State Bank of India (SBI) Chairman C.S. Setty has signalled that SBI General Insurance and SBI Mutual Fund are strong contenders for public listing. While no IPO timeline is set, both are under active consideration.

The statement came during the launch of SBI General Insurance’s first dedicated health insurance branches in Telangana and Andhra Pradesh, with plans for a nationwide rollout.

SBI General Insurance – Health-Focused Expansion

SBI General Insurance is opening specialised health insurance branches to increase penetration in underserved markets. Setty aims to position the company as “the health insurer for every Indian.” This move complements SBI’s broader vision of serving every household in the country.

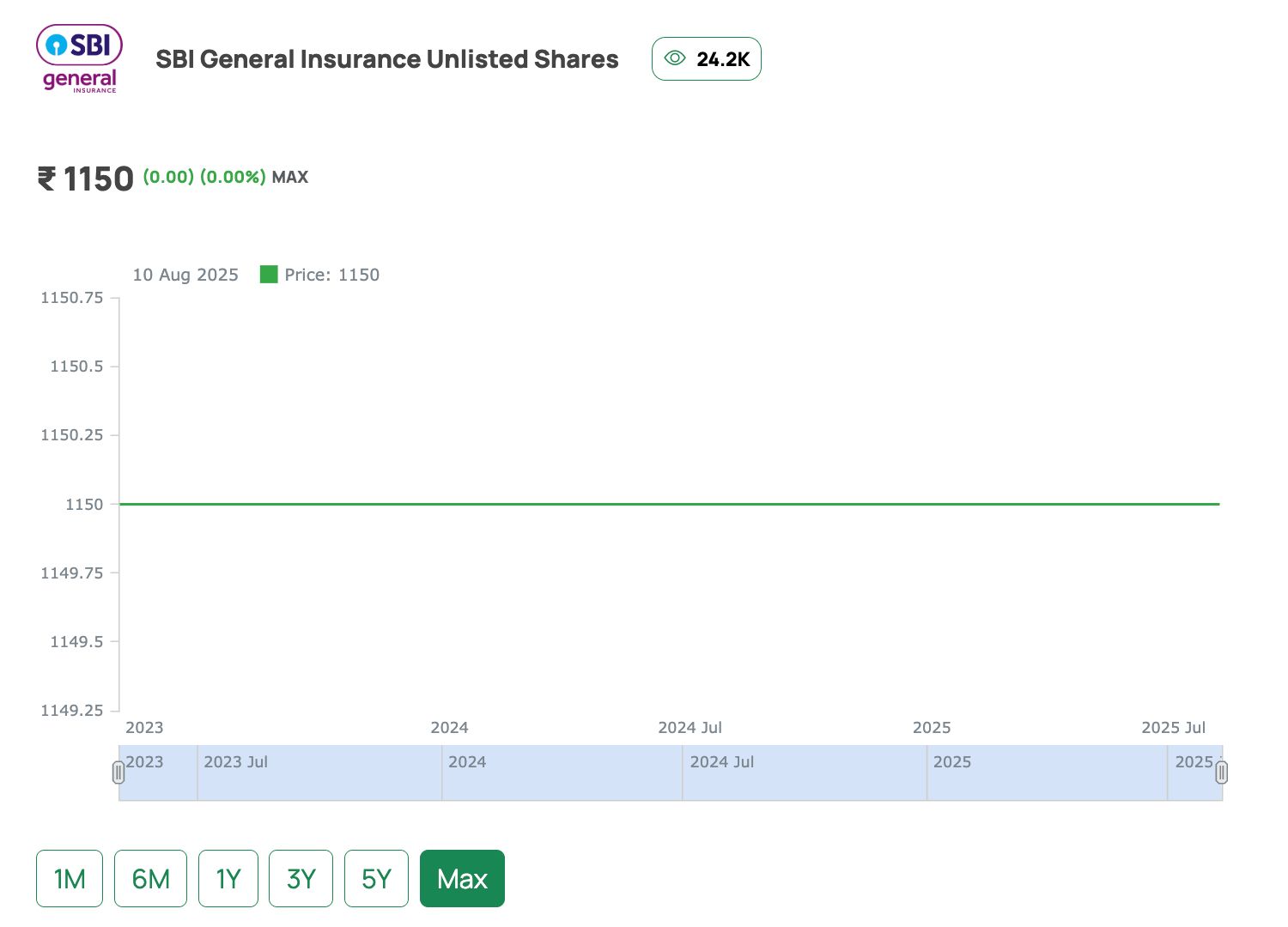

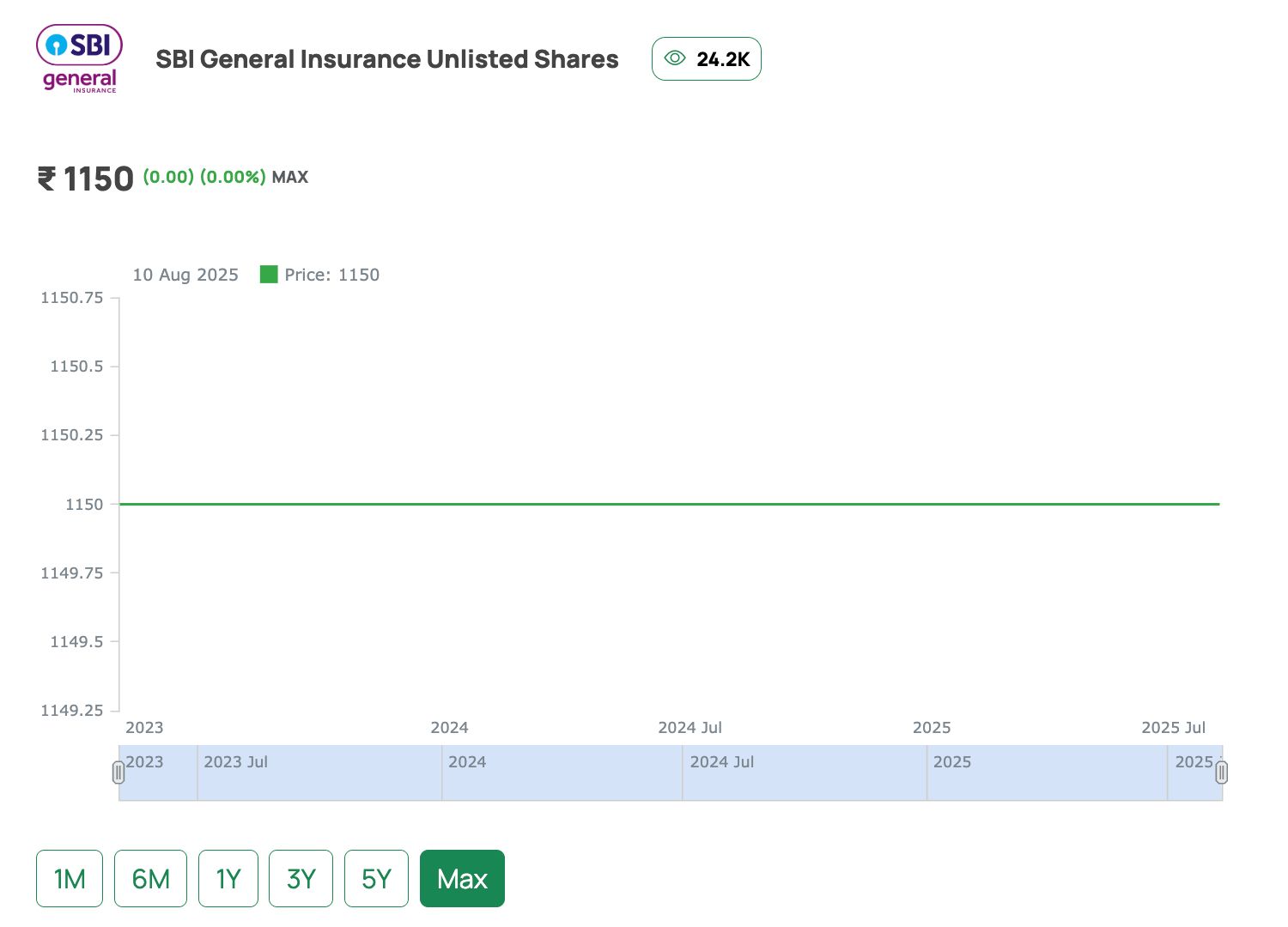

More Details: SBI General Insurance Unlisted Shares

SBI Mutual Fund – AMC Market Leader

SBI Mutual Fund is India’s largest Asset Management Company by Assets Under Management (AUM). Its retail reach and market dominance make it a top candidate for a high-value IPO, potentially one of the biggest in the financial services sector.

