Fractal.ai, formerly known as Fractal Analytics, has emerged as one of India’s most successful enterprise AI and analytics companies. With a consistent track record of innovation and global expansion, the company has attracted marquee investors and achieved unicorn status. Now, as it heads toward its highly anticipated IPO, here’s a detailed look at Fractal.ai’s funding history, valuation growth, and unlisted market performance.

About Fractal.ai

Fractal.ai is a global leader in enterprise data, analytics, and AI solutions, serving Fortune 500 clients across sectors like healthcare, retail, and financial services. The company’s AI-driven products such as Cogentiq and Vaidya.ai have positioned it as a front-runner in applied artificial intelligence.

Founded in the early 2000s, Fractal’s evolution from a niche analytics player to a global AI powerhouse has been fueled by multiple funding rounds and strategic investments.

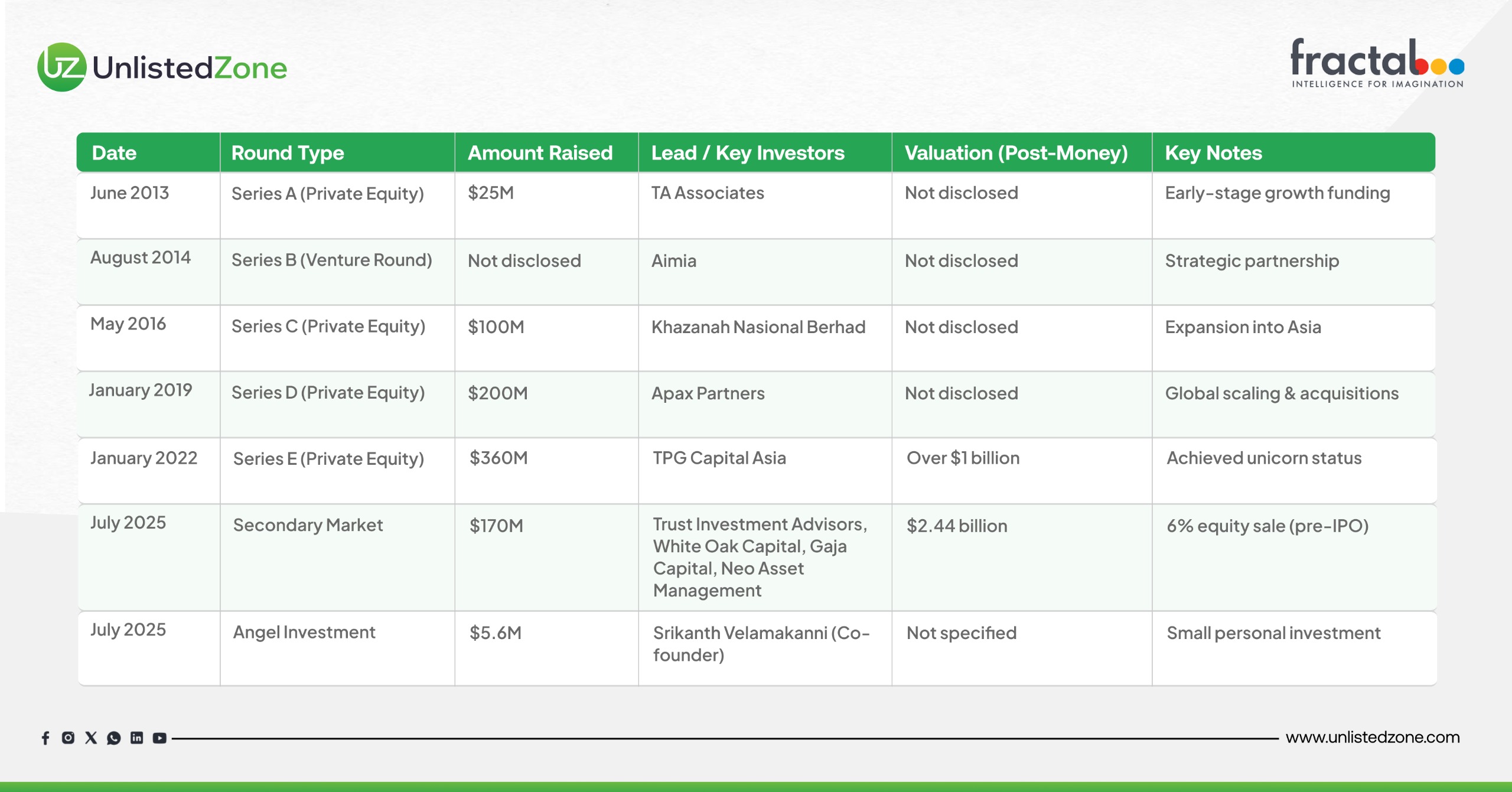

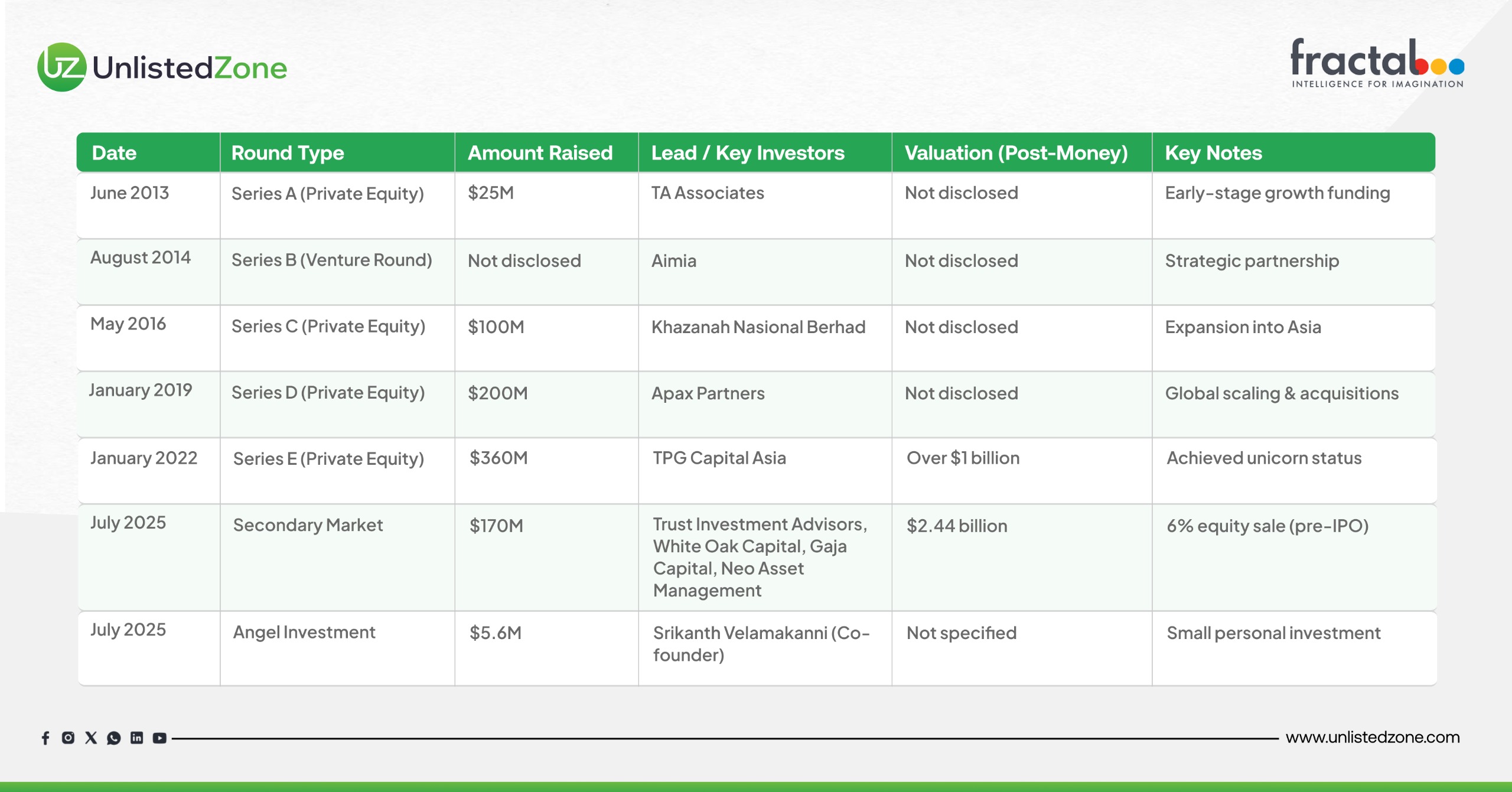

Fractal.ai Funding History

Fractal.ai has raised approximately $855 million across several rounds (including secondaries), with valuation milestones marking its steady rise toward IPO readiness.

🟢 Key Highlights

-

Total Funding Raised: ~$855 million

-

Latest Valuation (2025): $2.44 billion (post-money)

-

Unicorn Status: Achieved in 2022 with TPG Capital’s $360M round

-

Major Investors: TA Associates, Aimia, Khazanah Nasional, Apax Partners, TPG, and Neo Asset Management

