A) About the Company

Pace Digitek Infra Private Limited (formerly Pace Power Systems Private Limited)

Headquarterd in Bengaluru, India .Founded with expertise in power systems for telecom infrastructure, the company has evolved into an integrated infrastructure solutions provider with diversified verticals including telecom, energy, and EPC. The rebranding to Pace Digitek Infra reflects its expansion into large-scale infrastructure execution.

Business Model (Core Operations)

-

Power Management Systems: Design, manufacture, installation, and maintenance for telecom infrastructure.

-

Optic Fiber Laying Solutions: Deployment of high-speed connectivity networks.

-

Renewable Energy Solutions: Implementation of sustainable energy and green infrastructure projects.

Key Clients: Telecom operators and government agencies (rural electrification & digital infrastructure projects).

Industry Positioning

With India's strong infrastructure push (5G rollout, PM GatiShakti, green energy transition), Pace Digitek has positioned itself as a key EPC and infrastructure solutions player.

B) Key Highlights of the Year (FY2025)

-

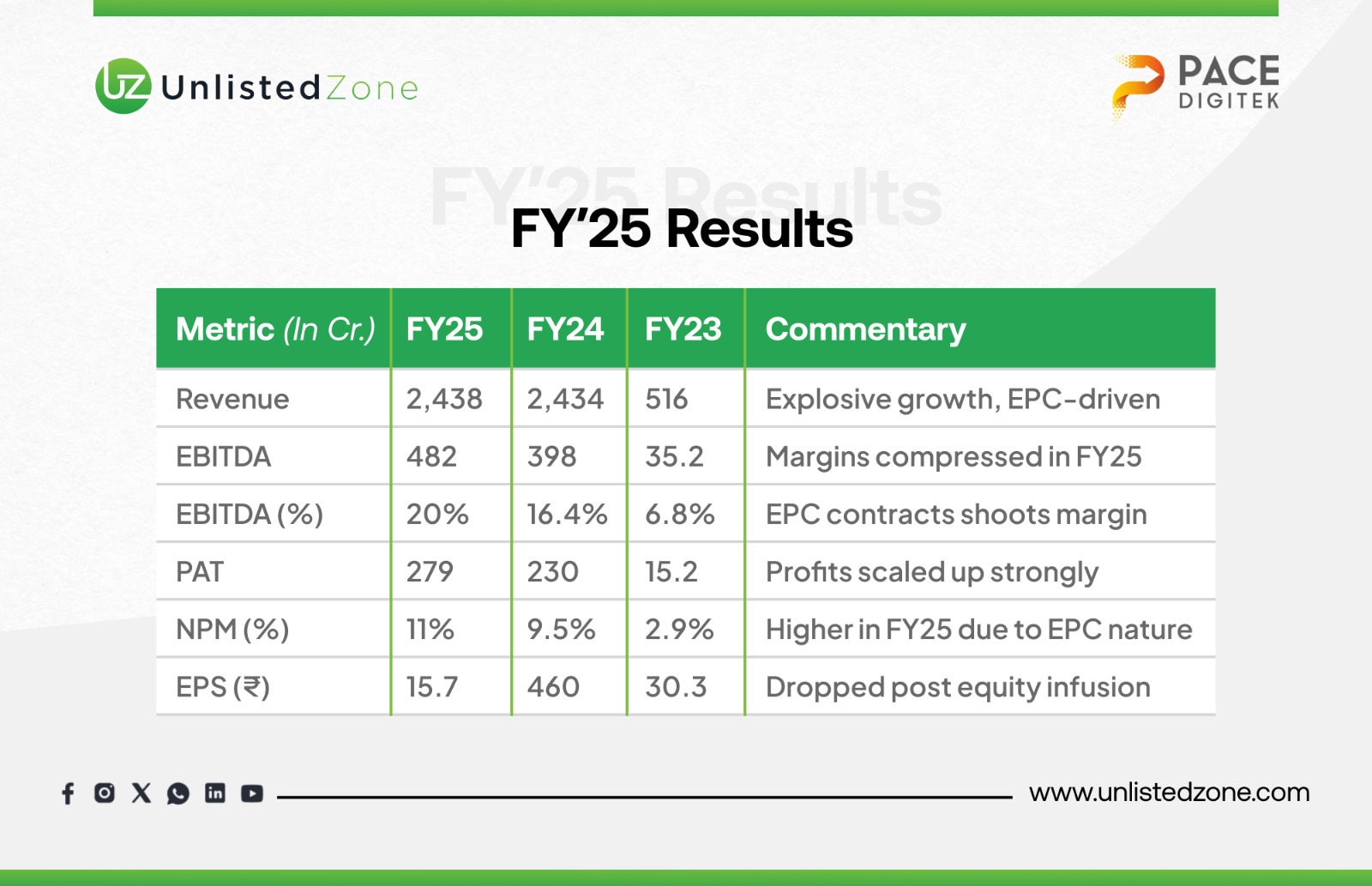

Revenue Growth: Jumped from ₹516 Cr (FY23) to ₹24,388 Cr (FY25), a 4626% increase in just two years.

-

EPC Pivot: 97.4% of FY25 revenue came from EPC projects, making it the dominant business segment.

