HDB Financial Services, a renowned Non-Banking Financial Company (NBFC) established in 2008, recently announced its impressive financial results for the quarter ending December 31, 2023, and the nine-month period of FY24. These results are particularly significant for investors and analysts interested in HDB Financial unlisted shares, as they provide valuable insights into the company's financial health and future prospects.

Key Financial Highlights and Growth in HDB Financial Unlisted Share Value

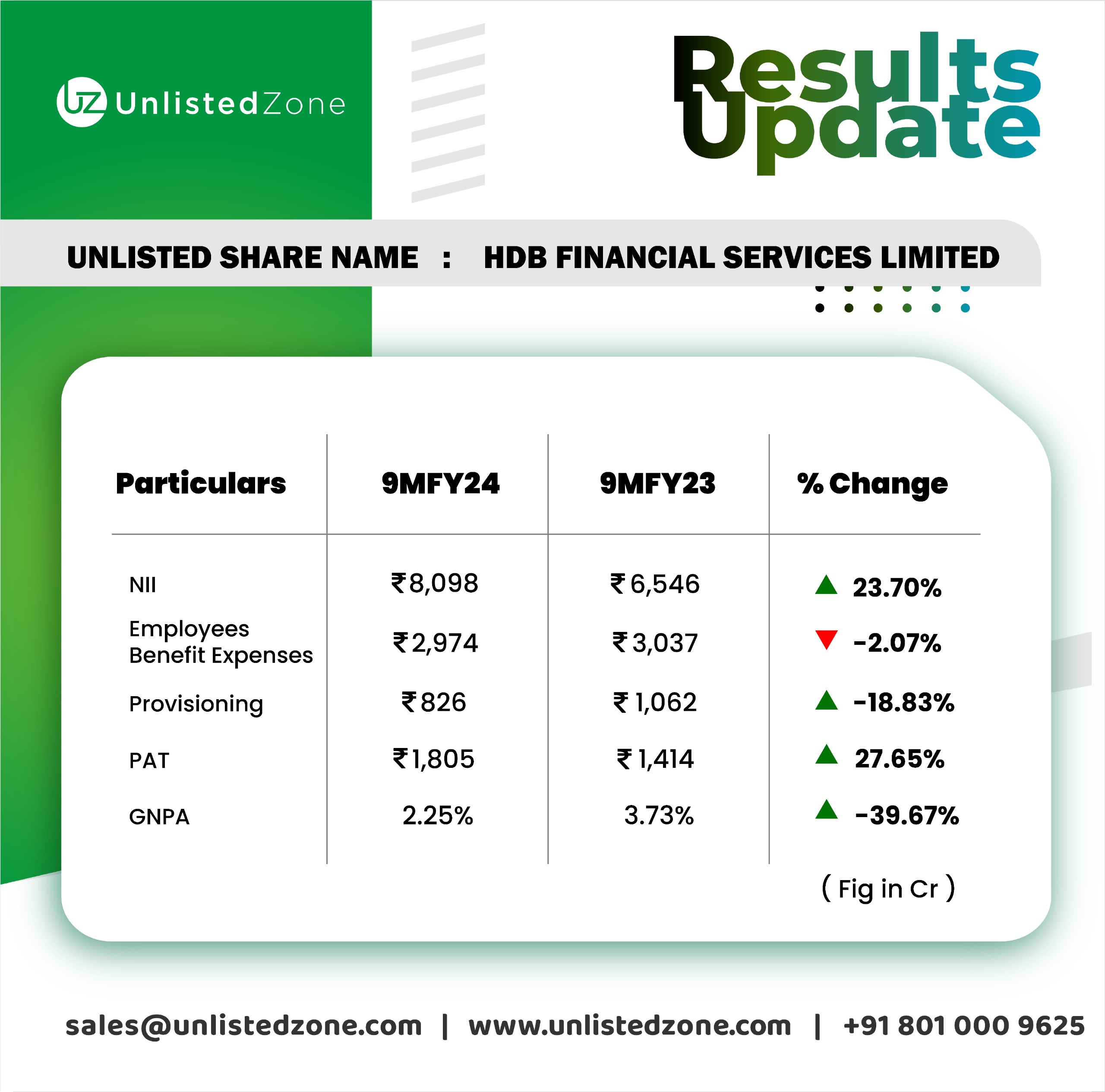

In the latest financial reports, HDB Financial Services showcased a steady growth trajectory. The company's Net Interest Income for the 9 months ended December 31, 2023, witnessed a 23% increase, reaching INR 8098 crore compared to INR 6546 crore in the preceding 9 months of the same fiscal year. This uptrend is a positive indicator for the valuation of HDB Financial unlisted shares.

Moreover, over the nine months ending in FY24, the total revenue surged by 14%, amounting to Rs. 10504.3 crore, up from Rs. 9182.7 crore in the same period the previous year. This robust growth in revenue underscores the company's strong performance and the increasing attractiveness of HDB Financial unlisted shares in the financial market.

Expense Management and Operational Efficiency

The total expenses for the quarter ended December 31, 2023, saw a modest rise of 1.4%, totaling Rs. 2746.2 crore, compared to Rs. 2708.9 crore in the previous quarter. Over the nine months, the expenses increased by 10.4% to Rs. 8081.4 crore. This controlled increase in expenses reflects HDB Financial Services' effective cost management strategies, further enhancing the appeal of HDB Financial unlisted shares.

Profitability Analysis

A key highlight for investors in HDB Financial unlisted shares is the company's profitability. The Profit Before Tax (PBT) for the quarter ended December 31, 2023, grew by 6% to Rs. 855.6 crore from Rs. 806.8 crore in the previous quarter. The PBT for the nine-month period showed an even more impressive increase of 27.9%, reaching Rs. 2422.9 crore, up from Rs. 1894.2 crore in the previous year. This substantial growth in profitability is a strong signal for the potential of HDB Financial unlisted shares.