A) About the Company

NCL Buildtek Ltd., part of the prestigious ₹3,000 crore NCL Group, is a 30+ year legacy brand in the building materials sector. Originally known as NCL Alltek & Seccolor Ltd., the company was rebranded to represent its expanded portfolio as a one-stop-shop for construction solutions. It operates 17 manufacturing units across India and is a pioneer in putty and Colour Coated Galvanized Iron (CCGI) technology in India. The company’s business is segmented into four key verticals:

-

NCL Windoors: Manufacturing of CCGI, uPVC, Aluminium windows & doors, Colour-Coated GI Windows & Doors and ABS doors through international collaborations.

-

NCL Coatings: Manufacturing of wall putties, paints, emulsions and textures.

-

NCL Wall Solutions: Production of Aerated Autoclaved Concrete (AAC) blocks, dry-mix mortars, and tile adhesives.

-

NCL Services: Providing services to buildings and manufacturing units.

International Partnerships

Coatings: ICP, Sweden for putties, textures, and paints.

Windows & Doors:

CCGI Steel: Secco, Italy

uPVC: VEKA AG, Germany

High-End Aluminium: SCHÜCO, Germany

ABS Doors: KOS

B) Key Highlights of the Year

-

Challenging Macro Environment: FY25 was a tough year due to general elections, state-level transitions in key markets (Andhra Pradesh and Telangana), liquidity constraints, and extended monsoons.

-

Strategic Expansions: The company successfully commissioned its new Steel Doors manufacturing facility in Q4 FY25.

-

Exceptional Growth in New Verticals: The Aluminium business grew 125% YoY, and the Tile Adhesives business grew over 85% YoY, albeit from a small base.

-

Legacy Product Decline: The CCGI and AAC Blocks divisions witnessed significant declines of 30% and 20% YoY, respectively, impacting overall revenue.