-

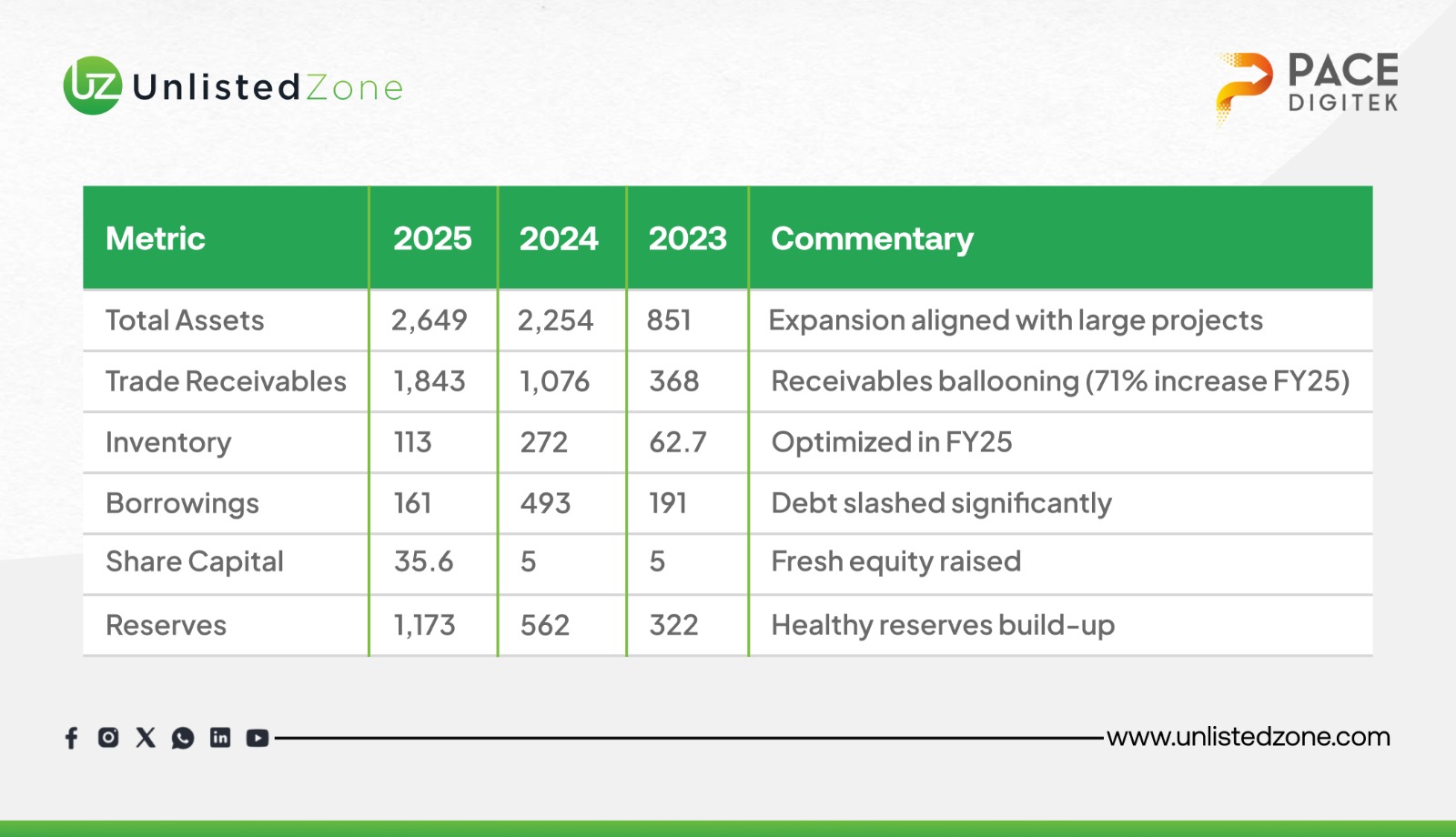

Equity Infusion: Share capital increased from ₹5 Cr to ₹35.6 Cr in FY25.

