By UnlistedZone Research | October 2025

Introduction

Religare Enterprises Limited (REL) has become a focal point for investors as its most valuable subsidiary, Care Health Insurance Ltd., prepares for an IPO. The upcoming listing is expected to unlock significant value for Religare shareholders, especially since the holding company currently trades at a steep discount to its underlying assets.

This article analyses the sum-of-parts (SoTP) valuation of Religare Enterprises, applies 30%, 40%, and 50% holding company discounts, and explores which is a better investment — Religare Enterprises (listed) or Care Health Insurance (unlisted/IPO-bound).

1. Understanding Religare Enterprises’ Structure

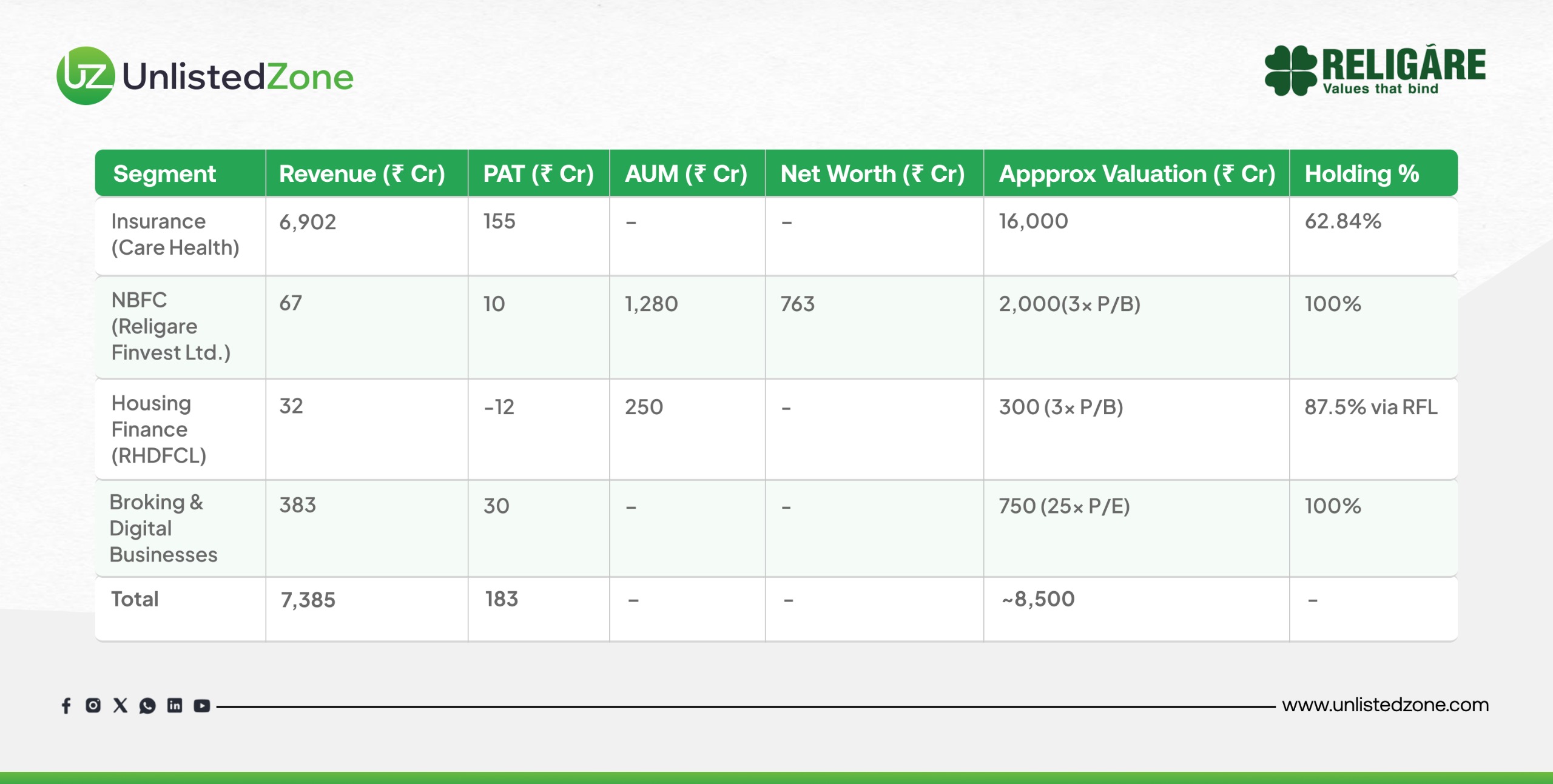

Religare Enterprises is a diversified financial holding company operating across four major segments:

