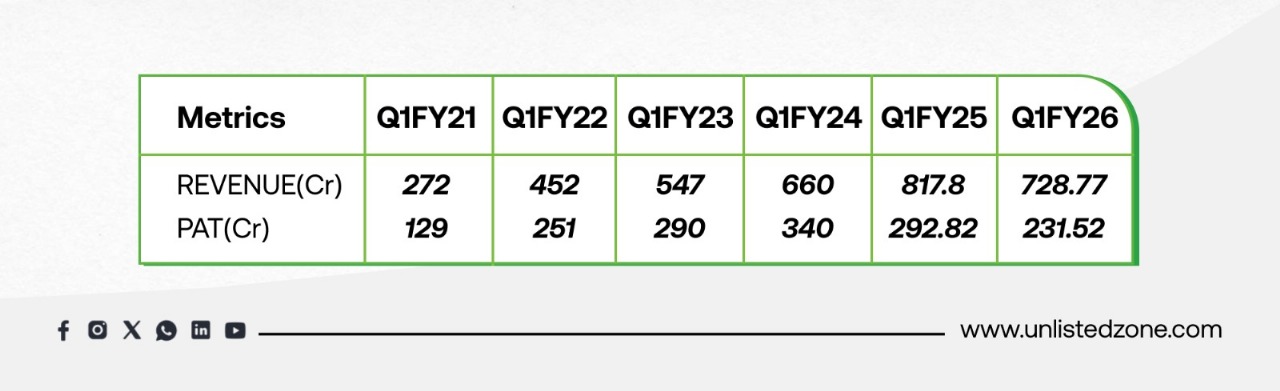

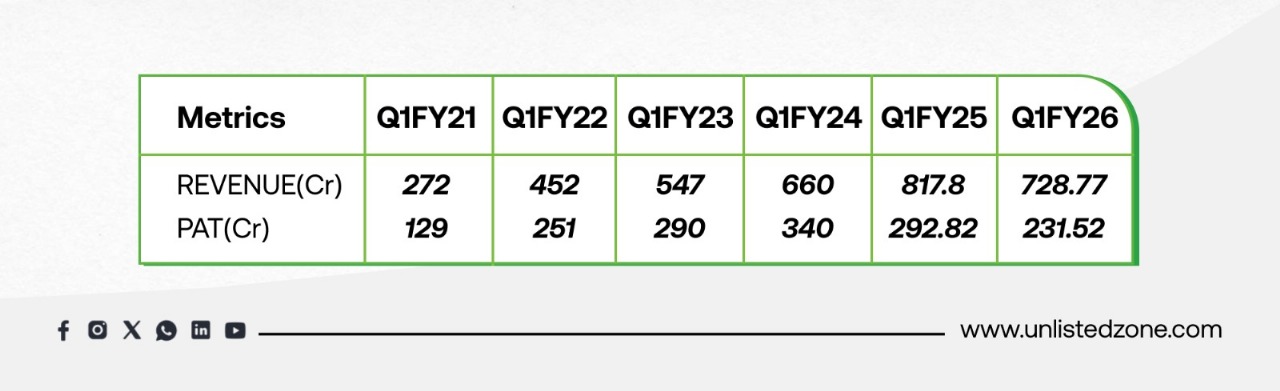

HDFC Securities Limited, one of India’s leading stock broking firms, has announced its unaudited financial results for Q1 FY26. The numbers reveal a concerning trend: both revenue and profit after tax (PAT) have dipped when compared to previous quarters. This decline, however, reflects more than just company-specific issues—it signals a shift in the broader stock broking industry impacted by recent SEBI regulations on F&O trading.

A) Key Financial Highlights:

This sequential and YoY decline in PAT points to structural changes in the market environment rather than internal inefficiencies.

B) Why Are HDFC Securities' Profits Falling?

The decline in revenue and profitability is largely attributed to reduced income from the derivatives (F&O) segment, historically a major driver of broker revenues in India. This segment has been severely affected by new SEBI directives implemented in October 2024.

SEBI’s Game-Changing F&O Reforms

In an attempt to curb rampant speculation in the derivatives market, SEBI introduced major changes:

These reforms led to a sharp drop in trading volumes, especially in F&O, hitting brokerage earnings across the industry.

C) Broader Industry Impact: Not Just HDFC Securities

HDFC Securities is not alone in facing this revenue slump. Other brokerage firms like Angel One (Angel Broking) have also reported similar financial pressures. The industry, which saw exponential growth during the 2020–2024 bull market fueled by retail participation and high F&O activity, is now entering a consolidation phase.

D) What Does the Future Hold?

Despite the current challenges, the long-term outlook for India’s equity markets remains optimistic.

The Rise of Financialisation in India

The broader theme of the financialisation of the Indian economy is a structural trend that continues to gain momentum. Key drivers include:

-

Increasing retail investor participation

-

Growing financial literacy

-

Wider adoption of digital trading platforms

-

Robust regulatory frameworks

As India’s capital markets mature, the temporary dip due to regulatory shifts may eventually be seen as a necessary correction to promote sustainable and healthy market growth.

Conclusion: A Short-Term Dip in a Long-Term Growth Story

The Q1 FY26 results of HDFC Securities highlight the immediate impact of SEBI’s reforms on brokerage firms. However, the fundamentals of India’s financial markets remain strong. With increasing formalisation of savings and growing public market participation, the stage is set for long-term growth.

While short-term profitability may face pressure, firms that adapt to the new regulatory regime and diversify their revenue models are likely to thrive in the next phase of India’s capital market evolution.