Eyewear retailer Lenskart Solutions Limited has delivered a strong performance for the quarter ended June 30, 2025 (Q1 FY26), posting a net profit of ₹61.2 crore, compared to a loss of ₹10.9 crore in the same quarter last year. The company’s robust growth comes just days before its much-awaited ₹2,150 crore IPO.

1. Financial Performance Overview

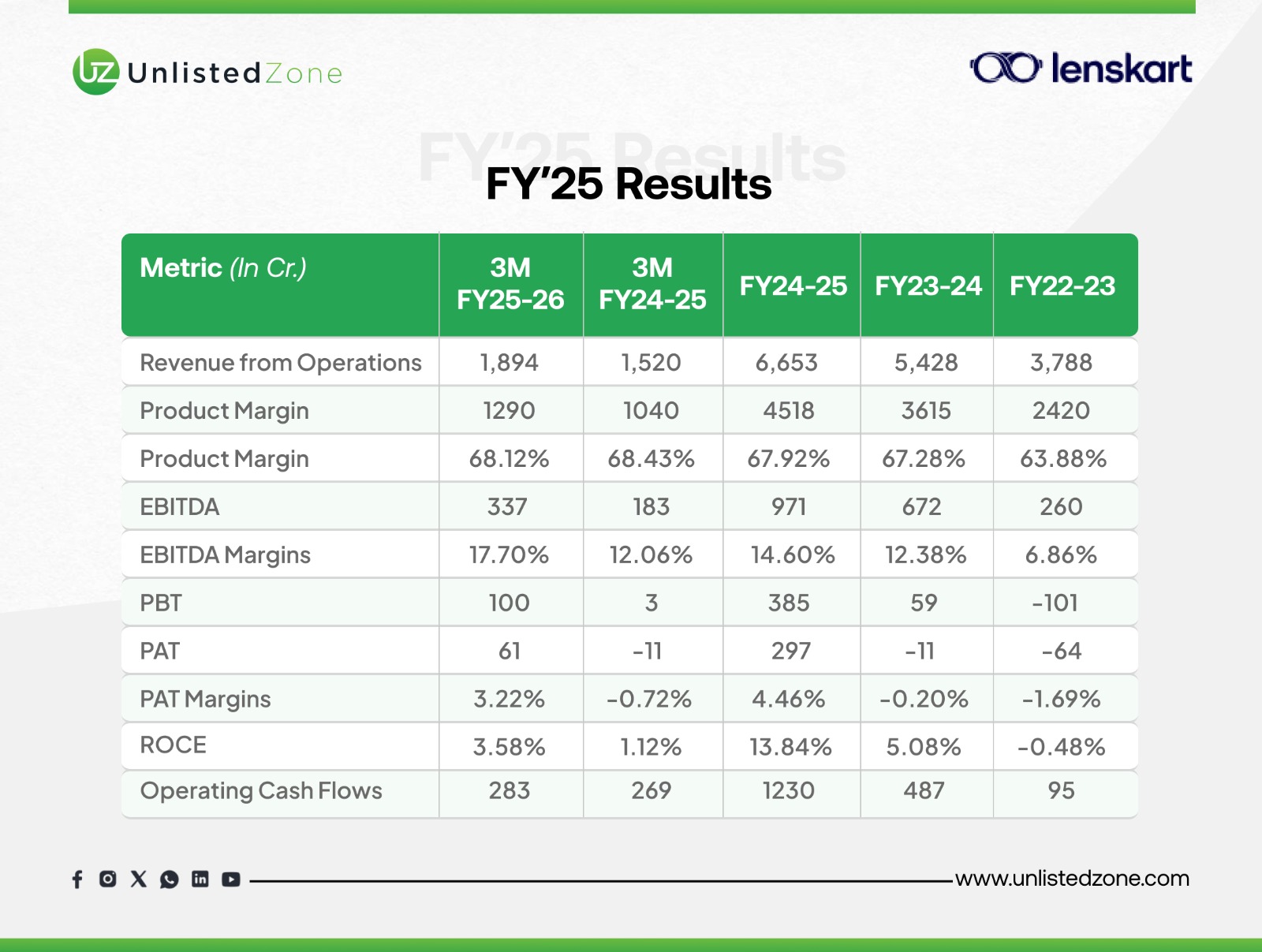

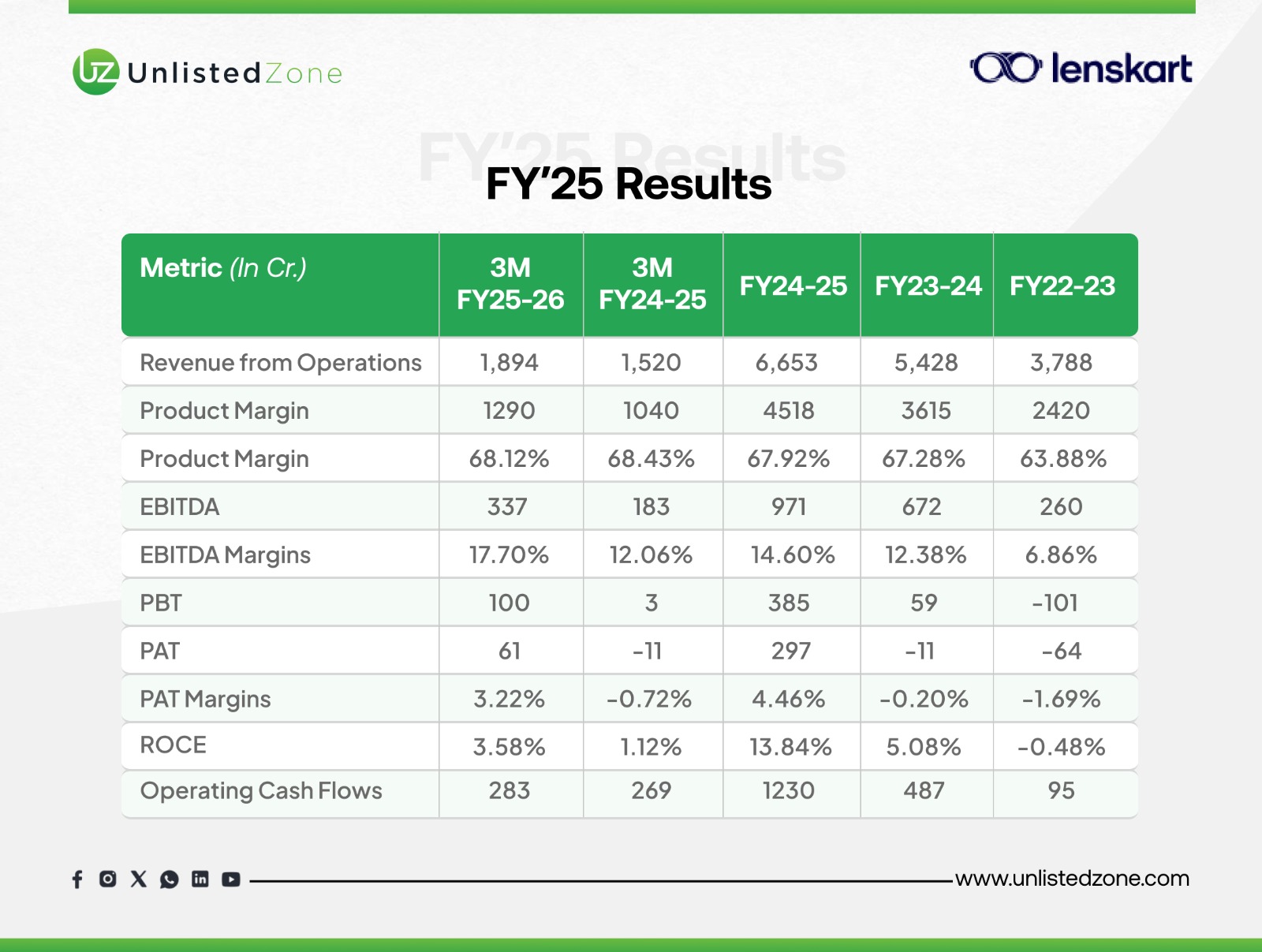

Lenskart’s revenue from operations jumped 24.6% year-on-year to ₹1,894.5 crore from ₹1,520.4 crore in Q1 FY25, driven by strong demand across both online and offline channels and steady expansion in domestic and international markets.

The company’s profit before tax (PBT) stood at ₹75.9 crore, compared to a loss of ₹12.4 crore a year ago. Total income rose to ₹1,934.1 crore, while total expenses increased to ₹1,858 crore, reflecting higher marketing and expansion costs.

2. Strong Operating Leverage and Cost Discipline

Lenskart’s EBITDA surged to ₹336.6 crore from ₹183.4 crore in Q1 FY25, supported by higher sales productivity, improved product margins, and cost discipline.

The company attributed the improvement to better operating leverage from its growing store network and investments in technology infrastructure.

