SBI General Insurance delivered a resilient performance in the first half of FY26, maintaining its growth momentum in premium collections while improving underwriting profitability. Despite a dip in investment income due to volatile markets, the company showcased operational strength through improved claim ratios and a significantly higher operating profit.

1. Premium Growth Remains Strong

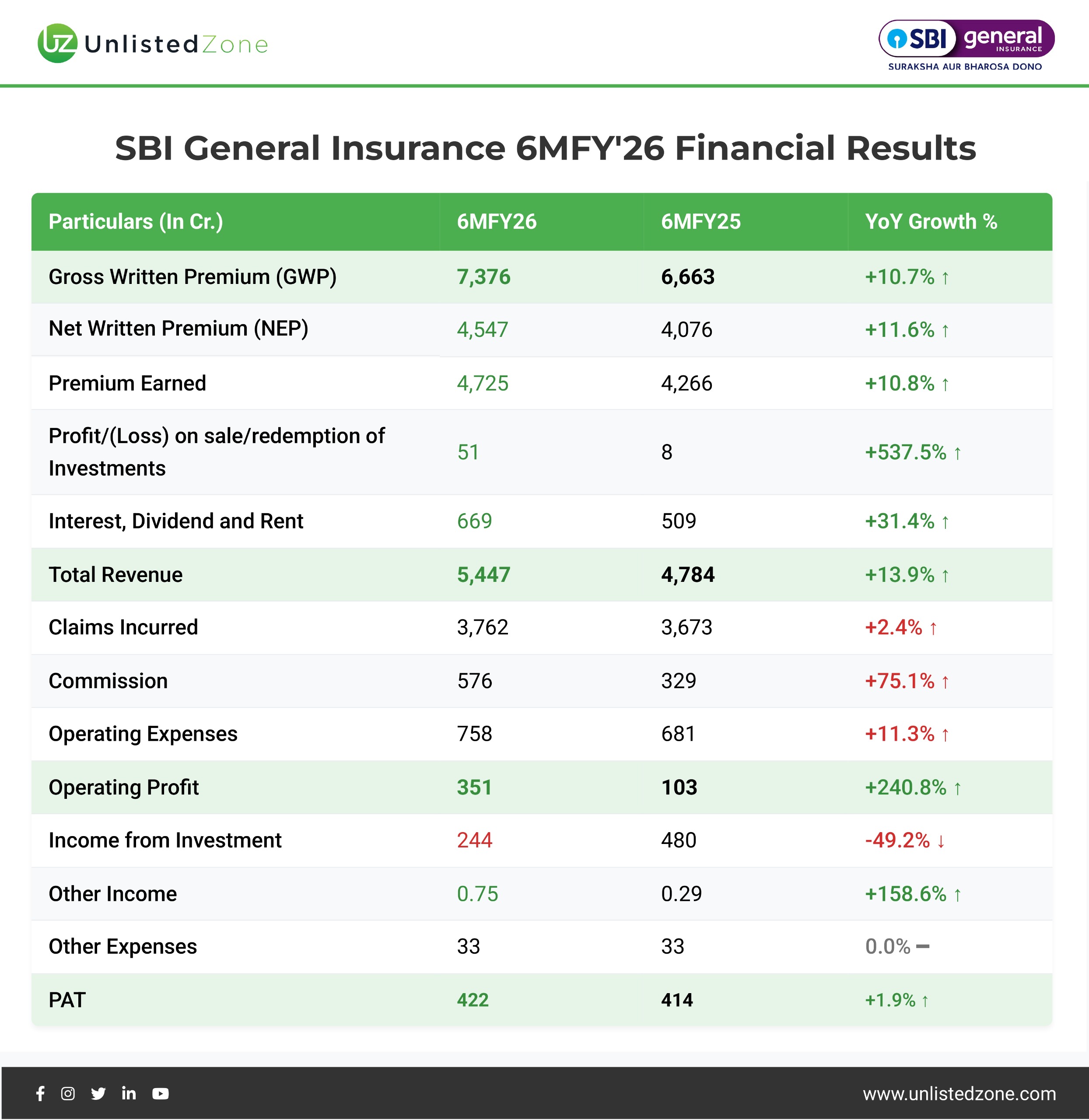

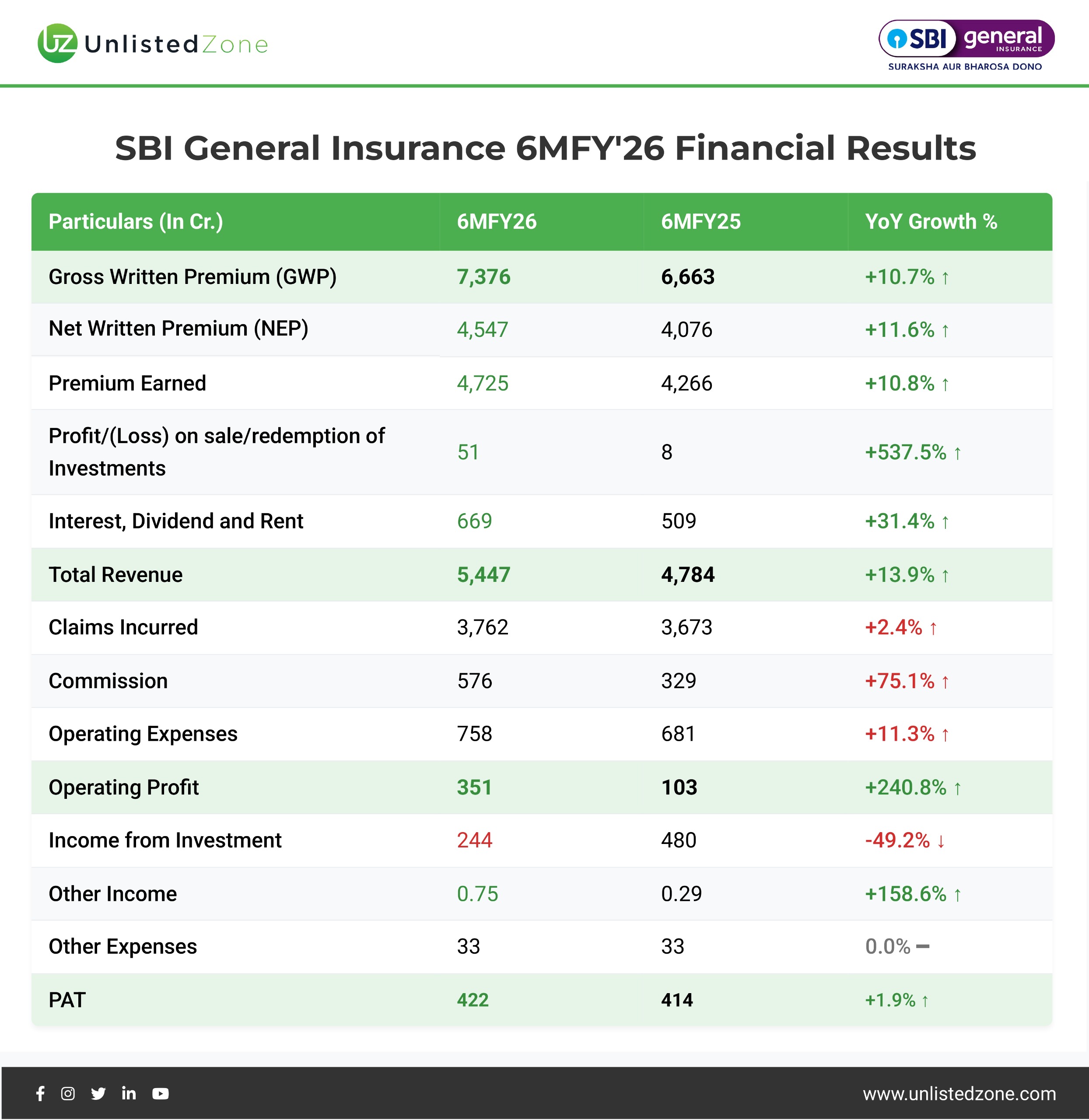

SBI General’s Gross Written Premium (GWP) grew 10.7% YoY to ₹7,376 crore in 6MFY26 from ₹6,663 crore in the same period last year. This indicates continued traction across both retail and corporate segments, particularly in motor and health portfolios.

The Net Written Premium (NEP) increased 11.6% YoY to ₹4,547 crore, reflecting effective risk retention and portfolio expansion. Premium Earned rose 10.8% YoY to ₹4,725 crore, suggesting consistent revenue flow from prior policy renewals and new business growth.

While the growth rate has moderated compared to FY25 (15.7%), it still exceeds the industry average of around 8–9%, highlighting SBI General’s ability to sustain business momentum despite competitive pricing pressures.