C) Financial Performance Analysis

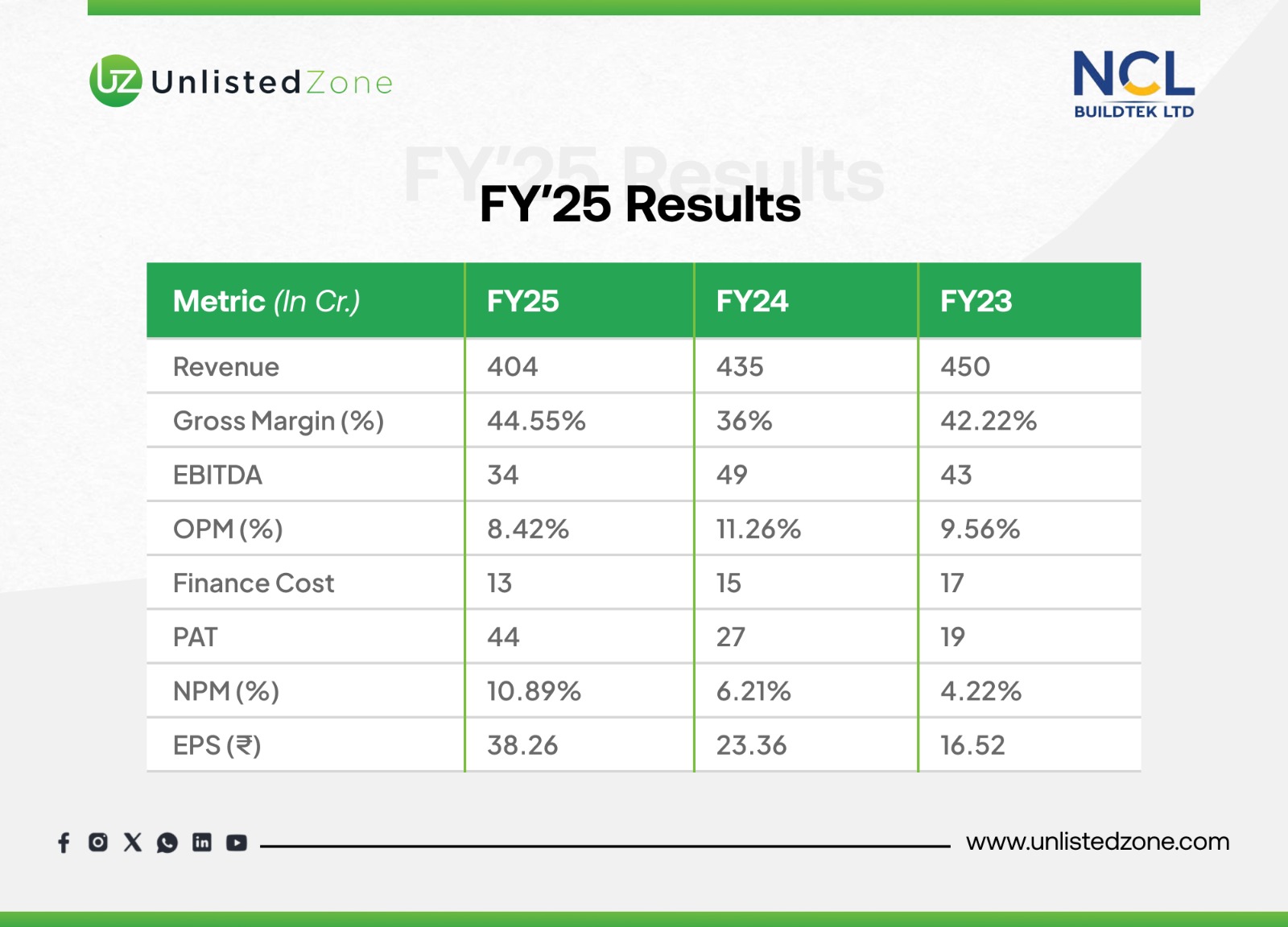

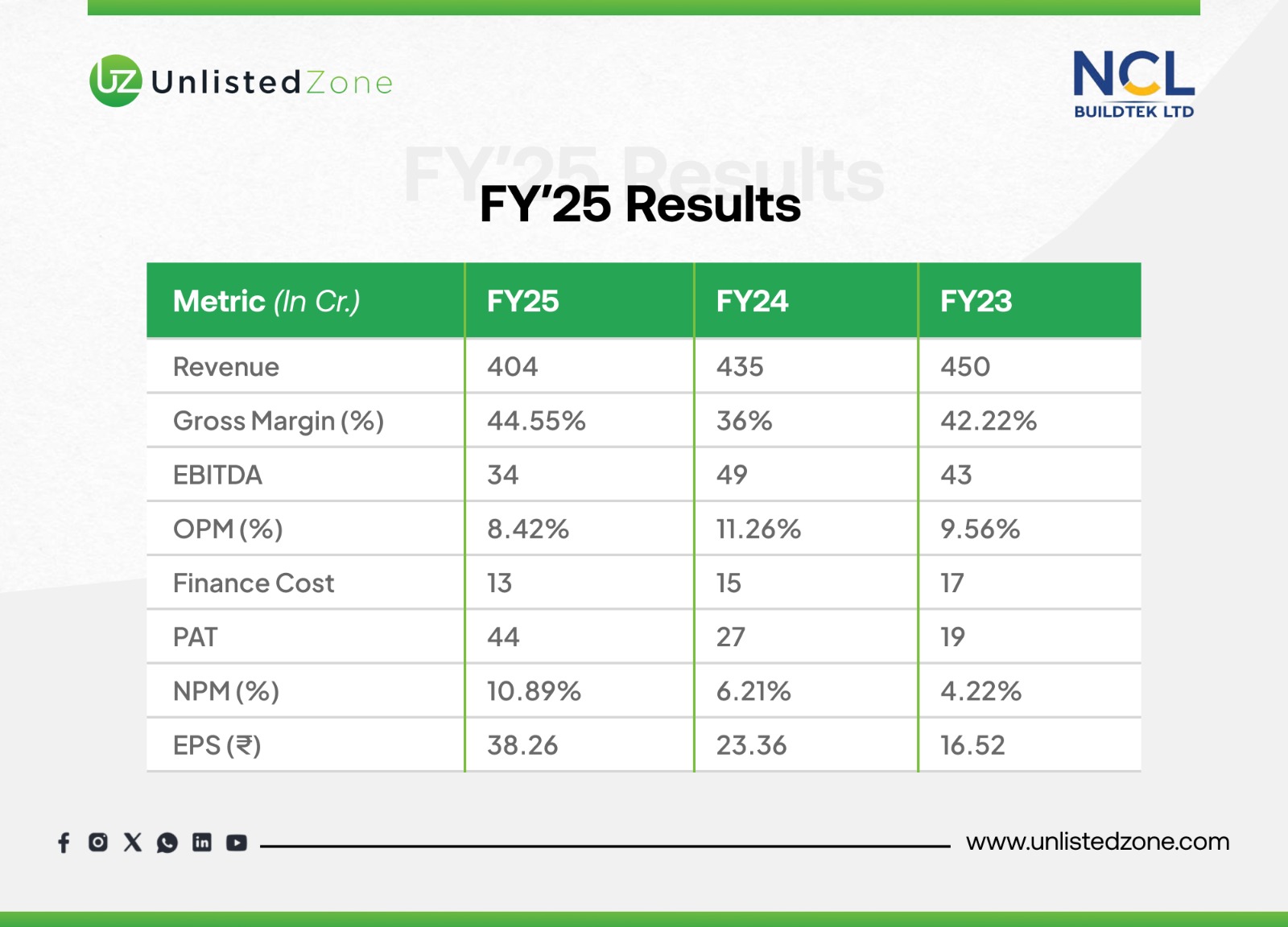

Profit & Loss Statement (₹ in Crores)

A year of contrasting performance. Revenue declined due to market headwinds, but bottom-line profitability surged to record levels, driven by exceptional other income.

Key Observations:

-

Top-Line Pressure: Revenue fell consistently (₹450Cr → ₹404Cr), reflecting a tough market for building materials.

-

Core Operating Weakness: EBITDA and Operating Profit Margin (OPM) declined in FY25, indicating profitability from main business activities was squeezed.