-

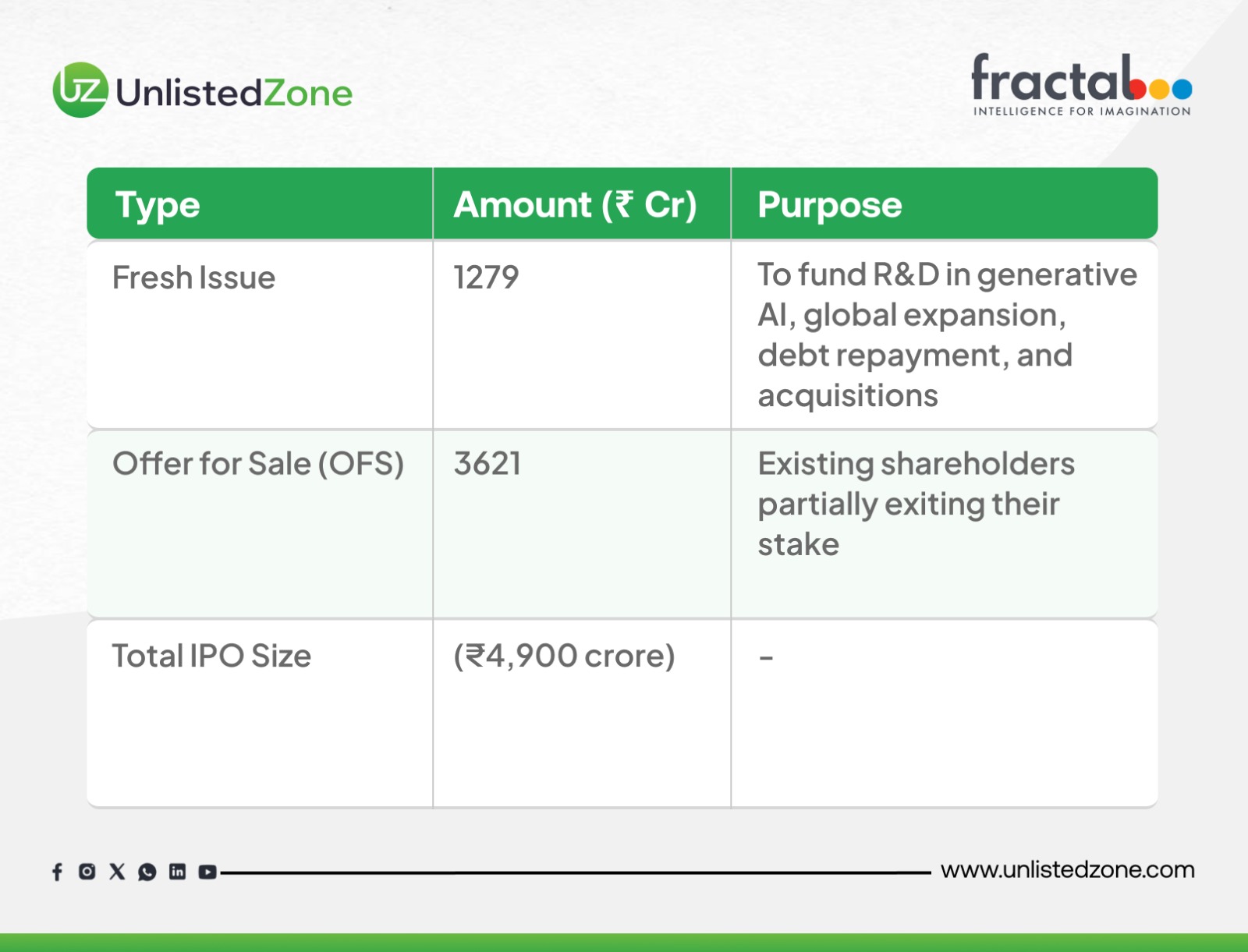

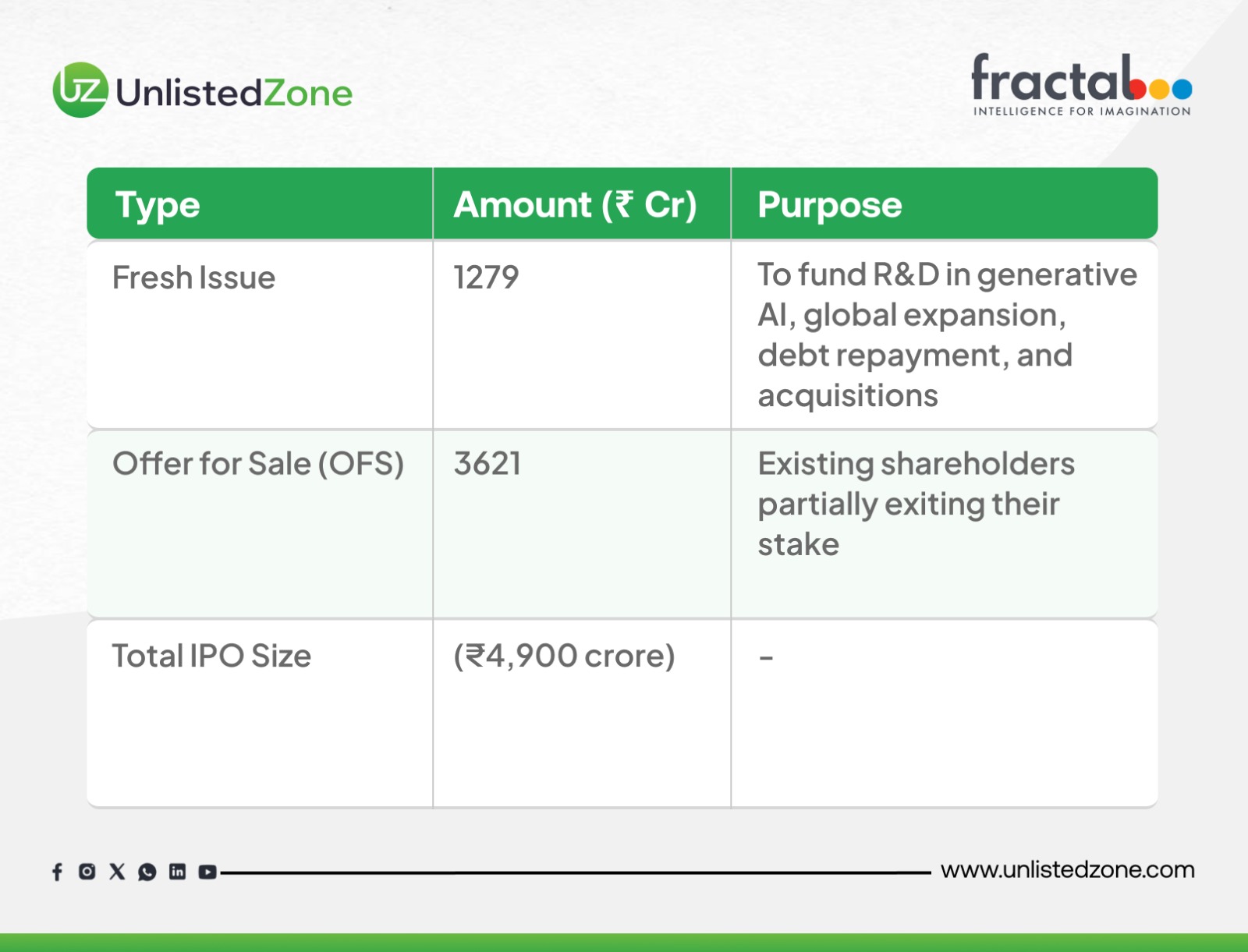

IPO Filing: Draft Red Herring Prospectus filed in August 2025 for a ₹4900 Cr IPO

Fractal.ai IPO Details (2025)

Fractal.ai is all set to enter the public markets with a IPO, combining fresh issuance and an offer for sale.

The IPO is expected to value Fractal.ai above $3.5 billion, reinforcing investor confidence in India’s enterprise AI story.

Fractal.ai Unlisted Market Insights

While Fractal.ai shares have not yet commenced trading in the unlisted market, a valuation benchmark exists from its last funding round. Based on a valuation of $2.2 billion (approximately ₹17,600 crores, at an exchange rate of $1 = ₹80), the implied per-share value is approximately ₹1,060. This calculation is based on the roughly 16.6 crore shares outstanding as reported in its Draft Red Herring Prospectus (DRHP).

Valuation Growth Timeline