Insight: Religare Enterprises currently has a market capitalization of around ₹8,500 crore. Of this, the NBFC and Home Finance businesses are estimated to be worth approximately ₹2,300 crore, based on a price-to-book multiple of 3x on their net worth. Additionally, the broking business is valued at around ₹750 crore, applying a P/E multiple of 25x.

Using a sum-of-the-parts (SOTP) approach, the implied value of Care Health Insurance within Religare Enterprises works out to ₹8,500 – ₹2,300 – ₹750 = ₹5,450 crore.

2. Valuation of Religare’s Key Assets

- Care Health’s expected IPO Valuation: ₹16,000 crore

- Religare’s stake: 62.84%

- Value of REL’s stake: ₹10,054 crore

This represents Religare’s pre-discount intrinsic worth of Care Health Insurance before applying a holding company discount.

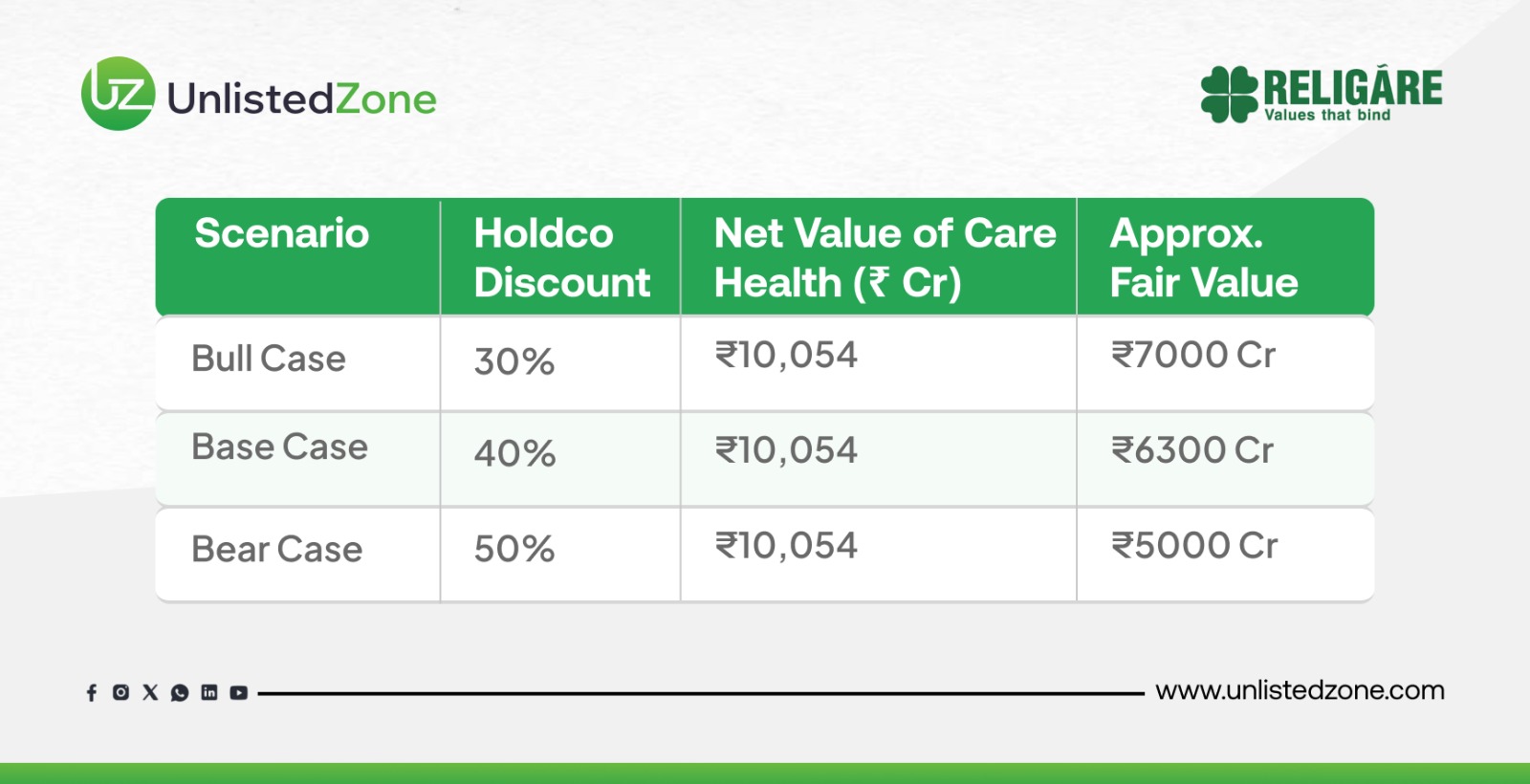

3. Applying Holding Company Discount (30–50%)

Holding companies typically trade at a 30–50% discount in India due to structural inefficiencies, taxation, and governance factors. Applying this to Religare’s Care Health business at INR 10,054 Cr as calculated above gives the following range:

Current Market Cap of Total Religare Enterprise business valuation is : ₹8,529 crore In the bear case, Religare Enterprises’ fair value in the listed market is broadly in line with its current valuation, indicating limited downside risk. In the base case, the company’s value could reach approximately ₹9,350 crore (₹6,300 crore from Care Health, ₹2,300 crore from NBFC+Housing, and ₹750 crore from Broking Business). This represents an upside potential of around 10%, making Religare Enterprises a small value-unlocking opportunity ahead of the Care Health IPO.

4. Why the Valuation Gap Exists

- Holding Company Structure: Investors can’t directly access Care Health’s profits.

- Governance History: Past controversies have made the market cautious.

- Regulatory Delays: Any postponement of Care Health’s IPO can affect near-term sentiment.

- Diversified Portfolio: Smaller, low-profit subsidiaries dilute consolidated profitability.

However, Religare’s renewed focus on its core verticals and strong performance in Care Health are improving overall perception.

5. Triggers for Value Unlocking

a. Care Health IPO Listing

The listing will provide transparent market valuation of Care Health. A possible demerger or share distribution to existing Religare shareholders could directly unlock embedded value.

b. Reduction in Holdco Discount

As management improves governance and transparency, the market could re-rate Religare closer to the 25–30% discount range, adding valuation gains.

c. Strength in Broking and Lending

Religare Broking and Finvest are profitable and expanding steadily, contributing incremental value alongside Care Health’s growth.

d. Sector Growth Tailwinds

India’s low health insurance penetration and rising awareness post-COVID position Care Health for strong, sustainable growth — benefiting Religare as a majority owner.

