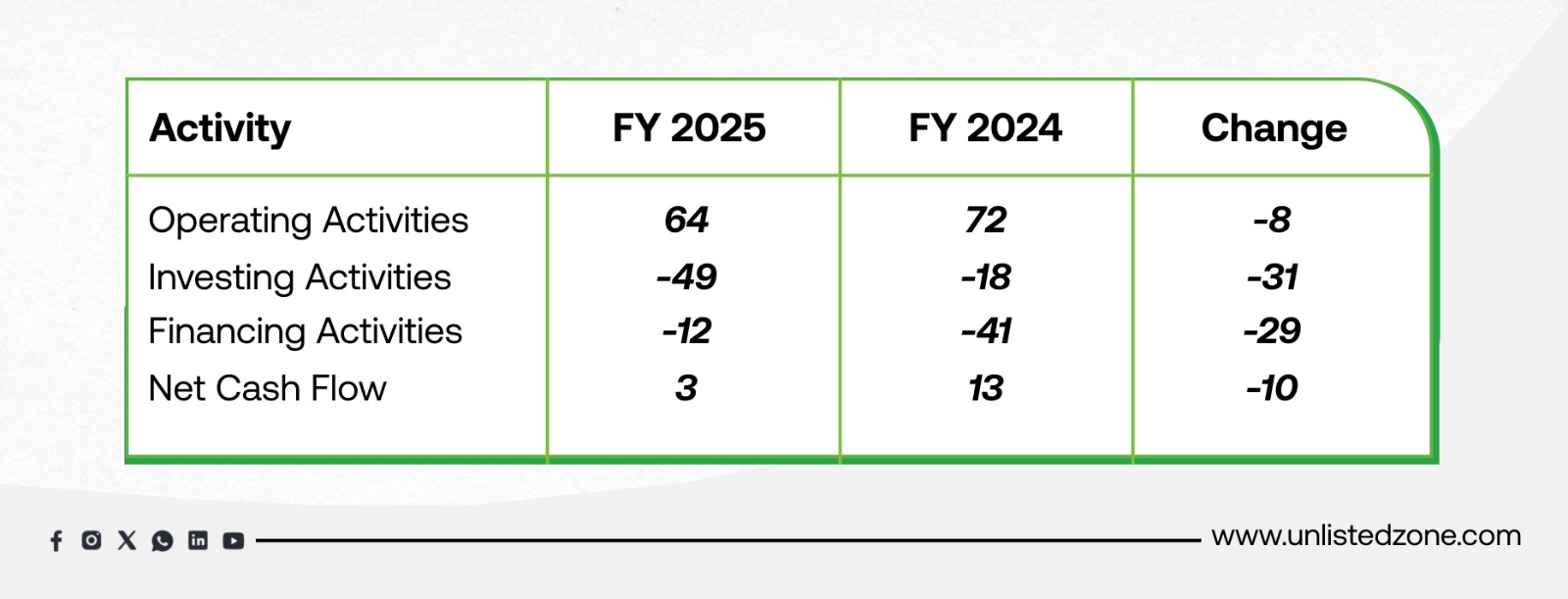

D) Cash Flow Analysis (₹ in Crores)

While operating cash flows fell slightly due to higher working capital requirements, the company increased its investment spending significantly (₹49 Cr vs ₹18 Cr), indicating capacity expansion and R&D initiatives. Financing outflows reduced, suggesting lower debt repayments compared to last year. Overall, Studds maintained a positive net cash flow.

E) Investment Outlook for Unlisted Investors

Studds Accessories Limited showcases a strong growth trajectory, backed by:

-

Leadership position in the helmet industry (domestic & global)

-

Rising exports contributing to diversification

-

Expanding margins and efficient capital structure

-

Strong dealer network and brand recognition

With improved profitability, low leverage, and consistent demand for two-wheeler safety gear, Studds unlisted shares present an attractive investment opportunity for long-term investors.

Stay updated with UnlistedZone for more insights on Studds Accessories Limited and other unlisted market opportunities.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.