-

2013–2018: Early growth backed by TA Associates & Aimia

-

2019: $200M infusion by Apax Partners boosted global acquisitions

-

2022: $360M TPG-led round made Fractal.ai a unicorn

-

2025: $2.44B valuation post-secondary round; IPO targeting $3.5B+

This consistent rise in valuation reflects the company’s strong financial performance, AI product innovation, and expanding enterprise customer base.

Investor Takeaway

Fractal.ai’s journey showcases the evolution of Indian AI startups into global leaders. Backed by deep investor trust, a scalable business model, and high-growth AI verticals, Fractal.ai’s IPO is one of the most awaited events in India’s tech market.

The company’s ** valuation, robust financial metrics, and low leverage** make it a compelling story for both institutional and retail investors ahead of its listing.

Final Thoughts

Fractal.ai’s funding history is not just about capital raised—it’s a reflection of strategic scaling, global credibility, and technological leadership. With its upcoming IPO and a strong unlisted market performance, Fractal.ai stands at the forefront of India’s AI revolution.

Whether you’re an early investor, a retail enthusiast, or an AI market watcher, Fractal.ai’s IPO journey is one to keep an eye on.

Disclaimer:

UnlistedZone is not a SEBI-registered Research Analyst or Investment Advisor. All information provided on our platform is strictly for educational and informational purposes. We do not offer investment advice or stock recommendations. Investors are advised to conduct their own due diligence or consult a SEBI-registered advisor. Investments in unlisted and pre-IPO shares are subject to market risks including illiquidity and volatility. UnlistedZone does not assure any returns or accept liability for investment outcomes based on this report.