-

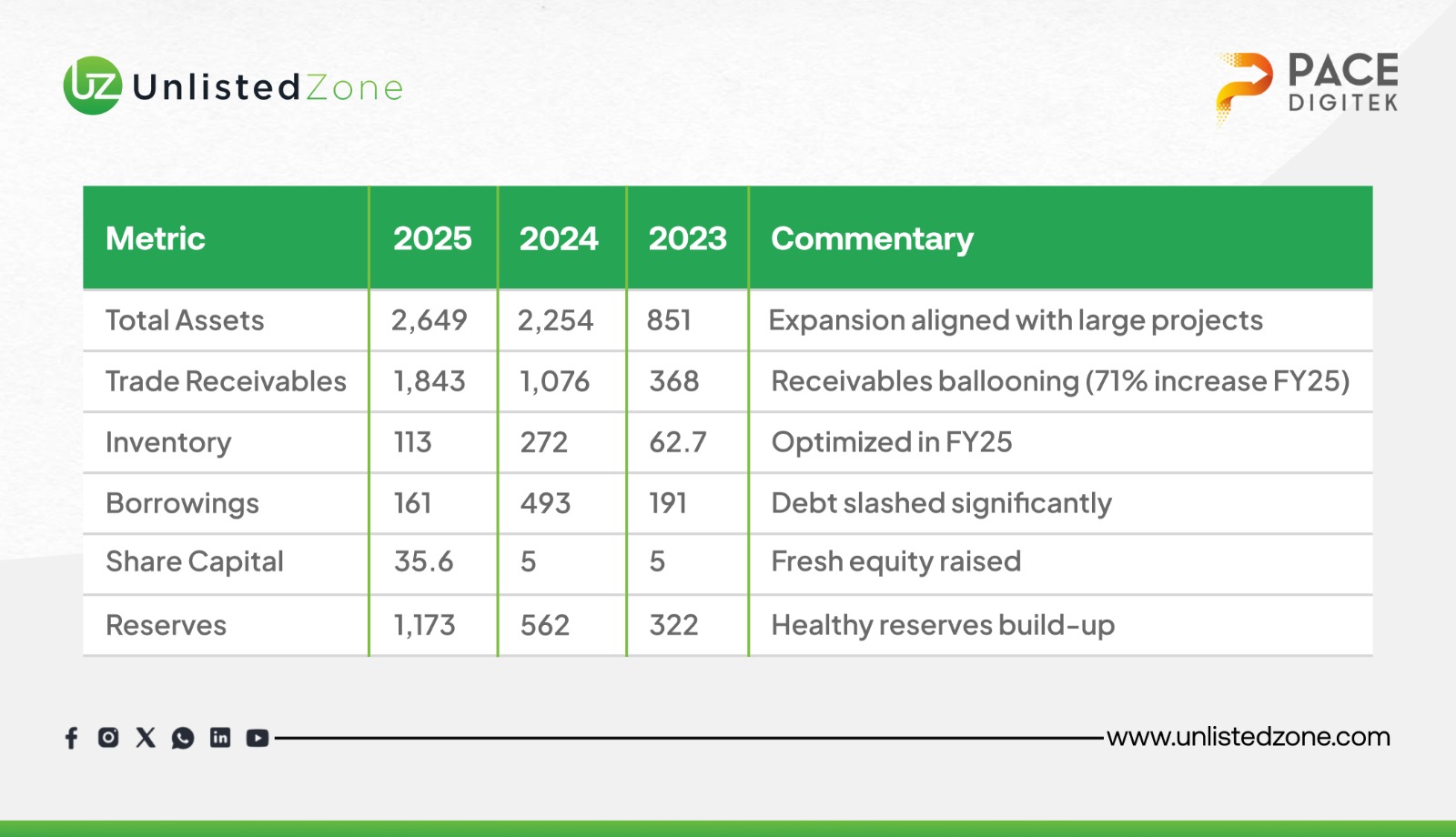

Debt Reduction: Borrowings reduced by 67%, strengthening the balance sheet.

-

