1. Background – What is KEIL?

Kratos Energy & Infrastructure Ltd. (KEIL)is a small, financially distressed company listed on the Bombay Stock Exchange (BSE).

In February 2024, KEIL initiated a Pre-Packaged Insolvency Resolution Process (PPIRP) under the Insolvency & Bankruptcy Code (IBC) to settle liabilities and bring in a strong strategic investor.

Lords Mark Industries Pvt. Ltd. (LMI) — a diversified private company active in pharmaceuticals, renewable energy, defence, batteries, LED lighting, and packaging — emerged as the strategic investor and submitted a revival plan to acquire and merge with KEIL.

2. NCLT Approval of Resolution Plan

On 28 July 2025, the Mumbai Bench of NCLT approved the Final Base Resolution Plan jointly submitted by KEIL (Corporate Debtor) and LMI.

The plan includes:

- Full settlement of creditors (operational and financial, including SEBI-related dues).

- Change of control: Old promoters exit; a new board nominated by Lords Mark takes charge.

- Restructuring through a Reverse Merger — a corporate strategy where a private company merges into a listed shell.

3. Step 1 – Acquisition & Open Offer

- Under SEBI (SAST) Regulations, any acquirer who takes more than 25% and control of a listed company must give public shareholders an exit opportunity through an open offer.

- To comply, Mr. Sachidanand Upadhyay (Director of LMI):

- Is purchasing the promoter’s 49% stake (4.90 lakh shares) in KEIL.

- Has launched a mandatory open offer to acquire up to 26% from the public at ₹30 per share.

Shareholder choice:

- Tender shares → Exit at ₹30.

- Do not tender → Remain a KEIL shareholder in the new merged entity.

⚠️ Important: Open offer does not cancel shares. It is simply a transfer of ownership.

4. Step 2 – Reverse Merger Mechanics

- After taking control, Lords Mark Industries Pvt. Ltd. will merge into KEIL (renamed Lords Mark India Ltd.).

- Swap ratio approved: 1 LMI share (FV ₹5) → 1.25 KEIL shares (FV ₹10)

- LMI ( Lords Mark Industries ) share base: 18 crore shares.

- New KEIL shares to be issued: 18Cr×1.25 = 22.5Cr.