-

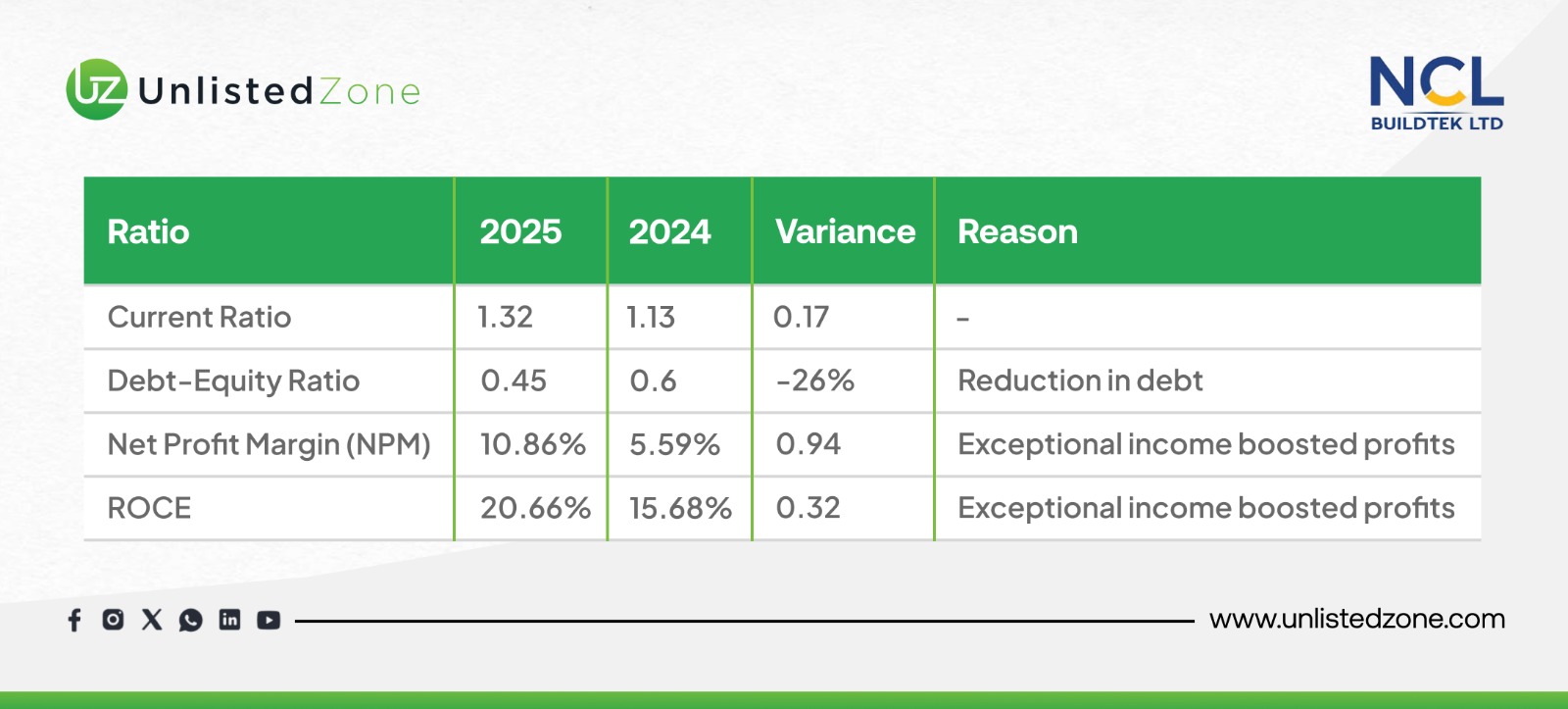

Bottom-Line Strength: Despite operational challenges, Net Profit (PAT) more than doubled in two years (₹19Cr → ₹44Cr), and Net Profit Margin (NPM) hit 10.89%, primarily due to a large, one-off ₹48Cr other income.

-

Improved Financial Health: The company reduced its debt, leading to a lower finance cost (₹17Cr → ₹13Cr), strengthening the balance sheet.

-

Shareholder Value: Earnings Per Share (EPS) grew dramatically to ₹38.26, making the stock more attractive.

