In the fast-paced world of Indian logistics, few names command as much respect as Skyways Air Services Limited (SASL). From its humble beginnings as a Custom House Agent in 1984, Skyways has taken flight to become a multimodal logistics powerhouse. Now, with its highly anticipated Initial Public Offering (IPO), the company is poised to redefine its journey and offer investors a chance to be part of its next growth chapter.

A) From Custom House Agent to Cargo King: The Skyways Evolution

Headquartered in New Delhi, Skyways’ story is one of strategic evolution. Over four decades, the company has meticulously built an integrated, tech-enabled logistics ecosystem. Under its umbrella, a family of homegrown brands has flourished:

-

Skyways Air Services (1983) – The flagship and the foundation of its market dominance.

-

Forin Container Line (2004) – Expanding its reach into ocean freight.

-

Phantom Road Express (2018) – Strengthening its domestic trucking network.

-

sKart Global Express (2019) – Entering the competitive express delivery space.

-

SLS Logistik Academy (2019) – Investing in the future by building logistics talent.

This diversification allows Skyways to be a one-stop logistics partner for over 7,600 clients across FMCG, pharma, automotive, and textiles.

B) Unmatched Leadership in the Skies

Skyways isn’t just a participant in the air freight market; it leads it.

The data confirms this dominance: in FY24, the company handled over 40,000 MT of cargo. By FY25, volumes rose further, cementing its leadership over global giants like DHL and DB Schenker in the Indian market.