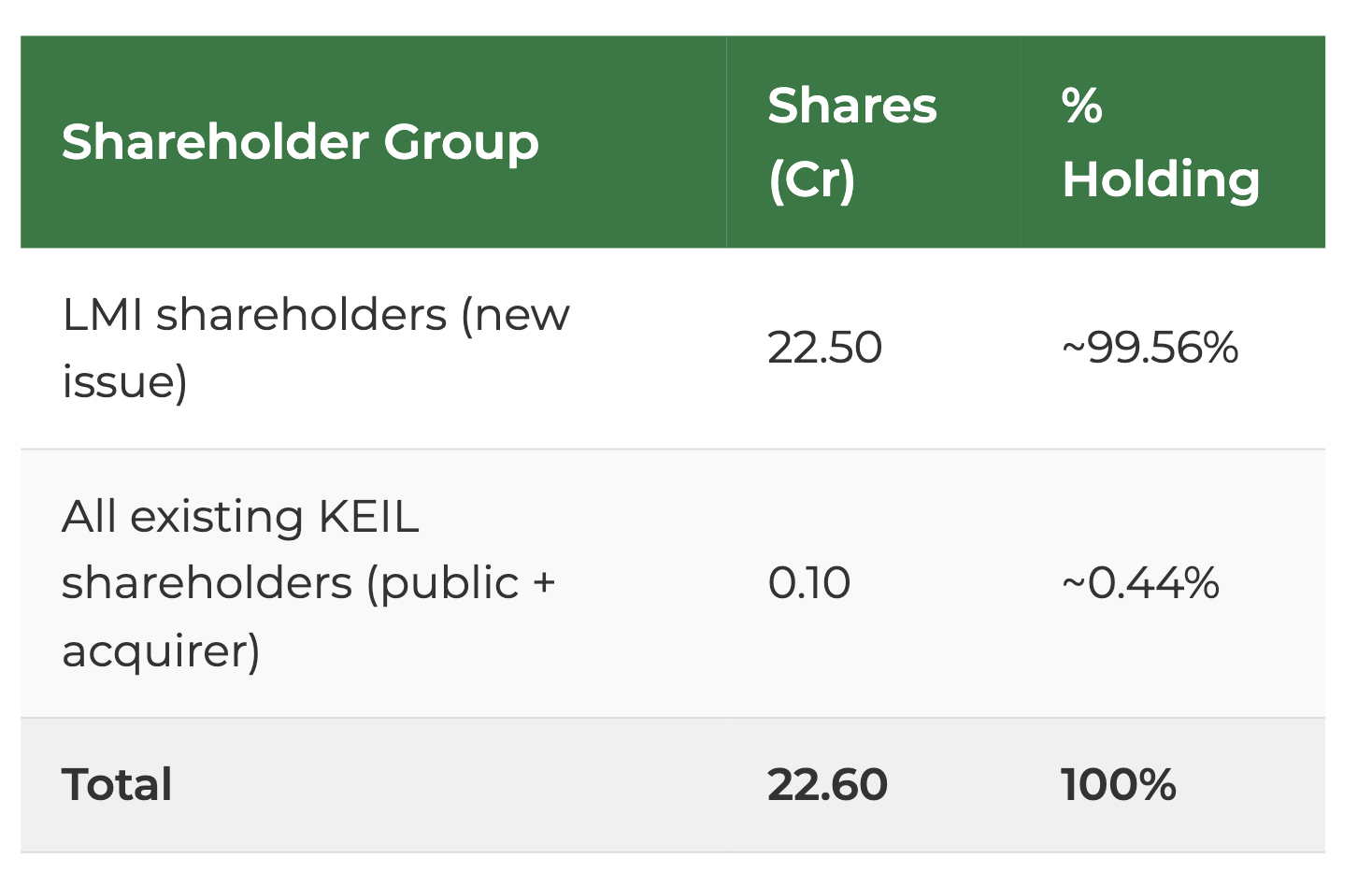

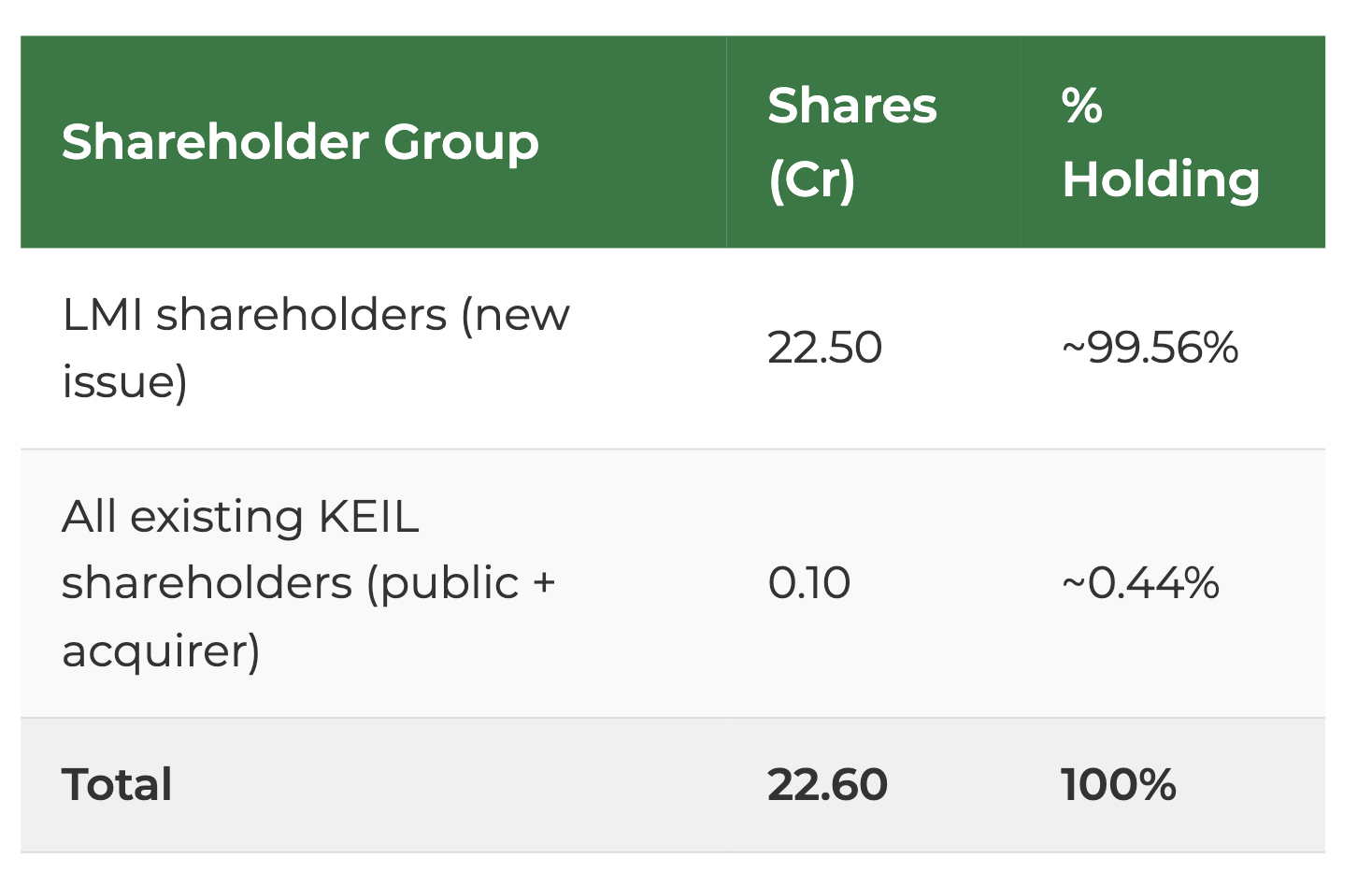

- Existing KEIL shares: 0.10 Cr (10 lakh).

- Total post-merger KEIL shares: 22.60 Cr.

Post-Merger Ownership

Key point: Existing KEIL shareholders — including the acquirer’s 75% — will together own less than 0.5% of the enlarged company after the new 22.5 Cr shares are issued.

