In India’s financial markets, stock exchanges sit at the top of the credibility pyramid. NSE dominates the landscape, BSE has reinvented itself, and together they handle nearly all of India’s equity trading activity.

But far away from the spotlight sits a third national exchange — the Metropolitan Stock Exchange of India (MSEI) — a platform that has spent more than a decade trying to reclaim a meaningful place in the country’s trading ecosystem.

Yet, unlike most struggling institutions, MSEI hasn’t had trouble finding capital. In fact, it has done something quite extraordinary:

it has raised ₹1,240 crore in two rounds — ₹240 crore first, and then a massive ₹1,000 crore recently.

The money was meant to rebuild the exchange from the ground up — upgrade technology, strengthen compliance systems, revive its equity (cash) market, and ultimately create a viable alternative to NSE and BSE.

So has the investment worked?

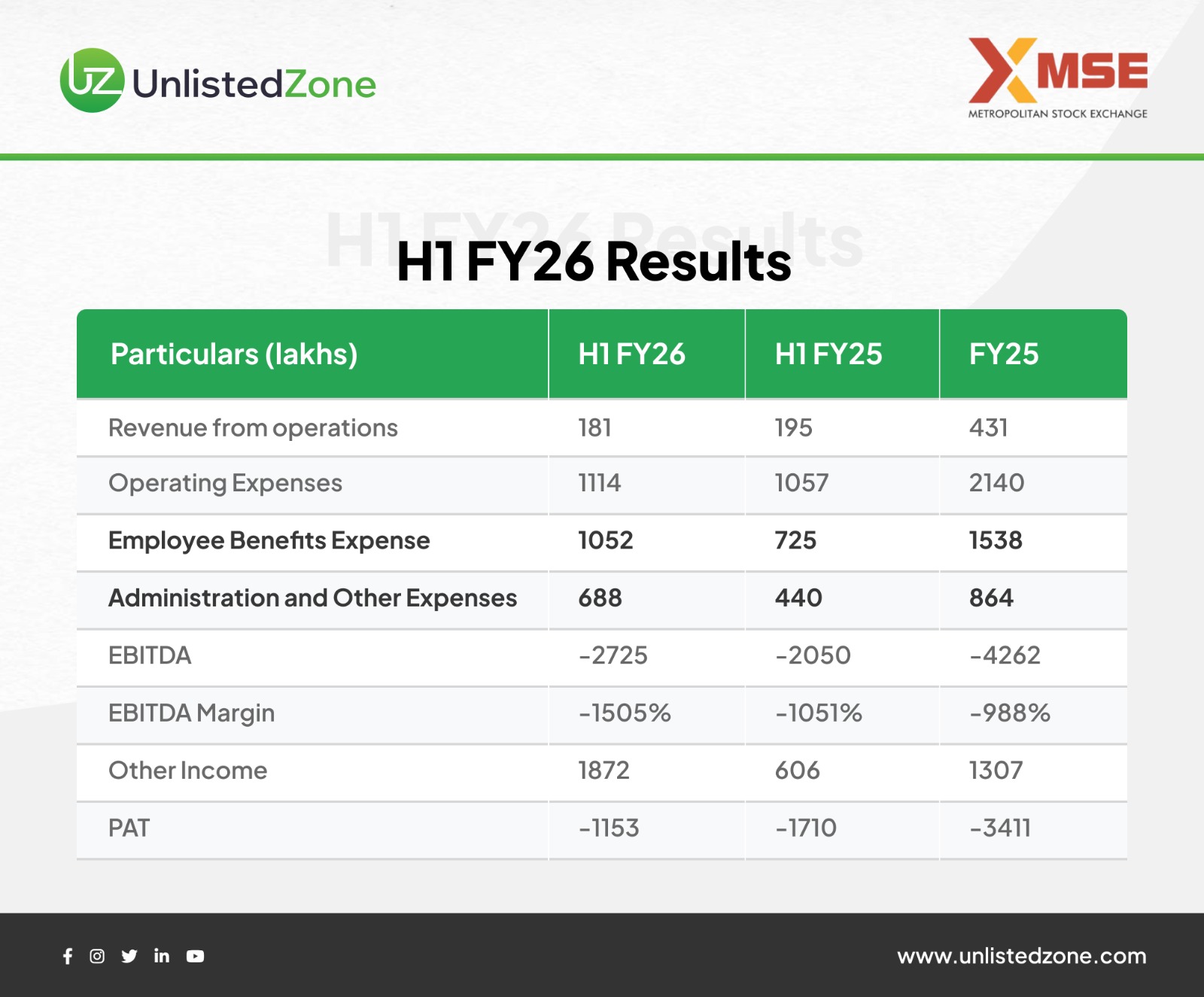

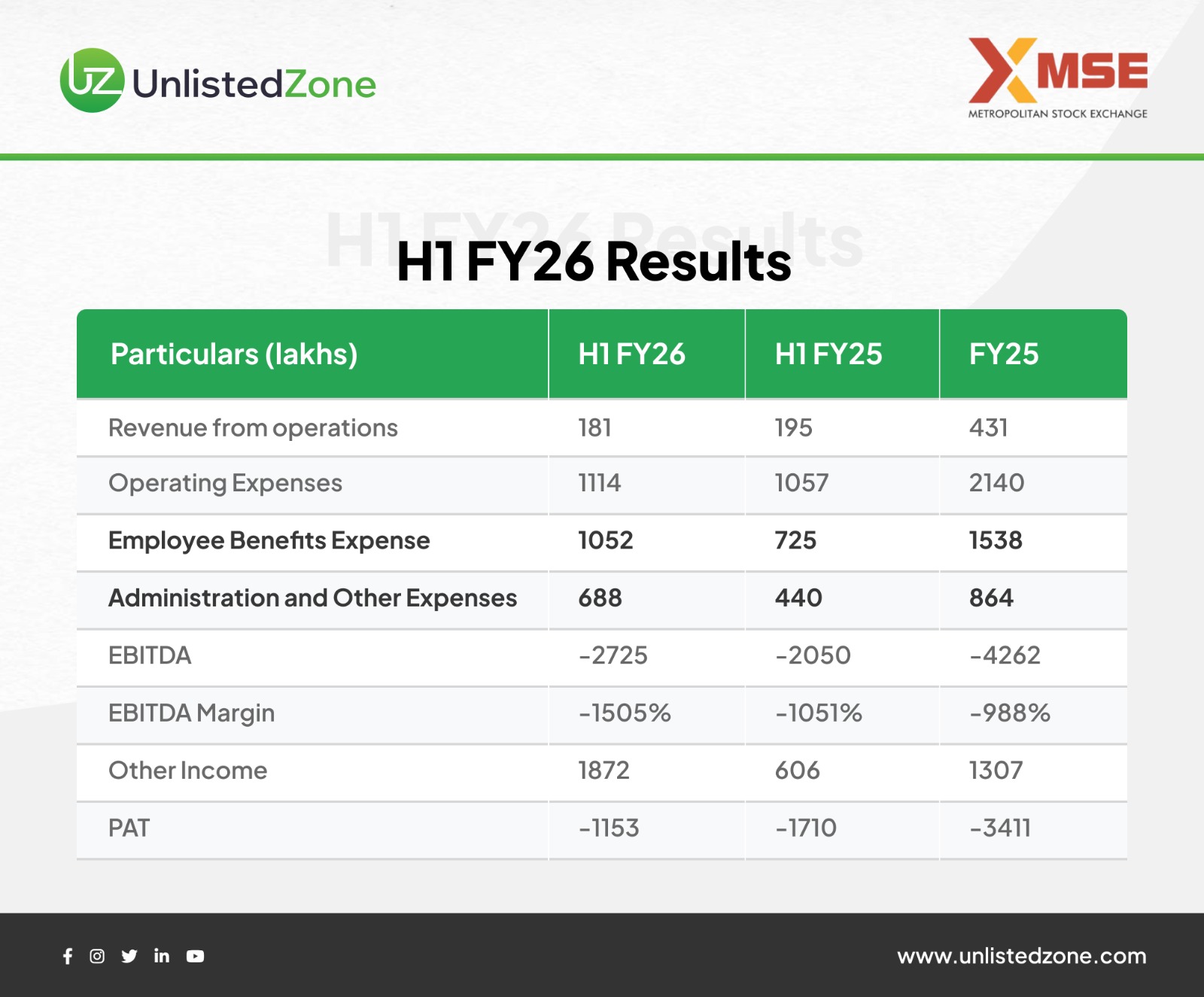

The latest H1 FY26 financial results offer a reality check.

