A) Introduction

OYO (Oravel Stays Ltd.) is one of India’s most recognizable travel-tech and hospitality brands. Founded in 2013, the company grew rapidly by aggregating budget hotels across India, later expanding into Southeast Asia and other markets. Despite its meteoric rise, OYO faced challenges related to service quality, profitability, and over-expansion.

However, the last two years mark a clear turnaround story for OYO. The company has restructured its operations, focused on high-margin segments, tightened cost control, and returned to profitability. Today, OYO is not just a budget accommodation provider—it is a diversified player spanning hotels, homes (vacation rentals), and co-working spaces under its Innov8 brand.

With the much-anticipated OYO IPO on the horizon, investors are tracking the company’s performance in the unlisted shares market and closely analyzing its quarterly financials.

B) OYO’s Property Footprint

OYO has built its presence across India and Southeast Asia (SEA), with India continuing to be its largest and most profitable market.

-

Hotels: Rapidly scaling mid-premium and premium portfolio, moving beyond its early reliance on budget stays.

-

Co-working (Innov8): Grew from 30 centers in June 2024 to 49 centers by July 2025, with presence in Delhi-NCR, Bengaluru, Hyderabad, and Mumbai.

This dual focus—accommodation plus workspaces—positions OYO uniquely among Indian startups, making it a rare company straddling both the hospitality and flexible real estate-tech industries.

C) OYO Hotels vs OYO Homes

1. OYO Hotels

2. OYO Homes

Hotels remain the larger revenue driver, while Homes strategically diversify OYO’s customer base.

D) OYO Owned vs Franchise-Owned Model

-

Company-Serviced Properties: Directly managed mid-premium/premium hotels ensuring service consistency.

-

Franchise-Owned Properties: Independently owned hotels/homes leveraging OYO’s branding, tech, and booking network. OYO earns commissions.

This asset-light model enables rapid scaling without heavy capital expenditure.