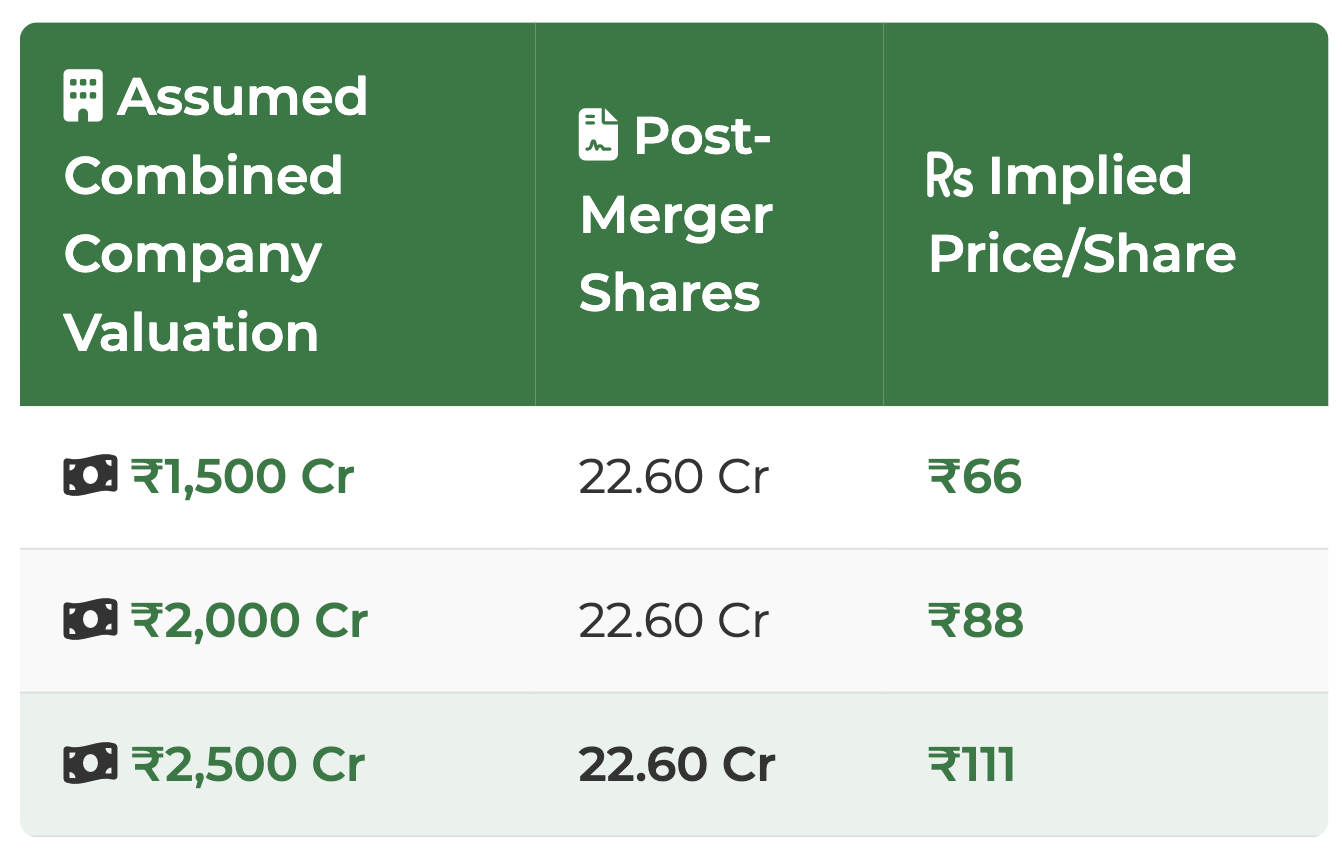

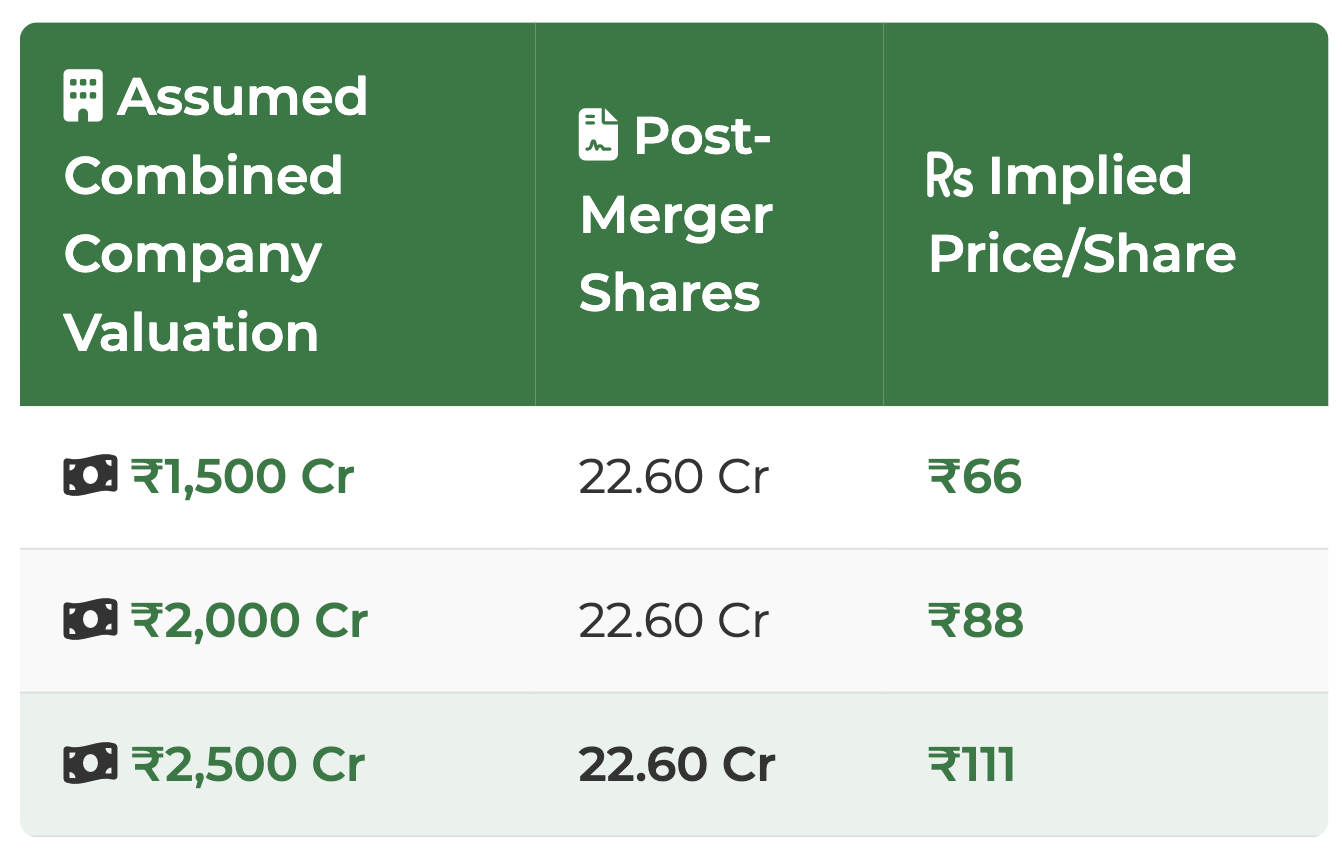

5. Valuation Impact – Sensitivity Scenarios

Currently, KEIL trades at ₹638 per share with only 10 lakh shares outstanding → market cap ≈ ₹64 Cr. This price is on a tiny free float and ignores the massive dilution coming from the merger.

Once the merger completes, total shares will rise to 22.60 Cr. Post-merger price will depend entirely on the market valuation of Lords Mark Industries.

Key insight: Today’s ₹638 is based on a tiny float; once 22.5 Cr new shares list, prices will mathematically adjust downward toward the ranges above.

6. What Happens to KEIL Shareholders ( Listed Entity )

Option A – Tender Shares in the Open Offer (₹30 per share)

- Provides immediate cash exit for investors who prefer not to wait for the merger to complete.

- Eliminates the risk of heavy post-merger dilution, but also means you forgo any potential upside if the merged Lords Mark entity is later valued significantly higher.

Option B – Retain KEIL Shares and Participate in the Merger

- Your current KEIL shares will continue to exist but will be diluted to about 0.44% of the expanded company once 22.5 crore new shares are issued.

- At a post-merger valuation of ₹1,500–₹2,500 crore, the implied value per existing KEIL share would range from approximately ₹66 to ₹111.

- This may be appealing for investors who bought early at ₹30–₹40, but is highly unattractive for anyone entering now at ₹638, given the severe dilution.

- Note: The company will be required to restore the minimum 25% public shareholding (MPS) post-merger, likely through a large equity sale — which could put selling pressure on the stock and impact pricing.

7. Impact on Unlisted Lords Mark Investors

Lords Mark Industries (LMI) currently trades in the unlisted market at a valuation of ~₹1,500 Cr.

