A) About the Company

Ownership & Global Parent:

Philips India Limited is a subsidiary of Royal Philips of the Netherlands (Koninklijke Philips N.V., or KPNV). KPNV holds 96.13% of the shares, with the remaining 3.87% held by minority shareholders.

Business Overview:

Philips India operates in two major areas – Healthcare Systems and Personal Healthcare, with strong R&D capabilities through its innovation centers.

-

Healthcare Systems: Imports, assembles, and sells advanced medical equipment, including Diagnostic Imaging (MRI, CT, X-Ray), Ultrasound, Image-Guided Therapy solutions, and Patient Care Monitoring systems.

-

Personal Healthcare: Covers domestic appliances, personal care products, and health & wellness solutions.

-

Healthcare Innovation Center (Pune): Functions as an R&D hub and also assembles medical equipment locally.

-

Philips Innovation Campus (Bangalore): Established in 1996, it has evolved into a global software and innovation hub, working on AI, Cloud, IoT, and Data Analytics for Philips’ global imaging and healthcare products.

Industry Positioning:

Philips India is among the leading hi-tech healthcare and personal health solution providers in India, leveraging global expertise, strong R&D, and innovation hubs to cater to the growing healthcare market.

B) Key Highlights of the Year (FY25)

-

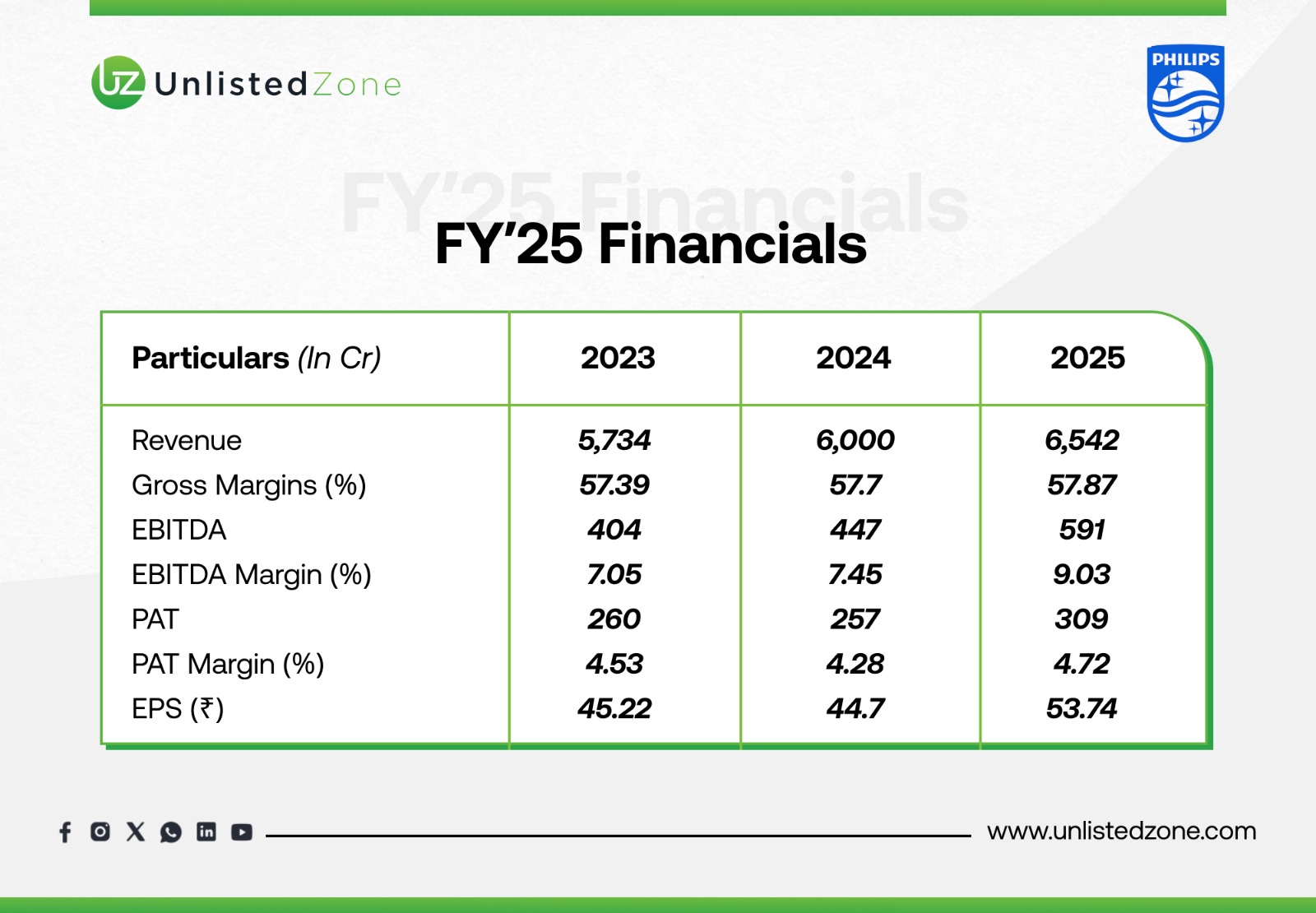

Revenue increased to ₹6,542 crore, showing steady growth from ₹5,481 crore in FY22.

-

EBITDA margins improved to 9.03% in FY25 from 6.09% in FY22.

-

PAT grew to ₹309 crore in FY25, though margins remained modest at 4.72%.

-

Sales mix: Health Systems (50.4%), Innovation Services (36%), Personal Health (12.5%), Others (1.1%).

-

Strong global R&D collaboration through the Pune and Bangalore innovation centers.

C) Financial Performance (Consolidated)

