GFCL EV Products Calls EGM to Approve Key Capital Expansion Moves

GFCL EV Products Limited, a subsidiary of Gujarat Fluorochemicals Limited (GFL), has announced an Extraordinary General Meeting (EGM) on 15th October 2025, to be held virtually through Video Conferencing (VC) or Other Audio-Visual Means (OAVM).

The company seeks shareholder approval for two key resolutions:

-

Increasing its Authorized Share Capital, and

-

Issuing new equity shares to its promoter and holding company, GFL, on a private placement basis.

These strategic steps align with GFCL’s long-term vision of expanding its EV manufacturing operations both in India and global markets.

1. Increase in Authorized Share Capital

The company has proposed a significant enhancement of its authorized capital to support its upcoming expansion initiatives.

-

Current Authorized Capital: ₹1,500 Crores

-

Proposed Authorized Capital: ₹2,500 Crores

-

1,200 Crore Equity Shares of ₹1 each

-

300 Crore Preference Shares of ₹1 each

-

10 Crore Compulsorily Convertible Preference Shares (CCPS) of ₹100 each

This change will involve amending Clause V of the Memorandum of Association (MoA) under Sections 13, 61, and 64 of the Companies Act, 2013.

The proposed increase will enable GFCL EV Products to raise adequate funds for scaling up production capacity and accelerating its global manufacturing footprint.

2. Private Placement to Gujarat Fluorochemicals Limited

The second major agenda item concerns the issuance of new equity shares to Gujarat Fluorochemicals Limited (GFL) — the company’s promoter and holding entity.

Key details of the issue:

-

Number of Shares: Up to 2,64,20,992 equity shares

-

Face Value: ₹1 per share

-

Issue Price: ₹35 per share (₹34 premium)

-

Total Fundraise: ₹92.47 Crores

-

Allotment Timeline: Within 60 days of receiving application money

-

Relevant Sections: 42 and 62(1)(c) of the Companies Act, 2013

The pricing is backed by a valuation report prepared by Mr. Hitesh Jhamb, Registered Valuer (IBBI/RV/11/2019/1235), with 30th June 2025 as the relevant date.

Importantly, this allotment will not result in any change in management control, and the newly issued shares will rank pari-passu with the existing equity shares.

Purpose of the Capital Raise

The proceeds from the private placement and capital restructuring will primarily be used to:

-

Expand manufacturing operations across India and international markets.

-

Strengthen the company’s financial flexibility to support future projects.

-

Enhance product innovation and scale up EV component production.

The proposed capital actions underscore GFCL EV Products’ commitment to becoming a key player in the EV ecosystem.