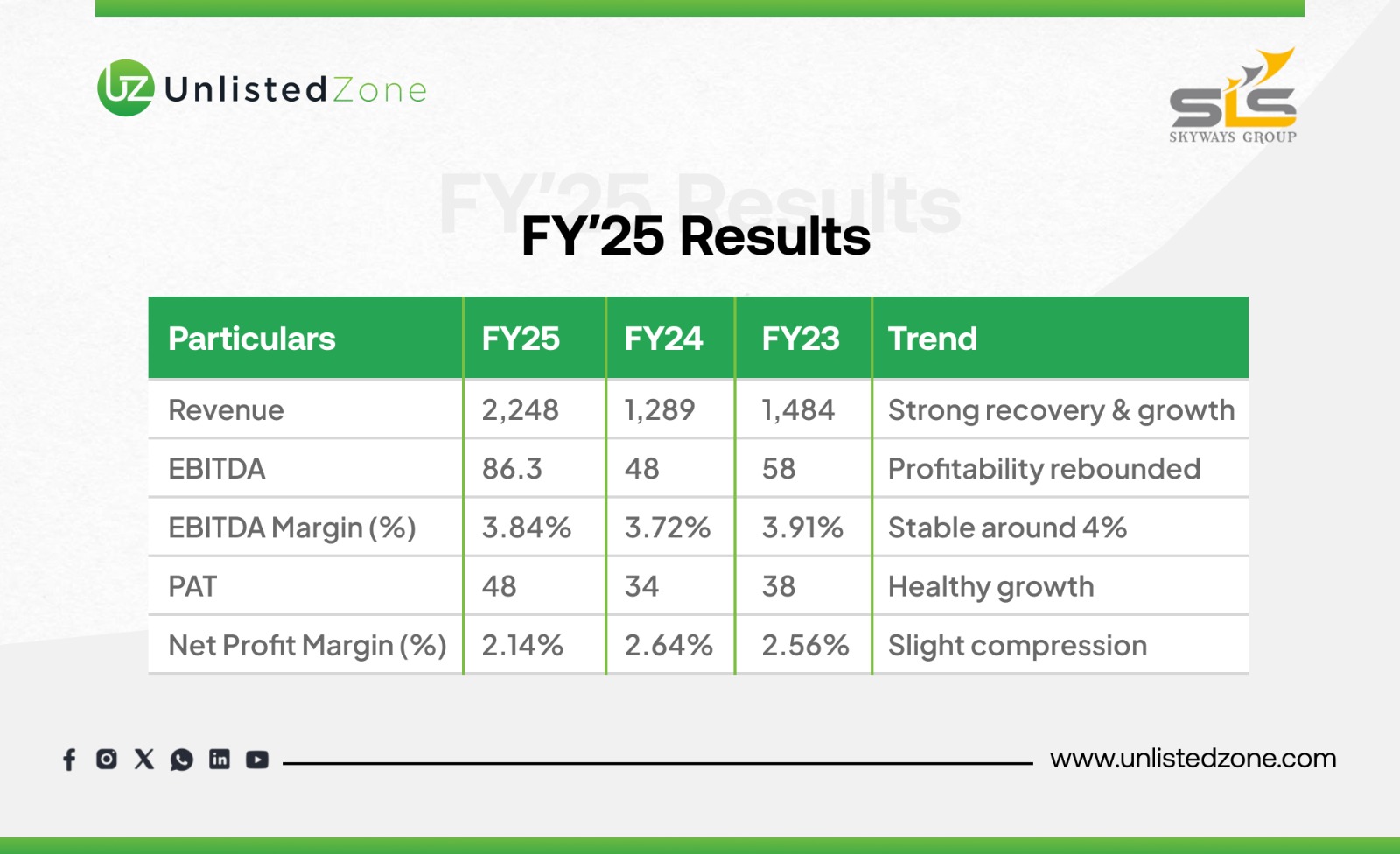

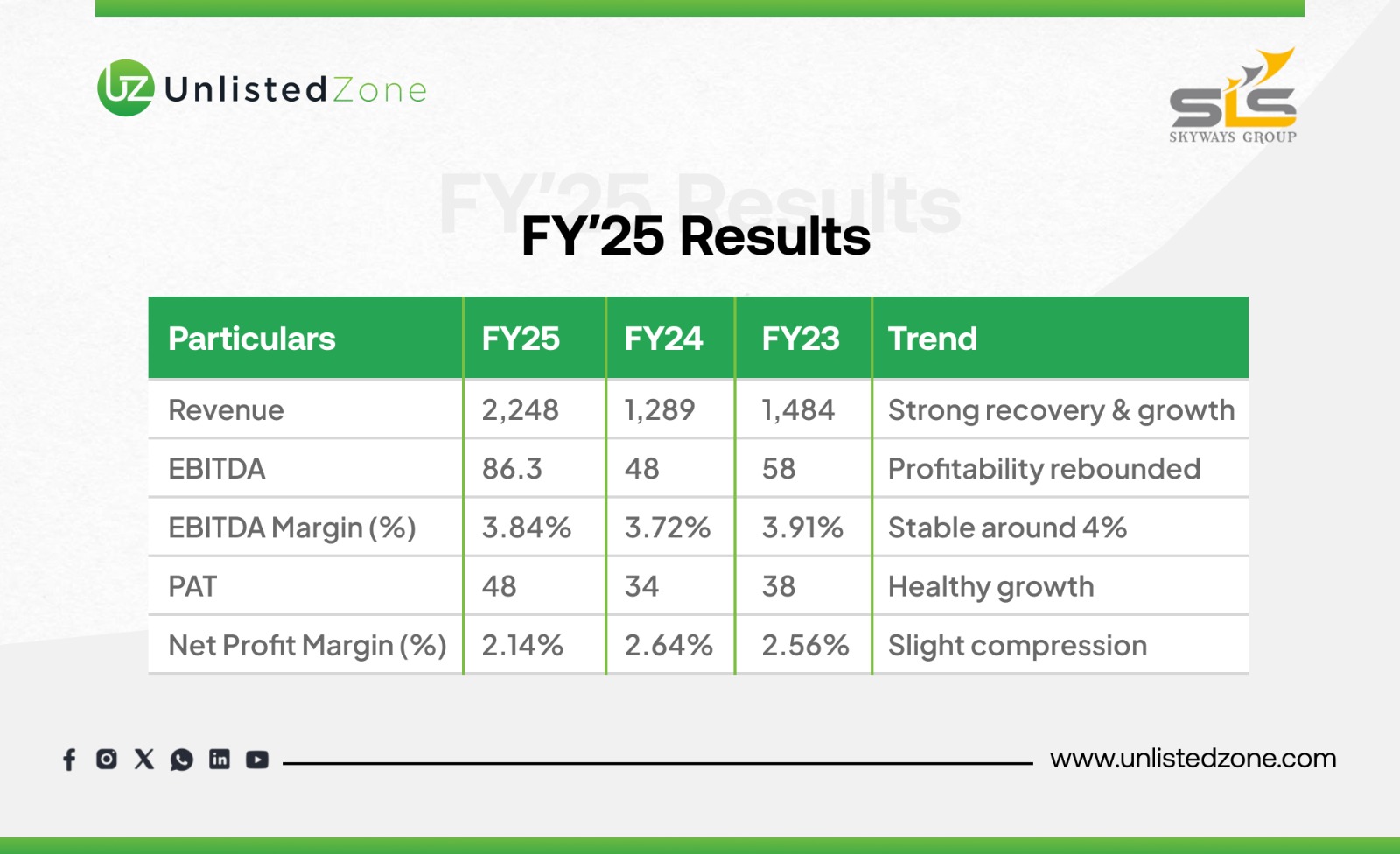

C) Financial Performance: Growth at Full Throttle (₹ Crore) of Skyways Air Services Unlisted Shares

Profit & Loss Statement

The strong revenue recovery in FY25 (₹2,248 Cr) indicates successful business expansion and market capture. However, the slight compression in Net Profit Margin (NPM) from 2.64% to 2.14% suggests that costs (likely interest on debt and operational expenses) grew faster than revenue this year, a common occurrence in high-growth phases. The rebound in EBITDA and PAT absolutes confirms that the core business remains fundamentally profitable.