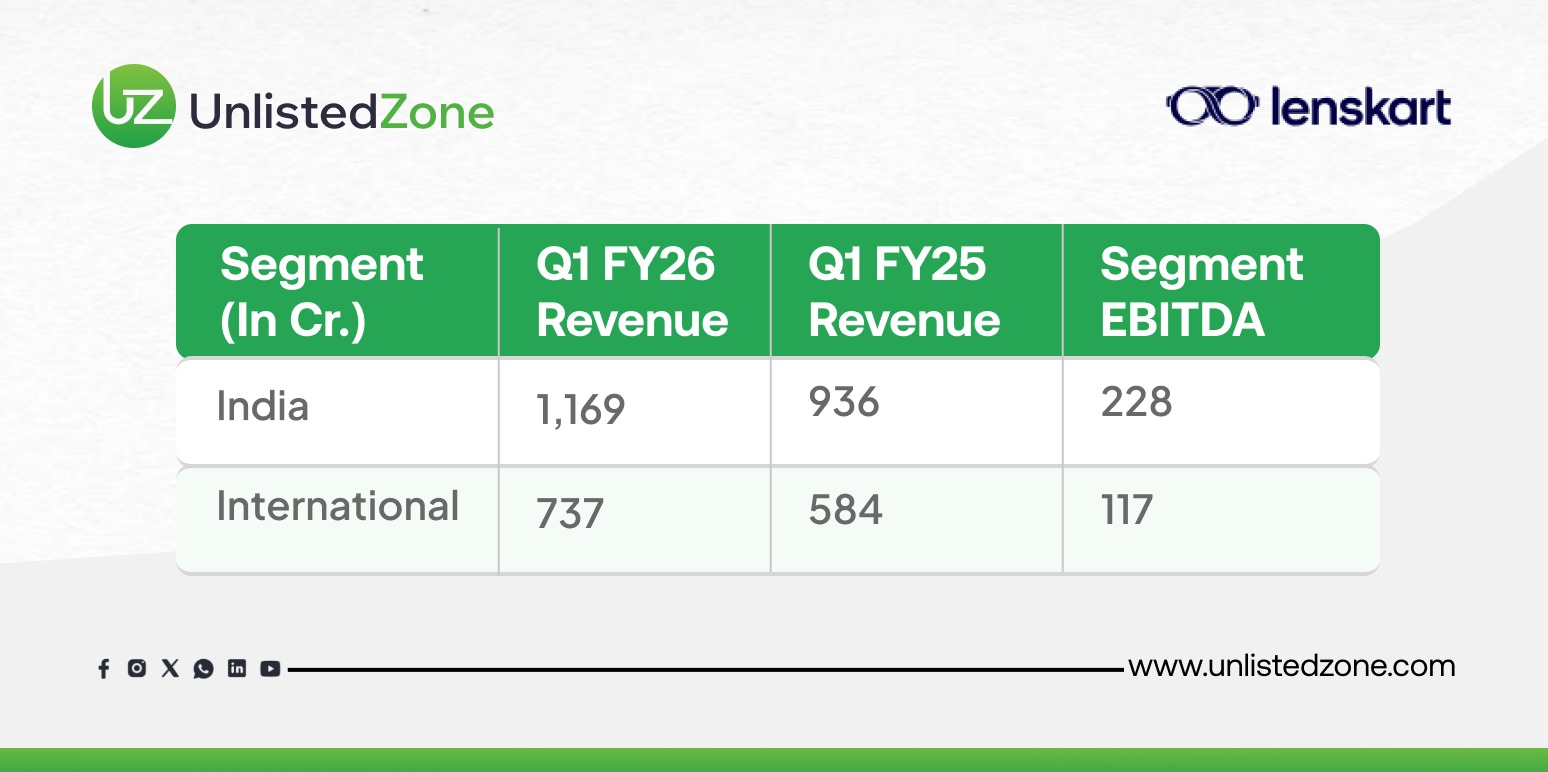

3. India and International Business Breakdown

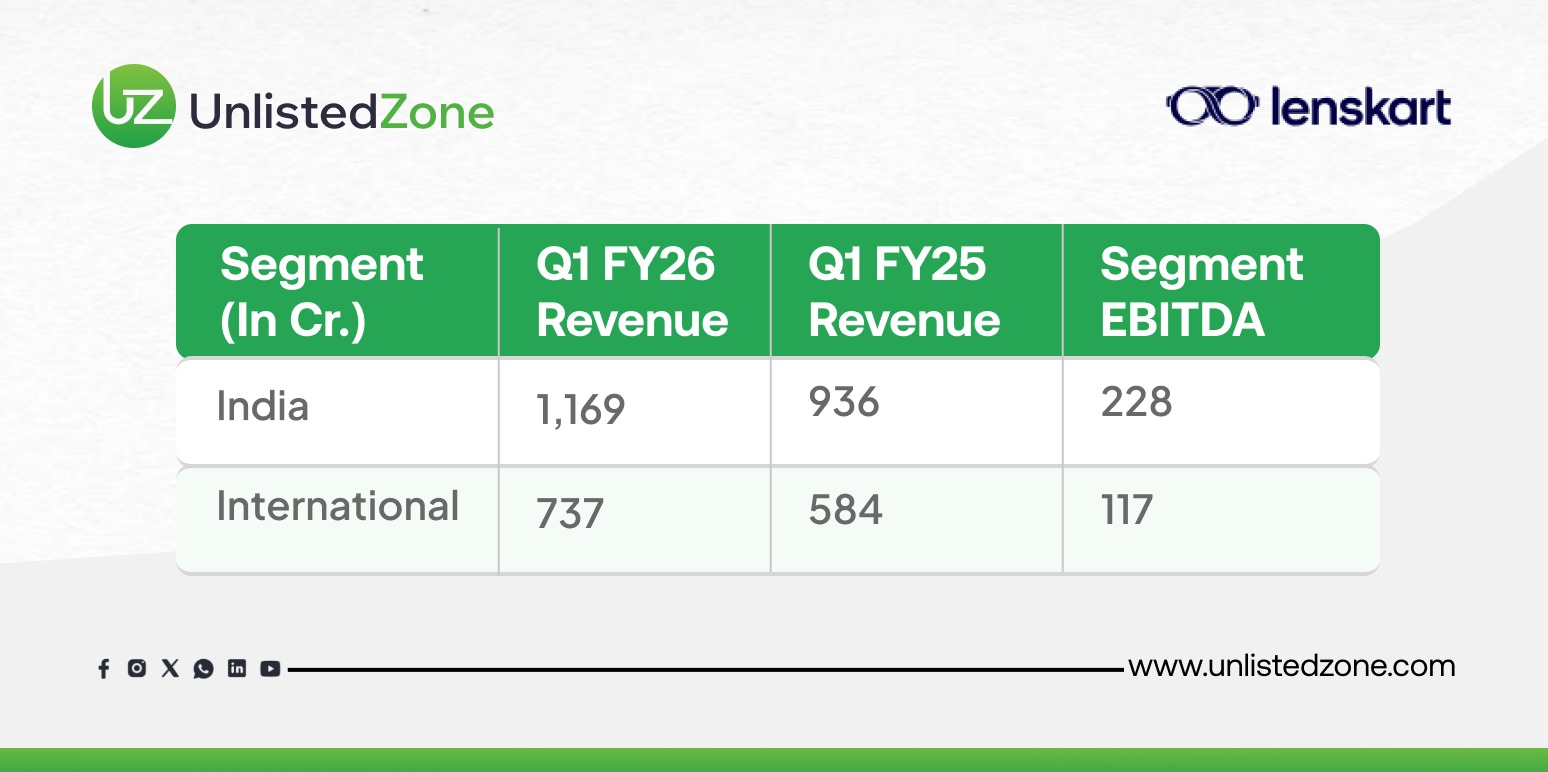

The India business continues to lead performance with a 25% year-on-year revenue growth. Meanwhile, the international segment — covering the Middle East and Southeast Asia — grew over 26%, underlining Lenskart’s accelerating global presence.

The India business continues to lead performance with a 25% year-on-year revenue growth. Meanwhile, the international segment — covering the Middle East and Southeast Asia — grew over 26%, underlining Lenskart’s accelerating global presence.