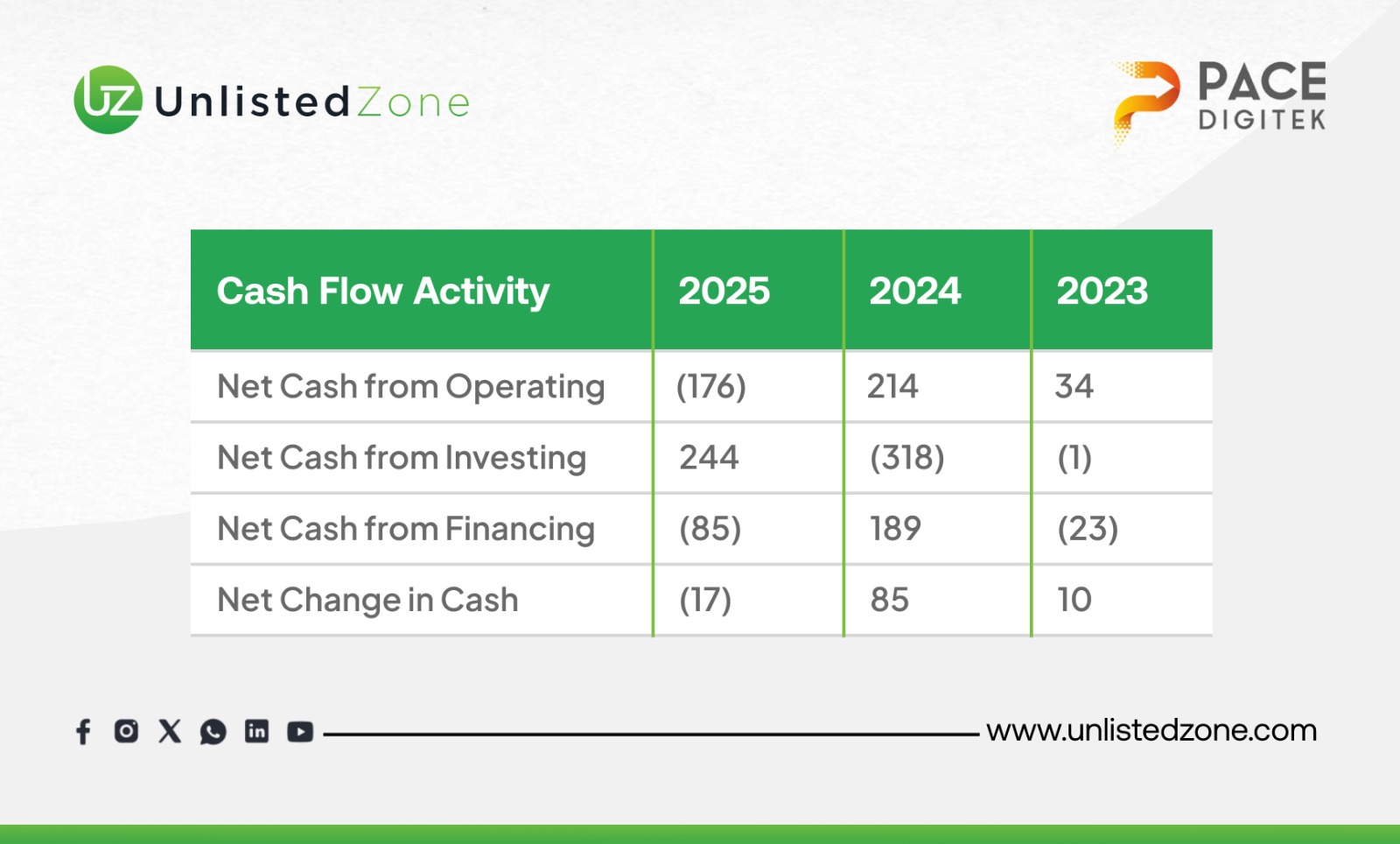

Cash Flow Stress: Despite profits, the company posted negative operating cash flow due to mounting receivables.