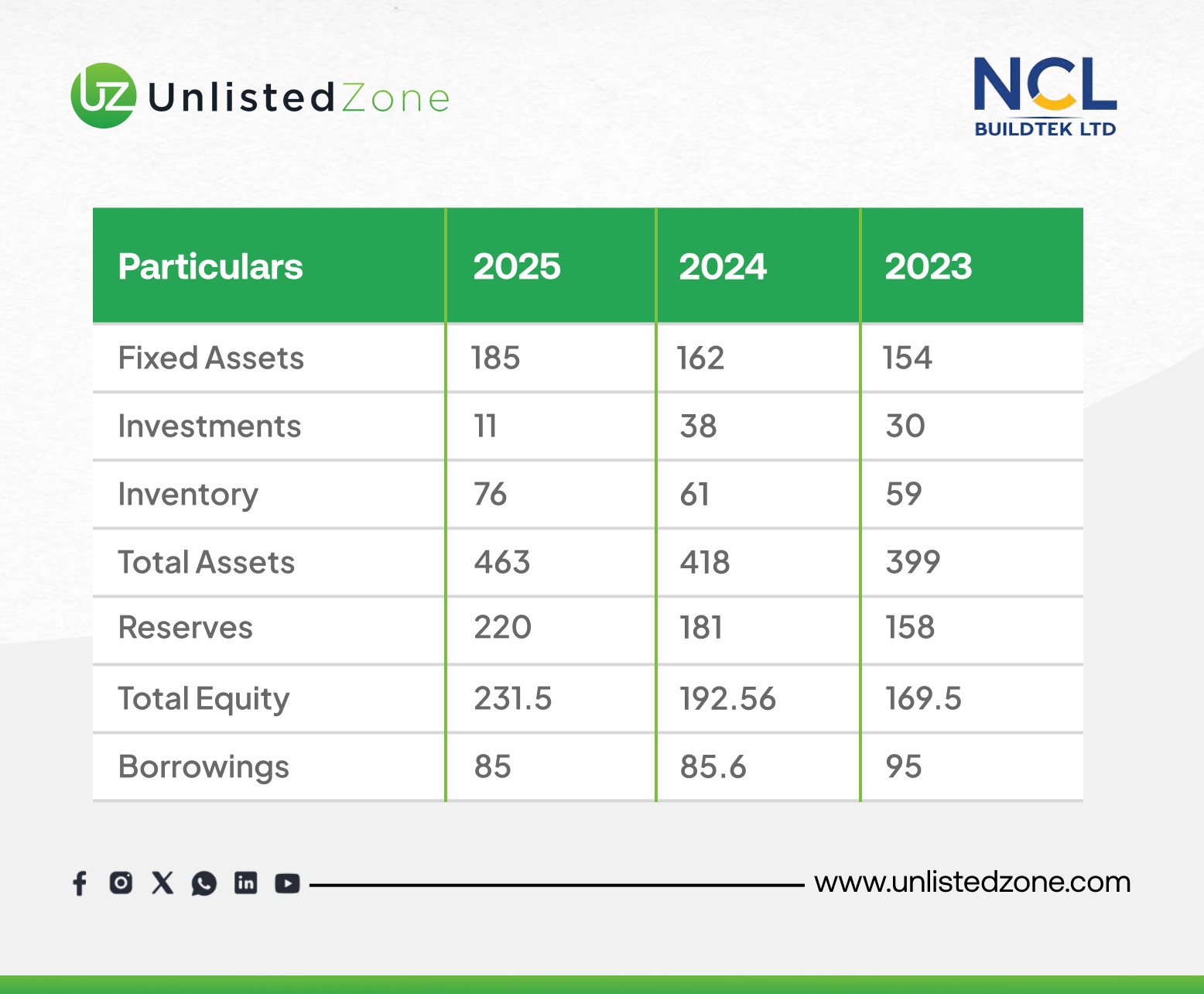

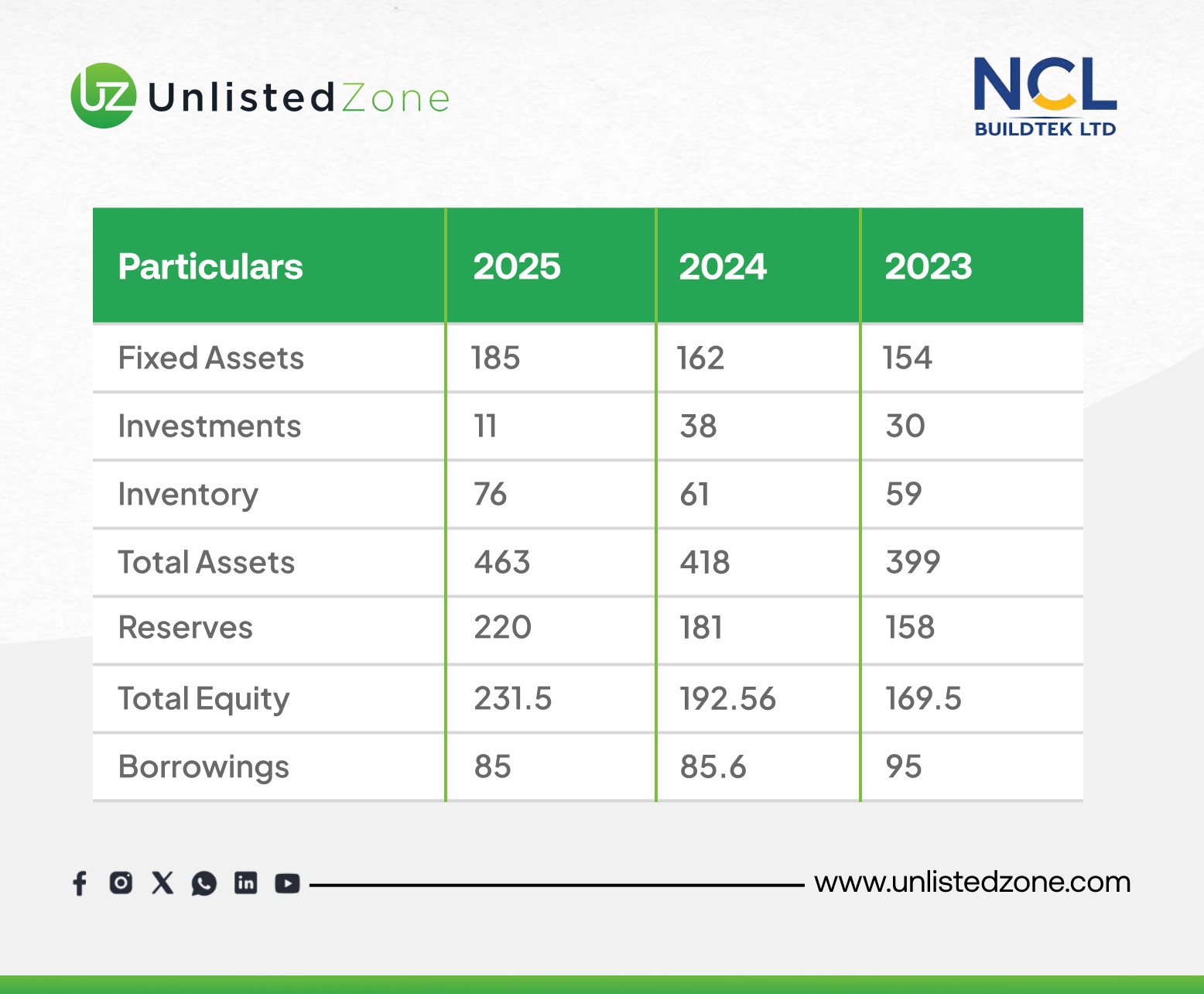

Balance Sheet (₹ in Crores)

The company demonstrates strong asset growth and improving financial stability, with significant expansion in fixed assets and reserves, while effectively reducing its debt burden.

Key Observations:

-

Strategic Expansion & Growth:

-

Fixed Assets increased steadily (154 → 185 Cr), indicating ongoing investment in production capacity and new facilities (e.g., Steel Doors plant).

-

Total Assets grew significantly (399 Cr → 463 Cr), reflecting the company's expansion.

-

Strengthening Financial Foundation:

-

Reserves saw substantial growth (158 Cr → 220 Cr), showcasing strong profit retention and a healthier equity base.

-

Total Equity increased markedly (169.5 Cr → 231.5 Cr), improving the company's ability to absorb shocks.