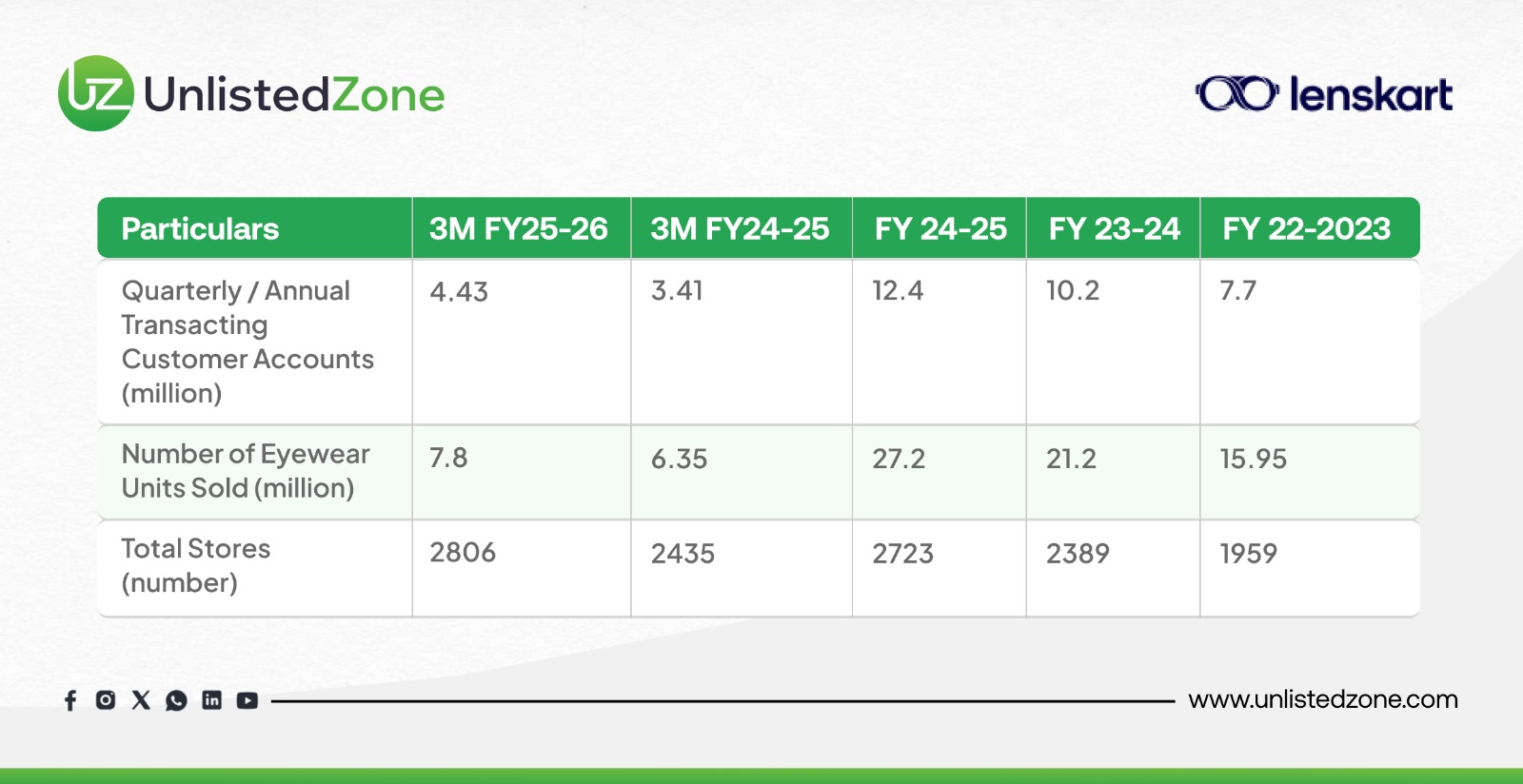

4. Operational Highlights

Highlights:

-

Transacting customer accounts: 4.43 million (up from 3.41 million YoY)

-

Eyewear units sold: 7.8 million (up from 6.35 million YoY)

-

Store count: 2,806 (up from 2,435 YoY)

-

Operating cash flow: ₹283 crore

Lenskart’s expanding footprint, coupled with efficient store performance, continues to strengthen its omnichannel growth strategy.

5. Upcoming IPO Details

Lenskart’s IPO is among the most anticipated public issues in 2025. The anchor round opens on October 30, followed by the public offer between October 31 and November 4, 2025.

The offering includes:

-

Fresh issue: ₹2,150 crore

-

Offer for sale (OFS): 12.76 crore shares by existing investors like SoftBank, Kedaara Capital, ChrysCapital, and KKR

Key Takeaway

Lenskart’s Q1 FY26 performance reflects strong demand momentum, improved profitability, and effective cost control — signaling a confident entry into the public markets. With a rapidly expanding store network and rising global presence, the company is well-positioned to sustain its growth trajectory.

Disclaimer: UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.

The India business continues to lead performance with a 25% year-on-year revenue growth. Meanwhile, the international segment — covering the Middle East and Southeast Asia — grew over 26%, underlining Lenskart’s accelerating global presence.

The India business continues to lead performance with a 25% year-on-year revenue growth. Meanwhile, the international segment — covering the Middle East and Southeast Asia — grew over 26%, underlining Lenskart’s accelerating global presence.