A) About the Company

Orbis Financial Corporation Limited (OFCL), established in 2005, is a SEBI-registered Custodian, Clearing Member, and Registrar & Transfer Agent (RTA). The company plays a critical role in India’s financial ecosystem by providing backend infrastructure and transaction support to institutional investors.

Its service verticals span across:

-

Custody & Fund Accounting

-

Clearing (Equity, Commodity, Currency Derivatives)

-

Registrar & Share Transfer Agent (RTA) Services

-

Trusteeship

Industry positioning: Orbis is among the few players in India with a comprehensive custodial license, enabling it to cater to FPIs, AIFs, PMS, DIIs, and Trading Members. Recently, it also expanded into GIFT City with IFSCA approval, positioning itself for global business.

B) Key Highlights of the Year (FY25) Orbis Financial Unlisted Shares

-

Expansion into GIFT City: Approval from IFSCA marks its entry into global financial markets.

-

Scaling Institutional Base: Growing presence across FPIs, AIFs, and DIIs amid rising India-focused investments.

-

Technology-Led Operations: Strengthened digital platforms for custody, clearing, and fund accounting services.

-

Low-Profile Operator: Despite its quiet profile, Orbis is a vital enabler for institutional flows in Indian capital markets.

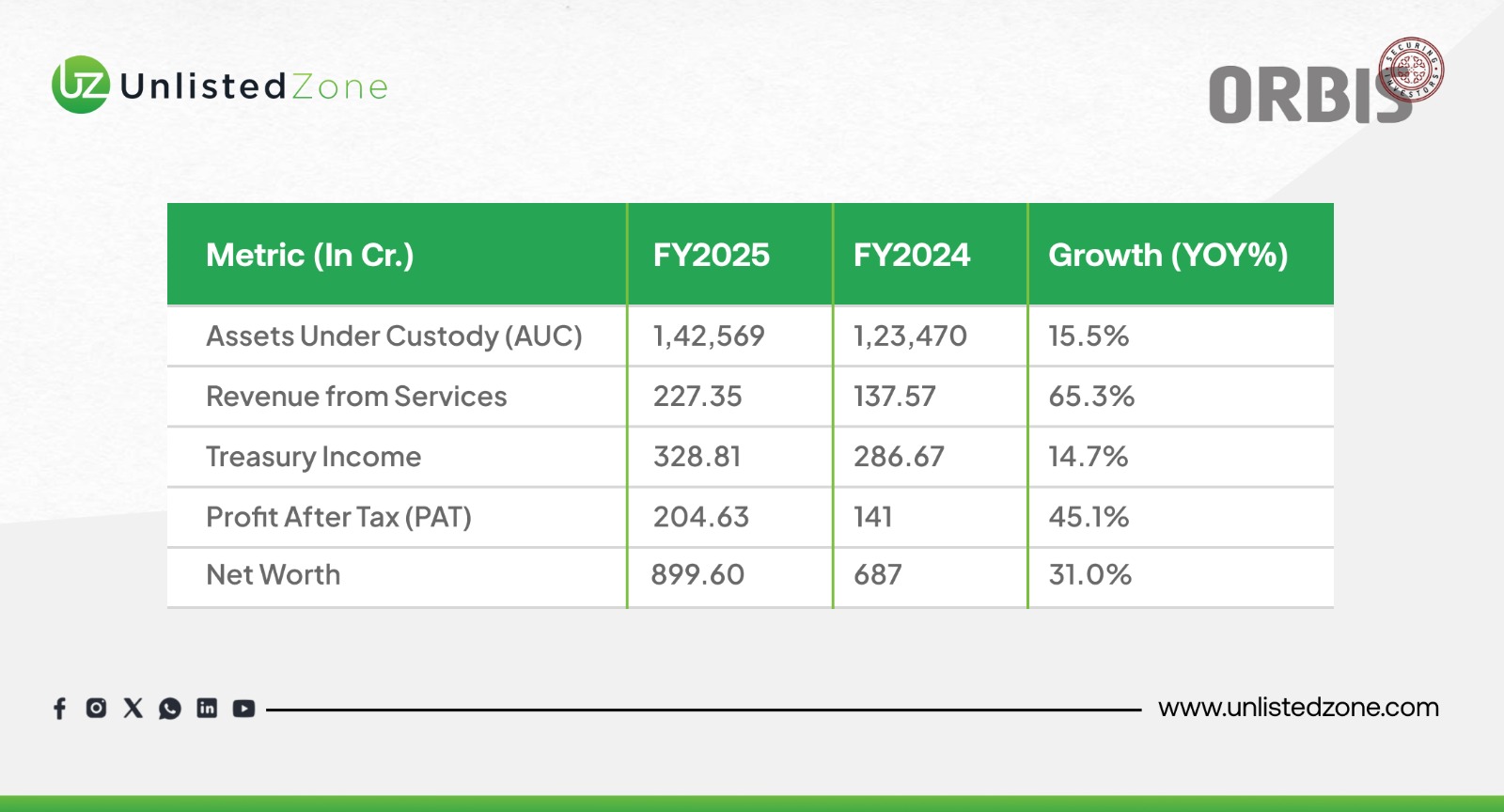

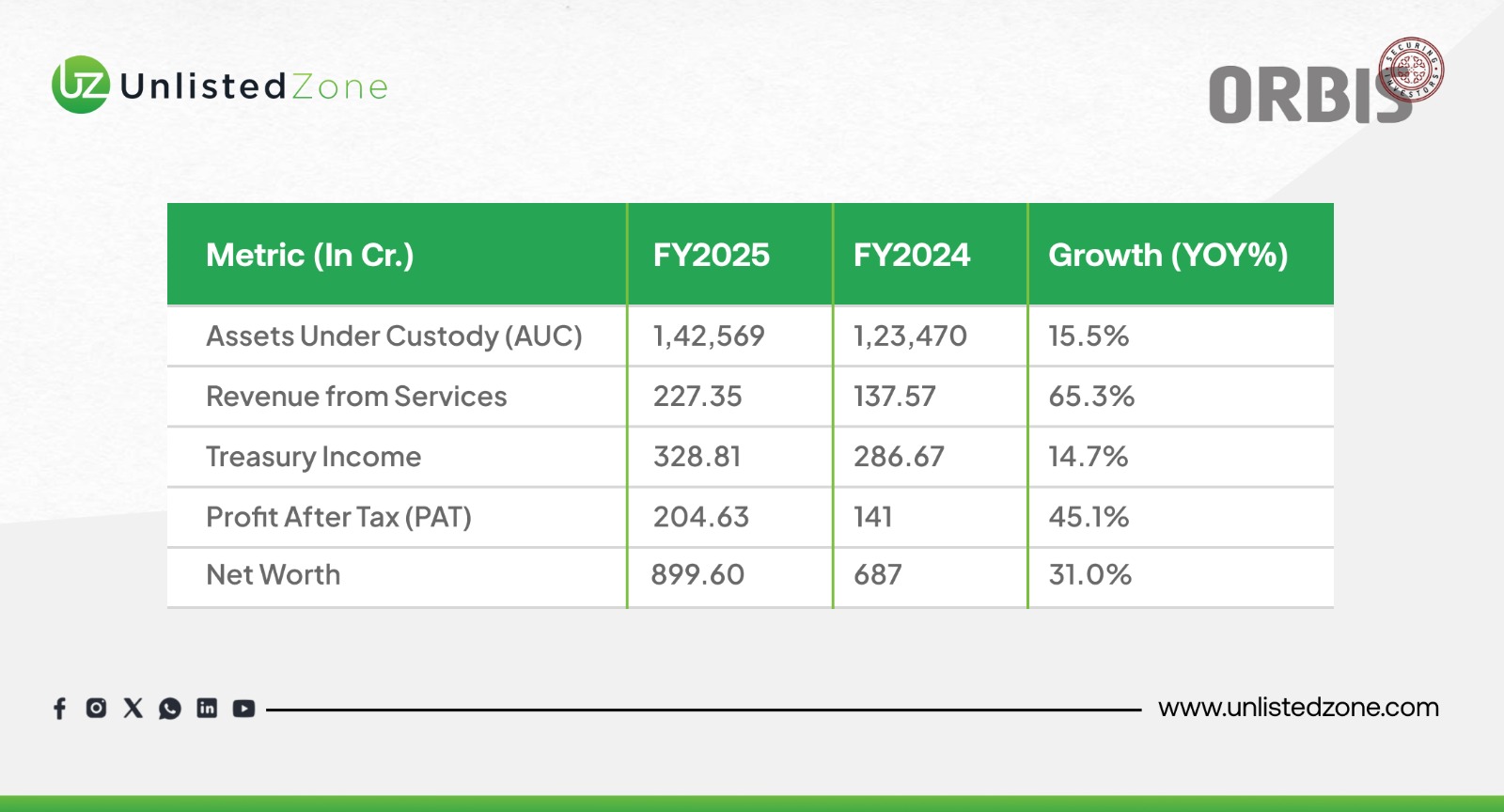

C) Orbis Financial Corporation: Key Highlights & Growth (FY24-FY25)

Other Operational Highlights (FY25)