-

Prudent Debt Management:

-

Working Capital Build-Up:

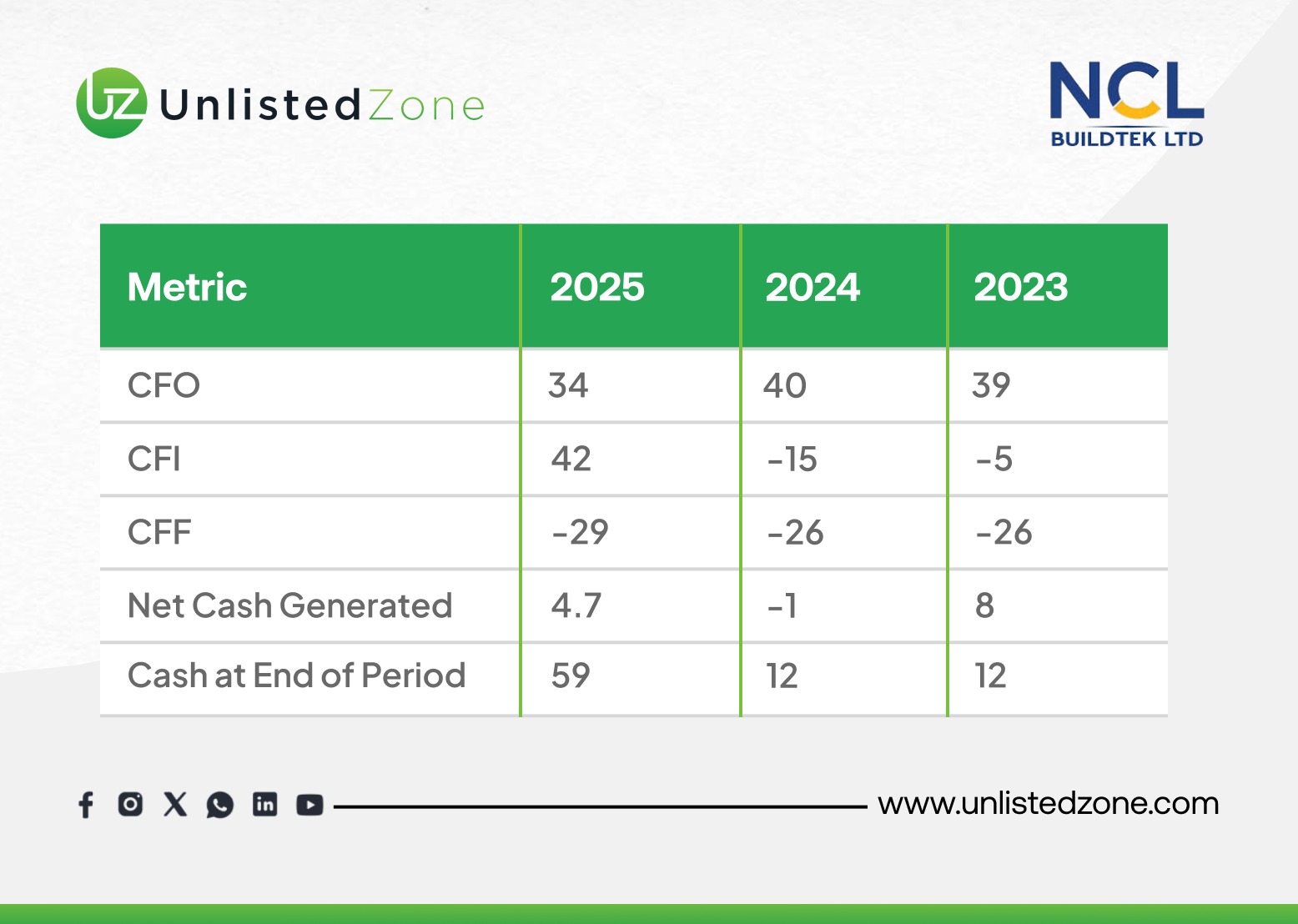

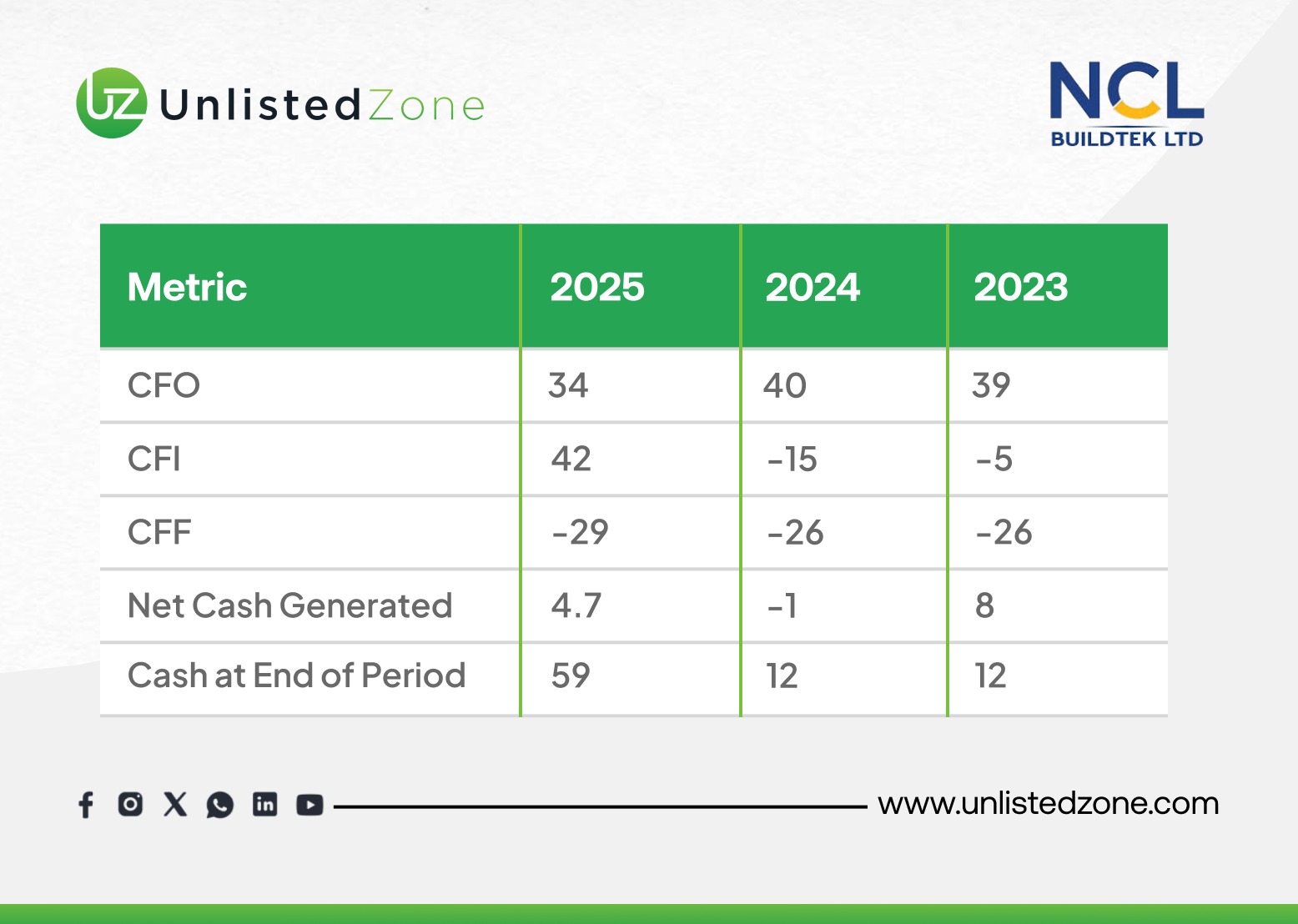

Cash Flow Statement (₹ in Crores)

The company demonstrates strong and stable operational cash generation, with a major strategic shift in investment activity in FY2025, funded internally and through reduced debt.

Key Observations:

-

Operational Stability (CFO):

-

Cash Flow from Operations (CFO) remained strong and consistent (₹39-40 Cr) in FY23 and FY24.

-

A slight dip to ₹34 Cr in FY25 is minor and still reflects a healthy ability to generate cash from core business.

-

Strategic Shift in Investment (CFI):

-

FY23 & FY24: CFI was negative (-5 Cr, -15 Cr), indicating moderate capital expenditure (e.g., setting up new plants).

-

FY25: CFI surged to +₹42 Cr. This is a major reversal, strongly suggesting the sale of a significant asset or investments, not just reduced capex. This is the primary source of the large "Other Income" on the P&L.

-

Consistent Financial Strategy (CFF):

-

Cash Flow from Financing is consistently negative (~ -26 Cr to -29 Cr). This is a positive sign, showing the company is consistently repaying debt (as seen in the balance sheet) and paying dividends, not relying on external borrowing.

-

Cash Position:

