Delta Galaxy Engineering Services Limited, an infrastructure EPC contractor specialising in hydro dams, mining works, and water infrastructure, has delivered a strong financial performance in FY 2024–25. The company works primarily as a sub-contractor for industry leaders such as Patel Engineering and Afcons—giving it both scale and credibility.

Financial Highlights – FY 2024–25

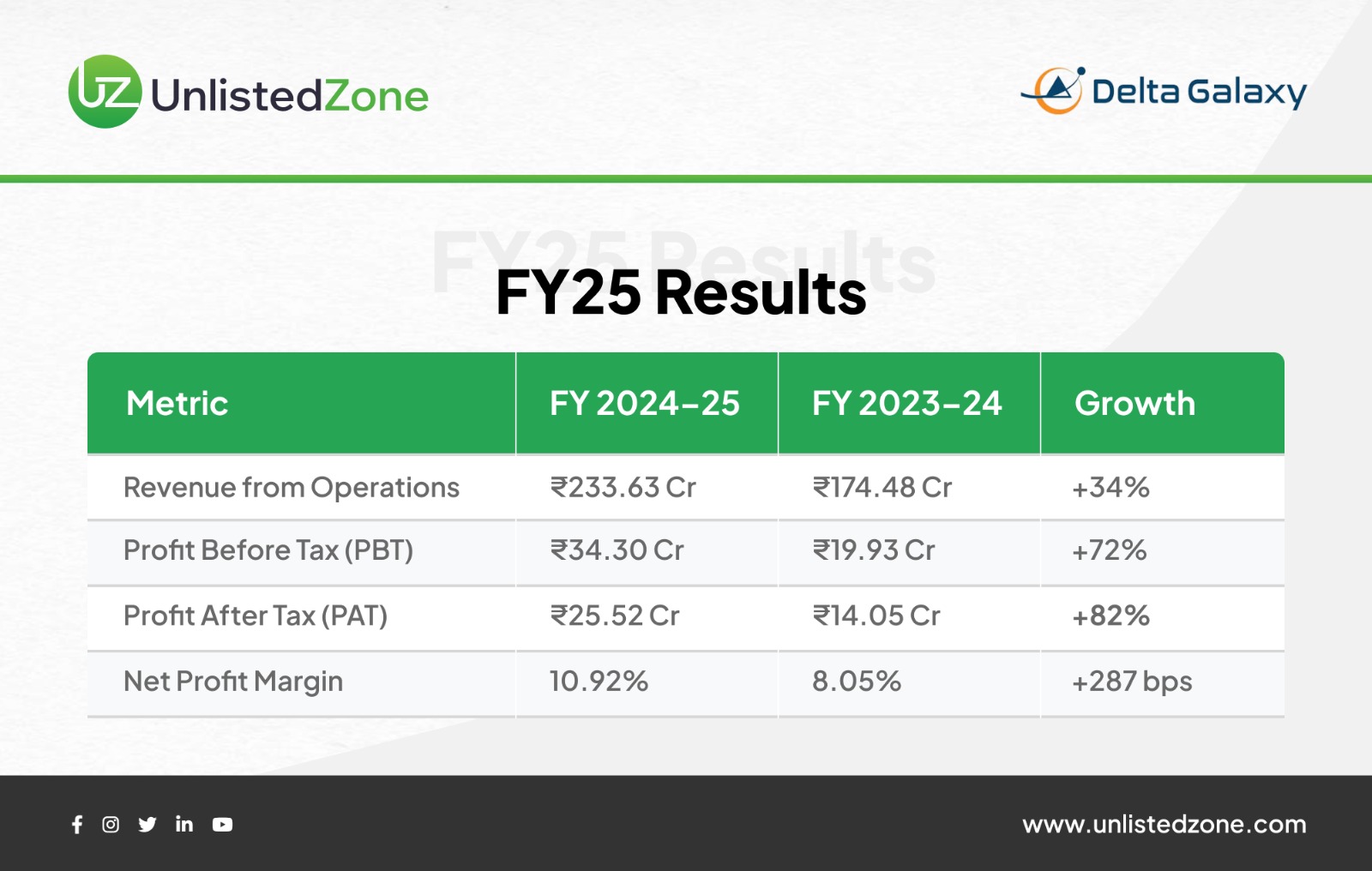

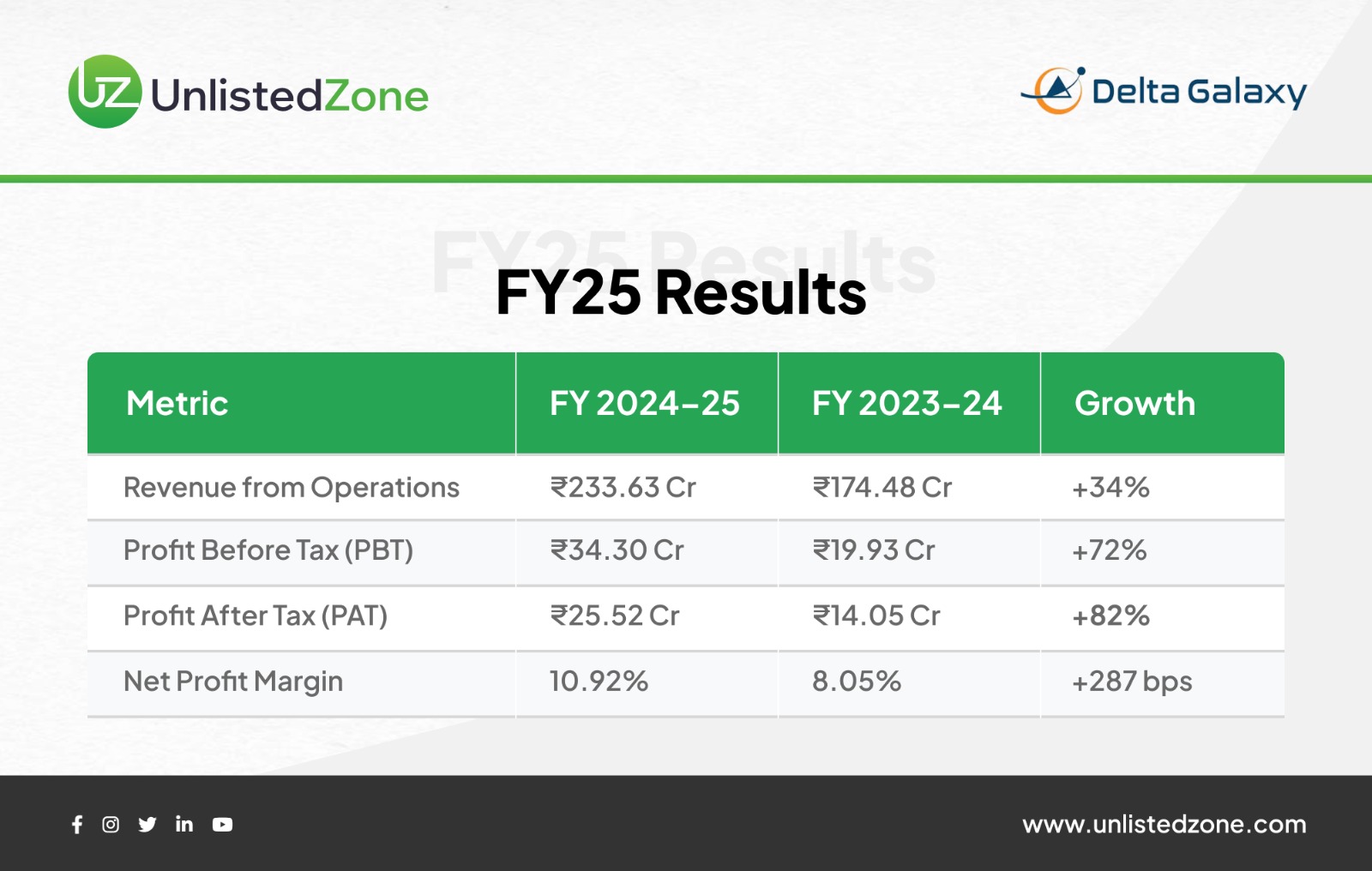

Revenue and Profitability Growth

PAT growth at 82% far outpaced revenue growth of 34%, signalling operational leverage and improved project execution efficiency.