C) Financial Performance (₹ Crore)

Profit & Loss Snapshot

Revenue Mix (FY25):

-

EPC Projects – ₹2376Cr (97.4%)

-

Services – ₹33.1 Cr (1.4%)

-

Products – ₹29.4 Cr (1.2%)

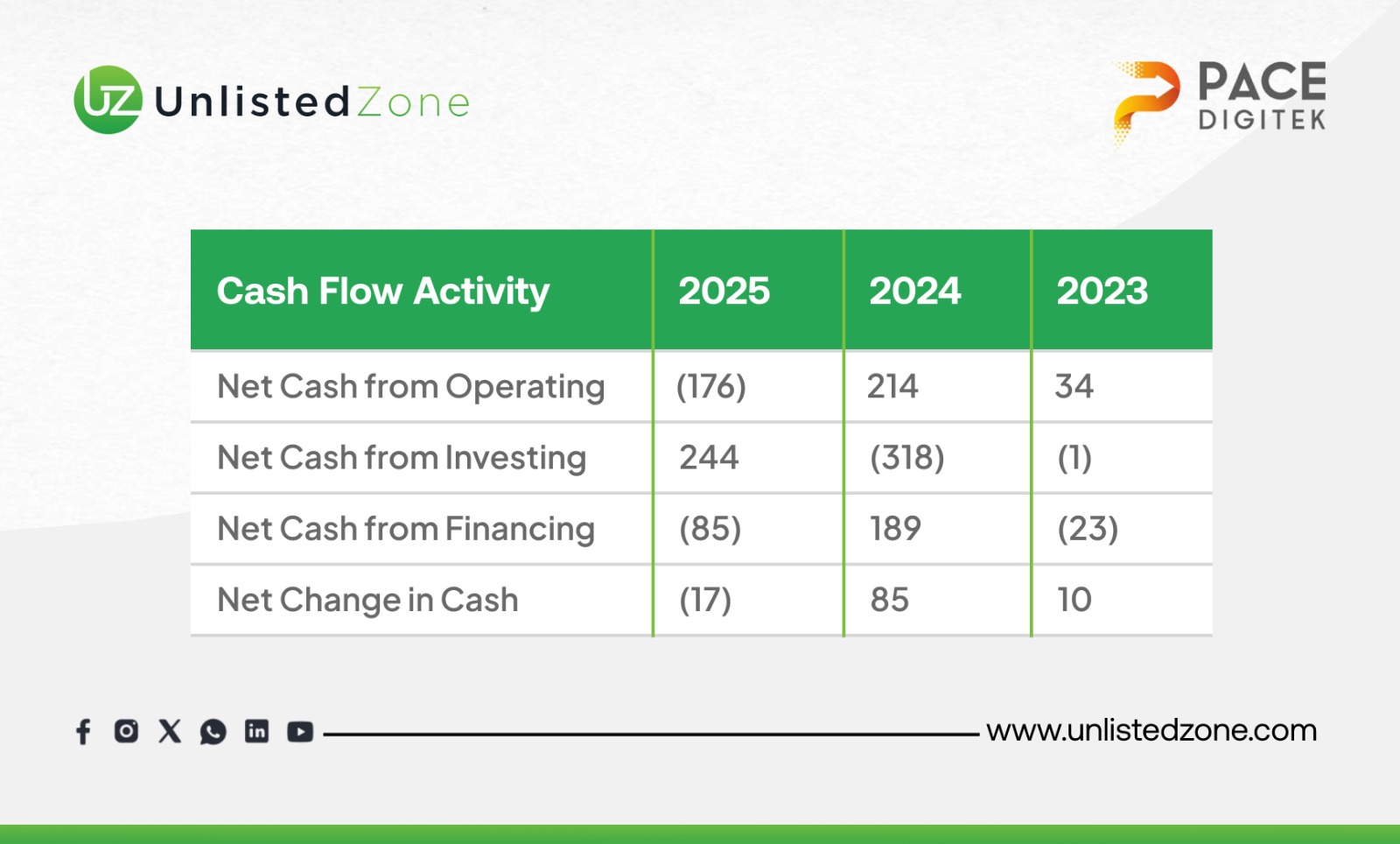

Cash Flow Analysis

Insight: Negative operating cash flow in FY25 is a critical concern, driven by receivable buildup.

