India’s infrastructure and construction boom has created fertile ground for companies like Infra.Market, a Bengaluru-based unicorn in the building materials space. In its latest move, the company has confidentially filed a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) to raise around Rs 5,000 crore ($563 million) through an initial public offering (IPO).

The issue will be split equally between fresh equity shares and an offer-for-sale (OFS) by existing investors, according to sources familiar with the matter. This balanced structure ensures capital infusion for growth while also offering partial exits to investors.

A) Why Infra.Market is Going Public Now

-

Final Private Fundraise: Infra.Market raised Rs 731.58 crore (about $83 million) in a Series G funding round, valuing it at Rs 24,600 crore ($2.8 billion).

-

Key Investors in Series G: Led by Nikhil Kamath’s family office NKSquared (Rs 200 crore). Co-founders Souvik Sengupta and Aaditya Sharda invested Rs 250 crore, and Rs 280 crore came from Accel, Tiger Global, Nexus Ventures, and Evolvence.

-

Promoter Stake Increase: Founders boosted their combined stake to ~30%, officially classifying them as promoters before IPO.

-

Additional Fundraising: Earlier in the year, the company raised $120 million from marquee investors and secured $150 million in debt funding from Mars Growth Capital.

-

Strategic Intent: The IPO aims to leverage India’s infrastructure growth and provide exits for long-standing backers.

Financial Performance

Infra.Market has been posting strong growth over the last few years:

-

FY24 Revenue: Rs 14,530 crore (up 23% YoY)

-

FY24 Net Profit: Rs 378 crore (2.4X jump from FY23)

-

FY25 (estimates): Rs 18,000 crore in revenue, Rs 1,500 crore EBITDA, and Rs 300 crore PAT

Comparatively, its peers in the competitive construction B2B space are also scaling rapidly:

-

OfBusiness: Rs 19,296 crore revenue in FY24

-

Zetwerk: Rs 14,436 crore

-

Moglix: Rs 4,964 crore

Infra.Market’s profitability trajectory and growth momentum make it a compelling IPO candidate.