In an industry where 3–6% margins are common, a 10.92% net margin positions Delta Galaxy significantly above peer averages.

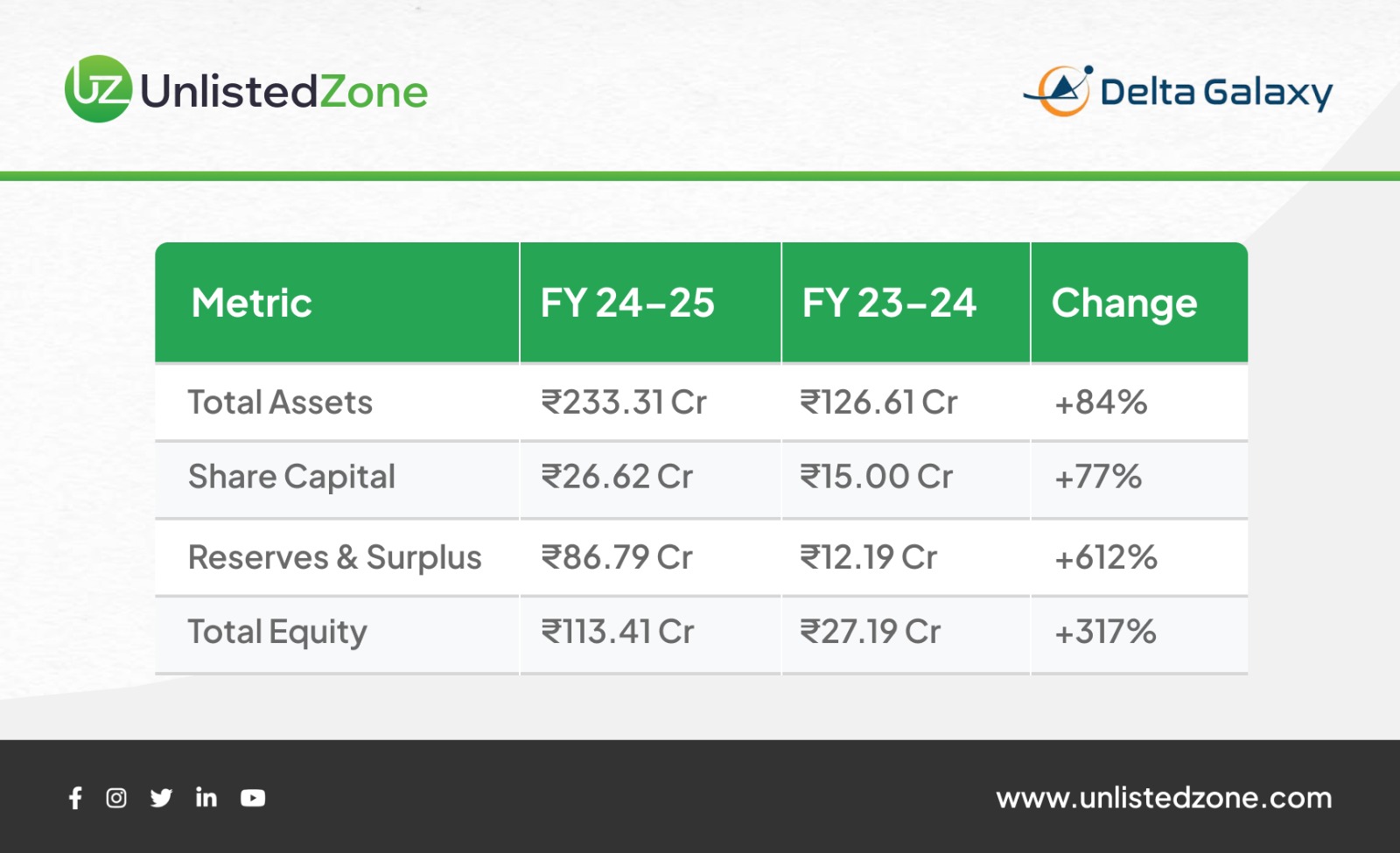

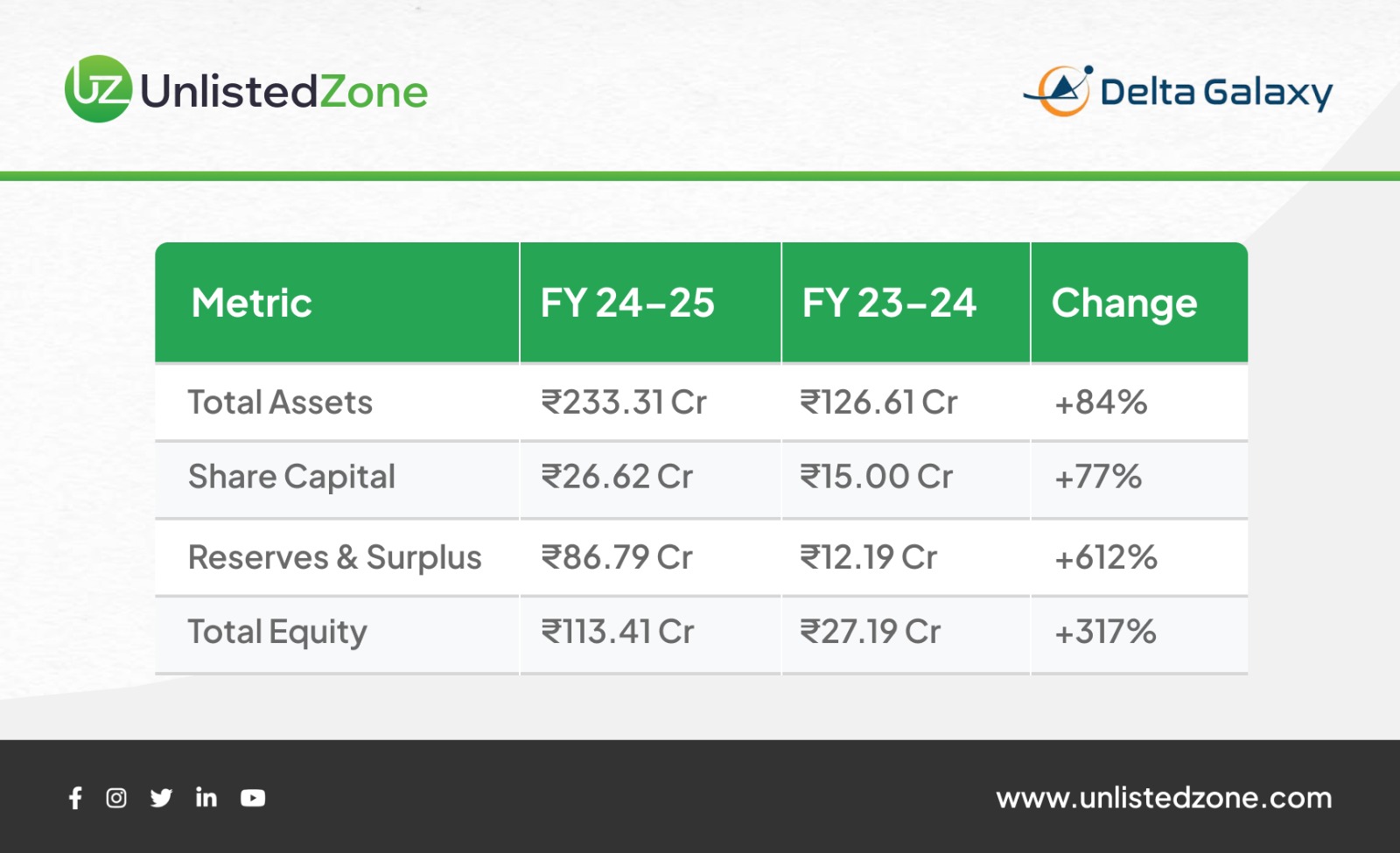

Balance Sheet Expansion

The company strengthened its balance sheet through retained profits and preferential allotment—enabling eligibility for larger EPC projects requiring bank guarantees and working capital buffers.

