A) Business Model: A Legacy Brewery with Diversified Offerings

Mohan Meakin Limited is one of India’s oldest and most respected beverage companies, tracing its roots back to 1855 with the establishment of a brewery in Kasauli by Edward Dyer. Over the decades, the company evolved through mergers, expansions, and modernizations, eventually emerging as a diversified player in alcoholic beverages, non-alcoholic drinks, and related industries. Its flagship brands such as Old Monk rum, Lion beer, and Solan No. 1 whisky hold iconic status in India and abroad. The company operates a robust manufacturing and distribution network, strategically located to leverage optimal brewing conditions and meet domestic as well as international demand.

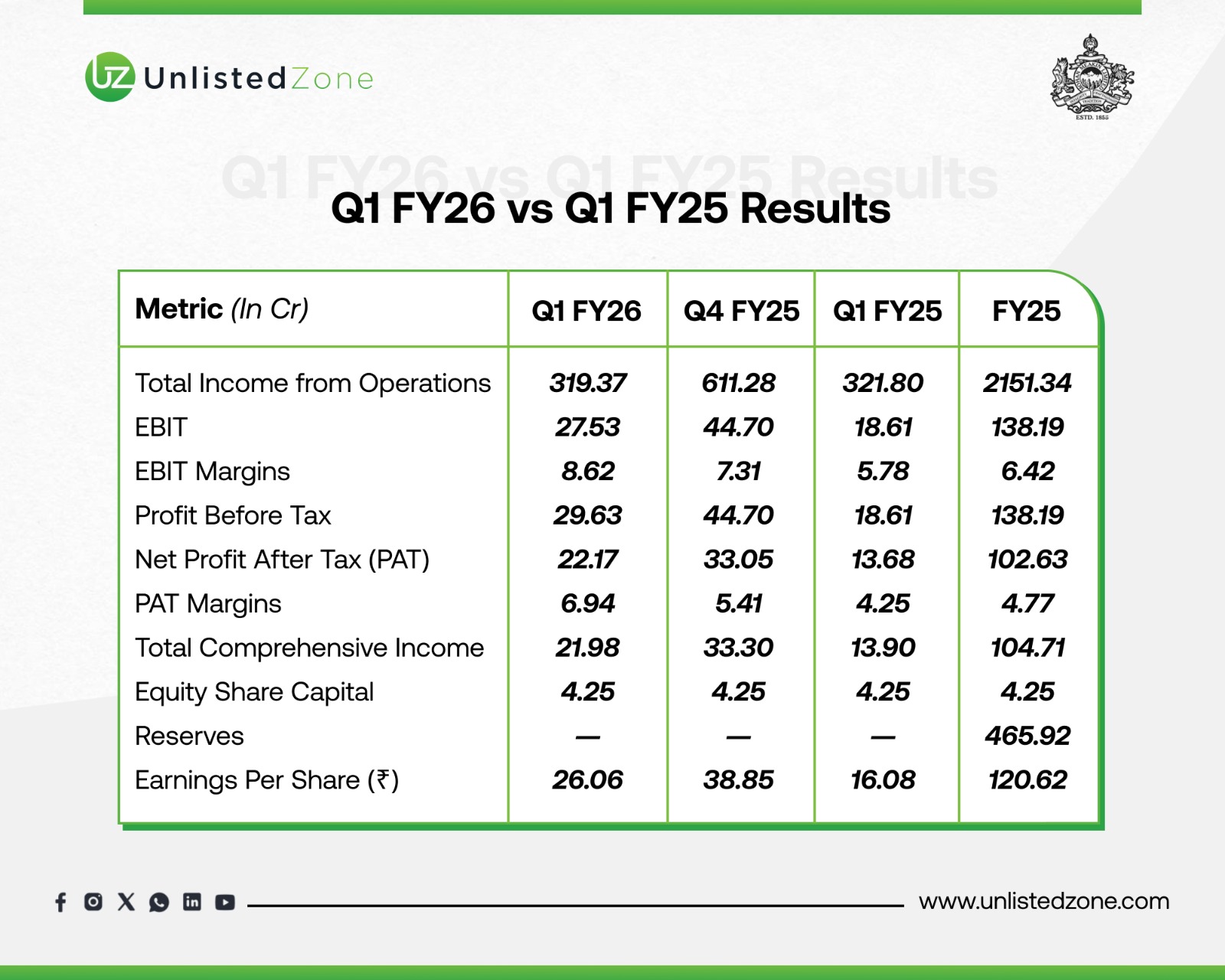

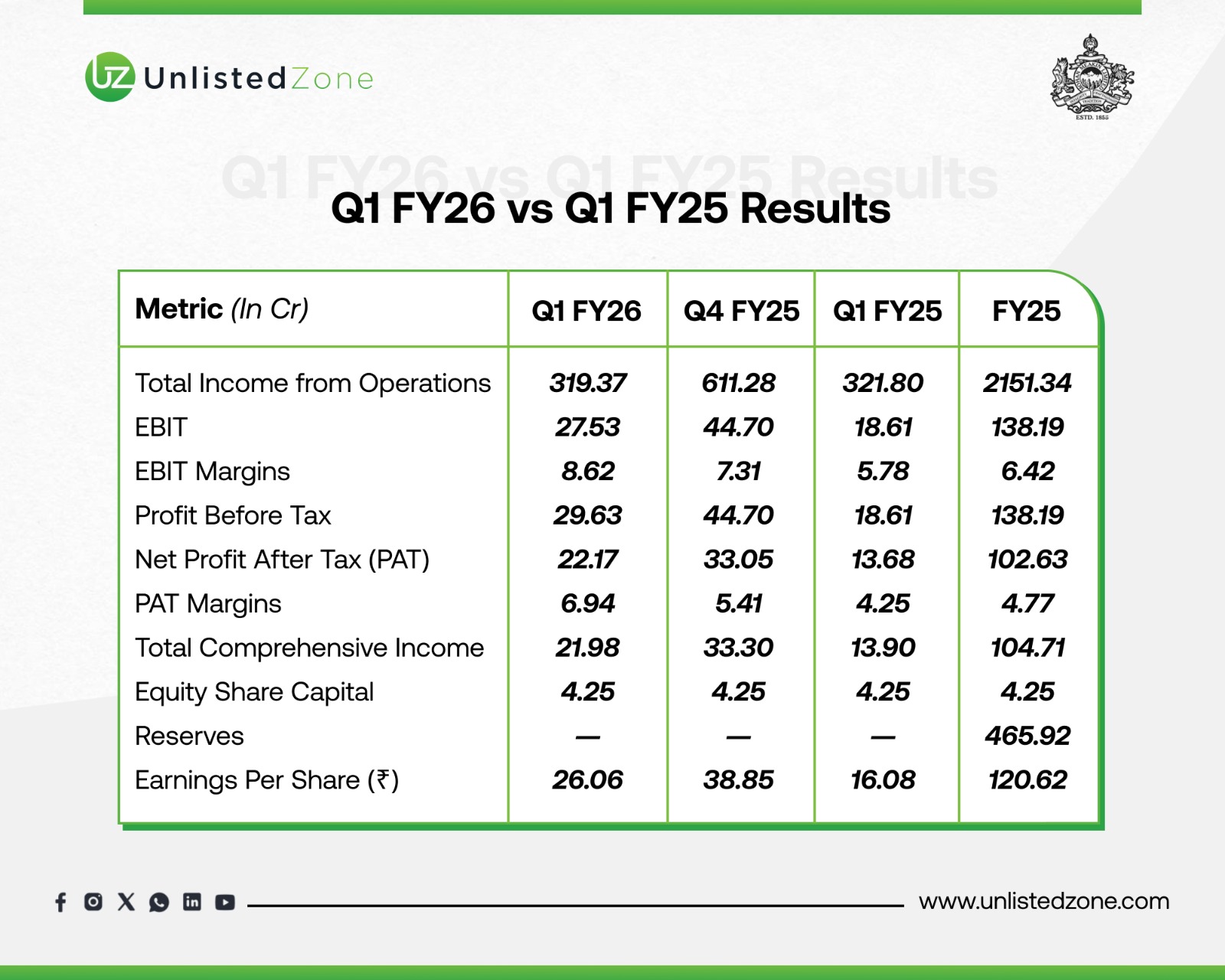

B) Q1 FY26 Financial Performance

C) Detailed Key Highlights

-

Stable Revenue Despite Marginal Decline

The company reported total income from operations of ₹319.36 Crore, a slight drop of 0.76% compared to ₹321.80 Crore in Q1 FY25. This indicates resilience in maintaining sales volumes despite seasonal variations in demand.

-

Significant Profitability Growth

Net Profit After Tax surged to ₹22.17 Crore, marking a robust 62.14% YoY increase from ₹13.68 Crore . This growth is attributed to cost optimization measures, better production efficiencies, and a favorable product mix.

-

Enhanced Shareholder Returns

EPS rose sharply from ₹16.08 in Q1 FY25 to ₹26.06 in Q1 FY26, reflecting strong earnings growth and improved returns for investors.

-

Operational Efficiency Gains

Despite a sequential revenue drop from Q4 FY25, the company managed to sustain high margins, highlighting operational discipline and effective cost control strategies.

-

Strong Balance Sheet Position

The equity base remains at ₹4.25 Crore with substantial reserves of ₹465.92 Crore, providing financial stability and capacity for future investments.

D) Historical Legacy and Market Position

With a legacy of over 160 years, Mohan Meakin has navigated multiple market cycles and industry shifts, consistently adapting to consumer preferences. Its heritage brands, coupled with modern manufacturing practices, keep it competitive in both domestic and international markets.

For More Information Visit : UnlistedZone

Conclusion

Mohan Meakin Limited’s Q1 FY26 results showcase a strong start to the fiscal year with significant profitability gains. The company’s focus on cost control, operational efficiency, and brand strength positions it well to capitalize on seasonal demand peaks and sustain long-term growth.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information shared is solely for educational and informational purposes. This article does not constitute any buy/sell recommendation or financial advice. Investors should conduct their own due diligence or consult a SEBI-registered advisor before making investment decisions. Investments in unlisted and pre-IPO shares are subject to market and liquidity risks.