NSE's latest results reveal the true cost of SEBI's regulatory tightening on derivatives trading. Behind the headline numbers lie two major one-time items that tell a more complex story.

A) The Headline Numbers

- Revenue: ₹7,709 crore (down 15% YoY)

- Reported PAT: ₹5,022 crore (down 12% YoY)

- Operating Margin: 77% (normalized)

B) The Two One-Time Items That Matter

1. SEBI Settlement Provision: -₹1,297 Crore

A one-time charge for the legacy colocation and dark fiber matter from 2015-16. SEBI's approval is still pending.

2. NSDL Stake Sale Profit: +₹1,201 Crore

NSE booked a one-time gain from selling its stake in NSDL.

C) What's the Real Performance?

When you remove both exceptional items, here's the truth:

Normalized Core PAT: ~₹5,092 crore (down 11% from ₹5,704 crore)

The core business genuinely took a hit. This isn't just accounting - it's the real impact of SEBI's F&O regulations.

D) Where's the Pain Coming From?

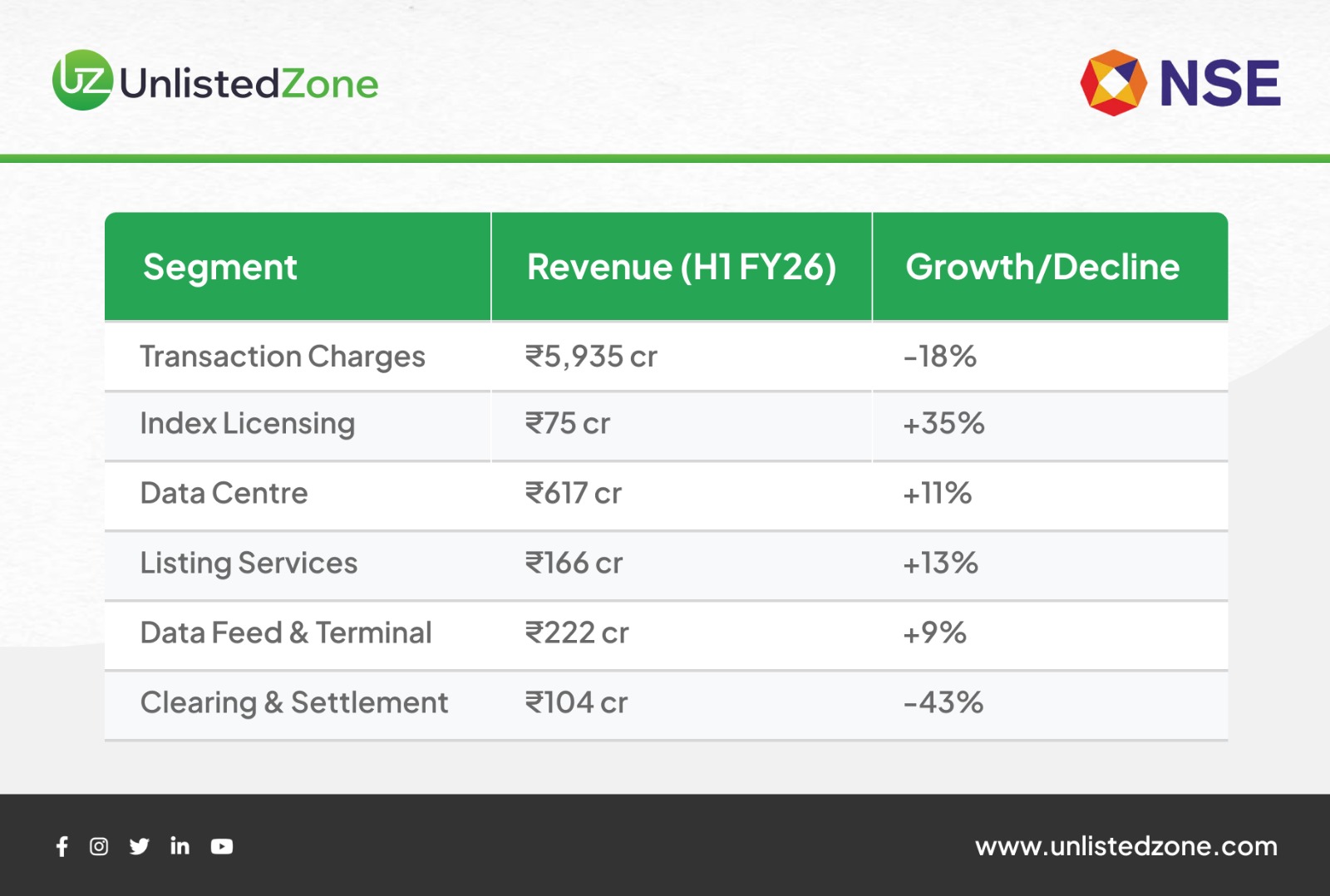

Transaction Charges Collapsed

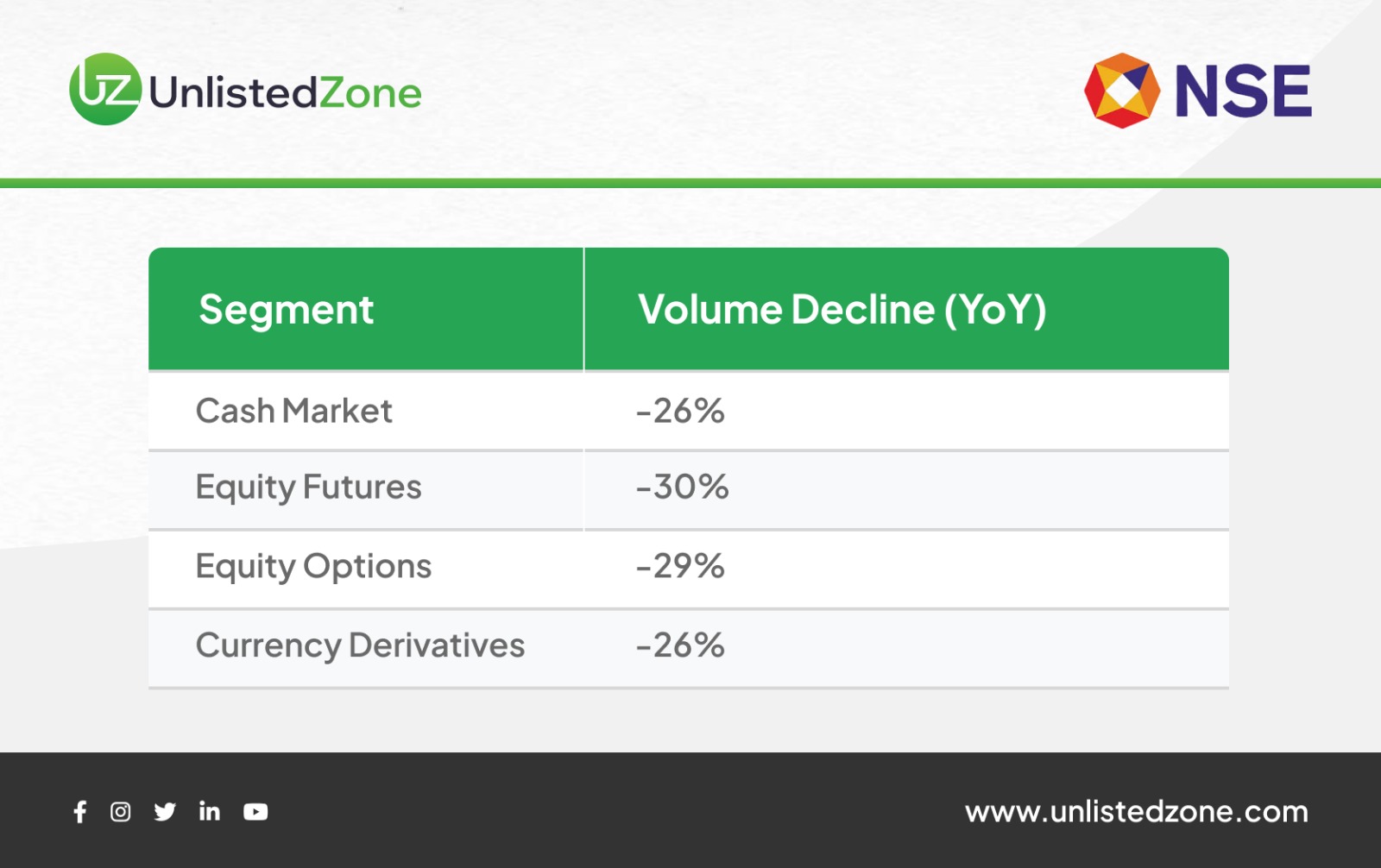

Transaction charges fell 18% to ₹5,935 crore, driven by massive volume declines:

Why? SEBI's measures to curb speculation:

- Bigger contract sizes

- Fewer weekly expiries (only one index instead of multiple stocks)

- Higher margin requirements