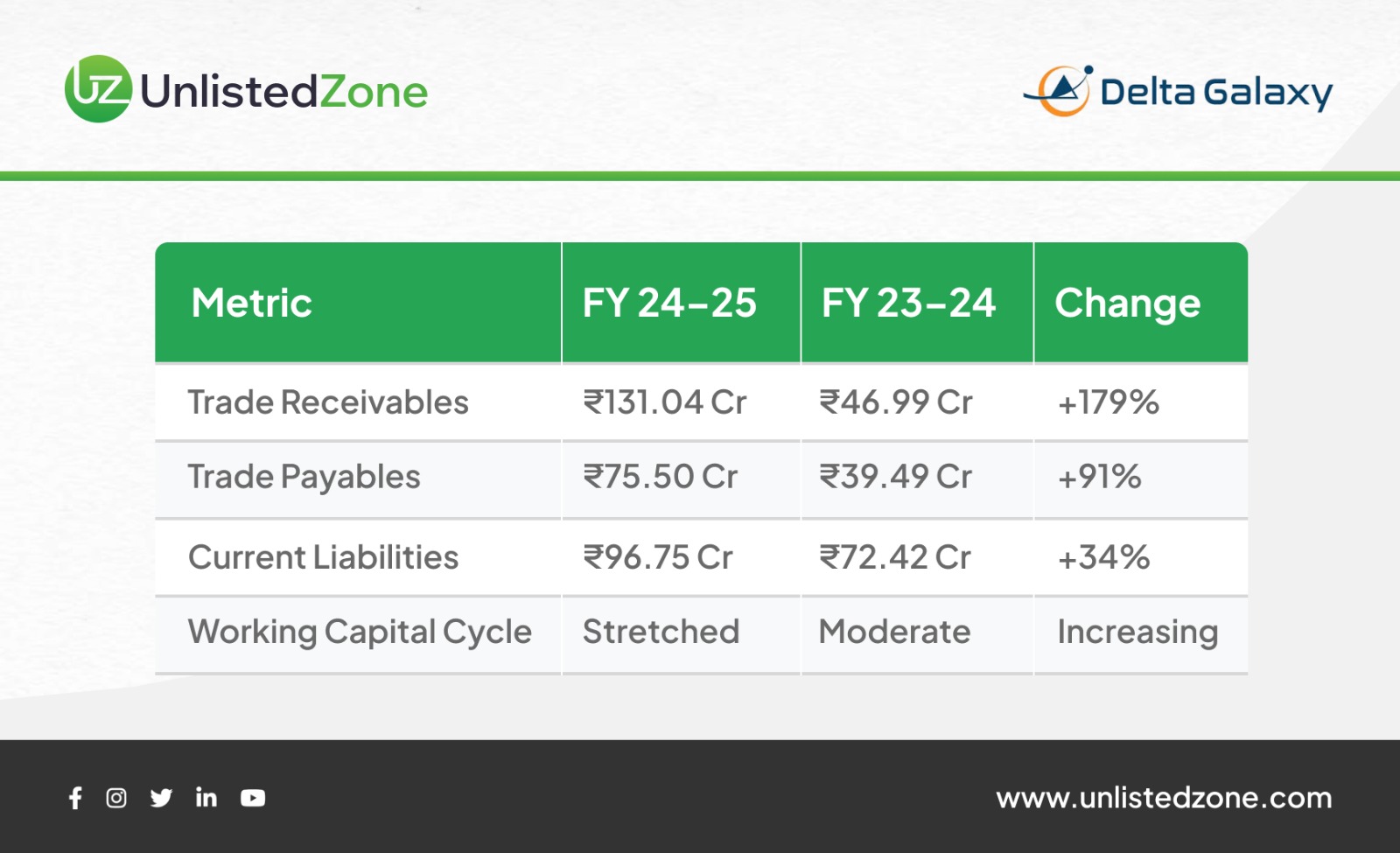

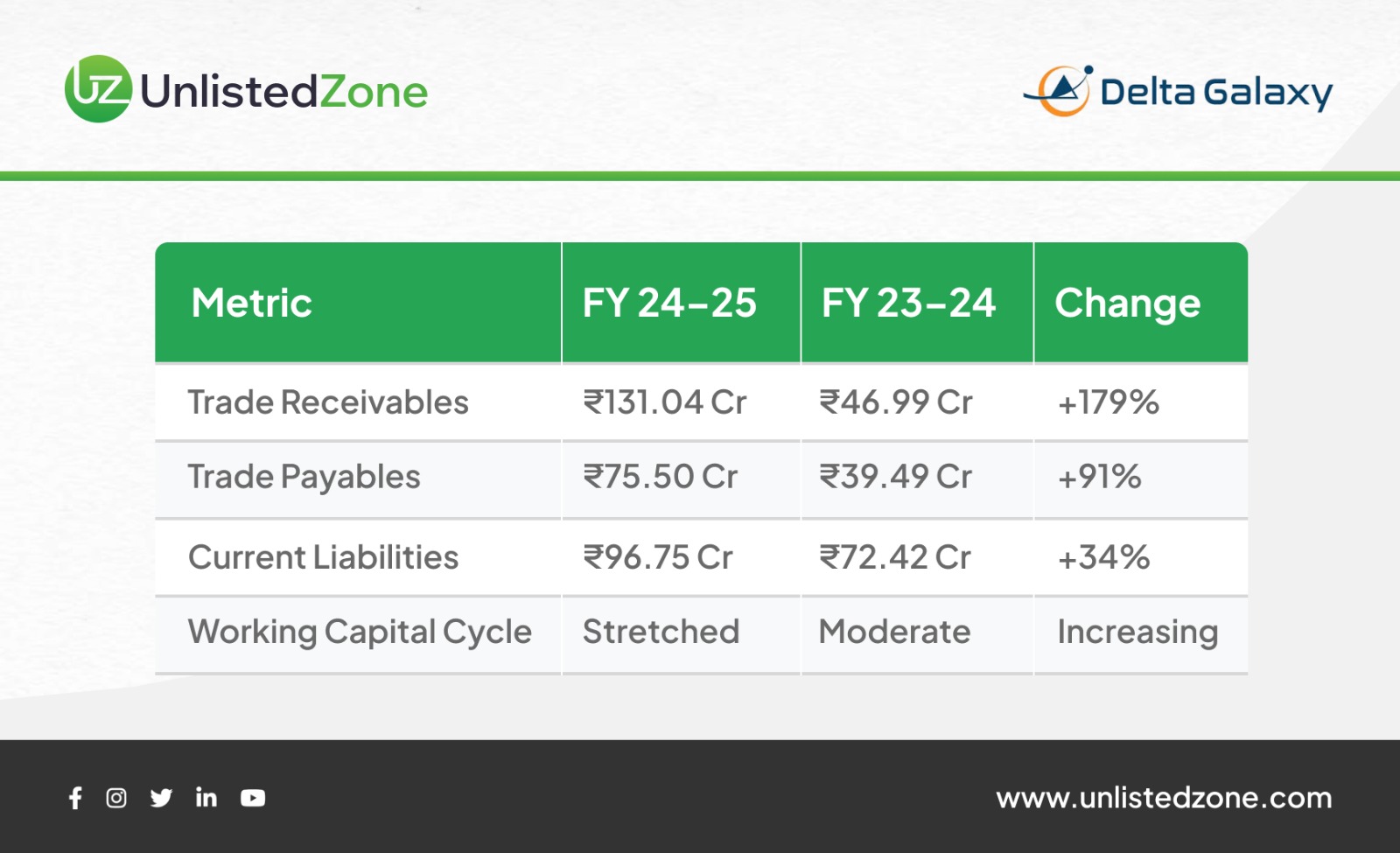

Working Capital – The EPC Reality

High receivables (56% of revenue) reflect industry billing norms:

This is typical for EPC—and not a financial distress signal—but requires active collection management.

