1. The GMV grew by 131% YoY and the top-line at Rs 540 Crores is up by 80% YoY.

2. Mobikwik has achieved this phenomenal growth with a cash burn of only Rs 72 Crores, all of which was related to the first half as we turned EBITDA positive in the second half of the financial year 2021-22

3. As per management, the first 5 months of FY23 have seen as many credit disbursals as they did in the whole of FY22 and with a further decline in credit costs.

4. Revenue is up from 302 Crores in FY21 to 543 Crores in FY22.

5. Total expenses have gone up from 404 Crores in FY21 to 652 Crores in FY22.

6. Mobikwik is still EBITDA negative with an EBITDA loss of 109 Crores in FY22.

7. PAT loss is ~126 Crores in FY22.

8. Cash flow from operations is still negative. That is ~320 Crores cash outflows from operations.

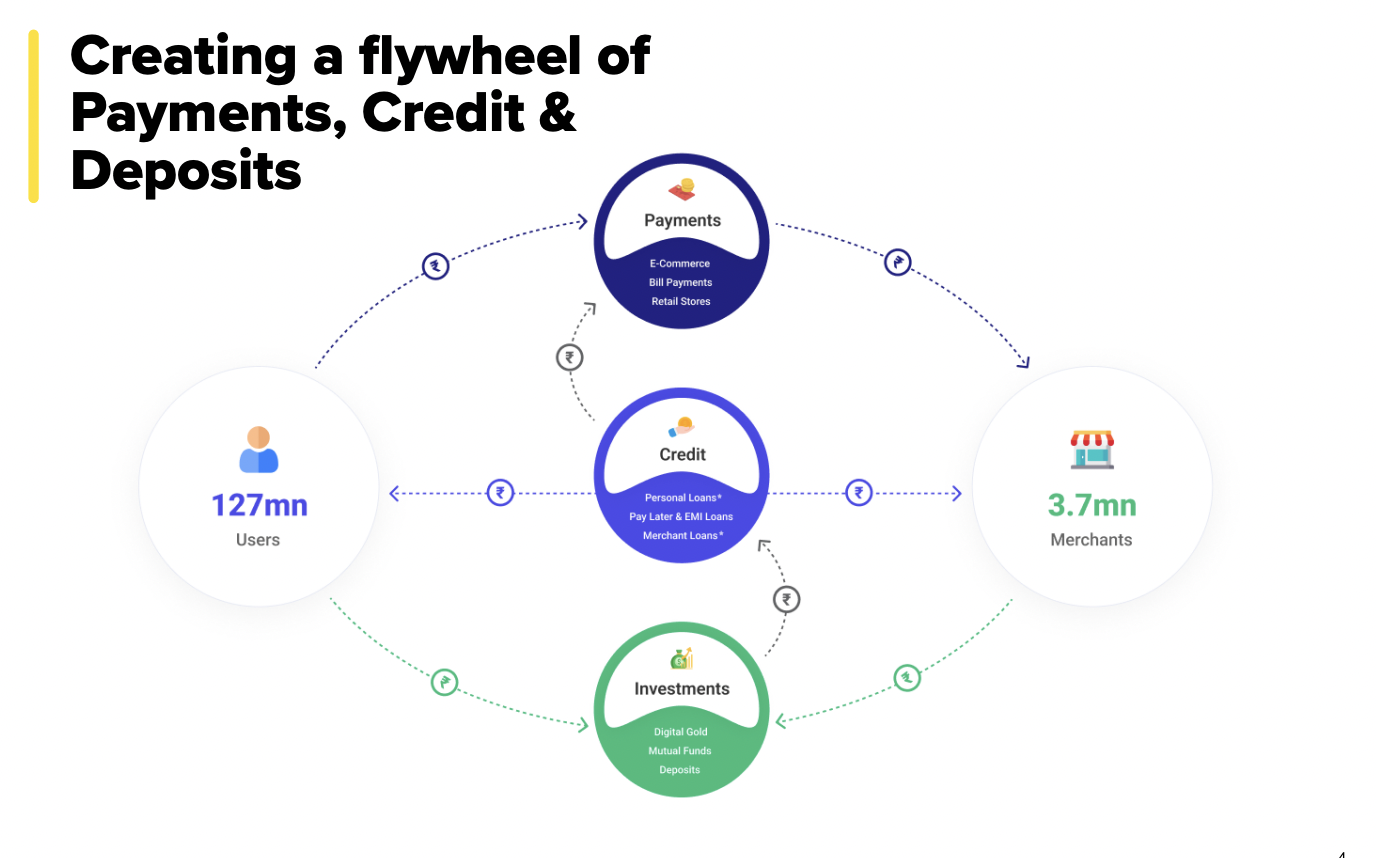

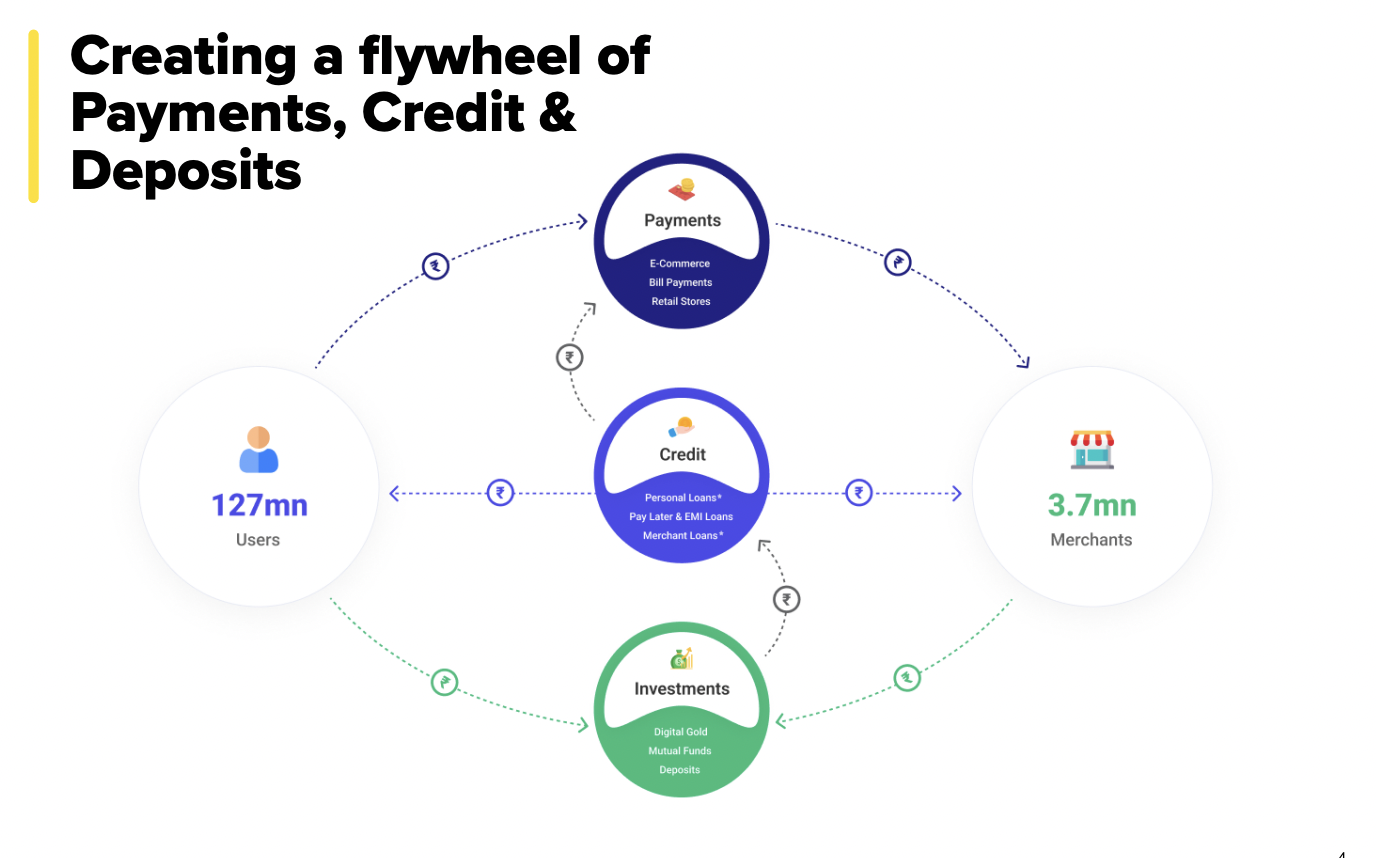

9. Mobikwik services at a glance.

10. Mcap = 5.71 *500 = 2900 Crores, a massive drop in valuation from ~$1 Billion dollar last year to almost 50% down now.