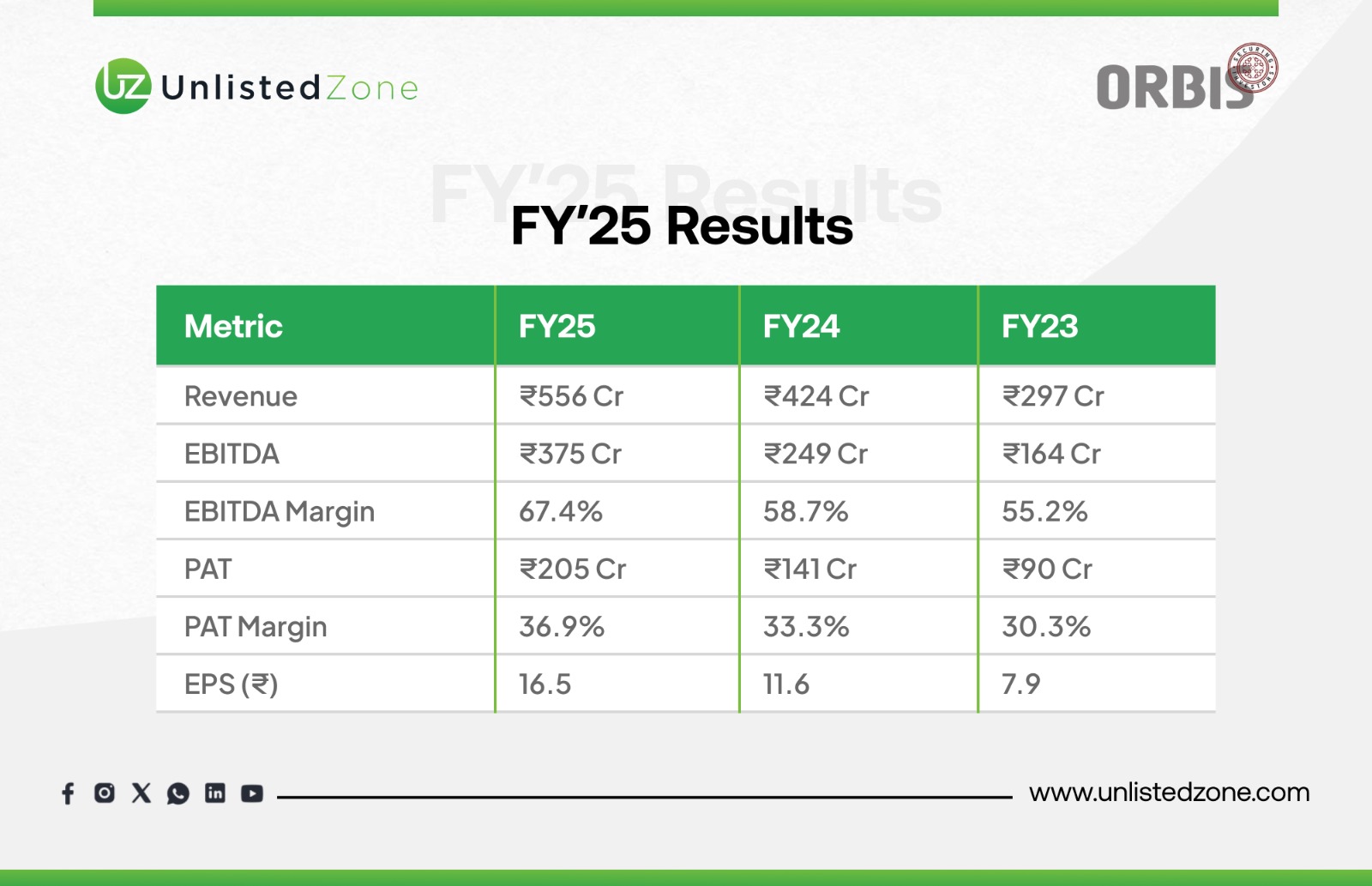

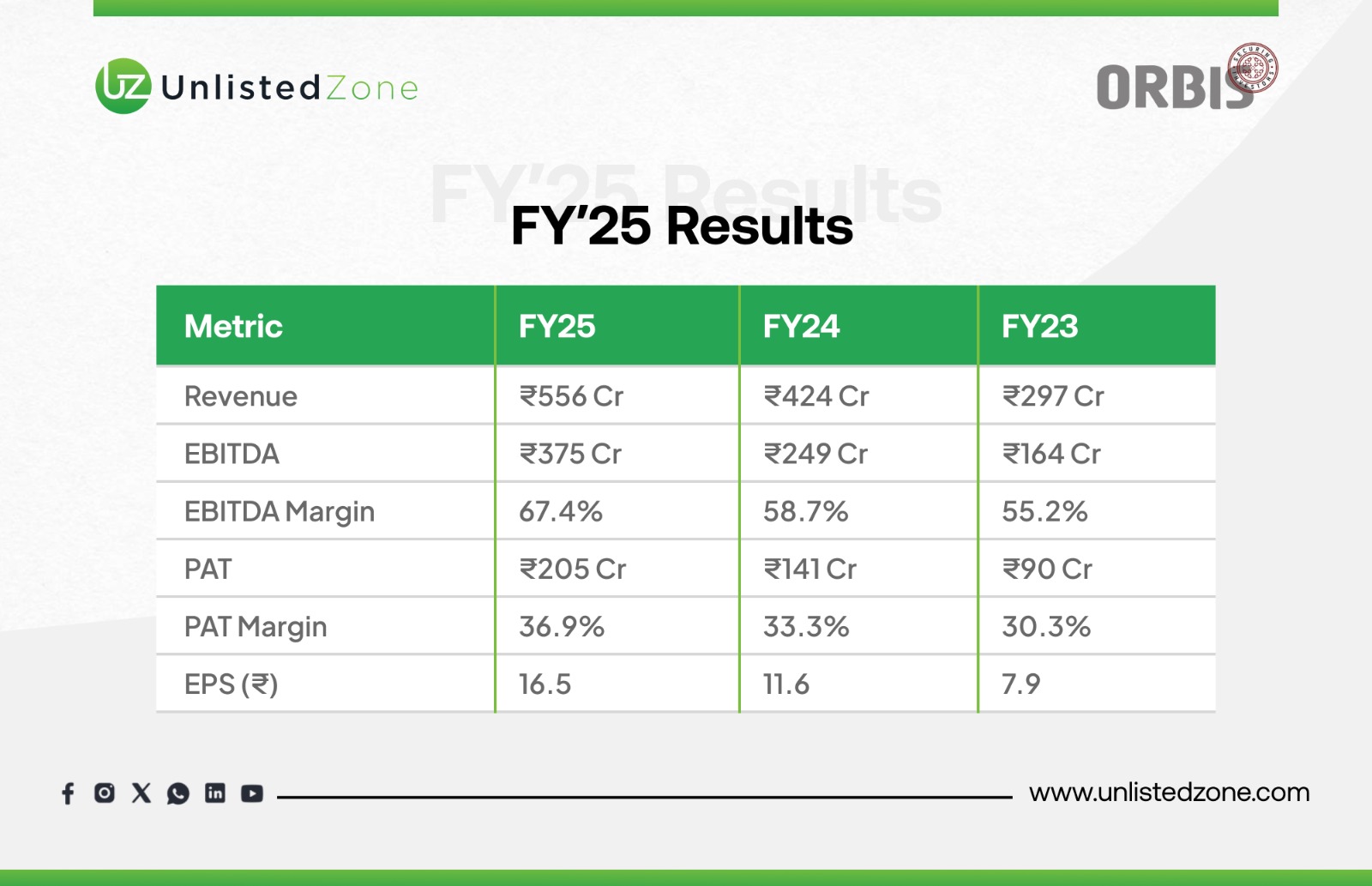

D) Financial Performance (FY23–FY25) of Orbis Financial Unlisted Shares

Revenue & Profitability of Orbis Financial Unlisted Shares

-

Revenue Growth:

-

Orbis’s revenue grew from ₹297 Cr in FY23 to ₹556 Cr in FY25, reflecting a robust CAGR of ~37%. This growth is driven by:

-

A 15.5% YoY increase in Assets Under Custody (AUC) to ₹1,42,569 Cr in FY25, indicating higher transaction volumes and client activity.