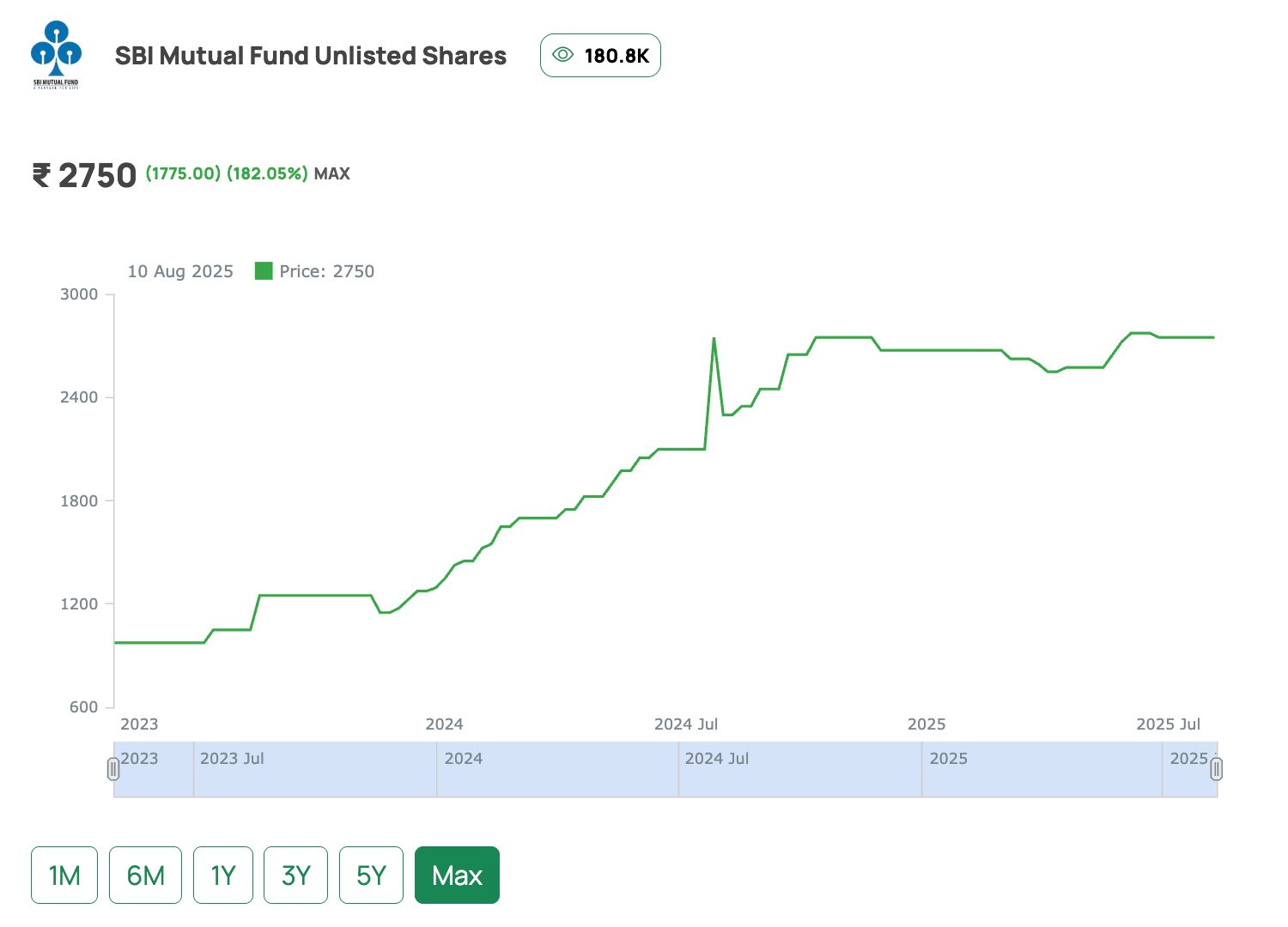

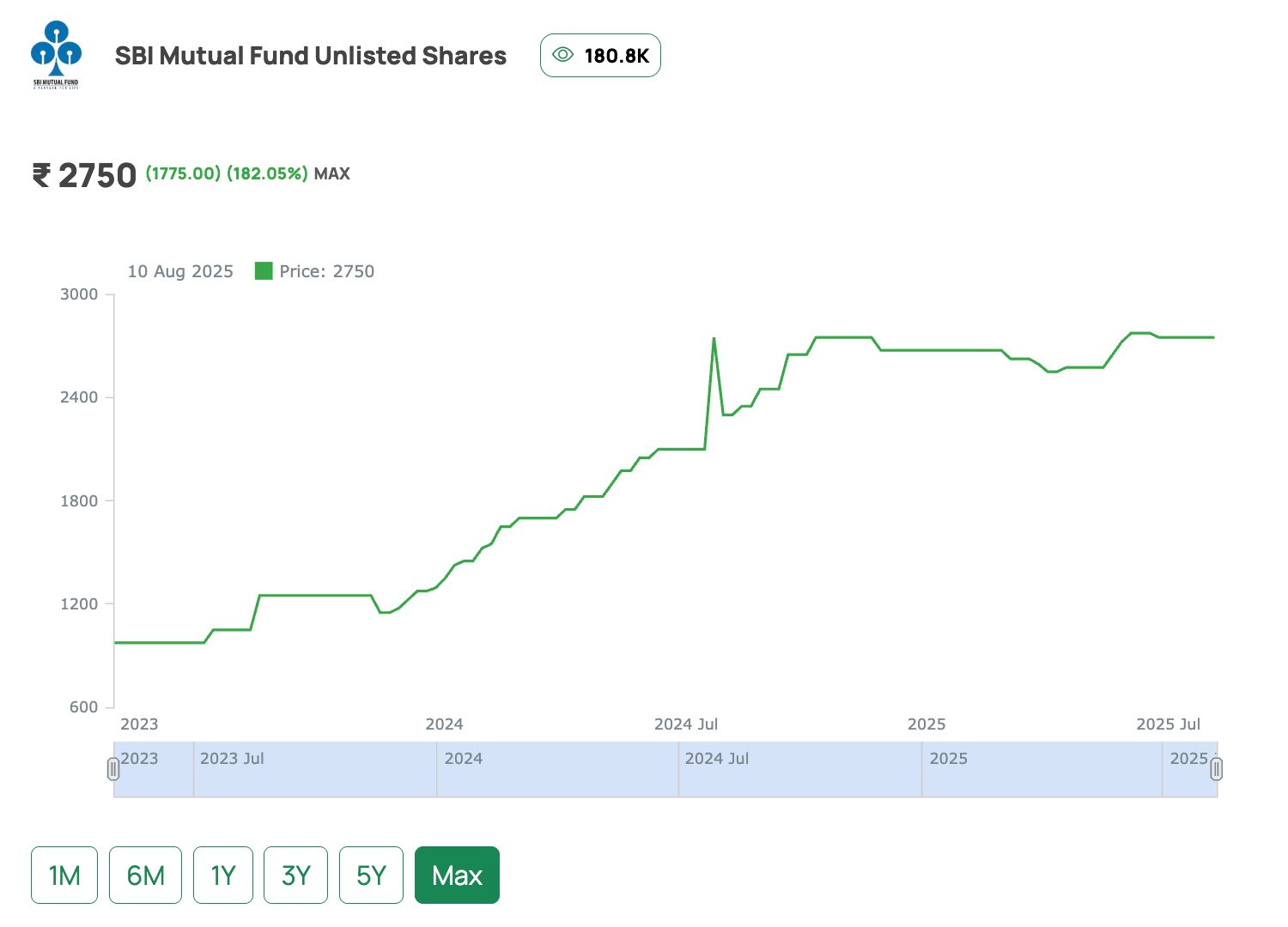

More Details: SBI Mutual Fund Unlisted Shares

IPO Plans – Awaiting Timelines

Setty confirmed that while both companies are “strong candidates for listing,” no schedule has been decided. For unlisted market investors, this means IPOs are likely but may take time.

Bancassurance & Customer Focus

Bancassurance — a bank selling insurance products through its network — remains a core strength for SBI General Insurance. Setty emphasised the importance of offering need-based, suitable insurance products and improving accessibility, with efforts involving regulators, banks, and insurers.

Investor Takeaways

-

Both companies operate in high-growth sectors — insurance and asset management.

-

SBI General Insurance’s health branch strategy could drive market share gains.

-

SBI Mutual Fund’s AMC leadership could attract significant IPO demand.

-

No IPO timelines announced; these remain long-term watchlist opportunities.

-

Currently, SBI General Insurance unlisted shares are unavailable; SBI Mutual Fund shares are available but at higher valuations than listed peers.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor.All information shared on our platform—including articles, posts, investment insights, and price trends—is solely for educational and informational purposes. We do not provide any buy/sell recommendations or financial advice.Investors are advised to do their own due diligence or consult a SEBI-registered advisor before making any investment decisions. Investments in unlisted and pre-IPO shares are subject to market risks, including liquidity risk and price volatility.UnlistedZone does not guarantee any returns and shall not be held liable for any losses incurred as a result of investment decisions taken based on the information provided.