HDFC Securities, the flagship company of HDFC Group has come up with the Q1FY22 numbers. In the first quarter of FY22, HDFC Securities has clocked revenue of 452 crores; it was only 272 crores last year in the same period. This has translated into a massive 66% growth in revenue. Total expenses have also gone up to 121 crores as compared to 100 crores last year in the same period.

The main expense of Broking Company is employee salaries, for HDFC Securities it accounted for 11% of total expense in the Q1FY22. The PAT has also grown by 100% to reach 251 crores as compared to just 130 crores last year. During the period, the Company had declared and paid interim dividend of ₹120 per share

Results Snapshot (in Crores)

| Date |

Total Income |

EBITDA |

OPM |

PAT |

NPM |

EPS |

| Q1FY21 |

272 |

177 |

65% |

129 |

47% |

82 |

| Q1FY22 |

452 |

348 |

76% |

251 |

55% |

159 |

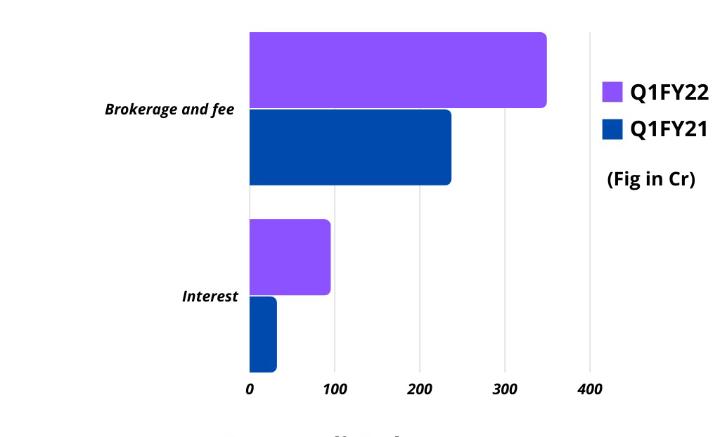

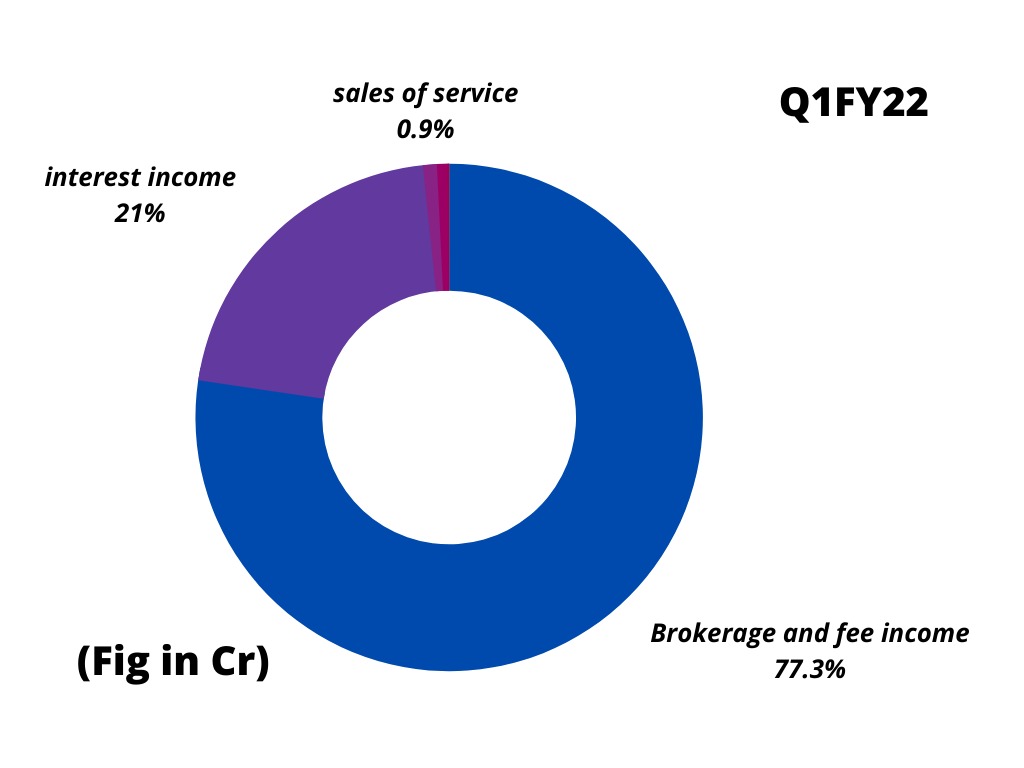

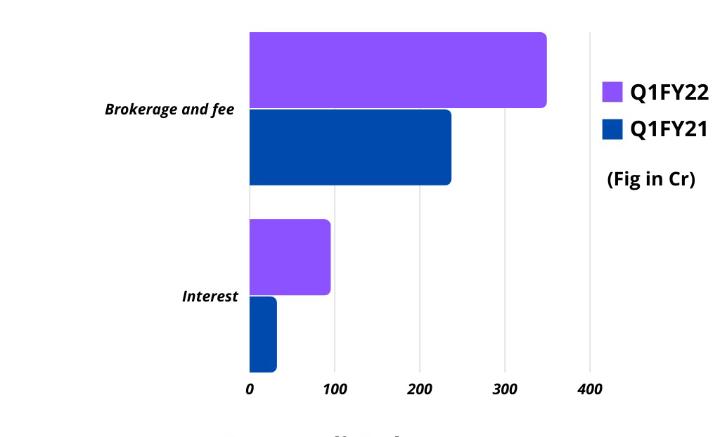

Revenue Comparison of Q1FY22 and Q1FY21  Revenue Contribution from different services in Q1FY22

Revenue Contribution from different services in Q1FY22

Current Valuation

If we annualize the EPS of Q1FY22, then it will come around 600. The current unlisted market price of HDFC Securities is 13500 per share. So, P/E would be 22.5x. ICICI Securities is trading at P/E of 21x and Angel Broking is trading at P/E of 29x. So, HDFC Securities' valuation look at par with other listed players in the market.

HDFC Securities Results Link