- Stricter position limits

- Upfront collection mandates

F) The Good News: Margin Expansion

Despite revenue falling 15%, NSE improved its operating margin to 77% from 72% last year.

How? Expenses (excluding SEBI provision) dropped 26% through:

- Tight cost control

- Operating leverage from past technology investments

- Regulatory fees down 36% (linked to lower volumes)

This demonstrates NSE's ability to protect profitability even when revenues decline - a sign of operational excellence.

G) Market Dominance Still Intact

NSE's monopoly position hasn't changed one bit:

Market Share (Q2 FY2026):

- Cash Market: 92.3%

- Equity Futures: 99.8%

- Equity Options: 75.6% (by premium value)

- Currency Derivatives: 100%

Global Rankings:

- World's #1 derivatives exchange (by number of contracts)

- World's #3 equity exchange (by number of trades)

H) Capital Markets Remain Healthy

While trading volumes fell, primary markets stayed strong:

- Total fund mobilization: ₹9.7 trillion

- IPO listings: 122 (Mainboard & SME)

- IPO capital raised: ₹0.6 trillion

- Total investor accounts: ~24 crore (growing)

- Unique investors: 12+ crore

- Listed companies: 2,856

This shows that while trading activity moderated, India's capital formation story remains intact.

I) What It Means for NSE Unlisted Share Investors

Current unlisted market price: ₹1900 per share

The Reality Check

Positives:

- 77% operating margins demonstrate pricing power

- Market monopoly unchanged across all segments

- Non-F&O businesses growing strongly (Index +35%, Data +11%)

- Strong balance sheet with healthy treasury income

- Long-term India growth story intact

- Investor base continuing to expand

Concerns:

- Core profits down 11% - this is a real decline

- F&O volumes show no recovery signs yet

- Near-term earnings visibility is weak

- SEBI settlement outcome still pending

- Volume recovery timeline uncertain (could take 2-4 quarters)

- Transaction charges constitute 77% of revenue - heavy concentration

J) Valuation Perspective

With normalized EPS of ~₹20.60 for H1 FY26 (annualized ~₹41-42), current unlisted prices imply a P/E multiple of 47.5x.

This premium valuation assumes:

- Volume recovery within 12-18 months

- Favorable resolution of SEBI settlement and IPO

- Continued market dominance

- Long-term structural growth in Indian capital markets

- No further regulatory tightening

Is it justified?

For patient, long-term investors who believe in India's financialization story - possibly yes. For those seeking near-term gains or margin of safety - the valuation leaves little room for disappointment.

