InCred Holdings Limited is an Indian financial services holding company with a vision to make finance accessible and efficient. Its core strategy involves leveraging advanced technology and analytics to offer tailored products like personal, education, home, and small business loans through its main, wholly-owned subsidiary, InCred Financial Services Limited (IFSL). The company's structure was solidified by a strategic merger with KKR India Financial Services, which unified its ownership. For the fiscal year 2024-25, InCred Financial Services, the operating subsidiary, delivered a robust financial performance, characterized by strong growth and stable profitability.

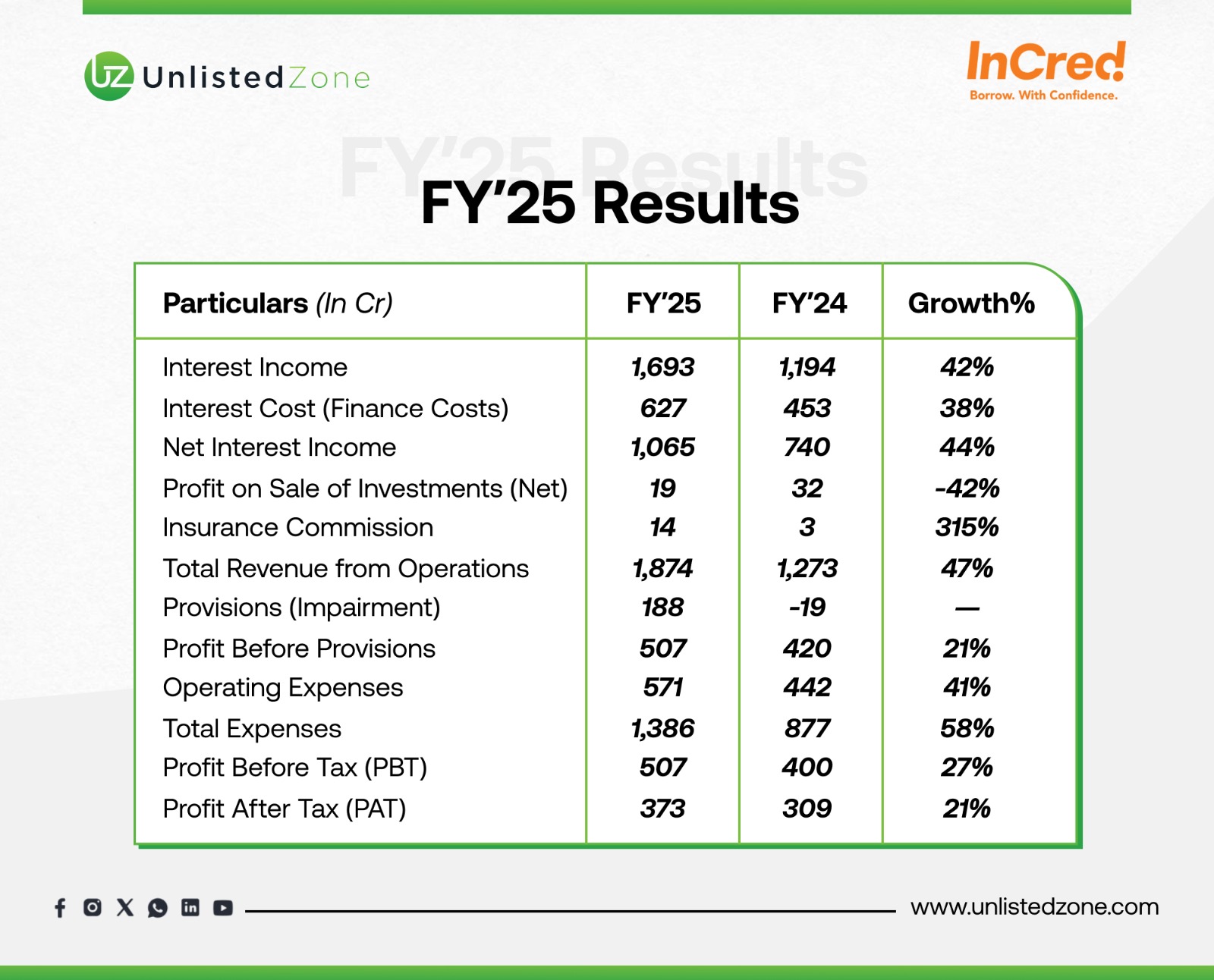

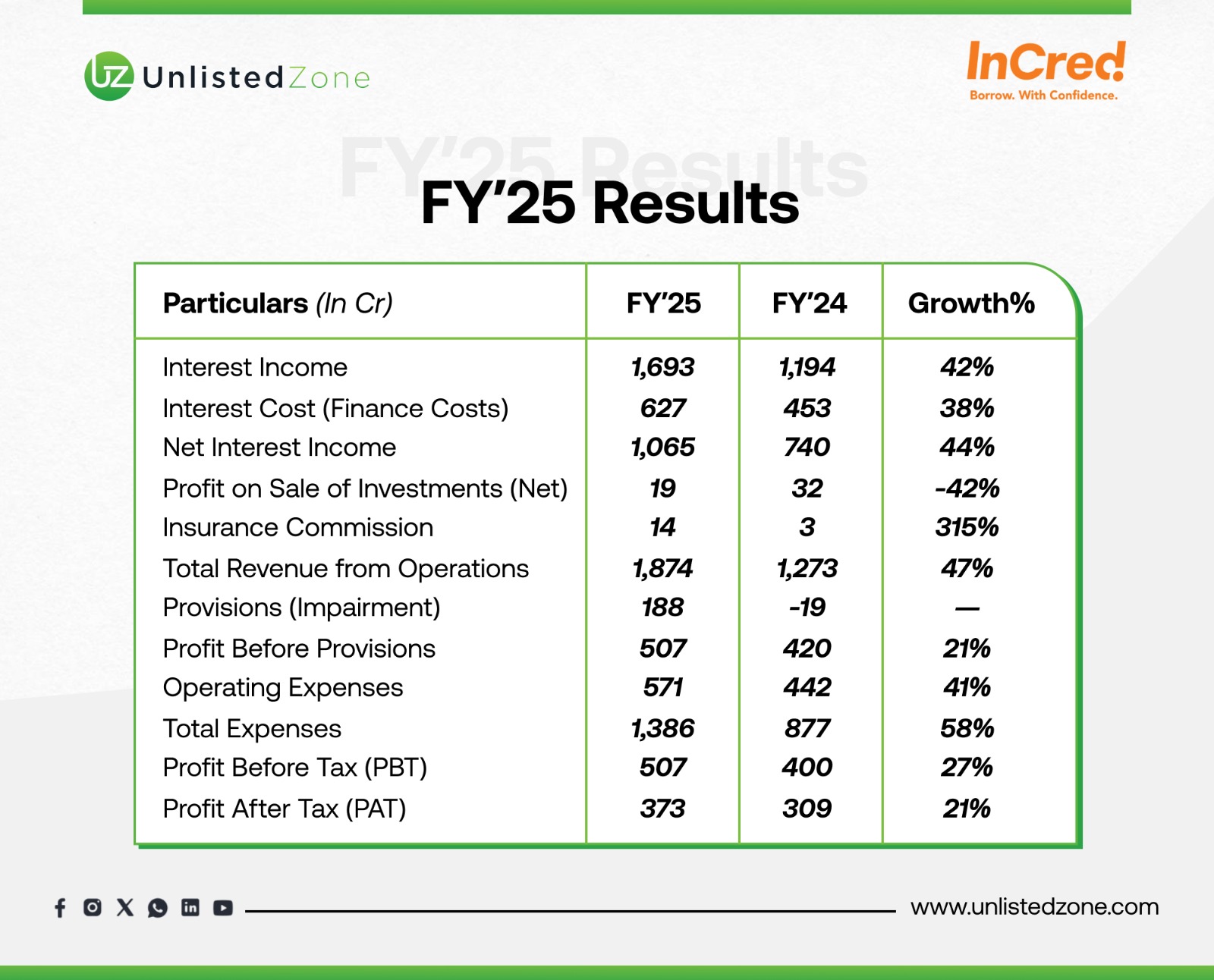

A) Financial Performance Metrics (₹ in Crore)

Financial Performance Discussion:

-

Interest Income: Increased by 42% YoY to ₹1,693 Cr due to strong loan growth across retail and SME segments.

-

Net Interest Income: Jumped 44%, showing effective cost of funds management and lending spread control.

-

Operating Expenses: Rose 41% to ₹571 Cr, mainly due to business expansion and higher employee & technology costs.

-

Provisions: ₹188 Cr versus a write-back last year, driven by higher NPAs recognition, impacting profitability but reflecting conservative risk management.

-

Profit Growth: Despite higher costs and provisions, PBT rose 27% and PAT grew 21%, showing resilience in earnings.

-

Revenue Diversification: Insurance commission income grew over 3x, reducing dependence on pure lending income.

Overall, the company displayed robust topline momentum, efficient cost management, and consistent profitability.

C) Ratio Analysis

-

GNPA (Gross NPA): Slightly lower at 1.94% vs 2.1% last year, mainly due to loan book expansion and marginal rise in stressed accounts.

-

NNPA (Net NPA): Decreased sharply from 2.1% to 0.72%, reflecting lower provisioning requirements and better results of having stricter recognition of bad loans.