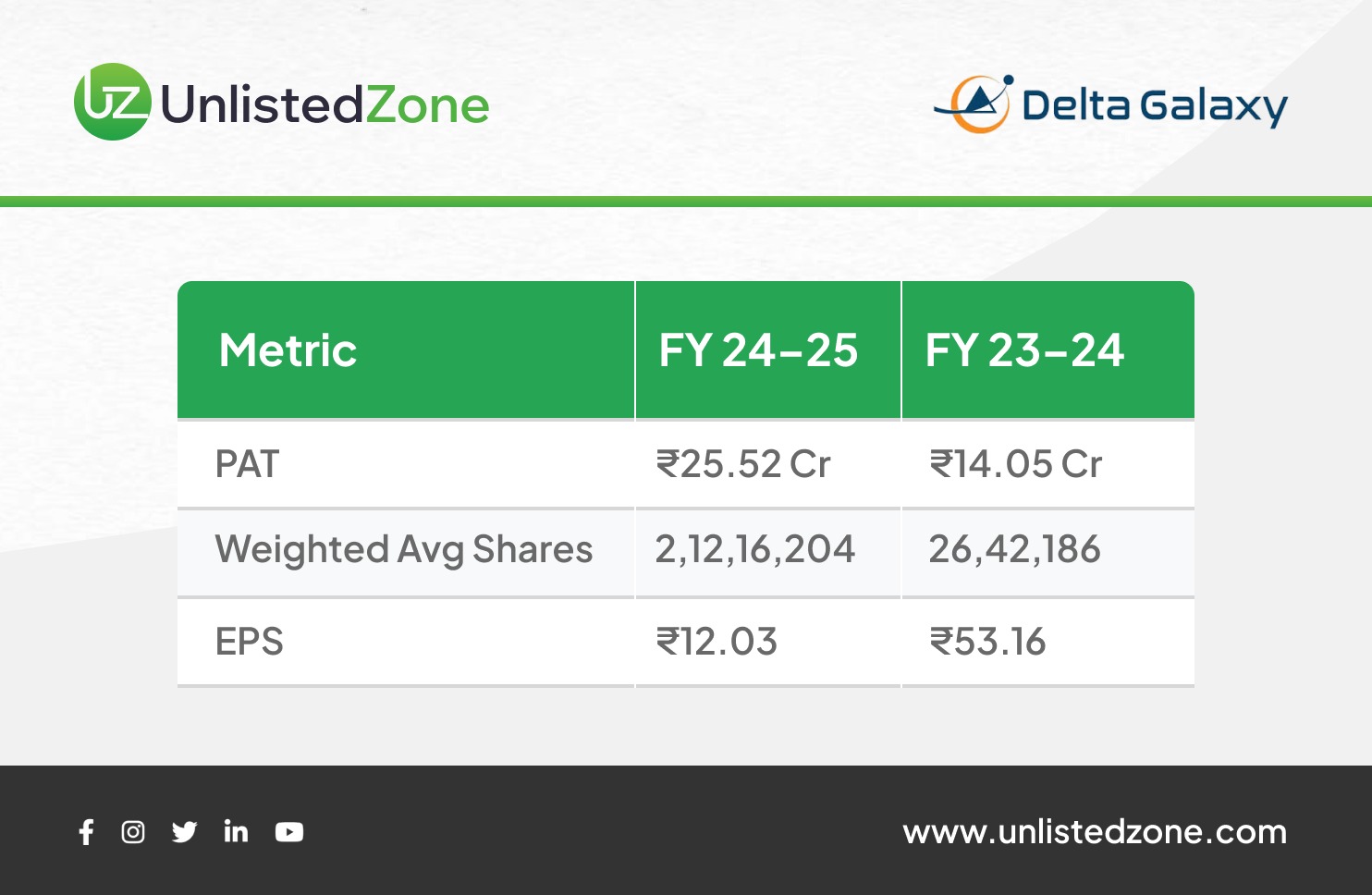

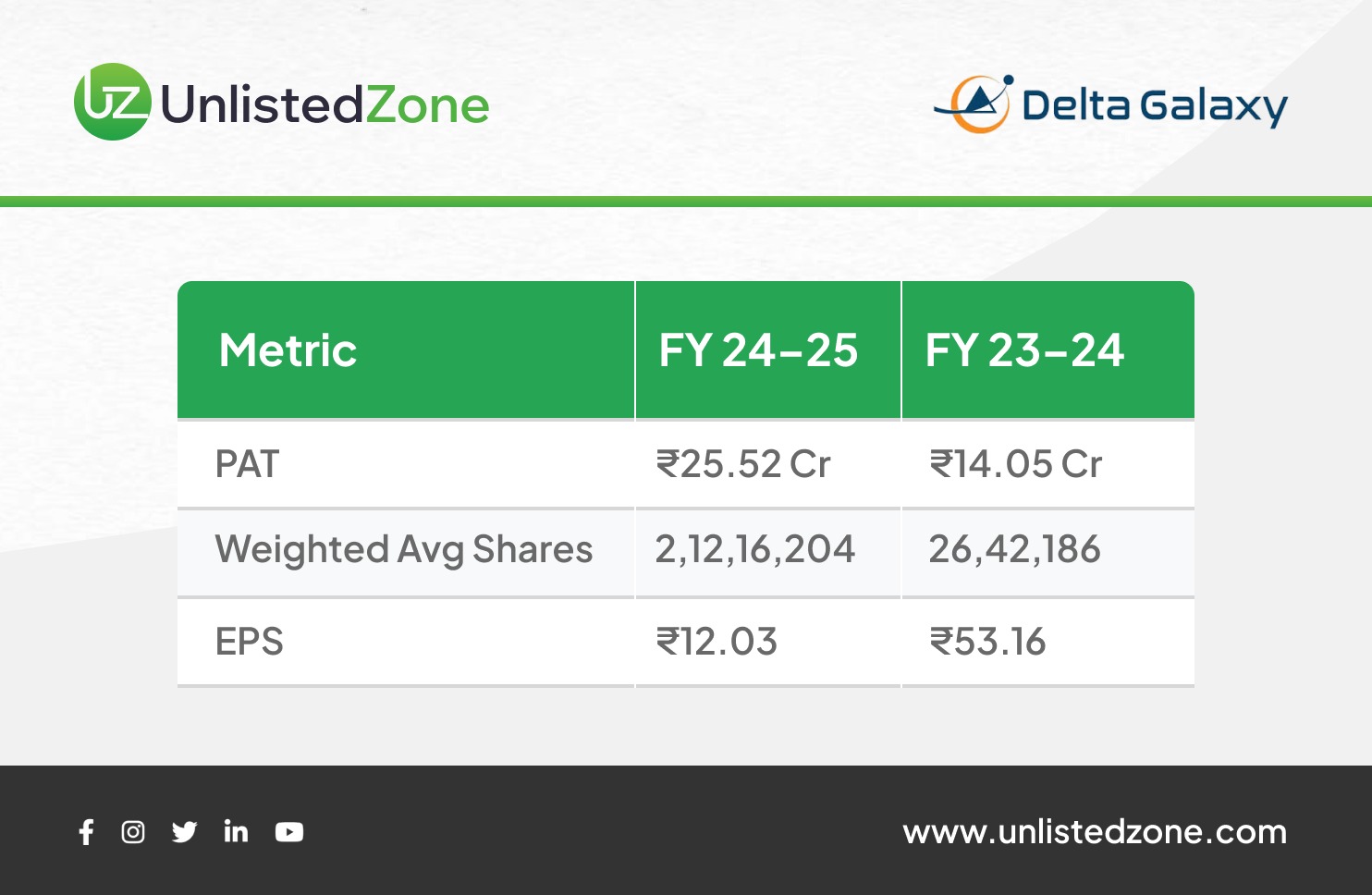

EPS Paradox Explained

Why did EPS fall despite 82% profit growth?

The weighted average number of shares increased 8x (from 26.42 lakhs to 2.12 crores) during FY25, primarily due to:

-

Preferential allotment of 1.16 crore shares during the year

-

Share capital increased from ₹15 crores to ₹26.62 crores

Impact: While absolute profit grew 82%, it's now split among 8x more shareholders, resulting in lower per-share earnings.