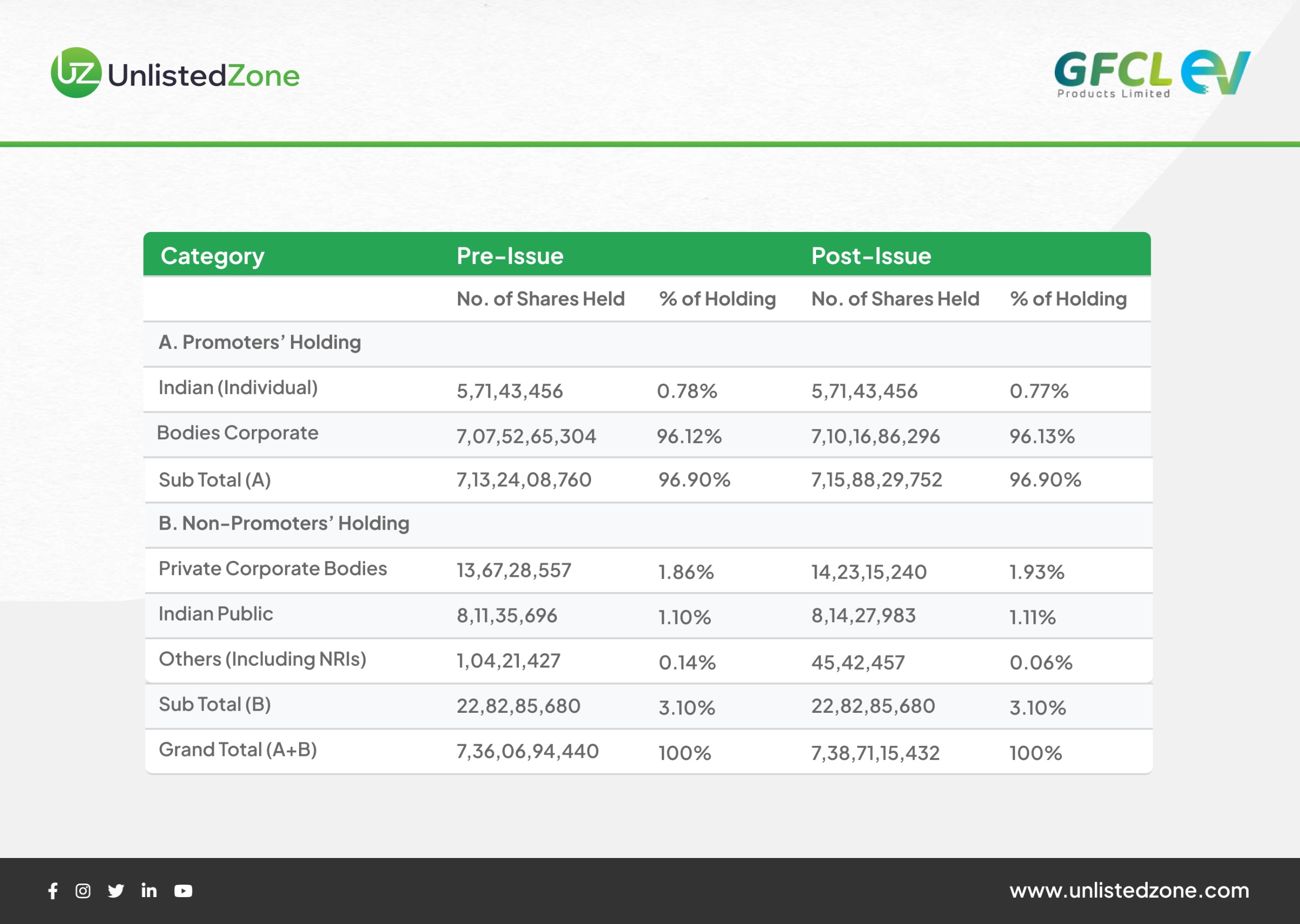

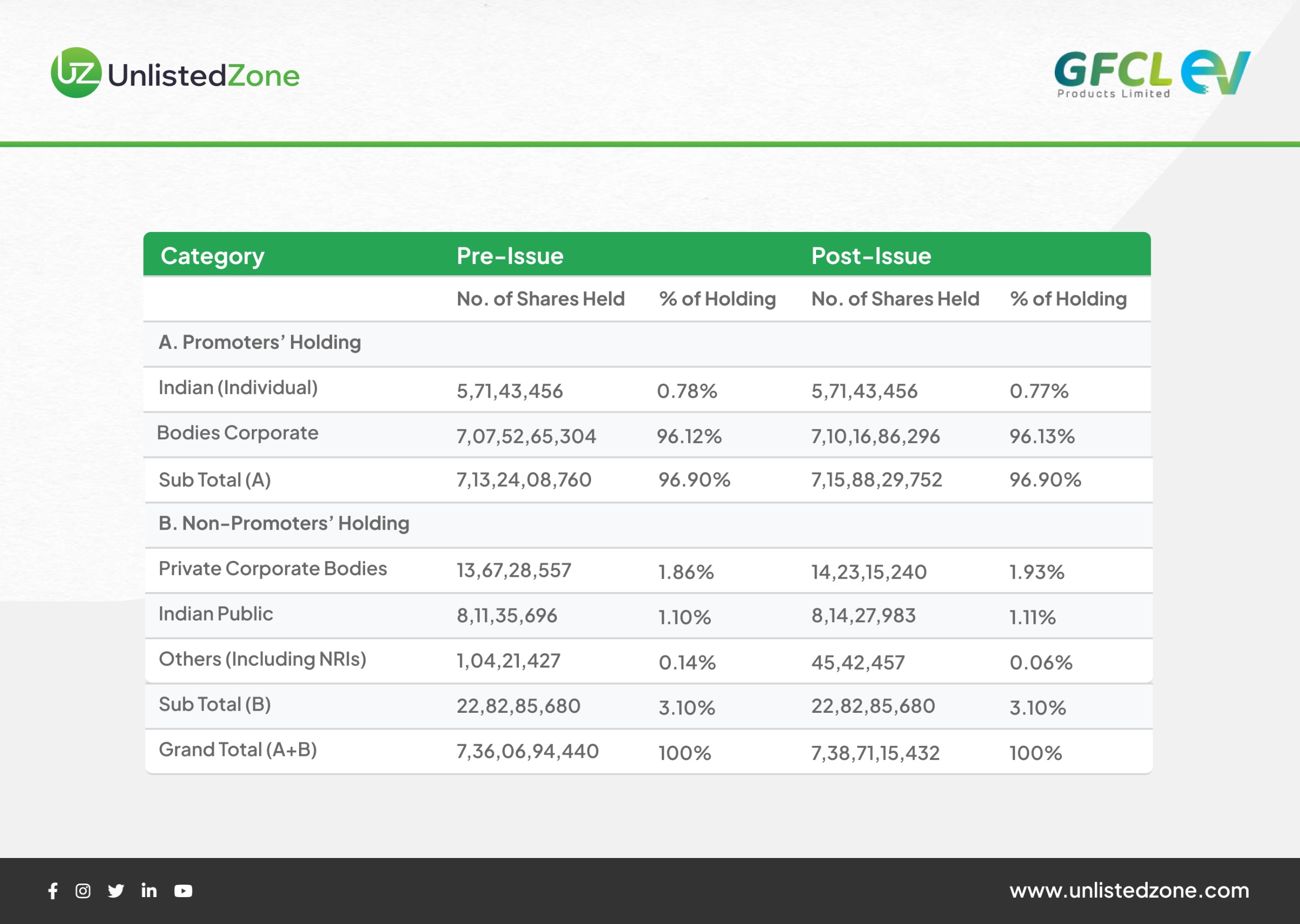

Post-Issue Shareholding Pattern

Conclusion

With its latest capital restructuring and fund infusion plan, GFCL EV Products is strategically positioning itself for the next phase of growth in the EV manufacturing space.

The proposed increase in authorized capital and private placement to Gujarat Fluorochemicals Limited will help the company expand its production capabilities, invest in new technologies, and reinforce its market leadership in the fast-evolving electric vehicle ecosystem.

Disclaimer

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.