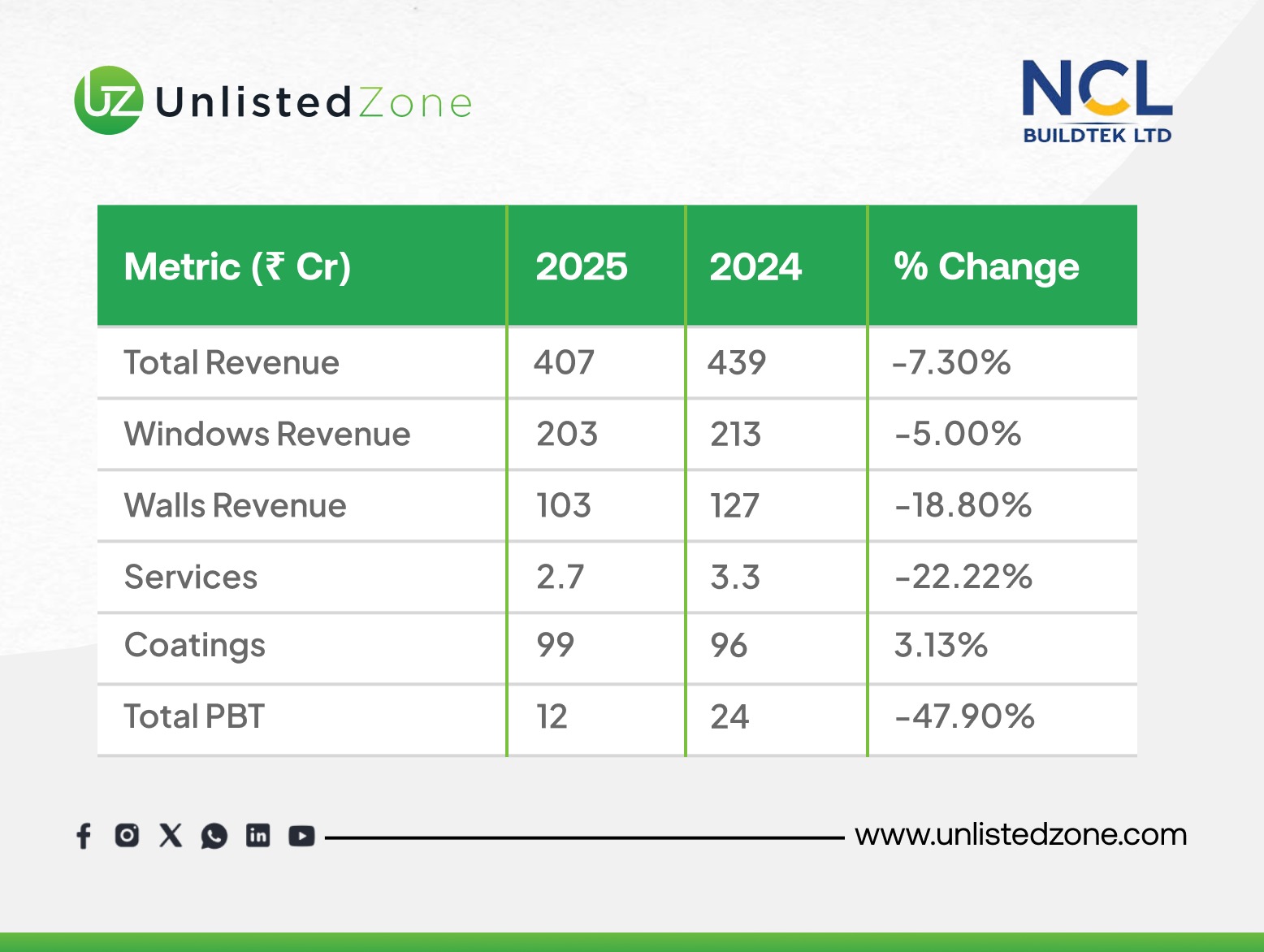

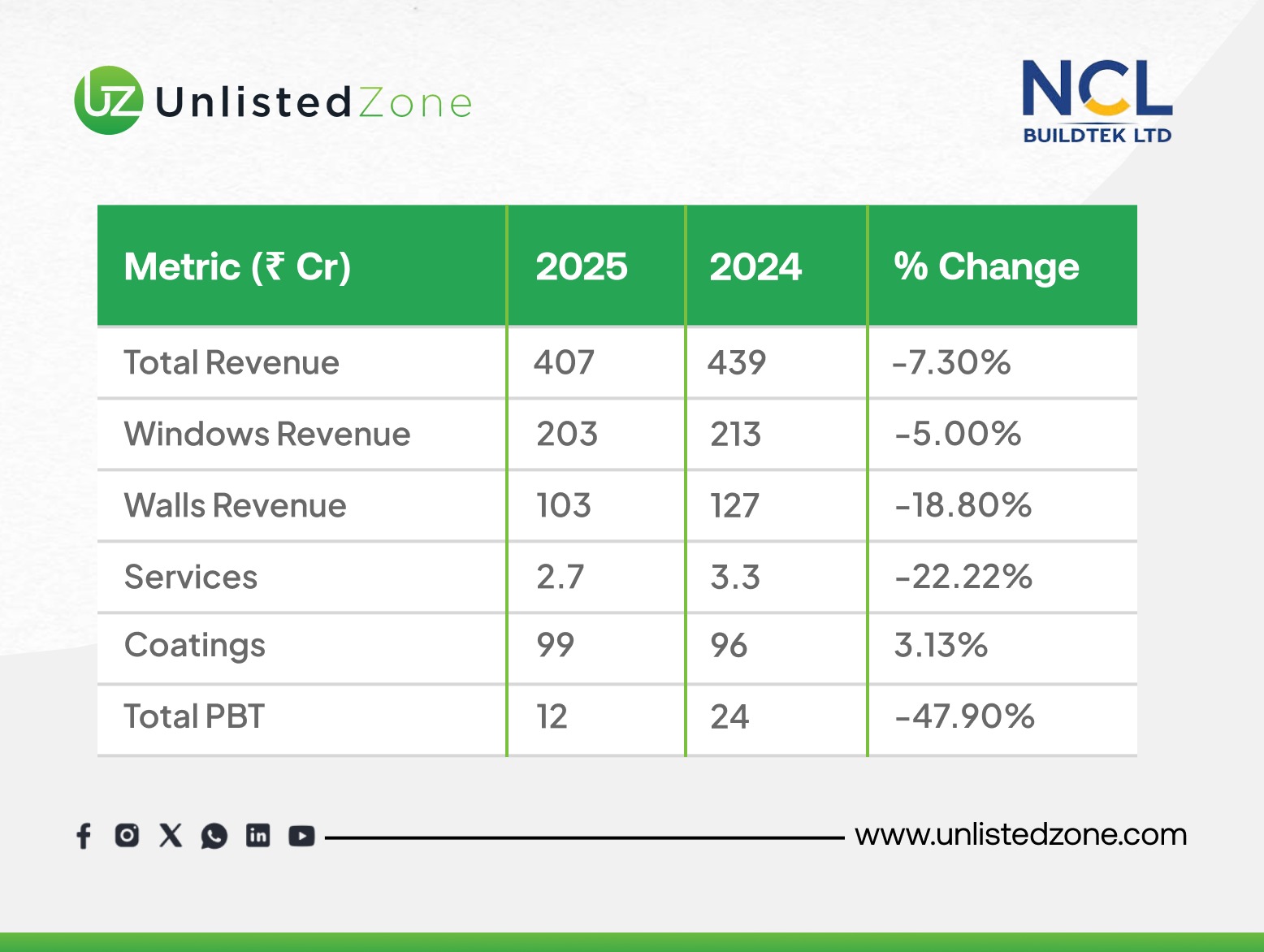

C) Segment Reporting

-

Key Observations:

-

Revenue Decline: Total revenue dropped to ₹407 Cr (-7.3%), reflecting tough market conditions.

-

Walls (AAC Blocks) was the worst hit, down -18.8% to ₹103 Cr.

-

Windows revenue fell a moderate -5% to ₹203 Cr.

-

Coatings (Putties/Paints) was the sole bright spot, growing +3.1% to ₹99 Cr.

-

Profitability Collapse: Total Profit Before Tax (PBT) halved (-47.9%) to ₹12 Cr. This severe drop is primarily attributed to the steep decline in the profitable Walls segment, which eroded overall earnings.