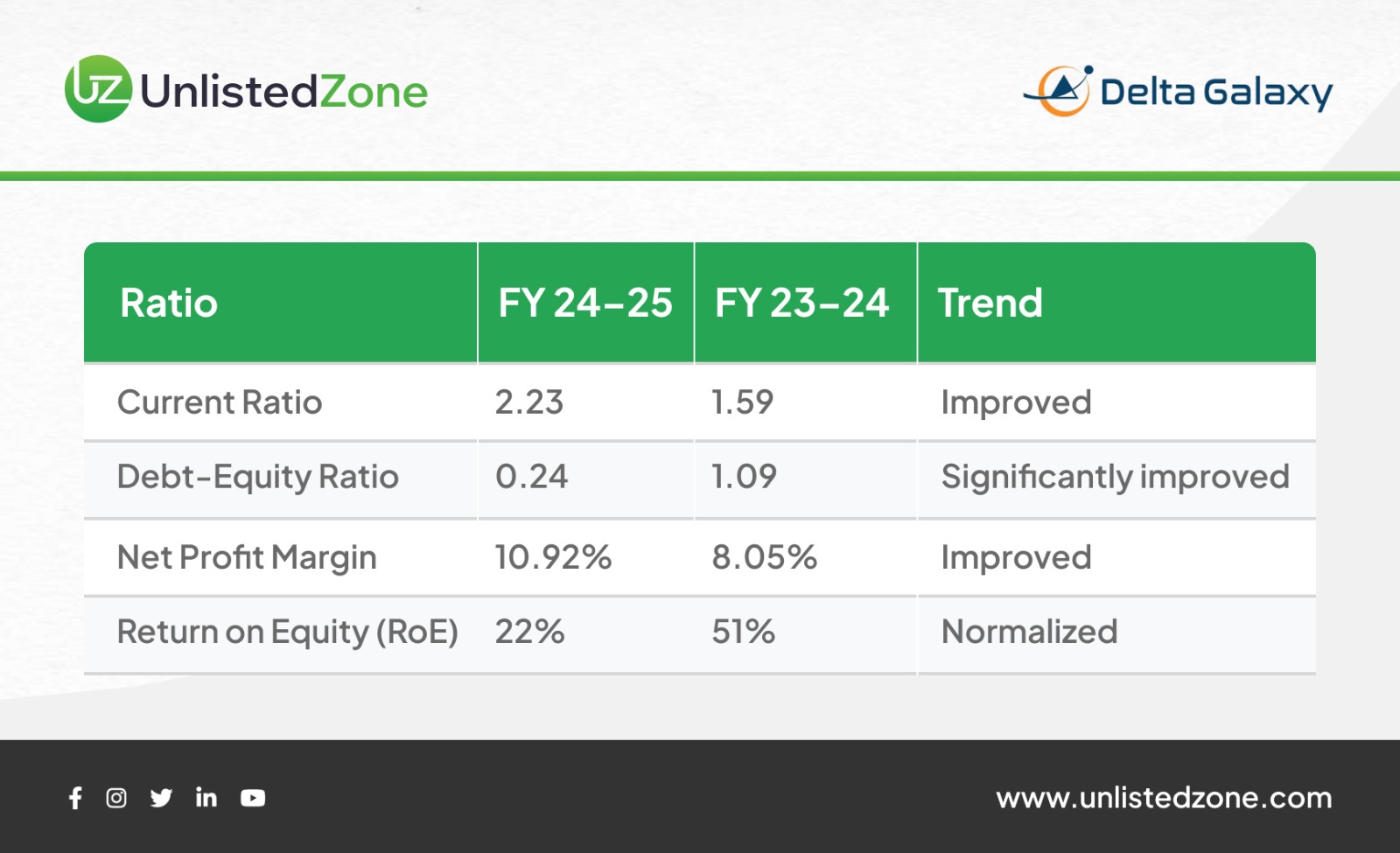

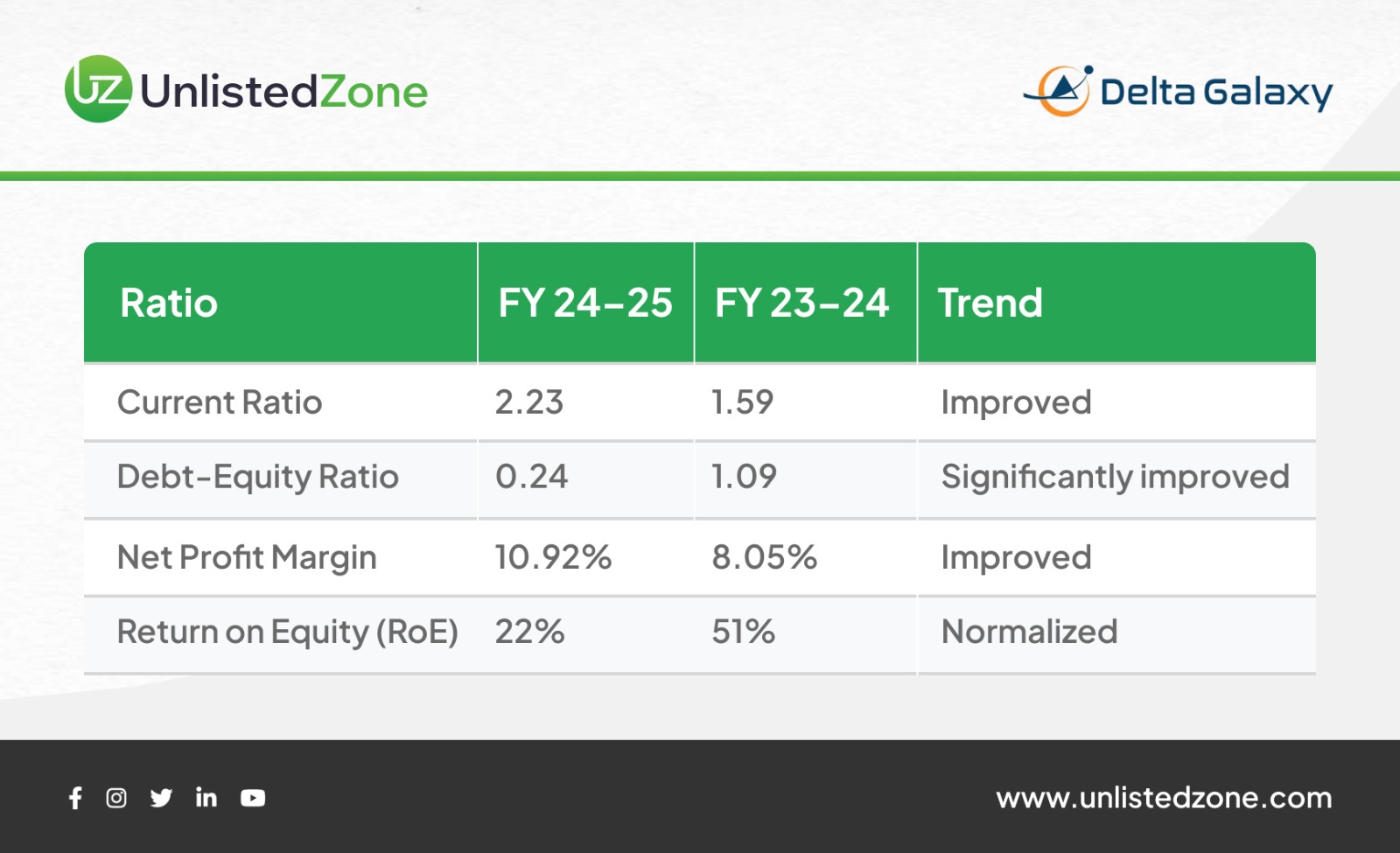

Key Financial Ratios

Analysis:

Positive Trends:

-

Current Ratio improved to 2.23: Strong liquidity position, can easily meet short-term obligations

-

Debt-Equity improved from 1.09 to 0.24: Company dramatically reduced leverage through equity infusion

-

Net Profit Margin expanded: Better cost management and operational efficiency

Interpretation: The company raised significant capital but is still in deployment phase. Returns will improve once the expanded capital base generates proportionate profits.

