Himalayan Heli Services Limited (HHSL), a leading helicopter operator in India, has released its performance update for the period April–July 2025 (4MFY26), highlighting resilience in the face of multiple challenges and reaffirming its strong growth potential ahead of its planned Main Board IPO.

1. Performance Overview (April–July 2025)

-

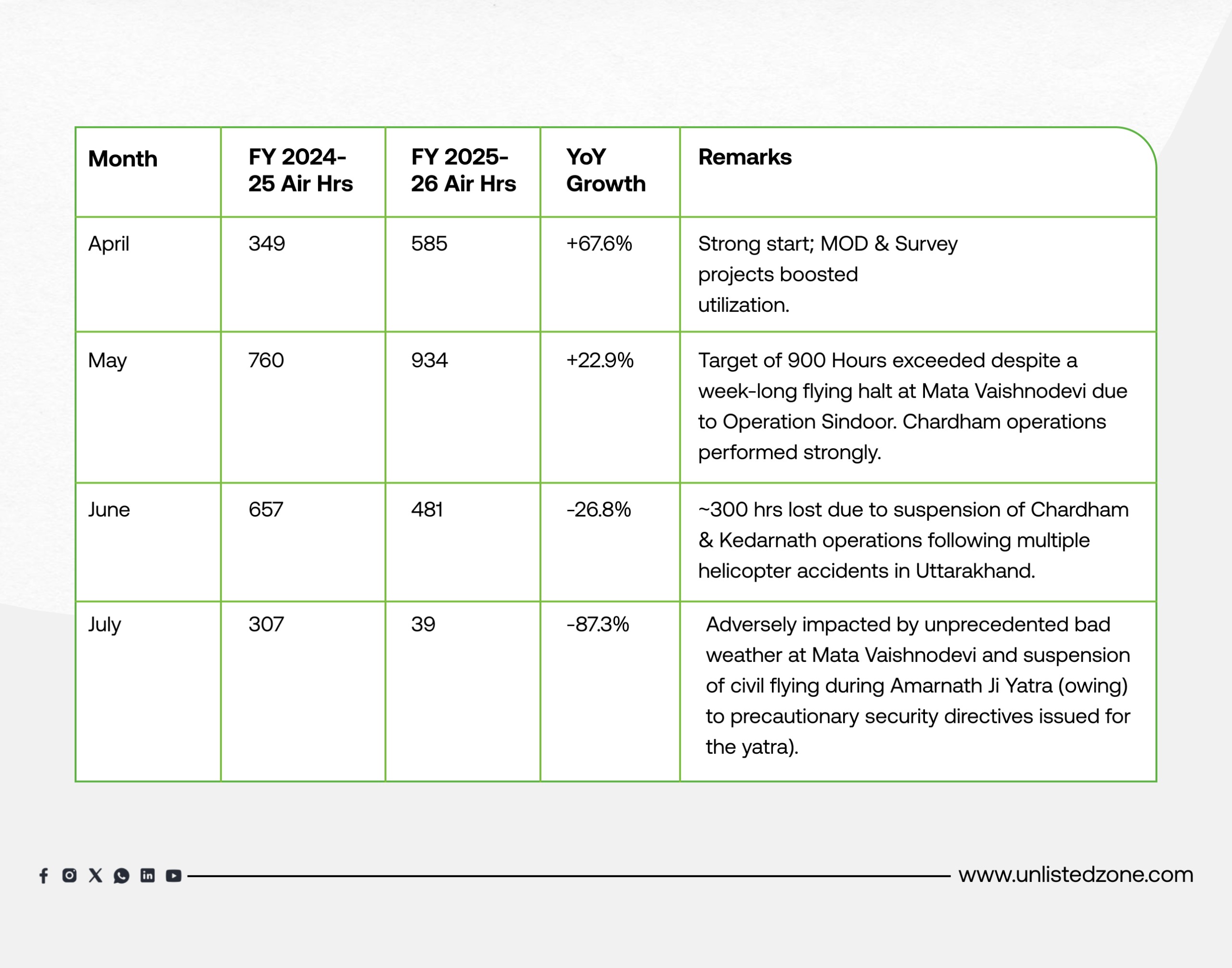

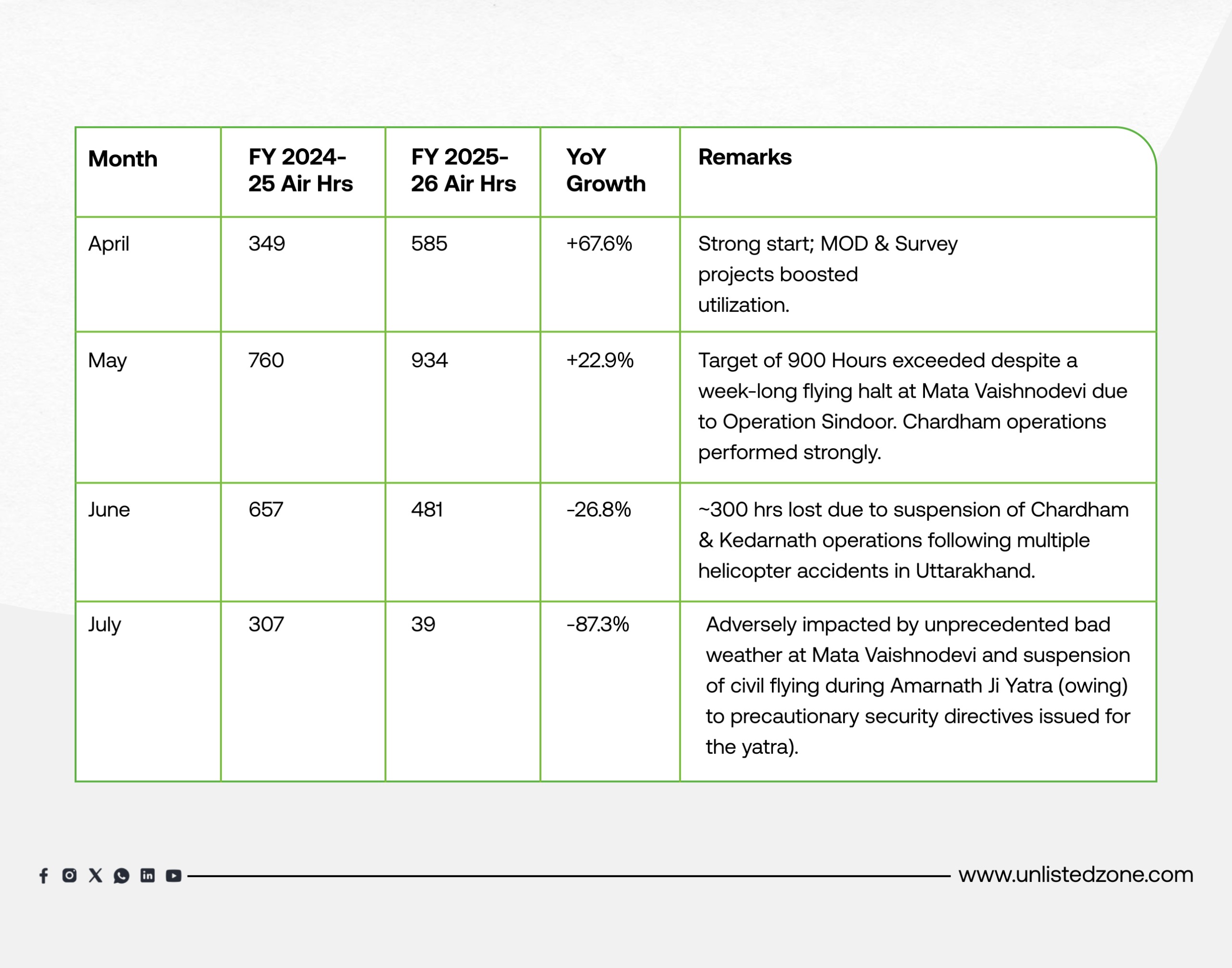

April 2025: 585 air hours (+67.6% YoY) – Boosted by MOD & Survey projects.