Balance Sheet Strength

Key Ratios:

-

Current Ratio: 1.53 (vs. 1.14 in FY24) → Improved liquidity but low-quality assets.

-

Debt-Equity: 0.14 (vs. 1.24) → Low leverage, stronger balance sheet.

-

ROE: 34% (down from 56%) → Diluted post-equity infusion.

-

Trade Receivables Days: 170 (worsened, slower collections).

Segment/Division-Wise Analysis

-

EPC Projects: Core revenue driver, ₹2376Cr contribution.

-

Products & Services: ₹62.6 Cr combined; minimal contribution.

E) Management Discussion & Analysis

Opportunities

-

Government infra push (PM GatiShakti, NIP).

-

Rural electrification and digital connectivity.

-

Renewable energy transition.

Challenges

-

Liquidity Crisis: Working capital cycle heavily stretched.

-

Competition: Intense margin pressures in EPC space.

-

Execution Risk: Project delays may erode profitability.

Strategic Roadmap

-

Strengthen receivable collection process.

-

Explore invoice discounting for cash flow.

-

Maintain EPC leadership while expanding renewable projects.

F) Product Control Portfolio

Hybrid DC Power System, DC Power System, Charge Control Unit (CCU), Lithium Battery, AMF, LT Panel / Meter panel, DG, Outdoor IP-55 Cabinet, Remote Monitoring System (RMS), Inverter, SMPS

Service Offerings

-

Power Management Systems – Reliable power infrastructure solutions.

-

Optic Fiber Laying – High-speed digital connectivity solutions.

-

Renewable Energy Solutions – Clean energy-driven infrastructure.

G) Valuation Insights (Unlisted Market)

-

Positive Tailwinds: Infrastructure push, renewable adoption.

-

Critical Fix Needed: Working capital management.

-

Long-Term Growth: Strong potential to become a market leader if liquidity is stabilized.

H) SWOT Analysis of Pace Digitiek Unlisted Shares

Strengths:

-

Diversified Revenue Model (Products, EPC, O&M).

-

Strong Order Book & Astronomical Revenue Growth.

-

Robust Balance Sheet with Low Debt and High Reserves.

-

Niche Expertise in high-demand sectors (Telecom, Power, Renewable Energy).

Weaknesses:

-

Severe Working Capital Management Issues.

-

Negative Operating Cash Flow.

-

High Customer Concentration Risk.

Opportunities:

-

Government Initiatives (Infra Pipeline, 5G, Green Energy).

-

Proven Scalability for Large Contracts.

-

Expansion in Rural Electrification & Connectivity.

Threats:

-

Intense Competition in the EPC Sector.

-

Execution & Project Delay Risks.

-

Potential Liquidity Crisis.

UnlistedZone View

Investment Thesis: Pace Digitek is an infrastructure growth story with explosive revenue scale-up and a strong balance sheet post-equity infusion. Its EPC dominance ensures future contracts, especially under India’s infrastructure boom.

Risks: Severe working capital issues may lead to solvency risks if not addressed immediately.

Suitability: Suitable for HNIs and long-term investors with a high-risk appetite. Short-term liquidity constraints may weigh on performance.

CONCLUSION

Pace Digitek Infra has undergone a transformative phase from FY2023 to FY2025, evolving into a significant entity in the infrastructure space. This transformation is marked by explosive revenue growth (from ₹516 Cr to ₹24,387 Cr), a strengthened balance sheet through a substantial equity infusion, and improved profitability. However, this rapid growth has introduced a significant challenge: severe working capital strain evidenced by soaring receivables and negative operating cash flow in FY2025. The company's strategic focus on large-scale EPC projects has been the key driver of this growth.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.