1. Profit & Loss Statement (₹ Crore)

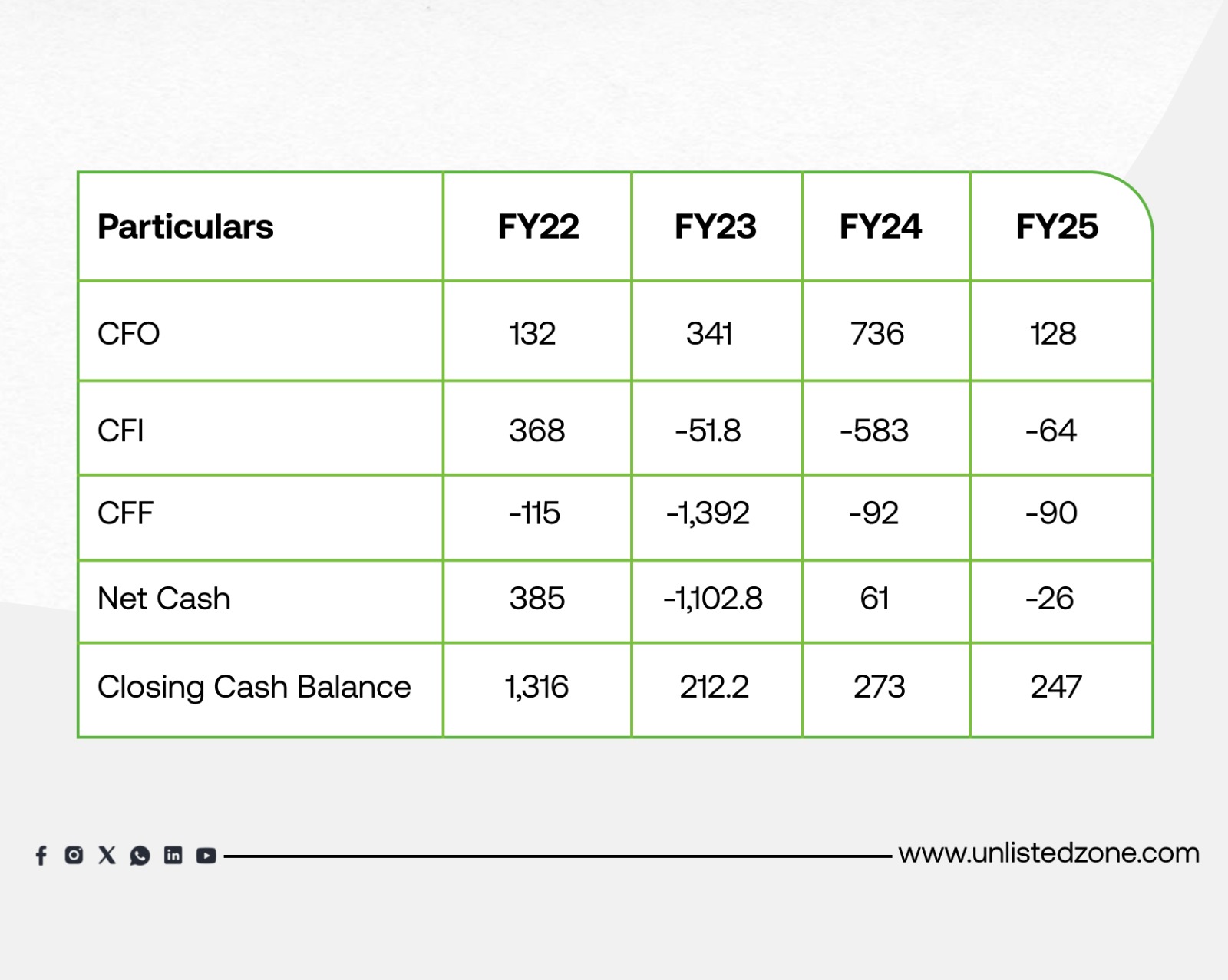

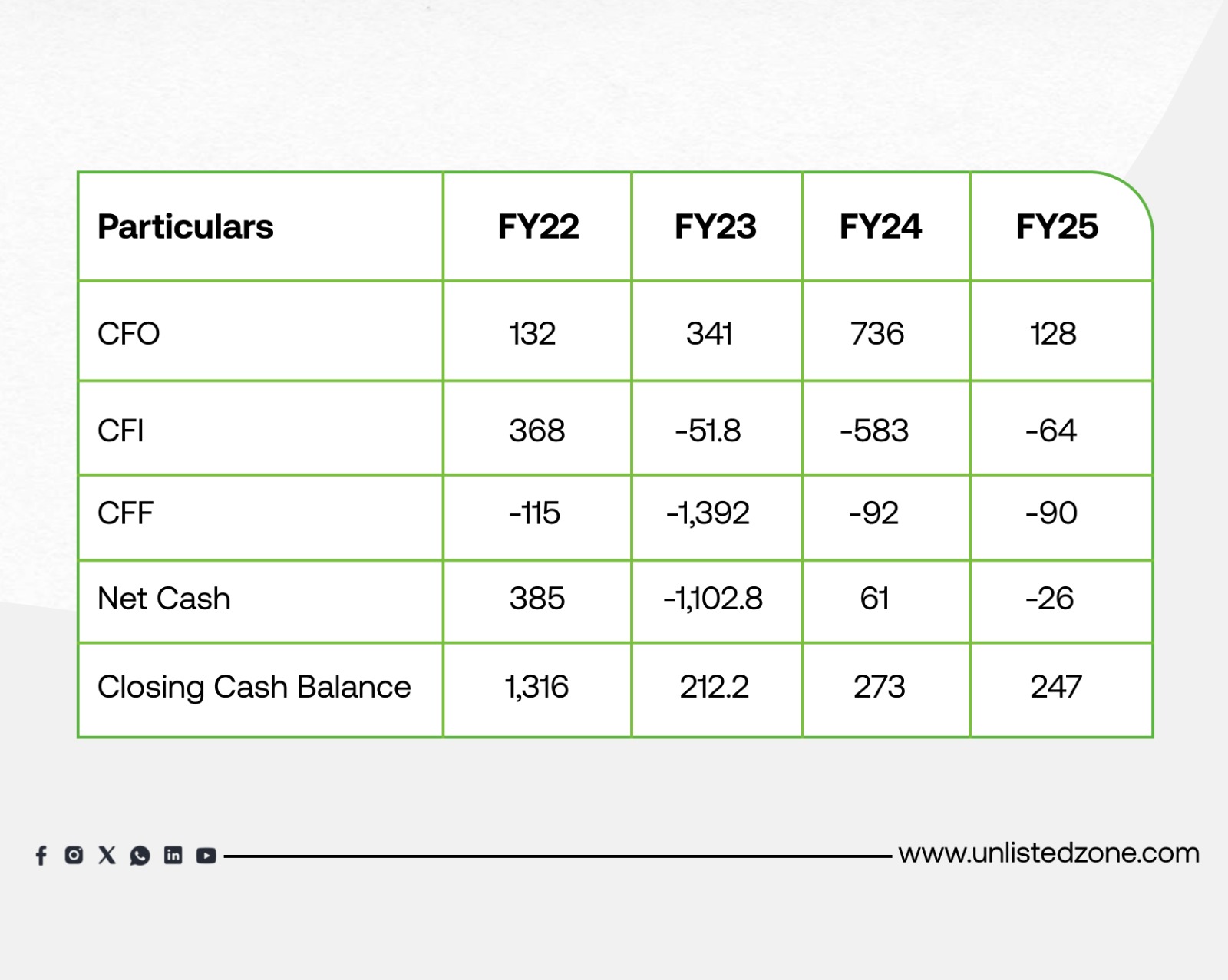

2. Cash Flow Highlights (₹ Crore)

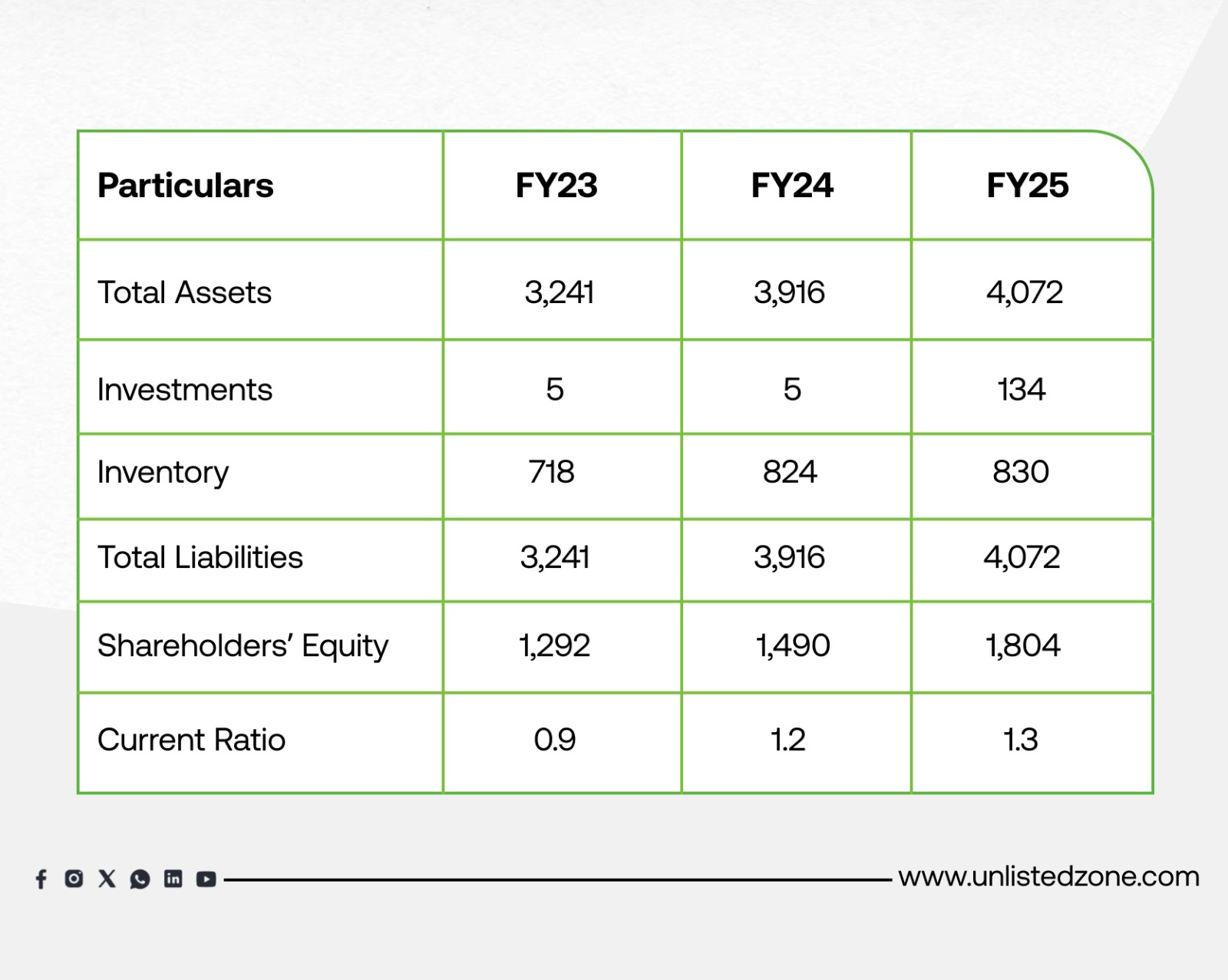

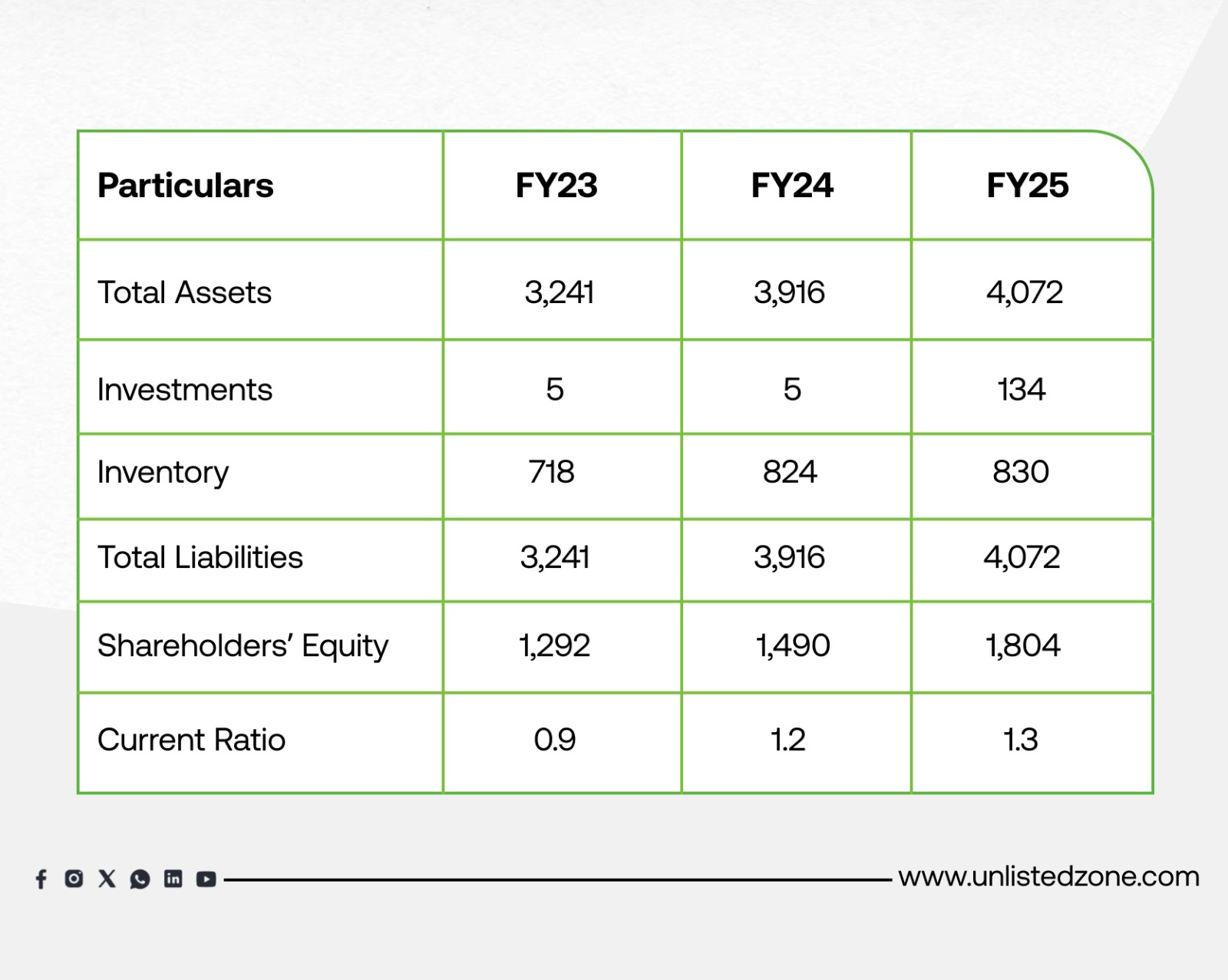

3. Balance Sheet Strength (₹ Crore)

Leverage Position:

D) Segment/Division-Wise Analysis

Sales by Segments (FY25):

-

Health Systems: 50.4%

-

Innovation Services: 36%

-

Personal Health: 12.5%

-

Others: 1.1%

Geographic/Operational Strength:

