The Q2FY26 results of HDFC Securities Limited highlight a cooling phase in India’s capital market activity. The data reveals declining revenues, compressing profitability, and subdued investor participation — trends that mirror what the broader brokerage industry is currently facing.

A) Financial Snapshot: Decline Across Segments

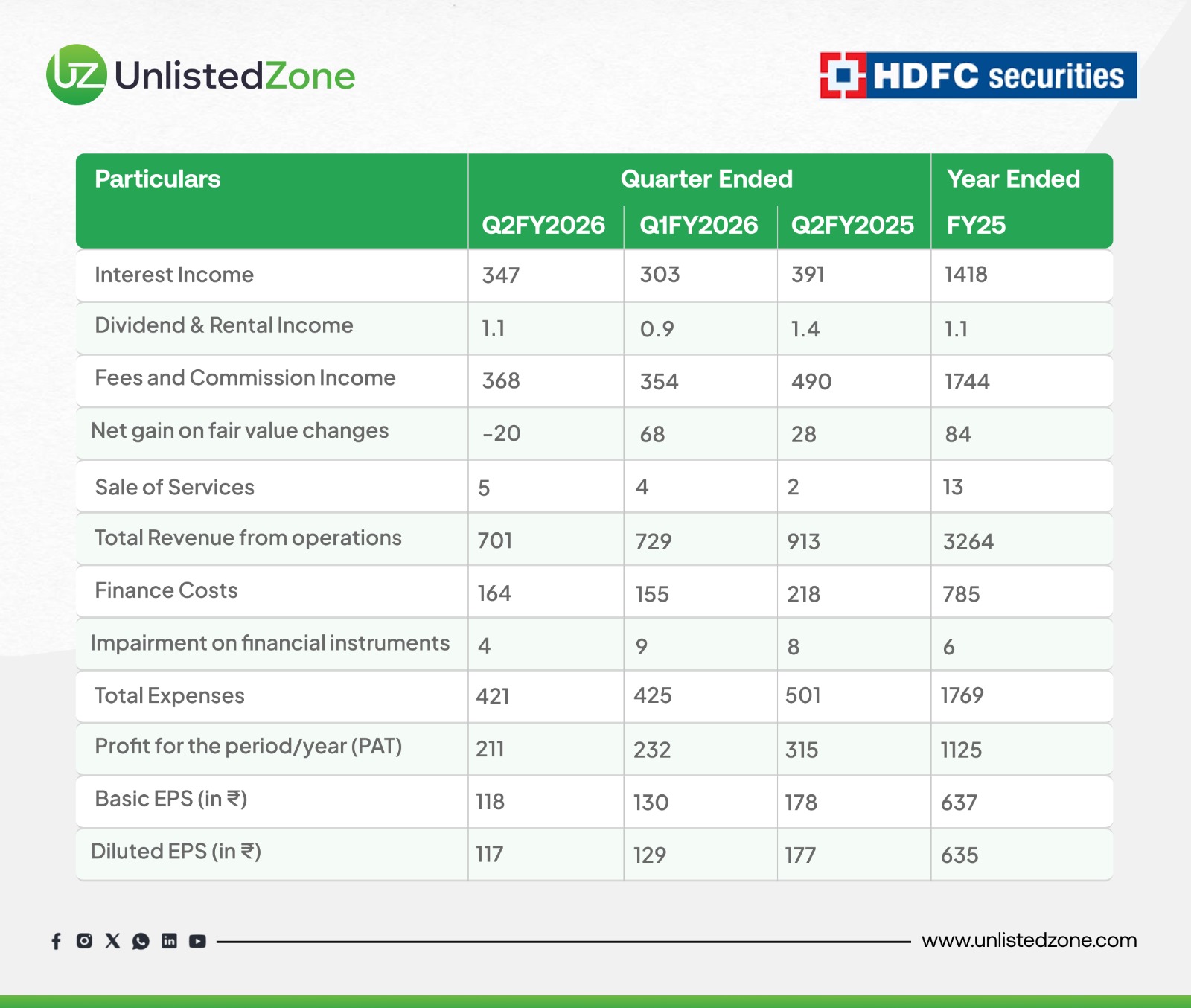

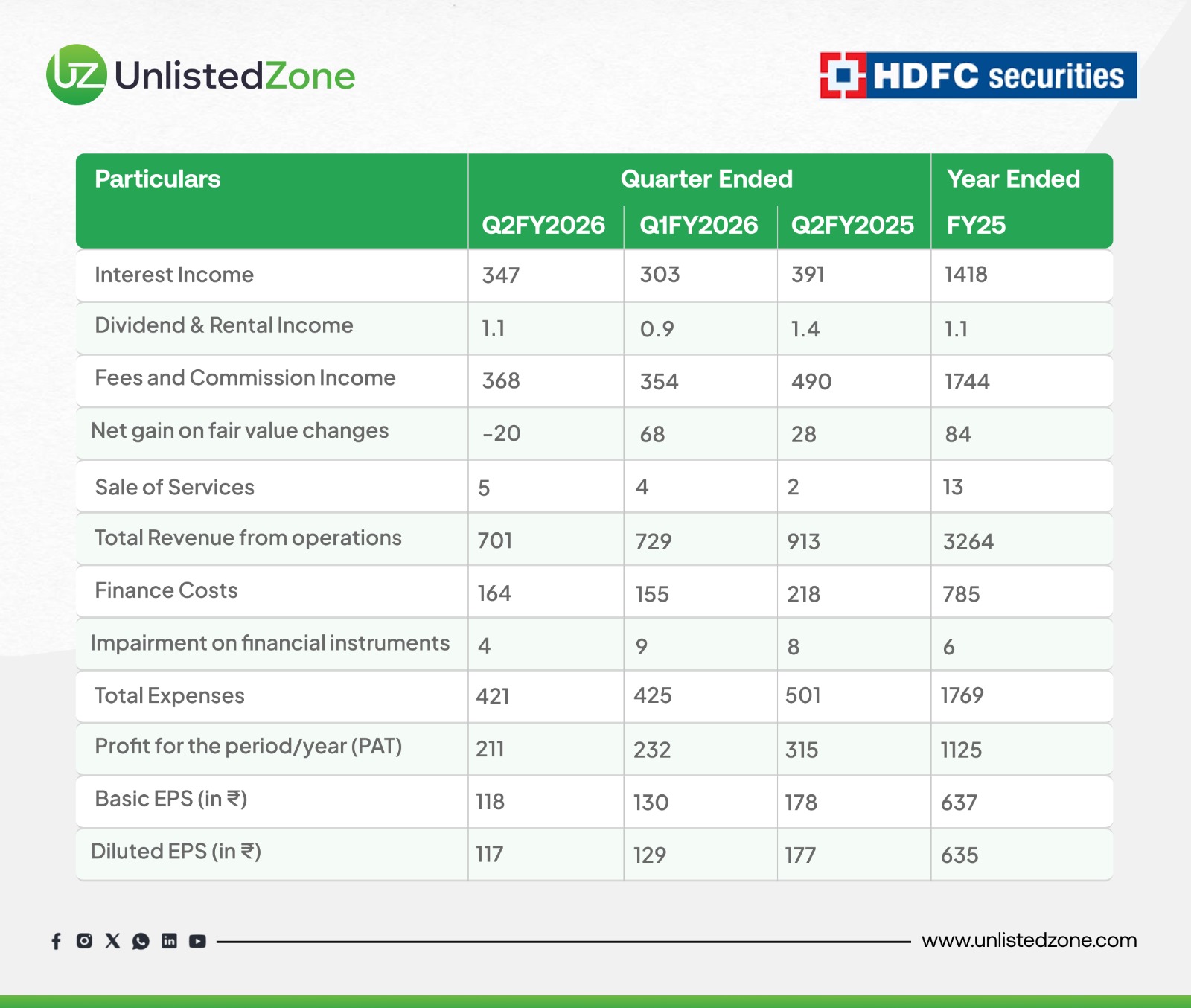

In Q2FY25, HDFC Securities reported a total revenue of ₹912 crore, comprising:

However, in Q2FY26, total revenue dropped to ₹700 crore, a sharp 23% year-on-year decline. The breakup indicates pressure across both major income sources:

Profitability has also been impacted. The company’s Profit After Tax (PAT) declined from ₹315 crore in Q2FY25 to ₹200 crore in Q2FY26, marking a 36% fall.

This dual decline — both in lending (interest income) and trading/commission income — suggests that the market environment has turned significantly cautious.

B) What’s Driving the Slowdown?