-

NIM (Net Interest Margin): Stable at 10.15%, showing consistent lending spreads and efficient interest income management.

-

ROE (Return on Equity): Declined to 9.12% from 9.81% as higher provisions and expenses reduced overall profitability on shareholder equity.

-

ROA (Return on Assets): Dropped to 2.90% from 3.50% due to increased provisioning impact on net income relative to asset base.

-

Cost-to-Income Ratio: Improved slightly to 3.04% vs 3.14%, supported by operational efficiencies and better income growth despite business expansion.

Overall, ratios reflect solid profitability with manageable risk levels, though rising NPAs highlight the need for stronger asset quality monitoring.

D) Valuation Insights

Insight: The valuation suggests the market price is significantly higher than its book value, often seen in companies with strong intangible assets (brand, tech capabilities) or high future profit potential.

E) Other Operational Highlights

-

Loan Book Size: Exceeds ₹10,000 Cr

-

Recent Investment: ₹250 Cr from Kamath Brothers (Nikhil & Nithin of Zerodha)

F) Major Strategic Milestones (Journey to IPO)

-

2022: Merged with KKR India Financial to strengthen its lending business.

-

2023: Achieved Unicorn status after a $60 Mn funding round.

-

2024: Expanded into new businesses:

-

2025: Secured a significant ₹250 Cr pre-IPO investment from the Kamath brothers.

Conclusion

InCred Financial Services has demonstrated robust growth in FY 2024-25, with significant expansion in interest income and net interest margins. Despite increased provisioning and higher operating costs, the company has sustained healthy profitability. With efficient capital utilization, diversified lending portfolio, and strategic backing from marquee investors, InCred is well-positioned for its upcoming IPO and long-term growth in the NBFC sector.

Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.