The National Stock Exchange (NSE) has demonstrated significant financial growth during the first half of FY25. Below, we delve into the key highlights from this period's performance.

1. Impressive Revenue Growth

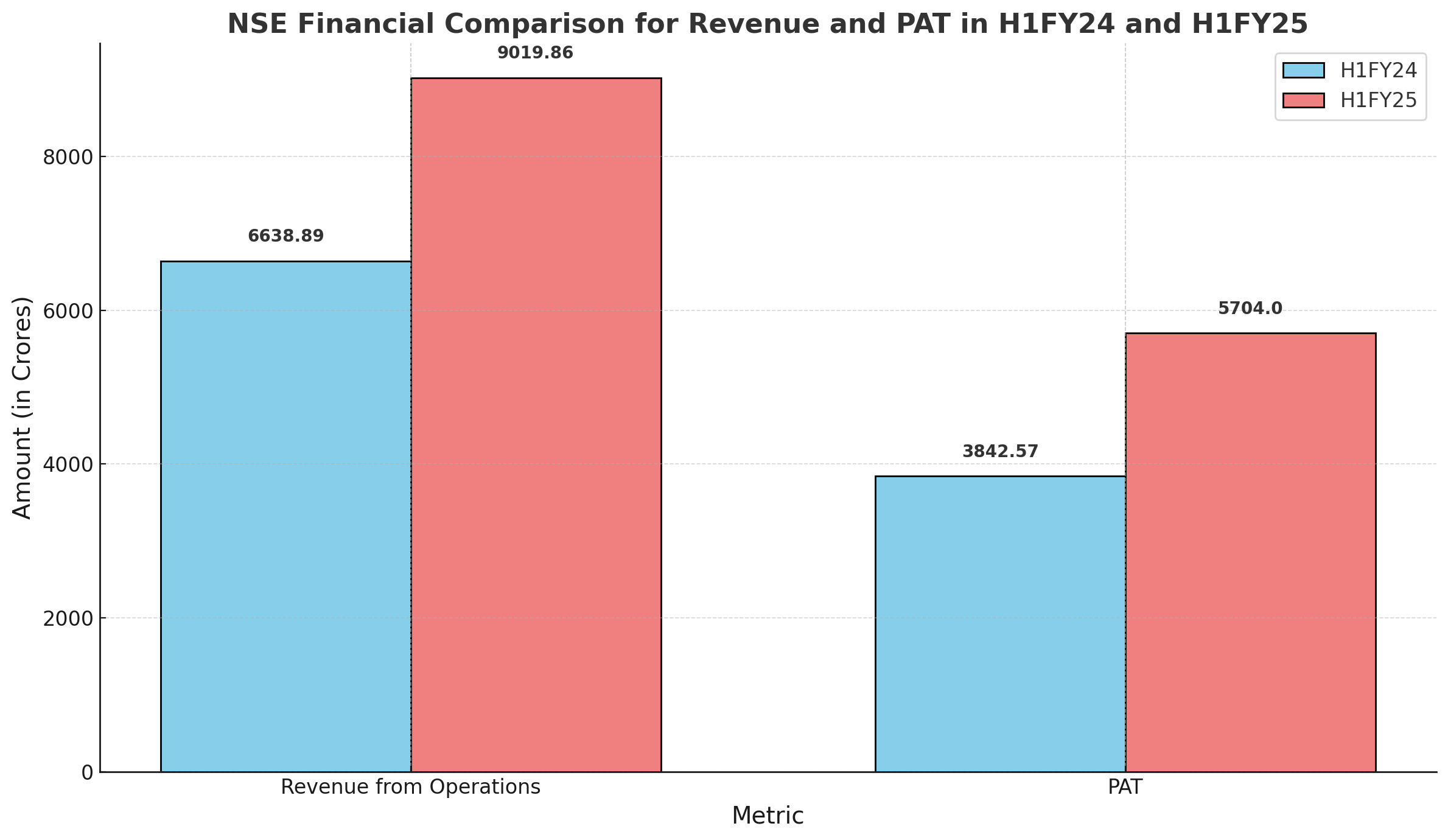

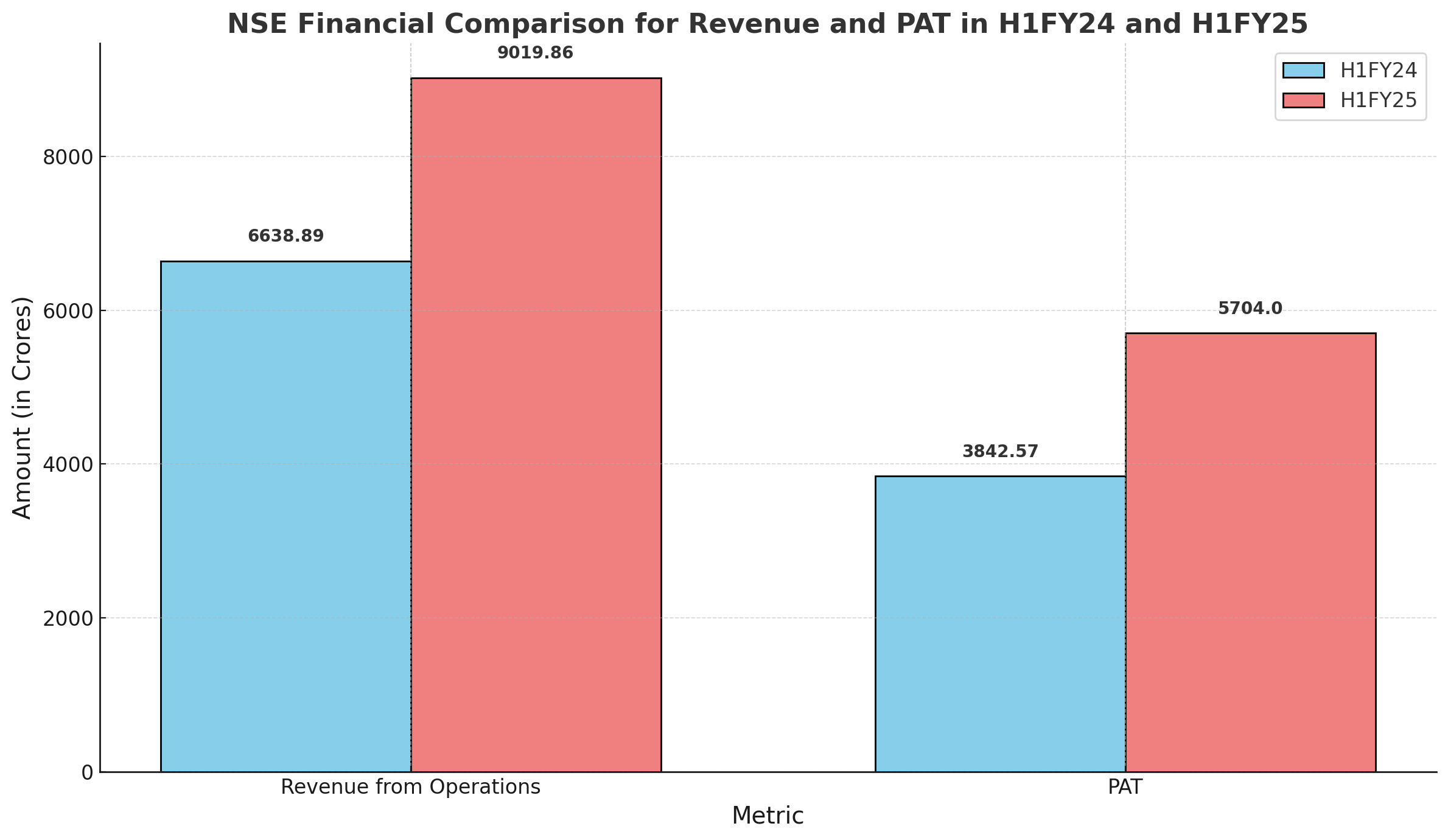

The NSE reported a remarkable 35% increase in its revenue from operations, climbing from ₹6,688 crore in H1FY24 to ₹9,000 crore in H1FY25. This robust growth can be attributed to increased trading volumes and heightened activity across various segments of the exchange.