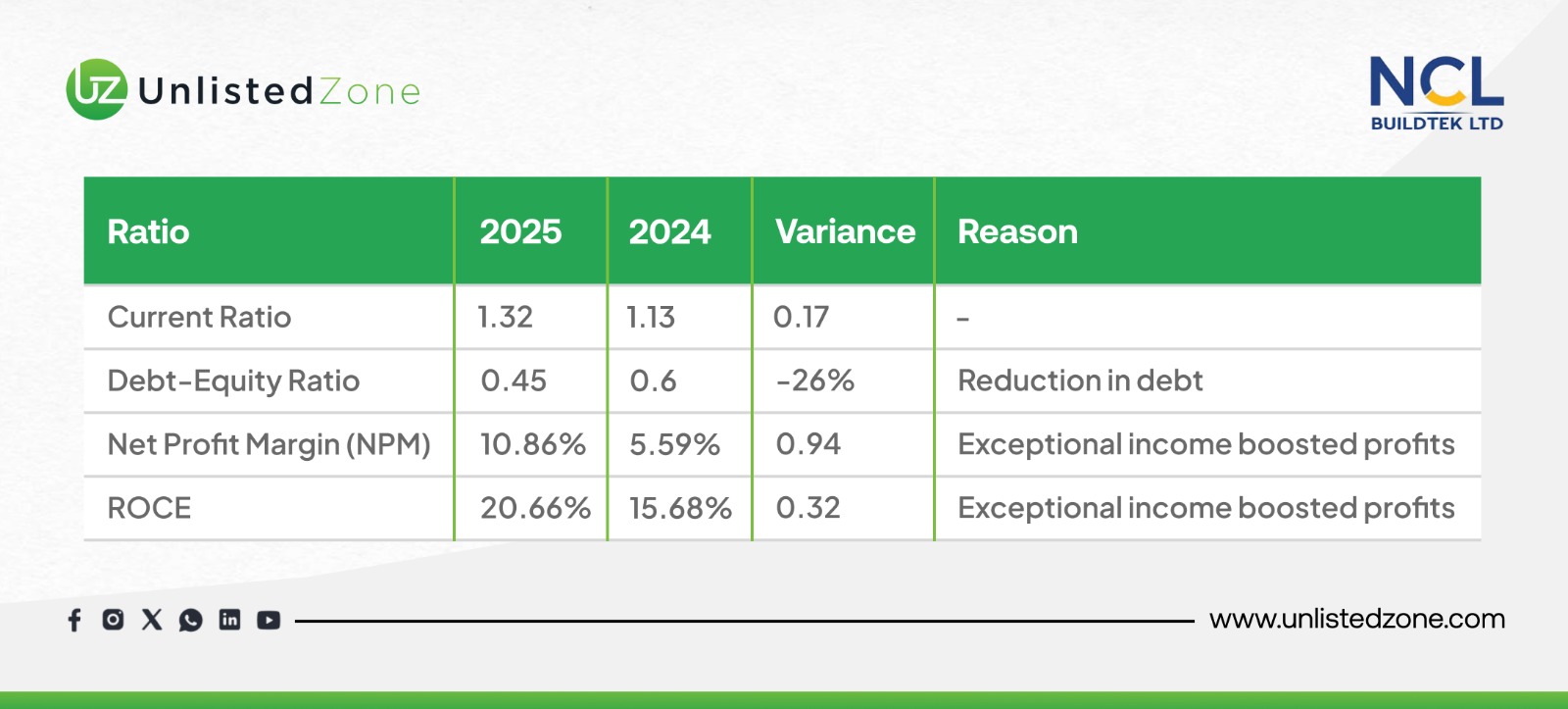

D) Analytical Ratios

E) Valuation Insights (Unlisted Market)

-

Current Unlisted Share Price: ~ ₹236 per share (Estimated based on P/B and disclosed Book Value)

-

Market Capitalization: ~ ₹272 Crores

-

P/E Ratio: 6.18x (FY25 EPS)

-

P/B Ratio: 1.13x (Book Value: ₹208.73 per share)

-

Debt-to-Equity: 0.37 (Very healthy)

-

Return on Equity (ROE): 19.01% (Boosted by one-time income)

F) Management Discussion & Analysis (MD&A)

-

Outlook: Management expects a revival in construction activity in Andhra Pradesh, which should stabilize the AAC Blocks business. The long-term transition from CCGI to uPVC/Aluminium is acknowledged.

-

Strategy: The focus remains on scaling new growth verticals (Aluminium, Steel Doors, Tile Adhesives) to achieve profitability and compensate for the decline in legacy products.

-

Risks: The business remains susceptible to regional political stability, liquidity in the real estate sector, and monsoon patterns.

-

Focus Areas: Aluminium, Steel Doors, and Tile Adhesives.

-

Expansion: New steel doors manufacturing facility commissioned in Q4 FY25 with a growing order pipeline.

-

Challenges in FY25: Multi-dimensional headwinds including elections, delayed policies, liquidity issues, and extended monsoons — particularly affecting Andhra Pradesh and Telangana.

G) UnlistedZone View

NCL Buildtek is a well-established player with a strong brand and distribution network. Its efforts to transform its product portfolio away from legacy systems are timely. A healthy, debt-free balance sheet with a large cash pile provides it with resilience and the ability to invest in growth. The current valuation is reasonable for a long-term investor betting on a construction cycle recovery and the success of its new verticals.

Conclusion:

NCL Buildtek faced a challenging FY2025 with revenue down 7% due to market headwinds impacting key segments. However, strong cost control, reduced debt, and a one-time gain drove a 63% surge in profit to ₹44 Cr. The company strengthened its balance sheet, boosting cash reserves to ₹59 Cr, and successfully grew new verticals like Aluminium (+125%). Financially robust and trading at reasonable valuations, it is positioned for recovery, making it a compelling option for long-term investors.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.