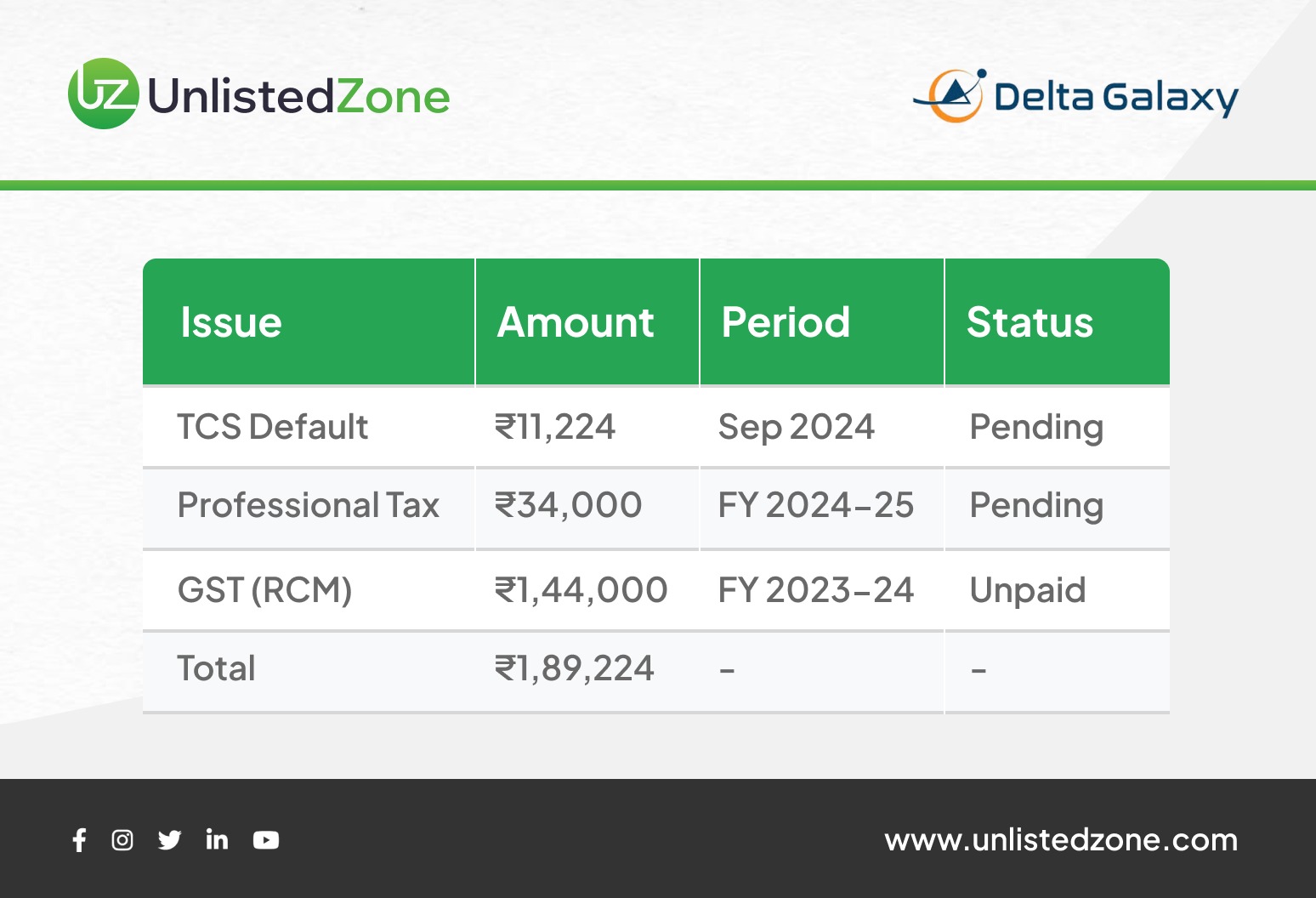

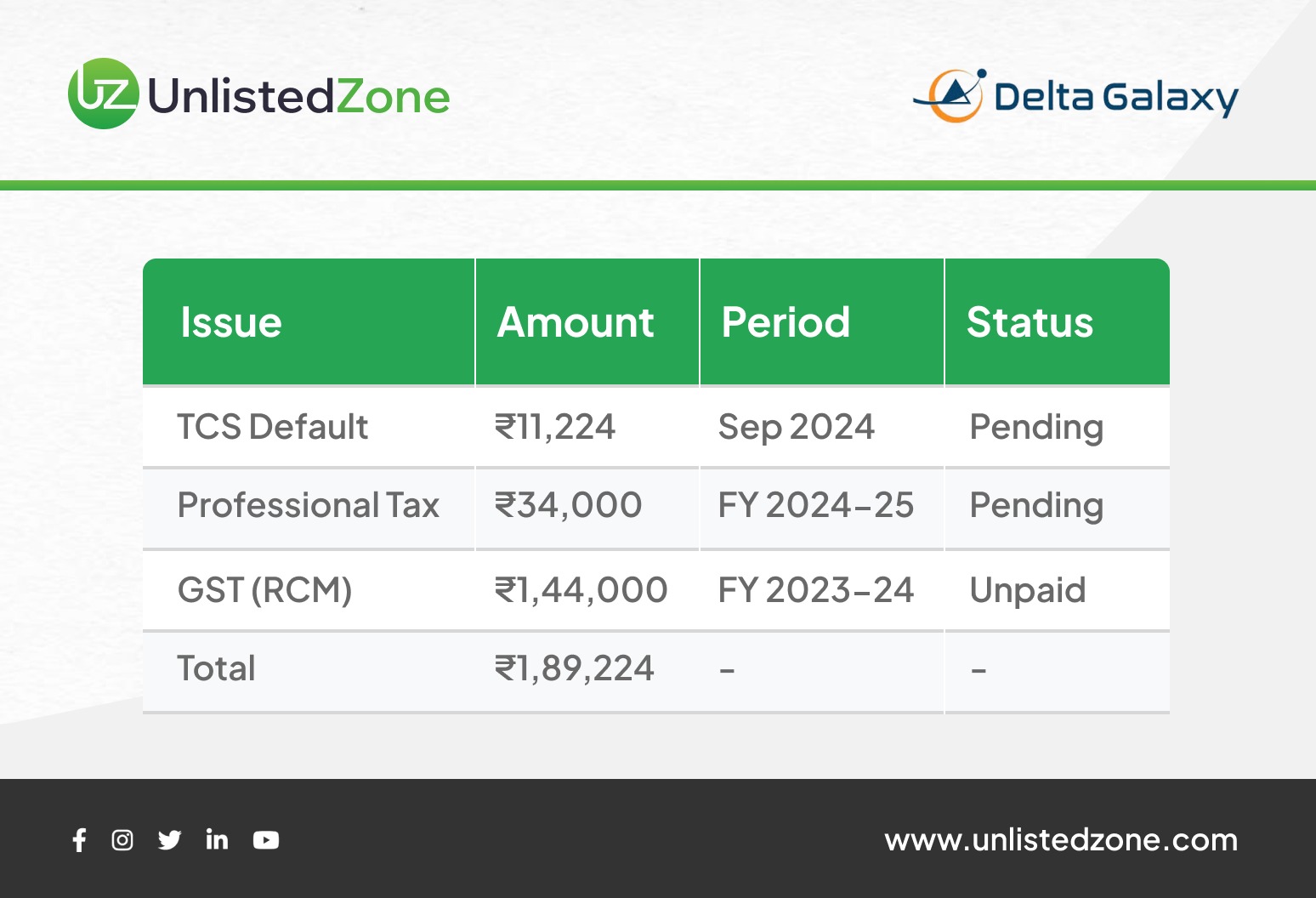

Compliance Issues & Defaults

These are administrative lapses—not financial weaknesses—but must be resolved to maintain EPC vendor compliance ratings.