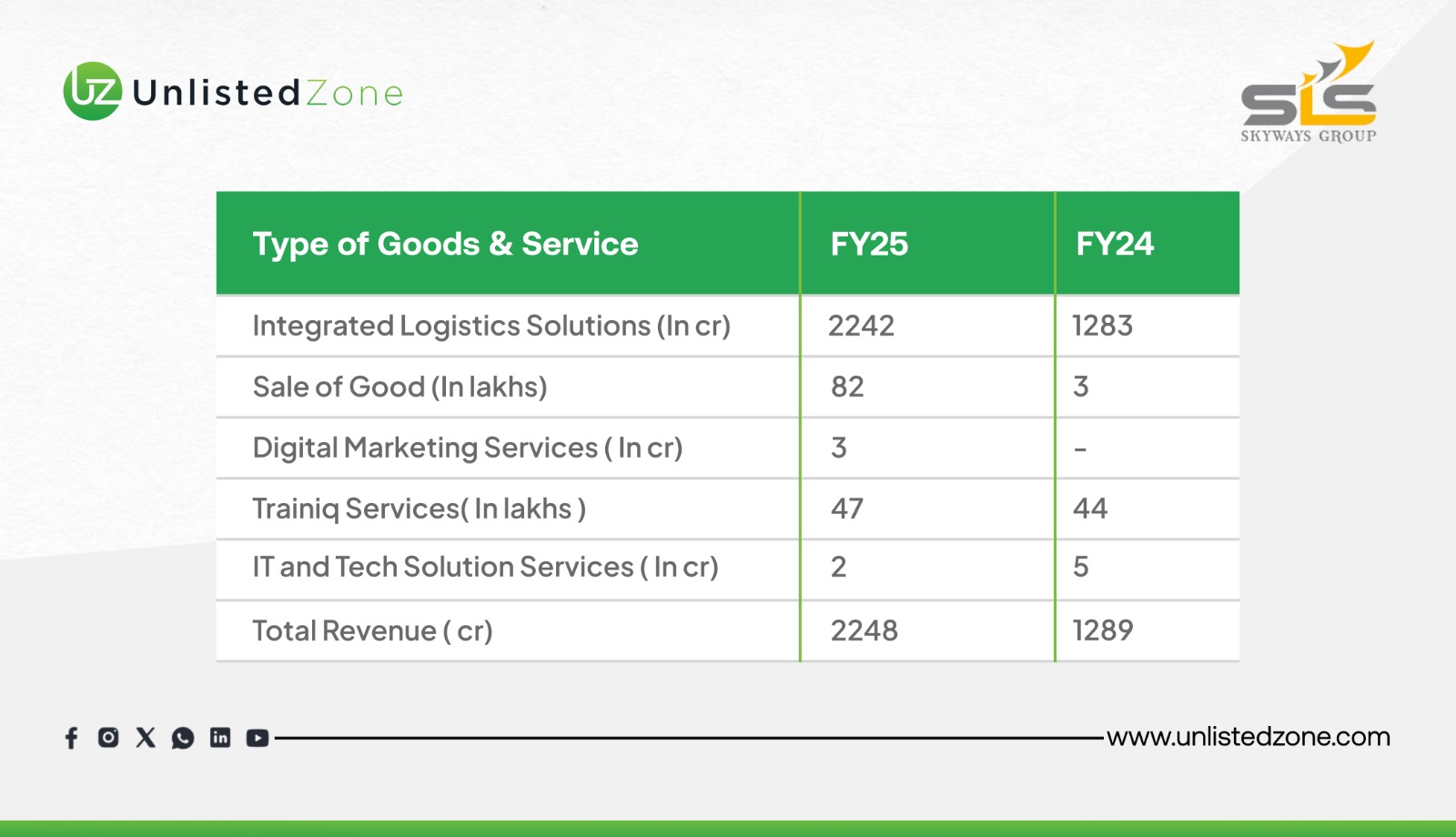

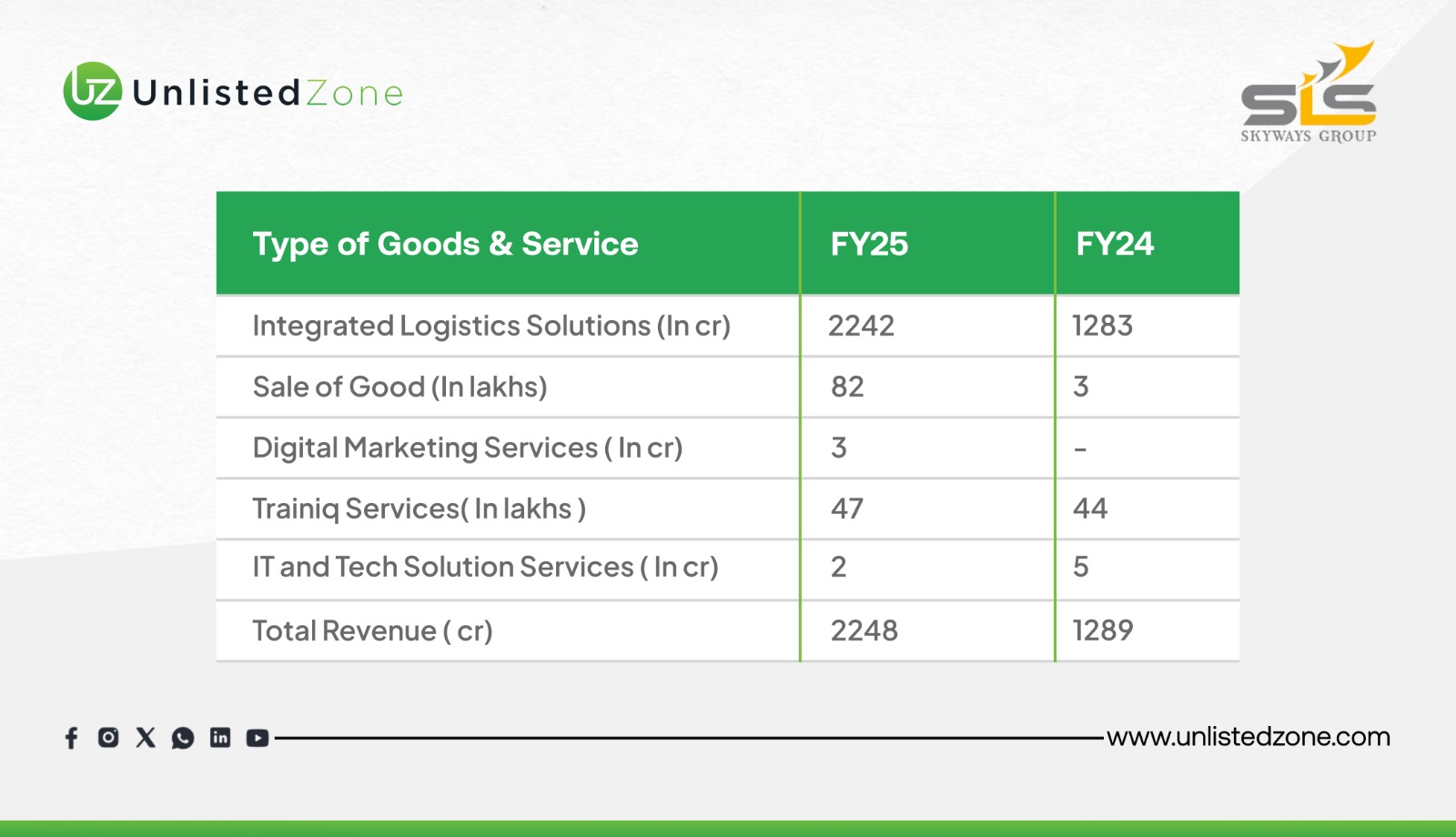

Revenue Mix

Geographical Revenue Mix ( In Cr )

-

By Service: This breakdown highlights the company's core focus, with Integrated Logistics Solutions constituting over 99% of total revenue. The minimal revenue from other segments like IT and Tech Solutions shows they are likely ancillary services supporting the main logistics business rather than standalone revenue drivers.

-

By Geography: The data reveals a significant strategic insight: international revenue more than doubled in FY25 (from ₹259 Cr to ₹559 Cr). This explosive growth outside India is a major contributor to the overall topline increase and points to successful global expansion and a reduced reliance on the domestic market.

Balance Sheet & Leverage ( In cr )

This snapshot of the company's financial health reveals an aggressive growth strategy. The near-tripling of assets in three years signals massive investment in capacity (like warehouses, vehicles, tech). This expansion has been primarily funded by debt, as seen in the sharp rise in borrowings to ₹558 Cr. The jump in Trade Receivables indicates that sales are being made on credit, which fuels growth but temporarily traps cash, leading to the working capital strain evident in the cash flow statement.