2. Financial Performance Overview

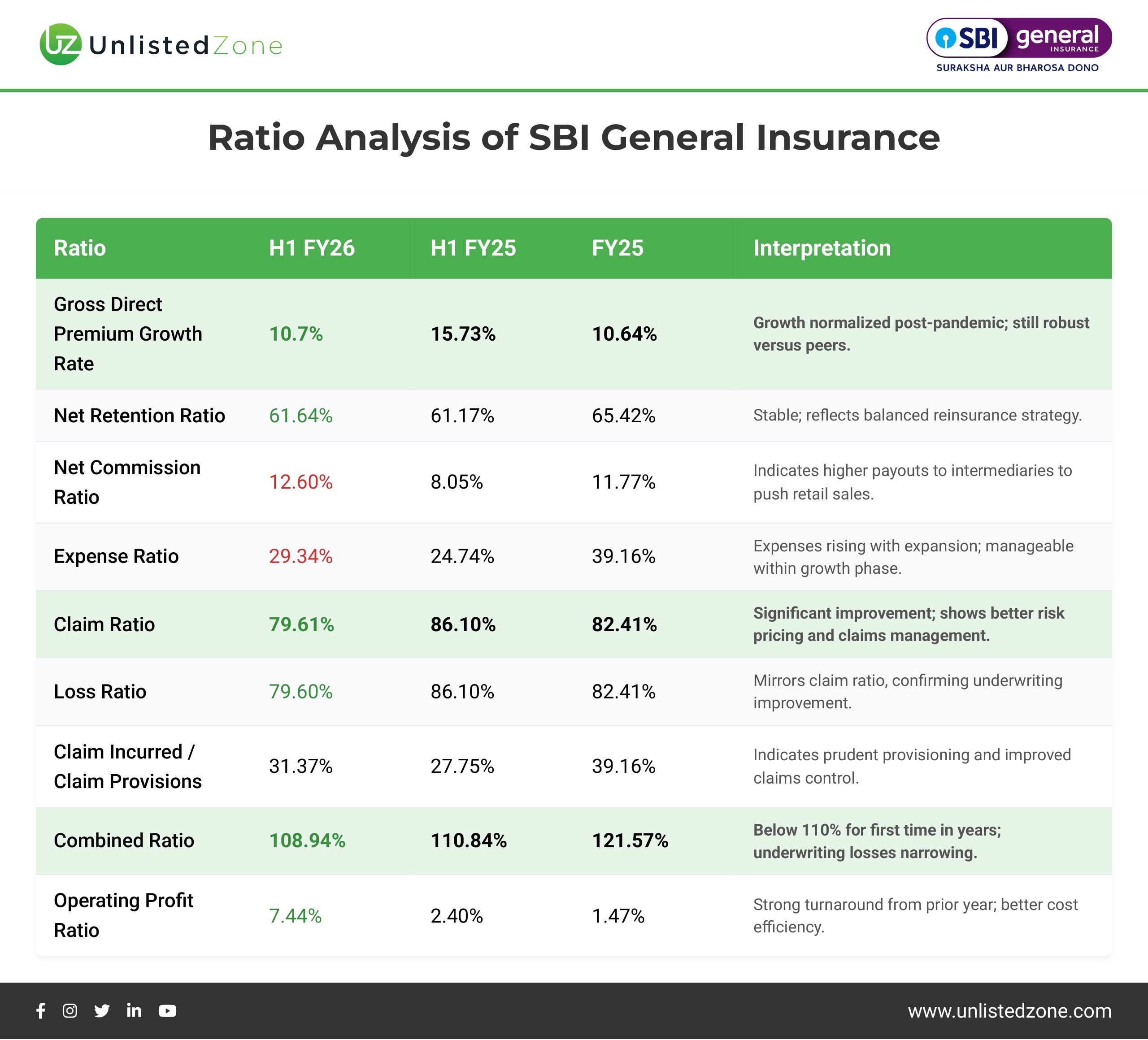

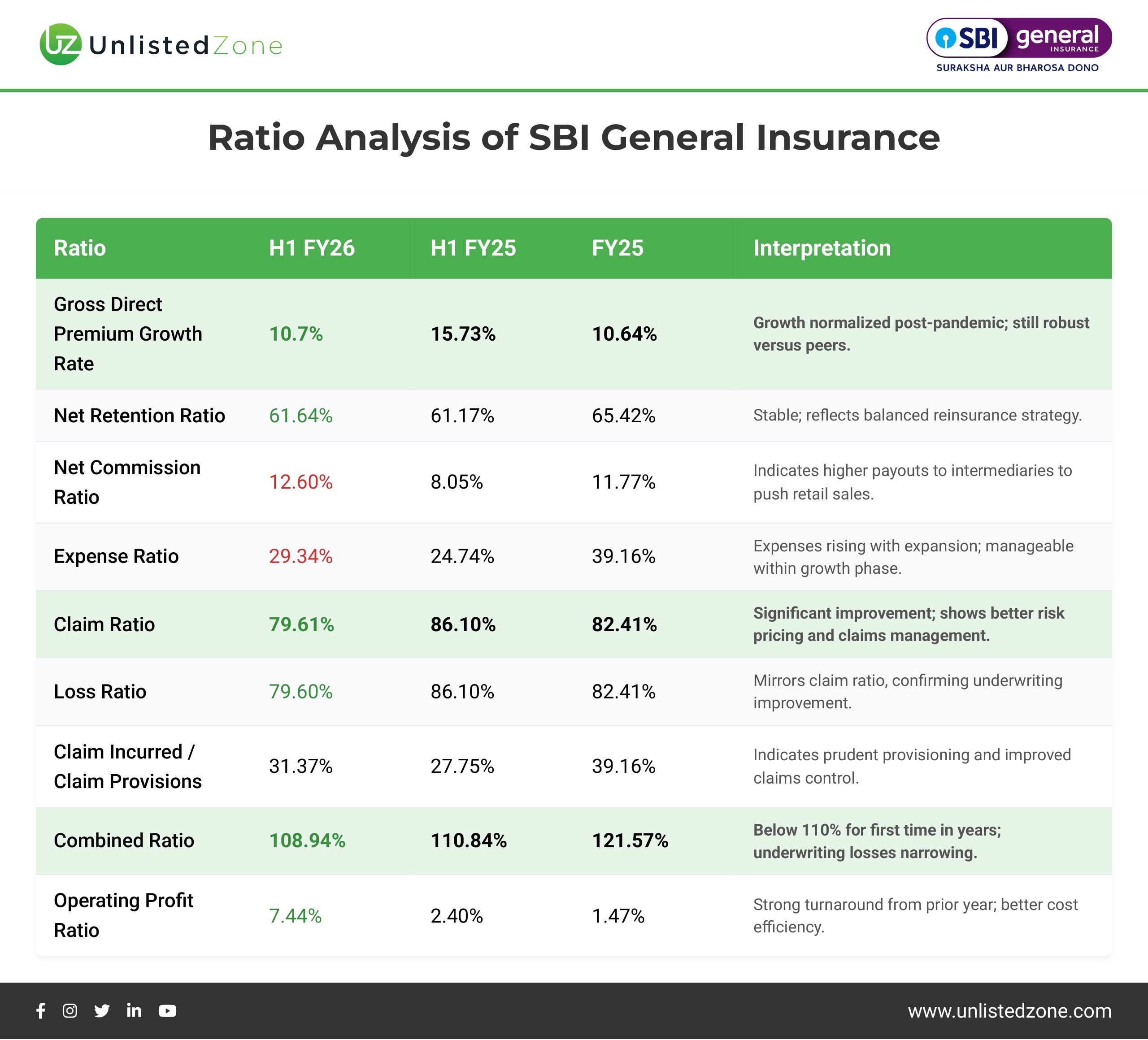

3. Ratio Analysis and Interpretation

4. Operational Efficiency

Claims and Costs:

-

Claim cost rose only 2.4% YoY, much slower than premium growth, driving down the claim ratio.

-

Commission expenses increased sharply, suggesting stronger focus on distribution expansion.

-

Operating expenses grew 11.3%, primarily due to marketing and digital initiatives.

Interpretation: The decline in claim ratio is the standout positive. SBI General is paying out a smaller portion of premiums as claims, indicating improved pricing and claim settlement processes. The combined ratio improving to 108.9% suggests operational efficiency gains, even if underwriting losses persist.

5. Investment Income Weakness

Investment income fell 49.2% YoY, significantly impacting the bottom line. Like most insurers, SBI General relies on investment returns to balance underwriting results. The fall was driven by market volatility and lower realized gains. However, a rebound in yields and equity markets could reverse this trend in H2 FY26.

6. Overall Business Health and Outlook

-

Operationally Strong: Improved claim and combined ratios demonstrate underwriting maturity.

-

Growth Sustained: Premiums growing in double digits despite slower market expansion.

-

Expense Pressure: Higher costs are strategic investments in scale and technology.

-

Investment Drag Temporary: Market-driven fluctuations; expected recovery in H2 FY26.

Outlook: SBI General is well-positioned for margin improvement through disciplined underwriting and controlled claims. The focus on retail health, motor, and SME lines provides a stable revenue base.

7. Conclusion

SBI General Insurance’s 6MFY26 results highlight a strong operational recovery. The company is evolving from growth-driven expansion to profitability-driven sustainability. Lower claim ratios, improved operating profits, and stable premium growth underline a healthy core business. While investment income volatility limited PAT growth, the fundamentals remain solid, positioning SBI General favorably for future growth and potential IPO readiness.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.