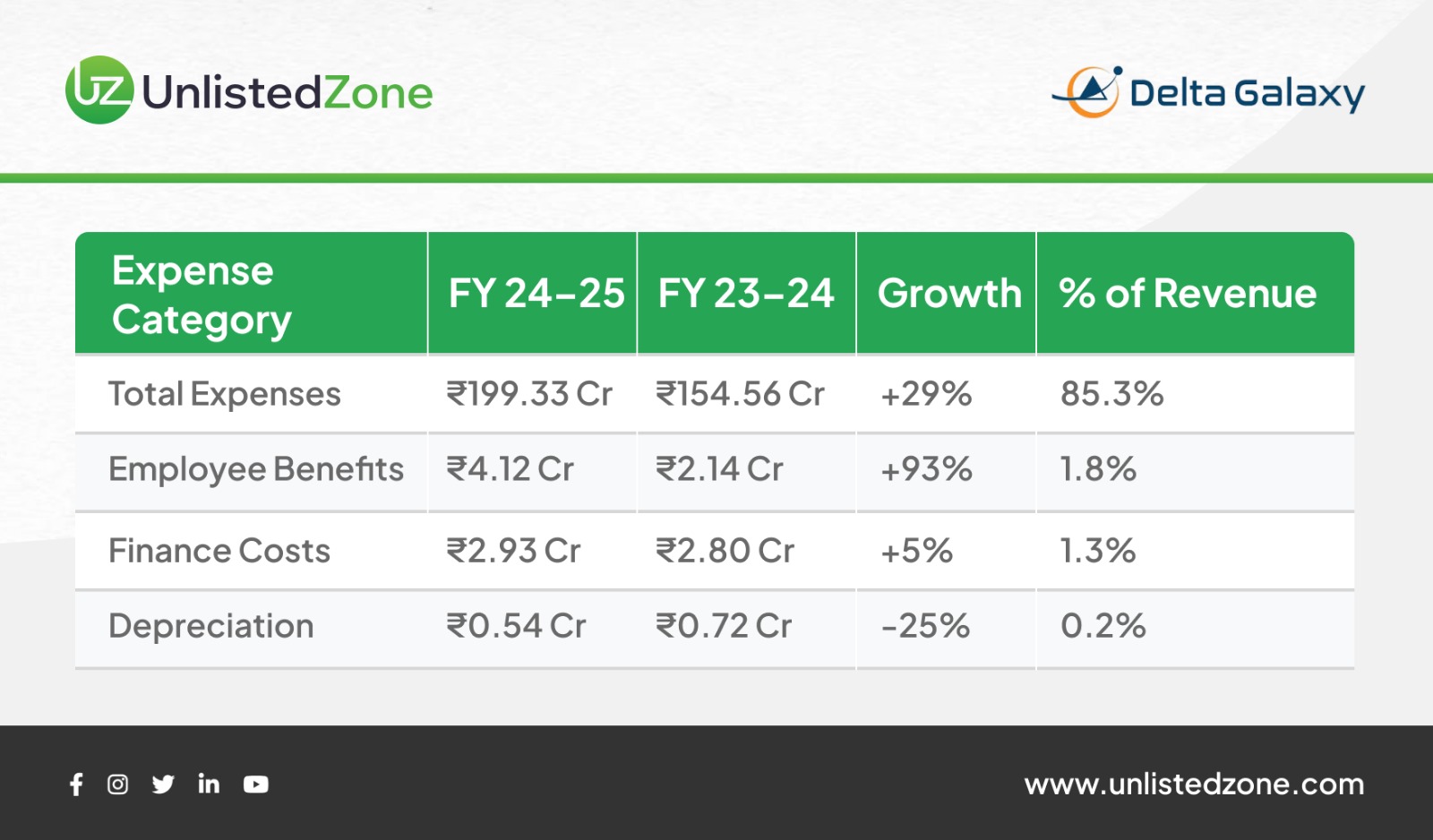

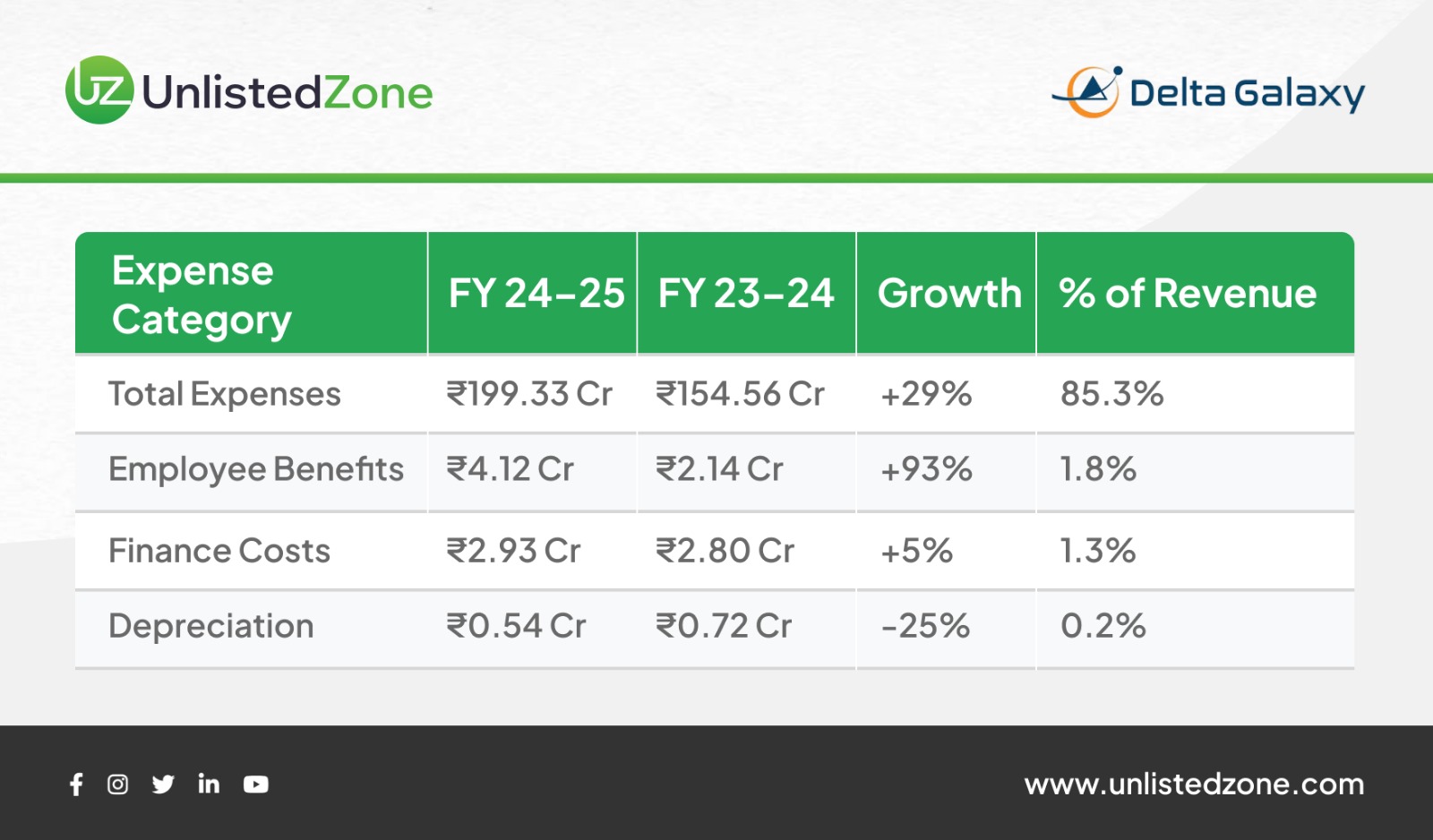

Expense Analysis

Key Observations:

-

Employee costs nearly doubled: Indicates aggressive hiring to support 34% revenue growth

-

Finance costs remained stable: Despite business expansion, borrowing costs controlled