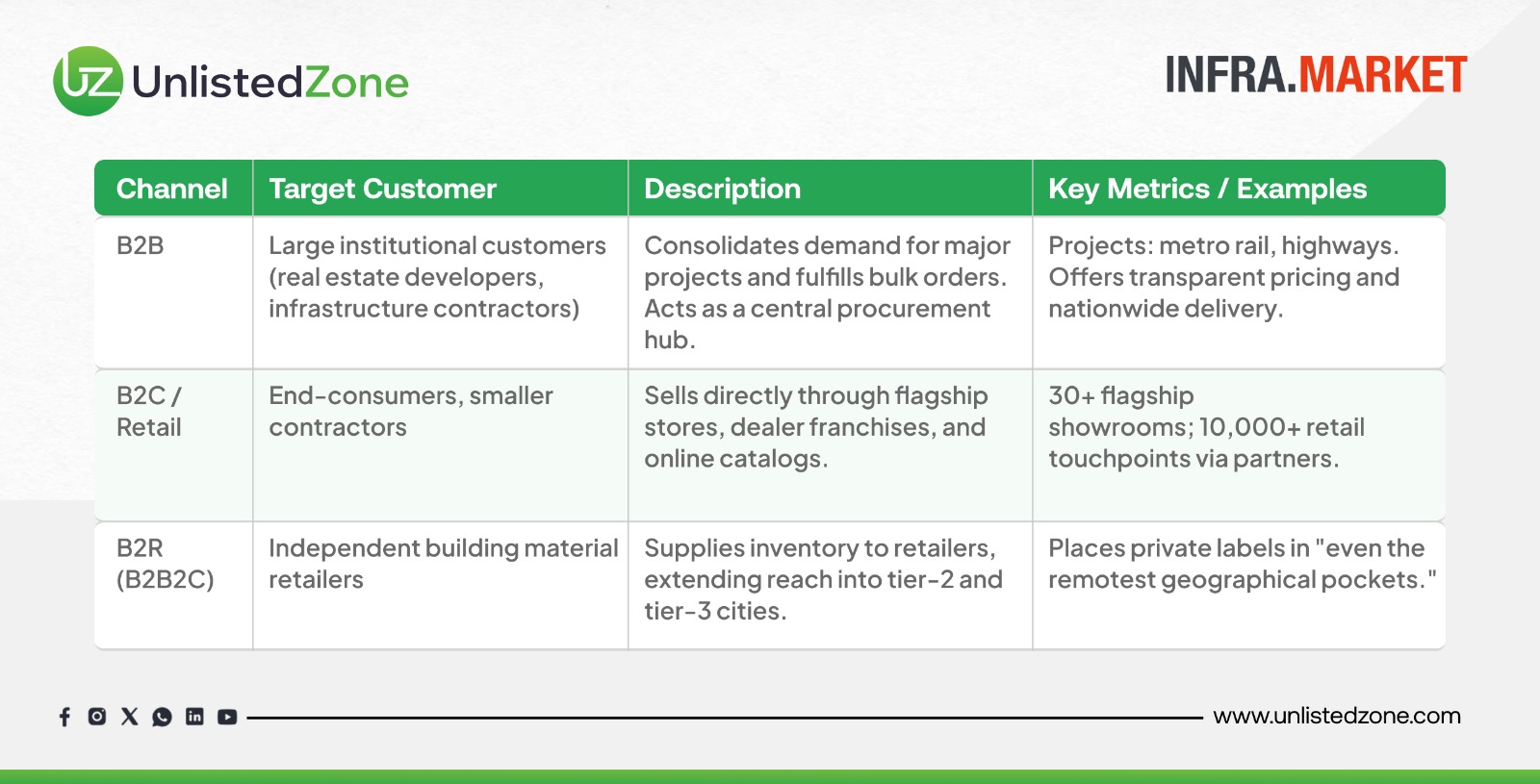

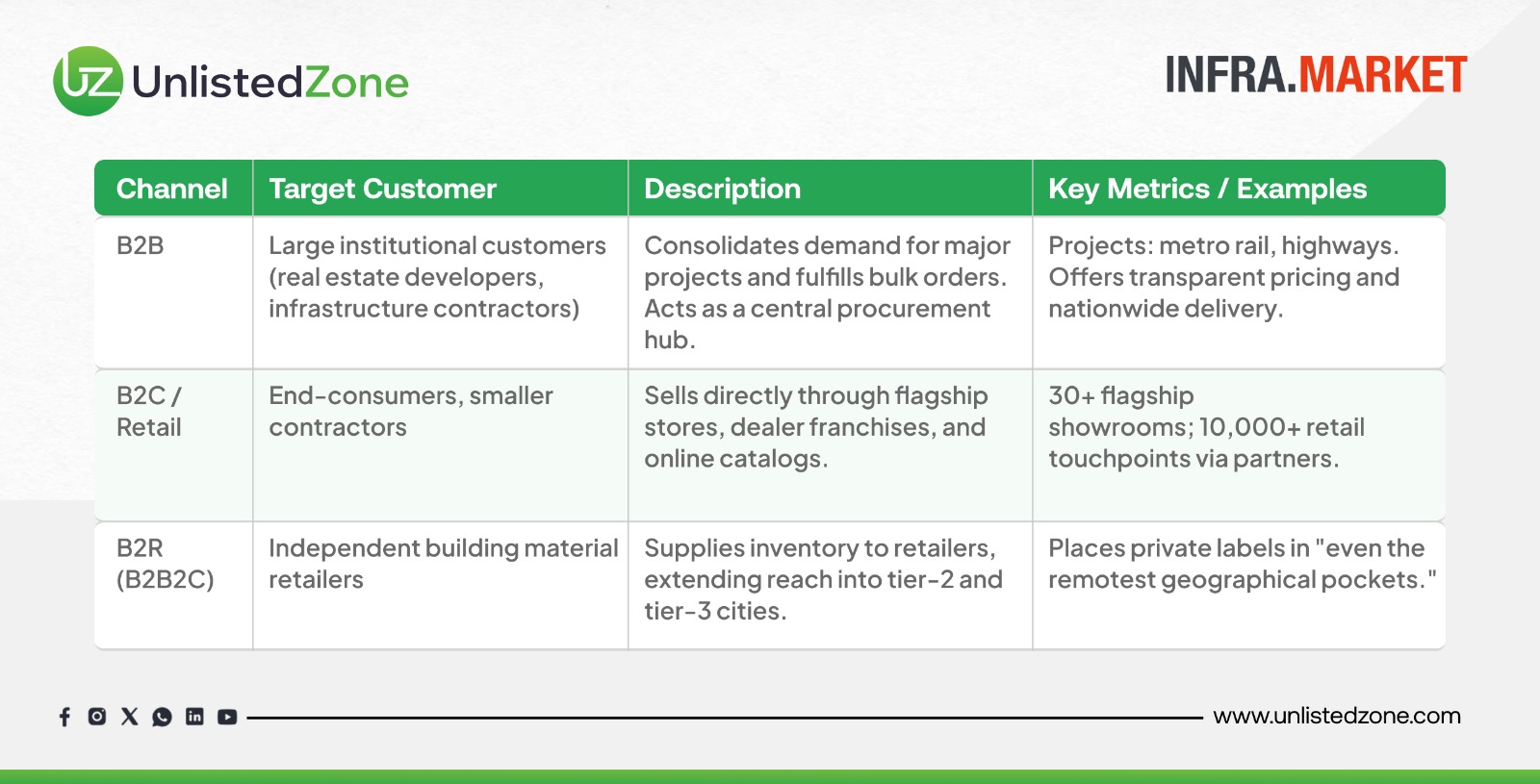

Infra.Market: Business & Revenue Model Data

Business Model & Offerings

Founded in 2016 by Sengupta and Sharda, Infra.Market provides end-to-end construction materials solutions across more than 15 categories including:

-

Concrete

-

Steel

-

Walling solutions

-

Tiles

-

Paints

-

Electricals

The company operates through a wide network of 250+ manufacturing units and 10,000 retail touchpoints across India, catering to both institutional clients (B2B) and retail outlets (B2R). Its product portfolio spans private label brands such as RDC Concrete, Million Tiles, and Shalimar Paints.

Vertical Integration & "House of Brands":

-

Approach: Not just a marketplace; owns a portfolio of brands and controls production.

Strategic acquisitions have also been central to Infra.Market’s growth:

-

2021: Acquired RDC Concrete and Shalimar Paints

-

2022: Acquired 57% stake in Emcer Tiles

-

2023: Bought majority stake in Metro Group (ceramic tiles) in a Rs 200 crore share swap deal

Today, Infra.Market is the second-largest player by revenue in India’s ready-mix concrete (RMC) segment and also holds significant capacity in AAC blocks and flooring tiles.Core Strategy: Hybrid, omnichannel presence underpinned by a “House of Brands” strategy.