-

A significant 65.3% YoY jump in Revenue from Services (₹227.35 Cr in FY25 vs. ₹137.57 Cr in FY24), showcasing strong demand for custody, clearing, and RTA services.

-

A 14.7% YoY increase in Treasury Income (₹328.81 Cr in FY25), which likely benefits from managing client funds and margin flows in a high-interest-rate environment.

-

The growth aligns with Orbis’s expansion into GIFT City and increasing institutional participation (FPIs, AIFs, DIIs) in India’s capital markets.

-

Profitability and Margins:

-

EBITDA grew from ₹164 Cr in FY23 to ₹375 Cr in FY25, with the EBITDA margin expanding from 55.2% to 67.4%. This reflects:

-

Operational efficiency from technology-led processes, reducing costs relative to revenue.

-

Scaling benefits as AUC and client base (4,800+ active custody clients in FY25) grow.

-

PAT increased from ₹90 Cr in FY23 to ₹205 Cr in FY25, with the PAT margin rising from 30.3% to 36.9%. The consistent margin expansion highlights Orbis’s ability to convert revenue growth into profitability.

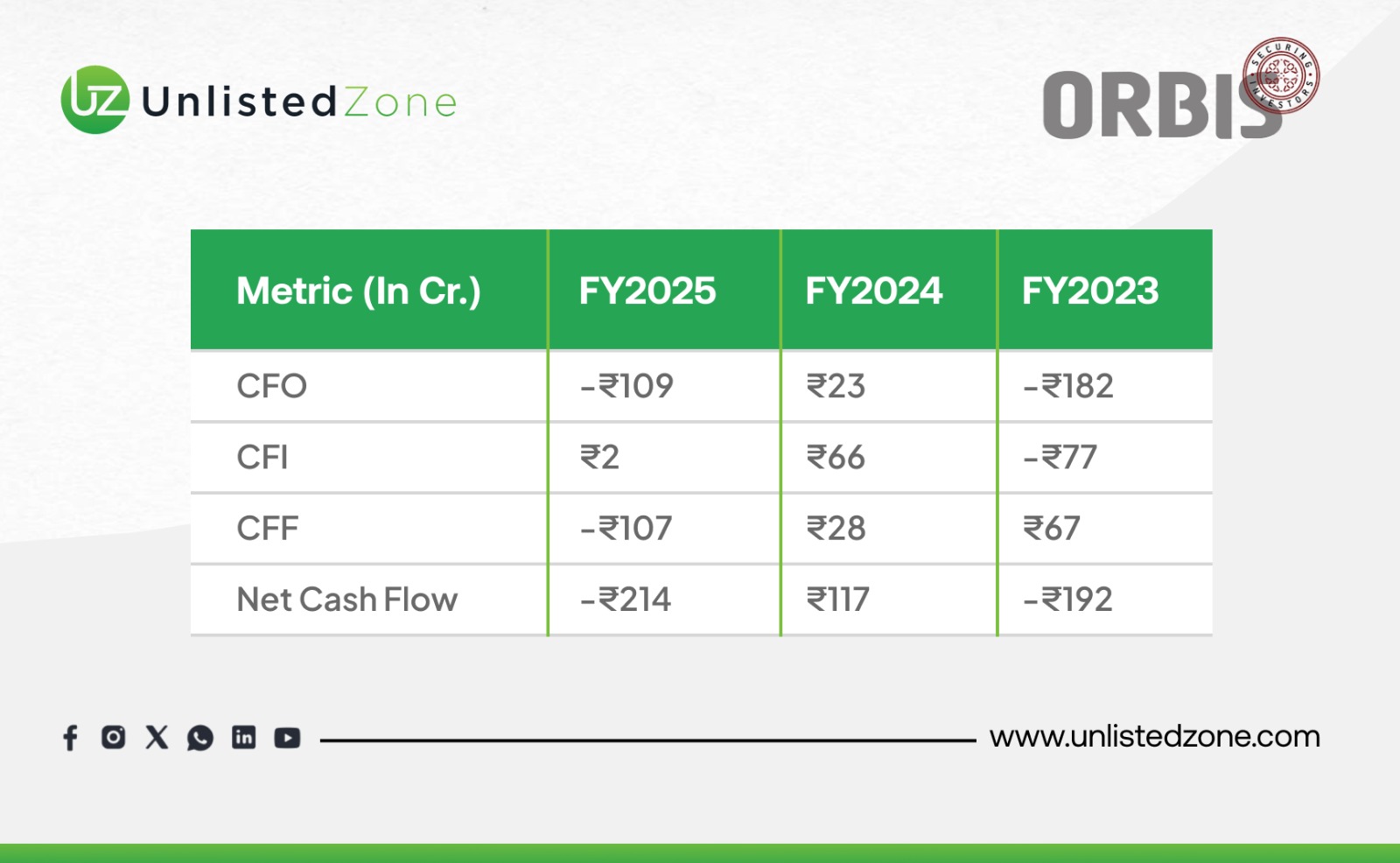

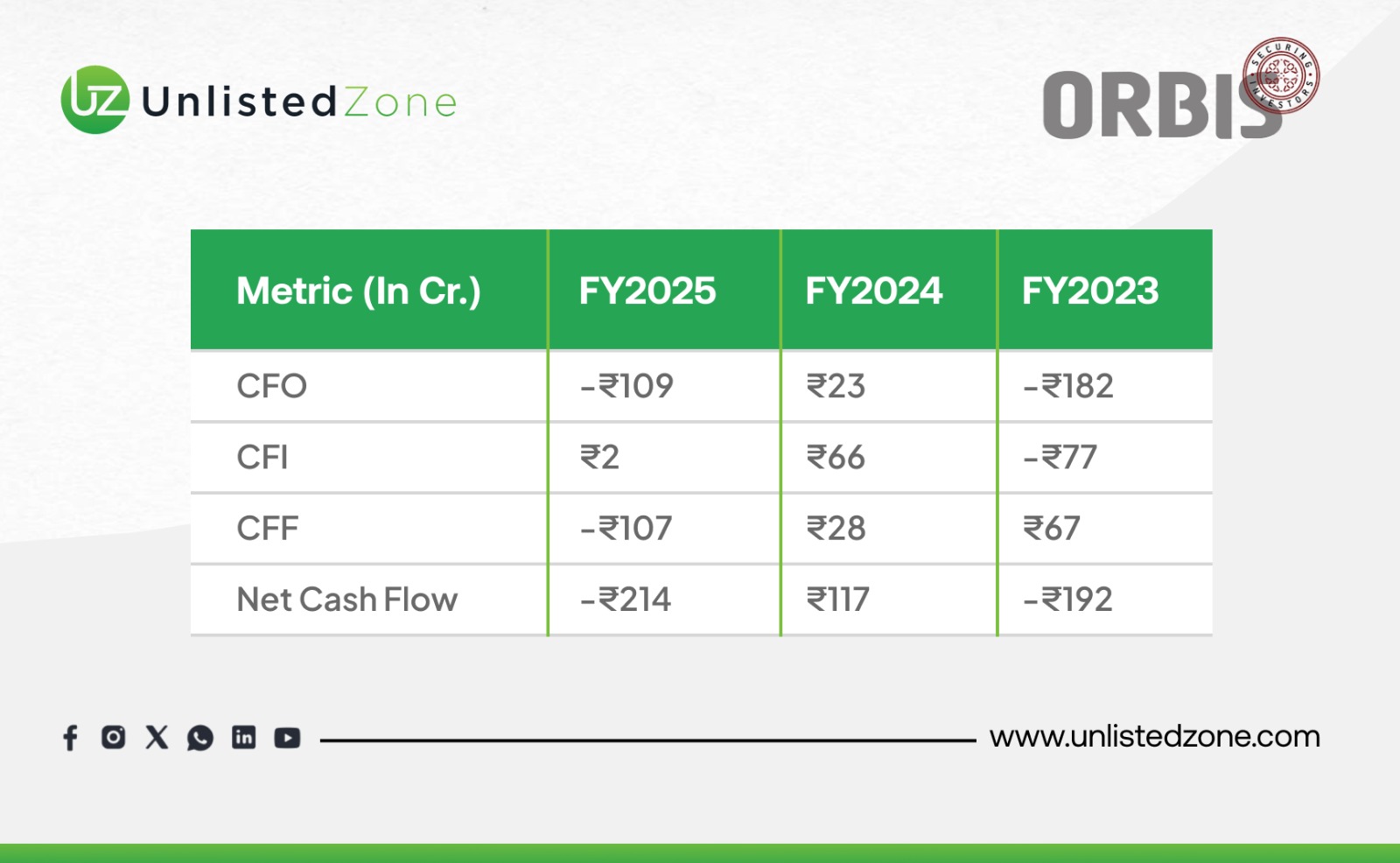

Cash Flow Analysis of Orbis Financial Unlisted Shares

-

Cash Flow from Operations (CFO):

-

FY25 saw a negative CFO of ₹109 Cr, compared to a positive ₹23 Cr in FY24 and a negative ₹182 Cr in FY23. The volatility is attributed to:

-

A significant ₹436 Cr outflow in working capital changes in FY25, typical for custodians handling client money and margin flows.

-

Custodial businesses often experience cash flow swings due to the timing of client fund settlements and margin requirements in equity, commodity, and currency derivatives.

-

Despite the negative CFO, Orbis’s business remains fundamentally strong, as evidenced by its profitability and zero-debt balance sheet.

-

Cash Flow from Investing (CFI):

-

CFI was negligible in FY25 (₹2 Cr), down from ₹66 Cr in FY24. This suggests limited capital expenditure or investments in FY25

-

The negative CFI in FY23 (-₹77 Cr) likely reflects earlier investments in infrastructure or tech upgrades.

-

Cash Flow from Financing (CFF):

-

FY25 saw a negative CFF of ₹107 Cr, possibly due to dividend payouts or share buybacks, as Orbis has no borrowings.

-

In contrast, FY24’s positive CFF (₹28 Cr) and FY23’s ₹67 Cr suggest prior capital-raising activities or inflows from shareholders.

