Current Philips India Unlisted Share Price

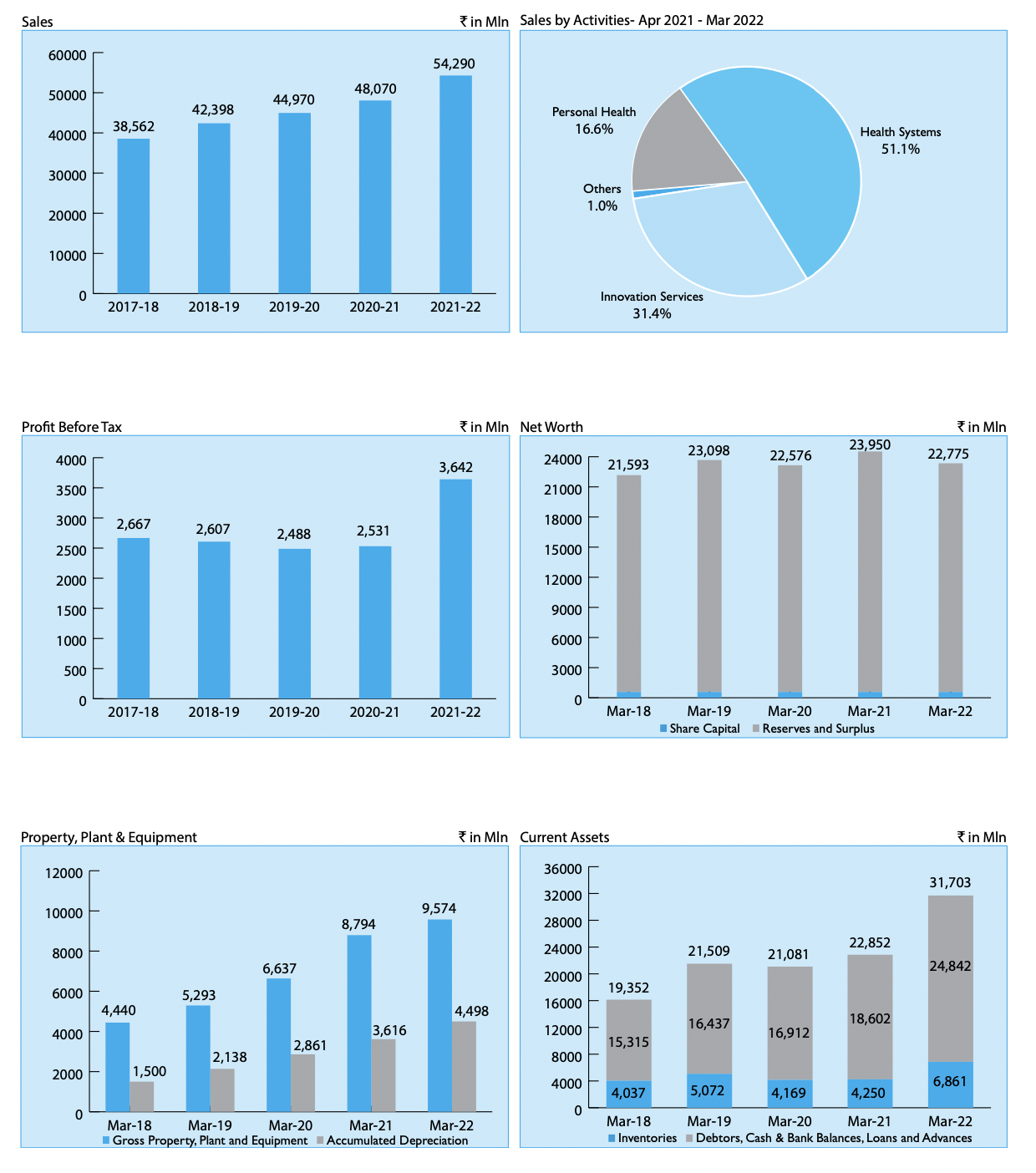

Currently, Philips India Unlisted Share Price is ₹1200 and P/E based on EPS of 46 is 26x, which is fairly valued.