A Business Still Without a Real Business

MSEI reported ₹181 lakh of operating revenue for the half year ended September 2025.

To put that in perspective, this is the kind of revenue you expect from a small fintech startup — not from a national stock exchange with more than ₹1,000 crore in capital infusion.

More strikingly, the exchange earned ₹1,872 lakh in “other income” — primarily interest on fixed deposits and treasury operations.

Which means the exchange currently earns far more from keeping money in the bank than from running its exchange operations.

This is not a business generating revenue; it is a business living off its savings.

Expenses That Tell a Different Story

Even though revenue is stagnant, MSEI’s expenses paint a picture of an organisation aggressively rebuilding itself:

-

Operating expenses: ₹1,114 lakh

-

Employee expenses: ₹1,052 lakh

-

Administration & other expenses: ₹688 lakh

-

Depreciation: ₹261 lakh

Total expenses for the half year stood at ₹3,206 lakh, reflecting a high fixed-cost structure typical of an exchange investing heavily in infrastructure upgrades.

The result is predictable:

MSEI posted a loss of ₹1,153 lakh in H1 FY26.

(A slight improvement over the ₹1,716 lakh loss in H1 FY25.)

The financials are not worsening, but they are not improving either. They simply show an exchange in transition — spending steadily while waiting for revenue to catch up.

So Where Did the ₹1,240 Crore Go?

To understand the situation, we need to go back to the core promise behind the fundraise.

MSEI’s revival plan hinges on a single product:

the launch of an SX-40-based cash equity trading platform.

Right now, MSEI only operates currency derivatives — a low-margin, highly competitive segment dominated by NSE and BSE.

Without a cash market:

-

brokers don’t onboard

-

traders don’t come

-

liquidity doesn’t build

-

and revenues don’t scale

In simpler words, a stock exchange that doesn’t run a cash market is like a mall without shops — the building is there, but nothing happens inside.

The entire ₹1,240 crore raised is being used to fix this.

Employee expenses have risen because engineering, compliance, operations, and technology teams are being staffed up.

Operating costs have gone up because the exchange is investing in new trading engines, clearing frameworks, cybersecurity, surveillance, and data architecture.

The problem is not that the money is being wasted.

The problem is that the core product — the cash market — is not yet live.

Until SX-40 trading launches, all this effort will remain underground, invisible in the numbers.

The Runway Is Long — And That’s the Good News

If MSEI were any other company burning cash at this pace, investors would be nervous.

But the exchange has one huge advantage:

A massive cash buffer from the two fundraises.

This gives MSEI enough financial runway to:

-

complete its technology overhaul

-

deploy and test the equity trading system

-

meet regulatory certification requirements

-

hire and retain skilled market infrastructure talent

-

prepare for a full-fledged relaunch of the exchange

In short, MSEI is not fighting for survival.

It is fighting for relevance.

The Real Test Is Yet to Come

Everything now depends on one thing:

Will MSEI successfully launch its SX-40 cash equity market?

If yes, the exchange finally enters the real race.

If liquidity builds, if brokers participate, if trading volume emerges, and if SX-40 gains some acceptance, the financial picture could change dramatically.

If not, the ₹1,240 crore capital infusion will buy MSEI time — but not traction.

This is why the current financials look flat.

The exchange is still in the “building phase.”

The revenue engine has not been switched on.

UnlistedZone’s Take

MSEI is not a turnaround story today.

It is a pre-turnaround story.

Its balance sheet is strong, its losses are manageable, and its infrastructure is being rebuilt — but its business model is yet to restart.

For unlisted investors, the bet is simple:

**You are not investing in what MSEI is today.

You are investing in what MSEI might become once the cash market launches.**

If the SX-40 launch succeeds, MSEI could finally begin its long-delayed comeback.

If it doesn’t, the exchange will remain a well-capitalised but commercially stagnant institution.

The runway is long.

The fuel tank is full.

But the takeoff is still ahead.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.