1. Capital Market Cycle Has Peaked

The capital market upcycle that began in 2020 — fueled by retail participation, low interest rates, and abundant liquidity — appears to have reached a plateau. Over the past 15 months, the NIFTY 50 index has remained largely flat, and new investor additions have slowed down.

2. Regulatory Tightening on F&O Income

The Securities and Exchange Board of India (SEBI) has recently tightened norms around Futures & Options (F&O) income reporting and margin requirements. These measures, while aimed at curbing speculative trading and improving transparency, have dampened trading volumes — a key revenue driver for brokerage firms.

3. Reduced Retail Participation

After three years of unprecedented activity in the retail segment, participation levels are now normalizing. Many new investors who entered the market during the 2020–2022 boom are now less active amid volatile markets and limited short-term gains.

4. Flat Index Returns and Lower Volatility

Brokerage revenues are highly correlated with market volatility and trading enthusiasm. With index returns stagnating and volatility index (VIX) hovering near multi-year lows, trading frequency has declined.

C) Peer Commentary: Warnings from the Industry

Even top industry leaders are echoing similar sentiments. Nithin Kamath, Founder and CEO of Zerodha, recently cautioned that Zerodha’s revenue could fall by up to 40% this year. He also hinted that the firm might reconsider its zero-brokerage delivery model, a move that would mark a significant shift in India’s brokerage pricing dynamics.

His statement underscores the broad-based weakness in retail trading activity — not just among full-service brokers like HDFC Securities, but also discount brokers that once thrived on high-frequency retail volumes.

D) Impact on Upcoming IPOs and New-Age Platforms

The timing of this slowdown coincides with the anticipated IPO of Groww, India’s largest investment platform by active users. Groww’s IPO, expected next month, comes at a time when the market enthusiasm around fintech listings is muted.

While Groww’s strong brand recall and user base could still attract investor interest, the weaker revenue outlook across the brokerage sector might weigh on investor sentiment and valuations.

E) Broader Industry Implications

The subdued performance of HDFC Securities is not an isolated case — it reflects structural shifts that could shape the brokerage landscape in the near term:

1. Margin Compression Across the Industry

With trading volumes falling and regulatory compliance costs increasing, most brokers are likely to witness margin compression. Smaller players could find it challenging to sustain profitability without diversification.

2. Shift Toward Wealth Management and Advisory Services

As transaction-based income weakens, firms may increasingly pivot toward fee-based wealth management, advisory, and distribution businesses to maintain revenue stability.

3. Digital Platforms to Reassess Pricing

If larger discount brokers like Zerodha begin charging delivery fees, it could reset pricing benchmarks across the industry — potentially improving revenue per user but at the cost of customer churn.

4. Consolidation Ahead

Industry consolidation appears inevitable. With regulatory costs rising and trading activity cooling, smaller brokers may either exit the business or merge with larger players to gain scale.

F) The Bigger Picture: Market Pause, Not Collapse

While the near-term environment looks challenging, it’s important to note that this appears to be a pause in the market cycle, not an end.

Between 2020 and 2023, India witnessed one of the most remarkable retail participation booms in its history, with over 12 crore demat accounts opened. The structural trend of financialization of savings remains intact — investors are still shifting from physical to financial assets, but their activity levels have moderated temporarily.

Once market momentum returns — driven by earnings growth, rate cuts, or global liquidity — brokerage volumes could recover quickly.

G) Outlook: Short-Term Pressure, Long-Term Potential

For the next few quarters, capital market-linked stocks are expected to remain under pressure. These include listed and unlisted entities in broking, depository, and fintech segments.

However, long-term investors should view this as a natural phase of correction in an otherwise growing industry. India’s per capita income growth, digital penetration, and under-served investment population continue to offer immense opportunities for financial intermediaries.

H) Key Takeaways

-

HDFC Securities’ Q2FY26 results reflect a cyclical slowdown in the capital markets, with both interest and fee-based incomes under pressure.

-

PAT declined 36% YoY, marking the weakest quarter since the pandemic-era rally began.

-

SEBI’s tightening of F&O rules and flat NIFTY performance are leading to subdued trading activity.

-

Even large brokers like Zerodha expect a 40% decline in revenue this year, indicating industry-wide stress.

-

The upcoming Groww IPO may face valuation challenges amid weak sentiment.

-

In the short term, capital market stocks will likely remain subdued; however, long-term fundamentals of financialization and digital adoption remain robust.

Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.