Note: Check the Latest Philips India Unlisted Share Price at UnlisteZone Android or iOS Mobile App.

Business Analysis For Philips India Unlisted Shares in FY18-19:

(i) During the year 2018-19, the Health Systems business suffered a revenue de-growth of 3.4% year-on-year, primarily due to the credit squeeze in the financial market attributable to the crisis in the non-banking financial companies (NBFC) sector. The overall Health Systems market de-grew by 3.6% in the fourth quarter of 2018 Moving Annual Turnover (MAT) level, led by the de-growth in Precision diagnostics and Image-Guided Therapy (IGT) equipment by 3.5% and 21.7%, respectively.

(ii) The Personal Health business registered sales growth of 14.6%, over the previous financial year. The growth was driven in all the categories especially with strong growth in Personal Care, Home Care, erstwhile Air, and Floor Care and Beauty Products. The growth of Air Purifiers was driven by public awareness around air quality, especially in the northern part of the country.

(iii) In FY 2018-19, Preethi, a subsidiary, registered significant progress and delivered a 19.5% sales growth over last year with improved profitability. During the year, the focus of the Preethi business was on the cooking appliances segment. Gas Stove category has achieved a sizable share in FY 2018-19 and contributed 13% of the revenue.

(iv) During the year, Philips Home Care, a subsidiary, the business segment didn’t expand to the expected levels due to various challenges in the marketplace.

(v) For brand improving, the Company has enhanced presence across various social media platforms to target youth of the Country. Further, the Company has also engaged famous cricketers, Mr. Virat Kohli and Mr. Rahul Dravid in order to attract the young consumers of the country.

Business Analysis of FY19-20 a) During the year 2019-20, the Health Systems business of the Company delivered another year of strong performance was driven by growth in Image-Guided Therapy (IGT 19.6%) and Patient Care & Monitoring solutions (10%) despite macroeconomic challenges including credit squeeze in the financial market attributable to the crisis in the non-banking financial companies (NBFC) sector.

b) In Image Guided Therapy (IGT), Philips Market share improved by 5%. The market is still reeling under the stent price capping which is causing the value and performance segments to grow. In Magnetic Resonance (MR), Philips Market share declined by 8% whereas in Computed Tomography (CT), and the company witnessed a dip of 3% in market share. Ultrasound business of the Company improved market share from 17.3% to 18%.

c) Financial year 2019-20 has been a challenging year with unfavorable macro-economic conditions, slowing market growths and then Covid-19 outbreak followed by lockdown as containment measures. With these ongoing headwinds, Personal Health business of the Company was still able to deliver sales growth of 5.8%, over the previous financial year. There has been and increase in cost trends of the commodities and adverse currency fluctuations due to global factors.

Business Performance of Philips India Unlisted Share in FY21-22 1. Philips India Health Systems business comprises of MRI Scanners, CT Scanner , Ultrasound etc had another year of exceptional success, with overall revenue growth of more than 60 percent, driven by favourable market growth and client demands during the pandemic.

2.As a result of the pandemic's effect on healthcare requirements, the addressable market of Health System business has expanded by 40 percent in the high double digits.

3. Philips India has added the entire Respironics Range under Sleep and Respiratory Care (S&RC) to its portfolio.

4. Despite a turbulent and dynamic economic environment, the Personal Health business of Philips India has produced 16.3% increase over the prior fiscal year (excluding the impact of the home appliances business which was shifted in Philips Domestic and it was de-merged last year).

5. In personal health business, Philips India has aunched new range of products such as Beard Trimmer Power adapt, Sonicare electric toothbrushes and locally manufactured Value-segment Hair Dryer. 6. This year company has also given a dividend of Rs.3 per share.