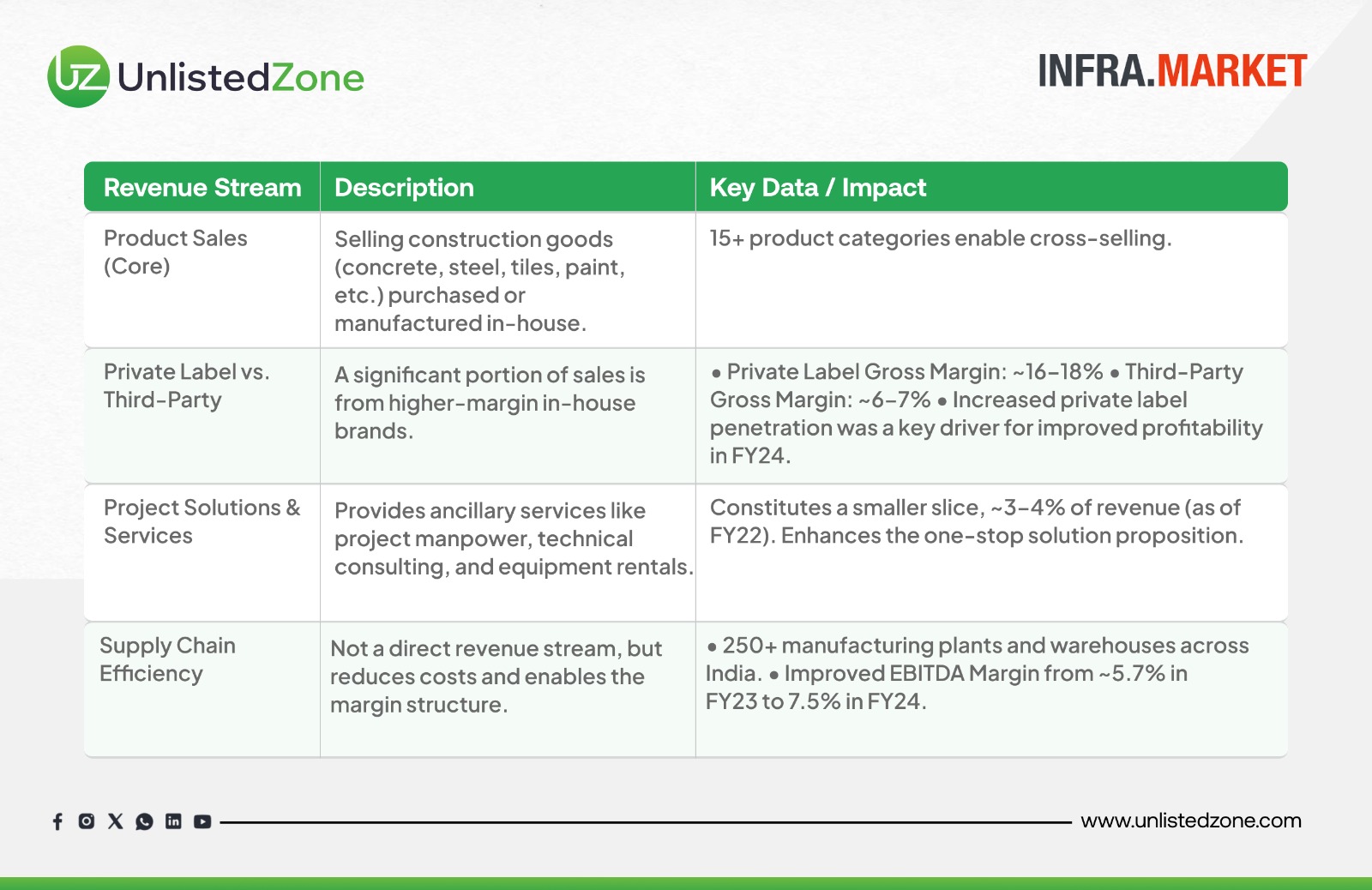

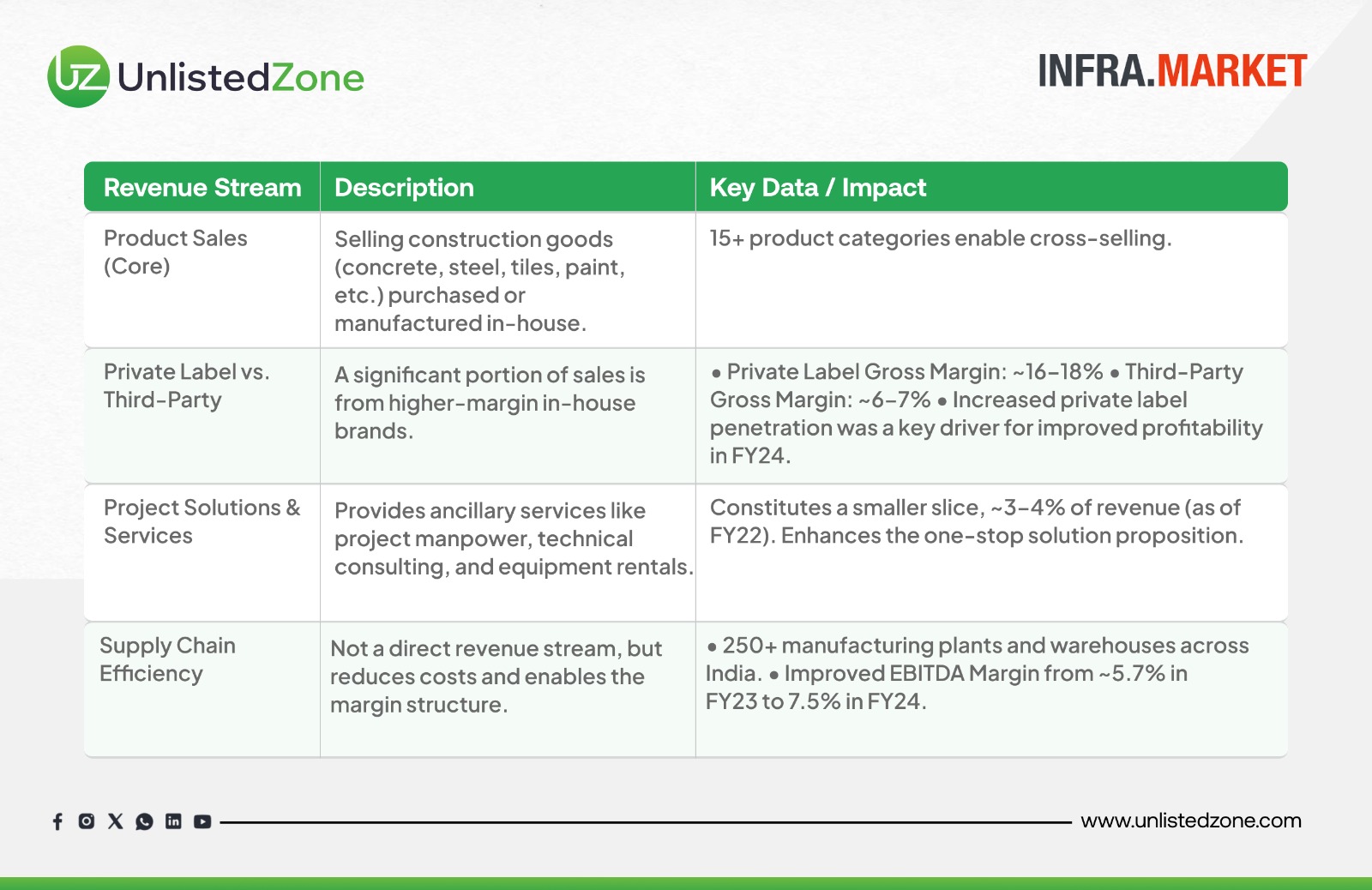

Revenue Model

Primary Source: Over 96% of operating income comes from the sale of construction materials.

The Confidential Filing Route

Infra.Market has chosen SEBI’s confidential filing mechanism, introduced in November 2022, for mainboard issuers. This allows companies to keep sensitive financial and strategic details private until closer to listing. If required, companies can even withdraw plans without making details public — a flexibility not available in the standard DRHP route.

Several other new-age companies have adopted this route recently, including PhonePe, Meesho, Groww, PhysicsWallah, Shiprocket, boAt, Oyo, and Swiggy. Infra.Market’s decision signals its intent to remain discreet until the right market conditions align for listing.

The Road Ahead

Infra.Market has raised over $700 million to date from marquee investors such as Tiger Global, Accel, Nexus, Evolvence, Nikhil Kamath, Ashish Kacholia, Abhijit Pai, Sumeet Kanwar, Capri Global, and Foundamental GmbH. With the IPO, it aims to strengthen its balance sheet, fund expansion, and further cement its leadership in India’s construction materials sector.

As India continues to push large-scale infrastructure development, Infra.Market’s positioning as a tech-enabled building materials marketplace gives it an edge. With robust growth, profitability, and strong investor backing, the company is poised to make one of the most closely watched public debuts in the infrastructure space this year.

In Summary:

-

IPO size: Rs 5,000 crore (equal split between fresh issue & OFS)

-

Recent valuation: $2.8 billion according to Last Funding Round Current Unlisted Valuation : Rs 22671 Cr

-

FY24 financials: Revenue Rs 14,530 crore | PAT Rs 378 crore

-

Backed by: Accel, Tiger Global, Nexus Ventures, Evolvence, Nikhil Kamath, others

-

Business: Construction materials marketplace + private label manufacturing

-

Route: Confidential DRHP filing with SEBI

Infra.Market’s IPO journey will be a bellwether for India’s infrastructure-linked unicorns looking to tap public markets. Investors and industry watchers will keenly follow how it leverages its scale and profitability in an increasingly competitive ecosystem.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.