H) Quarter-on-Quarter Trends

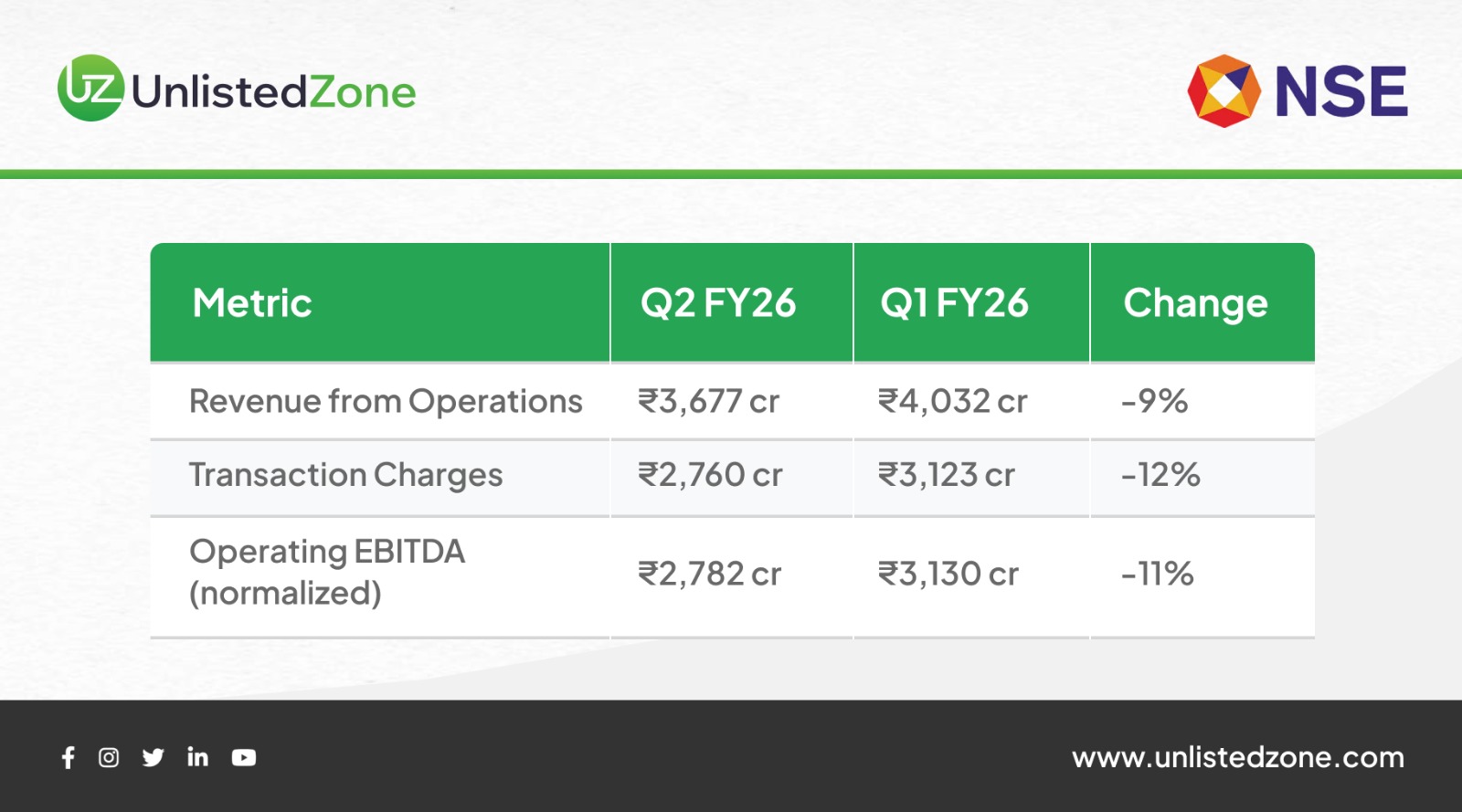

Q2 FY2026 vs Q1 FY2026 shows continued pressure:

The sequential decline indicates that regulatory impact is still playing out, and volumes haven't found a bottom yet.