Strong R&D and assembly support from Pune and Bangalore centers ensures global-level innovation capabilities.

E) Management Discussion & Analysis (MD&A)

1. Market Outlook:

-

Rising demand for advanced healthcare equipment in India driven by government initiatives and private hospital expansions.

-

Growing awareness of personal healthcare and wellness products.

-

Innovation and AI adoption are key growth drivers.

2. Risks & Challenges:

-

Import dependency for high-end equipment.

-

Regulatory changes in medical devices and healthcare compliance.

-

Competitive pressure from global and local players.

3. Strategic Roadmap:

-

Strengthen local assembly and R&D to reduce import reliance.

-

Expand in AI, IoT, and Cloud-based healthcare solutions.

-

Capture higher market share in personal health and wellness products.

F) Valuation Insights (Unlisted Market)

G) Future Outlook

-

Strong demand in healthcare systems with India’s growing hospital infrastructure.

-

Increased focus on AI, Cloud, and Data Analytics in medical imaging and diagnostics.

-

Potential expansion in personal healthcare with rising health-conscious consumer base.

-

Philips’ innovation centers in India will continue to act as global R&D hubs.

UnlistedZone View

Philips India offers a unique investment opportunity with:

-

Working in high growth medical devices circuit category and availabe at just P/E of 20.

-

Strong global parentage (Royal Philips, Netherlands).

-

Debt-free balance sheet and healthy ROE (~17%).

-

Consistent revenue growth with improving margins.

-

High promoter holding (96.13%), ensuring stability but limiting liquidity.

Risks:

Investment Thesis:

Suited for long-term HNIs and investors seeking exposure to India’s growing healthcare technology and personal wellness sector. With its strong innovation pipeline and global support, Philips India is well-positioned to capture growth opportunities in both healthcare and consumer health segments.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.