-

May 2025: 934 air hours (+22.9% YoY) – Target of 900 hours exceeded despite disruptions at Mata Vaishnodevi due to Operation Sindoor. Strong performance in Chardham operations.

-

June 2025: 481 air hours (–26.8% YoY) – Nearly 300 hours lost after suspension of Chardham & Kedarnath flying due to helicopter accidents in Uttarakhand.

-

July 2025: 39 air hours (–87.3% YoY) – Severe impact from bad weather at Mata Vaishnodevi and suspension of civil flying during Amarnath Ji Yatra due to precautionary security directives.

Q1 FY26 (Apr–Jun): +13.3% YoY (2,000 hrs vs 1,766 hrs)

Apr–Jul cumulative: –1.6% YoY (2,039 hrs vs 2,073 hrs)

👉 Despite severe headwinds, HHSL’s overall performance stayed broadly in line with last year, underlining its operational agility and resilience.

2. Business Updates & Pipeline Redevelopment

-

Manimahesh Yatra 2025: Secured L1 tender; operations began on 9th Aug 2025, extendable for 2 years (~100 hrs annually).

-

UCADA Disaster Management Contract: 100+ hrs contracted for Q2 (Jul–Sept 2025). HHSL played a critical role in the Uttarkashi cloudburst relief operations, enhancing its reputation as a trusted state partner.

-

Fleet Maintenance Milestone: Aircraft VT-BSG successfully completed its 144-month (12-year) inspection in-house by HHSL’s CAR-145 certified team, marking its third such achievement.

Pipeline for H2 FY26:

-

Defence & Survey: New tenders expected to be awarded, expanding MOD contracts.

-

Winter Upside: Exploring 400+ additional flying hours in winter ’25–’26 projects to offset seasonality and diversify revenues.

3. Fleet Updates

-

VT-HHC (inducted April 2025): Already flown 250+ hrs in 4 months, exceeding expectations.

-

VT-HHD (6th owned helicopter): Scheduled delivery in Oct 2025, operational by Nov 2025. This addition will further reduce leasing costs and improve margins.

4. Forward Outlook

-

Flying Projections FY26: Despite losing ~1,300 hrs in H1, HHSL remains on track to achieve 6,000+ air hours, matching FY25 levels.

-

Fleet Ownership Strategy: Ongoing shift from leased to owned fleet, driving cost efficiency and profitability.

-

Financial Performance: New aircraft induction and in-house maintenance efficiencies already improving margins, setting up HHSL for sustainable long-term growth.

5. IPO Progress

HHSL has officially announced its decision to pursue a Main Board IPO, reflecting its scale and growth trajectory. The IPO will be a crucial milestone, providing funds to:

Further IPO details will be shared soon, but management has reaffirmed its commitment to transparency, corporate governance, and timely communication with stakeholders.

Conclusion: Investor Outlook

Himalayan Heli’s journey in 4MFY26 shows a balanced mix of challenges and opportunities. Despite weather disruptions and operational suspensions, the company has secured new contracts, maintained fleet expansion plans, and moved closer to its IPO ambitions.

For investors in the unlisted shares of HHSL, the next big trigger will be:

-

Execution of upcoming contracts in Defence & Winter operations,

-

Successful induction of VT-HHD aircraft,

-

Formal progress on its IPO filing.

With ₹6,000+ annual flying hours targeted and strong sector demand in pilgrimage tourism, disaster management, and defence, HHSL is well-placed to deliver value in the medium to long term.

Disclaimer :

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.