-

Depreciation declined: Either asset write-offs completed or slower capex

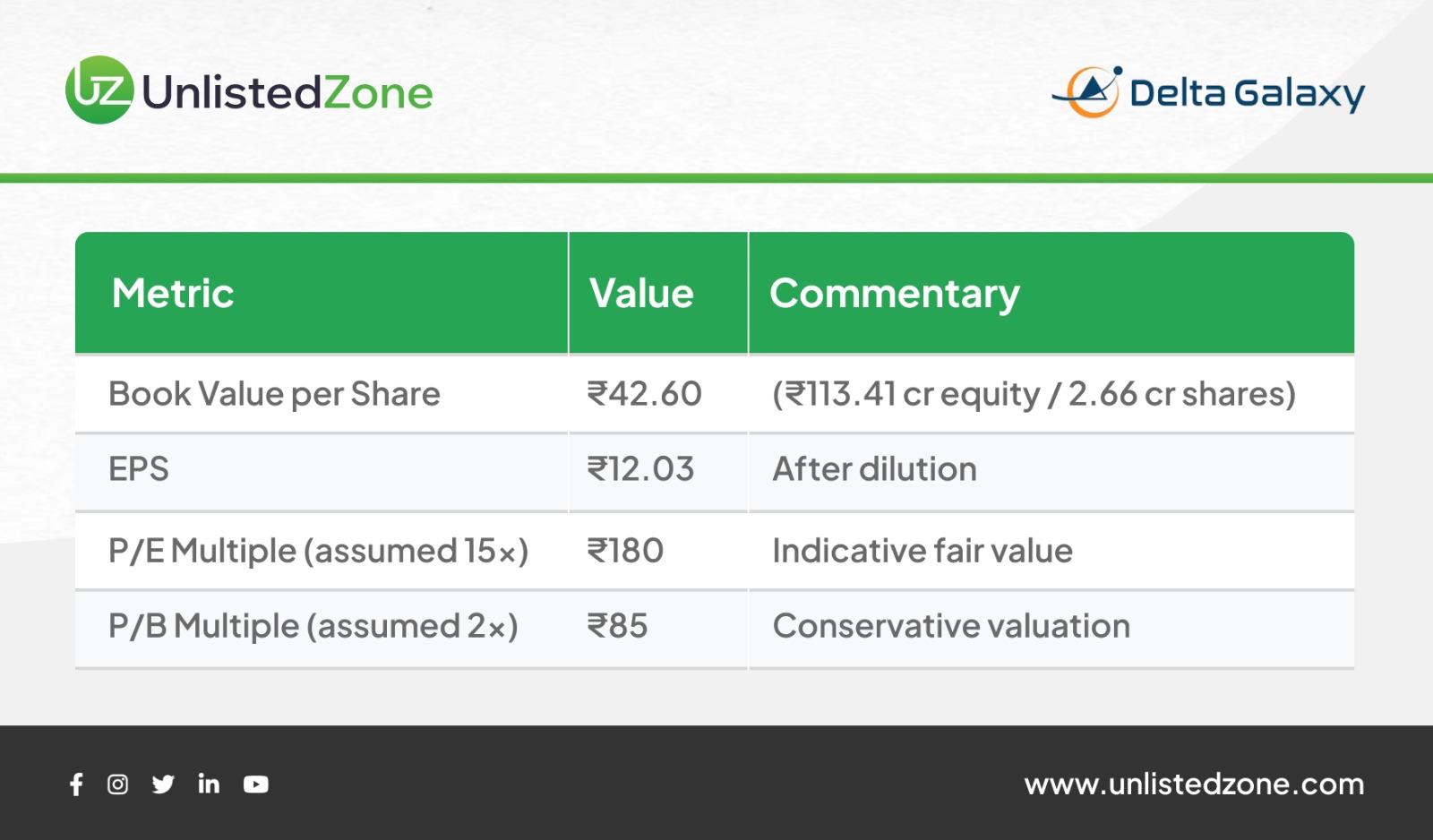

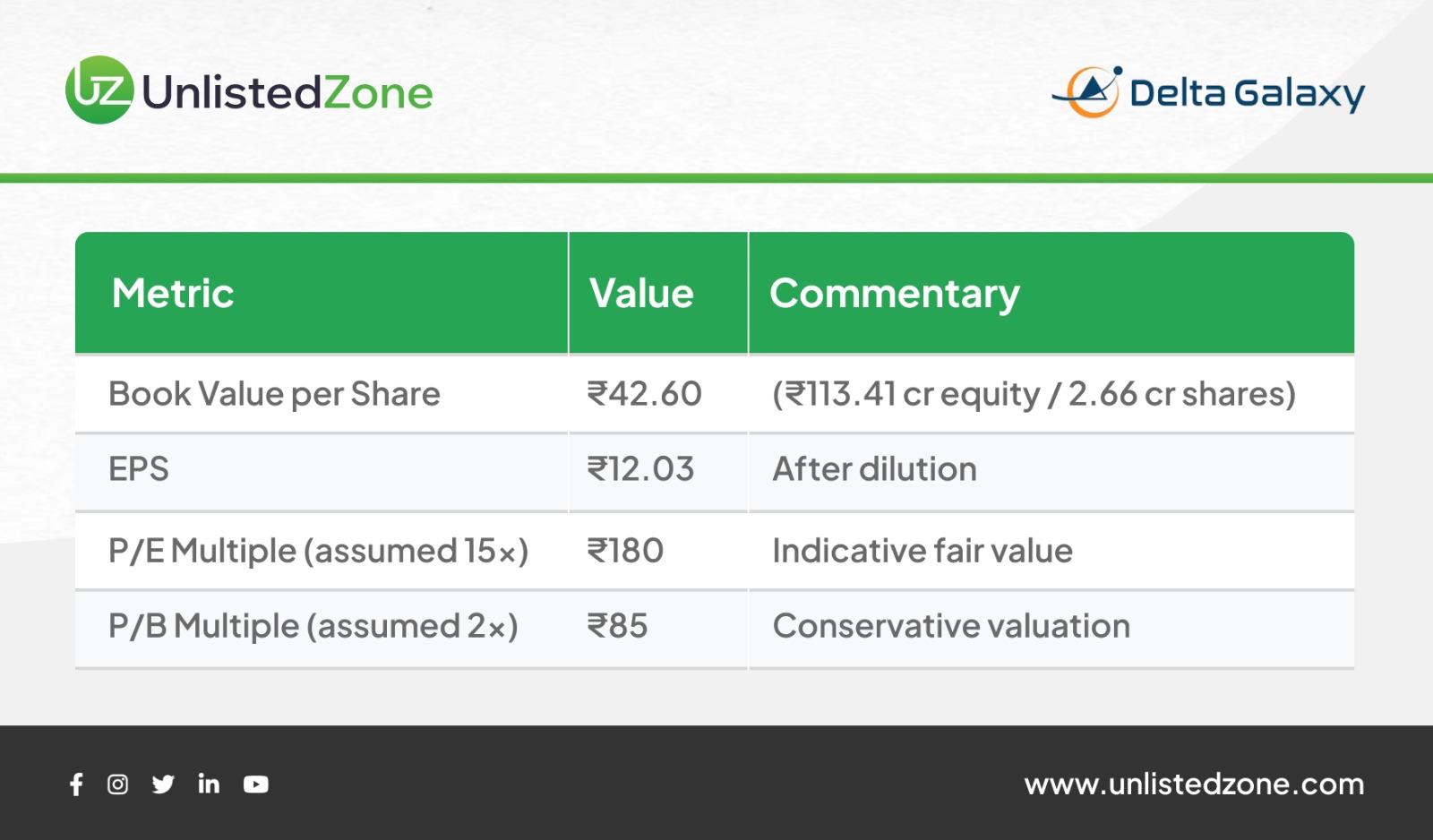

Valuation View

Note: Actual valuation depends on industry multiples, growth trajectory, and investor sentiment.

Final Verdict

Delta Galaxy Engineering Services Limited had a strong FY 2024-25 with:

However, concerns exist:

-

High receivables (₹131 cr - collection risk)

-

Massive shareholder dilution (EPS fell despite profit growth)

-

Statutory compliance lapses

-

Declining return ratios

Overall Assessment: The company is in a growth phase with strong fundamentals but needs to focus on working capital management and compliance. The dilution is a one-time event if capital is deployed wisely.