I) The Outlook

Next 6 months (Short-term):

- F&O volumes likely to remain under pressure

- Transaction revenues will stay weak

- Limited earnings growth visibility

- Focus on cost management to protect margins

12-24 months (Medium-term):

- Volumes should stabilize at a new equilibrium (lower than pre-regulation levels)

- Market adapts to new F&O rules

- Growth comes from investor base expansion rather than trading intensity

- Non-transaction revenue streams gain importance

- Potential SEBI settlement resolution

3+ years (Long-term):

Structural growth drivers remain powerful:

- Financialization of Indian household savings

- Demographic dividend (young population entering investing years)

- Digital adoption and fintech penetration

- Passive investing boom (NSE indices dominate)

- Corporate growth driving capital raising needs

- Deepening of India's capital markets

J) IPO Timeline and Implications

The long-awaited NSE IPO has been delayed primarily due to the colocation matter.

Expected Timeline: 12-18 months after SEBI settlement approval

Potential IPO Size: ₹15,000-20,000 crore (likely one of India's largest)

Estimated Valuation: ₹3.75-4 lakh crore (market conditions dependent)

For unlisted shareholders: The IPO will provide:

- Exit liquidity opportunity

- Price discovery in public markets

- Potential premium to current unlisted rates (depending on market sentiment)

- Enhanced transparency and regular disclosures

K) Key Risks to Monitor

1. Regulatory Risk: Further tightening of F&O regulations or new compliance requirements.

2. Volume Risk: Extended period of low trading activity or permanent structural decline in derivatives trading.

3. Competition Risk: Though minimal currently, regulatory changes could enable competitors like BSE.

4. Market Cyclicality: Prolonged bear market could further impact volumes and sentiment.

5. Technology Risk: Cybersecurity threats, system failures, or disruptive technologies.

6. Execution Risk: Inability to diversify revenue streams or develop new products.

L) Investment Verdict

For existing unlisted shareholders: Hold position. This is a quality business navigating temporary regulatory headwinds. The fundamental franchise value remains intact.

For fresh buyers at ₹1900-2000: Exercise caution. Current prices reflect optimistic assumptions about recovery. Better to wait for:

- Clarity on SEBI settlement outcome

- Signs of volume stabilization (2-3 quarters of data)

- IPO timeline announcement

- Better margin of safety

Best case for fresh entry: If volumes stabilize by Q4 FY26 and SEBI settlement is concluded favorably, current levels could prove attractive in a 3-5 year perspective.

Risk case: If F&O volumes decline further or stabilize at permanently lower levels, and if SEBI settlement is harsher than expected, current valuations may be stretched.

M) The Bottom Line

NSE's H1 FY2026 results show a genuine 11% decline in core business profits once you strip away the NSDL sale gain and SEBI provision. This is not accounting noise - it's real business impact from SEBI's F&O regulatory crackdown.

Volumes are down 26-30% across all segments, and there are no immediate signs of recovery. The market is still adjusting to the new regulatory regime, and this process will take time.

However, the fundamental business quality remains exceptional:

- Near-monopoly in all product segments

- 77% operating margins (among the highest globally)

- Proven ability to protect profitability through cost management

- Growing diversified revenue streams (index, data, listing)

- Strong balance sheet and cash generation

- Positioned at the heart of India's growth story

The honest assessment: This is a high-quality monopoly business going through a difficult transition period. The regulatory changes were necessary to protect retail investors from excessive speculation, and NSE is bearing the cost of that social good.

For long-term investors who can handle 2-3 quarters of earnings weakness and believe in India's long-term capital markets growth, NSE remains compelling. The current moderation in volumes is real, but the structural story hasn't changed.

For those seeking near-term returns or margin of safety, current unlisted prices at 100x earnings offer limited cushion against further disappointment.

NSE will remain what it always was - India's financial market infrastructure backbone. Just growing slower than before, which is the price of a more responsible and sustainable derivatives market.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. NSE unlisted shares are illiquid securities with limited price discovery and high risk. Past performance is not indicative of future results. Investors should conduct thorough due diligence and consult qualified financial advisors before making any investment decisions. The author may or may not hold positions in the securities discussed.

Source: NSE Investor Presentation Q2 | H1 FY2026, dated November 4, 2025