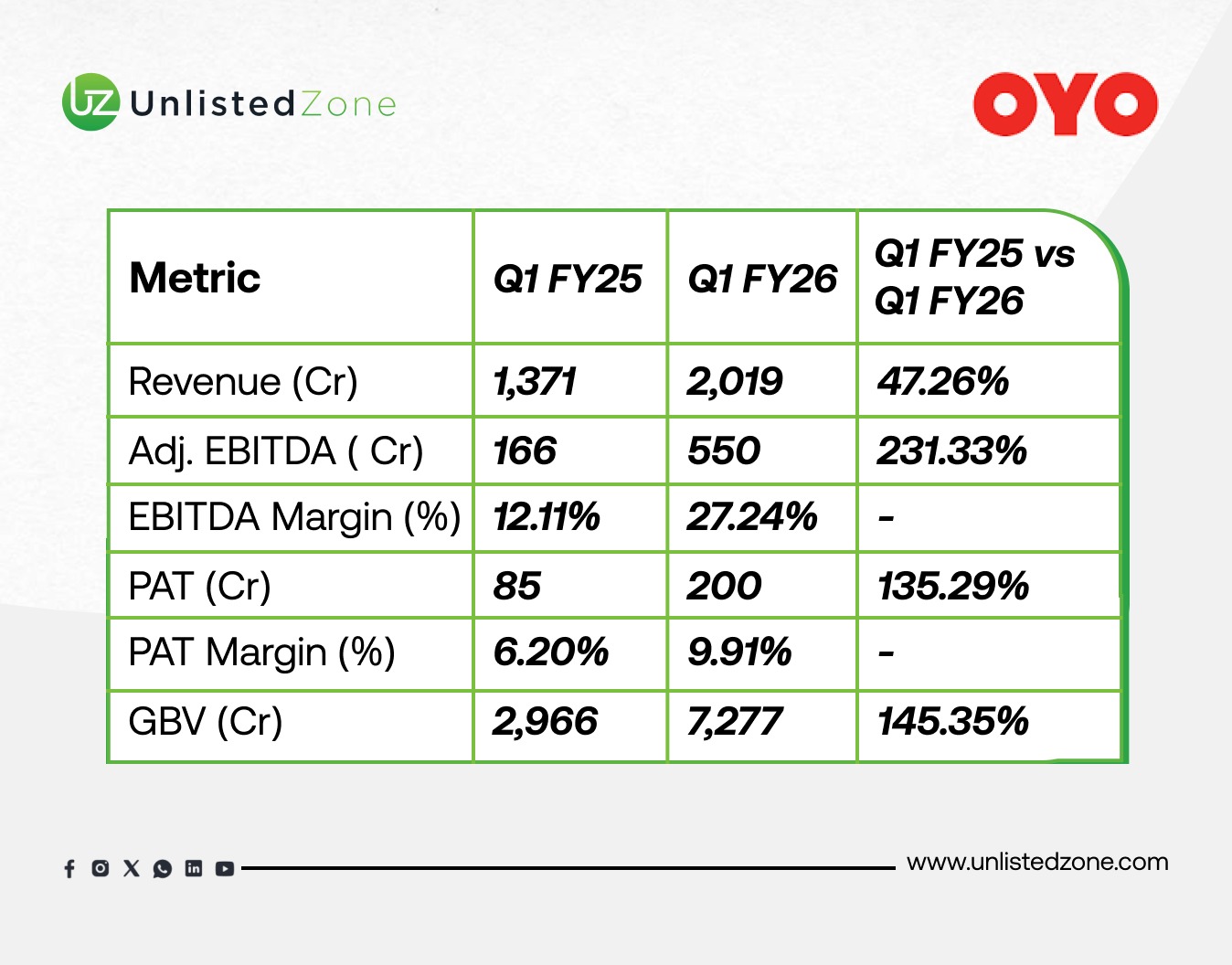

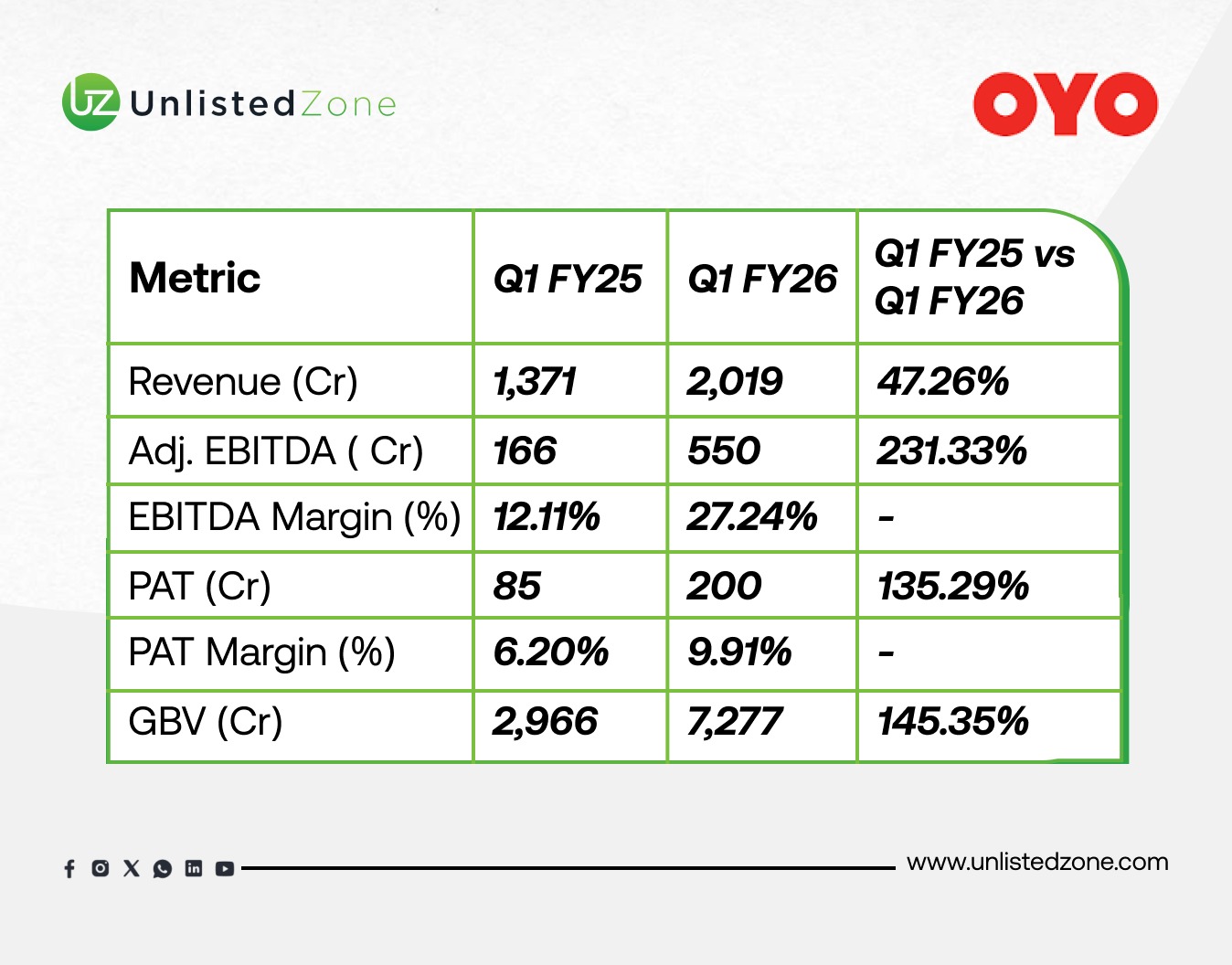

E) Financial Performance: Q1FY26 vs Q1FY25

-

Revenue: ₹2,019 Cr (+47% YoY)

-

Adjusted EBITDA: ₹550 Cr (+231% YoY)

-

PAT: ₹200 Cr (+135% YoY)

-

GBV: ₹7,277 Cr (+145% YoY)

Strong topline growth combined with disciplined cost structures highlights a sustainable turnaround.

F) Innov8: OYO’s Co-Working Subsidiary

Innov8 benefits from hybrid work demand, offering steady, high-margin growth.

G) OYO IPO News: What Investors Should Watch

-

Sustained Profitability: Maintaining margins across multiple quarters.

-

Hotels vs Homes Balance: Hotels dominate, but Homes need stronger monetization.

-

Innov8 Expansion: High-margin business with corporate clientele.

-

IPO Valuation: Will depend on FY26 audited financials and growth trajectory.

Conclusion

OYO’s journey from a cash-burning startup to a profitable hospitality and co-working leader reflects strategic restructuring and disciplined execution.

-

Hotels: Driving revenue and GBV growth.

-

Homes: Expanding alternative stay footprint.

-

Innov8: High-margin growth engine.

-

Financials: Strong YoY improvements across revenue, EBITDA, PAT, and GBV.

The OYO IPO 2026 represents a potential landmark in India’s startup ecosystem. With unlisted shares already in demand, the IPO could unlock significant value if OYO sustains its profitable momentum.

In short, OYO’s turnaround story is one to watch closely—both for investors in the unlisted market today and for those eyeing its IPO in 2026.