- Each unlisted LMI share (FV ₹5) will become 1.25 listed KEIL shares (FV ₹10) after the merger.

- If the listed company is valued at:

- ₹1,500 Cr → ~₹66 per KEIL share → 1 LMI share = 1.25 × 66 = ~₹82.5

- ₹2,000 Cr → ~₹88 per KEIL share → 1 LMI share = 1.25 × 88 = ~₹110

- ₹2,500 Cr → ~₹111 per KEIL share → 1 LMI share = 1.25 × 111 = ~₹138.75

Takeaway:

- If you are buying LMI in the unlisted market now (at implied ~₹83–₹100+), your post-listing value will depend directly on the market cap the listed entity achieves.

- A ₹1,500 Cr valuation gives ~₹82.5 per current LMI share — close to present unlisted prices.

- For upside, the merged company would need to list closer to ₹2,000–₹2,500 Cr or more.

8. Key Takeaways

- Open offer (₹30) is a regulatory exit for KEIL public holders; no shares are cancelled.

- Reverse merger gives Lords Mark a fast track to listing without IPO.

- Existing KEIL shareholders will be diluted to <0.5% ownership after the 22.5 Cr share issuance.

- Current ₹638 KEIL price is speculative and will likely re-rate downward when the new 22.5 Cr shares list.

- Lords Mark unlisted investors:

- Will automatically become shareholders of the listed entity at 1:1.25 swap.

- Your real gain depends on the listed market cap:

- Today’s unlisted pricing already assumes a strong listed valuation; upside needs a higher post-listing m-cap.

Bottom Line

- KEIL minorities: if you entered early at ₹30–₹40, holding may still pay if Lords Mark commands a ₹2,000–₹2,500 Cr valuation; but at current ₹638, dilution risk is extreme.

- Unlisted Lords Mark buyers: will get listed shares automatically, but your return depends on the final listed valuation. At current private pricing, you need a strong listing premium (above ₹2,000 Cr) to see meaningful upside.

- Open offer @₹30 is a safe exit for KEIL public holders unwilling to take valuation and liquidity risk.