Cash Flow Analysis

The Cash Flow statement tells the story of the company's growth strategy. Negative CFO in FY24 and a minimal positive in FY25 is a classic sign of a capital-intensive business growing rapidly, as cash is spent on operations faster than it is collected. The consistently negative CFI confirms continuous investment in long-term assets. To bridge this gap, the company relies heavily on external financing (positive CFF), through both debt and equity (including the upcoming IPO).

D) Market Leadership & Client Summary of Skyways Air Services Unlisted Shares

Market Dominance:

-

Award: Recognized as India's No. 1 Air Freight Forwarder for 8 consecutive years (2017-2024).

-

Scale: Handled 52,800 Air Waybills and 40,371 MT of cargo in FY25.

-

Leadership: The nearest competitor managed only 76% of Skyways' shipment volume.

Diverse Client Base (7,600+ Clients):

Skyways serves a vast portfolio of leading companies across key industries, including:

-

FMCG: ITC, Dabur, Patanjali

-

Pharmaceuticals: Cipla, Dr. Reddy's, Glenmark

-

Automotive: Tata Motors, Honda, Mahindra, TVS

-

Engineering: Larsen & Toubro, Honeywell, Samsung

-

Textile: Louis Vuitton, Arvind, Sainsbury's

Competitive Landscape:

Skyways leads the market in the number of shipments (AWBs), significantly outperforming all major global and domestic competitors like DHL, DB Schenker, and DSV.