2. Surge in Total Expenses

Despite the impressive revenue numbers, total expenses saw a substantial rise. In H1FY24, expenses before the contribution to the Core Settlement Guarantee Fund (SGF) stood at ₹1,665 crore. This figure surged by 60% to reach ₹2,672 crore in H1FY25. The significant increase was primarily due to a one-time payment of ₹642 crore made in September 2024 to settle a Trade Adjustment Program (TAP) case with the Securities and Exchange Board of India (SEBI). Such settlements, while impacting short-term expenses, are essential for maintaining the credibility and regulatory compliance of the exchange.

3. Contribution to Core SGF

A noteworthy change was seen in contributions to the Core SGF. While the NSE had contributed ₹610 crore during H1FY24, the contribution for H1FY25 was reduced to ₹160 crore. This reduction suggests that the current funding levels of the Core SGF are deemed sufficient by the NSE to meet SEBI regulations, ensuring stability in market operations.

4. Profit Surge Driven by Core Operations

Profit from core operations increased significantly, reflecting the underlying strength of the exchange. The profit figure rose from ₹3,893 crore in H1FY24 to ₹5,322 crore in H1FY25. This growth showcases the strong performance driven by NSE’s core operational activities, which continue to be a major revenue driver.

5. Strong Cash Flow Generation

Cash generation remains a crucial indicator of an entity’s operational health. For H1FY25, the total cash generated from operations was a solid ₹5,892 crore, indicating the NSE’s strong liquidity position and its ability to fund ongoing and future growth initiatives.

6. Projected EPS Growth

A key metric for investors, the Earnings Per Share (EPS), shows promising growth based on H1FY25 numbers. Post-bonus and annualized, the EPS is projected to be close to ₹40. This suggests a positive outlook for shareholders, reflecting strong returns and the potential for future dividends.

7. Anticipated Impact of SEBI's New F&O Regulations

The Securities and Exchange Board of India (SEBI) has introduced new regulations aimed at curbing speculative retail trading in the Futures and Options (F&O) segment. These measures, set to take effect in phases beginning November 20, 2024, include:

-

Reduction of Weekly Expiries: SEBI will reduce the number of weekly expiries for index derivative contracts to one per benchmark index per exchange. This aims to curb speculative trading and limit the risks associated with uncovered or naked option selling.

-

Increased Contract Sizes: The minimum trading amount for derivatives will rise from the current range of ₹5–10 lakh to ₹15 lakh. This increase aims to ensure that investors take on appropriate risks while participating in the derivatives market.

-

Higher Margin Requirements: To address the high volatility observed on expiry days, SEBI will implement an additional extreme loss margin (ELM) of 2% for all open short options on the day of expiry. This measure is intended to protect investors from extreme market fluctuations, particularly during high-volume trading sessions.

These regulatory changes are expected to impact trading volumes in the F&O segment. Analysts suggest that the new measures could lead to a reduction of up to 40% in NSE’s options premium turnover, which has raised concerns among investors and traders alike.

Conclusion

The NSE's half-yearly performance for FY25 paints a picture of robust revenue growth coupled with significant one-time expenses. While the increase in costs, driven by compliance and settlement-related payments which are essential for an IPO, impacted overall expenditure, the growth in profit and strong cash flow generation underscore the exchange’s resilience and solid operational foundation. However, the forthcoming SEBI regulations on F&O trading are anticipated to influence trading volumes and revenue streams. Investors should monitor how the NSE adapts to these regulatory changes in the second half of FY25, as sustained growth could further strengthen its financial footing and boost shareholder value.