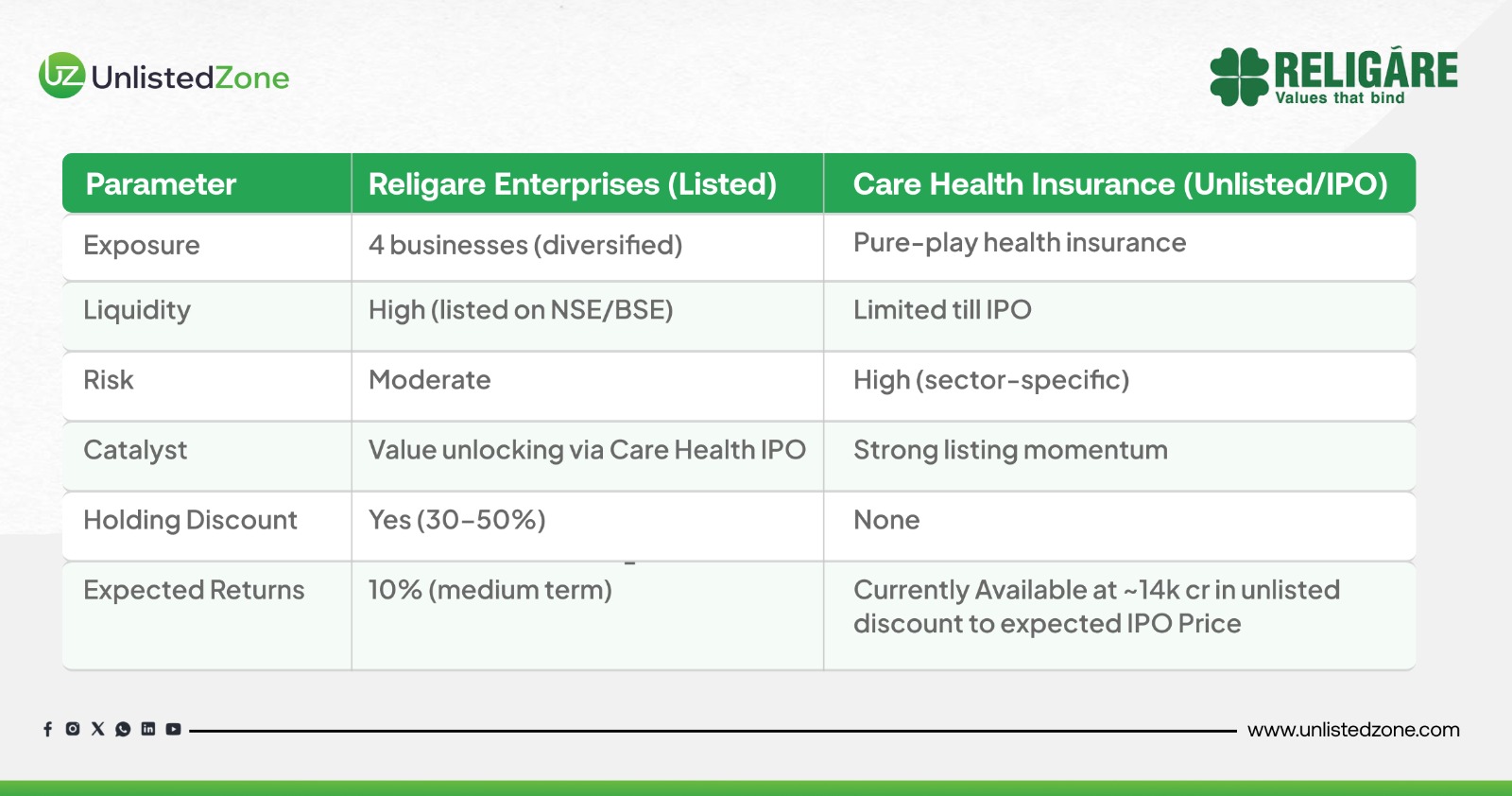

6. Religare vs. Care Health — Which Is the Better Bet?

Parameter Religare Enterprises (Listed) Care Health Insurance (Unlisted/IPO) Exposure 4 businesses (diversified) Pure-play health insurance Liquidity High (listed on NSE/BSE) Limited till IPO Risk Moderate High (sector-specific) Catalyst Value unlocking via Care Health IPO Strong listing momentum Holding Discount Yes (30–50%) None Expected Returns 10% (medium term) Currently Available at ~14k cr in unlisted discount to expected IPO Price

Interpretation: If you want direct exposure to India’s health insurance boom, Care Health is the cleaner bet post-listing or you can buy before IPO from unlisted market.

7. Final Valuation View

After incorporating a realistic 40% holdco discount, Religare’s fair valuation stands around ₹9,350 crore, compared to its market cap of ₹8,529 crore. That’s an implied upside of 10%, even before Care Health’s IPO is factored in.

If Care Health lists at a higher valuation (₹17,000–₹18,000 crore), Religare’s Enterprise intrinsic value could so more upside.

Conclusion

Religare Enterprises represents a small value-unlocking story — a holding company with a high-quality insurance subsidiary nearing listing. Once Care Health hits the bourses, the market will likely revalue Religare closer to its true worth.

UnlistedZone View: Religare Enterprises remains undervalued. With Care Health’s IPO on the horizon, investors could see meaningful value unlocking in the next 12–18 months depend upon how Care Health Performed after listing.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.