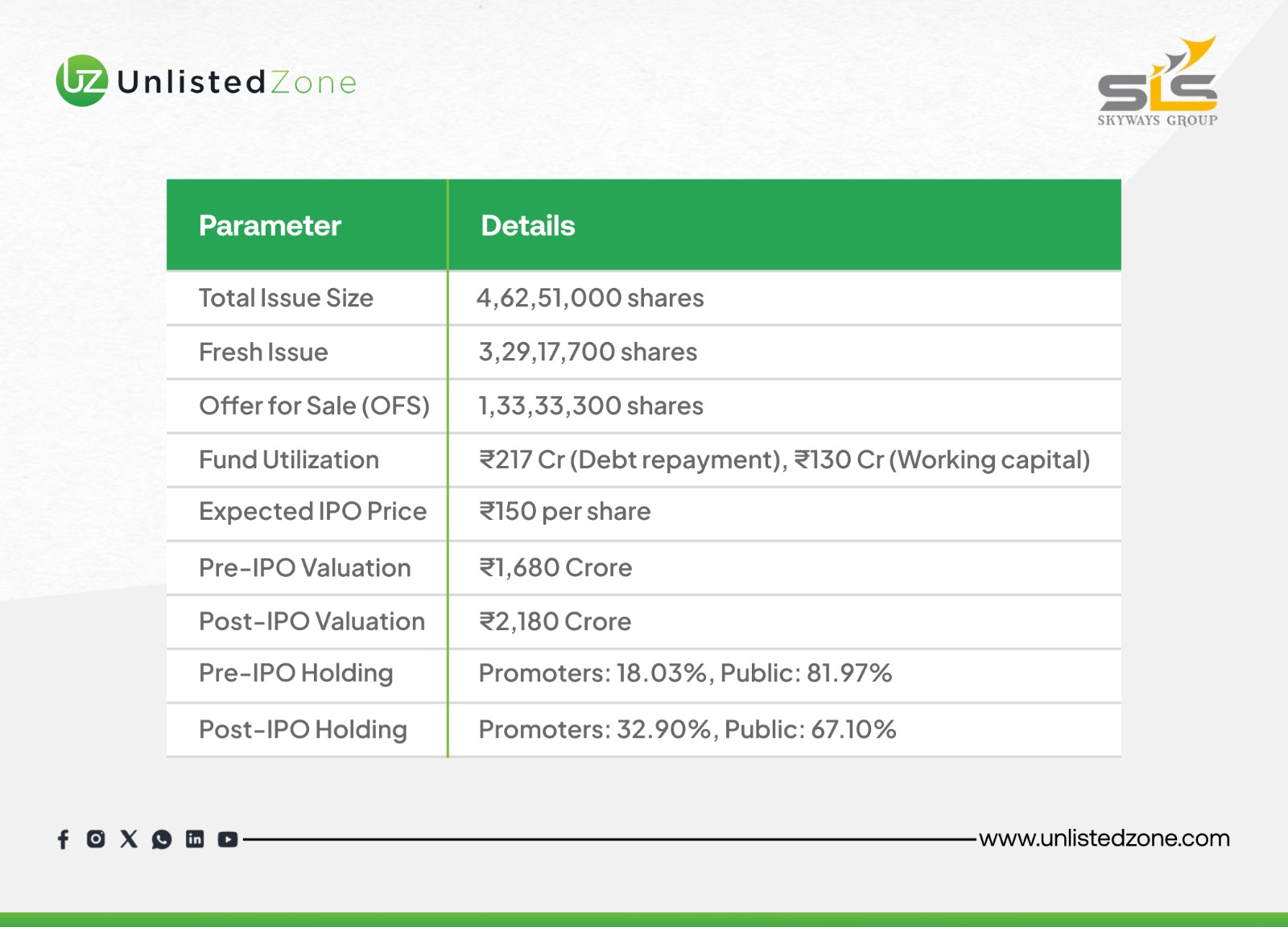

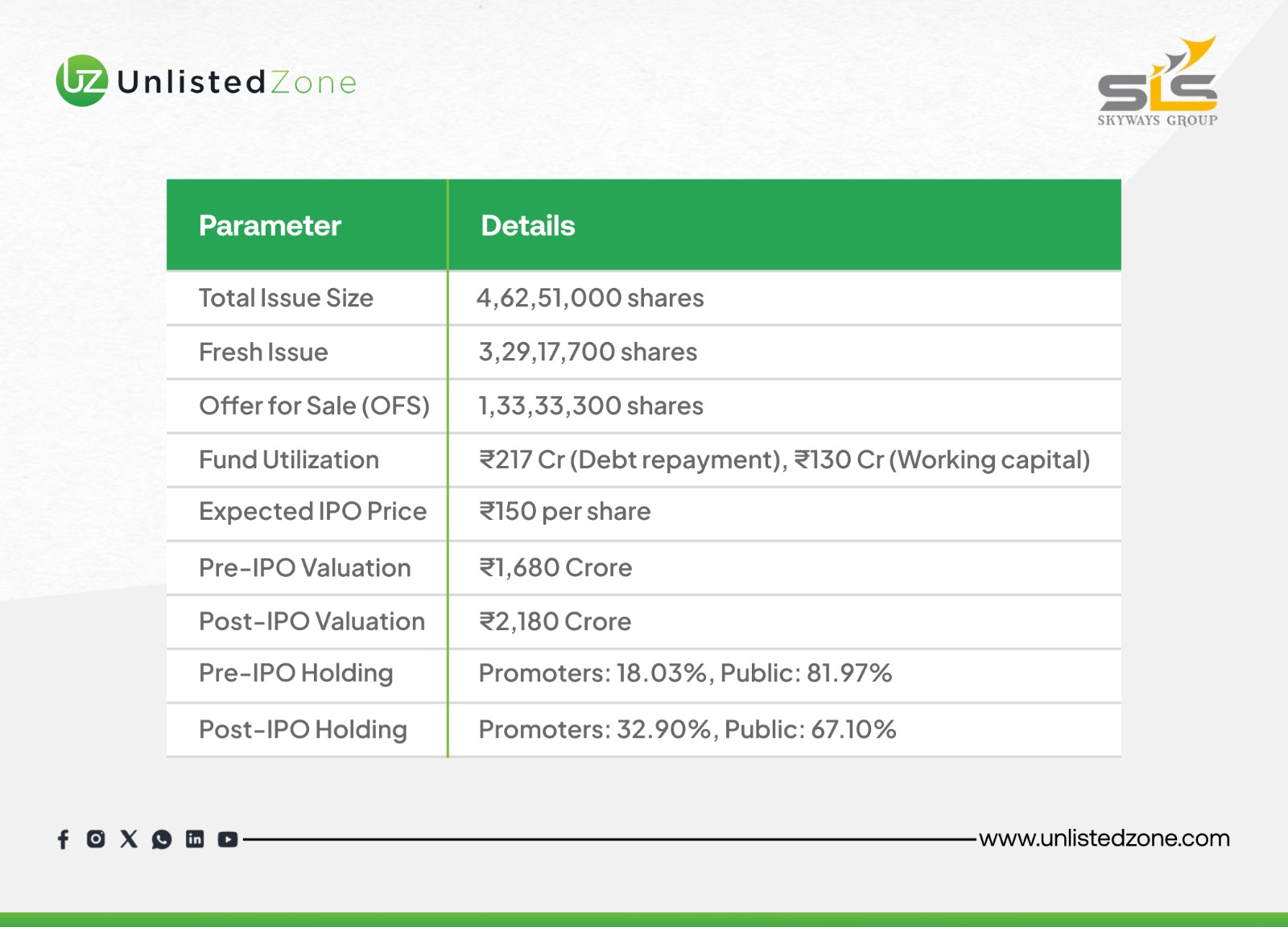

E) IPO Details at a Glance of Skyways Air Services Unlisted Shares

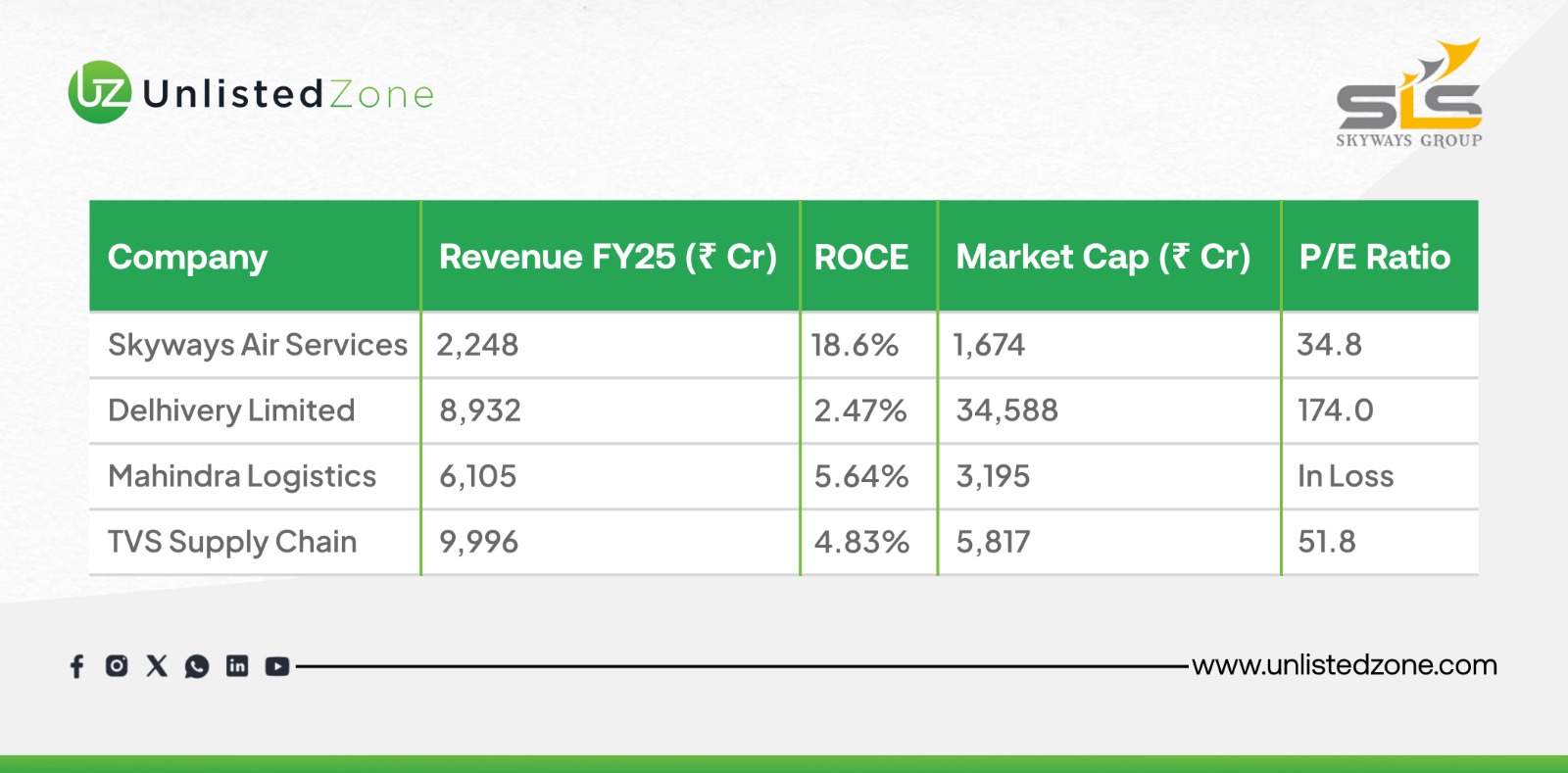

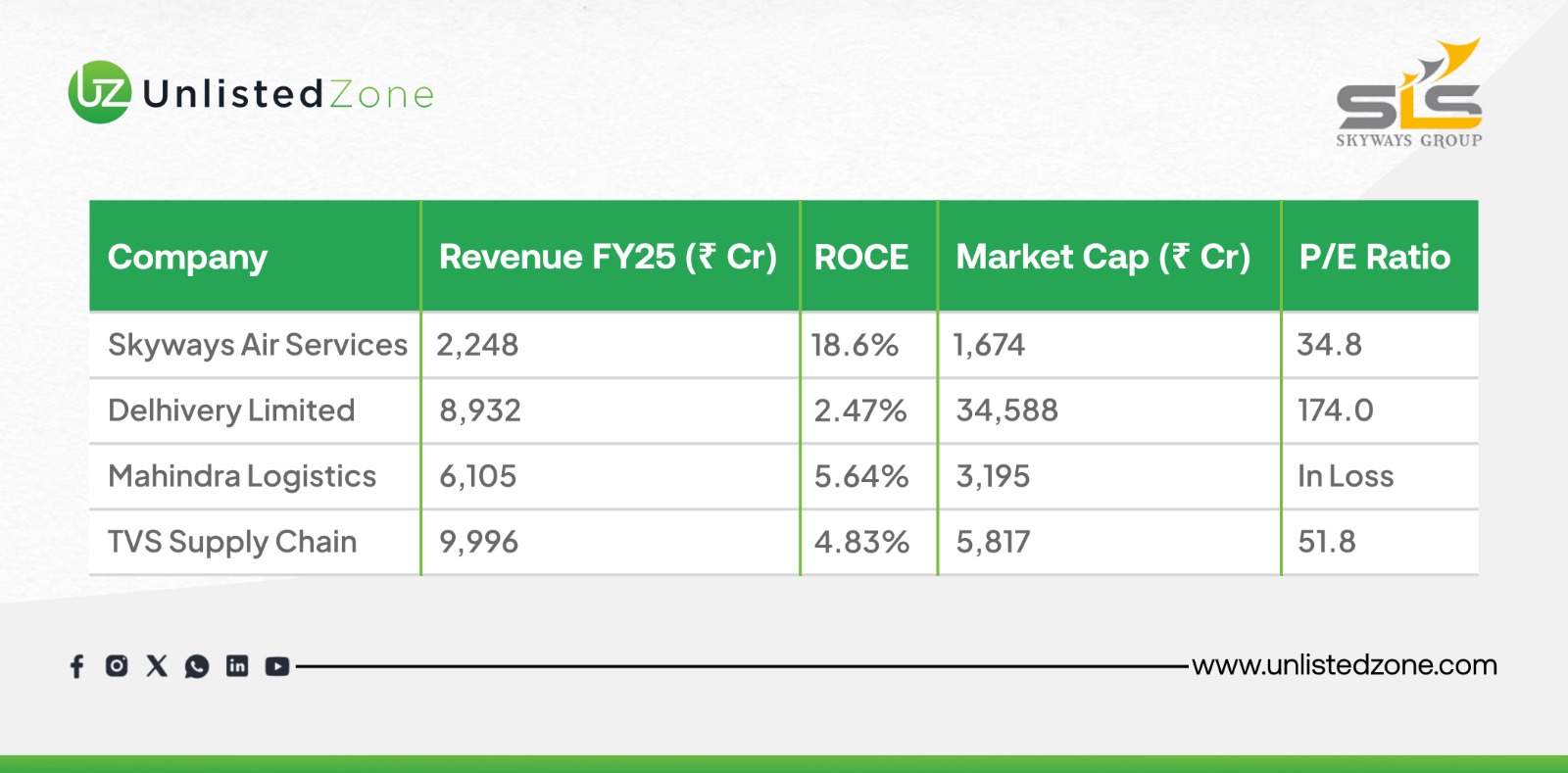

F) Peer Comparison (as of Sept 2025) of Skyways Air Services Unlisted Shares

G) Unlisted Market Overview of Skyways Air Services Unlisted Shares

Current Unlisted Price : ₹142

Unlisted Market Cap : ₹ 1674 Cr

P/B Ratio: 4.16

D/E Ratio : 1.42

ROE : 12.23

This contextualizes Skyways' valuation and operational efficiency within the industry. The standout metric is Skyways' ROCE of 18.6%, which dwarfs its listed peers. This indicates that the company generates a much higher return on every rupee of capital invested, making it a more efficient operator. Furthermore, its P/E ratio of 34.8x is significantly more reasonable compared to Delhivery's 174x, suggesting that while the market values its growth, it is not as hyper-inflated as some competitors.

H) Strengths vs Risks in Skyways Air Services Unlisted Shares

Strengths:

-

Undisputed market leadership in air freight.

-

Diversified multimodal logistics model.

-

Superior profitability with ROCE of 18.6%.

-

Award-winning brand trusted by clients.

Risks:

-

High leverage of ₹558 Cr, though IPO funds will reduce this.

-

Working capital intensity with rising receivables.

-

Margin pressure despite revenue growth.

-

Execution risks due to rapid expansion.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.