-

Net Cash Flow:

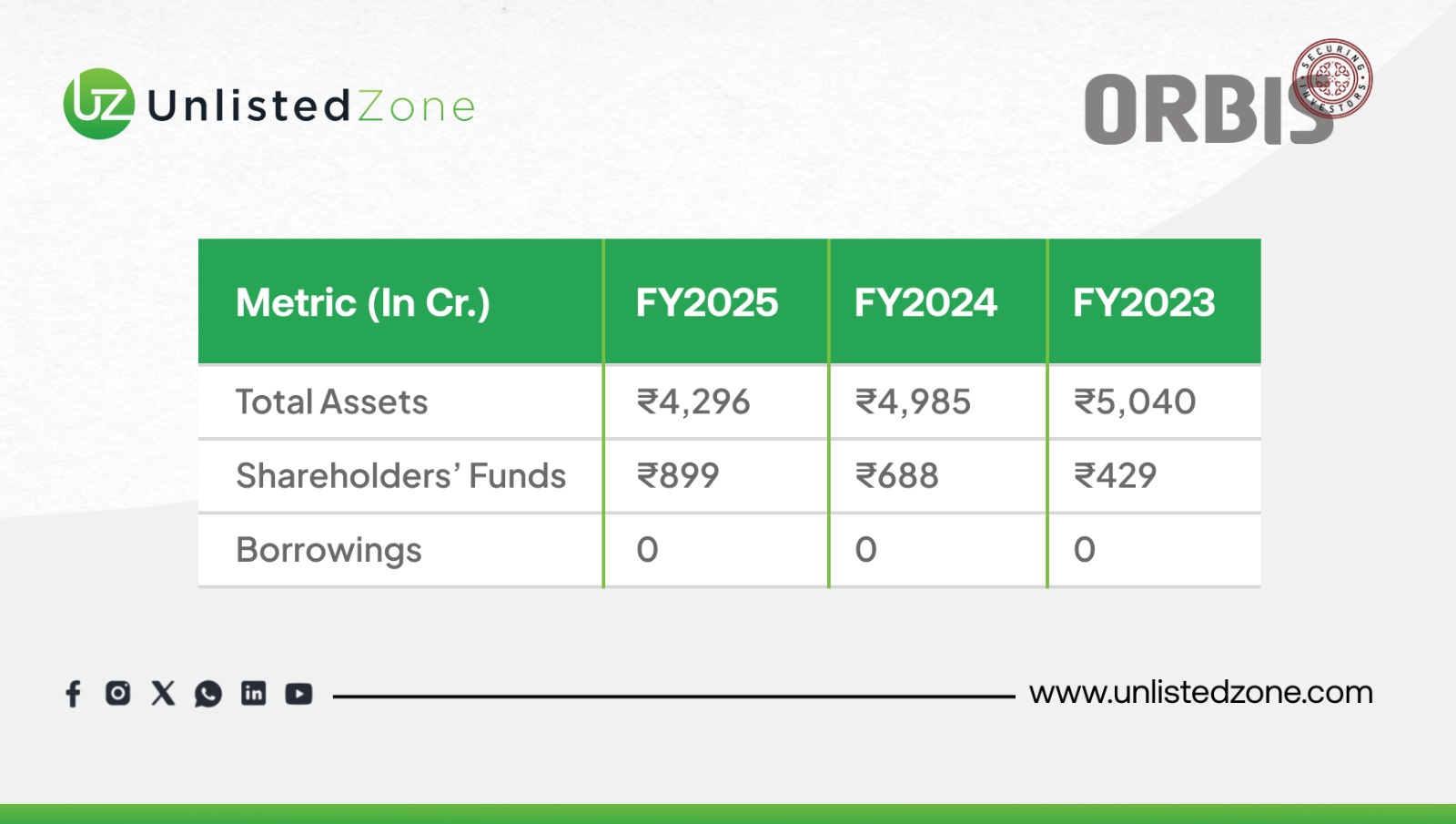

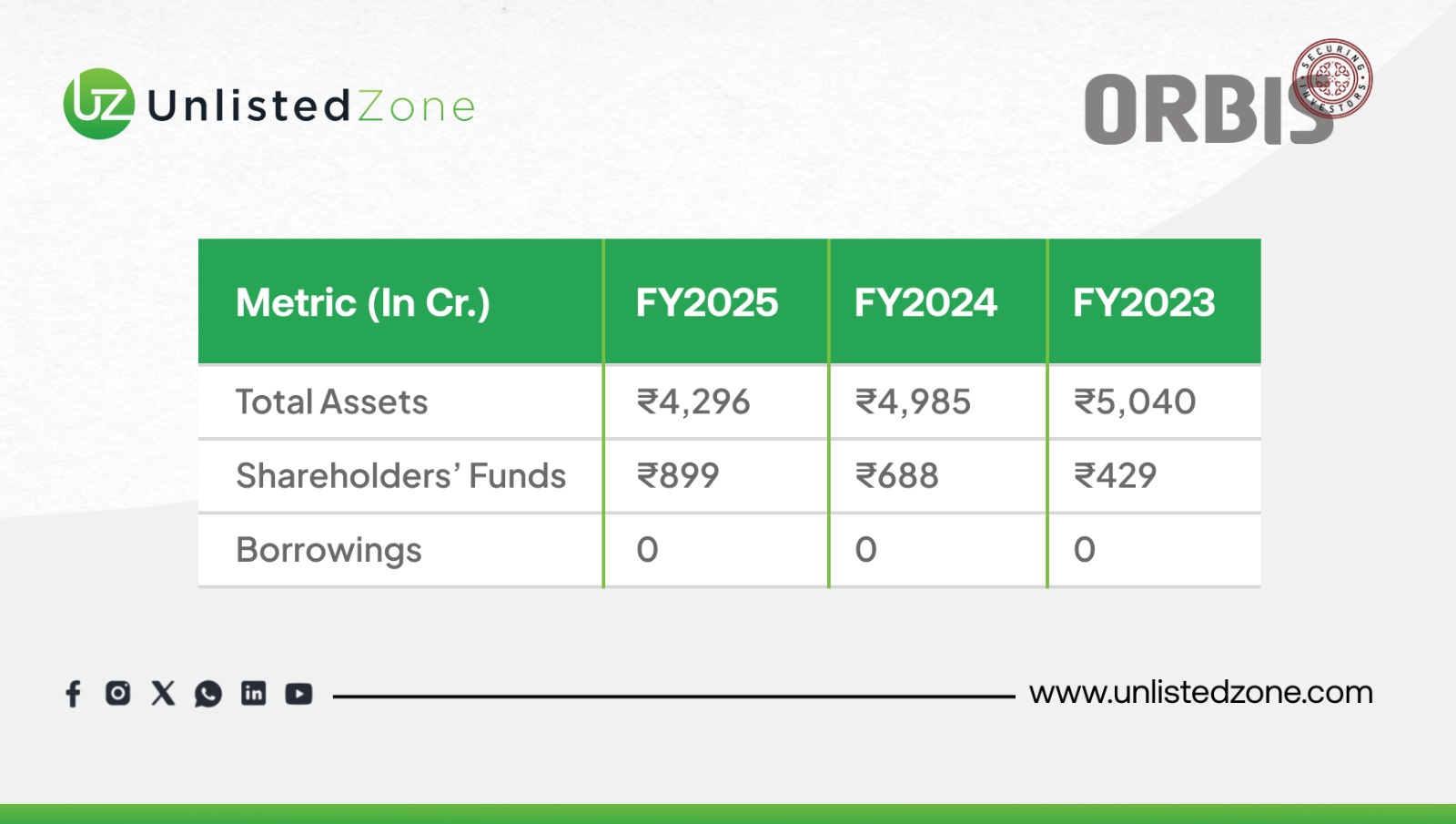

Balance Sheet Strength of Orbis Financial Unlisted Shares

-

Total Assets:

-

Total assets decreased from ₹5,040 Cr in FY23 to ₹4,296 Cr in FY25. Due to A contraction in client-driven assets (e.g., custodial funds or margin balances), which are volatile in nature.

-

Despite the decline, the asset base remains substantial for a company with 192 employees and an asset-light model.

-

Shareholders’ Funds:

-

Shareholders’ funds nearly doubled from ₹429 Cr in FY23 to ₹899 Cr in FY25, reflecting:

-

The increase in net worth strengthens Orbis’s ability to absorb market or operational shocks.

-

Zero Borrowings:

-

Liquidity and Resilience:

E) Management Discussion & Analysis (MD&A) on Orbis Financial Unlisted Shares

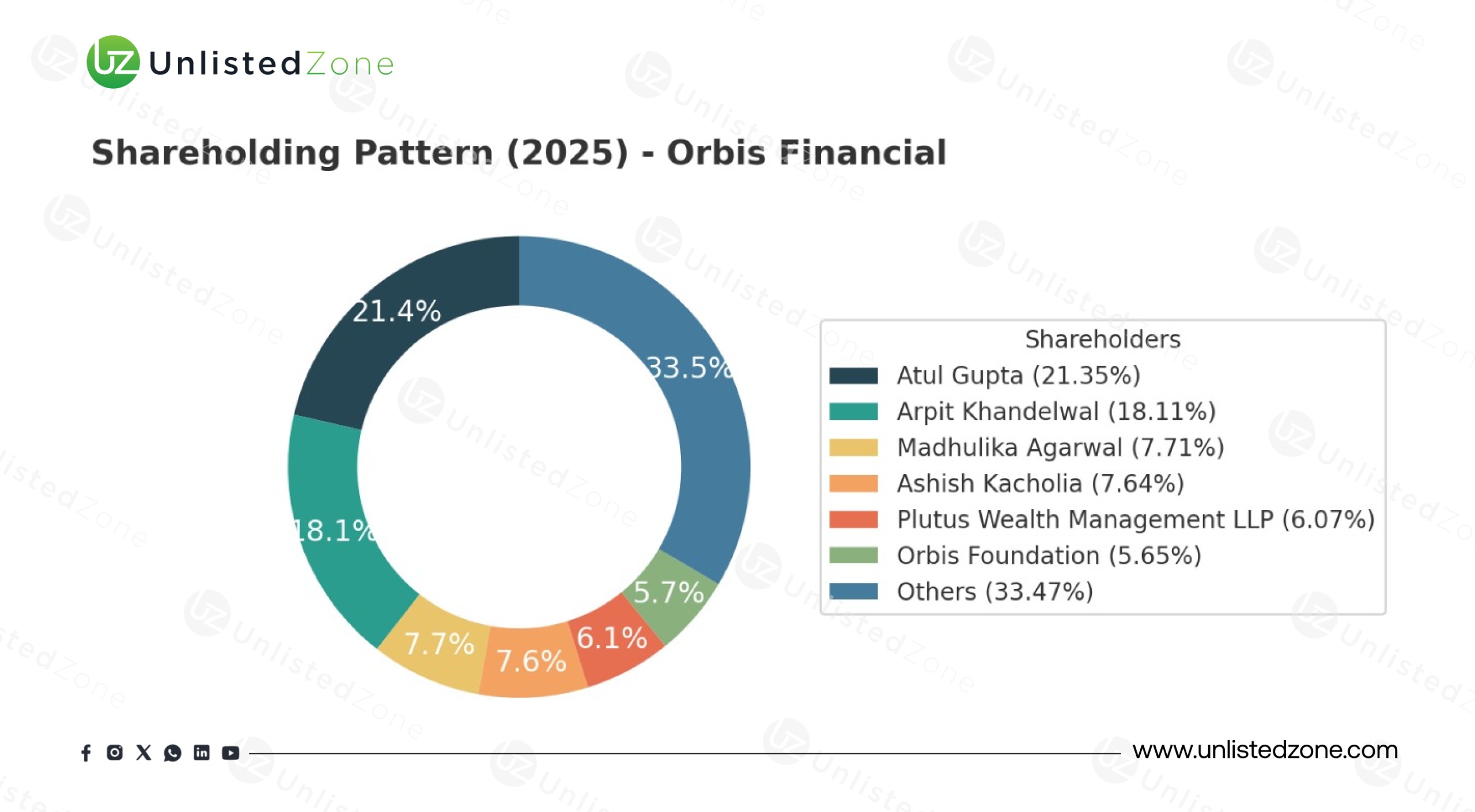

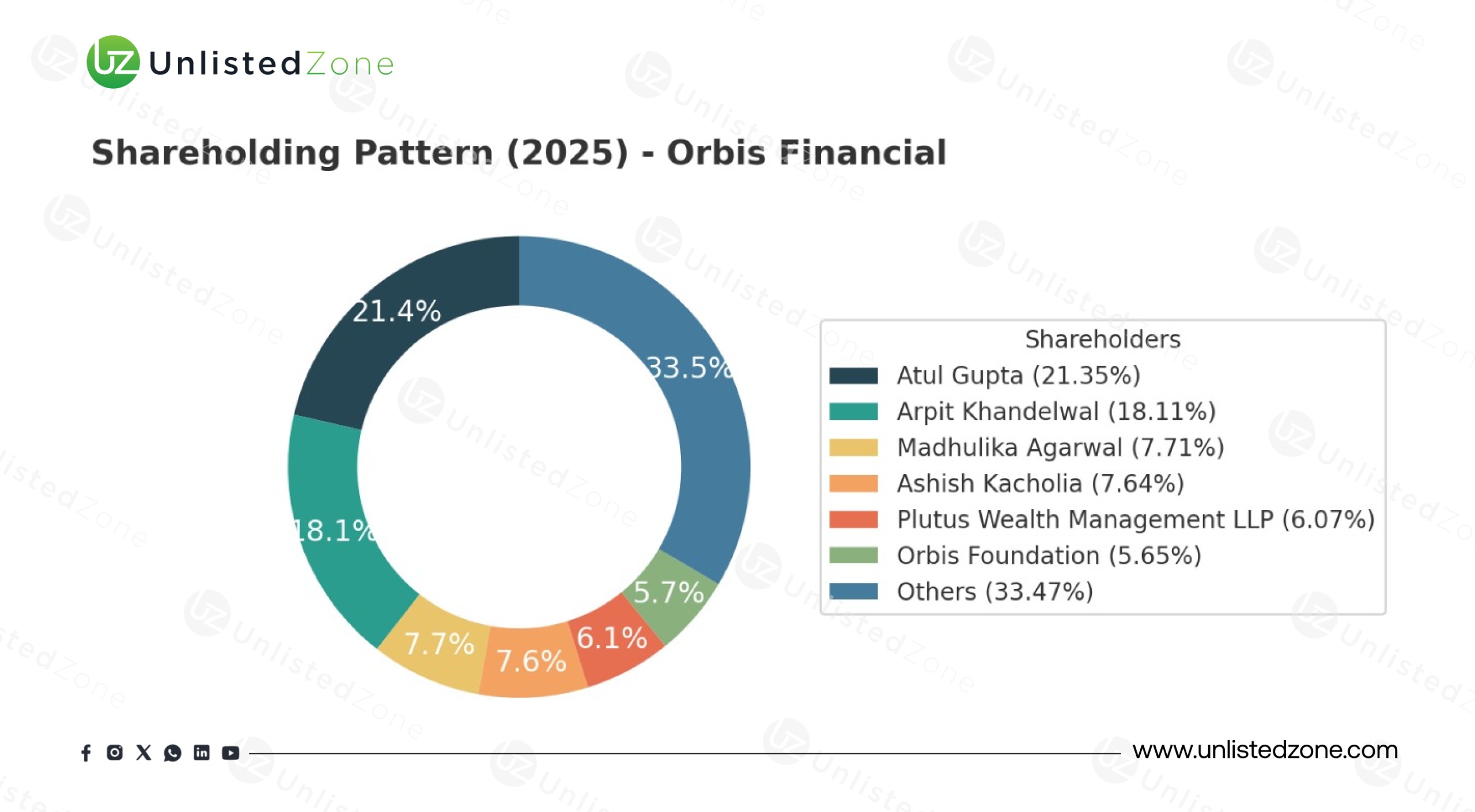

F) Shareholding Pattern (2025) of Orbis Financial Unlisted Shares

Promoter + key investors collectively hold a significant stake, reflecting skin in the game.

G) Valuation Insights (Unlisted Market) of Orbis Financial Unlisted Shares

H) Future Outlook og Orbis Financial Unlisted Shares

-

Growth Opportunities:

-

Rising participation of FPIs & AIFs in India.

-

GIFT City as a gateway for global fund flows.

-

Expanding demand for independent custodians outside bank-owned entities.

-

Tailwinds: Strong India capital market activity, regulatory push for transparency.

-

Headwinds: Volatile cash flows, high dependency on institutional capital markets.

I) UnlistedZone View

Orbis Financial is a rare play on India’s institutional capital market infrastructure. Its high-margin, asset-light, and debt-free business makes it an attractive bet for long-term investors.

-

Investment Thesis: Strong revenue growth, expanding margins, and institutional-grade client base.

-

Risks: Cash flow volatility, regulatory changes, and market dependency.

-

Suitability: Best suited for HNIs and long-term investors seeking exposure to India’s capital market backbone ahead of a potential future listing.

Discliamer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.